3 GW Dogger Bank South Offshore Wind Farms Reach New Development Stage

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK Planning Inspectorate has accepted into the examination phase the Development Consent Order (DCO) application for the Dogger Bank South (DBS) Offshore Wind Farms developed by RWE and Masdar.

The first two paragraphs give a brief description of the wind Farm.

The DBS East and DBS West offshore wind farms, which could provide electricity for up to three million typical UK homes, are located in shallow waters on the Dogger Bank over 100 kilometres off the northeast coast of England. The acceptance of the DCO application moves the projects into the pre-examination phase, which will become subject to a public examination later in 2024.

Together, the projects will have up to 200 turbines with a combined estimated capacity of 3 GW. Investment by RWE and Masdar during development and construction is predicted to deliver an economic contribution (Gross Value Added) to the UK of almost GBP 1 billion, including GBP 400 million in the Humber region.

There is a detailed map in the article on offshoreWIND.biz.

The Next Steps

These are given in the article.

The next steps for the projects, following a successful Development Consent Order, would be to secure Contracts for Difference (CfD), followed by financing and construction, the developers said.

It certainly looks like the 3 GW Dogger South Bank Wind Farm is on its way.

These are my thoughts about the project.

The Turbines To Be Used

The article says this about the turbines.

Together, the projects will have up to 200 turbines with a combined estimated capacity of 3 GW.

This means that the turbines will be 15 MW.

In RWE Orders 15 MW Nordseecluster Offshore Wind Turbines At Vestas, I said this.

Does this mean that the Vestas V236-15.0 MW offshore wind turbine, is now RWE’s standard offshore turbine?

This would surely have manufacturing, installation, operation and maintenance advantages.

There would surely be advantages for all parties to use a standard turbine.

It’s A Long Way Between Yorkshire And The Dogger Bank

The article says it’s a hundred kilometres between the wind farm and the coast of Yorkshire.

Welcome To The Age Of Hydrogen

This is the title of this page of the RWE web site.

The page starts with this paragraph.

RWE is actively involved in the development of innovative hydrogen projects. The H2 molecule is considered to be an important future building block of a successful energy transition. RWE is a partner in over 30 H2 projects and is working on solutions for decarbonising the industry with associations and corporations like Shell, BASF and OGE. Hydrogen projects are comprehensively supported in the separate Hydrogen department of the subsidiary RWE Generation.

AquaVentus

I also suggest, that you read this page on the RWE web site called AquaVentus.

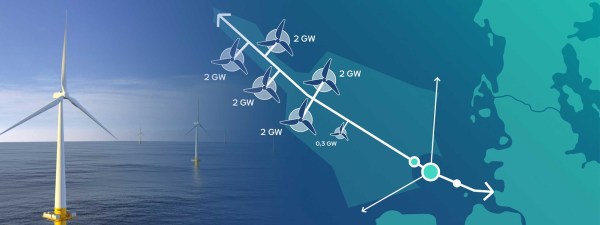

The page starts with this RWE graphic.

It appears that 10.3 GW of hydrogen will be created by wind farms and piped to North-West Germany.

These two paragraphs outline the AquaVentus initiative .

Hydrogen is considered the great hope of decarbonisation in all sectors that cannot be electrified, e.g. industrial manufacturing, aviation and shipping. Massive investments in the expansion of renewable energy are needed to enable carbon-neutral hydrogen production. After all, wind, solar and hydroelectric power form the basis of climate-friendly hydrogen.

In its quest for climate-friendly hydrogen production, the AquaVentus initiative has set its sights on one renewable energy generation technology: offshore wind. The initiative aims to use electricity from offshore wind farms to operate electrolysers also installed at sea on an industrial scale. Plans envisage setting up electrolysis units in the North Sea with a total capacity of 10 gigawatts, enough to produce 1 million metric tons of green hydrogen.

The page also gives these numbers.

- Total Capacity – 10 GW

- Tonnes Of Green Hydrogen – 1 million

- Members – 100 +

The web site says this about commissioning.

Commissioning is currently scheduled for early/mid 2030s.

The Germans can’t be accused of lacking ambition.

AquaVentus And The UK

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- There is a link to Denmark.

- There appears to be a undeveloped link to Norway.

- There appears to be a link to Peterhead in Scotland.

- There appears to be a link to just North of the Humber in England.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers distributing the hydrogen to where it is needed?

In the last century, the oil industry, built a substantial oil and gas network in the North Sea. It appears now the Germans are leading the building of a substantial hydrogen network.

