SSE Announces Construction Of Aberarder Wind Farm

The title of this post, is the same as that as an advert on my online edition of The Times.

Click the advert and you get this page, with the title of this post.

This is the sub-heading.

Aberarder secured 15-year CfD in UK Allocation Round 5

These three paragraphs give more details of the wind farm.

SSE has taken a final investment decision to proceed with Aberarder Wind Farm in the Scottish Highlands, in a circa £100m investment boost for its onshore wind portfolio.

Construction of the 12 turbine, 50MW wind farm, which is wholly owned by SSE Renewables, will begin before the end of the year with completion scheduled for the end of 2026. The Aberarder project was successful in September 2023 in the UK’s fifth Contract for Difference (CfD) Allocation round, securing a 15-year contract for low-carbon power generation.

Located at Strathnairn near Inverness, on a natural plateau at an average of 700m above sea level, the Aberarder project site sits directly adjacent to the operational 94MW Dunmaglass Wind Farm, which is jointly owned by SSE Renewables and Greencoat UK Wind.

It would appear that a £100m investment in the Scottish Highlands will get you a fully-operational 50 MW wind farm.

These are my observations and thoughts.

SSE’s Project Overview Of Aberarder Wind Farm

These four paragraphs are SSE’s project overview from this page on the SSE Renewables web site.

The Aberarder Wind Farm project is located in Strathnairn near Inverness, on a natural plateau at an average of 700m above sea level. It will sit directly adjacent to the operational 94MW Dunmaglass Wind Farm, which is jointly owned by SSE Renewables and Greencoat UK Wind.

The project was developed by RES and consented by The Highland Council in April 2017. The consent allows for the construction of a 12-turbine onshore wind farm, with each turbine having a maximum tip height of up to 130m and is expected to have an export capacity of 49.9MW. SSE Renewables reached an agreement with RES to acquire Aberarder in October 2022.

In September 2023 Aberarder was successful in the UK’s fifth Contract for Difference (CfD) Allocation Round and was awarded a 15-year contract for low carbon power generation. SSE took a final investment decision to proceed with Aberarder Wind Farm, in a circa £100m investment in May 2024, construction is scheduled to begin before the end of 2024 with completion scheduled for the end of 2026.

Our focus is now on building strong and meaningful relationships with the local community surrounding the Aberarder Wind Farm. As a responsible developer and operator, we are looking forward to working closely with the community in surrounding area to fully realise the benefits of this exciting project.

Construction has now started and it would appear that in two years, the twelve-turbine wind farm will be producing power.

SSE’s Description Of Dunmaglass Wind Farm

These four paragraphs are SSE’s description from this page on the SSE Renewables web site.

Located to the south east of Inverness, on a natural plateau at an average of 700m above sea level, Dunmaglass is SSE’s highest wind farm to be constructed.

SSE acquired the project from RES in May 2013 and initial enabling works began in the summer of 2013 which included the upgrading of 11km of tracks and the construction of two timber deck bridges.

Highland contractor RJ McLeod was awarded the £16m main civil works contract in summer 2014.

Dunmaglass became fully operational in 2017.

This paragraph also illustrates the challeges of the It looks like the construction of the larger Dunmaglass wind farm.

The height at which Dunmaglass is located presented its challenges during construction and the winter months brought high winds and plenty of snow. The site was fully completed and handed to the operations team in 2017.

Surprisingly, the legendary Highland midges didn’t get a mention.

The Sale Of 49.9 % Of Dunmaglass Wind Farm To Greencoat UK Wind

This sub-heading outlines the sale.

In February 2019, SSE sold 49.9% of Dunmaglass to Greencoat UK Wind PLC as part of a deal in which Greencoat acquired a 49.9% stake in both Dunmaglass and the nearby Stronelairg wind farm.

This paragraph gives more details of the sale.

