Cummins To Cease New Electrolyser Activity Amid Worsening Market

The title of this post, is the same as that of this article on Renewables Now.

These are the first three paragraphs.

Cummins Inc has decided to stop new commercial activity in the electrolysers space following a strategic review of the segment launched last year, citing deteriorating market conditions and weakening customer demand.

The decision is linked to USD 458 million (EUR 388.4m) of charges for the full-year 2025 related to the electrolyser business within the company’s zero-emission technologies arm, Accelera, of which USD 415 million were non-cash charges.

The company noted that it will continue to fulfil existing customer commitments before winding down new commercial activity in the segment.

Although, I am in favour of using hydrogen as a fuel, I recognise, that traditional electrolysis is not the most efficient process.

These methods are more efficient.

HiiROC

- HiiROC use a process, that they call Thermal Plasma Electrolysis to split any hydrocarbon gas into hydrogen and carbon black.

- HiiROC originated in the University of Hull.

- Typical gases that can be used are chemical plant off-gas, biomethane and methane.

- I like the ability to use chemical plant off-gas, as some of this is particularly nasty and HiiROC may offer safe disposal.

But the big advantage is that the HiiROC process is five times more energy efficient than traditional electrolysis.

The carbon black is no useless by-product, but has several valuable uses in its own right, which are detailed in its Wikipedia entry.

These two paragraphs from Wikipedia, give a summary of the more common uses of carbon black.

The most common use (70%) of carbon black is as a reinforcing phase in automobile tires. Carbon black also helps conduct heat away from the tread and belt area of the tire, reducing thermal damage and increasing tire life. Its low cost makes it a common addition to cathodes and anodes and is considered a safe replacement to lithium metal in lithium-ion batteries. About 20% of world production goes into belts, hoses, and other non-tire rubber goods. The remaining 10% use of carbon black comes from pigment in inks, coatings, and plastics, as well as being used as a conductive additive in lithium-ion batteries.

Carbon black is added to polypropylene because it absorbs ultraviolet radiation, which otherwise causes the material to degrade. Carbon black particles are also employed in some radar absorbent materials, in photocopier and laser printer toner, and in other inks and paints. The high tinting strength and stability of carbon black has also provided use in coloring of resins and films. Carbon black has been used in various applications for electronics. A good conductor of electricity, carbon black is used as a filler mixed in plastics, elastomer, films, adhesives, and paints. It is used as an antistatic additive agent in automobile fuel caps and pipes.

It can also be used as a soil improver in agriculture.

HiiROC would appear to be five times more energy efficient than traditional electrolysis.

I would also rate the range of their investors as a particular strength.

Google AI lists these companies as investors.

HiiROC, a UK-based developer of plasma torch technology for “turquoise” hydrogen production, is backed by a consortium of industrial and strategic investors. Key investors include Centrica, Melrose Industries, Hyundai Motor Company, Kia, HydrogenOne Capital, CEMEX Ventures, Wintershall Dea, and VNG.

Note.

- CEMEX must be going to decarbonise cement making.

- Melrose describe themselves as an industry-leading aerospace technology provider.

- Will we be seeing hydrogen cars from Korean manufacturers?

- Wintershall Dea is Europe’s leading independent gas and oil company.

HiiROC has an impressive list of investors.

Bloom Energy

I wrote about Bloom Energy’s process in Westinghouse And Bloom Energy To Team Up For Pink Hydrogen.

This method also looks promising.

- Westinghouse Electric Company is an American builder of nuclear power stations.

- Bloom Energy Corporation make a solid-oxide electrolyser.

- Pink hydrogen is green hydrogen produced using nuclear power.

It uses electrolysis at a higher temperature, which speeds it up.

Desert Bloom

This is an Australian process, that I wrote about in 10GW Green Hydrogen Project Aims To Electrolyze Water Drawn From Desert Air.

Conclusion

You can understand, why Cummins are getting jumpy!

But you have to remember that when I worked in a hydrogen plant in the 1960s, the hydrogen was an unwanted by-product and it was mixed with coal gas and sent down the power station to raise steam, so that it could be used to do something useful.

Hydrogen Energy Explained

The title of this post, is the same as this story on Centrica.

This is the sub-heading.

Hydrogen is a clean alternative to natural gas, when it’s burnt it doesn’t produce carbon dioxide, which is a harmful greenhouse gas. It has the potential to play a significant role in achieving net-zero and decarbonising various sectors.

The story is a good introduction to hydrogen.

