Apollo to Work On Celtic Sea Multi-Connection Offshore Substations

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Celtic Sea Power has awarded the Aberdeen-based engineering consultants, Apollo, with the pre-FEED contract for the 400 MW Pembrokeshire Demonstration Zone Multi-connection Offshore Substation (PDZ MOS) and 2x 1 GW MOSs targeting The Crown Estate Refined Area of Search (RAoS) A offshore Wales

This is the first paragraph.

Located 19 kilometres off the Pembrokeshire coast, the PDZ MOS project is designed to allow offshore renewable energy technology developers easy access to a consented test site complete with a grid connection to prove their technology in the offshore environment.

Sounds like the sort of infrastructure that is needed, so you can tow up your experimental floating wind turbine, secure it and just plug it in.

RWE Underlines Commitment To Floating Offshore Wind In The Celtic Sea Through New ‘Vision’ Document

The title of this post, is the same as that of this press release from RWE.

These are the three bullet points.

- Offshore floating wind in the Celtic Sea could unlock 3,000 jobs and £682 million in supply chain opportunities by 2030

- RWE is targeting the development at least 1GW of floating wind in the region

- Using experience from demonstrator projects and partnerships with local supply chain to strengthen ambitions

These opening three paragraphs outline more of RWE’s vision.

RWE, the world’s second largest offshore wind player and largest generator of clean power in Wales, has unveiled its vision for the future of floating offshore wind in the Celtic Sea region and the opportunities it presents from new large-scale, commercial projects. Entitled “RWE’s Vision for the Celtic Sea”, the document was unveiled during day one of the Marine Energy Wales conference, in Swansea, where RWE is the Platinum Sponsor.

RWE sees floating wind technology as the next frontier in the development of the offshore wind sector, and which could potentially unlock a multi-billion pound opportunity for the broader Celtic Sea region and the UK.

Studies anticipate the first GW of floating wind to be developed in the Celtic Sea could potentially deliver around 3,000 jobs and £682 million in supply chain opportunities for Wales and the south west of England. Against this backdrop, it’s anticipated the technology could unlock a resurgence in Welsh industry, helping to decarbonise industry and transport, spur on academic innovation, and spearhead the growth of a new, highly skilled workforce.

Reading further down, there are these statements.

- RWE will be bidding in the upcoming Celtic Sea auction with the aim of securing at least 1 gigawatt (GW) of installed capacity, to be developed throughout the 2020’s.

- The Celtic Sea region is pivotal to RWE’s ‘Growing Green’ strategy in the UK, where we expect to invest £15 billion in clean energy infrastructure by 2030.

- A cooperation agreement with Tata SteelUK to understand and explore the production of steel components that could be used in high-tech floating wind foundations and structures for projects in the Celtic Sea.

- The company has also signed agreements with ABP Port Talbot, the Port of Milford Haven and Marine Power Systems of Swansea, to explore opportunities for building the supply chain for floating wind.

- RWE is the largest power producer and renewable energy generator in Wales with more than 3GW of energy across 11 sites.

- If successful in the leasing round, RWE’s Celtic Sea projects will also play a key role in the development of RWE’s Pembroke Net Zero Centre, as well as decarbonizing wider industrial processes and transportation across South Wales.

It looks like RWE are very serious about the Celtic Sea and Pembrokeshire.

Pembroke Net Zero Centre

The Pembroke Net Zero Centre looks to be a powerful beast.

It will be located at the 2200 MW Pembroke power station, which is the largest gas-fired power station in Europe.

These are the first two paragraphs on its web page.

RWE is a world leader in renewables, a market leader in the development of offshore wind and a key driver of the global energy transition. In turn, Pembroke is looking to continue its transformation as part of a decarbonisation hub under the title of the PNZC, linking-up with new innovative technologies needed for a low carbon future, including hydrogen production, Carbon Capture and Storage and floating offshore wind.

The PNZC will bring together all areas of the company’s decarbonisation expertise, including innovation, offshore wind, power engineering, trading and the development/operation of highly technical plants.

The page also talks of burning hydrogen in the power station and an initial 100-300 MW ‘pathfinder’ electrolyser on the Pembroke site.

