‘Drone Boats Will Be The New Normal’

The title of this post is the same as this article on the BBC.

This is the sub-heading.

A remotely operated boat will survey an area hundreds of miles offshore – while being controlled from an inland airport.

These two paragraphs add more details to the story.

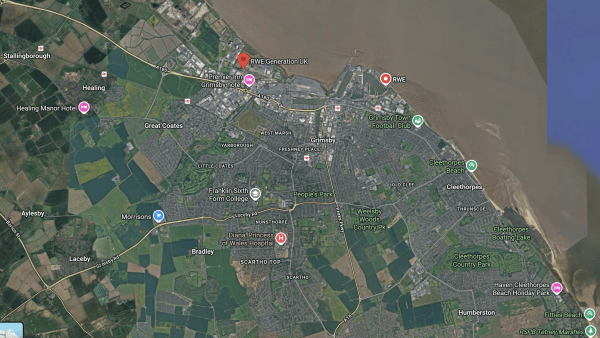

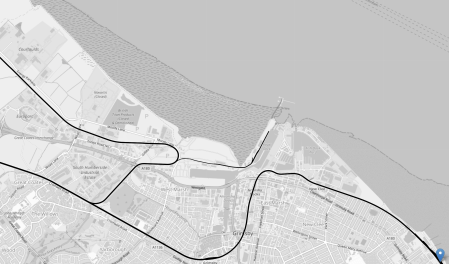

The Orsted Examiner is being launched this week from Grimsby by the renewable energy company, which is currently building the Hornsea 3 windfarm in the North Sea.

The vessel contains enough fuel to be at sea for several months, and an internet connection means it can be remotely controlled from anywhere.

Note.

- This would appear to be an elegant way to improve both productivity and safety.

- In RWE Opens ‘Grimsby Hub’ For Offshore Wind Operations And Maintenance, I indicated that RWE will have a Grimsby hub.

- Will the two companies have similar drone boats?

I certainly agree with the title of the post.

US Federal Court Clears Revolution Wind To Resume Construction As Ørsted, Skyborn’s Lawsuit Against Stop-Work Orders Progresses

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The US District Court for the District of Columbia has granted the preliminary injunction sought by the joint venture between Ørsted and Skyborn Renewables for the Revolution Wind project, which was ordered to pause construction by the US government. When the stop-work order was issued on 22 December 2025, the 704 MW project had seven wind turbines left to install.

This paragraph adds more detail.

The underlying lawsuit that the Revolution Wind joint venture filed against the first stop-work order issued for the offshore wind farm on 22 August 2025, which was supplemented to also challenge the 22 December 2025 order, continues to progress in the court, while the preliminary injunction will allow the construction activities to restart immediately.

Note.

- Ørsted said on the 12th January 2026, that they would resume work as soon as practically possible.

- Ørsted have also said that the project is approximately 87 per cent complete and was expected to begin generating power this month.

- In New York Attorney General Files Lawsuits Against Trump Admin’s Stop-Work Orders For Empire Wind, Sunrise Wind, Trump is also facing a second legal action over offshore wind.

It does seem that we are seeing what happens, when the irresistible force that is Trump meets the immovable force, that is United States law.

Ørsted to File for Another Preliminary Injunction Against Stop-Work Order In US

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted will submit a motion for a preliminary injunction against the recently imposed construction halt for its Sunrise Wind project in the US, the company said on 7 January, several days after announcing the same legal action in relation to Revolution Wind, which the developer is building through a joint venture with Skyborn Renewables.

These two paragraphs add more details.

For Sunrise Wind, Ørsted is set to file a complaint in the US District Court for the District of Columbia challenging the lease suspension order issued by the US Bureau of Ocean Energy Management (BOEM) on 22 December 2025, which will be followed by a motion for a preliminary injunction.

The company says that Sunrise Wind, being built off New York, is now nearly 45 per cent complete, with 44 of 84 monopile foundations, the offshore converter station, and nearshore export cables installed. The construction of the onshore electric infrastructure is also substantially complete, according to the developer.

It appears now that Ørsted is now involved in two injunctions, as another one that I outlined in Ørsted-Skyborn JV Takes Legal Action Against US Gov’t Over Stop-Work Order; Seven Turbines Left To Install On Revolution Wind.

