Ørsted Pulls Plug On 2.4 GW Hornsea 4 Offshore Wind Project In UK

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted has discontinued the development of the UK’s Hornsea 4 offshore wind farm in its current form. The developer said the 2.4 GW project has faced rising supply chain costs, higher interest rates, and increased construction and delivery risks since the Contract for Difference (CfD) award in Allocation Round 6 (AR6) in September 2024.

This introductory paragraph adds more detail.

In combination, these developments have increased the execution risk and deteriorated the value creation of the project, which led to Ørsted stopping further spending on the project at this time and terminating the project’s supply chain contracts, according to the Danish company. This means that the firm will not deliver Hornsea 4 under the CfD awarded in AR6.

Consider.

- Hornsea 4 will be connected to the grid at a new Wanless Beck substation, which will also include a battery and solar farm, which will be South West of the current Creyke Beck substation. Are Ørsted frightened of opposition from the Nimbies to their plans?

- I also wonder if political uncertainty in the UK, and the possibility of a Reform UK government, led by Nigel Farage is worrying companies like Ørsted.

So will factors like these prompt companies like Ørsted to move investment to countries, where they welcome wind turbines like Denmark, Germany and The Netherlands.

Could Ørsted Be Looking At An Alternative?

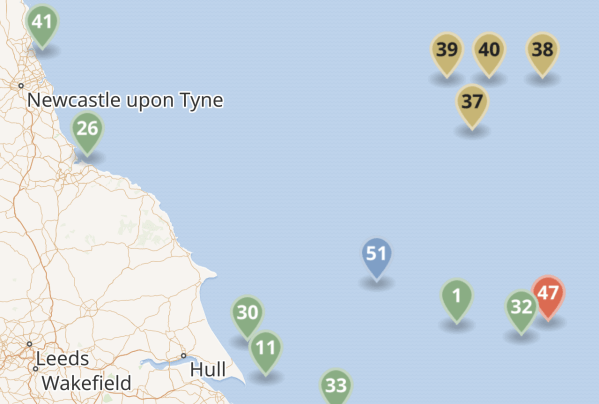

This is a map of wind farms in the North Sea in the Dogger Bank and Hornsea wind farms, that I clipped from Wikipedia..

These are the Dogger Bank and Hornsea wind farms and their developers and size

- 37 – Dogger Bank A – SSE Renewables/Equinor – 1,235 MW

- 39 – Dogger Bank B – SSE Renewables/Equinor – 1,235 MW

- 38 – Dogger Bank C – SSE Renewables/Equinor – 1,218 MW

- 40 – Sofia – RWE – 1,400 MW

- 1 – Hornsea 1 – Ørsted/Global Infrstructure Partners – 1,218 MW

- 32 – Hornsea 2 – Ørsted/Global Infrstructure Partners – 1,386 MW

- 47 – Hornsea 3 – Ørsted – 2,852 MW

- 51 – Hornsea 4 – Ørsted – 2,400 MW

Note.

- That is a total of 12, 944 MW, which is probably enough electricity to power all of England and a large part of Wales.

- Wikipedia’s List of offshore wind farms in the United Kingdom, also lists a 3,000 MW wind farm, that is being developed by German company ; RWE called Dogger Bank South,

- The Dogger Bank South wind farm is not shown on the map, but would surely be South of wind farms 37 to 40 and East of 51.

- The Dogger Bank South wind farm will raise the total of electricity in the Dogger Bank and Hornsea wind farms to just short of 16 GW.

Connecting 16 GW of new electricity into the grid, carrying it away to where it is needed and backing it up, so that power is provided, when the wind doesn’t blow, will not be a nightmare, it will be impossible.

An alternative plan is needed!

AquaVentus To The Rescue!

AquaVentus is a German plan to bring 10 GW of green hydrogen to the German mainland from the North Sea, so they can decarbonise German industry and retire their coal-fired power stations.

- I introduce AquaVentus in AquaVentus, which I suggest you read.

- AquaVentus is being developed by RWE.

- AquaVentus connects to a German hydrogen network called H2ercules to actually distribute the hydrogen.

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

I believe that offshore electrolysers could be built in the area of the Hornsea 4 and Dogger Bank South wind farms and the hydrogen generated would be taken by AquaVentus to either Germany or the UK.

- Both countries get the hydrogen they need.

- Excess hydrogen would be stored in Aldbrough and Rough.

- British Steel gets decarbonised.