Conclusion

In some ways, RWE are following a similar philosophy in the area, to that being pursued by SSE at Keadby on Humberside.

As The Crown Estate is talking of 4 GW in the Celtic Sea, it looks like RWE are positioning Pembroke to be the backup, when the wind doesn’t blow.

Welsh Government Greenlights Erebus Floating Offshore Wind Farm

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Welsh Government has granted consent for the country’s first floating offshore wind farm located 40 kilometres off the coast of Pembrokeshire

This is the first paragraph.

Project Erebus will feature seven next-generation 14 MW turbines on floating platforms, providing enough renewable energy to power 93,000 homes.

This near 100 MW project is the first in the Celtic Sea, where there 4 GW are to be installed in the next decade.

This is another paragraph.

Future phases of the development could realise an additional 20 GW of renewable energy, according to the Government.

Wales is not going to be short of energy!

Surveys Completed For Celtic Sea Floating Offshore Wind Projects

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

N-Sea Group has finished a series of benthic and geophysical surveys for Llŷr 1 and Llŷr 2 floating offshore wind projects in the Celtic Sea.

I described the two projects in detail in Two More Floating Wind Projects In The Celtic Sea.

- At least the surveys are complete and it still appears that a commissioning date of 2026/27 is still feasible for these twin 100 MW projects.

- In the original documents, it was stated that there would be six next generation turbines in each wind farm, with a capacity of between 12 and 20 MW.

- There appears to be no decision on the floats or turbine size to be used.

I wouldn’t be surprised to see larger turbines used and the capacity of the farms increased.

Crown Estate Accelerates Celtic Sea Floating Offshore Wind Surveys

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Crown Estate has announced the awarding of the first contracts for its first major investment in surveys to help with the construction of floating offshore wind farms in the Celtic Sea.

These two paragraphs describe the contracts.

Contracts have now been signed for the initial phase of metocean surveys, which look at wind, wave, and current patterns, to begin in Spring 2023. The Crown Estate is progressing the procurement of the remaining surveys over the coming weeks and months, subject to further commercial discussions.

By investing in these surveys at an early stage and making the data freely available to successful bidders, the Crown Estate is aiming to accelerate the delivery of the projects, making it easier for developers to take early decisions and manage risk while supporting future project-level Environmental Impact Assessments (EIAs) as part of the planning process.

It looks like a good idea to me, as it could make the bidding process much quicker and bidders with special expertise may be able to get contracts more suited to their expertise.

Regulator Approves New Grand Union Train Service From Carmarthen To London Paddington

The title of this post, is the same as that of this press release from the Office of Rail and Road.

This is the sub-heading of the press release.

The Office of Rail and Road (ORR) has opened up the Great Western Main Line to competition and enabled a significant increase in rail services between London and South Wales.

These points are made in the press release.

- The rail regulator has approved the introduction of new train services between London, Cardiff and South West Wales from the end of 2024.

- The services will be operated by a new open access operator, Grand Union Trains, bringing competition to the Great Western route out of Paddington.

- Passengers travelling between London, Bristol Parkway, Severn Tunnel Junction, Newport, Cardiff, Gowerton, Llanelli and Carmarthen will benefit from an extra five daily return services and greater choice of operator.

- The decision opens up the Great Western Main Line to competition for the first time, with potential benefits in terms of lower fares, improved service quality and innovation for all passengers using the route.

- The application, submitted to ORR in June 2022, was disputed by Network Rail due to concerns about capacity on the network. But following careful consideration and analysis, ORR has directed Network Rail to enter into a contract with Grand Union.

- Grand Union has committed to significant investment in new trains.

- As an ‘open access’ train operator, however, it will not get paid subsidies from public funds, unlike current operators along the route.

ORR supports new open access where it delivers competition for the benefit of passengers. In making this decision, the regulator has weighed this up against the impact on Government funds and effect on other users of the railway, both passengers and freight customers.

These are my thoughts.

The Company

Grand Union Trains have certainly persevered to get this approval.

- The company was created by Ian Yeowart, who previously created open access operators; Alliance Rail Holdings and Grand Central before selling both to Arriva.

