Ørsted Pulls Plug On 2.4 GW Hornsea 4 Offshore Wind Project In UK

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted has discontinued the development of the UK’s Hornsea 4 offshore wind farm in its current form. The developer said the 2.4 GW project has faced rising supply chain costs, higher interest rates, and increased construction and delivery risks since the Contract for Difference (CfD) award in Allocation Round 6 (AR6) in September 2024.

This introductory paragraph adds more detail.

In combination, these developments have increased the execution risk and deteriorated the value creation of the project, which led to Ørsted stopping further spending on the project at this time and terminating the project’s supply chain contracts, according to the Danish company. This means that the firm will not deliver Hornsea 4 under the CfD awarded in AR6.

Consider.

- Hornsea 4 will be connected to the grid at a new Wanless Beck substation, which will also include a battery and solar farm, which will be South West of the current Creyke Beck substation. Are Ørsted frightened of opposition from the Nimbies to their plans?

- I also wonder if political uncertainty in the UK, and the possibility of a Reform UK government, led by Nigel Farage is worrying companies like Ørsted.

So will factors like these prompt companies like Ørsted to move investment to countries, where they welcome wind turbines like Denmark, Germany and The Netherlands.

Could Ørsted Be Looking At An Alternative?

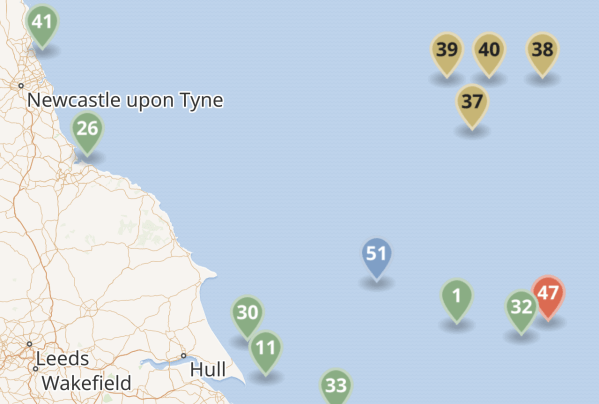

This is a map of wind farms in the North Sea in the Dogger Bank and Hornsea wind farms, that I clipped from Wikipedia..

These are the Dogger Bank and Hornsea wind farms and their developers and size

- 37 – Dogger Bank A – SSE Renewables/Equinor – 1,235 MW

- 39 – Dogger Bank B – SSE Renewables/Equinor – 1,235 MW

- 38 – Dogger Bank C – SSE Renewables/Equinor – 1,218 MW

- 40 – Sofia – RWE – 1,400 MW

- 1 – Hornsea 1 – Ørsted/Global Infrstructure Partners – 1,218 MW

- 32 – Hornsea 2 – Ørsted/Global Infrstructure Partners – 1,386 MW

- 47 – Hornsea 3 – Ørsted – 2,852 MW

- 51 – Hornsea 4 – Ørsted – 2,400 MW

Note.

- That is a total of 12, 944 MW, which is probably enough electricity to power all of England and a large part of Wales.

- Wikipedia’s List of offshore wind farms in the United Kingdom, also lists a 3,000 MW wind farm, that is being developed by German company ; RWE called Dogger Bank South,

- The Dogger Bank South wind farm is not shown on the map, but would surely be South of wind farms 37 to 40 and East of 51.

- The Dogger Bank South wind farm will raise the total of electricity in the Dogger Bank and Hornsea wind farms to just short of 16 GW.

Connecting 16 GW of new electricity into the grid, carrying it away to where it is needed and backing it up, so that power is provided, when the wind doesn’t blow, will not be a nightmare, it will be impossible.

An alternative plan is needed!

AquaVentus To The Rescue!

AquaVentus is a German plan to bring 10 GW of green hydrogen to the German mainland from the North Sea, so they can decarbonise German industry and retire their coal-fired power stations.

- I introduce AquaVentus in AquaVentus, which I suggest you read.

- AquaVentus is being developed by RWE.

- AquaVentus connects to a German hydrogen network called H2ercules to actually distribute the hydrogen.

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

I believe that offshore electrolysers could be built in the area of the Hornsea 4 and Dogger Bank South wind farms and the hydrogen generated would be taken by AquaVentus to either Germany or the UK.

- Both countries get the hydrogen they need.

- Excess hydrogen would be stored in Aldbrough and Rough.

- British Steel gets decarbonised.

- A 1.8 GW hydrogen-fired powerstation at Keadby gets the hydrogen it needs to backup the wind farms.

Germany and the UK get security in the supply of hydrogen.

These may be my best guesses, but they are based on published plans.