- A 1.8 GW hydrogen-fired powerstation at Keadby gets the hydrogen it needs to backup the wind farms.

Germany and the UK get security in the supply of hydrogen.

These may be my best guesses, but they are based on published plans.

9.58 GW of Renewable Energy Contracts Signed In UK’s Latest CfD Auction

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Low Carbon Contracts Company (LCCC), a UK government-owned company, has signed 130 contracts for a total of 9.58 GW of renewable energy generation, covering the projects that were successful in the country’s latest Contracts for Difference (CfD) allocation round 6 (AR6).

These three paragraphs give more detail.

AR6 secured a broad range of technologies from wind and solar to emerging, innovative projects like tidal and floating offshore wind.

Offshore wind developers were awarded contracts for approximately 5.3 GW of capacity.

In the Round 6 auction, nine contracts for fixed-bottom projects were awarded, totalling 4.9 GW, while a single contract was granted for a floating wind project to Green Volt Offshore Windfarm, a consortium of Flotation Energy and Vårgrønn.

Once operational, AR6 projects will see 9.58 GW of renewable generation coming online, bringing the total CfD capacity to 34.74 GW. According to LCCC, this is the highest number of contracts ever signed in a single round.

Note that this will add nearly a third to the UK’s current renewable capacity.

1.4GW Of BESS Capacity Could Be Co-Located With AR6 Winners

The title of this post, is the same as that of this article on Solar Power Portal.

These are the first two introductory paragraphs of the article.

Analysis from Modo Energy has revealed that renewable energy projects awarded contracts under the Contracts for Difference (CfD) Allocation Round 6 (AR6) could facilitate 1.4GW of co-located battery energy storage systems (BESS).

While BESS projects themselves cannot directly participate in the CfD auction, projects awarded contracts are able to co-locate with a battery. Following changes to the rules following Allocation Round 4, BESS co-location is now a far easier prospect for generators, and AR6 saw record high levels of awards for solar projects.

Modo Energy have used two rules to decide which projects will have a battery.

Modo Energy analysis suggests that 5GW of the 9.6GW of renewable energy capacity awarded contracts in AR6 could be suitable for, or has already revealed plans for, co-located battery storage. As a result, as much as 1.4GW of BESS capacity could be created as part of new renewable projects resulting from the AR6.

Using an average ratio of 60MW of BESS capacity for every 100MW of solar generation capacity, Modo Energy has calculated that 1GW of this potential BESS capacity could come from solar projects alone.

Longfield Solar Energy Farm

The article and related documents also say this about Longfield Solar Energy farm.

- This could be the largest battery to co-locate with renewables from this allocation round.

- The project does have a web site.

- The farm has a 399 MW solar array.

- The web site says that the project will store or export up to 500 MW to and from the grid.

- The project is being developed by EDF Renewables.

- The solar farm appears to be North-East of Chelmsford.

The project should be completed by 2027/28.

Conclusion

As time goes on, we’lll see more and more batteries of all kinds co-located with renewable resources.

Hawthorn Pit Solar Farm

This document from the Department of Business, Industry and Industrial Strategy lists all the Contracts for Difference Allocation Round 6 results for the supply of zero-carbon electricity.

Hawthorn Pit solar farm was given a Contract for Difference.

The solar farm has a web page on the Aura Power web site, where this paragraph describes the solar farm.

Aura Power is working on a solar farm proposal between Murton and South Hetton, with a capacity of up to 49.9MW (Megawatts). The solar farm will be built without subsidy and would generate enough clean electricity to power the equivalent of over 17,000 homes, saving around 15,203 tonnes of CO2 from entering the atmosphere each year.

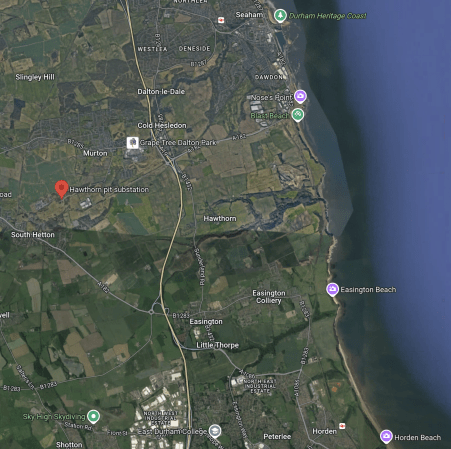

This Google Map shows the location of Hawthorn Pit.

Note.

- The Durham coast is at the East with Seaham at the North and Horden at the South.

