There Are Only Three Large Offshore Wind Farms In Contracts for Difference Allocation Round 6

This document from the Department of Business, Industry and Industrial Strategy lists all the Contracts for Difference Allocation Round 6 results for the supply of zero-carbon electricity.

The wind farms are.

- Green Volt – 400 MW – Floating – Claims to be “The first commercial-scale floating offshore windfarm in Europe”.

- Hornsea Four – 2,400 MW – Fixed – Ørsted

- East Anglia Two – 963 MW – Fixed – Iberdrola

Is this what misgovernment expected, when they raised the budget in July 2024, as I wrote about in UK Boosts Sixth CfD Auction Budget, Earmarks GBP 1.1 Billion For Offshore Wind.

Perhaps, some developers held back until government policy is clearer?

‘World’s First’ O&M Campaign Using Heavy-Lift Cargo Drones Underway At Dutch Offshore Wind Farm

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted has deployed heavy-lift cargo drones (HLCDs) for maintenance work at the Borssele 1&2 offshore wind farm in the Netherlands. This is the first time heavy-lift cargo drones are being used in an operational campaign, according to the company which tested the concept in 2023 at its Hornsea One offshore wind farm in the UK.

These are the first two paragraphs.

At the 752 MW Dutch offshore wind farm that has been in operation since 2020, the 70-kilogram drones will transport cargo of up to 100 kilograms from a vessel to all 94 wind turbines. The campaign now underway at Borssele 1&2 is being performed to update some critical evacuation and safety equipment in each of the turbines.

A drone can complete a task that typically takes several hours in minutes, according to Ørsted.

Note.

- The article claims, a lot of time is saved.

- I suspect we’ll be seeing the use of drones for multiple deliveries, a lot more in the future.

I like the concept, where deliveries to a number of sites are made by drone, rather than in a traditional way perhaps by a ship or truck with a crane.

Centrica Business Solutions And Highview Power

Centrica Business Solutions is one of Centrica’s business units.

It has its own web page, with this sub heading.

Helping Organisations Balance Planet And Profit

This is followed by this mission statement.

Centrica Business Solutions helps organisations to balance the demands of planet and profit, by delivering integrated energy solutions that help you save money and become a sustainable business.

Several pictures show some of the solutions, that Centrica Business Solutions can provide.

Centrica Business Solutions In Numbers

These numbers are given about the customers of Centrica Business Solutions.

- Customer Sites Globally – 7000

- Solar PV Installations Delivered Worldwide – 16,380+

- Solar PV Installations Delivered Power – 240 MW

- CHP Units Operated And Maintained Globally – 700 MW+

- Energy Data Points Collected Each Month Globally – 29 billion

Theses are large numbers.

How Would Centrica Business Solutions Use Highview Power’s Batteries?

The obvious use of Highview Power’s batteries is to connect them between a solar or wind farm and the grid, for when the sun isn’t shining or when the wind isn’t blowing.

Currently, there are three sizes of Highview Power batteries, either working on under development.

5MW/15 MWh

This is the demonstration system, which is described on this page of the Highview web site.

Surely, if a system of this size is very useful for Viridor, there may be other applications and customers out there.

This system will provide 5 MW for three hours.

50MW/300MWh

This is the Carrington system, which is described on this page of the Highview web site.

The Highview web site says this about output potential and connectivity.

The facility will store enough clean, renewable energy to serve the needs of 480,000 homes, as well as providing essential grid stabilisation services. The site will use existing substation and transmission infrastructure.

This system will provide 50 MW for six hours.

200MW/2.5GWh

This is the larger system for Scotland and the North East, which is under development and described on this page of the Highview web site.

The Highview web site says this about output their use.

These will be located on the national transmission network where the wind is being generated and therefore will enable these regions to unleash their untapped renewable energy potential and store excess wind power at scale.

This system will provide 200 MW for 12.5 hours.

In Rio Tinto Punts On British Start-Up To Plug Renewables Gap, I said this.

In Britain, Highview hopes to be putting four 2.5-gigawatt assets into planning this year – one in Scotland, three with Orsted in England.

This sentence was originally published in this article on the Australian Financial Review.

I believe that Centrica could find applications for all three sizes of Highview’s batteries.

Suppose, though Centrica find that an application needs say a 100 MW/1 GWh battery.