In February 2019, SSE signed agreements for the sale of 49.9% of Dunmaglass wind farm to Greencoat UK Wind Plc (“UKW”). This sale was part of a £635m deal in which Greencoat acquired a 49.9% stake in both Stronelairg and Dunmaglass wind farms. The stakes equate to 160.6MW (megawatts) of capacity, with an average valuation for the two wind farms of around £4m per MW. This valuation demonstrates SSE’s ability develop quality, low carbon assets and infrastructure vital to the GB energy market.

The interesting figure is that SSE was paid £4m per MW for the interest of 160.6 MW, that they sold.

Aberarder wind farm is a 50 MW wind farm and it appears that it will cost £100 million to build.

If after a couple of years of operation, the wind farm is worth £4 million per MW, then SSE have doubled their money.

Does this illustrate, why the professionals like SSE and Greencoat UK Wind invest in wind farms?

- SSE would have taken the risk, that they could build the wind farm.

- SSE have the engineering skillsto do an excellent job.

- Greencoat UK Wind are buying into a producing asset, with a known cash flow.

SSE also get more money to build more wind farms.

Where Are Aberarder And Dunmaglass?

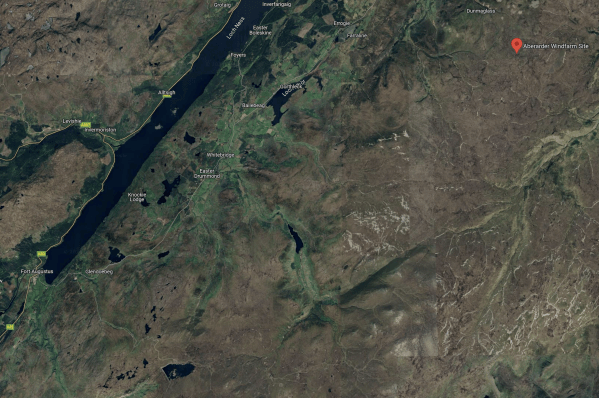

This Google Map shows the site of Aberarder wind farm with respect to Inverness.

Note.

- Inverness is at the top of the map on the waters of the Solway Firth.

- Aberarder wind farm is marked by the red arrow.

- Aberarder is a hamlet to the North-West of the wind farm.

- Drumnaglass is a shooting estate to the North-West of the wind farm.

- Loch Duntelchaig is the main reservoir for Inverness.

This second Google Map shows the Drumnaglass wind farm.

Note.

- Drumnaglass wind farm has 33 turbines and a capacity of 94.05 MW.

- There is a track network of 11 km. linking all the turbines.

- A good proportion of the turbines can be picked out on the map.

It would appear that Aberarder wind farm will lie to the South-East of this wind farm.

Aberarder Wind Farm To Fort Augustus

In Cloiche Onshore Wind Farm, I talked about the 130.5 MW Cloiche wind farm and its future construction to the East of Fort Augustus and Stronelairg wind farm.

This Google Map shows the position of Aberarder wind farm with respect to Ford Augustus.

Note.

- Loch Ness runs across the North-West corner of the map.

- Fort Augustus and Stronelairg wind farm, are at the Southern end of the loch.

- The red arrow shows Aberarder wind farm.

- Foyers pumped hydro is on the Eastern bank of Loch Ness, at about the same latitude as the Aberarder wind farm.

- The lake at the bottom of the map, to the South-East of Ford Augustus, is the Glendoe Reservoir, that powers the Glendoe hydroelectric scheme.

There are certainly, a lot of SSE-owned and/or SSE-controlled assets in the area and I wouldn’t be surprised, if SSE integrated them more closely, or added a few more wind farms.

Why Are SSE Advertising The Start Of Construction?

SSE have been advertising for some time on The Times web site.

As they are not a retail energy company anymore, as they sold their retail business to OVO, the advertising, is probably about spreading a good corporate message and getting their strategy broadcast.

Crown Estate Details Round 5 Plans

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Crown Estate has revealed details of a new leasing round, known as Round 5, for three commercial-scale floating wind projects in the Celtic Sea.

These are the first two paragraphs, which outline the three initial projects.

Located off the coast of South Wales and South West England, the sites will have a combined capacity of up to 4.5 GW, enough to supply four million homes with renewable energy.

