‘Mobilising EUR 1 Trillion in Investments’ | North Sea Countries, Industry, TSOs to Ink Offshore Wind Pact

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Government officials from Belgium, Denmark, France, Germany, Ireland, Luxembourg, the Netherlands, Norway and the UK are set to sign a declaration confirming the ambition to build 300 GW of offshore wind in the North Seas by 2050, and an investment pact with the offshore wind industry and transmission system operators (TSOs) that is said to mobilise EUR 1 trillion in economic activity.

These three paragraphs add a lot of powerful detail.

Under the Offshore Wind Investment Pact for the North Seas, to be signed today (26 January) at the North Sea Summit in Hamburg, governments of the nine North Sea countries will commit to building 15 GW of offshore wind per year from 2031 to 2040.

The heads of state and energy ministers will also vow to de-risk offshore wind investments through a commitment to provide two-sided Contracts for Difference (CfDs) as the standard for offshore wind auction design. The pact also commits governments to remove any regulatory obstacles to power purchase agreements (PPAs), according to WindEurope, which will sign the pact on behalf of the industry.

On the industry’s side, the commitment is to drive down the costs of offshore wind by 30 per cent towards 2040, mobilise EUR 1 trillion of economic activity for Europe, create 91,000 additional jobs and invest EUR 9.5 billion in manufacturing, port infrastructure and vessels.

These two paragraphs say something about cost reductions.

The cost reduction of offshore wind is planned to be achieved through scale effects, lower costs of capital and further industrialisation supported by clarity and visibility on the project pipeline.

The transmission system operators (TSOs) will identify cost-effective cooperation projects in the North Sea, including 20 GW of promising cross-border projects by 2027 for deployment in the 2030s.

I hope there is a project management system, that can step into this frenzy, just as Artemis did in the 1970s with North Sea Oil and Gas.

The BBC has reported the story under a title of UK To Join Major Wind Farm Project With Nine European Countries.

this is the sub-title.

The UK is set to back a vast new fleet of offshore wind projects in the North Sea alongside nine other European countries including Norway, Germany and the Netherlands.

These six paragraphs add more detail.

The government says the deal will strengthen energy security by offering an escape from what it calls the “fossil fuel rollercoaster”.

For the first time, some of the new wind farms will be linked to multiple countries through undersea cables known as interconnectors, which supporters say should lower prices across the region.

But it could prove controversial as wind farm operators would be able to shop around between countries to sell power to the highest bidder – potentially driving up electricity prices when supply is tight.

Energy Secretary Ed Miliband will sign a declaration on Monday at a meeting on the future of the North Sea in the German city of Hamburg, committing to complete the scheme by 2050.

Jane Cooper, deputy CEO of industry body RenewableUK, said the deal would “drive down costs for billpayers” as well as increasing “the energy security of the UK and the whole of the North Sea region significantly”.

But Claire Countinho, shadow energy secretary, warned “we cannot escape the fact that the rush to build wind farms at breakneck speed is pushing up everybody’s energy bills.”

Claire Coutinho, as an outsider at present and a member of a party out of Government had to say something negative, but her negotiations when she was UK Energy Minister with her German opposite number, which I wrote about in UK And Germany Boost Offshore Renewables Ties, seem very much a precursor to today’s agreement.

The 73 Group

The 73 Group was a finance company, that I owed jointly with a guy named David Mann, who was an experienced provider of finance for cars, trucks and other vehicles and equipment.

- The company had been the idea of an accountant, I shared with David, named Graham Manning.

- David put in his expertise and I put in some of the money, I received from the sale of my share of the Artemis software.

- It operated mainly in the area around Ipswich in Suffolk.

- Many of the customers were owner/drivers, who ferried containers to and from the docks at Felixstowe, who had known David for some years.

- The company certainly gave a better return, than putting money on deposit.

- One of the things, I did was extensively model a book of loans for vehicles and this gave me an insight into the dynamics of money.

Sadly in the end, David became ill and we wound the company up.

It gave me an interesting insight into local finance and I believe, that local finance companies with good connections and the right systems and people can be profitable.

It also gave me a few good tales.

Coaches Are Good Business

A good top-of-the range coach is good business for operators, coach dealers and finance companies.

I remember spending one evening with David and a coach operator in a pub, when the operator had had a fabulous day stitching together coaches as Rail Replacement Buses for British Rail after a train derailment, between Ipswich and Colchester.

I learned a lot about operating coaches that night and it’s why I’m so keen on hydrogen-powered coaches, with their expected long range, quietness and smoothness.

