Ocean Winds Enters Lease Agreement With Crown Estate For 1.5 GW Celtic Sea Floating Wind Project

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ocean Winds has entered into an agreement for lease with the Crown Estate for a 1.5 GW floating offshore wind project, for which the developer secured a site in the Round 5 seabed auction last year.

These two paragraphs add detail to the story.

Offshore Wind Leasing Round 5, the UK’s first dedicated floating wind seabed leasing round, was launched in February 2024, offering three areas. In June 2025, the Crown Estate announced Equinor and Gwynt Glas, a joint venture between EDF and ESB, as preferred developers for two project sites and said it was working to ensure the delivery of the full potential capacity of Round 5, which is up to 4.5 GW.

Equinor and Gwynt Glas entered into lease agreements for their floating wind projects in October 2025 and, the following month, the Crown Estate said Ocean Winds had secured the third floating offshore wind site in the Celtic Sea.

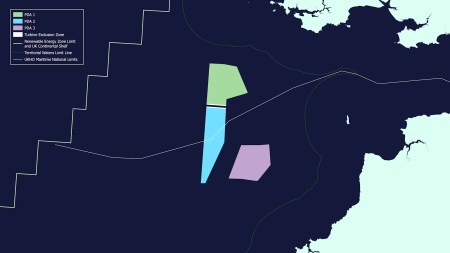

This map shows the three wind farms, that make up the Glynt Glas wind farm.

Note.

- It is expected to be built from and connect to the grid at Port Talbot in South Wales.

- The three sites are expected to be commissioned by the early-to-mid 2030s.

- The elongated white dot to the East of the wind farms would appear to be Lundy Island.

- The large bay to the North of Lundy is Carmarthen Bay with Caldey Island at its West end and Llanelli on its East.

- The Gower separates Swansea Bay from Carmarthen Bay.

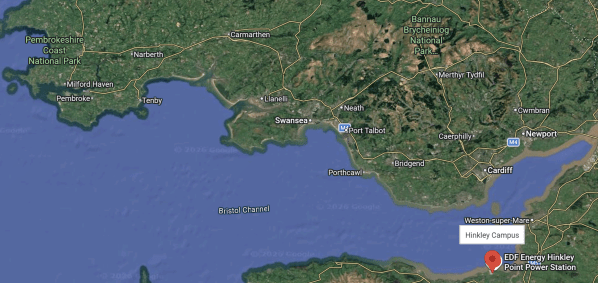

This Google Map shows the Bristol Channel from the wind farms in the West to Cardiff and Hinkley Point.

Note.

- Along the North coast of the Bristol Channel, working from West to East, my 78-year-old eyes can pick out Milford Haven, Pembroke, Caldey Island, Tenby, Llanelli, Swansea, Port Talbot, Porthcawl, BridgendCaerphilly, Cardiff and Newport.

- Coming back along the South Coast, I can see Weston-super-Mare, Hinkley Point C and the tip of Lundy Island in line with Tenby.

- The three sections of Glynt Glas will each generate 1.5 GW, making a total of 4.5 GW.

- Hinkley Point C when completed, will be a 3.26 GW nuclear power station.

- There is also a 2.2 GW gas-fired power station at Pembroke.

Nearly 8 GW of renewable electricity should be enough to convert Port Talbot steelworks to the manufacture of green steel.

How Much Wind Power Is Planned For The Western Approaches?

I asked Google AI, the title of this section and received this answer.

The UK has a target of 50 GW of offshore wind by 2030, with significant projects planned for the Celtic Sea (part of the Western Approaches), which is a key area for 5 GW of floating wind. Total UK offshore wind pipeline capacity exceeds 93 GW, with major developments in this region focusing on floating technology.

Key details regarding wind power in the Western Approaches (specifically the Celtic Sea) include:

Celtic Sea Developments: The area is a primary focus for floating wind projects, designed to capitalize on deep-water potential, with 5 GW of floating wind expected to be deployed across the UK by 2030.