It would appear that Trump is throwing good money down the drain in pursuit of his stupid vendetta against wind farms.

Ørsted-Skyborn JV Takes Legal Action Against US Gov’t Over Stop-Work Order; Seven Turbines Left To Install On Revolution Wind

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

On New Year’s Day, Revolution Wind LLC, the 50/50 joint venture between Ørsted and Skyborn Renewables, filed a supplemental complaint in the US District Court for the District of Columbia and plans to move for a preliminary injunction to block the lease suspension order recently imposed by the US government that stopped construction on its 704 MW project, which is now approximately 87 per cent complete and was expected to start generating power in January 2026.

These five paragraphs give more details of the story.

The lease suspension order, issued by the US Department of the Interior’s Bureau of Ocean Energy Management (BOEM) on 22 December 2025, directed all major offshore wind projects under construction to pause pending a review of alleged national security risks.

The developer asserts the suspension is unlawful and would cause substantial harm to the project, similar to the August 2025 stop-work order.

The project partners say Revolution Wind secured all required federal and state permits in 2023 after extensive reviews and engaged in multi-year consultations with defence authorities, resulting in formal mitigation agreements.

The project is approximately 87 per cent complete, with all foundations, offshore substations and export cables – and 58 of the total 65 wind turbines – installed, and was expected to begin generating power this month.

The developer also noted that the project will supply affordable power to over 350,000 homes under long-term power purchase agreements and support grid reliability in the Northeast.

A Verdict From Google AI

Pending any final result from my learned friends, I asked Google AI, if Revolution Wind will win their case and received this answer.

The question of whether Revolution Wind will ultimately win its case against the federal government’s Bureau of Ocean Energy Management (BOEM) has no final answer yet, as the litigation is ongoing. However, a federal judge has so far ruled in favor of Revolution Wind in a key preliminary step.

Key Developments in the Case

Initial Ruling: In September 2025, a U.S. District Court judge in D.C., Royce Lamberth, granted a preliminary injunction that allowed construction on the nearly-complete project to resume. The judge stated that Revolution Wind was likely to succeed on the merits of its claims and that the project would face “substantial harm” otherwise. The judge called the government’s initial “stop-work order” the “height of arbitrary and capricious action” because it failed to provide a factual basis for the cited national security concerns.

Outcome Uncertainty: The preliminary injunction allows work to continue while the full case proceeds, which could take years. The final outcome of the case depends on the court’s ultimate decision on the merits of the lawsuit

There is going to be some interesting reporting of this case, when the judges give their verdict.

The most interesting case, will probably be the one surrounding Coastal Virginia Offshore Wind as that is a 2.6 GW wind farm, which will generate a lot of fees for lawyers.

US Government Sends Stop Work Order To All Offshore Wind Projects Under Construction

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The US Department of Interior has paused the leases and suspended construction at all large-scale offshore wind projects currently under construction in the United States, citing ”national security risks identified by the Department of War in recently completed classified reports.”

The wind farms named are.

- Coastal Virginia Offshore Wind-Commercial – 2,600 GW

- Empire Wind 1 – 810 MW

- Revolution Wind – 704 MW

- Sunrise Wind – 924 MW

- Vineyard Wind 1 – 806 MW

Note.

- These five wind farms total 5,844 MW or 5.8 GW.

- The Empire Wind development is being led by Equinor, who are Norwegian.

- The Revolution Wind and Sunrise Wind developments are being led by Ørsted, who are Danish.

- The Vineyard Wind development is being led by Iberdrola, who are Spanish and Copenhagen Infrastructure Partners, who are Danish.

- Coastal Virginia Offshore Wind project uses 176 Siemens Gamesa SG 14-222 DD (Direct Drive) offshore wind turbines.

- Empire 1 Wind is using Vestas V236-15MW offshore wind turbines.

- Revolution Wind is using 65 Siemens Gamesa SG 11.0-200 DD offshore wind turbines.

- Sunrise Wind is using Siemens Gamesa wind turbines, specifically their 8.0 MW models (SG 8.0-167).

- Vineyard 1 Wind is using General Electric (GE) Haliade-X 13 MW offshore wind turbines.

- Some of the components for the Siemens wind turbines will be manufactured in Virginia.

- Coastal Virginia Offshore Wind has a budget of $11.2-3 billion.

- Empire 1 Wind has a budget of $5 billion.

