SeAH Steel Holdings’ UK Monopile Factory To Launch With Major Offshore Wind Deals

The title of this post is the same as that of this article on the CHOSUN Daily.

These three paragraphs give more details.

SeAH Wind, the British offshore wind structure subsidiary of SeAH Steel Holdings, is set to begin commercial operations at its local plant next month, bolstering annual revenue growth projected to reach billions of dollars. The facility has received a total investment of £900 million ($1.1 billion or 1.6 trillion won), and the company has already secured orders surpassing the plant’s construction costs, ensuring a solid foundation for stable operations, according to industry sources.

Located in Teesside, northeastern England, the plant is in the final stages of equipment installation and test production ahead of its commercial launch. The facility has an annual production capacity of up to 400,000 metric tons of monopiles—cylindrical steel structures welded from thick steel plates—which serve as seabed foundations for offshore wind turbines.

The £900 million SeAH Wind plant was established with support from various group affiliates. SeAH Steel Holdings founded SeAH Wind in the UK in 2021, initially investing approximately 400 billion won ($274 million or £217 million) in the facility. Additional funding was secured through capital increases, with contributions from SeAH Steel Holdings, its steel pipe subsidiary SeAH Steel, and overseas branches, including U.S.-based SeAH Steel America and South Korea-based SeAH Steel International.

As the UK’s sole offshore wind monopile supplier, SeAH Wind has attracted significant attention. On Feb. 13, King Charles III visited the plant to inspect its production facilities, underscoring its strategic role in the country’s renewable energy sector.

The plant is making monopiles for the Hornsea 3 and Norfolk Vanguard wind farms.

Site Investigations Underway At RWE’s Three Norfolk Offshore Wind Project Sites

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

RWE has kicked off geophysical and geotechnical site investigations at the Norfolk Boreas, Norfolk Vanguard East, and Norfolk Vanguard West offshore wind project sites in the UK, rights to which the German company acquired from Vattenfall earlier this year.

All three projects in RWE’s 4.14 GW wind farm off the Norfolk coast, at last seem to be making progress.

According to the Wikipedia entry for the List Of Offshore Wind Farms In The United Kingdom, this is the last status.

Norfolk Boreas

Owner: RWE

Turbines: Vestas

Status: Contract for Difference – Round 4

Commissioning Date: 2027

Norfolk Vanguard East

Owner: RWE

Turbines: Vestas

Status: Early Planning

Commissioning Date: Before 2030

Norfolk Vanguard West

Owner: RWE

Turbines: Vestas V236-15.0 MW

Status: Early Planning

Commissioning Date: Before 2030

Note.

- All three Norfolk wind arms, will be using Vestas turbines.

- The data for Norfolk Vanguard West shows that Vestas V236-15.0 MW turbines will be used.

- In SeAH To Deliver Monopiles For Vattenfall’s 2.8 GW Norfolk Vanguard Offshore Wind Project, I discussed the monopiles for the Norfolk wind farms. Will these be standardised across the Norfolk wind farms?

- In RWE Orders 15 MW Nordseecluster Offshore Wind Turbines At Vestas, I speculated that RWE had standardised on these large turbines for their North Sea wind farms, which would surely be a sensible action to take.

Using the same large turbines and monopiles for a number of wind farms, will surely give advantages in manufacture, installation, operation and and servicing for RWE, SeAH Wind and Vestas.

The finances should also be more beneficial.

These are my thoughts.

Will The Norfolk Wind Farms Produce Hydrogen For Germany?

Consider.

- As Hornsea 4 wind farm makes landfall in Norfolk, Norfolk should have enough renewable electricity.

- The Norfolk Nimbies will object to more electricity transmission lines across Norfolk.

- H2ercules, which is the large German hydrogen network will need lots of green hydrogen.

- Wilhelmshaven, which will be the main hydrogen feed point for H2ercules, is just across the North Sea at Wilhelmshaven.

- There are no Houthis roaming the North Sea.

- Hydrogen could be transported from the Norfolk wind farms to Wilhelmshaven by pipeline or coastal tanker.

- German companies are building the Norfolk wind farms.

I believe that there is a good chance, that the Norfolk wind farms will produce hydrogen for Germany.

This will have the following benefits.

- Germany will get the hydrogen it needs.

- The hydrogen link will improve energy security in Europe.