In the 1960s, when I first worked in a hydrogen electrolyser at ICI in Runcorn, I would have found a document like this one from Centrica invaluable.

Norway’s Sovereign Wealth Fund Acquires Stake In 573 MW Race Bank Offshore Wind Farm

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

A consortium made up of investment funds belonging to Australia-headquartered Macquarie Asset Management and Spring Infrastructure Capital has reached an agreement to divest a 37.5 per cent stake in the 573 MW Race Bank offshore wind farm in the UK to Norges Bank Investment Management.

These four paragraphs give more details of the deal.

The stake was sold to the Norwegian sovereign wealth fund for approximately GBP 330 million (about EUR 390.6 million).

According to Norges Bank Investment Management, the fund acquired Macquarie European Infrastructure Fund 5’s 25 per cent stake and Spring Infrastructure 1 Investment Limited Partnership’s 12.5 per cent interest in the Race Bank offshore wind farm.

A Macquarie Capital and Macquarie European Infrastructure Fund 5 consortium acquired a 50 per cent stake in Race Bank during the construction phase in 2016. Macquarie Capital divested its 25 per cent stake in the wind farm in 2017.

With the deal, Arjun Infrastructure Partners will remain co-investor for 12.5 per cent of the wind farm and Ørsted will remain a 50 per cent owner and operator of Race Bank.

These are my thoughts.

The Location of Race Bank Wind Farm

This map from the Outer Dowsing Web Site, shows Race Bank and all the other wind farms off the South Yorkshire, Lincolnshire and Norfolk coasts.

From North to South, wind farm sizes and owners are as follows.

- Hornsea 1 – 1218 MW – Ørsted, Global Infrastructure Partners

- Hornsea 2 – 1386 MW – Ørsted,Global Infrastructure Partners

- Hornsea 3 – 2852 MW – Ørsted

- Hornsea 4 – 2600 MW – Ørsted

- Westernmost Rough – 210 MW – Ørsted and Partners

- Humber Gateway – 219 MW – E.ON

- Triton Knoll – 857 MW – RWE

- Outer Dowsing – 1500 MW – Corio Generation, TotalEnergies

- Race Bank – 573 MW – Ørsted,

- Dudgeon – 402 MW – Equinor, Statkraft

- Lincs – 270 MW – Centrica, Siemens, Ørsted

- Lynn and Inner Dowsing – 194 MW – Centrica, TCW

- Sheringham Shoal – 317 MW – Equinor, Statkraft

- Norfolk Vanguard West – 1380 MW – RWE

Note.

- There is certainly a large amount of wind power on the map.

- Hornsea 1, 2 and 3 supply Humberside.

- Hornsea 4 will supply Norwich and North Norfolk.

- Norfolk Vanguard West would probably act with the other two wind farms in RWE’ Norfolk cluster.

- Ignoring Hornsea and Norfolk Vanguard West gives a total around 4.5 GW.

- There are also two 2 GW interconnectors to Scotland (Eastern Green Link 3 and Eastern Green Link 4) and the 1.4 GW Viking Link to Denmark.

I wouldn’t be surprised to see a large offshore electrolyser being built in the East Lincolnshire/West Norfolk area.

The primary purpose would be to mop up any spare wind electricity to avoid curtailing the wind turbines.

The hydrogen would have these uses.

- Provide hydrogen for small, backup and peaker power stations.

- Provide hydrogen for local industry, transport and agriculture,

- Provide hydrogen for off-gas-grid heating.

- Provide methanol for coastal shipping.

Any spare hydrogen would be exported by coastal tanker to Germany to feed H2ercules.

Do We Need Wind-Driven Hydrogen Electrolysers About Every Fifty Miles Or so Along The Coast?

I can certainly see a string along the East Coast between Humberside and Kent.

- Humberside – Being planned by SSE

- East Lincolnshire/West Norfolk – See above

- North-East Norfolk – See RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030.

- Dogger Bank – See RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030.

- Sizewell – See Sizewell C And Hydrogen.

- Herne Bay – Under construction

I can see others at possibly Freeport East and London Gateway.

Do RWE Have A Comprehensive Hydrogen Plan For Germany?

What is interesting me, is what Germany company; RWE is up to. They are one of the largest UK electricity producers.

In December 2023, they probably paid a low price, for the rights for 3 x 1.4 GW wind farms about 50 km off North-East Norfolk from in-trouble Swedish company; Vattenfall and have signed contracts to build them fairly fast.

