UK ESO Unveils GBP 58 Billion Grid Investment Plan To Reach 86 GW of Offshore Wind By 2035

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Great Britain’s electricity system operator (ESO) has proposed a GBP 58 billion (approximately EUR 68 billion) investment in the electricity grid. The proposal outlines a vision for incorporating an additional 21 GW of offshore wind into the grid by 2035, which would bring the country’s total offshore wind capacity to a potential 86 GW.

These three paragraphs add more details to what the investment in the grid means for offshore wind.

The ESO released on 19 March the first Beyond 2030 report. The plan sets up the necessary infrastructure to transfer power to and from future industries, as electricity demand is expected to rise by 64 per cent by 2035, according to the ESO.

The grid operator said that the plan connects a further 21 GW of offshore wind in development off the coast of Scotland to the grid in an efficient and coordinated way which would bring the country’s total offshore wind capacity to a potential 86 GW.

The proposals could assist the UK government in meeting the sixth Carbon Budget and allow for the connection of Crown Estate Scotland’s ScotWind leasing round.

These are my thoughts.

How Much Offshore Wind Is In The Pipeline?

This Wikipedia entry is a List Of Offshore Wind Farms In The United Kingdom.

It gives these figures for wind farms in various operational an development states.

- Operational – 14,703 MW

- Under Construction – 5,202 MW

- Pre-Construction – 6,522 MW

- Contracts for Difference – Round 3 – 12 MW

- Contracts for Difference – Round 4 – 1,428 MW

- Early Planning – England – 18,423 MW

- Early Planning – Wales – 700 MW

- Early Planning – Scotland – 30,326 MW

Note.

- These add up to a total of 77,316 MW.

- If all the wind farms in the Wikipedia entry are commissioned, the UK will be short of the 86,000 MW total by 8,664 MW.

- Some wind farms like Ossian could be increased in size by a few GW, as I reported in Ossian Floating Wind Farm Could Have Capacity Of 3.6 GW.

It looks like only another 7,164 MW of offshore wind needs to be proposed to meet the required total.

This article on offshoreWIND.biz is entitled The Crown Estate Opens 4.5 GW Celtic Sea Floating Wind Seabed Leasing Round, will add another 4,500 MW to the total, which will raise the total to 81,816 MW.

The article also finishes with this paragraph.

Round 5 is expected to be the first phase of development in the Celtic Sea. In November 2023, the UK Government confirmed its intention to unlock space for up to a further 12 GW of capacity in the Celtic Sea.

A further 12 GW of capacity will take the total to 93,816 MW.

In Three Shetland ScotWind Projects Announced, I talked about three extra Scotwind wind farms, that were to be developed to the East of Shetland.

These will add 2.8 GW, bringing the total to 96,616 MW.

I don’t think the UK has a problem with installing 86 GW of offshore wind by 2035, so we must create the electricity network to support it.

The Electricity Network In 2024

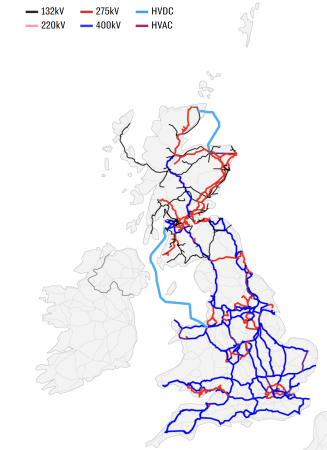

I clipped this map from this article in The Telegraph, which is entitled Britain’s Energy System Will Not Hit Net Zero Until 2035, National Grid Tells Labour.

The dark blue lines are the 400 kV transmission lines.

- The one furthest East in East Anglia serves the Sizewell site, which hosts the Sizewell B nuclear power station and will be the home of Sizewell C nuclear power station, unless the Green or LibDem Parties are a member of a coalition government.

- Kent and Sussex seem to be encircled by 400 kV lines, with small spurs to the interconnectors to Europe.

- Two 400 kV lines appear to serve the South-West peninsular, with one going along the South Coast and the other further North. I suspect these two motorways for electricity explain, why the Morocco-UK Power Project terminates in Devon.

- London seems to have its own M25 for electricity.

- There also appears to be an East-West link to the North of London linking Sizewell in the East and Pembroke in the West. Both ends have large power stations.

- There also appear to be two 400 kV lines from Keadby by the Humber Estuary to North Wales with the pumped storage hydro power station at Dinorwig.

- Two more 400 kV lines link Yorkshire to the South of Scotland.

- A lonely Northern cable connects Edinburgh and the North of Scotland.

The red lines, like the one encircling central London are the 275 kV transmission lines.

- Think of these as the A roads of the electricity network.

- They encircle London often deep underground or under canal towpaths.

- They reinforce the electricity network in South Wales.

- Liverpool appears to have its own local network.

- They also seem to provide most of the capacity North of and between Edinburgh and Glasgow.

Newer cables are starting to appear on this map.

