The Core Of Sunak’s Manifesto

I have a feeling, that the core of Sunak’s manifesto is a massive German project called H2ercules, which is intended to bring low-carbon hydrogen to industry in South Germany.

There will be a massive hydrogen hub at Wilhelmshaven on the North-Western coast, which is being built by Uniper, from which hydrogen will be imported and distributed.

I suspect that the Germans aim to source the hydrogen worldwide from places like Australia, the Middle East and Namibia. It would be brought from and round the Cape by tanker. The Suez route would be too risky.

But RWE, who are one of the UK’s largest electricity suppliers, are planning to deliver 7.2 GW of electricity in British waters on the Dogger Bank and North-East of Great Yarmouth.

Both wind farms would be difficult to deliver profitably to the UK, because Eastern England already has enough electricity and the Nimbies are objecting to more pylons.

I believe that RWE will build offshore electrolysers and coastal hydrogen tankers will take the hydrogen to Wilhelmshaven.

H2ercules will be fed with the hydrogen needed.

By the end of the next parliament, the Germans could be paying us substantial sums for green hydrogen, to decarbonise their industry.

Rishi Sunak hinted in his speech, that we will be exporting large amounts of energy.

Much of it will be in the form of green hydrogen to Germany.

If we need hydrogen for our industry, we would create it from some of our own wind farms.

H2ercules

H2ercules is a project that will create the German hydrogen network.

The H2ercules web site, introduces the project with these two paragraphs.

A faster ramp-up of the hydrogen economy in Germany is more important than ever in order to drive forward the decarbonisation programme, put the German energy system on a more robust footing, and thus contribute towards a green security of supply. What this needs is a geographical realignment of the infrastructure for energy in gas form: Instead of flowing from the east of Germany to the west and south of the country, the gas – natural gas now, hydrogen in the future – will have to make its way in future from generation locations in the north-west to centres of consumption located mainly in the west and south. That also means that new sources will have to be connected, and gaps in existing pipeline networks will have to be closed. To speed up this vital process, OGE and RWE have developed the national infrastructure project “H2ercules”, which is intended to supply consumers in Germany’s south and west with domestically produced green hydrogen from the north of the country, in addition to imported sources. This will involve connecting up the electrolyser capacities that are currently being planned and developing more besides. RWE wants to create up to 1 GW of additional electrolyser capacity as part of the H2ercules project. For the connection component, OGE is planning to put 1,500 km of pipelines in place. For the most part, this will mean converting pipelines from the existing natural gas network to hydrogen, supplemented by newly constructed facilities. Converting natural gas pipelines is not only the more cost-efficient solution, but it also allows for a faster schedule. The system is expected to be supplemented by the planned hydrogen storages of RWE.

The current plan is to complete the project in three stages between 2026 and 2030, in order to connect industries to the hydrogen supply as soon as possible. The aim of this collaboration across multiple value levels is to resolve the chicken-and-egg problem on a super-sized scale and also smooth the way forward for other projects.

Note.

There will be a lot of conversion of the existing natural gas network to hydrogen.

RWE wants to create up to 1 GW of additional electrolyser capacity as part of the H2ercules project.

The second paragraph indicates to me, that they want to move fast.

This map from the H2ercules web site, indicate the proposed size of the network in 2030.

These three paragraphs describe how H2ercules will be developed.

OGE and RWE are both strong companies that aim to combine forces as part of the H2ercules project in order to overcome this Herculean task. While the task for OGE will be to convert the required gas pipelines to hydrogen and construct new pipelines, RWE will expand its electrolyser capacity and import green hydrogen in addition. Gas-fired power stations with a capacity of at least 2 GW will be converted to hydrogen, and new H2 -storages as well as H2-storages repurposed from gas storages on the Dutch border will be connected to the hydrogen supply system.

