1.4GW Of BESS Capacity Could Be Co-Located With AR6 Winners

The title of this post, is the same as that of this article on Solar Power Portal.

These are the first two introductory paragraphs of the article.

Analysis from Modo Energy has revealed that renewable energy projects awarded contracts under the Contracts for Difference (CfD) Allocation Round 6 (AR6) could facilitate 1.4GW of co-located battery energy storage systems (BESS).

While BESS projects themselves cannot directly participate in the CfD auction, projects awarded contracts are able to co-locate with a battery. Following changes to the rules following Allocation Round 4, BESS co-location is now a far easier prospect for generators, and AR6 saw record high levels of awards for solar projects.

Modo Energy have used two rules to decide which projects will have a battery.

Modo Energy analysis suggests that 5GW of the 9.6GW of renewable energy capacity awarded contracts in AR6 could be suitable for, or has already revealed plans for, co-located battery storage. As a result, as much as 1.4GW of BESS capacity could be created as part of new renewable projects resulting from the AR6.

Using an average ratio of 60MW of BESS capacity for every 100MW of solar generation capacity, Modo Energy has calculated that 1GW of this potential BESS capacity could come from solar projects alone.

Longfield Solar Energy Farm

The article and related documents also say this about Longfield Solar Energy farm.

- This could be the largest battery to co-locate with renewables from this allocation round.

- The project does have a web site.

- The farm has a 399 MW solar array.

- The web site says that the project will store or export up to 500 MW to and from the grid.

- The project is being developed by EDF Renewables.

- The solar farm appears to be North-East of Chelmsford.

The project should be completed by 2027/28.

Conclusion

As time goes on, we’lll see more and more batteries of all kinds co-located with renewable resources.

Solar With Battery In Germany Now Cheaper Than Conventional Power

The title of this post, is the same as that of this article on Renewables Now.

These two paragraphs outline the article.

Ground-mounted solar PV and onshore wind energy are the most cost-effective technologies among all types of new power plants in Germany, with levelised cost of electricity (LCOE) ranging from EUR 41 (USD 44.75) to EUR 92 per MWh, according to a study by research institute Fraunhofer ISE.

The LCOE for new solar installations in combination with battery systems vary between EUR 60 and EUR 225 per MWh reflecting the high cost differences for battery and solar systems along with the different levels of solar radiation.

Note.

- The article states that these figures are lower than newly-built coal and gas-fired power plants.

- The Fraunhofer Institute for Solar Energy Systems ISE in Freiburg, Germany is the largest solar research institute in Europe.

The original Renewables Now article is well worth reading in full.

Conclusion

This paragraph concludes the Renewables Now article.

These calculations show that the large-scale projects currently underway in Germany, which combine ground-mounted PV systems, wind farms and stationary battery storage systems, are good investments,” says Christoph Kost, head of the Energy System Analysis Department at Fraunhofer ISE and lead author of the study.

As the climate for much of Northern Europe is not that different to Germany, I suspect we’ll be seeing large numbers of hybrid wind/solar/battery power plants created in the next few years.

Gresham House Energy Storage Reaches 1 Gigawatt Of Capacity

The title of this post, announcing a major milestone for Gresham House Energy Storage Fund appears on several web pages.

Many grid batteries are designed to give full power for two hours, so applying that rule to the Gresham House Energy Storage fleet, will mean that the total fleet would be a 1 GW/2 GWh battery.

Consider.

- In Centrica Business Solutions And Highview Power, I showed how Highview Power’s batteries could be used, instead of lithium-ion batteries.

- Highview Power’s largest battery is 200 MW/2.5 GWh, which compares well with the largest lithium-ion batteries, in the UK fleet.

- The Ffestiniog Power Station is a 360 MW/1.44 GWh pumped-storage hydroelectric power station in Wales. It is slightly smaller than Highview Power’s largest battery.

- Moss Landing Power Plant in California is proposing to have a 1,500 MW / 6,000 MWh lithium-ion battery.

- Other GWh-scale systems are under trial.

It would appear that battery systems are widening the sizes of where they can be employed.

This hopefully, will mean more competition and keener prices for battery systems.

UK Infrastructure Bank, Centrica & Partners Invest £300M in Highview Power Clean Energy Storage Programme To Boost UK’s Energy Security

The title of this post, is the same as that of this news item from Highview Power.

This is the sub-heading.

Highview Power kickstarts its multi-billion pound renewable energy programme to accelerate the UK’s transition to net zero in Carrington, Manchester.

These three paragraphs outline the investment.

