South Korea, UK Strengthen Offshore Wind Ties

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Republic of Korea (ROK) and the UK have signed a memorandum of understanding (MoU) concerning cooperation on offshore wind energy

These three paragraphs outline the MoU.

The UK and ROK already have a proven relationship in offshore wind, with large-scale investments in the UK’s supply chain and in the development of ROK’s offshore wind sector.

This MoU emphasises the will to build on this existing cooperation to accelerate deployment, address barriers to trade, and encourage mutual economic development through regular government-to-government dialogue and business-to-business cooperation, according to the partners.

The participants will support the UK and ROK’s offshore wind deployment by sharing experience and expertise from their respective sectors.

These are my thoughts.

The British And The Koreans Have A Long Record Of Industrial Co-operation

My own experience of this, goes back to the last century, where one of the biggest export markets for Artemis; the project management system, that I wrote was South Korea.

We had started with Hyundai in Saudi Arabia, where the Korean company was providing labour for large projects.

I can remember modifying Artemis, so that it handled the Korean won, which in those days, came with lots of noughts.

The Korean, who managed their Saudi projects returned home and luckily for us, wanted a system in Korea.

Paul, who was our salesman for Korea, used to tell a story about selling in Korea.

Our Korean friend from Hyundai had setup a demonstration of Artemis with all the major corporations or chaebols in Korea.

Paul finished the demonstration and then asked if there were any questions.

There was only one question and it was translated as “Can we see the contract?”

So Paul handed out perhaps a dozen contracts.

Immediately, after a quick read, the attendees at the meeting, started to sign the contracts and give them back.

Paul asked our friendly Korean, what was going on and got the reply. “If it’s good enough for Hyundai, it’s good enough for my company!”

The King Played His Part

King Charles, London and the UK government certainly laid on a first class state visit and by his references in his speech the King certainly said the right things.

I always wonder, how much the Royal Family is worth to business deals, but I suspect in some countries it helps a lot.

With Artemis, we won two Queen’s Awards for Industry. Every year the monarch puts on a reception to which each company or organisation can send three representatives. I recounted my visit in The Day I Met the Queen.

For the second award, I suggested that we send Pat, who was the highest American, in the company.

Later in his career with the company, when he was running our US operations, Pat. found talking about the time, he met the Queen and Prince Philip, very good for doing business.

I wonder how many business and cooperation deals between the UK and Korea, will be revealed in the coming months.

This Deal Is Not Just About The UK And Korea

This paragraph widens out the deal.

In addition, participants accept to promote business activities and facilitate opportunities for UK and ROK companies to collaborate in ROK and the UK, as well as joint offshore wind projects in third countries, according to the press release from the UK Government.

An approach to some countries without the usual bullies of this world may offer advantages.

Has One Secondary Deal Already Been Signed?

This paragraph talks about a recent deal between BP, Dutch company; Corio and the South Koreans.

The news follows the recent announcement from South Korea’s Ministry of Trade, Industry and Energy that two UK companies, Corio Generation and BP, submitted investment plans for offshore wind projects in South Korea totalling about EUR 1.06 billion.

This deal was apparently signed during the state visit.

There’s A Lot Of Wind Power To Be Harvested

These last two paragraphs summarise the wind potentials of the UK and Korea.

The UK has the world’s second-largest installed offshore wind capacity, with a government target to more than triple this capacity by 2030 to 50 GW, including 5 GW of floating offshore wind.

Back in 2018, the South Korean Government set a 2030 offshore wind target of 12 GW in its Renewable Energy 3020 Implementation Plan, which was reaffirmed by the now-former South Korea’s president Moon Jae-in in 2020. Since 2022, it has been reported that the country has a target of reaching 14.3 GW of offshore wind power by 2030.

Note that the UK’s population is almost exactly 30 % bigger than Korea’s.

So why will the UK by 2030, be generating three-and-half times the offshore wind power, than Korea?