There are two light blue cables and these are HVDC cables that run underwater.

- The 1.2 GW Caithness – Moray Link does what it says in the name and it connects the far North of Scotland direct towards Aberdeen.

- The much larger 2.25 GW Western HVDC Link connects Hunterston near Glasgow to Flintshire Bridge near Liverpool. Note how it passes to the West of the Isle of Man.

Not shown on the map are the smaller 500 MW Moyle Interconnector and the recently-opened 600 MW Shetland HVDC Connection.

The Electricity Network In 2050

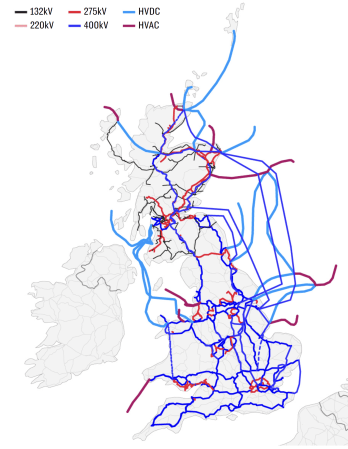

This second map shows how the network will look in 2050.

Note.

- The colours are the same, as the previous map.

- Although, I do think there are some errors in which have been used.

- There are a lot more cables.

There are several more light blue cables and these are HVDC cables that run underwater.

- Shetland is now linked to the North of Scotland by the Shetland HVDC Connection.

- There appears to be a cluster of HVDC interconnectors at Caithness HVDC switching station, near Wick, including a new one to Orkney, to go with the others to Moray and Shetland.

- The 2 GW Scotland England Green Link 1 will run from Torness in Southeast Scotland to Hawthorn Pit substation in Northeast England.

- The 2 GW Eastern Green Link 2 will run from Sandford Bay, at Peterhead in Scotland, to the Drax Power Station in Yorkshire, England.

- There also appear to be two or possibly three other offshore cables linking the East Coast of Scotland with the East Coast of England.

- If the Eastern cables are all 2 GW, that means there is a trunk route for at least 8 GW between Scotland’s wind farms in the North-East and Eastern England, which has the high capacity wind farms of Dogger Bank, Hornsea and around the Lincolnshire and East Angliam coasts.

- Turning to the Western side of Scotland, there appears to be a HVDC connection between the Scottish mainland and the Outer Hebrides.

- South-West of Glasgow, the Western HVDC Link appears to have been duplicated, with a second branch connecting Anglesey and North-West Wales to Scotland.

- The Moyle Interconnector must be in there somewhere.

- Finally, in the South a link is shown between Sizewell and Kent. It’s shown as 400 kV link but surely it would be a HVDC underwater cable.

There are also seven stubs reaching out into the sea, which are probably the power cables to the wind farms.

- The red one leading from South Wales could connect the wind farms of the Celtic Sea.

- The blue link North of Northern Ireland could link the MachairWind wind farm to the grid.

- The other two red links on the West Coast of Scotland could link to other ScotWind wind farms.

- The red link to the North of East Anglia could link RWE’s Norfolk wind farms to the grid.

- The other stubs in the East could either connect wind farms to the grid or be multi-purpose interconnectors linking to Germany and the Netherlands.

It looks to me, that National Grid ESO will be taking tight control of the grid and the connected wind farms, as an integrated entity.

As a Graduate Control Engineer, I can’t disagree with that philosophy.

Hydrogen Production

In How Germany Is Dominating Hydrogen Market, I talked about how Germany’s plans to use a lot of hydrogen, will create a large world-wide demand, that the UK because of geography and large amounts of renewable energy is in an ideal place to fulfil.

I can see several large electrolysers being built around the UK coastline and I would expect that National Grid ESO have made provision to ensure that the electrolysers have enough electricity.

Would I Do Anything Different?

Consider.

- If it is built the Morocco-UK Power Project will terminates in Devon.

- There could be more wind farms in the Celtic Sea.

- It is likely, that the wind farms in the Celtic Sea will connect to both Pembroke and Devon.

- Kent has interconnectors to the Continent.

Would a Southern HVDC link along the South Coast between Devon and Kent be a good idea?

Conclusion

Looking at the proposed list of wind farms, a total in excess of 96 GW could be possible, which is ten GW more than needed.

The network not only serves the UK in a comprehensive manner, but also tees up electricity for export to Europe.

UK Offshore Wind And CCS Colocation Projects Kick Off

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Offshore Wind and Carbon Capture and Storage (CCS) Colocation Forum (the Forum), set up to provide strategic coordination of colocation research and activity on the nation’s seabed, has commissioned two research projects.

These first two paragraphs, which set objectives and possible methods for the two projects.

The projects are designed to inform the best approach to test and demonstrate the colocation of offshore wind and CCS activities in the future.

The research projects – Project Colocate and Project Anemone – build on the Forum’s Spatial Characterisation Report, which identified areas of potential overlap for offshore wind and CCS on the seabed, and NSTA’s Seismic Imaging Report, which explored various options for monitoring carbon storage and offshore wind sites to help resolve possible colocation issues.

