AquaVentus

I suggest, that you read this page on the RWE web site called AquaVentus.

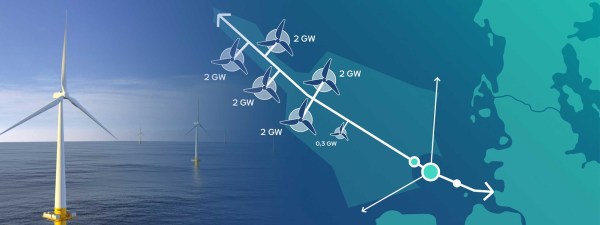

The page starts with this RWE graphic.

It appears that 10.3 GW of hydrogen will be created by offshore wind farms and piped to North-West Germany.

These two paragraphs outline the AquaVentus initiative .

Hydrogen is considered the great hope of decarbonisation in all sectors that cannot be electrified, e.g. industrial manufacturing, aviation and shipping. Massive investments in the expansion of renewable energy are needed to enable carbon-neutral hydrogen production. After all, wind, solar and hydroelectric power form the basis of climate-friendly hydrogen.

In its quest for climate-friendly hydrogen production, the AquaVentus initiative has set its sights on one renewable energy generation technology: offshore wind. The initiative aims to use electricity from offshore wind farms to operate electrolysers also installed at sea on an industrial scale. Plans envisage setting up electrolysis units in the North Sea with a total capacity of 10 gigawatts, enough to produce 1 million metric tons of green hydrogen.

The page also gives these numbers.

- Total Capacity – 10 GW

- Tonnes Of Green Hydrogen – 1 million

- Members – 100 +

The web site says this about commissioning.

Commissioning is currently scheduled for early/mid 2030s.

The Germans can’t be accused of lacking ambition.

Conclusion

AquaVentus will bring the Germans all the hydrogen they need.

I suspect AquaVentus can be expanded into the waters of other countries surrounding the German territorial waters.

UK Boosts Sixth CfD Auction Budget, Earmarks GBP 1.1 Billion For Offshore Wind

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK government has decided to increase the budget for the next Allocation Round 6 (AR6) to GBP 1.5 billion, including GBP 1.1 billion for offshore wind. The funding uplift represents more than a 50 per cent increase on the budget previously set in March this year.

These are the first three paragraphs.

At the beginning of this year, the UK government revealed a budget of GBP 1 billion for this year’s Contracts for Difference (CfD) AR6 with the majority of it, GBP 800 million, earmarked for offshore wind.

However, the new budget, announced on 31 July by the UK’s Secretary of State for Energy Security and Net Zero, Ed Miliband, marks a GBP 500 million increase over the funding set by the previous Conservative government.

The scheme’s design means the central government’s budget will not be impacted, following findings from a Treasury spending audit revealed GBP 22 billion of unfunded pledges inherited from the previous government, according to the press release.

I do find it interesting, that despite blaming some dubious funding from the previous government, that more of the same will be used to develop some more wind farms.

Welcoming GB Energy And Its Mission To Make Britain A Clean Energy Superpower

The title of this post, is the same as that of this press release from SSE.

This is the sub-heading.

Making Britain a clean energy superpower by 2030 is one of the new government’s five missions. The UK Government and Crown Estate have announced plans to join forces to create a new publicly owned energy firm. GB Energy will invest in homegrown, clean energy.

These are the first two paragraphs of SSE’s response to the announcement.

We welcome the focus of GB Energy on earlier stage technologies, such as carbon capture and storage (CCS), where the Government can de-risk projects and help accelerate the clean energy transition.

In areas such as offshore wind, where industry is already delivering mission-critical infrastructure, the biggest impact will be on delivering policies that speed up the build out of these essential projects.

It looks like SSE, see Great British Energy as a positive development.

UK Company Unveils Mooring Solution For Floating Offshore Wind

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

UK-based Blackfish Engineering has unveiled a mooring system, called C-Dart, which eliminates the direct handling of heavy mooring lines by operational personnel. The system is designed to rapidly connect various floating structures and assets, including wave and tidal energy converters, offshore wind, floating solar platforms, aquaculture, and more, according to the company.