The new wind farms are expected to be the first phase of commercial development in the region, with the UK Government confirming as part of its Autumn Statement in November its intention to unlock space for up to a further 12 GW of capacity in the Celtic Sea.

It looks like there could be another 7.5 GW available.

These four paragraphs indicate that the Crown Estate. expect the developers to to develop the local infratructure.

New details about the Round 5 auction include upfront investment in important workstreams to de-risk the process for developers and accelerate the deployment of projects.

This includes a multi-million-pound programme of marine surveys to better understand the physical and environmental properties around the locations of the new wind farms, as well as carrying out a Plan-Level Habitats Regulations Assessment early on in the process.

An Information Memorandum published today, on 7th December, also includes details of a series of contractual commitments for developers to create positive social and environmental impacts, focused on skills and training, tackling inequalities in employment, environmental benefits, and working with local communities.

In addition, bidders will be required to demonstrate commitments for the timely access to the port infrastructure needed to develop their projects, the Crown Estate said.

But it also appears that the Crown Estate are doing their bit by carrying out marine surveys.

Conclusion

It looks like the Crown Estate are making thing easier for developers, so that they increase the interest in Celtic Sea wind farms.

We’ll see if the strategy is successful, when contracts are awarded.

RWE Applies For Rampion 2 Development Consent, Reduces Number Of Offshore Wind Turbines

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Last month, RWE and its project partners submitted an application for the development consent order (DCO) for the Rampion 2 offshore wind farm in the UK. The Planning Inspectorate accepted the application for examination on 7 September and will start the examination process within three months.

RWE and other major wind developers may well have taken a pass in acquiring new offshore wind leases in the Contracts for Difference Allocation Round 5 last week, but RWE seem to be carrying on with the projects they already have.

Dates for the 1200 MW Rampion 2 wind farm include.

- Development Consent – Early 2025

- Construction Start – Late 2026 or Early 2027

- Fully Operational – End of the decade.

I wouldn’t be surprised to see Rampion 2 being earlier, as it is the only wind farm in the development queue in the South of England.

UK Confirms £205 Million Budget To Power More Of Britain From Britain

The title of this post, is the same as that of this press release from the Department of Energy Security And NetZero.

This is the sub title.

UK government confirms budget for this year’s Contracts for Difference scheme as it enters its first annual auction, boosting energy security.

These are the three bullet points.

- Government announces significant financial backing for first annual flagship renewables auction, boosting Britain’s energy security

- £170 million pledged for established technologies to ensure Britain remains a front runner in renewables and £10 million ring-fenced budget for tidal

- Scheme will bolster investment into the sector every year, delivering clean, homegrown energy as well as green growth and jobs

These are my thoughts.

First And Annual

The scheme is flagged as both first and annual!

Does this mean, that each Budget will bring forward a pot of money for renewables every year?

My father, who being a letterpress printer and a Cockney poet would say it did and I’ll follow his lead.

Two Pots

In Contracts for Difference Round 4, there were three pots.

- Pot 1 – Onshore Wind and Solar

- Pot 2 – Floating Offshore Wind, Remote Island Wind and Tidal Stream

- Pot 3 – Fixed Foundation Offshore Wind

This document on the government web site lists all the results.

For Contracts for Difference Round 5, there will be two pots, which is described in this paragraph of the press release.

Arranged across 2 ‘pots’, this year’s fifth Allocation Round (AR5) includes an allocation of £170 million to Pot 1 for established technologies, which for the first time includes offshore wind and remote island wind – and confirms an allocation of £35 million for Pot 2 which covers emerging technologies such as geothermal and floating offshore wind, as well as a £10 million ring-fenced budget available for tidal stream technologies.

It could be described as a two-pot structure with a smaller ring-fenced pot for tidal stream technologies.

Contract for Difference

There is a Wikipedia entry for Contract for Difference and I’m putting in an extract, which describes how they work with renewable electricity generation.