Fairground Rides Are Good Business

Surprisingly, if you don’t mind being paid in fifty pence pieces on the Ipswich bypass at ten o’clock at night.

You Need A Good Collections Guy

Our’s was excellent.

A Smorgasbord Of Misery

This phrase of Kemi Badenoch’s in her reply to Rachel Reeve’s budget speech will do her no harm.

Cornwall Insight Forecasts Lower Household Energy Bills In January

The title of this post, is the same as that of this article on Solar Power Portal.

This is a paragraph from the article.

The Default Tariff Cap is set by the UK’s energy regulator Ofgem as the maximum rate per unit and standing charge that can be billed to customers for their energy use. Cornwall Insight’s latest forecast predicts the cap will fall to £1,733 a year for a typical dual fuel household in the first quarter of 2026.

Consider.

- I am on a dual-fuel tariff for gas and electricity.

- At present, I pay £159 per month or £1,908 per year.

If I was on the new price cap, I’d pay £144.42 per month or about 10 % less.

The Thoughts Of Chris O’Shea

This article on This Is Money is entitled Centrica boss has bold plans to back British energy projects – but will strategy pay off?.

The article is basically an interview with a reporter and gives O’Shea’s opinions on various topics.

Chris O’Shea is CEO of Centrica and his Wikipedia entry gives more details.

These are his thoughts.

On Investing In Sizewell C

This is a paragraph from the article.

‘Sizewell C will probably run for 100 years,’ O’Shea says. ‘The person who will take the last electron it produces has probably not been born. We are very happy to be the UK’s largest strategic investor.’

Note.

- The paragraph shows a bold attitude.

- I also lived near Sizewell, when Sizewell B was built and the general feeling locally was that the new nuclear station was good for the area.

- It has now been running for thirty years and should be good for another ten.

Both nuclear power stations at Sizewell have had a good safety record. Could this be in part, because of the heavy engineering tradition of the Leiston area?

On Investing In UK Energy Infrastructure

This is a paragraph from the article

‘I just thought: sustainable carbon-free electricity in a country that needs electricity – and we import 20 per cent of ours – why would we look to sell nuclear?’ Backing nuclear power is part of O’Shea’s wider strategy to invest in UK energy infrastructure.

The UK certainly needs investors in UK energy infrastructure.

On Government Support For Sizewell C

This is a paragraph from the article.

Centrica’s 500,000 shareholders include an army of private investors, many of whom came on board during the ‘Tell Sid’ privatisations of the 1980s and all of whom will be hoping he is right. What about the risks that deterred his predecessors? O’Shea argues he will achieve reliable returns thanks to a Government-backed financial model that enables the company to recover capital ploughed into Sizewell C and make a set return.

I have worked with some very innovative accountants and bankers in the past fifty years, including an ex-Chief Accountant of Vickers and usually if there’s a will, there’s a solution to the trickiest of financial problems.

On LNG

These are two paragraphs from the article.

Major moves include a £200 million stake in the LNG terminal at Isle of Grain in Kent.

The belief is that LNG, which produces significantly fewer greenhouse gas emissions than other fossil fuels and is easier and cheaper to transport and store, will be a major source of energy for the UK in the coming years.

Note.

- Centrica are major suppliers of gas-powered Combined Heat and Power units were the carbon dioxide is captured and either used or sold profitably.

- In at least one case, a CHP unit is used to heat a large greenhouse and the carbon dioxide is fed to the plants.

- In another, a the gas-fired Redditch power station, the food-grade carbon dioxide is sold to the food and construction industries.

- Grain LNG Terminal can also export gas and is only a short sea crossing from gas-hungry Germany.

- According to this Centrica press release, Centrica will run low-carbon bunkering services from the Grain LNG Terminal.

I analyse the investment in Grain LNG Terminal in Investment in Grain LNG.

On Rough Gas Storage

These are three paragraphs from the article.

O’Shea remains hopeful for plans to develop the Rough gas storage facility in the North Sea, which he re-opened in 2022.

The idea is that Centrica will invest £2 billion to ‘create the biggest gas storage facility in the world’, along with up to 5,000 jobs.

It could be used to store hydrogen, touted as a major energy source of the future, provided the Government comes up with a supportive regulatory framework as it has for Sizewell.

The German AquaVentus project aims to bring at least 100 GW of green hydrogen to mainland Germany from the North Sea.