- After multiple negotiations with the Office of Road and Rail (ORR), Yeowart must know how to get an acceptable deal.

- Grand Union Trains have a similar application for a service between Euston and Stirling with the ORR.

Grand Union Trains also have a web site.

The home page has a mission statement of Railways To Our Core, with this statement underneath.

At Grand Union we are passionate about Britain’s railways. We are committed to the traditional values of providing a high-quality customer service and a comfortable journey experience at a fair price.

I’ll go with that.

The Financial Backing Of The Company

All the UK’s open access operators are well-financed either by Arriva or First Group.

The ORR would not receive any thanks, if they approved an operator, which duly went bust.

So what is the quality of the financing behind Grand Union Trains?

This article on Railway Gazette is entitled RENFE Looks At Entering UK Rail Market Through Open Access Partnership, which starts with this paragraph.

Open access passenger service developer Grand Union Trains is working with Spain’s national operator RENFE and private equity firm Serena Industrial Partners on a proposed service between London and Wales.

That is fairly clear and would surely help in the financing of Grand Union Trains.

The Route

Trains will run between Carmarthen and London Paddington, with stops at Llanelli, Gowerton, Cardiff, Newport, Severn Tunnel Junction and Bristol Parkway.

A new station at Felindre will replace Gowerton at some time in the future.

There will be five trains per day (tpd).

I have some thoughts and questions about the route

Felindre Station

Felindre station is named in Wikipedia as the West Wales Parkway station, where it is introduced like this.

West Wales Parkway is a proposed railway station north of Swansea, near to the boundaries of the neighbouring principal area of Carmarthenshire, and the villages of Felindre and Llangyfelach. The station is proposed to be situated at the former Felindre steelworks, near Junction 46 of the M4 and A48, and near Felindre Business Park and Penllergaer Business Park. The project is in the planning stages, as part of a wider Department for Transport proposal to re-open the Swansea District line to passenger traffic.

This Google Map shows where, it appears the Felindre station will be built.

Note.

- The Felindre Business Park in the North-West corner of the map, with a Park-and-Ride.

- The M4 running across the bottom of the map.

- The Swansea District Line runs East-West between the motorway and the Business Park.

It looks that the new station could be located on the South side of the Business Park.

When High Speed Two Opens Will Trains Call At Old Oak Common?

When High Speed Two opens, all GWR trains will stop at Old Oak Common station for these connections.

- Chiltern for for Banbury, Bicester, High Wycombe and the West Midlands

- Elizabeth Line for Central and East London and the Thames Valley

- Heathrow Airport

- High Speed Two for Birmingham and the North

- Overground for Outer London

As Old Oak Common will be such an important interchange, I think they should.

Will The Platforms At Carmarthen Station Need Lengthening?

This Google Map shows Carmarthen station.

Note.

- The station has two platforms.

- There are certainly pictures of the station with an InterCity 125 in the station. There is a picture on the Wikipedia entry for Carmarthen station.

These pictures show the station.

I suspect that the station will be upgraded to accommodate Grand Union Trains.

The Trains

An article in the June 2022 Edition of Modern Railways, which is entitled Grand Union Bids For London To Carmarthen, gives these details of the trains.

- Three classes.

- 2023 start for the service.

- Cycle provision.

- Vanload freight will be carried.

- Electric trains could start between London and Cardiff by 2023.

- In 2025, trains could be nine-car bi-modes.

- South Wales-based operation and maintenance.

- 125 full-time jobs created.

It certainly seems to be a comprehensive and well-thought out plan.

I have a few thoughts on the trains.

What Make Of Trains Will Be Procured?

Consider.

- Lumo’s Class 803 trains were ordered from Hitachi in March 2019 and entered service in October 2021.

- So if they ordered their version of the Hitachi trains by the end of 2022, the trains could be in service by July/August 2025.

- It would probably be easier, if the only fast trains on the Great Western Main Line between London and South Wales were all Hitachi trains with identical performance.

But the Spanish backers of Grand Union Trains may prefer Spanish-designed trains assembled in South Wales. So would a bi-mode version of CAF’s Class 397 trains be suitable?