- The UK government will receive a nice cash flow.

The only losers will be the dictators, who supply Europe with energy.

Do RWE Have A Comprehensive Hydrogen Plan For Germany?

What is interesting me, is what Germany company; RWE is up to. They are one of the largest UK electricity producers.

In December 2023, they probably paid a low price, for the rights for 3 x 1.4 GW wind farms about 50 km off North-East Norfolk from in-trouble Swedish company; Vattenfall and have signed contracts to build them fairly fast.

In March 2024, wrote about the purchase in RWE And Vattenfall Complete Multi-Gigawatt Offshore Wind Transaction In UK.

Over the last couple of years, I have written several posts about these three wind farms.

March 2023 – Vattenfall Selects Norfolk Offshore Wind Zone O&M Base

November 2023 – Aker Solutions Gets Vattenfall Nod To Start Norfolk Vanguard West Offshore Platform

December 2023 – SeAH To Deliver Monopiles For Vattenfall’s 2.8 GW Norfolk Vanguard Offshore Wind Project

Then in July 2023, I wrote Vattenfall Stops Developing Major Wind Farm Offshore UK, Will Review Entire 4.2 GW Zone

Note.

- There does appear to be a bit of a mix-up at Vattenfall, judging by the dates of the reports.Only, one wind farm has a Contract for Difference.

- It is expected that the other two will be awarded contracts in Round 6, which should be by Summer 2024.

In December 2023, I then wrote RWE Acquires 4.2-Gigawatt UK Offshore Wind Development Portfolio From Vattenfall.

It appears that RWE paid £963 million for the three wind farms.

I suspect too, they paid for all the work Vattenfall had done.

This transaction will give RWE 4.2 GW of electricity in an area with very bad connections to the National Grid and the Norfolk Nimbies will fight the building of more pylons.

So have the Germans bought a pup?

I don’t think so!

Where Is Wilhemshaven?

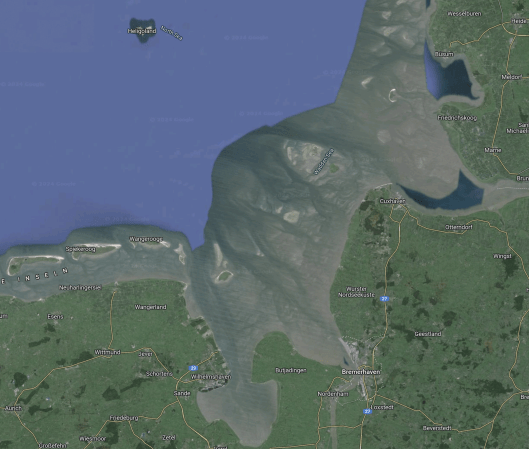

This Google Map shows the location of Wilhemshaven.

Note.

- Heligoland is the island at the top of the map.

- The Germans call this area the Wdden Sea.

- The estuaries lead to Wilhelmshaven and Bremerhaven.

- Cuxhaven is the port for Heligoland, which is connected to Hamburg by hydrogen trains.

This second map shows between Bremerhaven and Wilhelmshaven.

Note.

- Wilhelmshaven is to the West.

- Bremerhaven is in the East.

- The River Weser runs North-South past Bremerhaven.

I’ve explored the area by both car and train and it is certainly worth a visit.

The Wilhemshaven Hydrogen Import Terminal

German energy company; Uniper is building a hydrogen import terminal at Wilhemshaven to feed German industry with hydrogen from places like Australia, Namibia and the Middle East. I wrote about this hydrogen import terminal in Uniper To Make Wilhelmshaven German Hub For Green Hydrogen; Green Ammonia Import Terminal.

I suspect RWE could build a giant offshore electrolyser close to the Norfolk wind farms and the hydrogen will be exported by tanker or pipeline to Germany or to anybody else who pays the right price.

All this infrastructure will be installed and serviced from Great Yarmouth, so we’re not out of the deal.

Dogger Bank South Wind Farm

To make matters better, RWE have also signed to develop the 3 GW Dogger Bank South wind farm.

This could have another giant electrolyser to feed German companies. The wind farm will not need an electricity connection to the shore.

The Germans appear to be taking the hydrogen route to bringing electricity ashore.

Energy Security

Surely, a short trip across the North Sea, rather than a long trip from Australia will be much more secure and on my many trips between the Haven Ports and The Netherlands, I haven’t yet seen any armed Houthi pirates.

