US Installs 11.7 GW Of Clean Power In Record Q3

The title of this post, is the same as an article on Renewables Now.

Searching for the title of this post on Google AI gives this informative answer.

The United States installed a record 11.7 gigawatts (GW) of new utility-scale clean power capacity in the third quarter of 2025, marking a 14% increase over the same period in 2024. The data comes from the American Clean Power Association’s (ACP) latest “Clean Power Quarterly Market Report”.Key highlights from the report:

- Total Capacity: The 11.7 GW of new capacity includes utility-scale solar, energy storage, and onshore wind projects.

- Storage Surge: Battery storage set a new Q3 record with 4.7 GW installed, ensuring 2025 is on pace to be the biggest year for clean power deployment yet.

- Solar & Wind: Solar accounted for a large portion of new installations, and land-based wind increased 131% over Q3 2024.

- Strong Year Overall: Year-to-date installations reached 30.9 GW, already surpassing the pace of the previous record-setting year of 2024.

Despite the strong performance, the report also warns of future risks due to policy and regulatory uncertainty. Leading indicators, such as power purchase agreements (PPAs), fell significantly year-over-year, which points to potential slowdowns ahead. The full report with underlying datasets is available to ACP members, while a public version can be accessed via the press release on their website.

UK Breaks Yearly Record For Rooftop Solar PV Installations

The title of this post, is the same as that of this article on Solar Power Portal.

This is the sub-heading.

The 2025 rooftop installation figures represent the fifth consecutive year of year-on-year increases in rooftop solar deployments, according to MCS.

A few nuggets from the article.

- The UK has seen rooftop solar installations increase year-on-year since 2021.

- UK rooftop solar PV installations have hit 206,682 so far in 2025, a record for the sector that has pushed the total number of certified small-scale solar installations in the UK to 1.85 million.

- This is according to the latest figures from the Microgeneration Certification Scheme (MCS) Their web site is here.

- Somerset and Cornwall leading the country in installations, with 3,741 and 3,726, respectively. North Yorkshire (2,780), County Durham (2,668) and Wiltshire (2,545) make up the rest of the top five.

Great Britain is described as a very mature market. It certainly seems healthy too!

My Solar Panels

I have solar panels on the flat roof of my house.

In the last twelve months I have been paid.

- 29th November 2024 – £129.66

- 24th February 2025 – £31.58

- 27th May 2025 – £46.27

- 29th August 2025 – £114.63

Note.

- This is a total of £322.16

- There has been no servicing or charges from my energy supplier.

- My solar panels appear to have been installed in April 2016, according to the date on My Solar Panels Are On The Roof.

They’ve certainly been no trouble,

Operational UK Utility-Scale Ground Mount Solar Capacity Tips Over 14GWp, 2025 On Track For 2.5GWp

The title of this post, is the same as that of this article on Solar Power Portal.

This is the sub-heading.

Josh Cornes gives an overview of the UK’s operational solar capacity, which continues to rise at a healthy rate.

As I write this at five o’clock on a dark November evening.

- The UK is using 29.33 GW in total.

- 3.036 GW is coming from solar power.

- 8.939 GW is coming from wind power.

But as the graph shows the amount of solar is increasing year-on-year.

UK’s Largest Solar Plant Cleve Hill Supplying Full Power To The Grid

The title of this post, is the same as that of this article on the Solar Power Portal.

This is the sub-heading.

Quinbrook Infrastructure Partners has completed construction and started commercial operations of the 373MW Cleve Hill Solar Park, now the largest operational in the UK.

Note.

- According to Quinbrook, during the commissioning phase in May, electricity exports from Cleve Hill peaked at a level equivalent to 0.7% of the UK’s national power demand.

- Construction of the 373 MW solar project began in 2023, and Quinbrook said construction is now underway on a 150 MW co-located battery energy storage system (BESS).

- The gas-fired power stations at Coolkeeragh, Corby, Enfield, Great Yarmouth and Shoreham are all around 410-420 MW for comparison.

- On completion of the BESS, Cleve Hill will go from the largest solar plant in the UK to the largest co-located solar plus storage project constructed in the UK.

- The solar and storage plant was the first solar power project to be consented as a nationally significant infrastructure project (NSIP) and is supported by the largest solar + BESS project financing undertaken in the UK.