- Resolution Wind has a budget of $4 billion.

- Sunrise Wind has a budget of $5.3 billion.

- Vineyard 1 Wind has a budget of $4 billion.

There will only be one winner in this new round of the ongoing spat between Trump and the wind industry, that he hates so much – the 1.3 million active lawyers in the United States,which is a figure from according to Google AI.

Ørsted Raises EUR 7.98 Billion In Oversubscribed Rights Issue

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted has completed its rights issue, raising DKK 59.56 billion (approximately EUR 7.98 billion) with a subscription rate of approximately 99.3 per cent, the company said on 6 October.

These two introductory paragraphs add more details.

Existing shareholders were offered new shares at DKK 66.60 (EUR 8.92) each. The demand for shares not taken up via the rights issue was “extraordinarily high,” according to the developer’s announcement of the Rights Issue results, and allocations were capped per application, meaning no subscriptions were required under the underwriting bank syndicate.

As reported in August, the company appointed a syndicate of BNP PARIBAS, Danske Bank A/S and J.P. Morgan SE as Joint Global Coordinators, next to Morgan Stanley & Co International, to jointly underwrite the rights issue for the approximately 49.9 per cent that would not be subscribed to by Ørsted’s majority shareholder, the Danish state (50.1 per cent).

I dread to think what spiteful punishment that Trumpkopf will inflict on Ørsted.

But the oversubscribed Rights Issue may be good news for the UK.

Ørsted has only one major project under development or construction in the UK.

But it is the large Hornsea Three wind farm, which has this opening paragraph on its web site.

Hornsea 3 Offshore Wind Farm will deliver enough green energy to power more than 3 million UK homes. An £8.5 billion infrastructure project, Hornsea 3 will make a significant contribution toward UK energy security, as well as the local and national economy.

Note.

- Ørsted are raising £7.98 billion and spending £8.5 billion, which must do something for the UK’s economy.

- Hornsea 3 will have a generating capacity of 2.9 GW.

- Ørsted are now delivering the world’s single largest offshore wind farm.

- Hornsea 3 will connect to the National Grid at Swardestone in Norfolk.

In Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, I describe how the 300 MW/600 MWh Swardestone BESS will be built, where Hornsea 3 connects to the grid.

As Swardestone will have 2.9 GW from Hornsea 3 and a powerful battery, I would expect someone will be looking to site a data centre or something with a need for a lot of stable electricity at or near Swardestone.

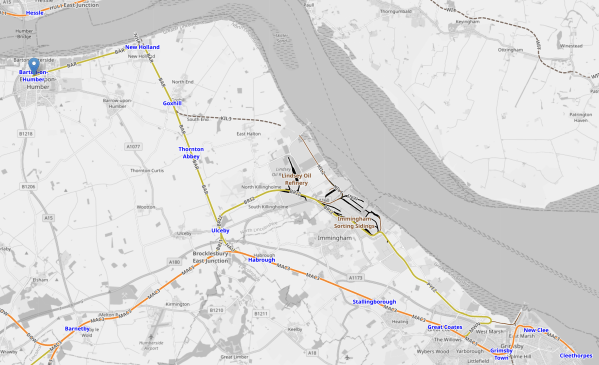

In Opportunity For Communities To Have Their Say On National Grid Proposals For Norwich To Tilbury Project, I talk about a line of pylons between Swardestone and Tilbury and show this map of the route.

This page on the National Grid web site has an interactive version of this map.

Note.

- The mauve line indicates the route of the Norwich to Tilbury project.

- Swardestone is at the Northern end of the project a few miles South of Norwich.

- Tilbury is at the Southern end of the project on the Thames estuary.

- The project connects Norwich, Ipswich, Colchester and Chelmsford to Hornsea 3 at Swardestone.

- I suspect the project will connect to Ipswich at the Bramford substation.

- The Sizewell nuclear site is to the North-East of Woodbridge and connects to the grid at the Bramford substation.

I know East Anglia well and I would suspect that Norwich, Ipswich, Colchester, Chelmsford and Southend-on-Sea could support one or more data centres.

Conclusion

I asked Google AI, who owns Hornsea 1 and received this reply.

Hornsea 1 is owned by a partnership including Ørsted, Equitix, TRIG, GLIL, Octopus, and Brookfield, with Ørsted also providing the operational management. A 2018 agreement between Ørsted and Global Infrastructure Partners (GIP) originally established the 50/50 joint venture for the project.