On the other hand, the Carmarthen and Cardiff section of the route without a reverse at Swansea is only seventy-five miles.

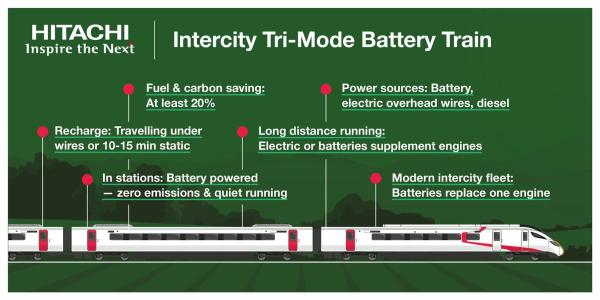

This Hitachi infographic shows the Hitachi Intercity Tri-Mode Battery Train.

Consider.

- Charging could be provided at Carmarthen using a short length of electrification or one of Furrer + Frey standard chargers.

- Charging would also use the electrification between London Paddington and Cardiff.

- A nine-car Class 800 or Class 802 train has five engines and a five-car train has three engines.

- The Intercity Tri-Mode Battery Train was announced in December 2022.

- In the intervening two years how far has the project progressed?

- For the last twelve months, Lumo have been running trains with an emergency battery-pack for hotel power. How are the batteries doing, whilst being ferried up and down, the East Coast Main Line?

Can Hitachi configure a train with more than one battery-pack and a number of diesel engines, that has a range of seventy-five miles? I suspect they can.

I suspect that CAF also have similar technology.

There is also a benefit to Great Western Railway (GWR).

If GWR were able to fit out their Class 802 trains in the same way, they would be able to run between Cardiff and Swansea on battery power.

- It is only 45.7 miles.

- Charging would need to be provided at Swansea.

- GWR could still run their one tpd service to Carmarthen.

It looks like both train operating companies could be able to do as Lumo does and advertise all electric services.

What Could Be The Maxmum Range Of A Hitachi Train On Batteries?

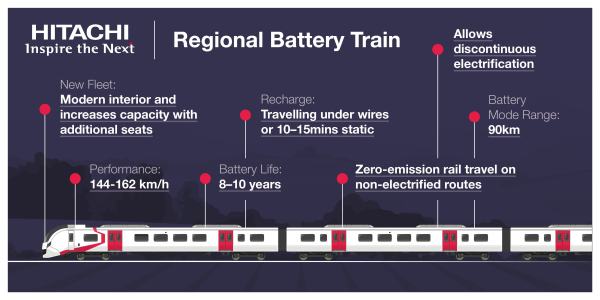

This Hitachi infographic shows the Hitachi Regional Battery Train.

Consider.

- It has a battery range of 90 km or 56 miles on the single battery.

- I would expect that by a regional train, Hitachi mean a five car Class 800 or 802 train, like those that go to Cheltenham, Lincoln or Middlesbrough.

- A five-car Hitachi Regional Battery Train would have a battery that could contain power equivalent to 280 car-miles.

- Five-car Class 800 or 802 trains have three engine positions.

- These Hitachi trains have a very sophisticated control system, which I wrote about in Do Class 800/801/802 Trains Use Batteries For Regenerative Braking?

I believe the engineers at Hyperdrive Innovation have designed the battery-packs that replace the diesel engines as simulations of the diesel engines, so they can be a direct replacement.

This would mean that battery-packs could be additive, so the following could apply to a five-car train.

- Two battery packs could have a range of 112 miles.

- Three battery packs could have a range of 168 miles.

GWR generally runs pairs of five-car trains to Swansea, which would be 90 miles without electrification.

If five-car trains with two battery packs, could be given a range of 112 miles, GWR could run an electric service to Swansea.

They could also run to Carmarthen, if Grand Union Trains would share the charger.

What ranges could be possible with nine-car trains, if one battery pack is good for 280 car-miles?