H2ercules also opens up new opportunities to connect Germany’s future centres of hydrogen consumption to key import routes, first via pipelines from Belgium and the Netherlands, and later via Norway and also from southern and eastern Europe, with the added prospects of import terminals for green molecules in Germany’s north. The project is thus contributing significantly to the creation of a European hydrogen market.

The first additional companies and organisations have already indicated their interest in this project, and it is expected that in the future smaller businesses will benefit in addition to large-scale customers, as the entire industry is guided towards a decarbonised future.

These are my thoughts.

Why Is It Called H2ercules?

I suspect, it’s nothing more, than the Germans wanted a recognisable and catchy name.

- Name selection is not helped by the German for hydrogen, which is wasserstoff.

- Hercules is Herkules in German, which doesn’t really help.

- Projekt Wasserstoff isn’t as memorable as H2ercules, which at least isn’t English.

It looks to me, that the Germans have come up with a good acceptable compromise.

The Wilhemshaven Hydrogen Import Terminal

German energy company; Uniper is building a hydrogen import terminal at Wilhemshaven to feed H2ercules and German industry with hydrogen from places like Australia, Namibia and the Middle East. I wrote about this hydrogen import terminal in Uniper To Make Wilhelmshaven German Hub For Green Hydrogen; Green Ammonia Import Terminal.

Wilhelmshaven and Great Yarmouth are 272 miles or 438 kilometres apart, so a pipeline or a tanker link would be feasible to export hydrogen from Notfolk to Germany.

I suspect RWE will build a giant offshore electrolyser close to the Norfolk wind farms and the hydrogen will be exported by tanker or pipeline to Germany or to anybody else who pays the right price.

RWE’s Norfolk Wind Farms

What is interesting me, is what Germany company; RWE is up to. Note they are one of the largest UK electricity producers.

In December 2023, they probably paid a low price, for the rights for 3 x 1.4 GW wind farms about 50 km off North-East Norfolk from in-trouble Swedish company; Vattenfall and have signed contracts to build them fairly fast.

In March 2024, I wrote about the purchase in RWE And Vattenfall Complete Multi-Gigawatt Offshore Wind Transaction In UK.

This map from RWE shows the three wind farms, with respect to the Norfolk coast.

Could it be, that RWE intend to build a giant offshore electrolyser to the East of Great Yarmouth?

- The planning permission for an electrolyser, which is eighty kilometres offshore, would be far easier, than for one onshore.

- The hydrogen pipeline between Norfolk and Germany would be less than 400 kilometres.

- Hydrogen could also be brought ashore in Norfolk, if the price was right.

- The Bacton gas terminal is only a few miles North of Great Yarmouth.

But the big advantage, is that the only onshore construction could be restricted to the Bacton gas terminal.

Adding More Wind Farms To The Electrolyser

Looking at the RWE map, the following should be noted.

South of Norfolk Vanguard East, there is the East Anglian Array wind farm, which by the end of 2026, will consist of these wind farms.

- East Anglia One – 714 MW – 2020

- East Anglia One North – 800 MW – 2026

- East Anglia Two – 900 MW – 2026

- East Anglia Three – 1372 MW – 2026

Note.

- The date is the commissioning date.

- There is a total capacity of 3786 MW

- All wind farms are owned by Iberdrola.

- There may be space to add other sections to the East Anglian Array.

I doubt, it would be difficult for some of Iberdrola’s megawatts to be used to generate hydrogen for Germany.

To the East of Norfolk Boreas and Norfolk Vanguard East, it’s Dutch waters, so I doubt the Norfolk cluster can expand to the East.

But looking at this map of wind farms, I suspect that around 4-5 GW of new wind farms could be squeezed in to the North-West of the the Norfolk Cluster and South of the Hornsea wind farms.

The 1.5 GW Outer Dowsing wind farm, which is being planned, will be in this area.

I can certainly see 8-10 GW of green electricity capacity being available to electrolysers to the North-East of Great Yarmouth.