RWE And Hydrogen

On this page on their web site, RWE has a lot on hydrogen.

Very Interesting!

H2ercules

This web site describes H2ercules.

The goal of the H2ercules initiative is to create the heart of a super-sized hydrogen infrastructure for Germany by 2030. To make this happen, RWE, OGE and, prospectively, other partners are working across various steps of the value chain to enable a swift supply of hydrogen from the north of Germany to consumers in the southern and western areas of the country. In addition to producing hydrogen at a gigawatt scale, the plan is also to open up import routes for green hydrogen. The transport process will involve a pipeline network of about 1,500 km, most of which will consist of converted gas pipelines.

Where’s the UK’s H2ercules?

Conclusion

The Germans have got there first and will be buying up all of our hydrogen to feed H2ercules.

Hyundai Heavy Sets Sights On Scottish Floating Offshore Wind

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Major South Korean shipbuilder, HD Hyundai Heavy Industries, has signed a Memorandum of Understanding with two Scottish enterprise agencies which is expected to unlock expertise in the design and manufacture of floating offshore wind substructures.

These are the first three paragraphs.

Scottish Enterprise (SE) and Highlands & Islands Enterprise (HIE) signed the MoU with Hyundai Heavy in Edinburgh, described as a “vote of confidence” in Scotland, committing each other to pursue opportunities for floating offshore wind projects in Scotland.

This is the South Korean company’s first agreement in Europe on floating offshore wind manufacturing.

HD Hyundai Heavy Industries is the world’s largest shipbuilding company and a major manufacturer of equipment such as the floating substructures that form a critical part of the multi-billion offshore wind supply chain.

To say this is a big deal, could be a massive understatement, as my history with large Korean companies could say otherwise.

Around 1980, one of the first prestigious overseas projects, that was managed by Artemis was in Saudi Arabia.

- This may have been something like the King Khaled City, but I can’t be sure.

- Most of the hard work on the project was done by labour imported by Hyundai from South Korea.

After a few years, the Korean running Hyundai’s part of the project returned to Korea and he indicated that he would help us break into the Korean market.

Our salesman; Paul, with responsibility for Korea, who sadly passed away last year, told me this tale of doing business in the country.

Our Korean friend had bought a system for Hyundai in Korea and he organised a meeting for important Korean companies, so that Paul could present the system.

Everything went well, with our friend doing the necessary pieces of translation.

When he had finished, Paul asked if there were any questions.

The most common one was “Can we see the contract?”

Contracts were given out and after a cursory read, the leaders of Korean industry, all started signing the contracts.

So Paul asked our Korean friend, what was going on.

After a brief discussion, Paul was told. “If it’s good enough for Hyundai, it’s good enough for my company!”

And that was how we broke the Korean market.

Conclusion

In UK And South Korea Help Secure Millions For World’s Largest Monopile Factory, I talked about Korean company; SeAH Wind’s new monopile factory on Teesside.

In South Korea, UK Strengthen Offshore Wind Ties, I talk about a developing partnership.

In Mersey Tidal Project And Where It Is Up To Now, I talk about Korean involvement in the Mersey Tidal Project.

The Koreans are coming and Hyundai’s endorsement will help.

SeAH Wind Goes On Recruitment Spree For UK Monopile Factory

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

South Korea’s SeAH Wind has started its large-scale drive to recruit for positions including welders, platers, roll bending machine operatives, mechanical and electrical technicians, supervisors, and general operatives for its XXL monopile manufacturing facility on Teesworks, the UK.

These are the first two paragraphs.

Applications will be accepted via the company’s dedicated recruitment website where individuals can sign up for job alerts, register their expressions of interest, and apply directly for jobs.

SeAH Wind will hold events across multiple Teesside towns, including Middlesbrough, Redcar, Cleveland, and Hartlepool over the coming months where more details will be shared about vacancies and training opportunities at the South Bank site.

These three paragraphs talk about the education and training, and the number of jobs.

As part of the recruitment drive, the South Korean firm has also joined forces with Nordic Products and Services and Middlesbrough College to create two programmes under its SeAH Wind Academy programme.

During the 24-week training and development programme, 30 people will be trained to become welders for SeAH Wind.

Once fully operational, it is expected that a total of 750 direct jobs and 1,500 further supply chain jobs are set to come from the SeAH manufacturing facility.

