Jurgen Maier To Chair Great British Energy

This article in The Times is entitled Pylons Are The Price Of Lower Bills, Keir Starmer Tells Rural Britain.

These are two paragraphs from the article.

Starmer confirmed that Jürgen Maier, the former UK chief executive of the Siemens conglomerate, would chair the energy company.

Maier has advised Labour on rail and transport since December. He was openly critical of the party’s decision to drop a pledge to spend £28 billion a year on green investment, saying the figure was an “absolute minimum” and that scrapping the promise was “not good for climate change or for the growth of our economy”.

Note.

- His Wikipedia entry is impressive.

- He has dual Austrian and British citizenship.

- He went to school in Leeds and is a graduate of Nottingham Trent University.

- He rose to be Chief Executive of Siemens UK and retired in 2019 at 55.

- I have heard him several times on the radio and he seems to talk a lot of sense.

In my view he could be an excellent choice as Chair of Great British Energy.

I also have some further thoughts.

Jürgen Maier And Peter Hendy

Jürgen Maier and Peter Hendy, who is Starmer’s Rail Minister, have remarkably similar backgrounds and I wouldn’t be surprised if they know each other well, through dealings around Siemens’ contract for Transport for London’s new trains for the Piccadilly Line.

When last, were two technological heavyweights, so close to the heart of a UK government?

RWE

German energy company; RWE are the UK’s largest power generator.

- RWE have five gas-fired power stations with a total output of 6.56 GW.

- RWE have two onshore wind farms in operation with a total output of 67 MW.

- RWE have four offshore wind farms in operation with a total output of 1.88 GW.

- RWE have eight offshore wind farms under development with a total output of 9.90 GW.

- RWE also has other electrical gubbins, like an electrolyser in South Wales.

Would Jürgen Maier be an ideal person, to persuade RWE to keep investing in the UK?

When he was with Siemens, he certainly invested heavily in the UK.

The German Problem

Germany’s problem is how they generate electricity.

Sources are as follows for Germany and the UK.

- Coal – 26 % – 1 %

- Natural Gas – 10.5 % – 32 %

- Wind – 32 % – 29.4 %

- Solar 12.2 % – 4.9 %

- Biomass – 9.7 % – 12.3 %

- Nuclear – 1.5 % – 14.2 %

- Hydro – 4.5 % – 1.8 %

- Oil – 0.7 % – 0 %

- Other – 2.9 % – 0 %

- Storage – 0 % – 1 %

- Imports – 0 % – 10.7 %

Note.

- Figures are for 2023.

- Germany is the first percentage.

- UK is the second percentage.

- Germany has pledged to end coal-fired electricity production by 2030.

- Both countries seem to generate similar amounts of electricity from wind, biomass and hydro.

To replace the coal and make up for lack of nuclear, Germany needs to find a new power source.

The German Solution

The Germans are going for hydrogen in a big way.

The title of this page of the RWE web site is Welcome To The Age Of Hydrogen.

The page starts with this paragraph.

RWE is actively involved in the development of innovative hydrogen projects. The H2 molecule is considered to be an important future building block of a successful energy transition. RWE is a partner in over 30 H2 projects and is working on solutions for decarbonising the industry with associations and corporations like Shell, BASF and OGE. Hydrogen projects are comprehensively supported in the separate Hydrogen department of the subsidiary RWE Generation.

I also suggest, that you read this page on the RWE web site called AquaVentus.

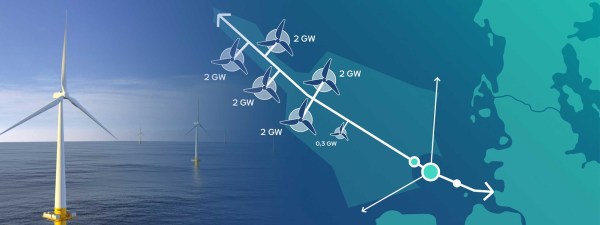

The page starts with this RWE graphic.

It appears that 10.3 GW of hydrogen will be created by wind farms and piped to North-West Germany.

These two paragraphs outline the AquaVentus initiative .

Hydrogen is considered the great hope of decarbonisation in all sectors that cannot be electrified, e.g. industrial manufacturing, aviation and shipping. Massive investments in the expansion of renewable energy are needed to enable carbon-neutral hydrogen production. After all, wind, solar and hydroelectric power form the basis of climate-friendly hydrogen.

In its quest for climate-friendly hydrogen production, the AquaVentus initiative has set its sights on one renewable energy generation technology: offshore wind. The initiative aims to use electricity from offshore wind farms to operate electrolysers also installed at sea on an industrial scale. Plans envisage setting up electrolysis units in the North Sea with a total capacity of 10 gigawatts, enough to produce 1 million metric tons of green hydrogen.

The page also gives these numbers.

- Total Capacity – 10 GW

- Tonnes Of Green Hydrogen – 1 million

- Members – 100 +

The web site says this about commissioning.

Commissioning is currently scheduled for early/mid 2030s.

The Germans can’t be accused of lacking ambition.

AquaVentus And The UK

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- There is a link to Denmark.

- There appears to be a undeveloped link to Norway.

- There appears to be a link to Peterhead in Scotland.

- There appears to be a link to just North of the Humber in England.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers distributing the hydrogen to where it is needed?

In the last century, the oil industry, built a substantial oil and gas network in the North Sea. It appears now the Germans are leading the building of a substantial hydrogen network.

AquaVentus And Aldbrough And Rough Gas Storage

Consider.

- In The Massive Hydrogen Project, That Appears To Be Under The Radar, I describe the Aldbrough Gas Storage.

- In Wood To Optimise Hydrogen Storage For Centrica’s Rough Field, I describe Centrica’s plans to turn Rough Gas Storage into the world’s largest hydrogen store.

- There is a small amount of hydrogen storage at Wilhelmshaven.

It looks like the East Riding Hydrogen Bank, will be playing a large part in ensuring the continuity and reliability of AquaVentus.

Dogger Bank South And AquaVentus

This Google Map shows the North Sea South of Sunderland and the Danish/German border.

Note.

- Sunderland is in the top-left hand corner of the map.

- A white line in the top-right corner of the map is the Danish/German border.

- Hamburg and Bremen are in the bottom-right hand corner of the map.

If you lay the AquaVentus map over this map, I believe that RWE’s Dogger Bank South wind farm could be one of the three 2 GW wind farms on the South-Western side of the AquaVentus main pipeline.

- Two GW would be converted to hydrogen and fed into the AquaVentus main pipeline.

- Two GW of hydrogen will be a nice little earner for UK plc.

- One GW of electricity would be sent to the UK.

But this is only one of many possibilities.

Conclusion

Could Jürgen Maier, be the man to develop British links to AquaVentus for the benefit of both the UK and Germany?

- The UK’s wind farms could provide a lot of hydrogen for AquaVentus.

- Aldbrough And Rough Gas Storage are conveniently places to add the hydrogen storage, that AquaVentus needs.

- AquaVentus can certainly be expanded to Norway, and possibly Orkney and Shetland.

He certainly has a lot of relevant experience.

No comments yet.

Leave a comment