Twenty days ago, I wrote UK And Germany Boost Offshore Renewables Ties, where I believe the sub-plot is about long-term power and energy security for the UK and Germany.

Long term, the numbers tell me, that UK and Irish seas will be Europe’s major powerhouse.

Australia’s Offshore Wind Market Could Significantly Benefit from Collaboration with UK Suppliers, Study Says

The title of this section, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

A new study has been launched that highlights significant opportunities for the UK to share its wind farm expertise with Australia’s emerging offshore wind market

These three paragraphs outline the study.

The Australian Offshore Wind Market Study, conducted by Arup, evaluates potential Australian offshore wind markets and analyses the strengths, weaknesses, and opportunities for UK support.

Key findings indicate that the Australian offshore wind market could “substantially” benefit from collaboration with the UK suppliers, given the UK’s 23 years of experience and its status as the second largest offshore wind market globally, boasting 13.9 GW of installed capacity as of 2023, according to the UK Government.

Currently, Australia has over 40 offshore wind projects proposed for development.

I believe that the Australians could be a partner in the deal between the UK and Korea, as all three countries have similar objectives.

Conclusion

The Korean and German deals. and a possible Australian deal should be considered together.

Each country have their strengths and together with a few friends, they can help change the world’s power generation for the better.

- Just as the UK can be Europe’s powerhouse, Australia can do a similar job for South-East Asia.

- Any country with lots of energy can supply the green steel needed for wind turbine floats and foundations.

I would have felt the Dutch would have been next to join, as their electricity network is solidly connected to the UK and Germany. But after this week’s Dutch election, who knows what the Dutch will do?

ABP To Explore Opportunities For Offshore Wind Port In Scotland

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Associated British Ports (ABP) has signed an agreement to investigate an area for the development of infrastructure to support offshore wind manufacturing, assembly, and marshalling and green energy on the Cromarty Firth in Scotland, within the Inverness Cromarty Firth Green Freeport.

This first paragraph gives a bit more information including the possible location.

The area, located within the proposed Nigg and Pitcalzean area of the Green Freeport, could support both fixed-bottom and floating offshore wind projects and play a major role in the development of current and future ScotWind leasing rounds, said ABP.

This Google Map shows the location of the Port of Nigg.

Note.

- The Moray Firth with Inverness at its Southern end is the large body of water in the centre of the Southern half of the map.

- The Port of Nigg is on Cromarty Firth and marked by a red arrow.

- Nigg and Pitcalzean are to the North of the port.

This second Google Map shows an enlarged view of the port.

Note.

- Pitcalzean House is in the North-East corner of the map.

- The Port of Nigg is in the centre of the map.

- The water to the West and South of the port is Cromarty Firth.

- The yellow structures in the port are fixed-bottom foundations for wind farms.

Inverness & Cromarty Firth Green Freeport has a web site.

A Quote From Henrik Pedersen

Henrik Pedersen is CEO of ABP and the article quotes him as saying this.

We’re excited to explore the potential of Nigg, applying our experience across the UK, including at our Ports of Grimsby, Hull, Lowestoft and Barrow which already host significant offshore wind activity and at Port Talbot, where we are developing a Floating Offshore Wind port project. We look forward to working with key local partners, the community, and public sector stakeholders.

The article also has this final paragraph.

The Floating Offshore Wind Taskforce’s recently published “Industry Roadmap 2040”, estimated that planed floating offshore wind projects in Scottish waters alone will require three to five integration ports.

There is certainly going to be a significant number of ports, that will be supporting offshore wind activity.

The Crown Estate Refines Plans For Celtic Sea Floating Wind

The title of this post, is the same as that of this press release from Crown Estate.

This is the first part of the press release.

The Crown Estate has set out further details on its plans for Offshore Wind Leasing Round 5, which aims to establish new floating offshore wind technology off the coast of Wales and South West England. The update includes details on the final planned locations for the new windfarms, as well as further information on a multi-million-pound programme of marine surveys.