To support new low carbon electricity generation in the United Kingdom, both nuclear and renewable, contracts for difference were introduced by the Energy Act 2013, progressively replacing the previous Renewables Obligation scheme. A House of Commons Library report explained the scheme as:

Contracts for Difference (CfD) are a system of reverse auctions intended to give investors the confidence and certainty they need to invest in low carbon electricity generation. CfDs have also been agreed on a bilateral basis, such as the agreement struck for the Hinkley Point C nuclear plant.

CfDs work by fixing the prices received by low carbon generation, reducing the risks they face, and ensuring that eligible technology receives a price for generated power that supports investment. CfDs also reduce costs by fixing the price consumers pay for low carbon electricity. This requires generators to pay money back when wholesale electricity prices are higher than the strike price, and provides financial support when the wholesale electricity prices are lower.

The costs of the CfD scheme are funded by a statutory levy on all UK-based licensed electricity suppliers (known as the ‘Supplier Obligation’), which is passed on to consumers.

In some countries, such as Turkey, the price may be fixed by the government rather than an auction.

Note.

- I would trust the House of Commons Library to write up CfDs properly.

- As a Control Engineer, I find a CfD an interesting idea.

- If a generator has more electricity than expected, they will make more money than they expected. So this should drop the wholesale price, so they would get less. Get the parameters right and the generator and the electricity distributor would probably end up in a stable equilibrium. This should be fairly close to the strike price.

I would expect in Turkey with Erdogan as President, there are also other factors involved.

Renewable Generation With Energy Storage

I do wonder, if wind, solar or tidal energy, is paired with energy storage, this would allow optimisation of the system around the Contract for Difference.

If it did, it would probably mean that the generator settled into a state of equilibrium, where it supplied a constant amount of electricity.

Remote Island Wind

Remote Island Wind was introduced in Round 4 and I wrote about it in The Concept Of Remote Island Wind.

This was my conclusion in that post.

I must admit that I like the concept. Especially, when like some of the schemes, when it is linked to community involvement and improvement.

Only time will tell, if the concept of Remote Island Wind works well.

There are possibilities, although England and Wales compared to Scotland and Ireland, would appear to be short of islands.

This map shows the islands of the Thames Estuary.

Note.

- In Kent, there is the Isle of Sheppey and the Isle of Grain.

- Between the two islands is a large gas terminal , a gas-fired power station and an electricity sub-station connecting to Germany.

- In Essex, there is Canvey, Foulness and Potton Islands.

- There is also the site at Bradwell, where there used to be a nuclear power station.

If we assume that each island could support 200 MW, there could be a GW of onshore wind for London and perhaps a couple of SMRs to add another GW.

This map shows the islands around Portsmouth.

Note.

- Hayling Island is to the East of Portsmouth.

- Further East is Thorney Island with an airfield.

The Isle of Wight could be the sort of island, that wouldn’t welcome wind farms, although they do make the blades for turbines. Perhaps they should have a wind farm to make the blades even more green.

But going round England and Wales there doesn’t seem to be many suitable places for Remote Island Wind.

I do think though, that Scotland could make up the difference.

Geothermal Energy

This is directly mentioned as going into the emerging technologies pot, which is numbered 2.

I think we could see a surprise here, as how many commentators predicted that geothermal heat from the London Underground could be used to heat buildings in Islington, as I wrote about in ‘World-First’ As Bunhill 2 Launches Using Tube Heat To Warm 1,350 Homes.

Perhaps, Charlotte Adams and her team at Durham University, will capitalise on some of their work with a abandoned coal mine, that I wrote about in Exciting Renewable Energy Project for Spennymoor.

Timescale

This paragraph gives the timescale.

The publication of these notices mean that AR5 is set to open to applications on 30 March with results to be announced in late summer/early autumn 2023, with the goal of building upon the already paramount success of the scheme.

It does look like the Government intends this round to progress at a fast pace.

Conclusion

If this is going to be an annual auction, this could turn out to be a big spur to the development of renewable energy.

Supposing you have a really off-beat idea to generate electricity and the idea place in the world is off the coast of Anglesey.

You will certainly be able to make a bid and know like Eurovision, one auction will come along each year.