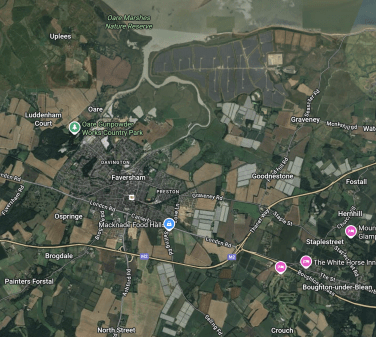

This Google Map shows the location of the solar farm with respect to Faversham.

Note.

The town of Faversham to the left of the middle of the map.

Faversham station has the usual railway station logo.

The North Kent coast is at the top of the map.

Cleve Hill Solar Park is on the coast to the East of the River Swale.

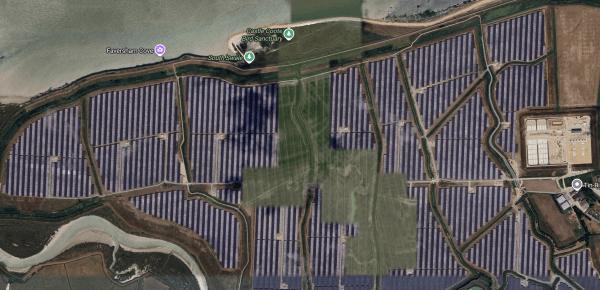

This second Google Map shows a close up of the solar farm.

Note.

- The large number of solar panels.

- The North Kent coast is at the top of the map.

- The River Swale in the South-West corner of the map.

- It appears that Cleve Hill substation is at the right edge of the map.

- The boxes at the left of the substation appear to be the batteries.

- The 630 MW London Array wind farm, which has been operational since 2013, also connects to the grid at Cleeve Hill substation.

- When completed, the London Array was the largest offshore wind farm in the world.

As a Control Engineer, I do like these Battery+Solar+Wind power stations, as they probably provide at least a reliable 500 MW electricity supply.

Could A System Like Cleeve Hill Solar Park Replace A 410 MW Gas-Fired Power Station?

The three elements of Cleeve Hill are as follows.

- Solar Farm – 373 MW

- BESS – 150 MW

- Wind Farm – 630 MW

That is a total of only 1,153 MW, which means a capacity factor of only 35.6 % would be needed.

How Much Power Does A Large Solar Roof Generate?

Some people don’t like solar panels on farmland, so how much energy do solar panels on a warehouse roof generate?

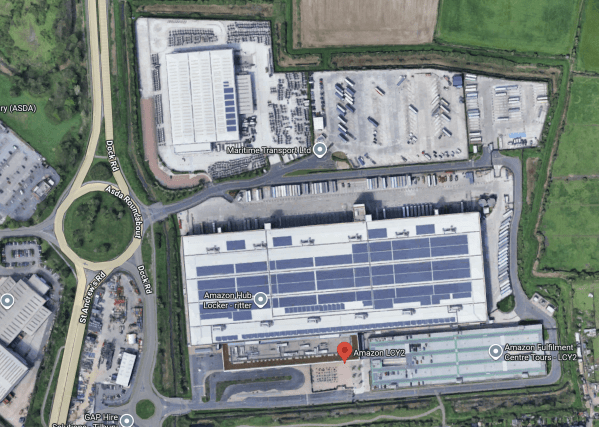

This Google Map shows Amazon’s warehouse at Tilbury.

I asked Google AI to tell me about Amazon’s solar roof at Tilbury and it said this.

Amazon’s solar roof at the Tilbury fulfillment center is the largest rooftop solar installation at any Amazon site in Europe, featuring 11,500 panels across the two-million-square-foot roof. Unveiled in 2020, it is part of Amazon’s larger goal to power its operations with 100% renewable energy by 2025 and reduce its emissions, contributing to its Climate Pledge to be net-zero carbon by 2040.

It generates 3.4 MW, which is less that one percent of Cleeve Hill Solar Park.

How Will The UK Power All These Proposed Data Centres?

On Wednesday, a cardiologist friend asked me if we have enough power to do Trump’s UK AI, so I felt this post might be a good idea.

Artificial Intelligence Gave This Answer

I first asked Google AI, the title of this post and received this reply.

The UK will power proposed data centres using a mix of grid-supplied low-carbon electricity from sources like offshore wind and through on-site renewable generation, such as rooftop solar panels. Data centre operators are also exploring behind-the-meter options, including battery storage and potential future nuclear power, to meet their significant and growing energy demands. However, the UK’s grid infrastructure and high energy prices present challenges, with industry calls for grid reform and inclusion in energy-intensive industry support schemes to facilitate sustainable growth.