Round 5 is expected to be the first phase of development in the Celtic Sea, with The Crown Estate working to catalyse and accelerate the UK’s energy transition, and to de-risk developments to speed up their deployment. This includes investing in an upfront Habitats Regulation Assessment, an extensive programme of marine surveys and working with the Electricity System Operator on a coordinated approach to grid design.

This latest update follows a period of engagement with developers and wider stakeholders on proposals set out in July over how to make best use of available space in the Celtic Sea. As a result of the feedback received, The Crown Estate has confirmed that:

- Three Project Development Areas (PDAs) of roughly equal size are expected to be made available to bidders, as opposed to the previously proposed four PDAs of varying sizes

- No bidder will be able to secure an Agreement for Lease for more than one PDA

- As a result of bringing forward three equal-sized PDAs – each with a potential capacity of up to 1.5GW – the overall capacity available through Round 5 has increased from a possible 4GW to up to 4.5GW, enough to power more than 4 million homes

Note.

- Another 4.5 GW of offshore wind should hit the queue.

- It sounds like they have been listening to developers.

To find out more of the potential of the Celtic Sea, I recommend this article on the Engineer, which is entitled Unlocking The Renewables Potential Of The Celtic Sea.

I’ll go along with what this article says and accept that 50 GW of wind capacity could be installed in the Celtic Sea.

Flotation Energy, Cobra File Onshore Planning Application For 100 MW Celtic Floater

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Flotation Energy and Cobra have submitted an onshore planning application to North Devon Council for their 100 MW White Cross floating offshore wind farm in the Celtic Sea.

These two paragraphs outline the project.

The proposed White Cross floating offshore wind farm will feature six to eight floating wind turbines installed some 52 kilometres off the North Devon coast.

The project’s associated cable route is proposed to make landfall at Saunton Sands, connecting to the electricity grid at the East Yelland substation.

The wind farm has its own web site.

This Google Map shows Saunton Sands and the village of Yelland

Note.

- Saunton Sands is indicated by the green marker in North-West corner of the map.

- Yelland is in the middle of the Eastern side of the map.

- I suspect there are innovative ways to connect the White Cross wind farm to the substation at East Yelland.

- The town of Appledore is on the estuary at the bottom of the map.

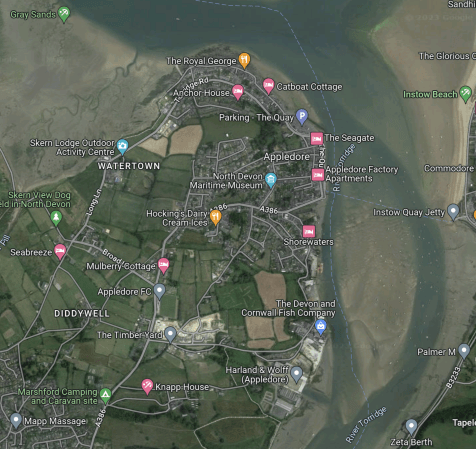

This second Google Map shows the town of Appledore.

At the bottom of the map is a marker labelled Harland & Wolff (Appledore).

Harland & Wolff (Appledore) has a web site, with these introductory paragraphs.

Located in North Devon at the mouth of the River Torridge, Harland & Wolff (Appledore) has a rich history of shipbuilding. More than 300 vessels have been built here including military craft, bulk carriers, LPG carriers, superyachts, ferries, and oil-industry support vessels.

The site features a 119m long covered drydock as part of the main building yard as well as the adjacent repair, commissioning and outfitting quay.

The Appledore Yard was founded in 1855. It constructed elements of the two Queen Elizabeth class aircraft carriers, bow sections for HMS Queen Elizabeth and built two Róisín class patrol boats for the Irish Naval Service.

The web site then lists an impressive list of facilities, which it underlines with this statement.

An expert team that is perfectly positioned to support the needs of the shipping and offshore industry.

I wouldn’t be surprised to see that Harland & Wolff (Appledore) will bid for the eight floaters for White Cross wind farm.