AquaVentus And Aldbrough And Rough Gas Storage

Consider.

- In The Massive Hydrogen Project, That Appears To Be Under The Radar, I describe the Aldbrough Gas Storage.

- In Wood To Optimise Hydrogen Storage For Centrica’s Rough Field, I describe Centrica’s plans to turn Rough Gas Storage into the world’s largest hydrogen store.

- There is a small amount of hydrogen storage at Wilhelmshaven.

It looks like the East Riding Hydrogen Bank, will be playing a large part in ensuring the continuity and reliability of AquaVentus.

Dogger Bank South And AquaVentus

This Google Map shows the North Sea South of Sunderland and the Danish/German border.

Note.

- Sunderland is in the top-left hand corner of the map.

- A white line in the top-right corner of the map is the Danish/German border.

- Hamburg and Bremen are in the bottom-right hand corner of the map.

If you lay the AquaVentus map over this map, I believe that Dogger Bank South wind farm could be one of the three 2 GW wind farms on the South-Western side of the AquaVentus main pipeline.

- Two GW would be converted to hydrogen and fed into the AquaVentus main pipeline.

- One GW of electricity would be sent to the UK.

But this is only one of many possibilities.

Hopefully, everything will be a bit clearer, when RWE publish more details.

Conclusion

I believe, that some or all of the Dogger Bank South electricity, will be converted to hydrogen and fed into the AquaVentus main pipeline.

I also believe, that the hydrogen stores in the East Riding of Yorkshire, will form an important part of AquaVentus.

Norway’s Sovereign Wealth Fund Acquires Stake In 573 MW Race Bank Offshore Wind Farm

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

A consortium made up of investment funds belonging to Australia-headquartered Macquarie Asset Management and Spring Infrastructure Capital has reached an agreement to divest a 37.5 per cent stake in the 573 MW Race Bank offshore wind farm in the UK to Norges Bank Investment Management.

These four paragraphs give more details of the deal.

The stake was sold to the Norwegian sovereign wealth fund for approximately GBP 330 million (about EUR 390.6 million).

According to Norges Bank Investment Management, the fund acquired Macquarie European Infrastructure Fund 5’s 25 per cent stake and Spring Infrastructure 1 Investment Limited Partnership’s 12.5 per cent interest in the Race Bank offshore wind farm.

A Macquarie Capital and Macquarie European Infrastructure Fund 5 consortium acquired a 50 per cent stake in Race Bank during the construction phase in 2016. Macquarie Capital divested its 25 per cent stake in the wind farm in 2017.

With the deal, Arjun Infrastructure Partners will remain co-investor for 12.5 per cent of the wind farm and Ørsted will remain a 50 per cent owner and operator of Race Bank.

These are my thoughts.

The Location of Race Bank Wind Farm

This map from the Outer Dowsing Web Site, shows Race Bank and all the other wind farms off the South Yorkshire, Lincolnshire and Norfolk coasts.

From North to South, wind farm sizes and owners are as follows.

- Hornsea 1 – 1218 MW – Ørsted, Global Infrastructure Partners

- Hornsea 2 – 1386 MW – Ørsted,Global Infrastructure Partners

- Hornsea 3 – 2852 MW – Ørsted

- Hornsea 4 – 2600 MW – Ørsted

- Westernmost Rough – 210 MW – Ørsted and Partners

- Humber Gateway – 219 MW – E.ON

- Triton Knoll – 857 MW – RWE

- Outer Dowsing – 1500 MW – Corio Generation, TotalEnergies

- Race Bank – 573 MW – Ørsted,

- Dudgeon – 402 MW – Equinor, Statkraft

- Lincs – 270 MW – Centrica, Siemens, Ørsted

- Lynn and Inner Dowsing – 194 MW – Centrica, TCW

- Sheringham Shoal – 317 MW – Equinor, Statkraft

- Norfolk Vanguard West – 1380 MW – RWE

Note.

- There is certainly a large amount of wind power on the map.

- Hornsea 1, 2 and 3 supply Humberside.

- Hornsea 4 will supply Norwich and North Norfolk.

- Norfolk Vanguard West would probably act with the other two wind farms in RWE’ Norfolk cluster.

- Ignoring Hornsea and Norfolk Vanguard West gives a total around 4.5 GW.

- There are also two 2 GW interconnectors to Scotland (Eastern Green Link 3 and Eastern Green Link 4) and the 1.4 GW Viking Link to Denmark.