Conclusion

UK offshore electricity could be the power behind H2ercules.

- The hydrogen could be sent to Germany by pipeline or tanker ship, as the distance is under 400 kilometers to the Wilhelmshaven hydrogen hub.

- Extra electrolysers and wind farms could be added as needed.

- The hydrogen won’t need to be shipped halfway round the world.

The cash flow won’t hurt the UK.

.

UK Offshore Wind In 2030

The next general election is likely to be held in 2029, so how much wind energy will be added during the next Parliament?

The Current Position

The Wikipedia entry for the list of operational wind farms in the UK, says this.

In October 2023, there were offshore wind farms consisting of 2,695 turbines with a combined capacity of 14,703 megawatts.

Due To Be Commissioned In 2024

It would appear these wind farms will come on-line in 2024.

- Neart Na Gaoithe – 450 MW – Fixed

- Doggerbank A – 1235 MW – Fixed

- Doggerbank B – 1235 MW – Fixed

This would add 2920 MW to give a total of 17,623 MW.

Due To Be Commissioned In 2025

It would appear these wind farms will come on-line in 2025.

- Moray West – 882 MW – Fixed

- Doggerbank C – 1218 MW – Fixed

This would add 2100 MW to give a total of 19,723 MW.

Due To Be Commissioned In 2026

It would appear these wind farms will come on-line in 2026.

- Sofia – 1400 MW – Fixed

- East Anglia 3 – 1372 MW – Fixed

- East Anglia 1 North – 800 MW – Fixed

- East Anglia 2 – 900 MW – Fixed

- Pentland – 100 MW – Floating

This would add 4572 MW to give a total of 24,295 MW.

Due To Be Commissioned In 2027

It would appear these wind farms will come on-line in 2027.

- Hornsea 3 – 2852 MW – Fixed

- Norfolk Boreas – 1380 MW – Fixed

- Llŷr 1 – 100 MW – Floating

- Llŷr 2 – 100 MW – Floating

- Whitecross – 100 MW – Floating

This would add 4532 MW to give a total of 28,827 MW.

Due To Be Commissioned In 2028

It would appear these wind farms will come on-line in 2028.

- Morecambe – 480 MW – Fixed

This would add 480 MW to give a total of 29,307 MW.

Due To Be Commissioned In 2029

It would appear these wind farms will come on-line in 2029.

- West Of Orkney – 2000 MW – Fixed

This would add 2000 MW to give a total of 31,307 MW.

Due To Be Commissioned In 2030

It would appear these wind farms will come on-line in 2030.

- Ramplion 2 Extension – 1200 MW – Fixed

- Norfolk Vanguard East – 1380 MW – Fixed

- Norfolk Vanguard West – 1380 MW – Fixed

- Awel y Môr – 1100 MW – Fixed

- Berwick Bank – 4100 MW – Fixed

- Outer Dowsing – 1500 MW – Fixed

- Hornsea 4 – 2600 MW – Fixed

- Caledonia – 2000 MW – Fixed

- N3 Project – 495 MW – Fixed/Floating

This would add 15755 MW to give a total of 47.062 MW.

Capacity Summary

- 2023 – None – 14703 MW

- 2024 – 2920 MW – 17,623 MW

- 2025 – 2100 MW – 19,723 MW

- 2026 – 4572 MW – 24,295 MW

- 2027 – 4532 MW- 28,827 MW

- 2028 – 480 MW – 29,307 MW

- 2029 – 2000 MW – 31,307 MW

- 2030 – 15755 MW – 47,062 MW

Note that capacity has increased more than threefold.

If we assume the following.

- New wind farms are commissioned throughout the year.

- 14703 MW of wind power, with all our gas-fired, nuclear and onshore wind farms is enough to power the UK.

- The average capacity factor is 45 %.

- The strike price is £35/MWh.

The levels I have set are deliberately on the low side.