From the mathematics, I did at ICI in the 1970s, when looking at the scaling of chemical plants, I believe that Highview’s battery design could be scalable, by just using appropriately-sized turbomachinery, matched to the right number of tanks.

So the customer would get the battery size they needed!

How Much Electricity Could One Of Highview’s Batteries Store?

This image shows large LNG tanks at Milford Haven.

In Could A Highview Power CRYOBattery Use A LNG Tank For Liquid Air Storage?, I did a rough calculation and found that the largest LNG tanks could hold enough liquid air, that would be the equivalent of around one GWh.

So the image above could be a 5 GWh battery.

This image clipped from Highview’s web site, shows large tanks for liquified gas storage.

With tanks like these, Highview could be building batteries with storage to rival the smaller pumped storage hydroelectric power stations.

In Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, I talked about how Ørsted were planning the Swardeston BESS, where the 2852 MW Hornsea Three wind farm connects to the grid.

The chosen battery will be from Tessla with an output of 300 MW and a capacity of 600 MWh.

I suspect Ørsted couldn’t wait for Highview, but circumstances might have changed now, with the financing deal for the Carrington battery!

Are Combined Heat And Power Units And Highview’s Batteries Interchangeable And Complementary Technologies?

According to the Centrica Business Systems web site, they have deployed over 700 MW of CHP systems globally.

I wonder how many of these systems could have used a standard Highview battery?

Perhaps, Centrica Business Systems have done a survey and found that it could be quite a few.

So, perhaps if Centrica Business Systems had access to Highview’s technology, it would increase their sales.

In addition how many of Centrica Business Systems existing CHP systems, would be improved with the addition of a Highview battery?

It appears to me, that if Centrica Business Systems were to develop a series of standard solutions based on Highview’s technology, they could substantially increase their sales.

What Could Centrica Business Systems Do For Highview Power?

Centrica Business Systems could probably develop several standard applications with Hoghview’s technology, which would be to the benefit of both companies.

But, I believe that as Centrica Business Systems are supporting large number of systems globally, that they are in a good place to help develop and possibly run Highview Power’s support network.

Conclusion

I can see Centrica Business Systems and Highview Power having a long and profitable relationship.

Rio Tinto Punts On British Start-Up To Plug Renewables Gap

The title of this post is the same as that of this article on the Australian Financial Review.

The article is a must-read and these are a few points.

- Highview is readying to take a big punt on the Australian market, with Rio Tinto and the Northern Territory government shaping up as potential customers.

- Highview is very committed to Australia. We think Australia can be as big as the UK for us, given their ambitions,

- Highview is working on concepts with Rio Tinto. And separate from Rio, we are well advanced in the Northern Territory with the government there to provide a solution to decarbonise the power grid.

- The process uses existing hardware from the gas industry, and the plant’s life should be at least 40 years – five times longer than a battery.

- Highview could replace fossil-fuel gas plants in situ, and could also be an alternative to the more complex and capital-intensive option of pumped hydro.

- Highview already had staff operating in Brisbane.

- Highview was negotiating the long-term contract with the government in Darwin, and had engaged Australian banks to start testing the market for a local fundraising.

- In Britain, Highview hopes to be putting four 2.5-gigawatt assets into planning this year – one in Scotland, three with Orsted in England.

As I said, the article is a must-read and it proves to me that Highview is on its way.

Norway’s Sovereign Wealth Fund Acquires Stake In 573 MW Race Bank Offshore Wind Farm

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

A consortium made up of investment funds belonging to Australia-headquartered Macquarie Asset Management and Spring Infrastructure Capital has reached an agreement to divest a 37.5 per cent stake in the 573 MW Race Bank offshore wind farm in the UK to Norges Bank Investment Management.

These four paragraphs give more details of the deal.

The stake was sold to the Norwegian sovereign wealth fund for approximately GBP 330 million (about EUR 390.6 million).

According to Norges Bank Investment Management, the fund acquired Macquarie European Infrastructure Fund 5’s 25 per cent stake and Spring Infrastructure 1 Investment Limited Partnership’s 12.5 per cent interest in the Race Bank offshore wind farm.

A Macquarie Capital and Macquarie European Infrastructure Fund 5 consortium acquired a 50 per cent stake in Race Bank during the construction phase in 2016. Macquarie Capital divested its 25 per cent stake in the wind farm in 2017.