These are the two projects.

Project Colocate, which is described in the article like this.

Delivered by the University of Aberdeen with funding from the Crown Estate and Crown Estate Scotland, Project Colocate will investigate the viability of areas on the seabed for colocation of CCS and offshore wind, with bespoke monitoring plans for each area.

Researchers from the University of Aberdeen will focus their investigations on the East Irish Sea and Central North Sea, both of which have been identified as having significant potential for future colocation of CCS and offshore wind, according to the Crown Estate.

Project Anenome, which is described in the article like this.

The complementary Project Anemone will explore mutually beneficial opportunities arising from the colocation of these developing industries.

The project aims to identify and map the routes to realising these opportunities to create practical guidance for how offshore wind and CCS technologies can operate alongside each other – from construction to decommissioning.

It does appear to be a lot of sensible thinking and words, although neither project appears to yet have a website.

This paragraph is a nice tailpiece to the article.

To achieve the UK’s net zero targets, the UK Government is targeting the delivery of 50 GW of offshore wind energy and the capture of 20-30 million tonnes of CO2 per year by 2030.

I’ve mentioned 50 GW of offshore wind before, but 20-30 million tonnes is a lot of CO2.

New Plan To Lay Out Path For UK Offshore Wind Growth Expected In Early 2024

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

RenewableUK, the Offshore Wind Industry Council (OWIC), the Crown Estate, and Crown Estate Scotland are developing a new Industrial Growth Plan (IGP) to boost the long-term growth of the UK offshore wind sector.

These two paragraphs outline the plan.

The industry players have appointed KPMG to support the development of the IGP which is expected to be published early next year.

The IGP will build on the recent Supply Chain Capability Analysis which outlined a GBP 92 billion opportunity for the country if it can develop its capacity and expertise in a number of key areas, according to RenewableUK.

When plans like this are announced, I wish I was still involved in writing project management software.

Flotation Energy, Vårgrønn Seal Exclusivity Agreements For 1.9 GW Scottish Floaters

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Vårgrønn, a joint venture between Plenitude (Eni) and HitecVision, and Flotation Energy have signed exclusivity agreements for two floating offshore wind developments under Crown Estate Scotland’s Innovation and Targeted Oil and Gas (INTOG) leasing round.

These two paragraphs give more details.

Once completed, the floating offshore wind farms, with up to a total of 1.9 GW capacity, will provide renewable electricity to oil and gas platforms, aiming to reduce carbon emissions from the assets they supply.

In addition, Green Volt and Cenos projects will also provide electricity to the UK grid.

Note.

I can’t see a loser with these wind farms.

- The wind farms provide zero-carbon electricity to oil and gas platforms.

- These platforms cut their emissions, by not using fossil fuels to generate the electricity they need for their operation.

- Some platforms use gas to generate the electricity, so this gas can be delivered to the shore for the UK gas network.

- Any spare electricity will be available for using in the UK electricity grid.

- Crown Estate Scotland will be paid for the lease for the wind farm.

There will be no carbon emissions from the platforms, but there will be extra onshore emissions from any gas that is currently used to power the platforms, if it is burnt onshore in power stations and industrial processes, or used for heating.

But increasingly gas in the UK will be used in applications, where the carbon emissions can be captured for use or storage.

It will be very interesting to see how as offshore operations are decarbonised our total carbon emissions change.

Offshore Wind Could Secure Scottish Green Hydrogen Potential – Report

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

New and existing offshore wind farms could help generate large amounts of green hydrogen and support the UK and EU meet their net zero targets, if the necessary infrastructure can be put in place, according to a new report commissioned by Crown Estate Scotland.

This page on the Crown Estate Scotland gives the full report.

The report contains a lot of interesting information.

Crown Estate Scotland Joins Scapa Flow Deepwater Port Plan

The title of this post is the same as that of this article on Riviera Maritime Media.

This is the sub-heading.

Orkney Islands Council (OIC) and Crown Estate Scotland have signed an agreement to work together in developing a deepwater quay at Scapa Flow

The picture and the words, indicate it is not a small facility.

The final comment of Crown Estate Scotland’s director of marine Colin Palmer, are a strong statement of intent about how Crown Estate Scotland will help Scotland towards net-zero.

13 Offshore Wind Projects Selected In World’s First Innovation And Targeted Oil & Gas Leasing Round

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Crown Estate Scotland has selected 13 out of a total of 19 applications with a combined capacity of around 5.5 GW in the world’s first leasing round designed to enable offshore wind energy to directly supply offshore oil and gas platforms.

This paragraph outlines INTOG (Innovation and Targeted Oil & Gas) and its objectives.

INTOG, which has been designed in response to demand from government and industry to help achieve the targets of the North Sea Transition Sector Deal through decarbonising North Sea oil and gas operations, is also expected to further stimulate innovation in Scotland’s offshore wind sector, create additional supply chain opportunity, assist companies to enter the renewable energy market, and support net-zero ambitions.