- One battery-pack, gives a range of 280/9 = 31 miles

- Two battery-packs, give a range of 2*280/9 = 62 miles

- Three battery-packs, give a range of 3*280/9 = 93 miles

- Four battery-packs, give a range of 4*280/9 = 124 miles

- Five battery-packs, give a range of 5*280/9 = 155 miles

- Six battery-packs, give a range of 6*280/9 = 187 miles

- Seven battery-packs, give a range of 7*280/9 = 218 miles

Note.

- I have rounded figures to the nearest mile.

- There are five cars with diesel engines in a nine-car train, which are in cars 2,3,5, 7 and 8.

- Diesel engines are also placed under the driver cars in five-car Class 810 trains.

- For the previous two reasons, I feel that the maximum numbers of diesel engines in a nine-car train could be a maximum of seven.

- I have therefor assumed a maximum of seven battery packs.

These distances seem sensational, but when you consider that Stradler’s Flirt Akku has demonstrated a battery range of 243 kilometres or 150 miles, I don’t think they are out of order.

But, if they are correct, then the ramifications are enormous.

- Large numbers of routes could become electric without any infrastructure works.

- Grand Union Trains would be able to run to Carmarthen and back without a charger at Carmarthen.

- GWR would be able to run to Swansea and back without a charger at Swansea.

Prudence may mean strategic chargers are installed.

Rrenewable Energy Developments In South West Wales

In Enter The Dragon, I talked about renewable energy developments in South West Wales.

I used information from this article on the Engineer, which is entitled Unlocking The Renewables Potential Of The Celtic Sea.

The article on the Engineer finishes with this conclusion.

For now, Wales may be lagging slightly behind its Celtic cousin to the north, but if the true potential of the Celtic Sea can be unleashed – FLOW, tidal stream, lagoon and wave – it looks set to play an even more prominent role in the net zero pursuit.

The Red Dragon is entering the battle to replace Vlad the Mad’s tainted energy.

South West Wales could see a massive renewable energy boom.

Grand Union Trains will increase the capacity to bring in more workers to support the developments from South Wales and Bristol.

The Celtic Cluster Launches New Regional Strategy To Maximise Offshore Wind Benefits

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Celtic Sea Cluster has released a new Regional Strategy that outlines how Wales and South West England can maximise floating offshore wind technology benefits, in line with the forthcoming Celtic Sea leasing process being delivered by the Crown Estate.

Who comprise the Celtic Cluster? This paragraph gives the answer.

According to the Cluster, which is led by its founding partners, the Welsh Government, Cornwall, Isles of Scilly Local Enterprise Partnership, Celtic Sea Power, Marine Energy Wales, and the Offshore Renewable Energy Catapult, the strategy will allow the region’s stakeholders to ensure their activities are aligned and can achieve their common objectives.

I am surprised the Irish aren’t involved politically.

- The Irish Republic has a coastline on the Celtic Sea.

- There are a lot of Irish companies, finance and engineers involved in wind farm development.

But the cluster does have a firm ambition, according to the article.

The Cluster’s ambition is to establish the Celtic Sea region as a world leader in floating offshore wind by 2030 and to deliver 4 GW of floating wind in the Celtic Sea by 2035, with the potential to grow to 20 GW by 2045.

Note.

- The Wikipedia entry for the Celtic Sea, gives the sea an area of 300,000 km2.

- 20 GW or 20,000 MW is to be installed by 2045.

That is an energy density of just 0.067 MW/km2.

In ScotWind Offshore Wind Leasing Delivers Major Boost To Scotland’s Net Zero Aspirations, I calculated that ten floating wind farms had an average energy density of about 3.5 MW per km².

I wouldn’t bet against a few more floating wind turbines being squeezed into the Celtic Sea.

Equinor Sets Sights On Gigawatt-Scale Floating Offshore Wind Projects In Celtic Sea

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the opening paragraph of the article.

Equinor has disclosed its interest in developing gigawatt-scale floating offshore wind in the Celtic Sea, with the upcoming Celtic Sea floating wind seabed leasing round in view.

These are some other points from the article.

- The Crown Estate is planning a seabed leasing round in the Celtic Sea in 2023.

- As the developer and soon-to-be operator of two of the world’s first floating offshore wind farms, Equinor said it views new floating opportunities in the Celtic Sea with great interest.