New York Governor: ‘I Will Not Allow This Federal Overreach To Stand’

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Following the order of the US Department of the Interior (DOI) to halt all construction activities on the Empire Wind 1 offshore wind project, New York Governor Kathy Hochul said she would fight the federal decision.

This fight could get very nasty.

In the green corner, we have the New York governor; Kathy Hochul, Østed, Denmark and probably a lot of workers who thought they’d retrained for a new growing industry.

And in the orange corner, we have Donald Trump, Vladimir Putin and all the other useful idiots.

Interestingly, I may have met one of referees to this spat.

In The Lady On The Train, I describe a meeting with one of the most powerful justices in the United States.

As she either sat on the US Supreme Court or the New York State Supreme Court, it will be interesting how she would judge this case, given the liberal scientifically-correct conversation we had a few years ago.

The fight in the Courts would be very hard against a whole bench of formidable adversaries like this lady.

Ørsted Breaks Ground On Innovative UK Battery Energy Storage System

The title of this post, is the same as that, as this news item from Ørsted.

This is the sub-heading.

Ørsted, a global leader in offshore wind energy, has marked breaking ground for its first large-scale UK battery energy storage system (BESS) with a golden shovel ceremony.

These four paragraphs give more details of the project.

Located alongside Ørsted’s Hornsea 3 Offshore Wind Farm, near Norwich, Norfolk, the system will have a capacity of 600 MWh (and a 300 MW power rating), equivalent to the daily power consumption of 80,000 UK homes.

The golden shovel ceremony officially kicks off the construction phase of the project, known as Iceni after the Norfolk-based warrior tribe of the Roman era. It is expected to be operational by the end of 2026.

Preparatory works are now complete and the Ørsted, Knights Brown and Tesla Iceni team will continue with the remainder of the installation.

When completed, the battery energy storage system will be one of the largest in Europe.

Note.

- The batteries themselves are from Tesla.

- The project was previously known as the Swardeston BESS.

- The project will be located near to the Swardeston substation to the South of Norwich.

- The project doesn’t seem very innovative to me, as it appears to be a BESS built from Tesla batteries.

Like many batteries, it is designed to supply power for two hours.

Ørsted’s Earnings from Operational Offshore Wind Farms Up 20 Pct

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted has reported 2024 earnings from its operational offshore wind farms of DKK 23.8 billion (approximately EUR 3.2 billion), up by 20 per cent compared to 2023.

And this is the introductory paragraph.

The global offshore wind developer said on 6 February the increase was mainly due to the ramp-up of generation at Greater Changhua 1 and 2a offshore wind project in Taiwan, South Fork in the US, and Gode Wind 3 in Germany, as well as higher wind speeds, higher pricing of the inflation-indexed CfDs and green certificates. The increase in 2024 was dampened by lower availability, according to the company.

I don’t think Trummkopf would get those sort of returns, if he invested any of his own money in his plan for the “Riviera of the Middle East”.

Although my American friend ; Jack and his family enjoyed themselves in the Lebanon in the 1960s, when he lectured at the American University of Beirut.

On the other hand this article in The Times is entitled Trump’s Gaza Plan Watered Down Amid Backlash From Allies.

UK Wind Risks ‘Exponentially Rising’ Curtailment Without Energy Storage

The title of this post, is the same as that of this article on Recharge.

This is the sub-heading.

UK liquid battery pioneer Highview Power is working with renewable energy giant Orsted on plan to store excess power from its Hornsea offshore wind projects

This is the introductory paragraph.

The UK wind sector faces “exponentially” increasing curtailment of assets without a rapid rollout of energy storage, says the chief of liquid battery pioneer Highview Power, which is working with Orsted on a project to store excess offshore wind power.

The article also states that according to Octopus Energy, this cost could have been as high as a billion pounds last year.

In Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, I described how Ørsted were planning to build a large BESS near the Swardeston substation in Norfolk, where the Hornsea 3 wind farm will connect to the grid.

Have Ørsted decided to put a Highview Power battery on the Swardeston site, as it can be a bigger battery, as Highview Power talk about 200MW/2.5GWh capacity batteries on the projects page of the web site?

Highview also say this about co-operation with Ørsted on that page.

Highview Power and Ørsted’s joint study shows that the co-location of LAES with Ørsted’s offshore wind offers a step forward in reducing wind curtailment, and helping to move to a more flexible, resilient zero carbon grid.

The words are accompanied by pictures of a smart gas storage site, which shows four of the largest tanks, that might be used to store LNG.

In Could A Highview Power CRYOBattery Use A LNG Tank For Liquid Air Storage?, I estimated that one of the largest LNG tanks could hold about a GWh of energy.

So Highview Power’s visualisation on their project page would be a 4 GWh battery.

.

Lakeside Facility Connects To Grid And Becomes UK’s Largest Transmission Connected Battery

The title of this post, is the same as that of this press release from National Grid.

