Iberdrola Looking To Sell 49 Pct Stake In UK Offshore Wind Farm – Report

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Iberdrola has begun exploring the sale of 49 per cent of its East Anglia Two offshore wind farm project in the UK, according to a report by the Spanish media outlet Cinco Días citing unnamed sources.

These four paragraphs give more details.

The renewable energy developer has already engaged Bank of America and BBVA as financial advisors to assist with the potential transaction, Cinco Días writes.

Iberdrola’s interest in selling a nearly half stake in East Anglia Two mirrors previous deals in the East Anglia portfolio, where the company has brought in financial partners in two other phases, East Anglia One and East Anglia Three.

The 714 MW East Anglia One offshore wind farm is owned by Iberdrola’s UK arm ScottishPower Renewables and Macquarie’s Green Investment Group (GIG), with Octopus Energy having acquired a 10 per cent stake from GIG this April. East Agnlia One has been in operation since 2021.

In July this year, Iberdrola and UAE clean energy company Masdar announced what the companies said was the largest offshore wind transaction of the decade as they signed an agreement to co-invest in the 1.4 GW East Anglia Three project, currently under construction.

But then being bought and sold is the way of life for an offshore wind farm.

In 2018, I wrote World’s Largest Wind Farm Attracts Huge Backing From Insurance Giant, which contains this extract from the Times says this about the funding of wind farms.

Wind farms throw off “long-term boring, stable cashflows”, Mr. Murphy said, which was perfect to match Aviva policyholders and annuitants, the ultimate backers of the project. Aviva has bought fixed-rate and inflation-linked bonds, issued by the project. While the coupon paid on the 15-year bonds, has not been disclosed, similar risk projects typically pay an interest rate of about 3 per cent pm their bonds. Projects typically are structured at about 30 per cent equity and 70 per cent debt.

Darryl Murphy is Aviva’s head of infrastructure debt. The article also says, that Aviva will have a billion pounds invested in wind farms by the end of the year.

I wonder how long it will be before individual investors can fund their pensions, with a direct investment in a wind farm?

- The wind farm would surely be a better investment if it had an integrated battery to supply power, when the wind didn’t blow.

- It would probably also be a safer investment, if it had been generating electricity for some years.

After all, at the present time, you can invest in batteries through companies like Gresham House and Gore Street.

RWE, Masdar Move Forward With 3 GW Dogger Bank South Offshore Wind Farms

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK’s Planning Inspectorate has concluded its six-month Nationally Significant Infrastructure Project (NSIP) examination period for the Dogger Bank South (DBS) offshore wind farms, being developed by RWE and Abu Dhabi’s Masdar.

These two introductory paragraphs add more details.

Since the start of the examination this January, the Planning Inspectorate has assessed the environmental, socio-economic, and technical attributes of the DBS projects against the UK’s standards for sustainable infrastructure development.

The Inspectorate plans to prepare and submit a detailed report with recommendations to the Secretary of State for Energy Security and Net Zero within the next three months, and a consent decision is expected within the next six months.

The development of this wind farm moves on.

- The lease with the Crown Estate was signed in Jan 2023.

- In November 2023, Masdar took a 49 % stake as I reported in RWE Partners With Masdar For 3 GW Dogger Bank South Offshore Wind Projects.

But there is no completion date anywhere for the whole project, that I can find with Google.

If you type RWE offshore electrolysis into Google AI, you get this answer.

RWE is actively involved in several hydrogen projects utilizing offshore wind power for electrolysis, particularly in the Netherlands and Germany. These projects aim to produce green hydrogen, which is then used in various applications like industrial processes, transportation, and potentially for export. RWE is a major player in offshore wind and is leveraging this experience to advance hydrogen production.

Note.

- RWE are one of the largest, if not the largest electricity generator in the UK.

- In RWE Opens ‘Grimsby Hub’ For Offshore Wind Operations And Maintenance, I stated that RWE are developing almost 12 GW of offshore wind power around our shores.

So just as RWE are utilizing offshore wind power for electrolysis, particularly in the Netherlands and Germany, could they be also be planning to do the same in UK waters with the Dogger Bank South wind farm?