I wouldn’t be surprised to see a large offshore electrolyser being built in the East Lincolnshire/West Norfolk area.

The primary purpose would be to mop up any spare wind electricity to avoid curtailing the wind turbines.

The hydrogen would have these uses.

- Provide hydrogen for small, backup and peaker power stations.

- Provide hydrogen for local industry, transport and agriculture,

- Provide hydrogen for off-gas-grid heating.

- Provide methanol for coastal shipping.

Any spare hydrogen would be exported by coastal tanker to Germany to feed H2ercules.

Do We Need Wind-Driven Hydrogen Electrolysers About Every Fifty Miles Or so Along The Coast?

I can certainly see a string along the East Coast between Humberside and Kent.

- Humberside – Being planned by SSE

- East Lincolnshire/West Norfolk – See above

- North-East Norfolk – See RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030.

- Dogger Bank – See RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030.

- Sizewell – See Sizewell C And Hydrogen.

- Herne Bay – Under construction

I can see others at possibly Freeport East and London Gateway.

TetraSpar Demonstrator Floating Wind Turbine Hits 63 Pct Capacity Factor In Norway

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Stiesdal has revealed that its TetraSpar Demonstrator, located in Norway, has reached a capacity factor of 63 per cent.

These three paragraphs give a few more details.

Since its commissioning in late 2021, the TetraSpar Demonstrator has been operational at METCentre in Norway, delivering green energy, gathering data, validating numerical models, supporting research and development projects, and serving as a living laboratory for the development of floating wind technology, said Stiesdal in a recent social media post.

To date, the demonstrator has generated more than 37 GWh of renewable energy, according to the company. The 3.6 MW Siemens Gamesa direct-drive wind turbine and very high wind speeds at the METCentre site combined to yield a capacity factor of 54 per cent, said Stiesdal.

In the first two years of operation, the availability was recorded at 97 per cent and 98.3 per cent, respectively. For 2024, the availability has increased to 99.5 per cent with a capacity factor of almost 63 per cent, according to the company.

I have some further thoughts.

Tetra Offshore Foundations For Any Water Depth

The title of this section, is the same as that of this page on the Siesdal web site.

The page gives a lot of information and says that the TetraSpar can handle water depth of over a thousand metres.

Wind Farm Capacity Factor

The Wikipedia entry for capacity factor says this about the range of wind farm capacity factors.

Wind farms are variable, due to the natural variability of the wind. For a wind farm, the capacity factor is determined by the availability of wind, the swept area of the turbine and the size of the generator. Transmission line capacity and electricity demand also affect the capacity factor. Typical capacity factors of current wind farms are between 25 and 45%. In the United Kingdom during the five year period from 2011 to 2019 the annual capacity factor for wind was over 30%.

From that paragraph, 63 % seems to be extraordinarily good.

Conclusion

The TetraSpar appears to be a powerful concept.

Aker Solutions To Pilot Floating-Wind Power Hub

The title of this post, is the same as that of this press release from Aker Solutions.

This is the sub-heading.

Aker Solutions to pilot world’s first subsea power distribution system for floating offshore wind at Norway´s METCentre

These four paragraphs describe the system and explain how it works.

Note.

Aker Solutions has signed a front-end engineering and design (FEED) contract with the Marine Energy Test Centre (METCentre) in Norway to pilot new subsea power system technology which has the potential to significantly reduce the costs and complexity of offshore wind farms.

The project will see Aker Solutions provide new power transmission technology, Subsea Collector, for the METCentre’s offshore wind test area which today consists of two floating offshore wind turbines located 10 kilometers off the southwestern coast of Karmøy, Norway. The test area will expand to seven floating offshore wind turbines from 2026.

Subsea Collector provides an alternative solution to connect multiple wind turbines electrically in a star configuration instead of the traditional daisy chain pattern, allowing for more flexibility in offshore wind farm architecture and construction. The design also allows for reduced cable length per turbine and park, as well as less vessel time and installation costs. Initial findings support total cost savings on a 1GW floating wind farm of up to 10 percent.

The main component parts of the Subsea Collector comprise a 66kV wet mate connection system provided by Benestad and subsea switchgear with supervisory control and data acquisition by subsea power and automation alliance partner, ABB. Installation will be carried out by Windstaller Alliance, an alliance between Aker Solutions, DeepOcean and Solstad Offshore. Aker Solutions will also provide the static export cable to shore.

Total cost savings of ten percent on any large project are not to be sneezed at.