- Project development areas are being prepared by The Crown Estate for the development of gigawatt-scale floating offshore wind projects.

Equinor could move into the Celtic Sea in a big way.

On the Projects page of the Blue Gem website, this is said about floating wind in the Celtic Sea.

Floating wind is set to become a key technology in the fight against climate change with over 80% of the worlds wind resource in water deeper than 60 metres. Independent studies have suggested there could be as much as 50GW of electricity capacity available in the Celtic Sea waters of the UK and Ireland. This renewable energy resource could play a key role in the UK meeting the 2050 Net-Zero target required to mitigate climate change. Floating wind will provide new low carbon supply chain opportunities, support coastal communities and create long-term benefits for the region.

How much of this possible 50 GW of offshore wind in the Celtic Sea will be leased by the Crown Estate in 2023?

Floating Wind Farms At Sea To Create 29,000 Jobs – Crown Estate

The title of this post, is the same as that of this article on the BBC.

These three paragraphs introduce the article.

Plans to generate electricity through floating wind farms off the south Wales coast could create thousands of new jobs, according to the Crown Estate.

The property business owned by the monarch but run independently said the new industry could create about 29,000 jobs, including 10,000 in Wales.

It is leasing the space to generate enough power for four million homes.

Will Wales be the world’s next offshore wind powerhouse?

Wind power experts have said there is a potential for 50 GW of offshore wind power in the Celtic Sea and the BBC article talks of an investment of £43.6 billion by 2050.

The process has started, but will the engineers be able to tame the dragons?

The Salamander Project

The Salamander project may be a strange name for a proposed Scottish offshore wind farm, but that is what it is.

It is being developed by Ørsted and the Simply Blue Group.

There is a web site, which has this bold mission statement.

Helping To Unlock Scotland’s Floating Offshore Wind.

These paragraphs outline the project.

The Salamander project will utilise innovative and cutting-edge floating offshore wind technologies to produce zero-carbon electricity. The development aims to be a stepping stone to help Scotland and the UK to progress towards a net-zero future.

With a proposed 100 MW pre-commercial size project, the Salamander project which is located off Peterhead in the East coast of Scotland, is in an advanced planning stage. Salamander has a strong focus on supply chain development and will provide an opportunity for the local supply chain to gear up for commercial scale opportunities in Scotland, as well as de-risking floating wind technologies for the future commercial projects in Scotland and beyond. This will allow Scotland to maximise the financial benefit of its strong offshore wind resource and generate long term jobs for its local communities.

The project will contribute to the Scottish government’s target of 11 GW of installed offshore wind by 2030, as well as the UK government’s target of 5 GW of operational floating offshore wind by the same date.

There is also a video, which is very much a must-watch.

Floating offshore wind is a relatively new technology and will become the major generator of the world’s electricity within the next decade.

Note this phrase in the first paragraph.

The development aims to be a stepping stone to help Scotland and the UK to progress towards a net-zero future.

This philosophy is shared with other projects.

In DP Energy And Offshore Wind Farms In Ireland, I said this.

They are also developing the Gwynt Glas offshore wind farm in the UK sector of the Celtic Sea.

- In January 2022, EDF Renewables and DP Energy announced a Joint Venture partnership to combine their knowledge and

expertise, in order to participate in the leasing round to secure seabed rights to develop up to 1GW of FLOW in the Celtic Sea. - The wind farm is located between Pembroke and Cornwall.

The addition of Gwynt Glas will increase the total of floating offshore wind in the UK section of the Celtic Sea.

- Blue Gem Wind – Erebus – 100 MW Demonstration project – 27 miles offshore

- Blue Gem Wind – Valorus – 300 MW Early-Commercial project – 31 miles offshore

- Falck Renewables and BlueFloat Energy – Petroc – 300 MW project – 37 miles offshore

- Falck Renewables and BlueFloat Energy – Llywelyn – 300 MW project – 40 miles offshore

- Llŷr Wind – 100 MW Project – 25 miles offshore

- Llŷr Wind – 100 MW Project – 25 miles offshore

- Gwynt Glas – 1000 MW Project – 50 miles offshore

This makes a total of 2.2 GW, with investors from several countries.