In March 2024, wrote about the purchase in RWE And Vattenfall Complete Multi-Gigawatt Offshore Wind Transaction In UK.

Over the last couple of years, I have written several posts about these three wind farms.

March 2023 – Vattenfall Selects Norfolk Offshore Wind Zone O&M Base

November 2023 – Aker Solutions Gets Vattenfall Nod To Start Norfolk Vanguard West Offshore Platform

December 2023 – SeAH To Deliver Monopiles For Vattenfall’s 2.8 GW Norfolk Vanguard Offshore Wind Project

Then in July 2023, I wrote Vattenfall Stops Developing Major Wind Farm Offshore UK, Will Review Entire 4.2 GW Zone

Note.

- There does appear to be a bit of a mix-up at Vattenfall, judging by the dates of the reports.Only, one wind farm has a Contract for Difference.

- It is expected that the other two will be awarded contracts in Round 6, which should be by Summer 2024.

In December 2023, I then wrote RWE Acquires 4.2-Gigawatt UK Offshore Wind Development Portfolio From Vattenfall.

It appears that RWE paid £963 million for the three wind farms.

I suspect too, they paid for all the work Vattenfall had done.

This transaction will give RWE 4.2 GW of electricity in an area with very bad connections to the National Grid and the Norfolk Nimbies will fight the building of more pylons.

So have the Germans bought a pup?

I don’t think so!

Where Is Wilhemshaven?

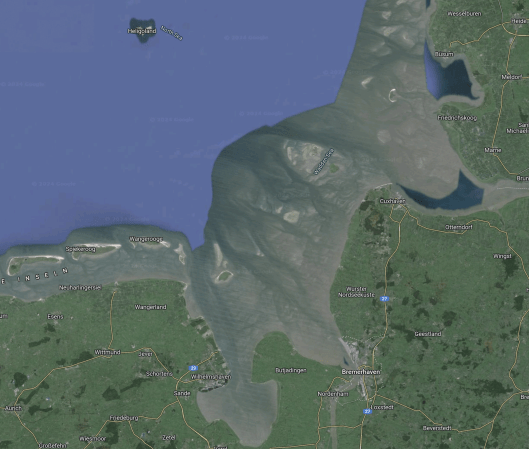

This Google Map shows the location of Wilhemshaven.

Note.

- Heligoland is the island at the top of the map.

- The Germans call this area the Wdden Sea.

- The estuaries lead to Wilhelmshaven and Bremerhaven.

- Cuxhaven is the port for Heligoland, which is connected to Hamburg by hydrogen trains.

This second map shows between Bremerhaven and Wilhelmshaven.

Note.

- Wilhelmshaven is to the West.

- Bremerhaven is in the East.

- The River Weser runs North-South past Bremerhaven.

I’ve explored the area by both car and train and it is certainly worth a visit.

The Wilhemshaven Hydrogen Import Terminal

German energy company; Uniper is building a hydrogen import terminal at Wilhemshaven to feed German industry with hydrogen from places like Australia, Namibia and the Middle East. I wrote about this hydrogen import terminal in Uniper To Make Wilhelmshaven German Hub For Green Hydrogen; Green Ammonia Import Terminal.

I suspect RWE could build a giant offshore electrolyser close to the Norfolk wind farms and the hydrogen will be exported by tanker or pipeline to Germany or to anybody else who pays the right price.

All this infrastructure will be installed and serviced from Great Yarmouth, so we’re not out of the deal.

Dogger Bank South Wind Farm

To make matters better, RWE have also signed to develop the 3 GW Dogger Bank South wind farm.

This could have another giant electrolyser to feed German companies. The wind farm will not need an electricity connection to the shore.

The Germans appear to be taking the hydrogen route to bringing electricity ashore.

Energy Security

Surely, a short trip across the North Sea, rather than a long trip from Australia will be much more secure and on my many trips between the Haven Ports and The Netherlands, I haven’t yet seen any armed Houthi pirates.

RWE And Hydrogen

On this page on their web site, RWE has a lot on hydrogen.

Very Interesting!

H2ercules

This web site describes H2ercules.

The goal of the H2ercules initiative is to create the heart of a super-sized hydrogen infrastructure for Germany by 2030. To make this happen, RWE, OGE and, prospectively, other partners are working across various steps of the value chain to enable a swift supply of hydrogen from the north of Germany to consumers in the southern and western areas of the country. In addition to producing hydrogen at a gigawatt scale, the plan is also to open up import routes for green hydrogen. The transport process will involve a pipeline network of about 1,500 km, most of which will consist of converted gas pipelines.