- The A 19 runs North-South in the middle of the map.

- Hawthorn Pit substation is marked by the red arrow.

This second Google Map shows the substation in more detail.

There are a lot of switches and wires.

From the map on the Aura Power web site, it appears that the solar farm is to to the North side of the substation.

Eastern Green Link One

In the future Hawthorn Pit substation will also host the Southern end of Eastern Green Link One, which will be a a 2 GW high voltage direct current (HVDC) electrical superhighway to be built between the Torness area in East Lothian, Scotland and Hawthorn Pit in County Durham, England.

This is number one of four such 2 GW undersea connections that will distribute energy between England and Scotland.

Conclusion

Hawthorn Pit substation could growto an important interchange in the grid.

Cloiche Onshore Wind Farm

This document from the Department of Business, Industry and Industrial Strategy lists all the Contracts for Difference Allocation Round 6 results for the supply of zero-carbon electricity.

The largest onshore wind farm in the Allocation Round, is the Cloiche wind farm, which has this web page,which is entitled Onshore Wind Projects , on the SSE Renewables web site.

It is the only project on the page and these two paragraphs describe its location and capacity.

The proposed 29 turbine Cloiche Wind Farm is located on the Glendoe and Garrogie Estates, adjacent to the operational Stronelairg Wind Farm and Glendoe Hydroelectric Scheme and approximately 11 kilometres (km) to the south-east of Fort Augustus in the Great Glen, in the Monadhliath mountain range.

It is anticipated that the wind farm will generate approximately 130.5MW.

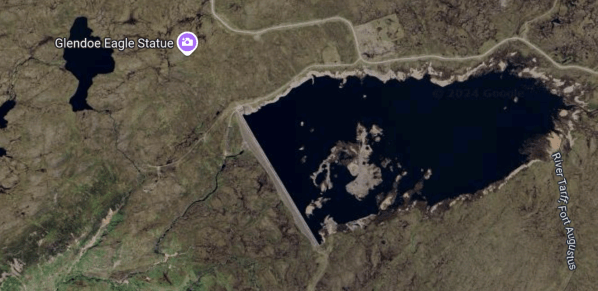

This Google Map shows the location.

Between the village of Fort Augustus and the Stronelairg wind farm, lies the Southern end of Loch Ness.

In the South-East corner of the map, there is a large lake, which is shown in more detail in this Google Map.

This is the Glendoe Reservoir for the Glendoe Hydro Scheme, that was built in the early years of this century, by damming the River Tarff.

The dam is clearly visible at the Western end of the Reservoir.

The Glendoe Hydro Scheme was opened in 2009 and has a generation capacity of 106.5 MW.

The planning and building of the scheme are described in this Wikipedia entry and the entry is well worth a read.

Stronelairg Wind Farm

Stronelairg wind farm, Cloiche wind farm and the Glendoe Hydro Scheme are all projects, that were or will be developed by SSE Renewables.

Stronelairg wind farm has 66 turbines and a total installed capacity of 228 MW.

It has a web page on the SSE Renewables web site.

These two paragraphs describe the location of Stronelairg wind farm.

Stronelairg sits at an elevation of around 600m above sea level in the Moadhliath Mountain range making it one of our windiest wind farms.

It sits within a natural bowl on a plateau, set well back from Loch Ness meaning that no turbines are visible from the main tourist routes in the area. Stronelairg is also located adjacent to our 100MW Glendoe hydro scheme and so the construction teams were able to use the hydro infrastructure as do our operational teams now.

Stronelairg wind farm appears tobe a powerful asset, hidden in the mountains.

Three Co-located Assets

As Cloche wind farm, will be adjacent to the operational Stronelairg Wind Farm and Glendoe Hydroelectric Scheme, these three energy producing assets, will be close together.

- Cloiche wind farm – 130.5 MW

- Stronelairg wind farm – 228 MW

- Glendoe Hydroelectric Scheme – 106.5 MW

Note.

- This is a total power of 465 MW.

- This would be equivalent to a medium-sized gas-fired power station.

- All three assets could use the same grid grid connection and other facilities.

It could be considered a 358.5 MW wind farm, backed by a 106.5 MW hydro power station.

When there is a shortage of wind, the Glendoe Hydroelectric Scheme could step in, if required.

Conclusion

Onshore wind, backed up by hydroelectric schemes would appear to be a good way to create reliable hybrid power stations.