This is undoubtedly the most important news of the day.

- When complete it will generate 5416 MW of electricity.

- 4068 MW will be used primarily to decarbonise oil and gas platforms with surplus electricity going to the grid.

- The amount of carbon dioxide released by oil and gas platforms in the North Sea will be reduced.

- The gas saved by decarbonising oil and gas platforms, will be transported to the shore and used in the UK gas grid.

- 449 MW will be generated in innovative ways in small wind farms, with a capacity of less than 100 MW.

One of the benefits of INTOG is that the UK will be able to reduce gas imports, which must increase energy security.

This map from this document from the Crown Estate Scotland, shows the INTOG wind farms.

This is a list of the farms.

- 1 – Bluefloat Energy/Renantis Partnership – Innovation – Commercial – 99.45 MW

- 2 – Bluefloat Energy/Renantis Partnership – Innovation – Supply Chain – 99.45 MW

- 3 – Simply Blue Energy (Scotland) – Innovation – Supply Chain – 100 MW

- 4 – BP Alternative Energy Investments – Innovation – New Markets – 50 MW

- 5 – ESB Asset Development – Innovation – Cost Reduction – 100 MW

- 6 – Floatation Energy – Targeted Oil & Gas – 560 MW

- 7 – Cerulean Winds – Targeted Oil & Gas – 1008 MW

- 8 – Harbour Energy – Targeted Oil & Gas – 15 MW

- 9 – Cerulean Winds – Targeted Oil & Gas – 1008 MW

- 10 – Cerulean Winds – Targeted Oil & Gas – 1008 MW

- 11 – Floatation Energy – Targeted Oil & Gas – 1350 MW

- 12 – TotalEnergies – Targeted Oil & Gas – 3 MW

- 13 – Harbour Energy – Targeted Oil & Gas – 15 MW

Note.

- These total up to 5.42 GW.

- The five Innovation sites seem to be as close to the coast as is possible.

- I thought some Innovation sites would be closer, so supply difficult to reach communities, but they aren’t.

- Floatation Energy and Cerulean Winds seemed to have bagged the lion’s share of the Targeted Oil & Gas.

- Sites 6 and 7 sit either side of a square area, where Targeted Oil & Gas will be considered. Is that area, the cluster of oil and gas facilities around Forties Unity, shown on the map in this page on the BP web site?

- Harbour Energy have secured two 15 MW sites for Targeted Oil & Gas.

These are my thoughts on the various companies.

Bluefloat Energy

Bluefloat Energy has posted this press release on their web site, which is entitled Bluefloat Energy | Renantis Partnership Bid Success For Two 99mw Innovation Projects In Crown Estate Scotland’s INTOG Process.

The press release starts with these three bullet points.

- BlueFloat Energy | Renantis Partnership offered exclusivity rights to develop its Sinclair and Scaraben floating wind projects north of Fraserburgh – leveraging synergies via its 900MW Broadshore project.

- The projects seek to trial innovative floating wind technology solutions, kick-starting supply chain growth and job creation in Scotland and providing a ‘stepping-stone’ to the partnership’s ScotWind projects.

- Bid proposals include the intention to develop a scalable community benefit model – creating a potential blueprint for floating offshore wind in Scotland.

The first three paragraphs expand the bullet points.

The BlueFloat Energy and Renantis Partnership has been offered seabed exclusivity rights to develop two 99MW projects under the innovation arm of Crown Estate Scotland’s INTOG (Innovation and Targeted Oil & Gas) auction process. The auction saw ten projects bid to bring forward the development of small-scale innovation projects.

The Sinclair and Scaraben projects, located north of Fraserburgh and adjacent to the Partnership’s 900MW Broadshore project, seek to trial innovative foundation technologies, associated fabrication works and mooring systems with a view to maximising opportunities for the Scottish supply chain, driving local investment and job creation.

A key element of the bid proposals is the opportunity to test and adapt a community benefit model, governed independently, and directed by the communities in which the schemes will operate, through collaboration with our supply chain and project partners. The model could create a blueprint, shaping the future of community benefit from floating offshore wind throughout the whole of Scotland. This builds on Renantis’ successful track record of deploying similar schemes via its onshore wind farms in Scotland.

Note.

- Companies called Sinclair Offshore Wind Farm and Scaraben Offshore Wind Farm were registered a few months ago in Inverness.

- I couldn’t find the websites, so I suspect they’re still being created.

- These two projects appear to be pathfinders for the 900 MW Broadshore project, with regards to the supply chain and community involvement.

It certainly looks like the partnership are going about the development of these two projects in a professional manner.

BP Alternative Energy Investments

There has been no press release from BP as I write this, so I will have to deduce what BP are planning.

This map from this document from the Crown Estate Scotland, shows the Southern INTOG wind farms.

Note.

- Site 4 is the site of BP Alternative Energy Investments’s proposed wind farm.