Highview Power has secured the backing of the UK Infrastructure Bank and the energy industry leader Centrica with a £300 million investment for the first commercial-scale liquid air energy storage (LAES) plant in the UK.

The £300 million funding round was led by the UK Infrastructure Bank (UKIB) and the British multinational energy and services company Centrica, alongside a syndicate of investors including Rio Tinto, Goldman Sachs, KIRKBI and Mosaic Capital.

The investment will enable the construction of one of the world’s largest long duration energy storage (LDES) facilities in Carrington, Manchester, using Highview Power’s proprietary LAES technology. Once complete, it will have a storage capacity of 300 MWh and an output power of 50 MWs per hour for six hours. Construction will begin on the site immediately, with the facility operational in early 2026, supporting over 700 jobs in construction and the supply chain.

Note.

- The backers are of a high quality.

- The Carrington LDES appears to be a 50 MW/300 MWh battery.

It finally looks like Highview Power is on its way.

These are my thoughts on the rest of news item.

Centrica’s Involvement

This paragraph talks about Centrica’s involvement.

Energy leader Centrica comes on board as Highview Power’s strategic partner and a key player in the UK’s energy transition, supporting Carrington and the accelerated roll-out of the technology in the UK through a £70 million investment. The programme will set the bar for storage energy systems around the world, positioning the UK as the global leader in energy storage and flexibility.

I suspect that Centrica have an application in mind.

In Centrica Business Solutions Begins Work On 20MW Hydrogen-Ready Peaker In Redditch, I talk about how Centrica is updating an old peaker plant.

In the related post I refer to this news item from Centrica Business Systems.

This paragraph in the Centrica Business Systems news item, outlines Centrica’s plans.

The Redditch peaking plant is part of Centrica’s plans to deliver around 1GW of flexible energy assets, that includes the redevelopment of several legacy-owned power stations, including the transformation of the former Brigg Power Station in Lincolnshire into a battery storage asset and the first plant in the UK to be part fuelled by hydrogen.

As Redditch power station is only 20 MW, Centrica could be thinking of around fifty assets of a similar size.

It seems to me, that some of these assets could be Highview Power’s LDES batteries of an appropriate size. They may even be paired with a wind or solar farm.

Larger Systems

Highview Power’s news item, also has this paragraph.

Highview Power will now also commence planning on the next four larger scale 2.5 GWh facilities (with a total anticipated investment of £3 billion). Located at strategic sites across the UK, these will ensure a fast roll-out of the technology to align with UK LDES support mechanisms and enable the ESO’s Future Energy Scenario Plans.

Elsewhere on their web site, Highview Power say this about their 2.5 GWh facilities.

Highview Power’s next projects will be located in Scotland and the North East and each will be 200MW/2.5GWh capacity. These will be located on the national transmission network where the wind is being generated and therefore will enable these regions to unleash their untapped renewable energy potential and store excess wind power at scale.

So will the four larger systems have a 200MW/2.5GWh capacity?

They could, but 200 MW may not be an appropriate output for the location. Or a longer duration may be needed.

Highview Power’s design gives the flexibility to design a system, that meets each application.

Working With National Grid

Highview Power’s news item, also has this sentence.

Highview Power’s technology will also provide stability services to the National Grid, which will allow for the long-term replacement of fossil fuel-based power plants for system support.

Highview Power’s technology is also an alternative to Battery Energy Storage Systems (BESS) of a similar capacity.

How does Highview Power’s technology compare with the best lithium-ion systems on price, performance and reliability?

Curtailment Of Wind Farms

Highview Power’s news item, also has these two paragraphs.

This storage will help reduce curtailment costs – which is significant as Britain spent £800m in 2023 to turn off wind farms.

Highview Power aims to accelerate the roll-out of its larger facilities across the UK by 2035 in line with one of National Grid’s target scenario forecasts of a 2 GW requirement from LAES, which would represent nearly 20% of the UK’s long duration energy storage needs. By capturing and storing excess renewable energy, which is now the cheapest form of electricity, storage can help keep energy costs from spiralling, and power Britain’s homes with 24/7 renewable clean energy.

I can see several wind farms, that are regularly curtailed would have a Highview Power battery installed at their onshore substation.

Receently, I wrote Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, which described how Ørsted are installing a 300 MW/600 MWh Battery Energy Storage Systems (BESS) at Swardeston substation, where Hornsea Three connects to the grid.

I would suspect that the purpose of the battery is to avoid turning off the wind farm.

Would a Highview Power battery be better value?

What’s In It For Rio Tinto?