Pipeline and Capacity: The total UK pipeline for offshore wind, which includes the Western Approaches, is 93 GW, and the government is aiming for 43-50 GW of installed offshore capacity by 2030.

Project Status: The region is expected to benefit from the Crown Estate’s leasing rounds aimed at accelerating floating wind, with 15.4 GW of new projects submitted across the UK in 2024.

Wales/South West England Context: Wales has 1.4 GW of projects in the pre-application stage, with some potential for developments off the South West coast.

For more detailed information on specific projects and their development status, you can visit the RenewableUK website and RenewableUK website.

It looks like about 20 GW of offshore wind could be installed in the Western Approaches.

Wind Farms Generate Record Power On Cold November Evening

The title of this post, is the same as that of this article on The Times.

This is the sub-heading.

Turbines produced record high of 22.7 gigawatts of electricity at 7.30pm on Tuesday last week, accounting for 55 per cent of Britain’s electricity mix.

These two introductory paragraphs add more detail.

Britain’s wind farms generated a record 22.7 gigawatts of electricity on Tuesday evening last week, enough to power more than 22 million homes.

The National Energy System Operator (Neso) said the new high was set at 7.30pm on November 11, beating a previous record of 22.5 gigawatts on December 18, 2024.

In addition.

Yesterday, I wrote Ocean Winds Secures Third Celtic Sea Floating Wind Site, which will add 4.5 GW by 2035.

In Renewable Power By 2030 In The UK, I calculated these pessimistic offshore wind power totals for 206-2030.

- 2025 – 1,235 MW

- 2026 – 4,807 MW

- 2027 – 5,350 MW

- 2028 – 4,998 MW

- 2029 – 9,631 MW

- 2030 – 15,263 MW

This adds up to a total of 58,897 MW.

Conclusion

We shall be needing some new ways to export electricity to Europe.

Ocean Winds Secures Third Celtic Sea Floating Wind Site

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ocean Winds has secured the third floating offshore wind site in the Celtic Sea, offered through the Crown Estate’s Round 5 auction earlier this year. The developer is joining Equinor and the Gwynt Glas joint venture, which were awarded rights for two of the three sites offered in Round 5 in June.

This paragraph outlines Ocean Winds’s deal.

On 19 November, the Crown Estate said that Ocean Winds was set to be awarded the rights for a third floating offshore wind site in the Celtic Sea.

There would now appear to be three Celtic Winds deals for wind farms.

- Gwynt Glas – 1.5 GW

- Ocean Winds – 1.5 GW

- Equinor – 1.5 GW

Note.

- 4.5 GW will be able to power a good proportion of South Wales and the South-West peninsular.

- In Gwynt Glas And South Wales Ports Combine Strength In Preparation For Multi-Billion Floating Wind Industry, I talk about partnerships between the wind farms and the ports.

- If you sign up for a large wind farm from the Crown Estate, do you get to have afternoon tea with Charles and Camilla in the garden at Highgrove or even Buckingham Palace?

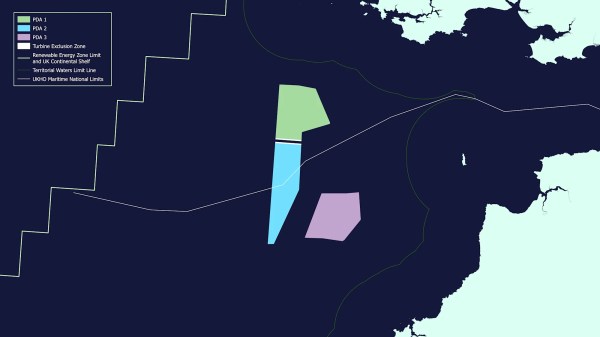

This map of the wind farms is available from download from this page on the Crown Estate web site.

Note.

- Gwynt Glas is in green.

- Ocean Winds is in blue.

- Equinor is in mauve.

- The white dot to the East of the wind farms is Lundy Island.

This triple wind farm is certainly well-placed to supply power to Cornwall, Devon and South Wales.