- Sites 6 and 7 could be either side of the cluster of platforms around Forties Unity.

Consider.

- In the wider picture of wind in the North Sea, BP’s proposed 50 MW wind farm is a miniscule one. SSE Renewables’s Dogger Bank wind farm is over a hundred times as large.

- A cable to the shore and substation for just one 50 MW wind farm would surely be expensive.

- BP Alternative Energy Investments are also developing a 2.9 GW wind farm some sixty miles to the South.

- It would probably be bad financial planning to put large and small wind farms so close together.

For these are other reasons, I believe that there is no reason to believe that the proposed 50 MW wind farm is a traditional wind farm.

But if I’m right about sites 6 and 7 indicating the location the position of Forties Unity, it might open up other possibilities.

This document from INEOS, who own the Forties Pipeline System, explains how the pipeline works.

The Forties Pipeline System (FPS) is an integrated oil and gas transportation and processing system. It is owned and operated by INEOS and utilises more than 500 miles of pipeline to smoothly transport crude oil and gas from more than 80 offshore fields for processing at the Kinneil Terminal. At Kinneil the oil and gas are separated, with the oil returned as Forties Blend to customers at Hound Point or pumped to the Petroineos refinery at Grangemouth.

At the same time the gas goes to our LPG export facilities or is supplied to the INEOS petrochemical plant. FPS transports around 40% of the UK’s oil production supply and brings over 400,000 barrels ashore every day.

In Can The UK Have A Capacity To Create Five GW Of Green Hydrogen?, I said the following.

Ryze Hydrogen are building the Herne Bay electrolyser.

- It will consume 23 MW of solar and wind power.

- It will produce ten tonnes of hydrogen per day.

The electrolyser will consume 552 MWh to produce ten tonnes of hydrogen, so creating one tonne of hydrogen needs 55.2 MWh of electricity.

If BP were to pair the wind farm with a 50 MW electrolyser it will produce 21.7 tonnes of hydrogen per day.

Could it be brought to the shore, by linking it by a pipeline to Forties Unity and then using the Forties Pipeline System?

As the category on site 4, is New Markets, are BP and INEOS investigating new markets for hydrogen and hydrogen blends?

- Some of the latest electrolysers don’t need pure water and can use sea water. This makes them more affordable.

- Do BP and/or INEOS have the capability to extract the hydrogen as it passes through the Cruden Bay terminal, to provide the hydrogen for Aberdeen’s buses and other users?

- INEOS and BP probably have some of the best oil and gas engineers in the world.

- How many other places in the world have an offshore oil or gas field set in a windy sea, where floating wind- turbine/electrolysers could generate hydrogen and send it ashore in an existing pipeline?

- Several of these offshore oil and gas fields and the pipelines could even be owned by BP or its associates.

- Remember that hydrogen is the lightest element, so I suspect it could be separated out by using this property.

This BP site, is to me, one of the most interesting of the successful bids.

- BP probably have a large collection of bonkers ideas, that have been suggested during their long involvement with offshore oil and gas.

- Some ideas could be even suggested by employees, whose fathers worked for BP fifty years ago. I’ve met a few BP employees, whose father also did.

- Will the wind farm, be a floating electrolyser at the centre of a cluster of a few large floating turbines?

- Will each turbine have its own electrolyser and the substation only handle hydrogen?

- Will the floating electrolyser have hydrogen storage?

- Have BP got a floating or semi-submersible platform, that could either go to the breakers or be repurposed as the floating electrolyser?

- Repurposing a previous platform, would make all the right noises.

So many possibilities and so far, no clues as to what will be built have been given.

See also.

Further Thoughts On BP’s Successful INTOG Bid

Cerulean Winds

In What Is INTOG?, I said this about Cerulean Winds.

Cerulean sounds like it could be a sea monster, but it is a shade of blue.

This article on offshoreWind.biz is entitled Cerulean Reveals 6 GW Floating Offshore Wind Bid Under INTOG Leasing Round.

These are the two introductory paragraphs.

Green energy infrastructure developer Cerulean Winds has revealed it will bid for four seabed lease sites with a combined capacity of 6 GW of floating wind to decarbonise the UK’s oil and gas sector under Crown Estate Scotland’s Innovation and Targeted Oil and Gas (INTOG) leasing round.

This scale will remove more emissions quickly, keep costs lower for platform operators and provide the anchor for large-scale North-South offshore transmission, Cerulean Winds said.

Note.

-

- It is privately-funded project, that needs no government subsidy and will cost £30 billion.

- It looks like each site will be a hundred turbines.

- If they’re the same, they could be 1.5 GW each.

- Each site will need £7.5 billion of investment. So it looks like Cerulean have access to a similar magic money tree as Kwasi Kwarteng.

Effectively, they’re building four 1.5 GW power stations in the seas around us to power a large proportion of the oil and gas rigs.

For more on Cerulean Winds’s massive project see Cerulean Winds Is A Different Type Of Wind Energy Company.