Google also pointed me at the article on the BBC, which is entitled Data Centres To Be Expanded Across UK As Concerns Mount.

This is the sub-heading.

The number of data centres in the UK is set to increase by almost a fifth, according to figures shared with BBC News.

These are the first three paragraphs.

Data centres are giant warehouses full of powerful computers used to run digital services from movie streaming to online banking – there are currently an estimated 477 of them in the UK.

Construction researchers Barbour ABI have analysed planning documents and say that number is set to jump by almost 100, as the growth in artificial intelligence (AI) increases the need for processing power.

The majority are due to be built in the next five years. However, there are concerns about the huge amount of energy and water the new data centres will consume.

Where Are The Data Centres To Be Built?

The BBC article gives this summary of the locations.

More than half of the new data centres would be in London and neighbouring counties.

Many are privately funded by US tech giants such as Google and Microsoft and major investment firms.

A further nine are planned in Wales, one in Scotland, five in Greater Manchester and a handful in other parts of the UK, the data shows.

While the new data centres are mostly due for completion by 2030, the biggest single one planned would come later – a £10bn AI data centre in Blyth, near Newcastle, for the American private investment and wealth management company Blackstone Group.

It would involve building 10 giant buildings covering 540,000 square metres – the size of several large shopping centres – on the site of the former Blyth Power Station.

Work is set to begin in 2031 and last for more than three years.

Microsoft is planning four new data centres in the UK at a total cost of £330m, with an estimated completion between 2027 and 2029 – two in the Leeds area, one near Newport in Wales, and a five-storey site in Acton, north-west London.

And Google is building a data centre in Hertfordshire, an investment worth £740m, which it says will use air to cool its servers rather than water.

There is a map of the UK, with dots showing data centres everywhere.

One will certainly be coming to a suitable space near you.

Concerns Over Energy Needs

These three paragraphs from the BBC article, talk about the concerns about energy needs.

According to the National Energy System Operator, NESO, the projected growth of data centres in Great Britain could “add up to 71 TWh of electricity demand” in the next 25 years, which it says redoubles the need for clean power – such as offshore wind.

Bruce Owen, regional president of data centre operator Equinix, said the UK’s high energy costs, as well as concerns around lengthy planning processes, were prompting some operators to consider building elsewhere.

“If I want to build a new data centre here within the UK, we’re talking five to seven years before I even have planning permission or access to power in order to do that,” he told BBC Radio 4’s Today programme.

But in Renewable Power By 2030 In The UK, I calculated that by 2030 we will add these yearly additions of offshore wind power.

- 2025 – 1,235 MW

- 2026 – 4,807 MW

- 2027 – 5,350 MW

- 2028 – 4,998 MW

- 2029 – 9,631 MW

- 2030 – 15,263 MW

Note.

- I have used pessimistic dates.

- There are likely to be more announcements of offshore wind power in the sea around the UK, in the coming months.

- As an example in Cerulean Winds Submits 1 GW Aspen Offshore Wind Project In Scotland (UK), I talk about 3 GW of offshore wind, that is not included in my yearly totals.

- The yearly totals add up to a total of 58,897 MW.

For solar power, I just asked Google AI and received this answer.

The UK government aims to have between 45 and 47 gigawatts (GW) of solar power capacity by 2030. This goal is set out in the Solar Roadmap and aims to reduce energy bills and support the UK’s clean power objectives. The roadmap includes measures like installing solar on new homes and buildings, exploring solar carports, and improving access to rooftop solar for renters.

Let’s assume that we only achieve the lowest value of 45 GW.

But that will still give us at least 100 GW of renewable zero-carbon power.

What will happen if the wind doesn’t blow and the sun doesn’t shine?

I have also written about nuclear developments, that were announced during Trump’s visit.

- Centrica And X-energy Agree To Deploy UK’s First Advanced Modular Reactors

- Is Last Energy The Artemis Of Energy?

- National Grid And Emerald AI Announce Strategic Partnership To Demonstrate AI Power Flexibility In The UK

- Nuclear Plan For Decommissioned Coal Power Station

- Raft Of US-UK Nuclear Deals Ahead Of Trump Visit

- Rolls-Royce Welcomes Action From UK And US Governments To Usher In New ‘Golden Age’ Of Nuclear Energy

This is an impressive array of nuclear power, that should be able to fill in most of the weather-induced gaps.