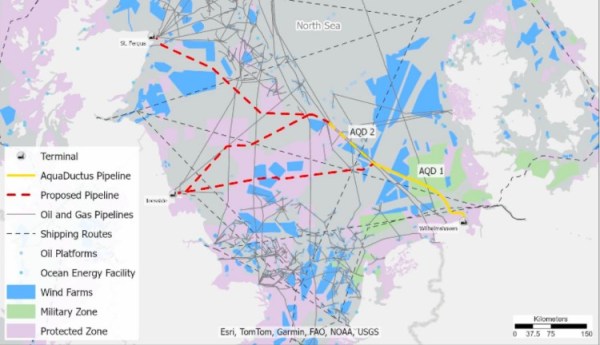

This map of the North Sea, which I downloaded from the Hydrogen Scotland web site, shows the co-operation between Hydrogen Scotland and AquaVentus

Note.

- The yellow AquaDuctus pipeline connected to the German coast near Wilhelmshaven.

- There appear to be two AquaDuctus sections ; AQD 1 and AQD 2.

- There are appear to be three proposed pipelines, which are shown in a dotted red, that connect the UK to AquaDuctus.

- The Northern proposed pipeline appears to connect to the St. Fergus gas terminal on the North-East tip of Scotland.

- The two Southern proposed pipelines appear to connect to the Easington gas terminal in East Yorkshire.

- Easington gas terminal is within easy reach of the massive gas stores, which are being converted to store hydrogen at Aldbrough and Rough.

- The blue areas are offshore wind farms.

- The blue area straddling the Southernmost proposed pipe line is the Dogger Bank wind farm, is the world’s largest offshore wind farm and could eventually total over 6 GW.

- RWE are developing 7.2 GW of wind farms between Dogger Bank and Norfolk in UK waters, which could generate hydrogen for AquaDuctus.

This cooperation seems to be getting the hydrogen Germany needs to its industry.

It should be noted, that Germany has no sizeable hydrogen stores, but the AquaVentus system gives them access to SSE’s Aldbrough and Centrica’s Rough hydrogen stores.

So will the two hydrogen stores be storing hydrogen for both the UK and Germany?

Storing hydrogen and selling it to the country with the highest need could be a nice little earner.

On X-energy

These are three paragraphs from the article.

He is also backing a £10 billion plan to build the UK’s first advanced modular reactors in a partnership with X-energy of the US.

The project is taking place in Hartlepool, in County Durham, where the existing nuclear power station is due to reach the end of its life in 2028.

As is the nature of these projects, it involves risks around technology, regulation and finance, though the potential rewards are significant. Among them is the prospect of 2,500 jobs in the town, where unemployment is high.

Note.

- This is another bold deal.

- I wrote in detail about this deal in Centrica And X-energy Agree To Deploy UK’s First Advanced Modular Reactors.

- Jobs are mentioned in the This is Money article for the second time.

I also think, if it works to replace the Hartlepool nuclear power station, then it can be used to replace other decommissioned nuclear power stations.

On Getting Your First Job

These are three paragraphs from the article.

His career got off to a slow start when he struggled to secure a training contract with an accountancy firm after leaving Glasgow University.

‘I had about 30, 40 rejection letters. I remember the stress of not having a job when everyone else did – you just feel different,’ he says.

He feels it is ‘a duty’ for bosses to try to give young people a start.

I very much agree with that. I would very much be a hypocrite, if I didn’t, as I was given good starts by two companies.

On Apprenticeships

This is a paragraph from the article.

‘We are committed to creating one new apprenticeship for every day of this decade,’ he points out, sounding genuinely proud.

I very much agree with that. My father only had a small printing business, but he was proud of the apprentices he’d trained.

On Innovation

Centrica have backed three innovative ideas.

- heata, which is a distributed data centre in your hot water tank, which uses the waste heat to give you hot water.

- HiiROC, which is an innovative way to generate affordable hydrogen efficiently.

- Highview Power, which stores energy as liquid air.

I’m surprised that backing innovations like these was not mentioned.

Conclusion

This article is very much a must read.

Sheffield Wednesday Placed In Administration

The title of this post, is the same as that of this article on the BBC.

Does this mean that the City of Sheffield will now work a six-day week?

Iberdrola Looking To Sell 49 Pct Stake In UK Offshore Wind Farm – Report

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Iberdrola has begun exploring the sale of 49 per cent of its East Anglia Two offshore wind farm project in the UK, according to a report by the Spanish media outlet Cinco Días citing unnamed sources.

These four paragraphs give more details.

The renewable energy developer has already engaged Bank of America and BBVA as financial advisors to assist with the potential transaction, Cinco Días writes.