So does it mean, that instead of 6 GW, they were only successful at three sites and the other or others were in the six unsuccessful applications?

There is a press release on the Cerulean Winds web site, which is entitled Cerulean Winds Wins Bid For Three INTOG Floating Wind Sites, where this is said.

Cerulean Winds and Frontier Power International have been awarded three lease options for the Central North Sea in the highly competitive INTOG leasing round, the results of which were announced by Crown Estate Scotland today.

The sites, in the Central North Sea, will enable the green infrastructure developer and its partners to develop large floating offshore windfarms to decarbonise oil and gas assets. The scale of the development will enable a UK wide offshore transmission system, that can offer green energy to offshore assets in any location and create a beneficial export opportunity.

Nothing about unsuccessful applications was said.

This map from this document from the Crown Estate Scotland, shows the Southern INTOG wind farms.

Note.

- Sites 7, 9 and 10 are Cerulean’s sites.

- Sites 6 and 11 are Floatation Energy’s sites.

- Site 4 is BP Alternative Energy Investments’s Innovation site.

- Sites 8, 12 and 13 are much smaller sites.

It looks like Cerulean and Floatation Energy are well-placed to power a sizeable proportion of the platforms in the area.

ESB Asset Development

ESB Asset Development appear to be a subsidiary of ESB Group.

The ESB Group is described like this in the first paragraph of their Wikipedia entry.

The Electricity Supply Board is a state owned (95%; the rest are owned by employees) electricity company operating in the Republic of Ireland. While historically a monopoly, the ESB now operates as a commercial semi-state concern in a “liberalised” and competitive market. It is a statutory corporation whose members are appointed by the Government of Ireland.

This press release, is entitled ESB Offered Exclusive Rights To Develop Innovative 100MW Floating Offshore Wind Project In The Malin Sea.

These two paragraphs outline the project.

ESB today welcomes the outcome of Crown Estate Scotland’s latest seabed leasing process which has resulted in the offer of exclusive development rights to ESB for a 100MW floating wind project in Scottish waters off the north coast of Northern Ireland. The successful project, Malin Sea Wind, is a collaborative bid between ESB and leading technology developers Dublin Offshore Technology and Belfast-based CATAGEN. The outcome underscores ESB’s growing capabilities and expanding presence in the offshore wind industry.

The Innovation and Targeted Oil and Gas (INTOG) seabed leasing process, run by Crown Estate Scotland, aims to drive cost reduction in the offshore wind sector by enabling the deployment of new and innovative technologies, and to harness wind energy to decarbonize the oil and gas sector. Malin Sea Wind aims to support the reduction of floating offshore wind costs by demonstrating Dublin Offshore’s patented load-reduction technology. Furthermore, the project will support decarbonisation of the aviation sector by powering sustainable aviation fuel (SAF) production technology currently under development by net-zero technology specialists, CATAGEN.

Note.

- I’ve just looked at the Technology page of the Dublin Offshore Technology web site.

- In the 1970s, I built large numbers of mathematical models of steel, concrete and water cylinders in my work with a Cambridge University spin-out called Balaena Structures.

- I believe, that an experienced mathematically modeller could simulate this clever system.

That would prove if it works or not!

This Google Map shows the Malin Sea.

Note.

- Malin Head is marked by the red arrows on the Northern Irish coast.

- The most Westerly Scottish island is Islay and the most Easterly is the Isle of Arran.

- Between the two islands is the Kintyre peninsula.

- Portrush can be picked out on the Northern Irish coast.

By overlaying the two maps, I suspect the centroid of the wind farm will be North of Portrush about a few miles North of the Southern end of Arran.

I suspect that if all goes well, there could be a lot of floating wind turbines in the area.

This Google Map shows the River Foyle estuary and Foyle Port to the North-East of Londonderry/Derry.

Note.

- Coolkeeragh ESB and Lisahally biomas power station on the South bank of the River Foyle.

- Lisahally biomas power station has a capacity of 16 MW.

- There appears to be a large substation at Coolkeeragh ESB.

- A tanker of some sort seems to be discharging.

Until told, I’ve guessed wrong, it looks to me like Coolkeeragh ESB could be the destination for the electricity generated by Malin Sea Wind. Given that this project’s aim is cost reduction, a 100 MW wind farm could make a difference.

In addition could Foyle Port be used to assemble and maintain the floating turbines?

Floatation Energy

Floatation Energy have posted this press release on their web site, which is entitled Flotation Energy and Vårgrønn Awarded Exclusivity To Develop Up To 1.9 GW Of Floating Offshore Wind In Scotland.

The first part of the press release, has a graphic.

It shows how their proposed system will work.

- A floating wind farm will be placed between the shore and oil and gas platforms to be decarbonised.

- The wind farm will be connected to the shore by means of a bi-directional cable, so that the wind farm can export electricity to the grid and when the wind isn’t blowing the grid can power the platforms.

- A cable between the wind farm and the platforms completes the system.

It is a simple system, where all elements have been built many times.