With the deal, Arjun Infrastructure Partners will remain co-investor for 12.5 per cent of the wind farm and Ørsted will remain a 50 per cent owner and operator of Race Bank.

These are my thoughts.

The Location of Race Bank Wind Farm

This map from the Outer Dowsing Web Site, shows Race Bank and all the other wind farms off the South Yorkshire, Lincolnshire and Norfolk coasts.

From North to South, wind farm sizes and owners are as follows.

- Hornsea 1 – 1218 MW – Ørsted, Global Infrastructure Partners

- Hornsea 2 – 1386 MW – Ørsted,Global Infrastructure Partners

- Hornsea 3 – 2852 MW – Ørsted

- Hornsea 4 – 2600 MW – Ørsted

- Westernmost Rough – 210 MW – Ørsted and Partners

- Humber Gateway – 219 MW – E.ON

- Triton Knoll – 857 MW – RWE

- Outer Dowsing – 1500 MW – Corio Generation, TotalEnergies

- Race Bank – 573 MW – Ørsted,

- Dudgeon – 402 MW – Equinor, Statkraft

- Lincs – 270 MW – Centrica, Siemens, Ørsted

- Lynn and Inner Dowsing – 194 MW – Centrica, TCW

- Sheringham Shoal – 317 MW – Equinor, Statkraft

- Norfolk Vanguard West – 1380 MW – RWE

Note.

- There is certainly a large amount of wind power on the map.

- Hornsea 1, 2 and 3 supply Humberside.

- Hornsea 4 will supply Norwich and North Norfolk.

- Norfolk Vanguard West would probably act with the other two wind farms in RWE’ Norfolk cluster.

- Ignoring Hornsea and Norfolk Vanguard West gives a total around 4.5 GW.

- There are also two 2 GW interconnectors to Scotland (Eastern Green Link 3 and Eastern Green Link 4) and the 1.4 GW Viking Link to Denmark.

I wouldn’t be surprised to see a large offshore electrolyser being built in the East Lincolnshire/West Norfolk area.

The primary purpose would be to mop up any spare wind electricity to avoid curtailing the wind turbines.

The hydrogen would have these uses.

- Provide hydrogen for small, backup and peaker power stations.

- Provide hydrogen for local industry, transport and agriculture,

- Provide hydrogen for off-gas-grid heating.

- Provide methanol for coastal shipping.

Any spare hydrogen would be exported by coastal tanker to Germany to feed H2ercules.

Do We Need Wind-Driven Hydrogen Electrolysers About Every Fifty Miles Or so Along The Coast?

I can certainly see a string along the East Coast between Humberside and Kent.

- Humberside – Being planned by SSE

- East Lincolnshire/West Norfolk – See above

- North-East Norfolk – See RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030.

- Dogger Bank – See RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030.

- Sizewell – See Sizewell C And Hydrogen.

- Herne Bay – Under construction

I can see others at possibly Freeport East and London Gateway.

UK Infrastructure Bank, Centrica & Partners Invest £300M in Highview Power Clean Energy Storage Programme To Boost UK’s Energy Security

The title of this post, is the same as that of this news item from Highview Power.

This is the sub-heading.

Highview Power kickstarts its multi-billion pound renewable energy programme to accelerate the UK’s transition to net zero in Carrington, Manchester.

These three paragraphs outline the investment.

Highview Power has secured the backing of the UK Infrastructure Bank and the energy industry leader Centrica with a £300 million investment for the first commercial-scale liquid air energy storage (LAES) plant in the UK.

The £300 million funding round was led by the UK Infrastructure Bank (UKIB) and the British multinational energy and services company Centrica, alongside a syndicate of investors including Rio Tinto, Goldman Sachs, KIRKBI and Mosaic Capital.

The investment will enable the construction of one of the world’s largest long duration energy storage (LDES) facilities in Carrington, Manchester, using Highview Power’s proprietary LAES technology. Once complete, it will have a storage capacity of 300 MWh and an output power of 50 MWs per hour for six hours. Construction will begin on the site immediately, with the facility operational in early 2026, supporting over 700 jobs in construction and the supply chain.

Note.

- The backers are of a high quality.

- The Carrington LDES appears to be a 50 MW/300 MWh battery.

It finally looks like Highview Power is on its way.