The hydrogen would be brought ashore in a pipeline.

There would be no need for any 3 GW overhead power lines marching across East Yorkshire and around the town of Beverley.

Two large hydrogen stores are being developed at Aldbrough and Rough in East Yorkshire.

H2ercules And AquaVentus

These are two massive German projects, that will end the country’s reliance on Russian gas and coal.

- H2ercules is a series of pipelines that will distribute the hydrogen in Southern Germany.

- AquaVentus will build a network of pipelines to bring 10.3 GW of green hydrogen from the North Sea to the German mainland for H2ercules to distribute.

Germany is embracing hydrogen in a big way.

- I introduce AquaVentus in AquaVentus, which I suggest you read.

- AquaVentus is being developed by RWE.

- AquaVentus connects to a German hydrogen network called H2ercules to actually distribute the hydrogen.

This video shows the structure of AquaVentus.

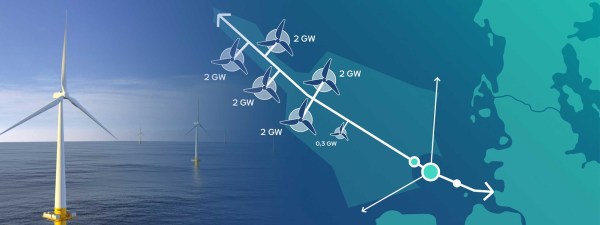

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Rough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

I believe that offshore electrolysers could be built in the area of the Hornsea 4, Dogger Bank South and other wind farms and the hydrogen generated would be taken by AquaVentus to either Germany or the UK.

- Both countries get the hydrogen they need.

- Excess hydrogen would be stored in Aldbrough and Rough.

- British Steel at Scunthorpe gets decarbonised.

- A 1.8 GW hydrogen-fired powerstation at Keadby gets the hydrogen it needs to backup the wind farms.

Germany and the UK get security in the supply of hydrogen.

3 GW Dogger Bank South Offshore Wind Farms Reach New Development Stage

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK Planning Inspectorate has accepted into the examination phase the Development Consent Order (DCO) application for the Dogger Bank South (DBS) Offshore Wind Farms developed by RWE and Masdar.

The first two paragraphs give a brief description of the wind Farm.

The DBS East and DBS West offshore wind farms, which could provide electricity for up to three million typical UK homes, are located in shallow waters on the Dogger Bank over 100 kilometres off the northeast coast of England. The acceptance of the DCO application moves the projects into the pre-examination phase, which will become subject to a public examination later in 2024.

Together, the projects will have up to 200 turbines with a combined estimated capacity of 3 GW. Investment by RWE and Masdar during development and construction is predicted to deliver an economic contribution (Gross Value Added) to the UK of almost GBP 1 billion, including GBP 400 million in the Humber region.

There is a detailed map in the article on offshoreWIND.biz.

The Next Steps

These are given in the article.

The next steps for the projects, following a successful Development Consent Order, would be to secure Contracts for Difference (CfD), followed by financing and construction, the developers said.

It certainly looks like the 3 GW Dogger South Bank Wind Farm is on its way.

These are my thoughts about the project.

The Turbines To Be Used

The article says this about the turbines.

Together, the projects will have up to 200 turbines with a combined estimated capacity of 3 GW.

This means that the turbines will be 15 MW.

In RWE Orders 15 MW Nordseecluster Offshore Wind Turbines At Vestas, I said this.

Does this mean that the Vestas V236-15.0 MW offshore wind turbine, is now RWE’s standard offshore turbine?

This would surely have manufacturing, installation, operation and maintenance advantages.

There would surely be advantages for all parties to use a standard turbine.

It’s A Long Way Between Yorkshire And The Dogger Bank

The article says it’s a hundred kilometres between the wind farm and the coast of Yorkshire.

Welcome To The Age Of Hydrogen

This is the title of this page of the RWE web site.

The page starts with this paragraph.

RWE is actively involved in the development of innovative hydrogen projects. The H2 molecule is considered to be an important future building block of a successful energy transition. RWE is a partner in over 30 H2 projects and is working on solutions for decarbonising the industry with associations and corporations like Shell, BASF and OGE. Hydrogen projects are comprehensively supported in the separate Hydrogen department of the subsidiary RWE Generation.