Floatation Energy must have been fairly confident that their bids would be successful as they have already named the farms and set up web sites.

- Site 6 – Green Volt – 560 MW

- Site 11 – Cenos – 1350 MW

The websites are very informative.

The Timeline for 2019-2021 on the Green Volt web site describes the describes the progress so far on the project.

2019 – As construction of the Kindardine offshore floating wind farm kicks off, Flotation Energy identifies the Buzzard oil facility (a relatively new oil and gas platform with a long field life and high electrical load) as the optimal starting point for a significant contribution to the North Sea Transition Deal – the process of replacing large scale, inefficient gas-fired power generation with renewable electricity from offshore wind.

2020 – Flotation Energy begins environmental surveys on the Ettrick/Blackbird oil field, a redundant site nearby Buzzard, which is in the process of decommissioning. The “brownfield” site is confirmed as an exceptional opportunity to create an offshore floating wind farm, with water depths of 90-100m and high quality wind resource.

2021 – Flotation Energy works with regulators to understand the potential for project “Green Volt” to decarbonise offshore power generation for Buzzard. Flotation Energy completes and submits an Environmental Scoping report to Marine Scotland, reaching the first major milestone in the Marine Consent process. Crown Estate Scotland announces a new leasing round for Innovation and Targeted Oil and Gas Decarbonisation (INTOG).

On a section on the Cenos web site, there is a section called Efficient Grid Connection, where this is said.

The power generated by the wind turbines will be Alternating Current (AC) and routed to a substation platform. AC power will be exported to the oil and gas platforms.

For efficient export to the UK grid, the substation platform will include a converter station to change the AC power to Direct Current (DC) before the power is transported to shore. This is due to transporting AC power over long distances leading to much of the power being lost.

Cenos is working in partnership with the consented NorthConnect interconnector project, to utilise their DC cable routing where possible. Cenos will also use the NorthConnect onshore converter station planned for Fourfields near Boddam, which then has an agreed link into the Peterhead Substation. This collaboration minimises the need to construct additional infrastructure for the Cenos project.

That all sounds very practical.

Note.

- Floatation Energy delivered the Kincardine offshore floating wind farm.

- Both wind farms appear to use the same shore substation.

- Buzzard oil field is being expanded, so it could be an even more excellent oil field to decarbonise.

- NorthConnect is a bit of an on-off project.

Floatation Energy seem to have made a very professional start to the delivery of their two wind farms.

Harbour Energy

The Wikipedia entry for Harbour Energy describes the company like this.

Harbour Energy plc is an independent oil and gas company based in Edinburgh, Scotland. It is the United Kingdom’s largest independent oil and gas business. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

But if you look at news items and the share price of the company, things could look better for Harbour Energy.

On their map of UK operations, I can count nearly twenty oil and gas fields.

As they have other oil and gas fields around the world, decarbonisation of their offshore operations could increase production by a few percent and substantially cut their carbon emissions.

That is a philosophy that could be good for profits and ultimately the share price.

So has the company gone for a very simple approach of two identical floating wind turbines?

They have been successful in obtaining leases for sites 8 and 13.

- Both have a capacity of 15 MW, so are the farms a single 15 MW wind turbine?

- I think this is likely, unless it is decided to opt for say a 16 MW turbine.

- Or even a smaller one, if the platform is in a bad place for wind.

- The wind turbine would be parked by the platform to be decarbonised and connected up, to a simple substation on the platform.

- I would recommend a battery on the platform, so that if the wind wasn’t blowing, power was still supplied to the platform.

- There would be no need for any cable between shore and wind farm and the only substation, would be a relatively simple one with a battery on the platform.

It could be a very efficient way of decarbonising a large number of platforms.

Once Harbour Energy have proved the concept, I could build a simple mathematical model in Excel, to work out any change in profitability and carbon emissions for a particular oil or gas platform.

Who Is Britannia Ltd?

In this document from the Crown Estate Scotland, there is a section that gives the partners in each project.

Listed for site 8 are Chrysaor (U.K.) and Britannia Limited and for site 13 is Chryasaor Petroleum Company UK Limited.

This page on the Harbour Energy web site gives the history of Chrysaor and Harbour Energy.

This is the heading.

Chrysaor was founded in 2007 with the purpose of applying development and commercial skills to oil and gas assets and to realise their value safely.

This is the history.

The Group grew rapidly over the years through a series of acquisitions. With backing from Harbour Energy – an investment vehicle formed by EIG Global Energy Partners – Chrysaor acquired significant asset packages in the UK North Sea from Shell (2017) and ConocoPhillips (2019) to become the UK’s largest producer of hydrocarbons.

In 2021, Chrysaor merged with Premier Oil to become Harbour Energy plc.

So that explains the use of the Chrysaor name or Chryasaor as someone misspelt it on the Crown Estate Scotland document.

I asked myself, if Britannia Ltd. could be a technology company, so I checked them out. The only company, I could find was a former investment trust, that was dissolved over ten years ago.