I suspect, this the sort of investment that Teesside needs and will welcome.

Vestas and Vattenfall Sign 1.4 GW Preferred Supplier Agreement For UK Offshore Wind Project And Exclusivity Agreements For 2.8 GW For Two Other UK Projects

The title of this post, is the same as that of this press release from Vestas.

These are the first two paragraphs.

Vattenfall, one of Europe’s largest producers and retailers of electricity and heat, and Vestas have signed agreements to elevate the partnership between the two companies and their offshore wind business towards 2030. The agreements are another step in the right direction for offshore wind energy in the UK and follow the UK Government’s recent announcement about the parameters for the next Contracts for Difference Auction round, which sent a very positive signal to renewable energy investors.

The agreements for the three projects include a preferred supplier agreement (PSA) for the 1,380 MW Norfolk Vanguard West project, comprising 92 of Vestas’ V236-15 MW offshore wind turbine. Vattenfall and Vestas have further signed exclusivity agreements for the Norfolk Vanguard East and Norfolk Boreas projects with a total installed capacity of 2,760 MW. The two latter projects will potentially feature up to 184 V236-15 MW turbines. Once installed, the agreements also include that Vestas will service the projects under long-term Operations and Maintenance (O&M) service contracts. The agreements are another step forward for what will be one of the largest offshore wind zones in the world, with a capacity to power over 4 million UK homes.

It looks like Norfolk Boreas is back on Vattenfall’s list of active projects.

Vattenfall’s Norfolk zone now includes the following.

- Norfolk Vanguard West – 92 x V236-15 MW – 1380 MW

- Norfolk Vanguard East – 92 x V236-15 MW – 1380 MW

- Norfolk Boreas – 92 x V236-15 MW – 1380 MW

Note.

- All turbines appear identical.

- The deal includes long-term Operations and Maintenance (O&M) service contracts.

- 276 identical turbines plus service contracts looks like a good deal for Vestas.

Since I wrote Vattenfall Stops Developing Major Wind Farm Offshore UK, Will Review Entire 4.2 GW Zone in July 2023, which has this sub-heading.

Vattenfall has stopped the development of the Norfolk Boreas offshore wind power project in the UK and will review the way forward for the entire 4.2 GW Norfolk Zone, the Swedish energy company revealed in its interim report.

I have written the following posts.

- November 2023 – Aker Solutions Gets Vattenfall Nod To Start Norfolk Vanguard West Offshore Platform

- November 2023 – Norfolk Boreas Windfarm Work Could Resume After Energy Price Rise

- December 2023 – SeAH To Deliver Monopiles For Vattenfall’s 2.8 GW Norfolk Vanguard Offshore Wind Project

- Earlier in March 2023, I wrote Vattenfall Selects Norfolk Offshore Wind Zone O&M Base

It appears that with the deal announced with Vestas, Vattenfall now have everything they need to develop 4.2 GW of offshore wind.

- The O & M base will be Great Yarmouth.

- SeAH will build the monopile foundations on Teesside. Will all monopiles be identical?

- An energy price rise could change the cash flow of the project.

- Aker Solutions will build the offshore substations.Will all sub-stations be identical?

- Vestas will build the wind turbines.Will all turbines be identical?

Nothing has been said since July 2023 about how the power will be brought ashore.

In February 2022, I wrote Norfolk Wind Farms Offer ‘Significant Benefit’ For Local Economy, where I published this map from Vattenfall, which shows the position of the farms and the route of the cable to the shore.

Note.

- The purple line appears to be the UK’s ten mile limit.

- Norfolk Boreas is outlined in blue.

- Norfolk Vanguard West and Norfolk Vanguard East are outlined in orange.

- Cables will be run in the grey areas.

- Cables to deliver 4.1 GW across Norfolk to the National Grid, will bring out the Nimbys in droves.

Landfall of the cables will be just a few miles to the South of the Bacton gas terminal.

In SeAH To Deliver Monopiles For Vattenfall’s 2.8 GW Norfolk Vanguard Offshore Wind Project, I asked if there could be an alternative approach.

Consider.

- If Vattenfall develop all three wind farms; Boreas, Vanguard East and Vanguard West, they will have 4.2 GW of capacity, when the wind co-operates.

- But East Norfolk is not noted for industries that need a large amount of electricity.