These are my thoughts on the rest of news item.

Centrica’s Involvement

This paragraph talks about Centrica’s involvement.

Energy leader Centrica comes on board as Highview Power’s strategic partner and a key player in the UK’s energy transition, supporting Carrington and the accelerated roll-out of the technology in the UK through a £70 million investment. The programme will set the bar for storage energy systems around the world, positioning the UK as the global leader in energy storage and flexibility.

I suspect that Centrica have an application in mind.

In Centrica Business Solutions Begins Work On 20MW Hydrogen-Ready Peaker In Redditch, I talk about how Centrica is updating an old peaker plant.

In the related post I refer to this news item from Centrica Business Systems.

This paragraph in the Centrica Business Systems news item, outlines Centrica’s plans.

The Redditch peaking plant is part of Centrica’s plans to deliver around 1GW of flexible energy assets, that includes the redevelopment of several legacy-owned power stations, including the transformation of the former Brigg Power Station in Lincolnshire into a battery storage asset and the first plant in the UK to be part fuelled by hydrogen.

As Redditch power station is only 20 MW, Centrica could be thinking of around fifty assets of a similar size.

It seems to me, that some of these assets could be Highview Power’s LDES batteries of an appropriate size. They may even be paired with a wind or solar farm.

Larger Systems

Highview Power’s news item, also has this paragraph.

Highview Power will now also commence planning on the next four larger scale 2.5 GWh facilities (with a total anticipated investment of £3 billion). Located at strategic sites across the UK, these will ensure a fast roll-out of the technology to align with UK LDES support mechanisms and enable the ESO’s Future Energy Scenario Plans.

Elsewhere on their web site, Highview Power say this about their 2.5 GWh facilities.

Highview Power’s next projects will be located in Scotland and the North East and each will be 200MW/2.5GWh capacity. These will be located on the national transmission network where the wind is being generated and therefore will enable these regions to unleash their untapped renewable energy potential and store excess wind power at scale.

So will the four larger systems have a 200MW/2.5GWh capacity?

They could, but 200 MW may not be an appropriate output for the location. Or a longer duration may be needed.

Highview Power’s design gives the flexibility to design a system, that meets each application.

Working With National Grid

Highview Power’s news item, also has this sentence.

Highview Power’s technology will also provide stability services to the National Grid, which will allow for the long-term replacement of fossil fuel-based power plants for system support.

Highview Power’s technology is also an alternative to Battery Energy Storage Systems (BESS) of a similar capacity.

How does Highview Power’s technology compare with the best lithium-ion systems on price, performance and reliability?

Curtailment Of Wind Farms

Highview Power’s news item, also has these two paragraphs.

This storage will help reduce curtailment costs – which is significant as Britain spent £800m in 2023 to turn off wind farms.

Highview Power aims to accelerate the roll-out of its larger facilities across the UK by 2035 in line with one of National Grid’s target scenario forecasts of a 2 GW requirement from LAES, which would represent nearly 20% of the UK’s long duration energy storage needs. By capturing and storing excess renewable energy, which is now the cheapest form of electricity, storage can help keep energy costs from spiralling, and power Britain’s homes with 24/7 renewable clean energy.

I can see several wind farms, that are regularly curtailed would have a Highview Power battery installed at their onshore substation.

Receently, I wrote Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, which described how Ørsted are installing a 300 MW/600 MWh Battery Energy Storage Systems (BESS) at Swardeston substation, where Hornsea Three connects to the grid.

I would suspect that the purpose of the battery is to avoid turning off the wind farm.

Would a Highview Power battery be better value?

What’s In It For Rio Tinto?

I can understand, why most companies are investing, but Rio Tinto are a mining company. My only thought is that they have a lot of redundant holes in the ground, that cost them a lot of money and by the use of Highview Power’s technology, they can be turned into productive assets.

Collateral Benefits

Highview Power’s news item, also has this paragraph.

Beyond contributing to the UK’s energy security by reducing the intermittency of renewables, Highview Power’s infrastructure programme will make a major contribution to the UK economy, requiring in excess of £9 billion investment in energy storage infrastructure over the next 10 years – with the potential to support over 6,000 jobs and generate billions of pounds in value add to the economy. It will also contribute materially to increasing utilisation of green energy generation, reducing energy bills for consumers and providing significantly improved energy stability and security.