Where’s the UK’s H2ercules?

Conclusion

The Germans have got there first and will be buying up all of our hydrogen to feed H2ercules.

Opportunity For Communities To Have Their Say On New Clean Energy Substation Proposed In High Marnham

The title of this post, is the same as that of this article on National Grid.

These three bullet points act as sub-headings.

- National Grid is consulting communities from 22 April to 20 May 2024 on its plans for a new electricity substation which will strengthen its network and connect clean energy to the grid – part of The Great Grid Upgrade

- Substation crucial to upgrade critical infrastructure and ensure a secure and reliable supply of clean energy

- Local people invited to attend consultation events to learn more about the proposals

This is the first paragraph.

National Grid is making changes to its network of electricity infrastructure that transports power around the country, in order to connect new sources of power generated from offshore wind and other low carbon sources to the homes and business across Britain.

These two paragraphs detail the work at High Marnham.

The Great Grid Upgrade is the largest overhaul of the grid in generations. It will play a large part in the UK government’s plan to boost homegrown power, helping the UK switch to clean energy and make sure our electricity network is fit for the future; carrying more clean, secure energy from where it’s generated to where it is needed.

As part of the Brinsworth to High Marnham project, National Grid is proposing to build and operate a new 400kV substation immediately west of its existing substation site in High Marnham. The new substation, which forms a key part of The Great Grid Upgrade, will play an important role in building a more secure and resilient future energy system and provide the ability to transport cleaner energy from the North of England to homes and businesses across the Midlands and beyond, helping to reduce our reliance on fossil fuels.

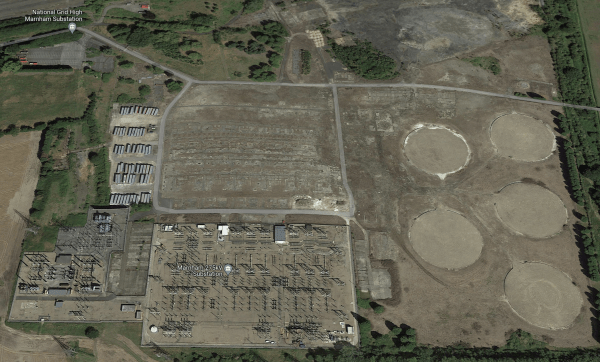

This is a 3D Google Map of the current sub-station.

Note.

- The three large circles are the bases of the cooling towers of the former High Marnham power station.

- The 9.3 MW HyMarnham electrolyser will be built on the site of the demolished coal-fired power station.

- The current sub-station is in the South-West quarter of the power station site.

- The new substation will be on the West side of the current substation.

It is a large site, with space for more electrical gubbings.

The Consultation

There is a web site, a webinar and two local in-person meetings.

- Friday 26 April from 2pm – 7pm at South Clifton Coronation Hall, South Clifton, Newark, Nottinghamshire, NG23 7BG

- Saturday 27 April from 9am – 2pm at Normanton on Trent Village Hall, South Street, Normanton on Trent, NG23 6RQ

This is the third Opportunity For Communities To Have Their Say in a few days.

I can’t fault that!

Fortescue Officially Opens Gladstone Electrolyser Facility

The title of this post, is the same as that of this press release from Fortescue.

This is the sub-heading.

Fortescue has today officially opened its world-leading electrolyser manufacturing facility in Gladstone, Queensland, Australia – one of the first globally to house an automated assembly line.

The first two paragraphs add more detail.

Fortescue has today officially opened its world-leading electrolyser manufacturing facility in Gladstone, Queensland, Australia – one of the first globally to house an automated assembly line.

The 15,000sqm advanced manufacturing facility, constructed and fully commissioned in just over 2 years, will have capacity to produce over 2GW of Proton Exchange Membrane (PEM) electrolyser stacks annually.

This is a very large increase in electrolyser production.

ScottishPower Makes Hydrogen Aviation Pact

The title of this post, is the same as that of this article on reNEWS.biz.

These two paragraphs outline the project.

ScottishPower has partnered with ZeroAvia to explore the development of green hydrogen supply solutions for key airports, with the aim of seeing the decarbonisation of air travel take off.

The collaboration will allow the companies to explore the hydrogen infrastructure for airports to support hydrogen-electric flight and other potential uses.

There is no point of having zero-carbon hydrogen-electric aircraft without the ability to refuel them.

This picture comes from ScottishPower’s original press release.

I can see a system like this having applications in industries like buses, farming, heavy transport and mining.