In Renewable Power By 2030 In The UK, I also summarise energy storage.

For pumped storage hydro, I asked Google AI and received this answer.

The UK’s pumped storage hydro (PSH) capacity is projected to more than double by 2030, with six projects in Scotland, including Coire Glas and Cruachan 2, potentially increasing capacity to around 7.7 GW from the current approximately 3 GW. This would be a significant step towards meeting the National Grid’s required 13 GW of new energy storage by 2030, though achieving this depends on policy support and investment.

There will also be smaller lithium-ion batteries and long duration energy storage from companies like Highview Power.

But I believe there will be another source of energy that will ensure that the UK achieves energy security.

SSE’s Next Generation Power Stations

So far two of these power stations have been proposed.

Note.

- Both power stations are being designed so they can run on natural gas, 100 % hydrogen or a blend of natural gas and hydrogen.

- Keadby will share a site with three natural gas-powered power stations and be connected to the hydrogen storage at Aldbrough, so both fuels will be available.

- Ferrybridge will be the first gas/hydrogen power station on the Ferrybridge site and will have its own natural gas connection.

- How Ferrybridge will receive hydrogen has still to be decided.

- In Hydrogen Milestone: UK’s First Hydrogen-to-Power Trial At Brigg Energy Park, I describe how Centrica tested Brigg gas-fired power station on a hydrogen blend.

- The power stations will initially run on natural gas and then gradually switch over to lower carbon fuels, once delivery of the hydrogen has been solved for each site.

On Thursday, I went to see SSE’s consultation at Knottingley for the Ferrybridge power station, which I wrote about in Visiting The Consultation For Ferrybridge Next Generation Power Station At Knottingley.

In the related post, I proposed using special trains to deliver the hydrogen from where it is produced to where it is needed.

Could HiiROC Be Used At Ferrybridge?

Consider.

- HiiROC use a process called thermal plasma electrolysis to split any hydrocarbon gas into hydrogen and carbon black.

- Typical input gases are chemical plant off gas, biomethane and natural gas.

- Carbon black has uses in manufacturing and agriculture.

- HiiROC uses less energy than traditional electrolysis.

- There is an independent power source at Ferrybridge from burning waste, which could be used to ower a HiiROC system to generate the hydrogen.

It might be possible to not have a separate hydrogen feed and still get worthwhile carbon emission savings.

Conclusion

I believe we will have enough electricity to power all the data centres, that will be built in the next few years in the UK.

Some of the new power stations, that are proposed to be built, like some of the SMRs and SSE’s Next Generation power stations could even be co-located with data centres or other high energy users.

In Nuclear Plan For Decommissioned Coal Power Station, I describe how at the former site of Cottam coal-fired power station, it is proposed that two Holtec SMR-300 SMRs will be installed to power advanced data centres. If the locals are objecting to nuclear stations, I’m sure that an SSE Next Generation power station, that was burning clean hydrogen, would be more acceptable.

Nuclear Plan For Decommissioned Coal Power Station

The title of this post, is the same as that of this article on the BBC.

This is the sub-heading.

Nuclear power could be generated on the site of a former coal power station in Nottinghamshire.

These first four paragraphs add details.

Cottam Power Station was decommissioned in 2019, and in August its eight 114m (375ft) cooling towers were demolished.

Three businesses – American energy firm Holtec International, EDF UK, and real estate manager Tritax – have now signed an agreement to set up a small modular reactor (SMR) to power “advanced” data centres at the 900-acre site.

Holtec said the project could create “thousands of high-skilled manufacturing and construction jobs”, as well as “long-term roles”.

The SMR at Cottam would be the second of its kind, following the creation of a plant at Palisades in Michigan, in the US.

Note.

- Cottam was a 2,000 MW power station, that could run on coal, oil and biomass.

- If a nuclear power station is built at Cottam, it will be one of the first nuclear stations not close to the coast.

I asked Google AI for details of the plant at Palisades in Michigan and received this reply.

The Palisades SMR project at the Palisades Nuclear Plant in Michigan will feature two Holtec SMR-300 units, each producing at least 300 megawatts of power, for a combined total of at least 600-640 megawatts of net power. This project aims to have the first US dual-unit SMR 300 system operational by 2030, and the SMRs are designed to produce electricity and provide steam for other industrial purposes.

It does appear that the new generation of reactors from Holtec, Rolls-Royce and X-energy are smaller than many nuclear reactors built in the last twenty years.