AquaVentus

I also suggest, that you read this page on the RWE web site called AquaVentus.

The page starts with this RWE graphic.

It appears that 10.3 GW of hydrogen will be created by wind farms and piped to North-West Germany.

These two paragraphs outline the AquaVentus initiative .

Hydrogen is considered the great hope of decarbonisation in all sectors that cannot be electrified, e.g. industrial manufacturing, aviation and shipping. Massive investments in the expansion of renewable energy are needed to enable carbon-neutral hydrogen production. After all, wind, solar and hydroelectric power form the basis of climate-friendly hydrogen.

In its quest for climate-friendly hydrogen production, the AquaVentus initiative has set its sights on one renewable energy generation technology: offshore wind. The initiative aims to use electricity from offshore wind farms to operate electrolysers also installed at sea on an industrial scale. Plans envisage setting up electrolysis units in the North Sea with a total capacity of 10 gigawatts, enough to produce 1 million metric tons of green hydrogen.

The page also gives these numbers.

- Total Capacity – 10 GW

- Tonnes Of Green Hydrogen – 1 million

- Members – 100 +

The web site says this about commissioning.

Commissioning is currently scheduled for early/mid 2030s.

The Germans can’t be accused of lacking ambition.

AquaVentus And The UK

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- There is a link to Denmark.

- There appears to be a undeveloped link to Norway.

- There appears to be a link to Peterhead in Scotland.

- There appears to be a link to just North of the Humber in England.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers distributing the hydrogen to where it is needed?

In the last century, the oil industry, built a substantial oil and gas network in the North Sea. It appears now the Germans are leading the building of a substantial hydrogen network.

AquaVentus And Aldbrough And Rough Gas Storage

Consider.

- In The Massive Hydrogen Project, That Appears To Be Under The Radar, I describe the Aldbrough Gas Storage.

- In Wood To Optimise Hydrogen Storage For Centrica’s Rough Field, I describe Centrica’s plans to turn Rough Gas Storage into the world’s largest hydrogen store.

- There is a small amount of hydrogen storage at Wilhelmshaven.

It looks like the East Riding Hydrogen Bank, will be playing a large part in ensuring the continuity and reliability of AquaVentus.

Dogger Bank South And AquaVentus

This Google Map shows the North Sea South of Sunderland and the Danish/German border.

Note.

- Sunderland is in the top-left hand corner of the map.

- A white line in the top-right corner of the map is the Danish/German border.

- Hamburg and Bremen are in the bottom-right hand corner of the map.

If you lay the AquaVentus map over this map, I believe that Dogger Bank South wind farm could be one of the three 2 GW wind farms on the South-Western side of the AquaVentus main pipeline.

- Two GW would be converted to hydrogen and fed into the AquaVentus main pipeline.

- One GW of electricity would be sent to the UK.

But this is only one of many possibilities.

Hopefully, everything will be a bit clearer, when RWE publish more details.

Conclusion

I believe, that some or all of the Dogger Bank South electricity, will be converted to hydrogen and fed into the AquaVentus main pipeline.

I also believe, that the hydrogen stores in the East Riding of Yorkshire, will form an important part of AquaVentus.

World’s First Floating Wind Farm To Undergo First Major Maintenance Campaign, Turbines To Be Towed To Norwegian Port

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The world’s first commercial-scale floating wind farm, the 30 MW Hywind Scotland, officially entered the operations and maintenance (O&M) phase in October 2017. After a little over six years of operation, the wind farm’s Siemens Gamesa wind turbines are now due for some major maintenance work.

And this is the first paragraph.

While offshore wind farms undergo turbine maintenance work more than once during their lifespans and tasks such as major component exchange are nothing uncommon, this is the first time a campaign of this kind will be done on a floating farm.

Hywind Scotland has a web site, where this is said on the home page.

The world’s first floating wind farm, the 30 MW Hywind Scotland pilot park, has been in operation since 2017, demonstrating the feasibility of floating wind farms that could be ten times larger.