It does seem that the Celtic Sea is becoming the next area of offshore wind around the British Isles to be developed.

These Celtic Sea wind farms include Erebus, which like Salamander is a 100 MW demonstration project.

Salamander And Erebus Compared

Consider.

- Both are 100 MW floating wind demonstration projects.

- Salamander and Erebus are 27 and 21 miles offshore respectively.

- Salamander and Erebus are close to the deepwater ports of Peterhead and Milford Haven.

- Both are described as stepping-stone projects.

- Both projects talk about developing supply chains.

- The developers of Salamander and Erebus include Ørsted and EDF Renewables respectively, who are both big beasts of the offshore wind industry.

Both wind farms are in areas, where the UK, Scottish and Welsh governments want to develop massive offshore wind farms, that will eventually total over 50 GW. I believe that Salamander and Erebus will indicate any problems, that will be likely to occur in the building of these massive offshore floating wind farms.

It is a very sensible plan and could lead to an energy rich future for the UK.

How Long Will It Take To Assemble A Floating Wind Turbine?

Each floating wind turbine requires these major components.

- A wind turbine, which in the Kincardine Wind Farm have a capacity of 9.5 MW, is obviously needed. Some proposed floating offshore wind farm are talking of turbines between 14 and 16 MW. These turbines will be very similar to onshore turbines.

- A float, usually made out of steel or possibly concrete. Various designs have been built or proposed. The Wikipedia entry for floating wind turbine gives several examples.

- The anchoring system to keep the float with its turbine in the desired position.

- The electrical system to connect the wind turbine to the offshore substation, which could also be floating.

Note that the designs for the float, anchoring and electrical systems will rely heavily on technology proven in the offshore oil and gas industry.

Principle Power are the designer of the WindFloat, which is one of the first floats to be used in floating offshore wind.

Their home page has a continuous full-screen video, that shows a WindFloat being assembled and towed out.

The video shows.

- The completed float being floated alongside a dock, which obviously has an appropriate water depth.

- The dock has a large crane.

- The turbine tower and then the blades being lifted into position and securely fixed.

- Finally, a tug tows the completed turbine/float assembly to its position in the wind farm.

This would appear to be an assembly operation, that could flow just like the production in any world-class vehicle factory.

- There would need to be just-in-time delivery of all components.

- The weather would need to be cooperative.

- Lighting might be needed to work in poorer light levels.

- This method of assembly would be turbine and float agnostic.

- Multiple shift working could be employed.

My project management involvement tells me, that it would not be unreasonable to assemble, at least one complete turbine and its float and accessories in a working day.

I can do a small calculation.

The average size of turbine is 15 MW.

One turbine is assembled per day.

There are 300 working days possible in a year with multiple shift working, ignoring Bank Holidays and bad weather.

Just one site could produce 4.5 GW of floating wind turbines per year.

How Many Production Sites Could There Be?

These are surely the best possibilities.

- Barrow

- Belfast

- Clyde

- Devon/Cornwall

- Forth Estuary

- Great Yarmouth

- Haven Ports

- Holyhead

- Humber

- Liverpool

- Milford Haven

- Peterhead

- Southampton Water

- South Wales

- Teesside

- Thames Estuary

I have named sixteen areas, that could be suitable for the assembly of floating wind turbines.

So let’s assume that eight will be developed. That could mean as much as 36 GW of capacity per year.

The Energy Density Of Floating Wind Farms

In ScotWind Offshore Wind Leasing Delivers Major Boost To Scotland’s Net Zero Aspirations, I summarised the latest round of Scotwind offshore wind leases.

- Six new fixed foundation wind farms will give a capacity of 9.7 GW in 3042 km² or about 3.2 MW per km².

- Ten new floating wind farms will give a capacity of 14.6 GW in 4193 km² or about 3.5 MW per km².

Returning to the earlier calculation, which says we could have the ability to create 36 GW of wind turbines per year, with 15 MW turbines, this means with a generating density of 3.5 MW per km², the 36 GW would take up around a hundred kilometre square of sea.

Conclusion

We will become Europe’s powerhouse.