If Highview Power can do that for the UK, what can it do for other countries?

No wonder companies of the quality of Centrica, Rio Tinto and Goldman Sachs are investing.

Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites

The title of this post, is the same as that of this article in The Times.

This is the sub-heading.

Orsted’s huge facility in Norfolk will store energy generated by its offshore wind farm

These three paragraphs give more details of the project.

The world’s largest developer of offshore wind farms is planning to build a vast battery storage facility near Norwich.

Orsted will install the energy storage system, which will be one of the largest in Europe, on the same site as the onshore converter station for its Hornsea 3 wind farm in Swardeston, Norfolk.

The project will store energy generated by Hornsea 3 when weather conditions are windy and when electricity supply exceeds demand so that it can be discharged later to help to balance the nation’s electricity grid.

Note.

- There is also a visualisation and a map.

- Tesla batteries will be used.

- The The battery will have an output of 300 MW, with a capacity of 600 MWh. So it is another two-hour BESS.

- It should be operational in 2026.

- The battery is on a 35-acre site.

- Cost is given as £8.5 billion, but that would appear to include the 2852 MW Hornsea 3 wind farm.

The BBC is reporting that local residents are worried about fire safety.

I have some thoughts of my own.

The Location Of The Swardeston Substation

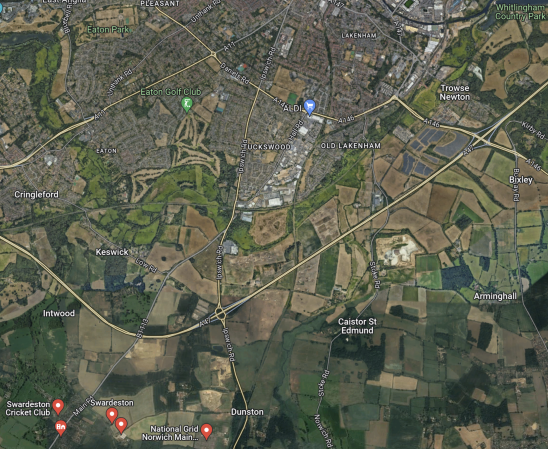

This Google Map shows the location of the Swardeston substation, which will also host the Swardeston BESS.

Note.

- The East-West road is the A 47 Norwich by-pass.

- Norwich is to the North of the by-pass.

- Just to the left-centre of the map, the main A 140 road runs between Norwich and Ipswich, which has a junction with the A 47.

- The A 140 passes through the village of Dunston, which is to the East of the National Grid sibstation, which will host the connection to the Hornsea Three wind farm.

This second Google Map shows the A 140 in detail from the junction to the A 47 to the Swardeston substation.

Note.

- The Swardeston substation is on a substantial site.

- The Norwich to Tilbury transmission line will have its Northern end at Swardeston substation.

- Once the infrastructure is complete at Swardeston substation, Hornsea Three wind farm will be connected to the electricity infrastructure around London.

There would appear to be plenty of space at the site for all National Grid’s plans.

Capital Cost Compared To Big Nuclear

Hornsea Three is a 2852 MW wind farm, that will cost with the battery and a few extras £8.5 billion or around around £ 3 billion per gigawatt.

Hinckley Point C on the other hand will cost between £ 31-35 billion or £ 9.5-10.7 billion per gigawatt.

Conclusion

National Grid would appear to be using a BESS at Swardeston substation to improve the reliability and integrity of the Hornsea Three wind farm.

How many other big batteries will be placed, where large wind farms connect to the National Grid?

As an Electrical and Control Engineer, I certainly, believe that energy storage at major substations, is a proven way to improve the grid.

RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030

This press release from RWE is entitled RWE And Masdar Join Forces To Develop 3 Gigawatts Of Offshore Wind Projects Off The UK Coast.

This is the last paragraph.

The UK plays a key role in RWE’s strategy to grow its offshore wind portfolio RWE is a leading partner in the delivery of the UK’s Net Zero ambitions and energy security, as well as in contributing to the UK build-out target for offshore wind of 50 GW by 2030. RWE already operates 10 offshore wind farms across the UK. Following completion of the acquisition of the three Norfolk offshore wind projects from Vattenfall announced at the end of 2023, RWE is developing nine offshore wind projects in the UK, representing a combined potential installed capacity of around 9.8 GW, with RWE’s pro rata share amounting to 7 GW. Furthermore, RWE is constructing the 1.4 GW Sofia offshore wind project in the North Sea off the UK’s east coast. RWE’s unparalleled track record of more than 20 years in offshore wind has resulted in 19 offshore wind farms in operation, with a goal to triple its global offshore wind capacity from 3.3 GW today to 10 GW in 2030.