Equinor and partner Masdar invested NOK 2 billion to realise Hywind Scotland, achieving a 60-70% cost reduction compared with the Hywind Demo project in Norway. Hywind Scotland started producing electricity in October 2017.

Each year since Hywind Scotland started production the floating wind farm has achieved the highest average capacity factor of all UK offshore windfarms, proving the potential of floating offshore wind farms.

This news item from Equinor is entitled Equinor Marks 5 Years Of Operations At World’s First Floating Wind Farm, says this about the capacity factor of Hywind Scotland.

Hywind Scotland, located off the coast of Peterhead, Scotland, is the world’s first floating offshore wind farm and the world’s best-performing offshore wind farm, achieving a capacity factor of 54% over its five years of operations. Importantly, Hywind Scotland has run to high safety standards, marking five years of no loss time injuries during its operation.

Any capacity factor over 50 % is excellent and is to be welcomed.

Maintaining A Floating Wind Farm

One of the supposed advantages of floating wind farms, is that the turbines can be towed into port for maintenance.

This first major maintenance of a floating wind farm, will test that theory and hopefully provide some spectacular pictures.

Masdar To Invest In Iberdrola’s 1.4 GW East Anglia Offshore Wind Project

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Iberdrola and Masdar have signed a strategic partnership agreement to evaluate the joint development of offshore wind and green hydrogen projects in Germany, the UK, and the US, which also includes an investment in Iberdrola’s 1.4 GW East Anglia 3 offshore wind project in the UK.

These first two paragraphs outline the del.

After the parties’ successful co-investment in the Baltic Eagle offshore wind farm in Germany, the new milestone of this alliance will be to achieve a further co-investment concerning the 1.4 GW East Anglia 3 offshore wind project in the UK, said the companies.

According to the partners, the deal has been under negotiation for the last few months and could be signed by the end of the first quarter of 2024. Masdar’s stake in the wind farm could be 49 per cent.

This deal appears to be very similar to Masdar’s deal with RWE, that I wrote about in RWE Partners With Masdar For 3 GW Dogger Bank South Offshore Wind Projects.

- The Iberdrola deal involves the 1.4 GW East Anglia 3 wind farm, which has a Contract for Difference at £37.35 £/MWh and is scheduled to be completed by 2026.

- The RWE deal involves the 3 GW Dogger Bank South wind farm, which doesn’t have a Contract for Difference and is scheduled to be completed by 2031.

- Both deals are done with wind farm developers, who have a long track record.

- Both wind farms are the latest to be built in mature clusters of wind farms, so there is a lot of production and maintenance data available.

I suspect, that many capable engineers and accountants can give an accurate prediction of the cash flow from these wind farms.

I will expect that we’ll see more deals like this, where high quality wind farms are sold to foreign energy companies with lots of money.

Just over five years ago, I wrote World’s Largest Wind Farm Attracts Huge Backing From Insurance Giant, which described how and why Aviva were investing in the Hornsea 1 wind farm.

Conclusion

It appears that Masdar are doing the same as Aviva and usind wind farms as a safe investment for lots of money.

RWE Partners With Masdar For 3 GW Dogger Bank South Offshore Wind Projects

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

RWE has signed an agreement with UAE’s Masdar as a partner for its 3 GW Dogger Bank South (DBS) offshore wind projects in the UK.

These three paragraphs outline the deal.

The partners acknowledged the signing of the new partnership during a ceremony at COP28 in Dubai.

Masdar will acquire a 49 per cent stake in the landmark renewables projects while RWE, with a 51 per cent share, will remain in charge of development, construction, and operation throughout the life cycle of the projects.

RWE’s proposed DBS offshore wind project is made up of two offshore wind farms, Dogger Bank South East and Dogger Bank South West (DBS East and DBS West), each 1.5 GW, which are located over 100 kilometres offshore in the shallow area of the North Sea known as Dogger Bank.

Note.

- Masdar is an energy company headquartered in Abu Dubai.

- The Chairman of Masdar is President of COP28.

Does this deal indicate that wind farms are good investments for those individuals, companies and organisations with money?