The amount of energy and cash flow generated by new wind farms in a year can be calculated as follows.

{Average New Capacity In Year}= ({Capacity at Year Start}+{Capacity at Year End})/2-14703

{Extra Electricity Generated In Year}= {Average New Capacity In Year}*365*24*{Capacity Factor}

{Cash Flow}={Extra Electricity Generated In Year} * {Strike Price}

The following figures are obtained.

- 2024 – 1460 MW – 5,755,320 MWh – £ 201,436,200

- 2025 – 3970 MW – 15,649,740 MWh – £ 547,740,900

- 2026 – 7306 MW – 28,800,252 MWh – £ 1,008,008,820

- 2027 – 11858 MW – 46,744,236 MWh – £ 1,636,048,260

- 2028 – 14,364 MW – 56,622,888 MWh – £ 1,981,801,080

- 2029 – 15,604 MW – 61,510,968 MWh – £ 2,152,883,880

- 3030 – 23,931.5 MW – 94,337,973 MWh – £ 3,301,829,055

Nate.

- The first column is the cumulative amount of new capacity about the 14,703 MW in December 2023.

- The second column is the extra electricity generated in the year over December 2023.

- The third column is the extra cash flow in the year over December 2023.

As the installed base of wind farms increases, the cash flow increases.

It should also be noted that there are a large number of wind farms, already pencilled in for 2031-2035.

What Will We Do With All This Extra Electricity?

We need more industries that will consume a lot of electricity, like cement, chemicals and steel.

But I suspect that the easiest thing to do, is to convert the excess electricity to hydrogen and export it to the Continent and especially the Germans by pipeline or tanker.

Conclusion

Whoever wins this year’s General Election, should have a growing source of revenue for the life of the parliament and beyond.

Do RWE Have A Comprehensive Hydrogen Plan For Germany?

What is interesting me, is what Germany company; RWE is up to. They are one of the largest UK electricity producers.

In December 2023, they probably paid a low price, for the rights for 3 x 1.4 GW wind farms about 50 km off North-East Norfolk from in-trouble Swedish company; Vattenfall and have signed contracts to build them fairly fast.

In March 2024, wrote about the purchase in RWE And Vattenfall Complete Multi-Gigawatt Offshore Wind Transaction In UK.

Over the last couple of years, I have written several posts about these three wind farms.

March 2023 – Vattenfall Selects Norfolk Offshore Wind Zone O&M Base

November 2023 – Aker Solutions Gets Vattenfall Nod To Start Norfolk Vanguard West Offshore Platform

December 2023 – SeAH To Deliver Monopiles For Vattenfall’s 2.8 GW Norfolk Vanguard Offshore Wind Project

Then in July 2023, I wrote Vattenfall Stops Developing Major Wind Farm Offshore UK, Will Review Entire 4.2 GW Zone

Note.

- There does appear to be a bit of a mix-up at Vattenfall, judging by the dates of the reports.Only, one wind farm has a Contract for Difference.

- It is expected that the other two will be awarded contracts in Round 6, which should be by Summer 2024.

In December 2023, I then wrote RWE Acquires 4.2-Gigawatt UK Offshore Wind Development Portfolio From Vattenfall.

It appears that RWE paid £963 million for the three wind farms.

I suspect too, they paid for all the work Vattenfall had done.

This transaction will give RWE 4.2 GW of electricity in an area with very bad connections to the National Grid and the Norfolk Nimbies will fight the building of more pylons.

So have the Germans bought a pup?

I don’t think so!

Where Is Wilhemshaven?