Note.

- Nine offshore wind projects in the UK, representing a combined potential installed capacity of around 9.8 GW

- RWE are saying they intend to add 6.7 GW in 2030.

The eight offshore wind farms, that RWE are developing in UK waters would appear to be.

- Sofia – 1,400 MW

- Norfolk Boreas – 1380 MW

- Norfolk Vanguard East – 1380 MW

- Norfolk Vanguard West – 1380 MW

- Dogger Bank South – 3000 MW

- Awel y Môr – 500 MW

- Five Estuaries – 353 MW

- North Falls – 504 MW

This is a total of 9897 MW, which ties in well with RWE’s new capacity figure of 9.8 GW.

The Location Of RWE’s Offshore Wind Farms

RWE’s wind farms seem to fit in groups around the UK.

Dogger Bank

This wind farm is on the Dogger Bank.

- Dogger Bank South – 3000 MW – Planned

This wind farm would appear to be rather isolated in the middle of the North Sea.

RWE could have plans to extend it or even link it to other wind farms in the German area of the Dogger Bank.

Lincolnshire Coast

This wind farm is along the Lincolnshire Coast.

- Triton Knoll – 857 MW – 2022

As there probably isn’t much heavy industry, where Triton Knoll’s power comes ashore, this wind farm can provide the power needed in the area.

But any excess power in the area can be exported to Denmark through the Viking Link.

Norfolk Coast

These wind farms are along the Norfolk Coast.

- Norfolk Boreas – 1380 MW – Planned

- Norfolk Vanguard East – 1380 MW – Planned

- Norfolk Vanguard West – 1380 MW – Planned

These three wind farms will provide enough energy to provide the power for North-East Norfolk.

North Wales Coast

These wind farms are along the North Wales Coast.

- Awel y Môr – 500 MW – Planned

- Gwynt y Môr – 576 MW – 2015

- Rhyl Flats – 90 MW – 2009

- North Hoyle – 60 MW – 2003

These wind farms will provide enough energy for the North Wales Coast.

Any spare electricity can be stored in the 1.8 GW/9.1 GWh Dinorwig pumped storage hydroelectric power station.

Electric Mountain may have opened in 1984, but it is surely a Welsh giant decades ahead of its time.

Suffolk Coast

These wind farms are along the Suffolk Coast.

- Five Estuaries – 353 MW – Planned

- Galloper – 353 MW – 2018

- North Falls – 504 MW – Planned

These wind farms will provide enough energy for the Suffolk Coast, which except for the Haven Ports, probably doesn’t have many large electricity users.

But if the area is short of electricity, there will be Sizewell B nuclear power station to provide it.

Teesside

This wind farm is along the Teesside Coast

- Sofia – 1,400 MW – Planned

Teesside is a heavy user of electricity.

These six areas total as follows.

- Dogger Bank – 3,000 MW

- Lincolnshire Coast – 857 MW

- Norfolk Coast – 4140 MW

- North Wales Coast – 1226 MW

- Suffolk Coast – 1210 MW

- Teesside – 1,400 MW

Backup for these large clusters of wind farms for when the wind doesn’t blow will be provided as follows.

- Dogger Bank – Not provided

- Lincolnshire Coast- Interconnectors to Denmark and Scotland

- Norfolk Coast – Not provided

- North Wales Coast – Stored in Dinorwig pumped storage hydroelectric power station

- Suffolk Coast – Sizewell B and Sizewell C

- Teesside – Interconnectors to Norway and Scotland and Hartlepool nuclear power stations

Note.

- The interconnectors will typically have a 2 GW capacity.

- The 1.9 GW/9.1 GWh Dinorwig pumped storage hydroelectric power station must be one of the best wind farm backups in Europe.

There is a very solid level of integrated and connected assets that should provide a reliable power supply for millions of electricity users.

How Will Dogger Bank And The Norfolk Coast Wind Clusters Work Efficiently?