These three paragraphs give a few details.

By utilising the principles of gravity, buoyancy, and rope tension, the C-Dart system facilitates a contact-free, automated connection process that secures equipment securely and swiftly, Blackfish said.

The system’s rapid connect and disconnect capability is said to cut down the time typically required for offshore operations which is vital in reducing the overall operational costs and downtime, particularly in the high-stakes environment of renewable energy projects.

Constructed from high-tensile, corrosion-resistant materials, the C-Dart system could withstand harsh oceanic environments, extending its service life while minimising maintenance requirements.

There is also this excellent video.

These are my thoughts.

The Companies Involved

The companies, organisations involved are listed on the C-Dart product page.

Skua Marine Ltd, Morek Ltd, Flowave, Underwater Trials Centre, Offshore Simulation Centre, National Decommissioning Centre, Bureau Veritas, Queen Mary University, The Waves Group, KML, Alex Alliston, Arnbjorn Joensen

Note.

- Blackfish Engineering are in Bristol.

- Bureau Veritas is a French company specialized in testing, inspection and certification founded in 1828.

- Queen Mary University is in London.

- The Underwater Trials Centre is in Fort William.

- The National Decommissioning Centre is in Aberdeen.

- The Offshore Simulation Centre, is in Norway.

Funding came from the Scottish Government.

Good Design And Improved Safety

It does look in this product that good design and improved safety go together.

Conclusion

This peoduct could be a real winner.

3 GW Dogger Bank South Offshore Wind Farms Reach New Development Stage

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK Planning Inspectorate has accepted into the examination phase the Development Consent Order (DCO) application for the Dogger Bank South (DBS) Offshore Wind Farms developed by RWE and Masdar.

The first two paragraphs give a brief description of the wind Farm.

The DBS East and DBS West offshore wind farms, which could provide electricity for up to three million typical UK homes, are located in shallow waters on the Dogger Bank over 100 kilometres off the northeast coast of England. The acceptance of the DCO application moves the projects into the pre-examination phase, which will become subject to a public examination later in 2024.

Together, the projects will have up to 200 turbines with a combined estimated capacity of 3 GW. Investment by RWE and Masdar during development and construction is predicted to deliver an economic contribution (Gross Value Added) to the UK of almost GBP 1 billion, including GBP 400 million in the Humber region.

There is a detailed map in the article on offshoreWIND.biz.

The Next Steps

These are given in the article.

The next steps for the projects, following a successful Development Consent Order, would be to secure Contracts for Difference (CfD), followed by financing and construction, the developers said.

It certainly looks like the 3 GW Dogger South Bank Wind Farm is on its way.

These are my thoughts about the project.

The Turbines To Be Used

The article says this about the turbines.

Together, the projects will have up to 200 turbines with a combined estimated capacity of 3 GW.

This means that the turbines will be 15 MW.

In RWE Orders 15 MW Nordseecluster Offshore Wind Turbines At Vestas, I said this.

Does this mean that the Vestas V236-15.0 MW offshore wind turbine, is now RWE’s standard offshore turbine?

This would surely have manufacturing, installation, operation and maintenance advantages.

There would surely be advantages for all parties to use a standard turbine.

It’s A Long Way Between Yorkshire And The Dogger Bank

The article says it’s a hundred kilometres between the wind farm and the coast of Yorkshire.

Welcome To The Age Of Hydrogen

This is the title of this page of the RWE web site.

The page starts with this paragraph.

RWE is actively involved in the development of innovative hydrogen projects. The H2 molecule is considered to be an important future building block of a successful energy transition. RWE is a partner in over 30 H2 projects and is working on solutions for decarbonising the industry with associations and corporations like Shell, BASF and OGE. Hydrogen projects are comprehensively supported in the separate Hydrogen department of the subsidiary RWE Generation.

AquaVentus

I also suggest, that you read this page on the RWE web site called AquaVentus.