Enabling The UK To Become The Saudi Arabia Of Wind?

The title of this post, is the same as that of a paper from Imperial College.

The paper can be downloaded from this page of the Imperial College web site.

This is a paragraph from the Introduction of the paper.

In December 2020, the then Prime Minister outlined the government’s ten-point plan for a green industrial revolution, expressing an ambition “to turn the UK into the Saudi Arabia of wind power generation, enough wind power by 2030 to supply every single one of our homes with electricity”.

The reference to Saudi Arabia, one of the world’s largest oil producers for many decades, hints at the significant role the UK’s energy ambitions hoped to play in the global economy.

Boris Johnson was the UK Prime Minister at the time, so was his statement just his usual bluster or a simple deduction from the facts.

The paper I have indicated is a must-read and I do wonder if one of Boris’s advisors had read the paper before Boris’s speech. But as the paper appears to have been published in September 2023, that is not a valid scenario.

The paper though is full of important information.

The Intermittency Of Wind And Solar Power

The paper says this about the intermittency of wind and solar power.

One of the main issues is the intermittency of solar and wind electricity generation, which means it cannot be relied upon without some form of backup or sufficient storage.

Solar PV production varies strongly along both the day-night and seasonal cycles. While output is higher during the daytime (when demand is

higher than overnight), it is close to zero when it is needed most, during the times of peak electricity demand (winter evenings from 5-6 PM).At present, when wind output is low, the UK can fall back to fossil fuels to make up for the shortfall in electricity supply. Homes stay warm, and cars keep moving.

If all sectors were to run on variable renewables, either the country needs to curb energy usage during shortfalls (unlikely to be popular with consumers), accept continued use of fossil fuels across all sectors (incompatible with climate targets), or develop a large source of flexibility such as energy storage (likely to be prohibitively expensive at present).

The intermittency of wind and solar power means we have a difficult choice to make.

The Demand In Winter

The paper says this about the demand in winter.

There are issues around the high peaks in heating demand during winter, with all-electric heating very expensive to serve (as

the generators built to serve that load are only

needed for a few days a year).Converting all the UK’s vehicles to EVs would increase total electricity demand from 279 TWh to 395 TWh. Switching all homes across the country to heat pumps would increase demand by a further 30% to 506 TWh.

This implies that the full electrification of the heating and transport sectors would increase the annual power needs in the country by 81%.

This will require the expansion of the electricity system (transmission capacity, distribution grids, transformers,

substations, etc.), which would pose serious social, economic and technical challenges.Various paths, policies and technologies for the decarbonisation of heating, transport, and industrial emissions must be considered in order for the UK to meet its zero-emission targets.

It appears that electrification alone will not keep us warm, power our transport and keep our industry operating.

The Role Of Hydrogen

The paper says this about the role of hydrogen.

Electrifying all forms of transport might prove difficult (e.g., long-distance heavy goods) or nigh impossible (e.g., aviation) due to the high energy density requirements, which current batteries cannot meet.

Hydrogen has therefore been widely suggested as a low-carbon energy source for these sectors, benefiting from high energy density (by weight), ease of storage (relative to electricity) and its versatility to be used in many ways.

Hydrogen is also one of the few technologies capable of

providing very long-duration energy storage (e.g., moving energy between seasons), which is critical to supporting the decarbonisation of the whole energy system with high shares of renewables because it allows times of supply and demand mismatch to be managed over both short and long timescales.It is a clean alternative to fossil fuels as its use (e.g., combustion) does not emit any CO2.

Hydrogen appears to be ideal for difficult to decarbonise sectors and for storing energy for long durations.

The Problems With Hydrogen

The paper says this about the problems with hydrogen.

The growth of green hydrogen technology has been held back by the high cost, lack of existing infrastructure, and its lower efficiency

of conversion.Providing services with hydrogen requires two to three times more primary energy than direct use of electricity.

There is a lot of development to be done before hydrogen is as convenient and affordable as electricity and natural gas.

Offshore Wind

The paper says this about offshore wind.

Offshore wind is one of the fastest-growing forms of renewable energy, with the UK taking a strong lead on the global stage.

Deploying wind turbines offshore typically leads to a higher electricity output per turbine, as there are typically higher wind speeds and fewer obstacles to obstruct wind flow (such as trees and buildings).

The productivity of the UK’s offshore wind farms is nearly 50% higher than that of onshore wind farms.

Offshore wind generation also typically has higher social acceptability as it avoids land usage conflicts and has a lower visual impact.