I then asked Google AI, who owns Hornsea 2 and received this reply.

The ownership of the Hornsea 2 wind farm is shared between several entities, including a 37.55% stake held by Ørsted, a 25% stake each by AXA IM Alts and Crédit Agricole Assurances, and a 12.45% stake held by Brookfield. The wind farm is located offshore in the UK’s North Sea, approximately 89 km off the Yorkshire coast.

In November 2019, I also wrote World’s Largest Wind Farm Attracts Huge Backing From Insurance Giant.

It does seem to me that Ørsted are past masters of developing a wind farm, then selling it on and using that money to develop the next wind farm.

The Rights Issue just makes that process easier.

Ørsted In Talks To Sell Half Of Huge UK Wind Farm To Apollo

The title of this post, is the same as that as this article in The Times.

This is the sub-heading.

The US investment giant is eyeing a 50 per cent stake in the Danish energy company’s £8.5 billion Hornsea 3 project off the Yorkshire coast

These are the first three paragraphs, which add more detail.

An American investment giant is negotiating a deal to buy half of what will be the world’s largest off-shore wind farm off the coast of Yorkshire from the troubled Danish energy company Ørsted.

New York-based Apollo, which oversees assets of about $840 billion, is in talks with Ørsted about acquiring a 50 per cent stake in Hornsea 3, an £8.5 billion project that started construction in 2023 and will be capable of powering more than three million UK homes.

A transaction would be a boost for Orsted, which has come under pressure in recent months from rising costs and a backlash against renewables in the United States by President Trump. Orsted started the process of selling a stake in Hornsea 3 in 2024 and said last month that it had an unnamed preferred bidder for the asset, which the Financial Times first reported was Apollo.

I have written several times about Ørstedregularly building a large wind farm and then selling it, so they must be doing something right.

In World’s Largest Wind Farm Attracts Huge Backing From Insurance Giant, I wrote about how Aviva bought Hornsea 1 from Ørsted.

One of the guys at Aviva explained that these sort of investments gave the right sort of cash flow to fund insurance risks and pensions.

Now that Trump has attempted to give his kiss of death to wind power in the United States, will US funds be looking for quality investments like Hornsea 3 in the UK and other large wind farms in France, Germany, Norway, Japan and Korea?

Already, Blackrock are investing billions to build a massive data centre at Blyth, where there are Gigawatts of offshore wind power and an interconnector to Norway, so that UK and Norwegian wind can be backed up by UK nuclear and Norwegian hydropower.

Highview Power And Ørsted

I wrote Highview Power, Ørsted Find Value In Integrating Offshore Wind With Liquid Air Energy Storage in November 2023.

I would have thought, that by now a battery would have been announced in one of Ørsted’s many projects.

I asked Google AI if Highview Power and Ørsted were still talking about liquid air energy storage and received this reply.

Yes, Highview Power and Ørsted are still actively involved in Liquid Air Energy Storage (LAES), having completed a joint study in late 2023 on combining LAES with offshore wind to benefit the UK grid, and the findings were presented to the government for its long-duration energy storage (LDES) consultation. They believe LAES can reduce wind curtailment, increase energy productivity, and support grid resilience, with potential projects aligned with offshore wind farm timelines.

Perhap’s Ørsted are getting their finances aorted first?

Conclusion

The Times They Are A-Changing!

Offshore Construction Work Resumes On Revolution Wind After US Judge’s Ruling

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

A US judge in Washington has cleared the way for work to resume on the 704 MW Revolution Wind offshore wind farm after granting a temporary injunction that lifted the federal stop-work order imposed in August.

These two paragraphs add details to the post.

On 22 August, the US Department of the Interior’s (DOI) Bureau of Ocean Energy Management (BOEM) issued a stop-work order halting all offshore construction activities on the 704 MW project, which is already 80 per cent completed, according to its developers, Ørsted and Skyborn Renewables.

A few days later, the joint venture challenged the stop-work order in the US District Court for the District of Columbia, while Connecticut and Rhode Island filed their own lawsuits against the decision on the same day.

I’ve written about this project before in ‘This Has Nothing To Do With National Security’ | Revolution Wind Halt Leaves Connecticut Leaders Demanding Answers