I also feel that this sort of architecture will be ideal for a test centre, where configurations are probably changed more often.

Is This Better News For Offshore Wind Farm Developers?

Two months ago this article on offshoreWIND.biz was published, which was entitled Offshore Wind Developers Take A Pass On UK’s Fifth CfD Round As Maximum Bid Price Was Too Low.

This was the sub-heading.

The UK government has awarded 3.7 GW of renewable energy projects with Contracts for Difference (CfDs) in its fifth allocation round. Among the 95 new projects that secured CfDs are onshore wind, solar and tidal energy developments – and not a single megawatt of offshore wind.

These are the first three paragraphs of the article.

According to the government, the global rise in inflation and the impact on supply chains presented challenges for projects participating in this round. The government also noted that similar results have been seen in countries such as Germany and Spain.

The industry does not disagree, however, multiple players have voiced their disappointment that the government had not taken these pressures into account for this round and emphasised that the UK’s goal of having 50 GW of offshore wind and 5 GW of floating wind could now be jeopardised.

Last year, the UK awarded CfDs to 7 GW of offshore wind projects alone.

Today, articles with these titles and sub-headings were published on offshoreWIND.biz.

- 50 Developers Express Interest To Build Wind Farms Offshore Portugal

Fifty entities, including individual companies and consortia, from more than ten countries have submitted their expressions of interest to develop offshore wind projects in Portugal as the country prepares for its first auction.

2. Fugro To Survey Site For Lithuania’s First Offshore Wind Farm

Ignitis Renewables has awarded Fugro a contract to conduct a geophysical survey at Lithuania’s first offshore wind farm site.

3. Norway’s Offshore Wind Tender Attracts Seven Applications

Norway’s Ministry of Petroleum and Energy has received seven applications to participate in the tender for the Southern North Sea II offshore wind project area.

4. Project To Retrofit CTV With Hydrogen Fuel Cells Kicks Off

A project to retrofit a crew transfer vessel (CTV) with hydrogen fuel cells, to cut CO2 and NOx emissions while servicing offshore wind farms, has kicked off.

5.Terna Energy Secures Survey Permit for Wind Farm Sites Offshore Greece

Terna Energy has been granted one out of the two first exploration and survey licences issued for pilot offshore wind projects in Greece.

6. UK Increases Offshore Wind Strike Price Ahead Of Next Auction

The government of the United Kingdom has increased the maximum strike price for offshore wind projects in the next Contracts for Difference (CfD) auction by 66 per cent for fixed-bottom and by 52 per cent for floating wind projects.

All would appear to be positive stories.

- Story 1 is about success in Portugal. What are the Portuguese doing right?

- Stories 2 and 5 are about offshore wind development in new countries; Lithuania and Greece.

- Story 3 may not appear significant, but Terje Aasland, who is Norway’s Minister of Petroleum and Energy seemed pleased in the article.

- Story 4 is about development of new technology, which wouldn’t be done if the market was non-existent.

- Story 6 is surely good news for wind farm developers in the UK.

I did leave out three stories, one of which was negative and two were rather boring. But six out of nine isn’t bad.

Is it Getting Better All The Time, as The Beatles once sang?

Thoughts On The Future Of Orkney

This article on the BBC is entitled Orkney Votes To Explore ‘Alternative Governance‘

This is the sub-heading.

Orkney councillors have voted to investigate alternative methods of governance amid deep frustrations over funding and opportunities.

These paragraphs outline the story.

Council leader James Stockan said the islands had been “held down” and accused the Scottish and UK governments of discrimination.

His motion led to media speculation that Orkney could leave the UK or become a self-governing territory of Norway.

It was supported by 15 votes to six.

It means council officers have been asked to publish a report to Orkney’s chief executive on options of governance.

This includes looking at the “Nordic connections” of the archipelago and crown dependencies such as Jersey and Guernsey.

A further change which would see the revival of a consultative group on constitutional reform for the islands was accepted without the need for a vote.

My Thoughts On The Economic Future Of The Islands

The economic future of Orkney looks good.

Tourism and the traditional industries are on the up, but the islands could play a large part in renewable energy.

The West of Orkney offshore wind farm, which will be a 2 GW wind farm with fixed foundations, is being developed and a large hydrogen production hub at Flotta is being proposed, along with the development of a large quay in Scapa Flow for the assembly of floating wind farms.

The West of Orkney wind farm could be the first of several.