To get the most out of this resource, very large structures (more than twice the height of Big Ben) must be connected to the ocean floor and operate in the harshest conditions for decades.

Offshore wind turbines are taller and have larger rotor diameters than onshore wind turbines, which produces a more consistent and higher output.

Offshore wind would appear to be more efficient and better value than onshore.

The Scale Of Offshore Wind

The paper says this about the scale of offshore wind.

The geographical distribution of offshore wind is heavily skewed towards Europe, which hosts over 80% of the total global offshore wind capacity.

This can be attributed to the good wind conditions and the shallow water depths of the North Sea.

The UK is ideally located to take advantage of offshore wind due to its extensive resource.

The UK could produce over 6000 TWh of electricity if the offshore wind resources in all the feasible area of the exclusive economic zone (EEZ) is exploited.

Note.

- 6000 TWh of electricity per annum would need 2740 GW of wind farms if the average capacity factor was a typical 25 %.

- At a price of 37.35 £/MWh, 6000 TWh would be worth $224.1 billion.

Typically, most domestic users seem to pay about 30 pence per KWh.

The Cost Of Offshore Wind

The paper says this about the cost of offshore wind.

The cost of UK offshore wind has fallen because of the reductions in capital expenditure (CapEx), operational expenditure (OpEx), and financing costs.

This has been supported by the global roll-out of bigger offshore wind turbines, hence, causing an increase in offshore wind energy capacity.

This increase in installed capacity has been fuelled by several low-carbon support schemes from the UK government.

The effect of these schemes can be seen in the UK 2017 Contracts for Difference (CfD) auctions where offshore wind reached strike prices as low as 57.50 £/MWh and an even lower strike price of 37.35 £/MWh in 2022.

Costs and prices appear to be going the right way.

The UK’s Offshore Wind Targets

The paper says this about the UK’s offshore wind targets.

The offshore wind capacity in the UK has grown over the past decade.

Currently, the UK has a total offshore wind capacity of 13.8GW, which is sufficient to power more than 10 million homes.

This represents a more than fourfold increase compared to the capacity installed in 2012.

The UK government has set ambitious targets for offshore wind development.

In 2019, the target was to install a total of 40 GW of offshore wind capacity by 2030, and this was later raised to 50 GW, with up to 5 GW of floating offshore wind.

This will play a pivotal role in decarbonising the UK’s power system by the government’s deadline of 2035.

As I write this, the UK’s total electricity production is 31.8 GW. So 50 GW of wind will go a good way to providing the UK with zero-carbon energy. But it will need a certain amount of reliable alternative power sources for when the wind isn’t blowing.

The UK’s Hydrogen Targets

The paper says this about the UK’s hydrogen targets.

The UK has a target of 10 GW of low-carbon hydrogen production to be deployed by 2030, as set out in the British Energy Security Strategy.

Within this target, there is an ambition for at least half of the 10 GW of production capacity to be met through green hydrogen production technologies (as opposed to hydrogen produced from steam methane reforming using carbon capture).

Modelling conducted by the Committee on Climate Change in its Sixth Carbon Budget estimated that demand for low-carbon hydrogen across the whole country could reach 161–376 TWh annually by 2050, comparable in scale to the total electricity demand.

We’re going to need a lot of electrolyser capacity.

Pairing Hydrogen And Offshore Wind

The paper says this about pairing hydrogen and offshore wind.

Green hydrogen holds strong potential in addressing the intermittent nature of renewable generation sources, particularly wind and solar energy, which naturally fluctuate due to weather conditions.

Offshore wind in particular is viewed as being a complementary technology to pair with green hydrogen production, due to three main factors: a) the high wind energy capacity factors offshore, b) the potential for large-scale deployment and c) hydrogen as a supporting technology for offshore wind energy integration.

It looks like a match made in the waters around the UK.

The Cost Of Green Hydrogen

The paper says this about the cost of green hydrogen.

The cost of green hydrogen is strongly influenced by the price of the electrolyser unit itself.

If the electrolyser is run more intensively over the course of the lifetime of the plant, a larger volume of hydrogen will be produced and so the cost of the electrolyser will be spread out more, decreasing the cost per unit of produced hydrogen.

If the variable renewable electricity source powering the electrolyser has a higher capacity factor, this will contribute towards a

lower cost of hydrogen produced.Offshore wind in the UK typically has a higher capacity factor than onshore wind energy (up to 20%), and is around five times higher than solar, so pairing

offshore wind with green hydrogen production is of interest.