The Dogger Bank and the Norfolk Coast clusters will generate up to 3 and 4.14 GW respectively.

So what purpose is large amounts of electricity in the middle of the North Sea?

The only possible purpose will be to use giant offshore electrolysers to create hydrogen.

The hydrogen will then be transported to point of use by pipeline or tanker.

Feeding H2ercules

I described H2ercules in H2ercules.

H2ercules is an enormous project that will create the German hydrogen network.

The H2ercules web site, shows a very extensive project, as is shown by this map.

Note.

- Hydrogen appears to be sourced from Belgium, the Czech Republic, The Netherlands and Norway.

- RWE’s Dogger Bank South wind farm will be conveniently by the N of Norway.

- RWE’s Norfolk cluster of wind farms will be conveniently by the N of Netherlands.

- The Netherlands arrow points to the red circles of two hydrogen import terminals.

For Germany to regain its former industrial success, H2ercules will be needed to be fed with vast amounts of hydrogen.

And that hydrogen could be in large amounts from the UK sector of the North Sea.

Uniper’s Wilhelmshaven Hydrogen Hub

This page on the Uniper web site is entitled Green Wilhelmshaven: To New Horizons

This Uniper graphic shows a summary of gas and electricity flows in the Wilhelmshaven Hydrogen Hub.

Note.

- Ammonia can be imported, distributed by rail or ships, stored or cracked to provide hydrogen.

- Wilhelmshaven can handle the largest ships.

- Offshore wind energy can generate hydrogen by electrolysis.

- Hydrogen can be stored in underground salt caverns.

I suspect hydrogen could also be piped in from an electrolyser in the East of England or shipped in by a hydrogen tanker.

All of this is well-understood technology.

Sunak’s Magic Money Tree

Rishi Sunak promised a large giveaway of tax in his manifesto for the 2024 General Election.

As we are the only nation, who can provide the colossal amounts of hydrogen the Germans will need for H2ercules, I am sure we will be well paid for it.

A few days ago we celebrated D-Day, where along with the Americans and the Canadians, we invaded Europe.

Now eighty years later, our hydrogen is poised to invade Europe again, but this time for everybody’s benefit.

This document on the Policy Mogul web site is entitled Rishi Sunak – Conservative Party Manifesto Speech – Jun 11.

These are three paragraphs from the speech.

We don’t just need military and border security. As Putin’s invasion of Ukraine has shown, we need energy security too. It is only by having reliable, home-grown sources of energy that we can deny dictators the ability to send our bills soaring. So, in our approach to energy policy we will put security and your family finances ahead of unaffordable eco zealotry.

Unlike Labour we don’t believe that we will achieve that energy security via a state-controlled energy company that doesn’t in fact produce any energy. That will only increase costs, and as Penny said on Friday there’s only one thing that GB in Starmer and Miliband’s GB Energy stands for, and that’s giant bills.

Our clear plan is to achieve energy security through new gas-powered stations, trebling our offshore wind capacity and by having new fleets of small modular reactors. These will make the UK a net exporter of electricity, giving us greater energy independence and security from the aggressive actions of dictators . Now let me just reiterate that, with our plan, we will produce enough electricity to both meet our domestic needs and export to our neighbours. Look at that. A clear, Conservative plan not only generating security, but also prosperity for our country.

I believe that could be Rishi’s Magic Money Tree.

Especially, if the energy is exported through electricity interconnectors or hydrogen or ammonia pipelines and tankers.

Will This Be A Party Anyone Can Join?

Other wind farm clusters convenient for the H2ercules hydrogen import terminals on the North-West German coast include.

- Dogger Bank – SSE, Equinor – 5008 MW

- East Anglian – Iberdrola – 3786 MW

- Hornsea – Ørsted – 8056 MW

That totals to around 16.5 GW of wind power.

I can see offshore electrolysers producing hydrogen all around the coasts of the British Isles.

What Happens If Sunak Doesn’t Win The Election?

RWE and others have signed contracts to develop large wind farms around our shores.

They didn’t do that out of the goodness of their hearts, but to make money for themselves and their backers and shareholders.

Conclusion

I believe a virtuous circle will develop.

- Electricity will be generated in the UK.

- Some will be converted to hydrogen.

- Hydrogen and electricity will be exported to the highest bidders.

- European industry will, be powered by British electricity and hydrogen.