Gwynt Glas And South Wales Ports Combine Strength In Preparation For Multi-Billion Floating Wind Industry

The title of this post, is the same as that of this news item from the Gwynt Glas wind farm.

The news item starts with a spectacular image of a port, that is assembling floating wind turbines and these three paragraphs.

Gwynt Glas Offshore Wind Farm has signed a Memorandum of Understanding (MoU) with the UK’s largest port operator, Associated British Ports, and Wales’ largest energy port, the Port of Milford Haven, to ready the ports for the future needs of floating offshore wind in the Celtic Sea.

Gwynt Glas is a joint venture partnership between EDF Renewables UK and DP Energy. The proposed floating offshore wind farm would generate 1GW of low carbon green energy in the Celtic Sea.

Under the MoU, information and industry knowledge will be shared to investigate the potential opportunities for manufacture, assembly, load-out and servicing for the Gwynt Glas project from the key South Wales Ports of Port Talbot and Milford Haven. This collaborative approach demonstrates a major commitment to supporting economic growth, investment and maximising social value in the region.

Equinor, EDF-ESB Joint Venture Secure 1.5 GW Sites In UK Floating Wind Leasing Round

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Crown Estate has selected Equinor and Gwynt Glas, a joint venture between EDF Renewables UK and ESB, as preferred bidders in the seabed leasing round for floating wind projects in the Celtic Sea.

These two paragraphs give more details.

Selected on 12 June, each of the two developers was awarded 1.5 GW of capacity in their respective project development area (PDA) for an annual option fee of GBP 350/MW (approximately EUR 410/MW).

The Crown Estate launched the floating wind leasing round (Offshore Wind Leasing Round 5) in February 2024, offering three areas off the coasts of Wales and South West England for a total of up to 4.5 GW of installed capacity.

Note.

- It looks like the Crown Estate are working to get a contract for the third site.

- The ports of Bristol and Port Talbot could be handling the assembly of the floating turbines.

- The Crown Estate has also established a new strategic approach with the National Energy System Operator (NESO).

Given the problems some wind and solar farms have had to get connected, the Crown Estate’s link up with NESO could be attractive to developers?

Conclusion

This looks a good bit of business by the Crown Estate in the Celtic Sea.

Did they get NESO to be helpful, by asking senior people for tea with Charles and Camilla at Highgrove?

Offshore Grid For Irish, Celtic and North Seas Closer To Delivery

The title of this post, is the same as that of this article on The Irish Times.

This is the sub-heading.

Joint development can be ‘key step for Europe’s energy future’ and climate neutrality

These paragraphs add detail.

EirGrid and other leading European power transmission system operators (TSOs) have backed moves to develop an offshore electricity grid for the Irish, Celtic and North seas.

The next stage in a collaboration, being undertaken by nine system operators under the Offshore TSO Collaboration (OTC), was announced at the WindEurope annual conference in Copenhagen on Wednesday.

It followed the initial results of a pilot study evaluating how the grid could be established.

The report supports Europe’s goal of establishing a “green power plant” offshore that will play a crucial role in the Continent securing an independent, affordable and climate-neutral energy supply.

If you open the article, there is an excellent map of the various interconnectors, that will be in place by 2040.

Conclusion

This is all good stuff and can only lead to energy security for the participating countries.

Where Will Lumo Strike Next?

Yesterday, First Group reported that they had added more possible services to their network of open-access services.

I gave my view in FirstGroup Acquires London – South Wales Open Access Business And Plans Lumo To Devon.

Their list of possible services and destinations include.