The page starts with this RWE graphic.

It appears that 10.3 GW of hydrogen will be created by wind farms and piped to North-West Germany.

These two paragraphs outline the AquaVentus initiative .

Hydrogen is considered the great hope of decarbonisation in all sectors that cannot be electrified, e.g. industrial manufacturing, aviation and shipping. Massive investments in the expansion of renewable energy are needed to enable carbon-neutral hydrogen production. After all, wind, solar and hydroelectric power form the basis of climate-friendly hydrogen.

In its quest for climate-friendly hydrogen production, the AquaVentus initiative has set its sights on one renewable energy generation technology: offshore wind. The initiative aims to use electricity from offshore wind farms to operate electrolysers also installed at sea on an industrial scale. Plans envisage setting up electrolysis units in the North Sea with a total capacity of 10 gigawatts, enough to produce 1 million metric tons of green hydrogen.

The page also gives these numbers.

- Total Capacity – 10 GW

- Tonnes Of Green Hydrogen – 1 million

- Members – 100 +

The web site says this about commissioning.

Commissioning is currently scheduled for early/mid 2030s.

The Germans can’t be accused of lacking ambition.

AquaVentus And The UK

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- There is a link to Denmark.

- There appears to be a undeveloped link to Norway.

- There appears to be a link to Peterhead in Scotland.

- There appears to be a link to just North of the Humber in England.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers distributing the hydrogen to where it is needed?

In the last century, the oil industry, built a substantial oil and gas network in the North Sea. It appears now the Germans are leading the building of a substantial hydrogen network.

AquaVentus And Aldbrough And Rough Gas Storage

Consider.

- In The Massive Hydrogen Project, That Appears To Be Under The Radar, I describe the Aldbrough Gas Storage.

- In Wood To Optimise Hydrogen Storage For Centrica’s Rough Field, I describe Centrica’s plans to turn Rough Gas Storage into the world’s largest hydrogen store.

- There is a small amount of hydrogen storage at Wilhelmshaven.

It looks like the East Riding Hydrogen Bank, will be playing a large part in ensuring the continuity and reliability of AquaVentus.

Dogger Bank South And AquaVentus

This Google Map shows the North Sea South of Sunderland and the Danish/German border.

Note.

- Sunderland is in the top-left hand corner of the map.

- A white line in the top-right corner of the map is the Danish/German border.

- Hamburg and Bremen are in the bottom-right hand corner of the map.

If you lay the AquaVentus map over this map, I believe that Dogger Bank South wind farm could be one of the three 2 GW wind farms on the South-Western side of the AquaVentus main pipeline.

- Two GW would be converted to hydrogen and fed into the AquaVentus main pipeline.

- One GW of electricity would be sent to the UK.

But this is only one of many possibilities.

Hopefully, everything will be a bit clearer, when RWE publish more details.

Conclusion

I believe, that some or all of the Dogger Bank South electricity, will be converted to hydrogen and fed into the AquaVentus main pipeline.

I also believe, that the hydrogen stores in the East Riding of Yorkshire, will form an important part of AquaVentus.

UK’s First Offshore Hydrogen Production Trials Kick Off in South Wales

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

After six years of development, sustainability consultancy ERM has launched offshore trials to test its Dolphyn Hydrogen process which combines electrolysis, desalination, and hydrogen production on a floating wind platform, marking the first time hydrogen has been produced from seawater in a marine environment in the UK.

These are the first three paragraphs.

The trials conducted in Pembroke Port, South Wales, through July 2024 are said to represent an important step forward in enabling the UK to produce low-carbon hydrogen safely, reliably, and at scale.

In ERM’s Dolphyn Hydrogen process, hydrogen is transported to shore via a pipeline and it can be used directly for power generation, transport, industrial purposes, and heating.

The development of the Dolphyn Hydrogen process has been supported by the UK Government’s Department for Energy Security and Net Zero, through the Low Carbon Hydrogen Supply 2 Competition in the GBP 1 billion (approximately USD 1.2 billion) Net Zero Innovation Portfolio (NZIP). It has been awarded funding of over GBP 8 million (about USD 10.13 million) to date and has also been championed by devolved Governments in Wales and Scotland.