Iberdrola’s interest in selling a nearly half stake in East Anglia Two mirrors previous deals in the East Anglia portfolio, where the company has brought in financial partners in two other phases, East Anglia One and East Anglia Three.

The 714 MW East Anglia One offshore wind farm is owned by Iberdrola’s UK arm ScottishPower Renewables and Macquarie’s Green Investment Group (GIG), with Octopus Energy having acquired a 10 per cent stake from GIG this April. East Agnlia One has been in operation since 2021.

In July this year, Iberdrola and UAE clean energy company Masdar announced what the companies said was the largest offshore wind transaction of the decade as they signed an agreement to co-invest in the 1.4 GW East Anglia Three project, currently under construction.

But then being bought and sold is the way of life for an offshore wind farm.

In 2018, I wrote World’s Largest Wind Farm Attracts Huge Backing From Insurance Giant, which contains this extract from the Times says this about the funding of wind farms.

Wind farms throw off “long-term boring, stable cashflows”, Mr. Murphy said, which was perfect to match Aviva policyholders and annuitants, the ultimate backers of the project. Aviva has bought fixed-rate and inflation-linked bonds, issued by the project. While the coupon paid on the 15-year bonds, has not been disclosed, similar risk projects typically pay an interest rate of about 3 per cent pm their bonds. Projects typically are structured at about 30 per cent equity and 70 per cent debt.

Darryl Murphy is Aviva’s head of infrastructure debt. The article also says, that Aviva will have a billion pounds invested in wind farms by the end of the year.

I wonder how long it will be before individual investors can fund their pensions, with a direct investment in a wind farm?

- The wind farm would surely be a better investment if it had an integrated battery to supply power, when the wind didn’t blow.

- It would probably also be a safer investment, if it had been generating electricity for some years.

After all, at the present time, you can invest in batteries through companies like Gresham House and Gore Street.

Conservatives Would Scrap Stamp Duty, Badenoch Announces

The title of this post, is the same as that of this article on the BBC.

This is the sub-heading.

The next Conservative government would abolish stamp duty on the purchase of main homes, Kemi Badenoch has said, in a surprise announcement at the end of her first conference speech as party leader.

These two introductory paragraphs add more detail.

Badenoch received a standing ovation from Tory activists in Manchester as she declared: “That is how we will help achieve the dream of home ownership for millions.”

She said scrapping stamp duty – a tax paid by home buyers in England and Northern Ireland – will “unlock a fairer and more aspirational society” and help people of all ages.

Note.

- I have a degree in Control Engineering at Liverpool University and graduated in 1968.

- Badenoch has a degree in Systems Engineering at Sussex University and graduated much recently.

Our degrees are both very mathematically-based and probably surprisingly similar.

My feeling as a Control Engineer, is that to selectively remove stamp duty could be a good idea, as you are affecting the derivatives rather than the rates.

Only time will tell, but some thorough mathematical modelling will probably show the validity of the idea.

It is unlikely that I will move, but given the state of the buses, there is a small chance that I might.

- My current house is probably worth about a million.

- If I bought a similarly-priced house, I would pay tax of £43,750.

- But, if I bought a house at double the price, I would pay tax of £153,750.

Given the progressive nature of the tax, I think I’ll be staying put, occupying a three-bedroom family house with a garage, all by myself.

If the tax is removed, I would be more likely to move into a house, that suited me better!

Ørsted Raises EUR 7.98 Billion In Oversubscribed Rights Issue

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted has completed its rights issue, raising DKK 59.56 billion (approximately EUR 7.98 billion) with a subscription rate of approximately 99.3 per cent, the company said on 6 October.

These two introductory paragraphs add more details.

Existing shareholders were offered new shares at DKK 66.60 (EUR 8.92) each. The demand for shares not taken up via the rights issue was “extraordinarily high,” according to the developer’s announcement of the Rights Issue results, and allocations were capped per application, meaning no subscriptions were required under the underwriting bank syndicate.

As reported in August, the company appointed a syndicate of BNP PARIBAS, Danske Bank A/S and J.P. Morgan SE as Joint Global Coordinators, next to Morgan Stanley & Co International, to jointly underwrite the rights issue for the approximately 49.9 per cent that would not be subscribed to by Ørsted’s majority shareholder, the Danish state (50.1 per cent).

I dread to think what spiteful punishment that Trumpkopf will inflict on Ørsted.

But the oversubscribed Rights Issue may be good news for the UK.

