The Thoughts Of Chris O’Shea

This article on This Is Money is entitled Centrica boss has bold plans to back British energy projects – but will strategy pay off?.

The article is basically an interview with a reporter and gives O’Shea’s opinions on various topics.

Chris O’Shea is CEO of Centrica and his Wikipedia entry gives more details.

These are his thoughts.

On Investing In Sizewell C

This is a paragraph from the article.

‘Sizewell C will probably run for 100 years,’ O’Shea says. ‘The person who will take the last electron it produces has probably not been born. We are very happy to be the UK’s largest strategic investor.’

Note.

- The paragraph shows a bold attitude.

- I also lived near Sizewell, when Sizewell B was built and the general feeling locally was that the new nuclear station was good for the area.

- It has now been running for thirty years and should be good for another ten.

Both nuclear power stations at Sizewell have had a good safety record. Could this be in part, because of the heavy engineering tradition of the Leiston area?

On Investing In UK Energy Infrastructure

This is a paragraph from the article

‘I just thought: sustainable carbon-free electricity in a country that needs electricity – and we import 20 per cent of ours – why would we look to sell nuclear?’ Backing nuclear power is part of O’Shea’s wider strategy to invest in UK energy infrastructure.

The UK certainly needs investors in UK energy infrastructure.

On Government Support For Sizewell C

This is a paragraph from the article.

Centrica’s 500,000 shareholders include an army of private investors, many of whom came on board during the ‘Tell Sid’ privatisations of the 1980s and all of whom will be hoping he is right. What about the risks that deterred his predecessors? O’Shea argues he will achieve reliable returns thanks to a Government-backed financial model that enables the company to recover capital ploughed into Sizewell C and make a set return.

I have worked with some very innovative accountants and bankers in the past fifty years, including an ex-Chief Accountant of Vickers and usually if there’s a will, there’s a solution to the trickiest of financial problems.

On LNG

These are two paragraphs from the article.

Major moves include a £200 million stake in the LNG terminal at Isle of Grain in Kent.

The belief is that LNG, which produces significantly fewer greenhouse gas emissions than other fossil fuels and is easier and cheaper to transport and store, will be a major source of energy for the UK in the coming years.

Note.

- Centrica are major suppliers of gas-powered Combined Heat and Power units were the carbon dioxide is captured and either used or sold profitably.

- In at least one case, a CHP unit is used to heat a large greenhouse and the carbon dioxide is fed to the plants.

- In another, a the gas-fired Redditch power station, the food-grade carbon dioxide is sold to the food and construction industries.

- Grain LNG Terminal can also export gas and is only a short sea crossing from gas-hungry Germany.

- According to this Centrica press release, Centrica will run low-carbon bunkering services from the Grain LNG Terminal.

I analyse the investment in Grain LNG Terminal in Investment in Grain LNG.

On Rough Gas Storage

These are three paragraphs from the article.

O’Shea remains hopeful for plans to develop the Rough gas storage facility in the North Sea, which he re-opened in 2022.

The idea is that Centrica will invest £2 billion to ‘create the biggest gas storage facility in the world’, along with up to 5,000 jobs.

It could be used to store hydrogen, touted as a major energy source of the future, provided the Government comes up with a supportive regulatory framework as it has for Sizewell.

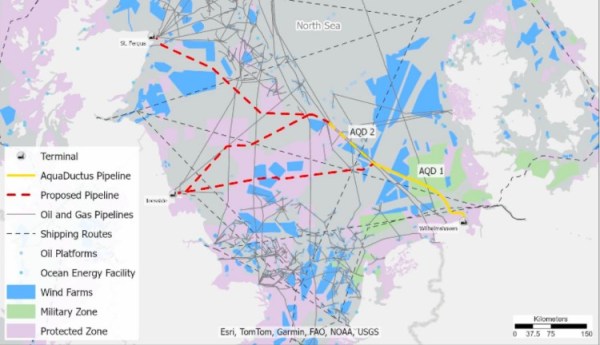

The German AquaVentus project aims to bring at least 100 GW of green hydrogen to mainland Germany from the North Sea.

This map of the North Sea, which I downloaded from the Hydrogen Scotland web site, shows the co-operation between Hydrogen Scotland and AquaVentus

Note.

- The yellow AquaDuctus pipeline connected to the German coast near Wilhelmshaven.

- There appear to be two AquaDuctus sections ; AQD 1 and AQD 2.

- There are appear to be three proposed pipelines, which are shown in a dotted red, that connect the UK to AquaDuctus.

- The Northern proposed pipeline appears to connect to the St. Fergus gas terminal on the North-East tip of Scotland.

- The two Southern proposed pipelines appear to connect to the Easington gas terminal in East Yorkshire.

- Easington gas terminal is within easy reach of the massive gas stores, which are being converted to store hydrogen at Aldbrough and Rough.

- The blue areas are offshore wind farms.

- The blue area straddling the Southernmost proposed pipe line is the Dogger Bank wind farm, is the world’s largest offshore wind farm and could eventually total over 6 GW.

- RWE are developing 7.2 GW of wind farms between Dogger Bank and Norfolk in UK waters, which could generate hydrogen for AquaDuctus.

This cooperation seems to be getting the hydrogen Germany needs to its industry.

It should be noted, that Germany has no sizeable hydrogen stores, but the AquaVentus system gives them access to SSE’s Aldbrough and Centrica’s Rough hydrogen stores.

So will the two hydrogen stores be storing hydrogen for both the UK and Germany?

Storing hydrogen and selling it to the country with the highest need could be a nice little earner.

On X-energy

These are three paragraphs from the article.

He is also backing a £10 billion plan to build the UK’s first advanced modular reactors in a partnership with X-energy of the US.

The project is taking place in Hartlepool, in County Durham, where the existing nuclear power station is due to reach the end of its life in 2028.

As is the nature of these projects, it involves risks around technology, regulation and finance, though the potential rewards are significant. Among them is the prospect of 2,500 jobs in the town, where unemployment is high.

Note.

- This is another bold deal.

- I wrote in detail about this deal in Centrica And X-energy Agree To Deploy UK’s First Advanced Modular Reactors.

- Jobs are mentioned in the This is Money article for the second time.

I also think, if it works to replace the Hartlepool nuclear power station, then it can be used to replace other decommissioned nuclear power stations.

On Getting Your First Job

These are three paragraphs from the article.

His career got off to a slow start when he struggled to secure a training contract with an accountancy firm after leaving Glasgow University.

‘I had about 30, 40 rejection letters. I remember the stress of not having a job when everyone else did – you just feel different,’ he says.

He feels it is ‘a duty’ for bosses to try to give young people a start.

I very much agree with that. I would very much be a hypocrite, if I didn’t, as I was given good starts by two companies.

On Apprenticeships

This is a paragraph from the article.

‘We are committed to creating one new apprenticeship for every day of this decade,’ he points out, sounding genuinely proud.

I very much agree with that. My father only had a small printing business, but he was proud of the apprentices he’d trained.

On Innovation

Centrica have backed three innovative ideas.

- heata, which is a distributed data centre in your hot water tank, which uses the waste heat to give you hot water.

- HiiROC, which is an innovative way to generate affordable hydrogen efficiently.

- Highview Power, which stores energy as liquid air.

I’m surprised that backing innovations like these was not mentioned.

Conclusion

This article is very much a must read.