There’s more about Dolphyn Hydrogen on their web site.

Conclusion

This self-contained floating hydrogen factory could be very useful operating either singly or as a small fleet.

It would help if Dolphyn Hydrogen disclosed some hydrogen production capacities.

This is said in a press release.

The pilot project at Vattenfall’s Offshore Wind Farm in Aberdeen Bay will have an output of 8.8MW and will be able to produce enough hydrogen every day to power a hydrogen bus to travel 24,000km.

That looks about right.

I shall be following Dolphyn Hydrogen.

Norway’s Sovereign Wealth Fund Acquires Stake In 573 MW Race Bank Offshore Wind Farm

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

A consortium made up of investment funds belonging to Australia-headquartered Macquarie Asset Management and Spring Infrastructure Capital has reached an agreement to divest a 37.5 per cent stake in the 573 MW Race Bank offshore wind farm in the UK to Norges Bank Investment Management.

These four paragraphs give more details of the deal.

The stake was sold to the Norwegian sovereign wealth fund for approximately GBP 330 million (about EUR 390.6 million).

According to Norges Bank Investment Management, the fund acquired Macquarie European Infrastructure Fund 5’s 25 per cent stake and Spring Infrastructure 1 Investment Limited Partnership’s 12.5 per cent interest in the Race Bank offshore wind farm.

A Macquarie Capital and Macquarie European Infrastructure Fund 5 consortium acquired a 50 per cent stake in Race Bank during the construction phase in 2016. Macquarie Capital divested its 25 per cent stake in the wind farm in 2017.

With the deal, Arjun Infrastructure Partners will remain co-investor for 12.5 per cent of the wind farm and Ørsted will remain a 50 per cent owner and operator of Race Bank.

These are my thoughts.

The Location of Race Bank Wind Farm

This map from the Outer Dowsing Web Site, shows Race Bank and all the other wind farms off the South Yorkshire, Lincolnshire and Norfolk coasts.

From North to South, wind farm sizes and owners are as follows.

- Hornsea 1 – 1218 MW – Ørsted, Global Infrastructure Partners

- Hornsea 2 – 1386 MW – Ørsted,Global Infrastructure Partners

- Hornsea 3 – 2852 MW – Ørsted

- Hornsea 4 – 2600 MW – Ørsted

- Westernmost Rough – 210 MW – Ørsted and Partners

- Humber Gateway – 219 MW – E.ON

- Triton Knoll – 857 MW – RWE

- Outer Dowsing – 1500 MW – Corio Generation, TotalEnergies

- Race Bank – 573 MW – Ørsted,

- Dudgeon – 402 MW – Equinor, Statkraft

- Lincs – 270 MW – Centrica, Siemens, Ørsted

- Lynn and Inner Dowsing – 194 MW – Centrica, TCW

- Sheringham Shoal – 317 MW – Equinor, Statkraft

- Norfolk Vanguard West – 1380 MW – RWE

Note.

- There is certainly a large amount of wind power on the map.

- Hornsea 1, 2 and 3 supply Humberside.

- Hornsea 4 will supply Norwich and North Norfolk.

- Norfolk Vanguard West would probably act with the other two wind farms in RWE’ Norfolk cluster.

- Ignoring Hornsea and Norfolk Vanguard West gives a total around 4.5 GW.

- There are also two 2 GW interconnectors to Scotland (Eastern Green Link 3 and Eastern Green Link 4) and the 1.4 GW Viking Link to Denmark.

I wouldn’t be surprised to see a large offshore electrolyser being built in the East Lincolnshire/West Norfolk area.

The primary purpose would be to mop up any spare wind electricity to avoid curtailing the wind turbines.

The hydrogen would have these uses.

- Provide hydrogen for small, backup and peaker power stations.

- Provide hydrogen for local industry, transport and agriculture,

- Provide hydrogen for off-gas-grid heating.