- Hull Trains – London King’s Cross and Beverley via Stevenage, Grantham, Retford, Doncaster, Selby, Howden, Brough, Hull Paragon and Cottingham

- Hull Trains – London King’s Cross and Hull Paragon via Stevenage, Grantham, Retford, Doncaster, Selby, Howden and Brough

- Hull Trains – London King’s Cross and Sheffield via Worksop and Woodhouse

- Lumo – London Euston and Rochdale via Warrington Bank Quay, Newton-le-Willows, Eccles and Manchester Victoria

- Lumo – London King’s Cross and Edinburgh/Glasgow via Stevenage, Newcastle and Morpeth

- Lumo – London Paddington and Carmarthen via Bristol Parkway, Newport, Severn Tunnel Junction, Cardiff Central, Gowerton and Llanell

- Lumo – London Paddington and Paignton via Bath Spa, Bristol Temple Meads, Taunton, Exeter St David’s and Torquay

I believe that all services could be run by identical versions of Hitachi’s high speed Intercity Battery Electric Train, which are described in this page on the Hitachi web site.

The London Paddington and Paignton service would require the longest running without electrification at 210 km. and I don’t believe First Group would have put in a bid, unless they were certain zero-carbon trains with sufficient performance would be available.

Other possible open access services could be.

Hull And Blackpool Airport

Note.

- This could be the first half of a Green Route between the North of England and the island of Ireland, if zero-carbon aircraft can fly from Blackpool Airport.

- Trains would call at Selby, Leeds, Bradford, Huddersfield, Manchester Victoria, Blackburn and Preston.

- Blackpool Airport has good access from Squires Gate station and tram stop, which could be improved.

- Blackpool Airport could be well supplied with green electricity and hydrogen from wind power.

These are distances to possible airports.

- Belfast City – 111 nm.

- Belfast International – 114 nm.

- Cardiff – 143 nm.

- Cork – 229 nm.

- Donegal – 200 nm.

- Derry/Londonderry – 163 nm.

- Dublin – 116 nm.

- Inverness – 228 nm

- Ireland West Knock – 204 nm.

- Kerry – 253 nm.

- Ronaldsway, IOM – 59 nm.

- Shannon – 220 nm.

Note.

- The Wikipedia entry for the all-electric Eviation Alice, gives the range with reserves as 250 nm.

- The Belfast and Dublin airports could be within range of a round trip from Blackpool without refuelling.

- ,Cork, Kerry and Shannon airports may need to go by another airport, where a small battery charge is performed.

- The Isle of Man is surprisingly close.

Blackpool has reasonably good coverage for the island of Ireland.

London Euston And Holyhead

This could be the first half of a Green Route to Dublin, if the trains met a high speed hydrogen-powered catamaran to speed passengers across to Dun Laoghaire.

London King’s Cross And Aberdeen Or Inverness

Why not? But these routes would probably be best left to LNER.

London King’s Cross And Grimsby Or Cleethorpes

In Azuma Test Train Takes To The Tracks As LNER Trials Possible New Route, I talked about how LNER had run a test train to Grimsby and Cleethorpes.

The Government might prefer that an open access operator took the risk and got all the blame if the route wasn’t worth running.

Humberside is very much involved in the energy industry, with several gas-fried power-stations at Keadby.

It might be more efficient in terms of trains and infrastructure, if this service was an extension of the Lincoln service.

London King’s Cross And Scarborough Via Beverley

This would probably be one for Hull Trains, but it would also serve Bridlington and Butlin’s at Filey.

The BBC was running a story today about how holiday camps are making a comeback. Surely, one on a direct train from London wouldn’t be a bad thing. for operators, train companies or holidaymakers.

London King’s Cross And Middlesbrough, Redcar Or Saltburn

As with the Grimsby and Cleethorpes service, the government might think, that this might be a better service for an open access operator.

Teesside is heavily involved in the offshore wind industry and may add involvement in the nuclear industry.

London Paddington And Fishguard, Haverfordwest, Milford Haven Or Pembroke Dock

Note.

- This could be the first half of a Green Route to Southern Ireland, if the trains met a high speed hydrogen-powered catamaran to speed passengers across to Rosslare or an electric or hydrogen-powered aircraft from Haverfordwest Airport.

- These three ports and one airport will feature heavily in the development of offshore wind power in the Celtic Sea.

- RWE are already planning a hydrogen electrolyser in Pembrokeshire, as I wrote about in RWE Underlines Commitment To Floating Offshore Wind In The Celtic Sea Through New ‘Vision’ Document.