Artemis Technologies Unveils All-Electric CTV Design

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

UK-based Artemis Technologies has unveiled the design of its 100 per cent electric high-speed crew transfer vessel (CTV) for the offshore wind industry.

These are the first two paragraphs.

The Artemis EF-24 CTV has a maximum speed of 36 knots and a foiling range of 87 nautical miles.

The vessel is intended to transport up to 24 industrial personnel and the incorporation of the company’s Artemis eFoiler system should ensure a smooth and comfortable ride as well as reduce passenger and crew susceptibility to seasickness, Artemis said.

The Artemis Technologies web site has a home page with a video showing one of their hydrofoil workboats at speed in Belfast Harbour.

Conclusion

This looks to be viable technology.

The last two paragraphs, indicate how the vessels could be charged in the future.

Artemis Technologies, together with its partners, is developing offshore charging points for electric vessels.

The goal of the project is to design, build, and test an electric charge point situated on a wind turbine. This approach will access the infrastructure already in place such as a turbine platform and electrical cables, to provide renewable electricity to vessels.

Artemis Technologies is certainly a company that appears to be going places.

World’s Largest Floating Offshore Wind Farm Officially Opens

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Norwegian energy major Equinor, together with its partners, will inaugurate today the world’s largest floating offshore wind farm, Hywind Tampen

The story is according to Reuters.

This page on the Equinor web site, outlines the project.

Hywind Tampen is the world’s first floating wind farm built specifically to power offshore oil and gas installations, and is now supplying electricity to Equinor’s oil and gas fields Snorre and Gullfaks in the Norwegian North Sea.

With a system capacity of 88 MW it is also the world’s largest floating offshore wind farm and an important step forward in industrialising solutions and reducing costs for future offshore wind power projects.

With Hywind Tampen now operational, Equinor is now operating nearly half (47 percent) of the world’s offshore floating wind capacity.

This floating wind farm powering oil and gas fields will be the first of many.

CIP’s Flagship Fund On Track To Become World’s Largest Dedicated To Greenfield Renewable Energy Investments

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Copenhagen Infrastructure Partners (CIP) has reached the first close on its fifth flagship fund, Copenhagen Infrastructure V (CI V), at EUR 5.6 billion in capital commitments received. This puts the fund on track to reach its target size of EUR 12 billion, which would make this the world’s largest dedicated greenfield renewable energy fund, according to CIP

These three paragraphs give more details on the size and investments of the latest fund, which is named CI V.

The first close of the flagship fund saw a large group of leading institutional investors across continental Europe, the Nordics, the UK, North America, and the Asia-Pacific region.

CIP noted that there is a strong interest from additional investors already in process, so CI V is on the way to reaching its target fund size of EUR 12 billion.

The fund now has ownership of more than 40 renewable energy infrastructure projects with a total potential CI V commitment of approximately EUR 20 billion, corresponding to more than 150 per cent of the target fund size.

The CIP web site gives more details on the company, including this summary on the front page.

Founded in 2012, Copenhagen Infrastructure Partners P/S (CIP) today is the world’s largest dedicated fund manager within greenfield renewable energy investments and a global leader in offshore wind. The funds managed by CIP focuses on investments in offshore and onshore wind, solar PV, biomass and energy-from-waste, transmission and distribution, reserve capacity, storage, advanced bioenergy, and Power-to-X.

CIP manages 11 funds and has to date raised approximately EUR 25 billion for investments in energy and associated infrastructure from more than 150 international institutional investors.

In the UK, CIP are currently involved in the Ossian and Pentland floating wind farms.

Denmark Exploring Multiple Platforms As Alternative To Building Artificial Island

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

After concluding that the current concept of its North Sea Energy Island would be too expensive for the State, the Danish government, the transmission system operator (TSO) Energinet, and other relevant agencies are now looking into the concept for the island to be established on several large platforms.

I feel this could be a sensible decision, as it would fit well with a modular approach to the building of offshore wind farms.