- Money will be paid to the UK and the energy suppliers for the energy.

The more energy we produce, the more we can export.

In the future more interconnectors, wind farms and electrolysers will be developed.

Everybody will benefit.

As the flows grow, this will certainly become a Magic Money Tree, for whoever wins the election.

Ørsted Secures Exclusive Access To Lower-Emission Steel From Dillinger

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted will be offered the first production of lower-emission steel from German-based Dillinger, subject to availability and commercial terms and conditions. The steel plates are intended to be used for offshore wind monopile foundations in future projects.

These three paragraphs outline the deal.

Under a large-scale supply agreement entered into in 2022, Ørsted will procure significant volumes of regular heavy plate steel from 2024, giving the company access at scale to and visibility of the most crucial raw material in offshore wind while supporting Dillinger to accelerate investments in new lower-emission steel production, according to Ørsted.

The Danish renewable energy giant expects to be able to procure lower-emission steel produced at Dillinger’s facility in Dillingen, Germany, from 2027-2028.

Taking the current technology outlook into account, the reduction of the process-related carbon emissions from production is expected to be around 55-60 per cent compared to conventional heavy plate steel production, Ørsted said.

Increasingly, we’ll see lower emission steel and concrete used for wind turbine foundations.

This press release on the Dillinger web site is entitled Historic Investment For Greater Climate Protection: Supervisory Boards Approve Investment Of EUR 3.5 billion For Green Steel From Saarland.

These are two paragraphs from the press release.

Over the next few years leading up to 2027, in addition to the established blast furnace route, the new production line with an electric arc furnace (EAF) will be built at the Völklingen site and an EAF and direct reduced iron (DRI) plant for the production of sponge iron will be built at the Dillinger plant site. Transformation branding has also been developed to visually represent the transformation: “Pure Steel+”. The message of “Pure Steel+” is that Saarland’s steel industry will retain its long-established global product quality, ability to innovate, and culture, even in the transformation. The “+” refers to the carbon-neutrality of the products.

The availability of green hydrogen at competitive prices is a basic precondition for this ambitious project to succeed, along with prompt funding commitments from Berlin and Brussels. Local production of hydrogen will therefore be established as a first step together with the local energy suppliers, before connecting to the European hydrogen network to enable use of hydrogen to be increased to approx. 80 percent. The Saarland steel industry is thus laying the foundation for a new hydrogen-based value chain in the Saarland, in addition to decarbonizing its own production. In this way, SHS – Stahl-Holding-Saar is supporting Saarland on its path to becoming a model region for transformation.

It sounds to me, that Tata Steel could be doing something similar at Port Talbot.

- Tata want to build an electric arc furnace to replace the blast furnaces.

- There will be plenty of green electricity from the Celtic Sea.

- RWE are planning a very large hydrogen electrolyser in Pembroke.

- Celtic Sea offshore wind developments would probably like a supply of lower emission steel on their door-step.

I would suspect, that Welsh steel produced by an electric arc furnace will match the quality of the German steel, that is made the same way.

BlueFloat, Renantis And Ørsted Move Forward With 1 GW Scottish Floater

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Stromar Offshore Wind Farm Limited, a joint venture between Ørsted, BlueFloat Energy, and Renantis, has submitted the environmental impact assessment (EIA) scoping and habitats regulations appraisal (HRA) screening reports for the 1 GW floating offshore wind farm in Scotland.

These are the first three paragraphs, which outline the progress that has been made so far.

The reports for the project, which is located approximately 50 kilometres from the Port of Wick, were delivered to the Marine Directorate and Aberdeenshire Council.

The EIA scoping reports outline the plans for the development, addressing both onshore and offshore considerations while the HRA screening reports outline the key protected sites and species of relevance to the Stromar development area. The HRA screening reports also present how impacts will be assessed in more detail at the next stage, the developer said.

The project team will now schedule several community consultation events in Spring 2024 to ensure stakeholders are fully informed and that their views are considered in the site selection, design, and development of the project, according to the developer.

This map shows the various ScotWind leases.

Note.

- The numbers are Scotwind’s lease number in their documents.

- 10 is now Stromar

- This is the Stromar web site.

- One of the partners; Falck Renewables changed its name to Renantis in 2022.

- The next stage is to be awarded a Contract for Difference.

The Internet is suggesting a completion date of 2028.