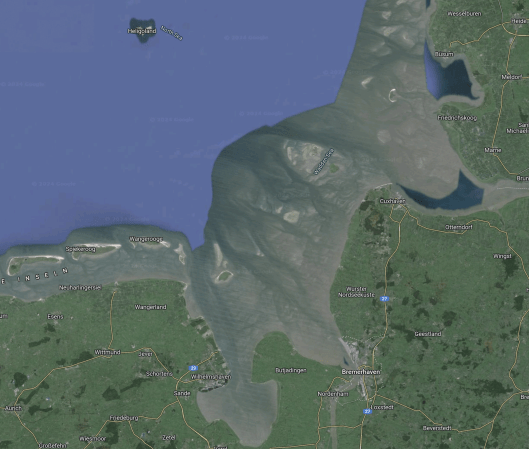

This Google Map shows the location of Wilhemshaven.

Note.

- Heligoland is the island at the top of the map.

- The Germans call this area the Wdden Sea.

- The estuaries lead to Wilhelmshaven and Bremerhaven.

- Cuxhaven is the port for Heligoland, which is connected to Hamburg by hydrogen trains.

This second map shows between Bremerhaven and Wilhelmshaven.

Note.

- Wilhelmshaven is to the West.

- Bremerhaven is in the East.

- The River Weser runs North-South past Bremerhaven.

I’ve explored the area by both car and train and it is certainly worth a visit.

The Wilhemshaven Hydrogen Import Terminal

German energy company; Uniper is building a hydrogen import terminal at Wilhemshaven to feed German industry with hydrogen from places like Australia, Namibia and the Middle East. I wrote about this hydrogen import terminal in Uniper To Make Wilhelmshaven German Hub For Green Hydrogen; Green Ammonia Import Terminal.

I suspect RWE could build a giant offshore electrolyser close to the Norfolk wind farms and the hydrogen will be exported by tanker or pipeline to Germany or to anybody else who pays the right price.

All this infrastructure will be installed and serviced from Great Yarmouth, so we’re not out of the deal.

Dogger Bank South Wind Farm

To make matters better, RWE have also signed to develop the 3 GW Dogger Bank South wind farm.

This could have another giant electrolyser to feed German companies. The wind farm will not need an electricity connection to the shore.

The Germans appear to be taking the hydrogen route to bringing electricity ashore.

Energy Security

Surely, a short trip across the North Sea, rather than a long trip from Australia will be much more secure and on my many trips between the Haven Ports and The Netherlands, I haven’t yet seen any armed Houthi pirates.

RWE And Hydrogen

On this page on their web site, RWE has a lot on hydrogen.

Very Interesting!

H2ercules

This web site describes H2ercules.

The goal of the H2ercules initiative is to create the heart of a super-sized hydrogen infrastructure for Germany by 2030. To make this happen, RWE, OGE and, prospectively, other partners are working across various steps of the value chain to enable a swift supply of hydrogen from the north of Germany to consumers in the southern and western areas of the country. In addition to producing hydrogen at a gigawatt scale, the plan is also to open up import routes for green hydrogen. The transport process will involve a pipeline network of about 1,500 km, most of which will consist of converted gas pipelines.

Where’s the UK’s H2ercules?

Conclusion

The Germans have got there first and will be buying up all of our hydrogen to feed H2ercules.

RWE And the Norfolk Wind Farms

In March 2024, I wrote RWE And Vattenfall Complete Multi-Gigawatt Offshore Wind Transaction In UK, which described how Vattenfall had sold 4.2 GW of offshore wind farms, situated off North-East Norfolk to RWE.

This map from RWE shows the wind farms.

Note.

- The Norfolk Zone consists of three wind farms; Norfolk Vanguard West, Norfolk Boreas and Norfolk Vanguard East.

- The three wind farms are 1.4 GW fixed-foundation wind farms.

- In Vattenfall Selects Norfolk Offshore Wind Zone O&M Base, I describe how the Port of Great Yarmouth had been selected as the O & M base.

- Great Yarmouth and nearby Lowestoft are both ports, with a long history of supporting shipbuilding and offshore engineering.

The wind farms and the operational port are all close together, which probably makes things convenient.

So why did Vattenfall sell the development rights of the three wind farms to RWE?

Too Much Wind?