Suppose, the floating turbines used by a company like Ørsted were all similar. This would surely simplify management of their portfolio of wind farms.

If it works for floating wind turbines, surely, it would work for substations, electrolysers and other offshore hardware.

Conclusion

Artificial energy islands may seem an impressive way to go, but I suspect that the modular approach using standard components, that either sit on the sea bed or float may be a more affordable and faster way to build offshore wind farms.

Thoughts On The Future Of Orkney

This article on the BBC is entitled Orkney Votes To Explore ‘Alternative Governance‘

This is the sub-heading.

Orkney councillors have voted to investigate alternative methods of governance amid deep frustrations over funding and opportunities.

These paragraphs outline the story.

Council leader James Stockan said the islands had been “held down” and accused the Scottish and UK governments of discrimination.

His motion led to media speculation that Orkney could leave the UK or become a self-governing territory of Norway.

It was supported by 15 votes to six.

It means council officers have been asked to publish a report to Orkney’s chief executive on options of governance.

This includes looking at the “Nordic connections” of the archipelago and crown dependencies such as Jersey and Guernsey.

A further change which would see the revival of a consultative group on constitutional reform for the islands was accepted without the need for a vote.

My Thoughts On The Economic Future Of The Islands

The economic future of Orkney looks good.

Tourism and the traditional industries are on the up, but the islands could play a large part in renewable energy.

The West of Orkney offshore wind farm, which will be a 2 GW wind farm with fixed foundations, is being developed and a large hydrogen production hub at Flotta is being proposed, along with the development of a large quay in Scapa Flow for the assembly of floating wind farms.

The West of Orkney wind farm could be the first of several.

If the future wind farms are further from shore, they will most likely be based on floating technology, with the turbines and their floats assembled in Scapa Flow, from components shipped in from mainland UK and Europe.

Political Future

With a good financial future assured, I believe that Orkney will be able to choose where its political future lies. It could be a Crown Dependency or join Norway.

Whichever way it goes, it could be an island that effectively prints money, by turning electricity into hydrogen and shipping it to countries like Germany, The Netherlands, Poland and Sweden!

From a UK point of view, a Crown Dependency could be a favourable move.

Would Shetland follow the same route?

Offshore Hydrogen Production And Storage

Orkney is not a large archipelago and is just under a thousand square kilometres in area.

It strikes me, that rather than using up scarce land to host the large electrolysers and hydrogen storage, perhaps it would be better, if hydrogen production and storage was performed offshore.

Aker Northern Horizons

In Is This The World’s Most Ambitious Green Energy Solution?, I talk about Northern Horizons, which is an ambitious project for a 10 GW floating wind farm, which would be built a hundred kilometres to the North-East of Shetland, that would be used to produce hydrogen on Shetland.

Other companies will propose similar projects to the West and East of the Northern islands.

This map shows the sea, that could be carpeted with armadas of floating wind farms.

Consider.

- There are thousands of square miles of sea available.

- As the crow flies, the distance between Bergen Airport and Sumburgh Airport in Shetland is 226 miles.

- A hundred mile square is 10,000 square miles or 2590 square kilometres.

- In ScotWind Offshore Wind Leasing Delivers Major Boost To Scotland’s Net Zero Aspirations, I calculated that the floating wind farms of the Scotwind leasing round had an energy density of 3.5 MW per km².

- It would appear that a hundred mile square could generate, as much as nine GW of green electricity.

How many hundred mile squares can be fitted in around the UK’s Northern islands?

Crown Estate Scotland Joins Scapa Flow Deepwater Port Plan

The title of this post is the same as that of this article on Riviera Maritime Media.

This is the sub-heading.

Orkney Islands Council (OIC) and Crown Estate Scotland have signed an agreement to work together in developing a deepwater quay at Scapa Flow

The picture and the words, indicate it is not a small facility.

The final comment of Crown Estate Scotland’s director of marine Colin Palmer, are a strong statement of intent about how Crown Estate Scotland will help Scotland towards net-zero.