- Provide methanol for coastal shipping.

Any spare hydrogen would be exported by coastal tanker to Germany to feed H2ercules.

Do We Need Wind-Driven Hydrogen Electrolysers About Every Fifty Miles Or so Along The Coast?

I can certainly see a string along the East Coast between Humberside and Kent.

- Humberside – Being planned by SSE

- East Lincolnshire/West Norfolk – See above

- North-East Norfolk – See RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030.

- Dogger Bank – See RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030.

- Sizewell – See Sizewell C And Hydrogen.

- Herne Bay – Under construction

I can see others at possibly Freeport East and London Gateway.

Vestas’s 15 MW Wind Turbine Up At Danish Port of Thyborøn

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Vestas has completed the installation of its V236-15.0 MW offshore wind turbine in the Port of Thyborøn in Denmark, only three months after the port ordered the company’s flagship model.

This is the first paragraph.

On 8 June, the wind turbine produced its first kWh of power, a crucial step in the final verification campaign, Vestas said in a social media post.

I suspect that soon, Vestas will be accepting orders for these large turbines.

The Core Of Sunak’s Manifesto

I have a feeling, that the core of Sunak’s manifesto is a massive German project called H2ercules, which is intended to bring low-carbon hydrogen to industry in South Germany.

There will be a massive hydrogen hub at Wilhelmshaven on the North-Western coast, which is being built by Uniper, from which hydrogen will be imported and distributed.

I suspect that the Germans aim to source the hydrogen worldwide from places like Australia, the Middle East and Namibia. It would be brought from and round the Cape by tanker. The Suez route would be too risky.

But RWE, who are one of the UK’s largest electricity suppliers, are planning to deliver 7.2 GW of electricity in British waters on the Dogger Bank and North-East of Great Yarmouth.

Both wind farms would be difficult to deliver profitably to the UK, because Eastern England already has enough electricity and the Nimbies are objecting to more pylons.

I believe that RWE will build offshore electrolysers and coastal hydrogen tankers will take the hydrogen to Wilhelmshaven.

H2ercules will be fed with the hydrogen needed.

By the end of the next parliament, the Germans could be paying us substantial sums for green hydrogen, to decarbonise their industry.

Rishi Sunak hinted in his speech, that we will be exporting large amounts of energy.

Much of it will be in the form of green hydrogen to Germany.

If we need hydrogen for our industry, we would create it from some of our own wind farms.

RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030

This press release from RWE is entitled RWE And Masdar Join Forces To Develop 3 Gigawatts Of Offshore Wind Projects Off The UK Coast.

This is the last paragraph.

The UK plays a key role in RWE’s strategy to grow its offshore wind portfolio RWE is a leading partner in the delivery of the UK’s Net Zero ambitions and energy security, as well as in contributing to the UK build-out target for offshore wind of 50 GW by 2030. RWE already operates 10 offshore wind farms across the UK. Following completion of the acquisition of the three Norfolk offshore wind projects from Vattenfall announced at the end of 2023, RWE is developing nine offshore wind projects in the UK, representing a combined potential installed capacity of around 9.8 GW, with RWE’s pro rata share amounting to 7 GW. Furthermore, RWE is constructing the 1.4 GW Sofia offshore wind project in the North Sea off the UK’s east coast. RWE’s unparalleled track record of more than 20 years in offshore wind has resulted in 19 offshore wind farms in operation, with a goal to triple its global offshore wind capacity from 3.3 GW today to 10 GW in 2030.

Note.

- Nine offshore wind projects in the UK, representing a combined potential installed capacity of around 9.8 GW

- RWE are saying they intend to add 6.7 GW in 2030.

The eight offshore wind farms, that RWE are developing in UK waters would appear to be.

- Sofia – 1,400 MW

- Norfolk Boreas – 1380 MW

- Norfolk Vanguard East – 1380 MW

- Norfolk Vanguard West – 1380 MW

- Dogger Bank South – 3000 MW

- Awel y Môr – 500 MW

- Five Estuaries – 353 MW

- North Falls – 504 MW

This is a total of 9897 MW, which ties in well with RWE’s new capacity figure of 9.8 GW.