East Anglia is fringed with wind farms all the way between the Wash and the Thames Estuary.

- Lincs – 270 MW

- Lynn and Inner Dowsing – 194 MW

- Race Bank – 580 MW

- Triton Knoll – 857 MW

- Sheringham Shoal – 317 MW

- Dudgeon – 402 MW

- Hornsea 3 – 2852 MW *

- Scroby Sands – 60 MW

- East Anglia One North – 800 MW *

- East Anglia Two – 900 MW *

- East Anglia Three – 1372 MW *

- Greater Gabbard – 504 MW

- Galloper – 353 MW

- Five Estuaries – 353 MW *

- North Falls – 504 MW *

- Gunfleet Sands – 172 MW

- London Array – 630 MW

Note.

- Wind farms marked with an * are under development or under construction.

- There is 4339 MW of operational wind farms between the Wash and the Thames Estuary.

- An extra 6781 MW is also under development.

If all goes well, East Anglia will have over 11 GW of operational wind farms or over 15 GW, if the three Norfolk wind farms are built.

East Anglia is noted more for its agriculture and not for its heavy industries consuming large amounts of electricity, so did Vattenfall decide, that there would be difficulties selling the electricity?

East Anglia’s Nimbies

East Anglia’s Nimbies seem to have started a campaign against new overground cables and all these new wind farms will need a large capacity increase between the main substations of the National Grid and the coast.

So did the extra costs of burying the cable make Vattenfall think twice about developing these wind farms?

East Anglia and Kent’s Interconnectors

East Anglia and Kent already has several interconnectors to Europe

- Viking Link – Bicker Fen and Jutland – 1.4 GW

- LionLink – Suffolk and the Netherlands – 1.8 GW – In Planning

- Nautilus – Suffolk or Isle of Grain and Belgium – 1.4 GW – In Planning

- BritNed – Isle of Grain and Maasvlakte – 1.0 GW

- NeuConnect – Isle of Grain and Wilhelmshaven – 1.4 GW – Under Construction

- GridLink Interconnector – Kingsnorth and Warande – 1.4 GW – Proposed

- HVDC Cross-Channel – Sellinge and Bonningues-lès-Calais – 2.0 GW

- ElecLink – Folkestone and Peuplingues – 1.0 GW

- Nemo Link – Richborough and Zeebrugge – 1.0 GW

Note.

- Five interconnectors with a capacity of 6.4 GW.

- A further four interconnectors with a capacity of 6 GW are on their way.

At 12.4 GW, the future capacity of the interconnectors between South-East England and Europe, is nor far short of South-East English wind power.

There are also two gas pipelines from the Bacton gas terminal between Cromer and Great Yarmouth to Europe.

The Wikipedia entry for the Bacton gas terminal gives these descriptions of the two gas pipelines.

Interconnector UK – This can import gas from, or export gas to, Zeebrugge, Belgium via a 235 km pipeline operating at up to 147 bar. There is a 30-inch direct access line from the SEAL pipeline. The Interconnector was commissioned in 1998.

BBL (Bacton–Balgzand line) – This receives gas from the compressor station in Anna Paulowna in the Netherlands. The BBL Pipeline is 235 km long and was commissioned in December 2006.

It would appear that East Anglia and Kent are well connected to the Benelux countries, with both electricity and gas links, but with the exception of the Viking Link, there is no connection to the Scandinavian countries.

Did this lack of connection to Sweden make convincing the Swedish government, reluctant to support Vattenfall in their plans?

Bringing The Energy From The Norfolk Wind Farms To Market

It looks to me, that distributing up to 4.2 GW from the Norfolk wind farms will not be a simple exercise.

- Other wind farms like the 2852 MW Hornsea 3 wind farm, may need a grid connection on the North Norfolk coast.

- The Nimbies will not like a South-Western route to the National Grid at the West of Norwich.