- According to the Wikipedia entry for Fishguard Harbour station, it was built as a station to handle ship passengers and is now owned by Stena Line, who run the ferries to Rosslare in Ireland.

- I can see a tie-up between FirstGroup and Stena Line to efficiently transfer passengers between Lumo’s planned service to Carmarthen and Stena Line’s ships to Ireland.

All four secondary destinations would be a short extension from Carmarthen.

Summing Up

Note how energy, a Green Route to Ireland and other themes keep appearing.

I do wonder if running a budget train service to an area, is an easy way of levelling up, by attracting people, commuters and industry.

Have the budget airlines improved the areas they serve?

They’ve certainly created employment in the transport, construction and hospitality industries.

Zero-Carbon Ferries And Short-Haul Aircraft

These will be essential for Anglo-Irish routes and many other routes around the world.

I will deal with the ferries first, as to create a zero-carbon ferry, only needs an appropriate power unit to be installed in a ship design that works.

But with aircraft, you have to lift the craft off the ground, which needs a lot of energy.

This article on Transport and Environment is entitled World’s First ‘Carbon Neutral’ ship Will Rely On Dead-End Fuel, with this sentence as a sub-heading.

The Danish shipping giant Maersk announced it will operate the world’s first carbon-neutral cargo vessel by 2023. The company had promised a carbon-neutral container ship by 2030 but now says it will introduce the ship seven years ahead of schedule following pressure from its customers. While welcoming Maersk’s ambition, T&E says the company is betting on the wrong horse by using methanol which may not be sustainable and available in sufficient amounts.

Note.

- I’d not heard of this ship.

- Pressure from customers brought the date forward by seven years.

- As always, it appears that the availability of enough green hydrogen and methanol is blamed.

Perhaps, Governments of the world should put more teeth in green legislation to ensure that companies and governments do what they say they are gong to do?

But worthwhile developments in the field of shipping are underway.

For instance, I estimate that this Artemis Technologies hydrofoil ferry could take passengers across the 54 nautical miles between Dun Laoghaire and Holyhead in around 90 minutes.

This ferry is being designed and built in Northern Ireland and I can’t believe, it is the only development of its type.

A Fast Green Route To Ireland

I have talked about this before in High-Speed Low-Carbon Transport Between Great Britain And Ireland and I am certain that it will happen.

- Air and sea routes between the UK and the island of Ireland carry a lot of traffic.

- Some travellers don’t like flying. Especially in Boeings, which are Ryanair’s standard issue.

- It is the sort of trip, that will appeal to a lot of travellers and most probably a lot with Irish connections.

- An electric or hydrogen-powered aircraft or a fast surface craft will be able to cross the Irish Sea in a quick time.

- High speed trains and then High Speed Two will consistently reduce the travel times on the UK side of the water.

Cross-water travel routes, be they by aircraft, ferries, bridges or tunnels are generally popular and successful.

Conclusion

Given the opportunity at Fishguard, I can see that FirstGroup next move would be to extend the Carmarthen service to Fishguard Harbour.

UK Unveils GBP 50 Million Fund To Boost Offshore Wind Supply Chain

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Crown Estate has initiated a Supply Chain Accelerator to stimulate early-stage investment in the UK offshore wind supply chain.

These are the first three paragraphs.

The accelerator is a new GBP 50 million (approximately EUR 58.7 million) fund created to accelerate and de-risk the early-stage development of projects linked to offshore wind.

An initial GBP 10 million round of funding is now open for Expressions of Interest for businesses looking to establish UK projects that could support the development of a new UK supply chain capability for floating offshore wind in the Celtic Sea.

The application process opens formally in mid-June and closes at the end of July. The final announcement will be made in October 2024.

This sounds like a very good idea.

This is the next paragraph.