I can understand, why most companies are investing, but Rio Tinto are a mining company. My only thought is that they have a lot of redundant holes in the ground, that cost them a lot of money and by the use of Highview Power’s technology, they can be turned into productive assets.

Collateral Benefits

Highview Power’s news item, also has this paragraph.

Beyond contributing to the UK’s energy security by reducing the intermittency of renewables, Highview Power’s infrastructure programme will make a major contribution to the UK economy, requiring in excess of £9 billion investment in energy storage infrastructure over the next 10 years – with the potential to support over 6,000 jobs and generate billions of pounds in value add to the economy. It will also contribute materially to increasing utilisation of green energy generation, reducing energy bills for consumers and providing significantly improved energy stability and security.

If Highview Power can do that for the UK, what can it do for other countries?

No wonder companies of the quality of Centrica, Rio Tinto and Goldman Sachs are investing.

Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites

The title of this post, is the same as that of this article in The Times.

This is the sub-heading.

Orsted’s huge facility in Norfolk will store energy generated by its offshore wind farm

These three paragraphs give more details of the project.

The world’s largest developer of offshore wind farms is planning to build a vast battery storage facility near Norwich.

Orsted will install the energy storage system, which will be one of the largest in Europe, on the same site as the onshore converter station for its Hornsea 3 wind farm in Swardeston, Norfolk.

The project will store energy generated by Hornsea 3 when weather conditions are windy and when electricity supply exceeds demand so that it can be discharged later to help to balance the nation’s electricity grid.

Note.

- There is also a visualisation and a map.

- Tesla batteries will be used.

- The The battery will have an output of 300 MW, with a capacity of 600 MWh. So it is another two-hour BESS.

- It should be operational in 2026.

- The battery is on a 35-acre site.

- Cost is given as £8.5 billion, but that would appear to include the 2852 MW Hornsea 3 wind farm.

The BBC is reporting that local residents are worried about fire safety.

I have some thoughts of my own.

The Location Of The Swardeston Substation

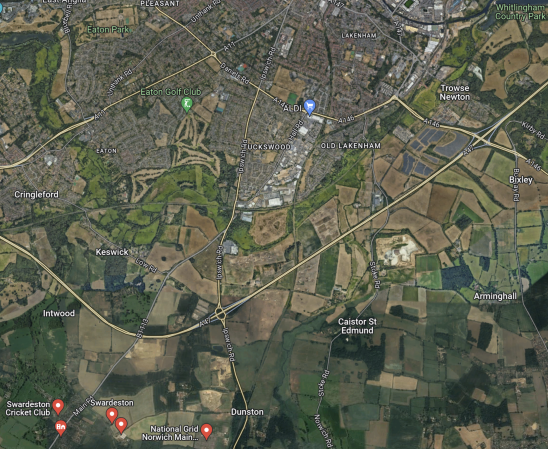

This Google Map shows the location of the Swardeston substation, which will also host the Swardeston BESS.

Note.

- The East-West road is the A 47 Norwich by-pass.

- Norwich is to the North of the by-pass.

- Just to the left-centre of the map, the main A 140 road runs between Norwich and Ipswich, which has a junction with the A 47.

- The A 140 passes through the village of Dunston, which is to the East of the National Grid sibstation, which will host the connection to the Hornsea Three wind farm.

This second Google Map shows the A 140 in detail from the junction to the A 47 to the Swardeston substation.

Note.

- The Swardeston substation is on a substantial site.

- The Norwich to Tilbury transmission line will have its Northern end at Swardeston substation.

- Once the infrastructure is complete at Swardeston substation, Hornsea Three wind farm will be connected to the electricity infrastructure around London.

There would appear to be plenty of space at the site for all National Grid’s plans.

Capital Cost Compared To Big Nuclear

Hornsea Three is a 2852 MW wind farm, that will cost with the battery and a few extras £8.5 billion or around around £ 3 billion per gigawatt.

Hinckley Point C on the other hand will cost between £ 31-35 billion or £ 9.5-10.7 billion per gigawatt.

Conclusion

National Grid would appear to be using a BESS at Swardeston substation to improve the reliability and integrity of the Hornsea Three wind farm.

How many other big batteries will be placed, where large wind farms connect to the National Grid?

As an Electrical and Control Engineer, I certainly, believe that energy storage at major substations, is a proven way to improve the grid.

Teesworks Joins Forces With NatPower On 1GW UK BESS

The title of this post, is the same as that of this article on Solar Power Portal.

These are the first two paragraphs.