But Britannia is an oil and gas field in the North Sea, which is partially owned by Harbour Energy. It has a page on Harbour Enerrgy’s web site, which is entitled Greater Britannia Area.

This is said about the Britannia field.

Britannia in Block 16/26 of the UK central North Sea sits approximately 210-kilometres north east of Aberdeen. The complex consists of a drilling, production and accommodation platform, a long-term compression module of mono-column design and a 90-metre bridge connected to a production and utilities platform. Britannia is one of the largest natural gas and condensate fields in the North Sea. Commercial production began in 1998. Condensate is delivered through the Forties Pipeline to the oil stabilisation and processing plant at Kerse of Kinneil near Grangemouth and natural gas is transported through a dedicated Britannia pipeline to the Scottish Area Gas Evacuation (SAGE) facility at St Fergus.

Looking at the maps on the Crown Estate Scotland, Harbour Energy and others, it looks like site 8 could be close to the

Greater Britannia Area or even the Britannia field itself.

Simply Blue Energy

Simply Blue Energy are developing the 100 MW Salamander wind farm.

I wrote about this project in The Salamander Project.

Did it get chosen, as it was a project, where the design was at an advanced stage?

TotalEnergies

I wouldn’t be surprised to find out that TotalEnergies have gone a very similar route to Harbour Energy, but they are trying it out with a 3 MW turbine.

Conclusion

They are an excellent group of good ideas and let’s hope that they make others think in better and move innovative ways.

Politics will never save the world, but engineering and science just might!

100 MW Scottish Floating Wind Project To Deliver Lifetime Expenditure Of GBP 419 Million

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub heading, that gives more details on lifetime expenditure and full-time equivalent (FTE) jobs created.

The 100 MW Pentland Floating Offshore Wind Farm in Scotland is estimated to deliver lifetime expenditure of GBP 419 million in the UK and to support the creation of up to 1,385 full-time equivalent (FTE) jobs.

It does seem these figures have been compiled using the rules that will apply to all ScotWind leases and have used methods laid down by Crown Estate Scotland. So they should be representative!

Does it mean that a 1 GW floating wind farm would have a lifetime expenditure of £4.19 billion and create 13, 850 full-time equivalent (FTE) jobs?

This article from Reuters is entitled UK Grid Reforms Critical To Hitting Offshore Wind Targets and contains this paragraph.

The government aims to increase offshore wind capacity from 11 GW in 2021 to 50 GW by 2030, requiring huge investment in onshore and offshore infrastructure in England, Wales and Scotland.

If I assume that of the extra 39 GW, half has fixed foundations and half will float, that means that there will be 19.5 GW of new floating wind.

Will that mean £81.7 billion of lifetime expenditure and 270,075 full-time equivalent (FTE) jobs?

Conclusion

It does seem to me, that building floating offshore wind farms is a good way to bring in investment and create full time jobs.

Simply Blue Group And Marine Power Systems To Pursue INTOG Innovation Project Opportunity

The title of this post, is the same as this of this press release from Simply Blue Group.

These two paragraphs explain the proposals.

Marine Power Systems (MPS) have partnered with Simply Blue Group to develop a project proposal for the Innovation and Targeted Oil and Gas (INTOG) leasing round run by Crown Estate Scotland.

The collaboration between Simply Blue Group and MPS would see six wind turbines deployed on the MPS floating platform, PelaFlex, in waters between 60 and 100m in depth, delivering a total capacity of 100MW.

The INTOG proposal, that I outlined in What Is INTOG?, seems to have got engineers and financiers thinking.

Simply Blue Group are quoted saying this about the PelaFlex platform.

MPS has been selected as the preferred technology partner based on the strengths of their structurally efficient tension legged platform which delivers significantly reduced system mass and a smaller mooring footprint than its peers. The technology has been designed to optimise local content delivery through a decentralised logistics model, and those benefits help utility scale developers minimise costs whilst maximising local economic benefits and accelerating industrial scale farm development.

That sounds good to me!

There is also more on the PelaFlex web page including a video.

The Turbine Size

The press release talks of six turbines totalling up to 100 MW, which is probably around 17 MW per wind turbine.

These are no ordinary wind turbines!

About INTOG

The press release also says this about INTOG.

The INTOG leasing round aims to support projects that will directly reduce emissions from oil and gas production (up to a total capacity of 5.7GW) but also drive commercialisation and innovation in offshore wind (up to a total capacity of 500MW) as well as support supply chain development. This forms part of the Scottish Government’s drive to reach net zero emissions by 2045 where the decarbonisation of oil and gas installations is seen as playing an important role in the transition to net zero.

Decarbonisation of our oil and gas fields, will obviously be a good thing because of a reduction of the carbon dioxide emitted. but it will also mean that the gas that would have been used to power the platform can be brought ashore to power industry and domestic heating, or be exported to countries who need it.

Conclusion

INTOG seems to be a good idea, as it is provoking new and innovative designs.