Do any other schemes in Allocation Round 6, involve combining onshore wind with existing hydro schemes?

There Are Only Three Large Offshore Wind Farms In Contracts for Difference Allocation Round 6

This document from the Department of Business, Industry and Industrial Strategy lists all the Contracts for Difference Allocation Round 6 results for the supply of zero-carbon electricity.

The wind farms are.

- Green Volt – 400 MW – Floating – Claims to be “The first commercial-scale floating offshore windfarm in Europe”.

- Hornsea Four – 2,400 MW – Fixed – Ørsted

- East Anglia Two – 963 MW – Fixed – Iberdrola

Is this what misgovernment expected, when they raised the budget in July 2024, as I wrote about in UK Boosts Sixth CfD Auction Budget, Earmarks GBP 1.1 Billion For Offshore Wind.

Perhaps, some developers held back until government policy is clearer?

England’s First Onshore Wind Farm Of A New Generation

This document from the Department of Business, Industry and Industrial Strategy lists all the Contracts for Difference Allocation Round 6 results for the supply of zero-carbon electricity.

There is only one English onshore wind farm listed in the document and it is the 8 MW Alaska Wind Farm in Dorset.

It has its own web site and this is the sub heading.

Alaska is a wind energy project comprising 4 wind turbines that are currently under construction at Masters Quarry in East Stoke, near Wareham, Purbeck. This website aims to update you on progress and provide ways to get in touch with the project team.

This is the introductory paragraph.

Alaska Wind Farm is the first of its kind in the county. Dorset has a limited potential for large-scale onshore wind development due to a variety of environmental and technical constraints, such as landscape designations and grid connection opportunities. Extensive technical assessments undertaken during the planning process have demonstrated that the quarry off Puddletown Road makes an excellent site for a wind farm. At present, all four wind turbines have been installed and the team is working on connecting them to the local electricity network. Grid connection is taking longer than anticipated, but the project team are working with the Distribution Network Operator, SSE Networks, to get the wind farm connected over the summer. Once operational, the amount of green electricity generated is expected to meet the annual demand of up to 5,200 average UK households every year*.

This Google Map shows the site on Puddletown Road.

This second Google Map shows an enlargement of part of the site.

Note that are sixteen segments of wind turbine towers.

This article on the Swanage News is entitled Twenty Year Battle To Build Purbeck Wind Farm Is Finally Over.

It gives full details of the history of the wind farm.

The wind farm and a solar farm, will be surrounded by a new heath.

I particularly like this paragraph.

The new heath is expected to be home to all of Britain’s reptiles, including rare smooth snakes and sand lizards among other animals, as well as threatened butterflies, birds, bats and plants.

Renewable energy doesn’t have to wreck the countryside.I shall be watching how this project develops.

UK Boosts Sixth CfD Auction Budget, Earmarks GBP 1.1 Billion For Offshore Wind

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK government has decided to increase the budget for the next Allocation Round 6 (AR6) to GBP 1.5 billion, including GBP 1.1 billion for offshore wind. The funding uplift represents more than a 50 per cent increase on the budget previously set in March this year.

These are the first three paragraphs.

At the beginning of this year, the UK government revealed a budget of GBP 1 billion for this year’s Contracts for Difference (CfD) AR6 with the majority of it, GBP 800 million, earmarked for offshore wind.

However, the new budget, announced on 31 July by the UK’s Secretary of State for Energy Security and Net Zero, Ed Miliband, marks a GBP 500 million increase over the funding set by the previous Conservative government.

The scheme’s design means the central government’s budget will not be impacted, following findings from a Treasury spending audit revealed GBP 22 billion of unfunded pledges inherited from the previous government, according to the press release.

I do find it interesting, that despite blaming some dubious funding from the previous government, that more of the same will be used to develop some more wind farms.

Dogger Bank D Welcomes Confirmation Of Grid Connection Location

The title of this post, is the same as that of this press release from SSE Renewables.

This is the sub-heading.

Project team now focusing full attention on electrical transmission system connection.

These four paragraphs describe the proposed connection to the National Grid.

SSE Renewables and Equinor have welcomed confirmation of a grid connection location from the Electricity System Operator (ESO) for a proposed fourth phase of the world’s largest offshore wind farm.

Dogger Bank D will now connect into Birkhill Wood, a proposed new 400kV substation located in the East Riding of Yorkshire which will be built as part of National Grid’s Great Grid Upgrade.

The announcement follows the publication of an impact assessment for the South Cluster by ESO, relating to energy projects which are due to be electrically connected off the east coast of England.