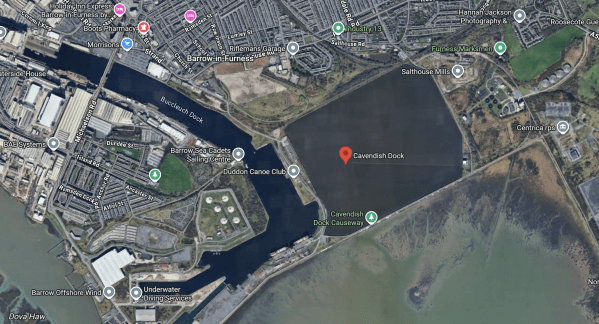

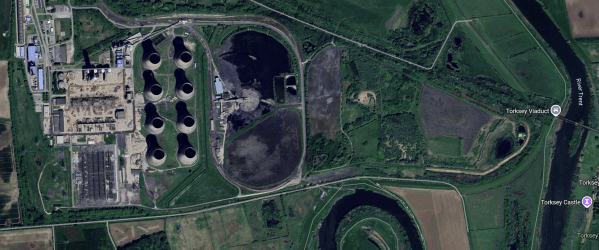

This Google Map shows the Cottam site.

Note.

- The River Trent surrounds the site.

- Could the Trent be used for cooling water?

- The cooling towers are still in place, so the image must have been taken before August.

- The sub-station is in the South-West corner of the site.

- The railway over Torksey viaduct is disused.

It would appear that there is generous space for the SMRs and a few data centres.

The Cottam Solar Project

In DCO Decision On 480MW West Burton Solar NSIP Delayed Until 2025, I wrote about three large solar projects in Eastern England.

The Cottam Solar Project was one of the projects and wants to use the Cottam site.

- The Cottam Solar Project has a web site.

- It will have a capacity of 600 MW, with a battery, with a battery with a 600 MW output and a 600 MWh capacity.

- The solar farm will use the grid connection of the former coal-powered Cottam power station.

- The project is massive and will cover 1270 hectares.

Will this solar project lease space for the SMR, so they can co-exist?

Conclusion

It does appear that there are more than one use for old coal-fired power station sites.

Renewable Power By 2030 In The UK

I am doing this to see what the total output will be by the net election.

Offshore Wind Power

I shall start with offshore wind power.

- Operational in July 2025 – 16,035 MW

- 2025 – Dogger Bank A – 1,235 MW

- 2026 – Sofia – 1,400 MW

- 2026 – Dogger Bank B – 1,235 MW

- 2026 – East Anglia 1 North – 800 MW

- 2026 – East Anglia 3 – 1,372 MW

- 2027 – Dogger Bank C – 1,218 MW

- 2027 – Hornsea 3 – 2,852 MW

- 2027 – Inch Cape – 1,080 MW

- 2027 – Llŷr 1 – 100 MW

- 2027 – Llŷr 2 – 100 MW

- 2027 – Norfolk Boreas – 1,380 M

- 2027 – Whitecross – 100 MW

- 2028 – Aspen – 1008 MW

- 2028 – Morecambe – 480 MW

- 2028 – Ossian – 2,610 MW

- 2028 – Stromar – 900 MW

- 2029 – Beech – 1008 MW

- 2029 – East Anglia 2 – 967 MW

- 2029 – Green Volt – 400 MW

- 2029 – Mona – 1,500 MW

- 2029 – Morgan – 1,500 MW

- 2029 – Norfolk Vanguard East – 1,380 MW

- 2029 – Norfolk Vanguard West – 1,380 MW

- 2029 – North Falls – 504 MW

- 2029 – West of Orkney – 2,000 MW

- 2030 – Awel y Môr – 500 MW

- 2030 – Bellrock – 1,200 MW

- 2030 – Berwick Bank – 4,100 MW

- 2030 – Caledonia – 2,000 MW

- 2030 – Cedar – 1008 MW

- 2030 – Five Estuaries – 353 MW

- 2030 – Morven – 2,907 MW

- 2030 – N3 Project – 495 MW

- 2030 – Outer Dowsing – 1,500 MW

- 2030 – Rampion 2 Extension – 1,200 MW

This gives these yearly totals, if I use pessimistic dates.

- 2025 – 1,235 MW

- 2026 – 4,807 MW

- 2027 – 5,350 MW

- 2028 – 4,998 MW

- 2029 – 9,631 MW

- 2030 – 15,263 MW

This adds up to a total of 58,897 MW.