Earlier this year, the Crown Estate published research, the Celtic Sea Blueprint, which predicted that 5,300 jobs and a GBP 4.1 billion economic boost could be generated through deploying the first floating offshore wind capacity, that will result from the current leasing Round 5 process, under which leases for up to 4.5 GW of generation capacity will be awarded in the waters off South Wales and South-West England.

It looks to me, that the £100 million could help prime the pumps to do the following for South Wales and South-West England.

- Create 5,300 jobs

- Create a £ 4.1 billion economic boost.

- Develop up to 4.5 GW of generation capacity.

If we assume the following.

- 4.5 GW of generation capacity.

- Capacity factor of 50 %.

- Strike price of £ 35/MWh.

- A year has 8,760 hours.

We can say the following.

- Average hourly generation is 2,250 MWh

- Average yearly generation is 19,710 GWh or 19,710,000 MWh

This would be a yearly income of £ 689, 850 million.

UK’s Sixth Contracts For Difference Round Open

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK Government has opened the sixth allocation round (AR6) of the Contracts for Difference (CfD) scheme on 27 March and will continue until 19 April 2024. The round will see a range of renewable technologies, including offshore wind compete for the government’s support.

This paragraph outlines how to apply and when the results will be published.

Applications may be submitted via National Grid ESO’s EMR Portal. The results are expected to be published at some point this summer.

The fifth round was a bit of a disaster for offshore wind and hopefully, it will be better this time, as the government will be upping prices.

At least it appears that Iberdrola will be bidding for two wind farm in their East Anglia Array, as I wrote about in Iberdrola Preparing Two East Anglia Offshore Wind Projects For UK’s Sixth CfD Round.

In The Crown Estate Refines Plans For Celtic Sea Floating Wind, I wrote about developments in the Celtic Sea, where contracts should be signed this year.

2024 could be a bumper year for new wind farm contracts.

Two Ports Advance To Next Stage Of UK Gov Funding For Floating Wind

The title of this post, is the same as this article in Ground Engineering.

This is the sub-heading.

Port Talbot in Wales and Port of Cromarty Firth in Scotland have advanced to the next stage of a government funding scheme to develop port infrastructure that will facilitate floating offshore wind.

These three paragraphs introduce the developments.

The UK Government has agreed that the port expansion projects should progress to the next stage of its floating offshore wind manufacturing investment scheme (FLOWMIS) known as the primary list phase.

Up to £160M of grant funding will be allocated to certain investments in the floating offshore wind sector under the scheme.

The money will go towards funding the basic infrastructure necessary to support the assembly of floating offshore wind turbines. This includes the construction, replacement and upgrade of port infrastructure to accommodate large components such as towers and blades, as well as steel and concrete foundations and mooring cables required for floating offshore wind.

The article also says this about Port Talbot.

The Future Port Talbot project in south Wales would see the port transformed into a major hub for the manufacturing, assembly, and integration of floating offshore wind components for projects in the Celtic Sea.

Associated British Ports (ABP), which owns and operates the port, welcomed the government’s decision.

Note.

- Port Talbot will almost certainly use locally produced steel.

- There appears to be at least 4,832 MW of floating wind to be developed in the Celtic Sea in the next few years.

Port Talbot would be ideally placed to handle both English and Welsh coasts and waters in the Celtic Sea.

The article also says this about the Port of Cromarty Firth.

The Port of Cromarty Firth (PoCF) on the east coast of the Scottish Highlands will undergo a fifth phase of expansion work. This will develop the facilities and infrastructure necessary to enable the port to support offshore wind infrastructure projects off the coast of Scotland.

Over £50M has also been earmarked for the port’s expansion.

There appears to be at least 15,216 MW of floating wind to be developed in Scotland in the next few years.

Both ports seem to have welcomed the funding.

Adding the plans for Scotland and the Celtic Sea together gives a figure of just over 20 GW of floating wind to be developed in the next few years.

Conclusion

Surely, the award of funding for floating wind, is a good way to create a new industry and jobs in these two areas and also perform some sensible levelling-up.

I also suspect that spending £160 million to enable the construction of 20 GW of floating wind farm is a good return on the investment.