With the location of a grid connection confirmed, Dogger Bank D will now focus its full attention on connecting to the electrical transmission system.

This is a big change from December 2023, when I wrote Plans for Hydrogen Development At Dogger Bank D Gain Ground, which indicated that Dogger Bank D would be used to produce hydrogen, so the grid connection wouldn’t be needed.

Using A Offshore Hybrid Asset Between the UK And Another European Country

This is the next paragraph on the SSE Renewables press release.

The project is also exploring the future possibility of the development of Dogger Bank D to be coordinated with an Offshore Hybrid Asset between the UK and another European country’s electricity market to form a multi-purpose interconnector. This option would increase energy security for the UK and reduce the need to curtail offshore wind output in times of oversupply on the GB network.

Note that just over the boundary of the UK’s Exclusive Economic Zone are the Dutch and German Exclusive Economic Zones.

It is not unreasonable to believe that UK, Dutch and German grid could all be connected on the Dogger Bank.

Connecting Everything Up At Birkhill Wood

This is the next paragraph on the SSE Renewables press release.

The project team are undertaking a site selection process to identify potential cable corridors and where other onshore infrastructure associated with the grid connection at Birkhill Wood may be sited. Consultation will be held later this year to introduce the connection proposals to the local community.

At least now, with the connection to Birkhill Wood confirmed, SSE and Equinor will be able to supply any electricity generated at Dogger Bank D to the UK grid, up to limit of the connection.

The Value Of Electricity That Could Be Generated At Dogger Bank D

Consider.

- The wind farm has a capacity of 2 GW or 2,000 MW.

- There are 365 days in most years.

- There are 24 hours in the day.

- This means that 17, 520,000 MWh could be generated in a year.

- A large wind farm like Hornsea One has a twelve month rolling capacity factor of 46.6%.

- Applying this capacity factor says that 8,164,320 MWh will be generated in a year.

- The Contract for Difference Round 6 for this electricity will be £73/MWh.

Applying that figure gives a yearly turnover of £ 595,995,360 or £ 297,997,680 per installed GW.

It is not unreasonable to assume that half of this electricity were to be exported to power Germany industry.

It could be a nice little earner for the Treasury.

UK Set To Provide Record GBP 800 Million Support For Offshore Wind Projects

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK government has revealed the budget of over GBP 1 billion (approximately EUR 1.2 billion) for this year’s Contracts for Difference (CfD) Allocation Round 6 (AR6) with the majority of it, GBP 800 million (around EUR 936 million), earmarked for offshore wind.

These three paragraphs explain the three pots.

The Department for Energy Security and Net Zero (DESNZ) confirmed that over GBP 1 billion will be set aside for the budget, divided into three pots.

Within the overall budget, GBP 120 million is designated for established technologies like solar and onshore wind in Pot 1, while GBP 105 million is set aside for emerging technologies such as floating offshore wind and geothermal in Pot 2.

According to DESNZ, following an extensive review of the latest evidence, including the impact of global events on supply chains, the government has allocated a record GBP 800 million for offshore wind, making this the largest round yet, with four times more budget available to offshore wind than in the previous round.

I am glad to see the support for geothermal energy.

Whilst, these three paragraphs explain the pricing.

This follows the increase in the maximum price for offshore wind and floating offshore wind in November and will help to deliver the UK’s ambition of up to 50 GW of offshore wind by 2030, including up to 5 GW of floating offshore wind, according to the government.

Last year, CfD Round 5 attracted no investors with the former maximum strike prices set at GBP 44/MWh for offshore wind with fixed-bottom foundations, which was too low for the developers who were facing the consequences of inflation and supply chain challenges. The maximum bid price for floating wind was GBP 114/MWh.

Now, the maximum price available for offshore wind projects with fixed-bottom foundations has risen by 66 per cent, from GBP 44/MWh to GBP 73/MWh. The maximum strike price for floating offshore wind projects increased by 52 per cent, from GBP 116/MWh to GBP 176/MWh ahead of AR6 which will open on 27 March.

Prices have certainly risen, but this paragraph explains a limiting mechanism, which is straight out of the Control Engineer’s Toolbox.

The funding for the support will be sourced from energy bills rather than taxation. However, if the price of electricity surpasses the predetermined rate, additional charges will be applied to wind power, with the excess funds returned to consumers.

I would hope that extensive mathematical modelling has been applied to test the new pricing structure.