It would appear that any improvements in wind turbine and electrolyser efficiency would be welcomed.

The Size Of Wind Farms

The paper says this about the size of wind farms.

Offshore wind farms can also be larger scale, due to increased availability of space and reduced restrictions on tip heights due to planning permissions.

The average offshore wind turbine in the UK had a capacity of 3.6 MW in 2022, compared to just 2.5-3 MW for onshore turbines.

As there are fewer competing uses for space, offshore wind can not only have larger turbines but the wind farms can comprise many more turbines.

Due to the specialist infrastructure requirements for hydrogen transport and storage, and the need for economies of scale to reduce the costs of

production, pairing large-scale offshore wind electricity generation with green hydrogen

production could hold significant benefits.

I am not surprised that economies of scale give benefits.

The Versatility Of Hydrogen

The paper says this about the versatility of hydrogen.

Hydrogen is a highly adaptable energy carrier with numerous potential applications and has been anticipated by some as playing a key role in the future energy system, especially when produced through electrolysis.

It could support the full decarbonisation of “hard to decarbonise” processes within the UK industrial sector, offering a solution for areas which may be difficult to electrify or are heavily reliant on fossil fuels for high-temperature heat.

When produced through electrolysis, it could be paired effectively as an energy storage technology with offshore wind, with the potential to store energy across seasons with little to no energy degradation and transport low-carbon energy internationally.

The UK – with its significant offshore wind energy resources and targets – could play a potentially leading role in producing green hydrogen to both help its pathway to net zero, and potentially create a valuable export industry.

In RWE Acquires 4.2-Gigawatt UK Offshore Wind Development Portfolio From Vattenfall, I postulated that RWE may have purchased Vattenfall’s 4.2 GW Norfolk Zone of windfarms to create a giant hydrogen production facility on the Norfolk coast. I said this.

Consider.

- Vattenfall’s Norfolk Zone is a 4.2 GW group of wind farms, which have all the requisite permissions and are shovel ready.

- Bacton Gas terminal has gas pipelines to Europe.

- Sizewell’s nuclear power stations will add security of supply.

- Extra wind farms could be added to the Norfolk Zone.

- Europe and especially Germany has a massive need for zero-carbon energy.

The only extra infrastructure needing to be built is the giant electrolyser.

I wouldn’t be surprised if RWE built a large electrolyser to supply Europe with hydrogen.

The big irony of this plan is that the BBL Pipeline between Bacton and the Netherlands was built, so that the UK could import Russian gas.

Could it in future be used to send the UK’s green hydrogen to Europe, so that some of that Russian gas can be replaced with a zero-carbon fuel?

Mathematical Modelling

There is a lot of graphs, maps and reasoning, which is used to detail how the authors obtained their conclusions.

Conclusion

This is the last paragraph of the paper.

Creating a hydrogen production industry is a transition story for UK’s oil and gas sector.

The UK is one of the few countries that could produce more hydrogen than it consumes in hydrocarbons today.

It is located in the centre of a vast resource, which premediates positioning itself at the centre of the European hydrogen supply chains.

Investing now to reduce costs and benefit from the generated value of exported hydrogen would make a reality out of the ambition to become the “Saudi Arabia of Wind”.

Boris may or may not have realised that what he said was possible.

But certainly make sure you read the paper from Imperial College.

Vestas and Vattenfall Sign 1.4 GW Preferred Supplier Agreement For UK Offshore Wind Project And Exclusivity Agreements For 2.8 GW For Two Other UK Projects

The title of this post, is the same as that of this press release from Vestas.

These are the first two paragraphs.

Vattenfall, one of Europe’s largest producers and retailers of electricity and heat, and Vestas have signed agreements to elevate the partnership between the two companies and their offshore wind business towards 2030. The agreements are another step in the right direction for offshore wind energy in the UK and follow the UK Government’s recent announcement about the parameters for the next Contracts for Difference Auction round, which sent a very positive signal to renewable energy investors.

The agreements for the three projects include a preferred supplier agreement (PSA) for the 1,380 MW Norfolk Vanguard West project, comprising 92 of Vestas’ V236-15 MW offshore wind turbine. Vattenfall and Vestas have further signed exclusivity agreements for the Norfolk Vanguard East and Norfolk Boreas projects with a total installed capacity of 2,760 MW. The two latter projects will potentially feature up to 184 V236-15 MW turbines. Once installed, the agreements also include that Vestas will service the projects under long-term Operations and Maintenance (O&M) service contracts. The agreements are another step forward for what will be one of the largest offshore wind zones in the world, with a capacity to power over 4 million UK homes.