- I also feel, that the locals would object to a steelworks or an aluminium smelter, just like they object to electricity cables.

But would they object to a 4 GW electrolyser?

Could this be Vattenfall’s alternative approach?

- A giant electrolyser is built close to the landfall of the cable to the wind farms.

- The hydrogen could be piped to Bacton, where it could be blended with the UK’s natural gas.

- Bacton also has gas interconnectors to Balgzand in the Netherlands and Zeebrugge in Belgium. Could these interconnectors be used to export hydrogen to Europe?

- The hydrogen could be piped to Yarmouth, where it could be exported by tanker to Europe.

There would be only a small amount of onshore development and no overhead transmission lines to connect the wind farms to the National Grid.

There would be even less onshore development, if the electrolyser was offshore.

From their decisions, Vattenfall seem to have a new plan.

SeAH To Deliver Monopiles For Vattenfall’s 2.8 GW Norfolk Vanguard Offshore Wind Project

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Vattenfall has signed a contract with SeAH Wind to provide the monopiles for the 2.8 GW Norfolk Vanguard East and Norfolk Vanguard West offshore wind farms in the UK.

These two paragraphs outline the order.

The monopiles for the Norfolk Vanguard offshore wind farms will weigh up to around 2,200 tonnes and have a length of up to 96 metres.

Production is due to start in 2026 at SeAH Wind’s new under-construction facility in Teesside, northeast England.

Note.

- Norfolk Vanguard now appears to be two 1.4 GW wind farms; East and West, which adds up to a 2.8 GW Norfolk Vanguard wind farm.

- There is no mention of the 1.4 GW Norfolk Boreas wind farm in the article, except that it has a Contract for Difference (CfD), whereas I don’t think Norfolk Vanguard has a contract.

- Would anybody buy wind farm foundations without a contract?

It looks like there has been some very tough negotiations between Vattenfall, the Crown Estate and the UK Government.

Is There An Alternative Approach?

Consider.

- If Vattenfall develop all three wind farms; Boreas, Vanguard East and Vanguard West, they will have 4.2 GW of capacity, when the wind co-operates.

- But East Norfolk is not noted for industries that need a large amount of electricity.

- I also feel, that the locals would object to a steelworks or an aluminium smelter, just like they object to electricity cables.

But would they object to a 4 GW offshore electrolyser?

Could this be Vattenfall’s alternative approach?

- A giant electrolyser is built close to the landfall of the cable to the wind farms.

- The hydrogen could be piped to Bacton, where it could be blended with the UK’s natural gas.

- Bacton also has gas interconnectors to Balgzand in the Netherlands and Zeebrugge in Belgium. Could these interconnectors be used to export hydrogen to Europe?

- The hydrogen could be piped to Yarmouth, where it could be exported by tanker to Europe.

There would be only a small amount of onshore development and no overhead transmission lines to connect the wind farms to the National Grid.

There would be even less onshore development, if the electrolyser was offshore.

From their decisions, Vattenfall seem to have a new plan.

UK And South Korea Help Secure Millions For World’s Largest Monopile Factory

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

UK Export Finance (UKEF) and South Korea’s export credit agency Korea Trade Insurance Corporation (K-Sure) have helped SeAH Wind to secure GBP 367 million in Standard Chartered Bank and HSBC UK financing to build the world’s largest wind monopile manufacturing facility.

These three paragraphs outline the story.

UKEF and K-Sure have secured support worth GBP 367 million for South Korean manufacturer SeAH Steel Holding’s construction of a wind tech factory near Redcar, in the Tees Valley.

Issuing its first-ever “Invest-to-Export” loan guarantee to secure overseas investment in British industry, UKEF together with K-Sure has ensured that SeAH Wind UK can fund the construction project – worth almost GBP 500 million – with GBP 367 million in financing from Standard Chartered Bank and HSBC UK.

SeAH Wind UK, a subsidiary of South Korean steel company SeAH Steel Holding, announced its decision to invest and broke ground at Teesworks Freeport last summer.

The article also says.

- This is SeAH Wind’s first such investment outside Korea.

- The factory will make between 100 and 150 monopiles a year.

- The factory will create 750 jobs when it opens in 2026.

- The factory is conveniently placed for transport to the North Sea.

Everybody seemed to have worked hard during the state visit of the Korean President and his wife.