The Location Of RWE’s Offshore Wind Farms

RWE’s wind farms seem to fit in groups around the UK.

Dogger Bank

This wind farm is on the Dogger Bank.

- Dogger Bank South – 3000 MW – Planned

This wind farm would appear to be rather isolated in the middle of the North Sea.

RWE could have plans to extend it or even link it to other wind farms in the German area of the Dogger Bank.

Lincolnshire Coast

This wind farm is along the Lincolnshire Coast.

- Triton Knoll – 857 MW – 2022

As there probably isn’t much heavy industry, where Triton Knoll’s power comes ashore, this wind farm can provide the power needed in the area.

But any excess power in the area can be exported to Denmark through the Viking Link.

Norfolk Coast

These wind farms are along the Norfolk Coast.

- Norfolk Boreas – 1380 MW – Planned

- Norfolk Vanguard East – 1380 MW – Planned

- Norfolk Vanguard West – 1380 MW – Planned

These three wind farms will provide enough energy to provide the power for North-East Norfolk.

North Wales Coast

These wind farms are along the North Wales Coast.

- Awel y Môr – 500 MW – Planned

- Gwynt y Môr – 576 MW – 2015

- Rhyl Flats – 90 MW – 2009

- North Hoyle – 60 MW – 2003

These wind farms will provide enough energy for the North Wales Coast.

Any spare electricity can be stored in the 1.8 GW/9.1 GWh Dinorwig pumped storage hydroelectric power station.

Electric Mountain may have opened in 1984, but it is surely a Welsh giant decades ahead of its time.

Suffolk Coast

These wind farms are along the Suffolk Coast.

- Five Estuaries – 353 MW – Planned

- Galloper – 353 MW – 2018

- North Falls – 504 MW – Planned

These wind farms will provide enough energy for the Suffolk Coast, which except for the Haven Ports, probably doesn’t have many large electricity users.

But if the area is short of electricity, there will be Sizewell B nuclear power station to provide it.

Teesside

This wind farm is along the Teesside Coast

- Sofia – 1,400 MW – Planned

Teesside is a heavy user of electricity.

These six areas total as follows.

- Dogger Bank – 3,000 MW

- Lincolnshire Coast – 857 MW

- Norfolk Coast – 4140 MW

- North Wales Coast – 1226 MW

- Suffolk Coast – 1210 MW

- Teesside – 1,400 MW

Backup for these large clusters of wind farms for when the wind doesn’t blow will be provided as follows.

- Dogger Bank – Not provided

- Lincolnshire Coast- Interconnectors to Denmark and Scotland

- Norfolk Coast – Not provided

- North Wales Coast – Stored in Dinorwig pumped storage hydroelectric power station

- Suffolk Coast – Sizewell B and Sizewell C

- Teesside – Interconnectors to Norway and Scotland and Hartlepool nuclear power stations

Note.

- The interconnectors will typically have a 2 GW capacity.

- The 1.9 GW/9.1 GWh Dinorwig pumped storage hydroelectric power station must be one of the best wind farm backups in Europe.

There is a very solid level of integrated and connected assets that should provide a reliable power supply for millions of electricity users.

How Will Dogger Bank And The Norfolk Coast Wind Clusters Work Efficiently?

The Dogger Bank and the Norfolk Coast clusters will generate up to 3 and 4.14 GW respectively.

So what purpose is large amounts of electricity in the middle of the North Sea?

The only possible purpose will be to use giant offshore electrolysers to create hydrogen.

The hydrogen will then be transported to point of use by pipeline or tanker.

Feeding H2ercules

I described H2ercules in H2ercules.

H2ercules is an enormous project that will create the German hydrogen network.

The H2ercules web site, shows a very extensive project, as is shown by this map.

Note.

- Hydrogen appears to be sourced from Belgium, the Czech Republic, The Netherlands and Norway.