Ørsted has only one major project under development or construction in the UK.

But it is the large Hornsea Three wind farm, which has this opening paragraph on its web site.

Hornsea 3 Offshore Wind Farm will deliver enough green energy to power more than 3 million UK homes. An £8.5 billion infrastructure project, Hornsea 3 will make a significant contribution toward UK energy security, as well as the local and national economy.

Note.

- Ørsted are raising £7.98 billion and spending £8.5 billion, which must do something for the UK’s economy.

- Hornsea 3 will have a generating capacity of 2.9 GW.

- Ørsted are now delivering the world’s single largest offshore wind farm.

- Hornsea 3 will connect to the National Grid at Swardestone in Norfolk.

In Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, I describe how the 300 MW/600 MWh Swardestone BESS will be built, where Hornsea 3 connects to the grid.

As Swardestone will have 2.9 GW from Hornsea 3 and a powerful battery, I would expect someone will be looking to site a data centre or something with a need for a lot of stable electricity at or near Swardestone.

In Opportunity For Communities To Have Their Say On National Grid Proposals For Norwich To Tilbury Project, I talk about a line of pylons between Swardestone and Tilbury and show this map of the route.

This page on the National Grid web site has an interactive version of this map.

Note.

- The mauve line indicates the route of the Norwich to Tilbury project.

- Swardestone is at the Northern end of the project a few miles South of Norwich.

- Tilbury is at the Southern end of the project on the Thames estuary.

- The project connects Norwich, Ipswich, Colchester and Chelmsford to Hornsea 3 at Swardestone.

- I suspect the project will connect to Ipswich at the Bramford substation.

- The Sizewell nuclear site is to the North-East of Woodbridge and connects to the grid at the Bramford substation.

I know East Anglia well and I would suspect that Norwich, Ipswich, Colchester, Chelmsford and Southend-on-Sea could support one or more data centres.

Conclusion

I asked Google AI, who owns Hornsea 1 and received this reply.

Hornsea 1 is owned by a partnership including Ørsted, Equitix, TRIG, GLIL, Octopus, and Brookfield, with Ørsted also providing the operational management. A 2018 agreement between Ørsted and Global Infrastructure Partners (GIP) originally established the 50/50 joint venture for the project.

I then asked Google AI, who owns Hornsea 2 and received this reply.

The ownership of the Hornsea 2 wind farm is shared between several entities, including a 37.55% stake held by Ørsted, a 25% stake each by AXA IM Alts and Crédit Agricole Assurances, and a 12.45% stake held by Brookfield. The wind farm is located offshore in the UK’s North Sea, approximately 89 km off the Yorkshire coast.

In November 2019, I also wrote World’s Largest Wind Farm Attracts Huge Backing From Insurance Giant.

It does seem to me that Ørsted are past masters of developing a wind farm, then selling it on and using that money to develop the next wind farm.

The Rights Issue just makes that process easier.

MoU Signed To Develop Scottish Highlands As Offshore Wind And Renewables Hub

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Inverness and Cromarty Firth Green Freeport (ICFGF) has signed a Memorandum of Understanding (MoU) with the UK and Scottish governments and The Highland Council, creating a formal framework for cooperation in developing the Highlands as a major international hub for the offshore wind and renewable energy sector

This is the first paragraph.

The agreement is said to unlock GBP 25 million (approximately EUR 29 million) in funding from the UK government, which ICFGF plans to use to support the delivery of significant infrastructure projects and its partner ports.

These are some points from the rest of the article.

- Inverness and Cromarty Firth Green Freeport aims to bring up to 11,300 jobs to the Highlands.

- Significant investments we’ve already include the Sumitomo subsea cable plant at Nigg and the Haventus energy transition facility at Ardersier.

- Over the next 25 years, ICFGF is expected to attract over GBP 6.5 billion of investment.

- The Green Freeport includes three tax sites: Cromarty Firth, which includes Port of Nigg, Port of Cromarty Firth, and Highland Deephaven.

- Ardersier Energy Transition Facility has secured a GBP 100 million joint credit facility to create nationally significant infrastructure for industrial-scale deployment of fixed and floating offshore wind.

- It has placed contracts with more than 110 local firms as part of the development.

These investments will setup the long-term future of Inverness and the Highlands of Scotland.

The Inverness and Cromarty Firth Green Freeport (ICFGF) has this web site, with these messages on the home page.

Europe’s strategic hub for renewable energy

Transforming the Highland economy and delivering national energy security

Conclusion

This area will become one of the most vibrant places in Europe.