Teesworks, the UK’s largest industrial zone, has revealed plans for a 1GW battery energy storage system (BESS) in partnership with renewables developer NatPower.

The project will be constructed over 50 acres of the Long Acres section of the 4500-acre Teesworks site. Construction costs are expected to total around £1 billion. While the main plan for the BESS is focused on renewable energy storage, the company also noted that the system could also support electric vehicle (EV) charging in the future.

The article then lists several large BESS projects, that are under development.

It also suggests that investment in batteries is in a healthy state.

Construction Under Way To Double Power Station Capacity At Centrica’s Brigg Energy Park

The title of this post, is the same as that of this press release from Centrica.

This is the sub-heading.

Four ultra-efficient engines have arrived at Centrica’s former combined cycle gas power station at Brigg, with construction work underway on an expansion of the peaking plant at the Lincolnshire site.

These three paragraphs give more details about the project.

The business is installing the four engines inside the former turbine hall at the power station, which was decommissioned in 2020, helping to create nearly 100MW of fast response assets capable of meeting demand when renewable generation is low.

The expanded power plant will be hydrogen-ready, and form part of a trial due to start in late 2024 to blend hydrogen into the gas, ramping up from a three per cent blend to 20 per cent, with a long term vision to move towards 100 per cent hydrogen and to deploy similar technology across all peaking plants.

Work at Brigg is expected to last around nine months and the plant will be fully operational in early 2025.

These are my thoughts.

Hydrogen Blend Operation

The second paragraph indicates that Centrica will be using Brigg power station to research the use of hydrogen blends.

Hydrogen blends could offer a way an easy way to cut hydrogen emissions, so it is good, that Centrica are researching their use in gas-fired power stations.

Brigg As A Peaking Plant

This paragraph from the press release, explains what Centrica means by a peaking plant.

Peaking plants only generate electricity when there’s high or peak demand for electricity, or when generation from renewables is too low to meet demand. Once connected to the grid, the engines will have the capacity to power 20,000 homes for a full day when required, which will maintain stability and deliver reliable power across the grid.

The second paragraph also says this.

A long term vision to move towards 100 per cent hydrogen and to deploy similar technology across all peaking plants.

Does this mean that all peaking plants will move to hydrogen-fired generation?

Brigg Redevelopment

This paragraph from the press release, outlines Centrica’s plans for Brigg power station.

Centrica is redeveloping the Brigg energy park which, once complete, will be home to a 50MW battery, commercial-scale hydrogen production using HiiROC technology (in which Centrica has a five per cent stake), and 100MW of gas peaking plant.

Note.

- I would assume that the battery, will be able to provide 50 MW for at least two hours, so the battery electric storage system (BESS) will be at least a 50 MW/100 MWh unit.

- The HiiROC technology is being developed on the other side of the Humber in Hull.

- HiiROC technology captures the carbon in the gas as carbon black, which has uses in its own right, in agriculture and tyre and other manufacturing.

- Both a battery and a gas peaking plant, will be used at Brigg to match generation with demand.

I wouldn’t be surprised that to use both a battery and a gas peaking plant, is the most efficient way to balance the renewable energy.

Hydrogen Production

The HiiROC technology that will be used at Brigg can extract hydrogen from a variety of sources including biomethane, chemical plant off gas or natural gas.

The HiiROC technology can be scaled to fit the application.

I feel that the versatility of the HiiROC technology, may result in using some unusual feeds to produce hydrogen.

As an example of the deployment of a small HiiROC system , one at a sewage works could provide hydrogen for the utility company’s vehicles.

The main use of the hydrogen would be to provide a clean fuel for the gas-fired peaking plant.

I also wouldn’t be surprised to see the hydrogen, sold and distributed to the local area, from an energy park, like Brigg.

Conclusion

Increasingly, backup for renewables will use a wide range of zero-carbon technologies.

Ameresco And Envision Energy To Deploy 624MWh UK BESS For Atlantic Green

The title of this post, is the same as that of this article on Energy Storage News.

These three paragraphs describe the project.

Developer-operator Atlantic Green has enlisted system integrator Ameresco and clean energy manufacturer Envision Energy for a 300MW/624MWh BESS project in the UK.

The Cellarhead battery energy storage system (BESS) project will be connected to National Grid’s Cellarhead substation in the West Midlands and have a maximum energy capacity of 624MWh. Construction is expected to begin this year, with final connection to the grid slated for the end of 2026.

The deal between the parties is worth £196.5 million (US$250 million). Ameresco will build the project via an engineering, procurement and construction (EPC) and operation & maintenance (O&M) agreement while Envision Energy will supply the BESS units.