- RWE’s Dogger Bank South wind farm will be conveniently by the N of Norway.

- RWE’s Norfolk cluster of wind farms will be conveniently by the N of Netherlands.

- The Netherlands arrow points to the red circles of two hydrogen import terminals.

For Germany to regain its former industrial success, H2ercules will be needed to be fed with vast amounts of hydrogen.

And that hydrogen could be in large amounts from the UK sector of the North Sea.

Uniper’s Wilhelmshaven Hydrogen Hub

This page on the Uniper web site is entitled Green Wilhelmshaven: To New Horizons

This Uniper graphic shows a summary of gas and electricity flows in the Wilhelmshaven Hydrogen Hub.

Note.

- Ammonia can be imported, distributed by rail or ships, stored or cracked to provide hydrogen.

- Wilhelmshaven can handle the largest ships.

- Offshore wind energy can generate hydrogen by electrolysis.

- Hydrogen can be stored in underground salt caverns.

I suspect hydrogen could also be piped in from an electrolyser in the East of England or shipped in by a hydrogen tanker.

All of this is well-understood technology.

Sunak’s Magic Money Tree

Rishi Sunak promised a large giveaway of tax in his manifesto for the 2024 General Election.

As we are the only nation, who can provide the colossal amounts of hydrogen the Germans will need for H2ercules, I am sure we will be well paid for it.

A few days ago we celebrated D-Day, where along with the Americans and the Canadians, we invaded Europe.

Now eighty years later, our hydrogen is poised to invade Europe again, but this time for everybody’s benefit.

This document on the Policy Mogul web site is entitled Rishi Sunak – Conservative Party Manifesto Speech – Jun 11.

These are three paragraphs from the speech.

We don’t just need military and border security. As Putin’s invasion of Ukraine has shown, we need energy security too. It is only by having reliable, home-grown sources of energy that we can deny dictators the ability to send our bills soaring. So, in our approach to energy policy we will put security and your family finances ahead of unaffordable eco zealotry.

Unlike Labour we don’t believe that we will achieve that energy security via a state-controlled energy company that doesn’t in fact produce any energy. That will only increase costs, and as Penny said on Friday there’s only one thing that GB in Starmer and Miliband’s GB Energy stands for, and that’s giant bills.

Our clear plan is to achieve energy security through new gas-powered stations, trebling our offshore wind capacity and by having new fleets of small modular reactors. These will make the UK a net exporter of electricity, giving us greater energy independence and security from the aggressive actions of dictators . Now let me just reiterate that, with our plan, we will produce enough electricity to both meet our domestic needs and export to our neighbours. Look at that. A clear, Conservative plan not only generating security, but also prosperity for our country.

I believe that could be Rishi’s Magic Money Tree.

Especially, if the energy is exported through electricity interconnectors or hydrogen or ammonia pipelines and tankers.

Will This Be A Party Anyone Can Join?

Other wind farm clusters convenient for the H2ercules hydrogen import terminals on the North-West German coast include.

- Dogger Bank – SSE, Equinor – 5008 MW

- East Anglian – Iberdrola – 3786 MW

- Hornsea – Ørsted – 8056 MW

That totals to around 16.5 GW of wind power.

I can see offshore electrolysers producing hydrogen all around the coasts of the British Isles.

What Happens If Sunak Doesn’t Win The Election?

RWE and others have signed contracts to develop large wind farms around our shores.

They didn’t do that out of the goodness of their hearts, but to make money for themselves and their backers and shareholders.

Conclusion

I believe a virtuous circle will develop.

- Electricity will be generated in the UK.

- Some will be converted to hydrogen.

- Hydrogen and electricity will be exported to the highest bidders.

- European industry will, be powered by British electricity and hydrogen.

- Money will be paid to the UK and the energy suppliers for the energy.

The more energy we produce, the more we can export.

In the future more interconnectors, wind farms and electrolysers will be developed.

Everybody will benefit.

As the flows grow, this will certainly become a Magic Money Tree, for whoever wins the election.