- An interconnector to Denmark or Germany from North Norfolk would probably help.

But at least there are two gas pipelines to Belgium and the Netherlands.

RWE, who now own the rights to the Norfolk wind farms, have a large amount of interests in the UK.

- RWE are the largest power producer in the UK.

- They supply 15 % of UK electricity.

- They have interest in twelve offshore wind farms in the UK. When fully-developed, they will have a capacity of almost 12 GW.

- RWE are developing the Pembroke Net Zero Centre, which includes a hydrogen electrolyser.

RWE expects to invest up to £15 billion in the UK by 2030 in new and existing green technologies and infrastructure as part of this.

Could this be RWE’s plan?

As the Norfolk wind farms are badly placed to provide electricity to the UK grid could RWE have decided to use the three Norfolk wind farms to produce hydrogen instead.

- The electrolyser could be placed onshore or offshore.

- If placed onshore, it could be placed near to the Bacton gas terminal.

- There are even depleted gas fields, where hydrogen could be stored.

How will the hydrogen be distributed and/or used?

It could be delivered by tanker ship or tanker truck to anyone who needs it.

In Developing A Rural Hydrogen Network, I describe how a rural hydrogen network could be developed, that decarbonises the countryside.

There are three major gas pipelines leading away from the Bacton gas terminal.

- The connection to the UK gas network.

- Interconnector UK to Belgium.

- BBL to The Netherlands.

These pipelines could be used to distribute hydrogen as a hydrogen blend with natural gas.

In UK – Hydrogen To Be Added To Britain’s Gas Supply By 2025, I describe the effects of adding hydrogen to the UK’s natural gas network.

Europe’s Mines Look To Gravity Energy Storage For Green Future

The title of this post, is the same as that of this article on Global Mining Review.

This is the sub-heading.

Mine owners across Europe are looking at a new form of underground energy storage to offer a low carbon future as operations wind down.

These are the first four paragraphs.

Active deep mine operators in Slovenia, Germany, The Czech Republic and Finland are all examining how underground gravity energy storage – provided by Edinburgh firm Gravitricity – could offer green opportunities to mining communities facing a downturn in employment.

Gravitricity has developed a unique energy storage system, known as GraviStore, which uses heavy weights – totalling up to 12 000 t – suspended in a deep shaft by cables attached to winches.

This offers a viable alternative future to end of life mine shafts, which otherwise face costly infilling and mine decommissioning costs.

They have teamed up with energy multinational and winch specialist ABB alongside worldwide lifting specialists Huisman to commercialise the technology for mine operators.

Note.

- Four projects are mentioned.

- It appears to be less costly, than infilling.

- Gravitricity have teamed with ABB and Huisman, who are two of Europe’s specialist in this field.

- You can’t have too much energy storage.

The article is worth a full read.

Conclusion

Gravitricity’s simple idea could be a big winner.

Wrightbus Secures Further German Order For 46 Hydrogen Buses

The title of this post, is the same as that of this press release from Wrightbus.

These paragraphs outline the deal.

World-beating zero-emission bus manufacturer Wrightbus today announced a milestone deal to provide 46 hydrogen buses to Germany – taking a demo bus from Belfast to showcase its reliability and range.

The buses ordered by Cottbusverkehr GmbH will serve the city of Cottbus, the second largest city in the state of Brandenburg, and and in the western part of the district of Spree-Neiße.

It follows a landmark announcement by the German government to implement a €350 million scheme to support the production of renewable hydrogen.

Wrightbus is Europe’s fastest-growing bus manufacturer and follows the company’s rapid rise since it was bought out of administration in 2019. It was named Northern Ireland’s fastest-growing company by Growth Index this week – employing 1,650 people and producing 22 buses a week.

The Cottbus order for the Kite Hydroliner buses follow deals in Germany with West Verkehr, Regionalverkehr Köln GmbH (RVK), and Saarbahn GmbH, with more European orders in the pipeline.