Note.

- It is another battery, that can provide full power for two hours.

- It is another battery, that is located near to one of National Grid’s substations.

As batteries seem to be made by different companies, it looks to me, that National Grid are possibly checking out, which batteries are best.

Gresham House BESS Fund Energises 50MWh Asset

The title of this post, is the same as that of this article on Solar Power Portal.

These three paragraphs detail the project.

Gresham House Energy Storage Fund has energised a 50MW/50MWh battery energy storage system (BESS) in Lancashire.

Situated in Penwortham, south-west of the county capital Preston, the 1-hour duration BESS is set to be expanded to 2-hours in the summer, meaning its capacity would be 50MW/100MWh.

With the commencement of this new BESS, Gresham House Energy Storage Fund’s operational capacity has now reached 790MW/926MWh. The project is the fund’s 25th operational asset since IPO.

Note.

- The battery will be upgraded to a two-hour battery in the summer.

- The average battery would appear to be 32 MW/37 MWh.

- The average full-power duration for all Gresham House’s batteries appears to be around 70 minutes.

This Google Map shows the battery, which is located next to National Grid’s Penwortham substation.

Note.

- The battery is the two rows of green containers at the top of the map.

- The substation appears to be large.

Co-location like this, must surely bring design, construction and operational advantages.

This page on the National Grid web site is entitled Network And Infrastructure, where this is said.

We own the national electricity transmission system in England and Wales. The system consists of approximately 4,500 miles of overhead line, over 900 miles of underground cable and over 300 substations.

If every substation in the UK were to be fitted with a 32 MW/64 MWh two hour battery, these would have a total capacity of 9.6 GW/19.2 GWh.

Compare that with these operational batteries and pumped-storage systems in the UK.

- Cruachan – 1000 MW/7.1 GWh – Pumped Storage

- Dinorwig – 1800 MW/9.1 GWh – Pumped Storage

- Ffestiniog – 360 MW/1.44 GWh – Pumped Storage

- Minety -150 MW/266 MWh – BESS

- Pillswood – 98 MW/196 MWh – BESS

And these systems are under development

- Coire Glas – 1.5GW/30 GWh – Pumped Storage

- Loch Na Cathrach/Red John – 450 MW/2.8 GWh – Pumped Storage

- London Gateway – 320 MW/640 MWh – BESS

There are at least another four substantial pumped storage systems under development.

Conclusion

A twin-track approach of grid-batteries at sub-stations and a few larger grid batteries and pumped storage hydroelectric schemes should be able to provide enough storage.

Aura Power Secures £10 Million Funding From Novuna

The title of this post, is the same as that of this article on Solar Power Portal.

These two paragraphs introduce the deal.

Aura Power has announced the successful closing of a £10 million debt facility with Novuna Business Finance. Novuna is a part of Mitsubishi HC Capital UK PLC, designed to support projects from early development through to the operational phase.

Bristol-based Aura Power is developing an active pipeline of utility-scale solar PV and battery energy storage of about 12GW in the UK, Europe and North America. The funding will help progress global development for Aura, covering expenditures like grid payments, planning fees and legal land costs.

These two paragraphs describe some of Aura’s projects.

In December 2023, Aura was granted planning permission for a 100MW/400MWh battery energy storage (BESS) project in Capenhurst, Cheshire. It was the third UK project to receive planning permission last year, alongside Aura’s 49.9MW Horton Solar Farm located in East Devon and its 49.9MW Hawthorn Pit Solar Farm in Durham.

Aura has been active within the solar and battery industries, with a pipeline in development in excess of 20GW. Last week (2 May), following an appeal, the developer secured planning permission for an Essex solar farm that will have an export capacity of 30 MW.

Nearly, forty years ago, I started a finance company in Ipswich with a friend. Our financing was mainly directed towards truck leasing for companies moving containers to and from the Port of Felixstowe.

Before, I committed my money to that venture, I built a large mathematical model of the proposed business. I found, that there were some unique financial properties to leasing quality trucks, that meant losing large sums of money were difficult.

I wouldn’t be surprised that leasing battery energy storage (BESS) systems have a lot of things going for them, if you have the right contract.

This may explain, why there a large number of companies in the market of providing grid batteries.

- At the top end; Centrica, Rolls-Royce and SSE will supply you with one.

- Funds like Gore Street and Gresham House and others allow you to invest in batteries.

- At the other end of the market are companies like Aura Power.

I suspect, that as with truck-leasing company, the financial flows are very stable and investor-friendly, if you get the model right.