If the future wind farms are further from shore, they will most likely be based on floating technology, with the turbines and their floats assembled in Scapa Flow, from components shipped in from mainland UK and Europe.

Political Future

With a good financial future assured, I believe that Orkney will be able to choose where its political future lies. It could be a Crown Dependency or join Norway.

Whichever way it goes, it could be an island that effectively prints money, by turning electricity into hydrogen and shipping it to countries like Germany, The Netherlands, Poland and Sweden!

From a UK point of view, a Crown Dependency could be a favourable move.

Would Shetland follow the same route?

Offshore Hydrogen Production And Storage

Orkney is not a large archipelago and is just under a thousand square kilometres in area.

It strikes me, that rather than using up scarce land to host the large electrolysers and hydrogen storage, perhaps it would be better, if hydrogen production and storage was performed offshore.

Aker Northern Horizons

In Is This The World’s Most Ambitious Green Energy Solution?, I talk about Northern Horizons, which is an ambitious project for a 10 GW floating wind farm, which would be built a hundred kilometres to the North-East of Shetland, that would be used to produce hydrogen on Shetland.

Other companies will propose similar projects to the West and East of the Northern islands.

This map shows the sea, that could be carpeted with armadas of floating wind farms.

Consider.

- There are thousands of square miles of sea available.

- As the crow flies, the distance between Bergen Airport and Sumburgh Airport in Shetland is 226 miles.

- A hundred mile square is 10,000 square miles or 2590 square kilometres.

- In ScotWind Offshore Wind Leasing Delivers Major Boost To Scotland’s Net Zero Aspirations, I calculated that the floating wind farms of the Scotwind leasing round had an energy density of 3.5 MW per km².

- It would appear that a hundred mile square could generate, as much as nine GW of green electricity.

How many hundred mile squares can be fitted in around the UK’s Northern islands?

Norway Has Room For 338 GW Of Offshore Wind, New Analysis Finds

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Norway has the potential to develop up to 338 GW of offshore wind in areas with a low level of conflict, according to a new analysis performed by Multiconsult and commissioned by the industry organisation Norwegian Offshore Wind, Equinor, Source Galileo, Hafslund and Deep Wind Offshore.

These two paragraphs are the main findings of the report.

The report, issued on 14 April, maps 28 areas as suitable for floating wind and 18 areas for fixed-bottom offshore wind, estimating the total potential installed capacity to be 241 GW at 5 MW/km2 and 338 GW at 7 MW/km2.

Of this, floating wind could account for 156 GW and up to 219 GW, while fixed-bottom capacity is between 85 GW and 119 GW.

So how does that figure look for the UK?

Consider.

- The UK has an Exclusive Economic Zone of 773,676 sq. kilometres.

- But if you include overseas territories, the UK’s area is 6,805,586 sq. kilometres and is the fifth largest in the world.

- Norway has an Exclusive Economic Zone of 2,385,178 sq. kilometres.

So taking the 338 GW figure for Norway and ignoring overseas territories, we could generate 109.6 GW.

Floating Offshore Substation Project Secures EUDP Funding

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Semco Maritime, ISC Consulting Engineers, Aalborg University, Energy Cluster Denmark, and Norway and Sweden-based Inocean have secured funding to further develop a floating offshore substation (FOSS) concept.

This is the first paragraph.

The parties announced their collaboration in 2022 and are now set to further accelerate floating offshore substation development through funding from the Energy Technology and Demonstration Program (EUDP).

These three paragraphs talk about the design.

The substation layout has been developed to fit the shape of a three-column stabilised substructure, according to the partners.

The floating offshore substation is a crucial component in the offshore wind farm industry as deeper ocean sites further from the coastline are to be utilised, the partners said.

Between 60-80 per cent of the world’s offshore wind energy potential is in areas with depths greater than 60+ metres, which presents a need for an alternative solution to bring the power to shore, such as a floating offshore substation, according to the developers.

That all seems sensible.

BW Ideol In Talks To Raise EUR 40 Million For Floating Wind Development

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Norway-headquartered BW Ideol and French state-owned investment company ADEME Investissement have agreed to enter into exclusive negotiations for EUR 40 million in funding by ADEME Investissement for BW Ideol’s project development activities.

The rest of the post is all about the clever, but I suspect legal ways, that the € 40 million is raised.

When I needed any advice in that area, I used to consult my late friend the banker; David, who is mentioned in Diversifying A US$200 billion Market: The Alternatives To Li-ion Batteries For Grid-Scale Energy Storage.

When he needed computing advice, that is another story.