Solar Power

For solar power, I just asked Google AI and received this answer.

The UK government aims to have between 45 and 47 gigawatts (GW) of solar power capacity by 2030. This goal is set out in the Solar Roadmap and aims to reduce energy bills and support the UK’s clean power objectives. The roadmap includes measures like installing solar on new homes and buildings, exploring solar carports, and improving access to rooftop solar for renters.

Let’s assume that we only achieve the lowest value of 45 GW.

But that will still give us at least 100 GW of renewable zero-carbon power.

Energy Storage

For pumped storage hydro, I asked Google AI and received this answer.

The UK’s pumped storage hydro (PSH) capacity is projected to more than double by 2030, with six projects in Scotland, including Coire Glas and Cruachan 2, potentially increasing capacity to around 7.7 GW from the current approximately 3 GW. This would be a significant step towards meeting the National Grid’s required 13 GW of new energy storage by 2030, though achieving this depends on policy support and investment.

It looks like there is about another 5 GW of capacity to find.

Global Offshore Wind Capacity Reaches 83 GW, 100 GW More To Be Awarded in 2025-2026, New Report Says

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

According to a new market report from the Global Wind Energy Council (GWEC), there are now 83 GW of offshore wind capacity installed globally, with 48 GW more in the construction phase worldwide as of May this year.

The first paragraph is a quote from Rebecca Williams, Deputy CEO at GWEC.

Our report finds that there is now already 83 GW of offshore wind installed worldwide, keeping the lights on for 73 million households, and powering countries’ economic development. There is currently a further 48 GW of offshore wind [under] construction worldwide. With its unique position in the marine space, and ability to produce large amounts of reliable, homegrown power, nations around the world are pushing forward the technology to enhance their energy independence and autonomy

I doubt Ms. Williams will be on the Donald Trump’s Christmas card list.

The article is worth a full read, as it contains some interesting statistics.

This is the last paragraph of the article.

Global Wind Energy Council’s 2024 global offshore wind outlook for total additions in the 2025-2029 period was 156.72 GW, which has now been downgraded to 118.56 GW.

These are my estimates for the amount of offshore wind in the UK.

- Currently Installed – 16, 035 MW

- To Be Installed in 2025 – 1,235 MW

- To Be Installed in 2026 – 4,907 MW

- To Be Installed in 2027 – 5,750 MW

- To Be Installed in 2028 – 480 MW

- To Be Installed in 2029 – 1,363 MW

The UK should be installing 13,735 MW, which would.

- Lift total offshore wind capacity to 29.8 GW.

- This is an 86 % increase in capacity from July 2025.

- As I write this, we are using 29.3 GW.

- We would be adding 11.6 % of the global additions for 2025-2029, which isn’t bad for such a small country.

All this wind will need to be backed up, for when the wind doesn’t blow.

So I asked Google AI how much electricity storage we will have by 2029 and got this AI Overview.

In 2029, the UK is expected to have a significant amount of battery energy storage capacity, with estimates ranging from 27 to 29 GW, according to the House of Commons Library and Cornwall Insight. This capacity is crucial for supporting the UK’s transition to a clean energy system and ensuring a stable electricity supply.

Obviously, Google AI isn’t that intelligent, as it made the mistake made by many electricity storage companies of just giving the output of the battery, as it sounds better, rather than both the output and the storage capacity.

Consider.

- Most Battery Energy Storage Systems (BESS) can provide two hours of output.

- Highview Power’s big batteries are 200 MW/2.5 GWh, so will provide 12.5 hours of output.

If I assume that the average storage is just two hours, that means the available storage will be at least 54 GWh.

Given that we also had 16 GW of solar power in June 2024 and if this increases at a similar rate to offshore wind power, it will certainly be able to help fill the energy storage, I think we’ll have enough renewable energy to play a big part in the next election.

About The Global Wind Energy Council (GWEC)

I asked Google AI for a summary about GWEC and got this AI Overview.

The Global Wind Energy Council (GWEC) has its global headquarters in Lisbon, Portugal. Additionally, they have offices in Brussels, Belgium; Singapore; and London, UK.

GWEC’s presence is not limited to these locations, as they have a global network of experts working across different continents, according to the organization’s website. Their flagship report, the Global Wind Report, is launched annually in London. For example, the 2025 report launch took place in London.

Unsurprisingly, it doesn’t mention an office in the United States.

The report, which forms the basis of this post, can be downloaded from the GWEC web site.