It looks like Norfolk Boreas is back on Vattenfall’s list of active projects.

Vattenfall’s Norfolk zone now includes the following.

- Norfolk Vanguard West – 92 x V236-15 MW – 1380 MW

- Norfolk Vanguard East – 92 x V236-15 MW – 1380 MW

- Norfolk Boreas – 92 x V236-15 MW – 1380 MW

Note.

- All turbines appear identical.

- The deal includes long-term Operations and Maintenance (O&M) service contracts.

- 276 identical turbines plus service contracts looks like a good deal for Vestas.

Since I wrote Vattenfall Stops Developing Major Wind Farm Offshore UK, Will Review Entire 4.2 GW Zone in July 2023, which has this sub-heading.

Vattenfall has stopped the development of the Norfolk Boreas offshore wind power project in the UK and will review the way forward for the entire 4.2 GW Norfolk Zone, the Swedish energy company revealed in its interim report.

I have written the following posts.

- November 2023 – Aker Solutions Gets Vattenfall Nod To Start Norfolk Vanguard West Offshore Platform

- November 2023 – Norfolk Boreas Windfarm Work Could Resume After Energy Price Rise

- December 2023 – SeAH To Deliver Monopiles For Vattenfall’s 2.8 GW Norfolk Vanguard Offshore Wind Project

- Earlier in March 2023, I wrote Vattenfall Selects Norfolk Offshore Wind Zone O&M Base

It appears that with the deal announced with Vestas, Vattenfall now have everything they need to develop 4.2 GW of offshore wind.

- The O & M base will be Great Yarmouth.

- SeAH will build the monopile foundations on Teesside. Will all monopiles be identical?

- An energy price rise could change the cash flow of the project.

- Aker Solutions will build the offshore substations.Will all sub-stations be identical?

- Vestas will build the wind turbines.Will all turbines be identical?

Nothing has been said since July 2023 about how the power will be brought ashore.

In February 2022, I wrote Norfolk Wind Farms Offer ‘Significant Benefit’ For Local Economy, where I published this map from Vattenfall, which shows the position of the farms and the route of the cable to the shore.

Note.

- The purple line appears to be the UK’s ten mile limit.

- Norfolk Boreas is outlined in blue.

- Norfolk Vanguard West and Norfolk Vanguard East are outlined in orange.

- Cables will be run in the grey areas.

- Cables to deliver 4.1 GW across Norfolk to the National Grid, will bring out the Nimbys in droves.

Landfall of the cables will be just a few miles to the South of the Bacton gas terminal.

In SeAH To Deliver Monopiles For Vattenfall’s 2.8 GW Norfolk Vanguard Offshore Wind Project, I asked if there could be an alternative approach.

Consider.

- If Vattenfall develop all three wind farms; Boreas, Vanguard East and Vanguard West, they will have 4.2 GW of capacity, when the wind co-operates.

- But East Norfolk is not noted for industries that need a large amount of electricity.

- I also feel, that the locals would object to a steelworks or an aluminium smelter, just like they object to electricity cables.

But would they object to a 4 GW electrolyser?

Could this be Vattenfall’s alternative approach?

- A giant electrolyser is built close to the landfall of the cable to the wind farms.

- The hydrogen could be piped to Bacton, where it could be blended with the UK’s natural gas.

- Bacton also has gas interconnectors to Balgzand in the Netherlands and Zeebrugge in Belgium. Could these interconnectors be used to export hydrogen to Europe?

- The hydrogen could be piped to Yarmouth, where it could be exported by tanker to Europe.

There would be only a small amount of onshore development and no overhead transmission lines to connect the wind farms to the National Grid.

There would be even less onshore development, if the electrolyser was offshore.

From their decisions, Vattenfall seem to have a new plan.

DuPont Introduces First Ion Exchange Resin For Green Hydrogen Production

The title of this post, is the same as that of this press release from DuPont.

This is the sub-heading.

Newly designed ion exchange resin with extended service time designed to enhance electrolyzer operation

This is the first paragraph.

DuPont today announced the launch of its first product dedicated to the production of green hydrogen – the DuPont™ AmberLite™ P2X110 Ion Exchange Resin. To support the production of hydrogen from water, this newly available ion exchange resin is designed for the unique chemistry of electrolyzer

Put simply, it appears, that DuPont’s new product will improve the overall efficiency of the electrolysis of water to produce hydrogen.