If Northern Irish hydrogen buses are selling well to the Germans, why are there so few in the UK.

These pictures show the UK version of the German buses in Crawley.

They are excellent buses.

Denmark Launches Massive Offshore Wind Auction

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Denmark has opened a new offshore wind tender, the country’s largest ever, offering a minimum of 6 GW of new capacity spread over six wind farms, with the overplanting option allowing for 10 GW or more of new capacity to be added.

These are two paragraphs from the article.

The offshore wind farms must deliver at least 6 GW, and as a new element, there will be freedom to establish as much offshore wind as possible on the tendered areas, with the exemption of Hesselø with a maximum capacity of 1.2 GW.

If the market utilizes this freedom to optimize the usage of the areas, it could result in the construction of 10 GW offshore wind or more, the agency said.

Recently, some wind farms in the UK have been increased in size after the auction.

In Crown Estate Mulls Adding 4 GW Of Capacity From Existing Offshore Wind Projects, I note how 4 GW of overplanting could be employed to raise the total capacity from 4.6 GW to 8.6 GW.

So have the Danes decided to build expansion into the tender?

One of the wind farms in the auction is called Nordsøen I.

- It will be about 50 km. from the West Coast of Denmark.

- It appears it will have a capacity of at least 1 GW.

- It could connect to the shore, not far from where the Viking Link between Lincolnshire and Denmark connects to the Danish grid.

- There is a 700 MW interconnector between the area and Eemshaven in The Netherlands.

- There is 1.5 GW of overland transmission lines to Germany.

All these connections, increase energy security for Denmark, Germany, the Netherlands and the UK.

Could the Danes be building the Nordsøen I, so it could work with the all the connections in Southern Jutland and improve energy security?

Canadian Pension Fund To Consolidate Its Offshore Wind Holdings Into UK-Based Reventus Power

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Canada Pension Plan Investment Board (CPP Investments) will consolidate its existing direct and indirect offshore wind holdings into Reventus Power, its UK-based portfolio company, which will become its dedicated global offshore wind platform.

This first paragraph gives more details.

Subject to customary approvals, the move will see Reventus Power growing its teams in the UK, Germany, Poland and Portugal to form a team of approximately 50 offshore wind specialists, according to CPP Investments, whose current exposure to offshore wind is more than CAD 1 billion (approximately EUR 678 million; USD 737 million).

According to their web site, the Reventus HQ is in London.

There is nothing on the web to indicate a special reason, so it must have been one of the following.

- Canadians like investing in the UK.

- The UK is good for tax reasons.

- London has all the lawyers, accountants and other services they will need.

- I suspect several wind farms, that they will develop will be in UK waters.

- Many of the extra staff, they have said they will recruit will be UK-based or UK-educated.

But overall, it must be a feather in its cap for London.

How Germany Is Dominating Hydrogen Market

The title of this post, is the same as that of this article on Hydrogen Fuel News.

This is the sub heading.

With 3827 kilometers of pipeline across the country, Germany is blazing a trail through the continent in terms of hydrogen infrastructure growth.

These are the first two paragraphs.

Indeed, plans within the country are so far advanced that Germany is set to become the biggest importer of hydrogen in Europe and the third biggest in the world, behind global leaders China and Japan.

All this leaves the German transport sector in good stead, with a strong infrastructure supporting clean fuel adoption, while the country transitions towards net zero.

So where are the Germans going to get their hydrogen from?

One possibility is the UK.

- The UK has vast amounts of renewable energy.

- We’re only hundreds of kilometres, instead of thousands of kilometres away.

- RWE; the German energy giant has full or partial interests in about 12,3 GW of UK wind farms.

- RWE is building the Pembroke Net Zero Centre which will generate green and blue hydrogen.

Hydrogen could be exported from the UK to Germany by tanker.

Conclusion

Production and exporting of green hydrogen will become significant industry in the UK.