These three bullet points, act as sub-headings.

- National Grid plugs TagEnergy’s 100MW battery project in at its Drax substation.

- Following energisation, the facility in North Yorkshire is the UK’s largest transmission connected battery energy storage system (BESS).

- The facility is supporting Britain’s clean energy transition, and helping to ensure secure operation of the electricity system.

This paragraph introduces the project.

A battery storage project developed by TagEnergy is now connected and energised on the electricity transmission network, following work by National Grid to plug the facility into its 132kV Drax substation in North Yorkshire.

- Lakeside Energy Park’s 100MW/200MWh facility is now the largest transmission connected BESS project in the UK following energisation.

- The new facility will boost the capacity and flexibility of the network, helping to balance the system by soaking up surplus clean electricity and discharging it back when the grid needs it.

- To ensure a safe connection, National Grid, working with its contractor Omexom, upgraded its Drax 132kV substation to accommodate the additional clean power.

- Works included extending the busbars – which enable power flows from generation source on to power lines – upgrading busbar protection and substation control systems, and installing an operational tripping scheme, all of which helps keep the network stable and operating securely.

Owned and operated by TagEnergy – with Tesla, Habitat Energy and RES as project partners – the newly-connected battery will help exploit the clean electricity potential of renewable projects in the region, storing and releasing green energy to power homes and businesses and also helping to relieve any system constraints.

National Grid’s adjacent Drax 400kV substation already hosts the connection for Drax power station – the UK’s largest biomass facility – and will also connect the Eastern Green Link 2 electrical superhighway when it starts importing clean energy from Scotland in 2029.

Drax power station seems to be growing into a large node with several gigawatts of electricity, the UK’s largest BESS, a large biomass power station and the Eastern Green Link 2 electrical superhighway which will import clean energy from Scotland from 2029.

Drax appears to be transforming from the dirty man of the UK into a Jolly Green Giant.

I can see further power stations and sources, storage devices and technology joining the party at Drax.

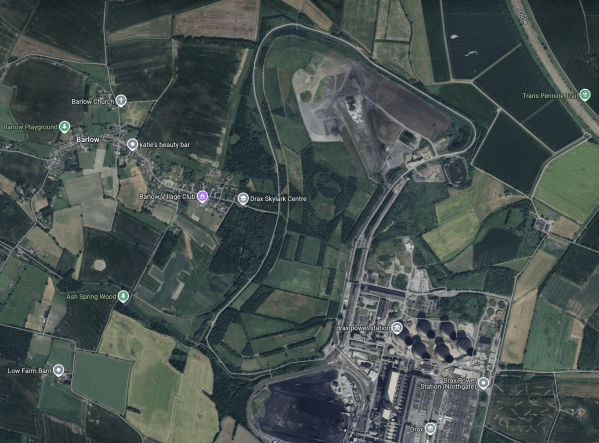

This Google Map shows the Drax site.

Note.

- The cooling towers can be picked out in the South-East quarter of the map.

- The site is rail and road connected, with the River Ouse nearby.

- There is a lot of space.

Surely, Drax would have a big enough space, with a high quality and high capacity electrical connection for Ørsted and Highview Power to put one of their three 200 MW/2.5 GWh batteries, that I talked about in Centrica Business Solutions And Highview Power.

South Korean Firm To Supply Power Equipment For Ørsted’s Hornsea 4 Offshore Wind Farm

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Denmark’s Ørsted has awarded a contract to Hyosung Heavy Industries for the supply of ultra-high voltage power equipment for the Hornsea 4 offshore wind farm in the UK

These two paragraphs add a bit of detail.

Under the contract, the South Korean company will supply 400 kV ultra-high voltage transformers and reactors, essential components for improving power quality for the 2.4 GW Hornsea 4 offshore wind project.

The most recent contract further strengthens the company’s presence in Europe, where it has accumulated over 1 trillion won (about EUR 667 million) in orders this year, as reported by the company.

Hyosung Heavy Industries seem to be doing rather well at supplying electrical gubbins in Europe.

But then Korean companies seem to be doing well in Europe and especially the UK, after the state visit of the Korean President and his wife in November 2023.

In the last century, we did very well dealing with Korean companies with Artemis; the project management computer system, that I wrote.

In Hyundai Heavy Sets Sights On Scottish Floating Offshore Wind, I describe some of our dealings there.

Conclusion

From other posts, I have written, it looks like the UK and Korea are building a strong partnership with offshore wind, and a secondary one with tidal power might be emerging. We also shouldn’t forget the partnership in North London over football.

BOEM Links Up With US Department of Defense On Offshore Wind

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The US Bureau of Ocean Energy Management (BOEM) and the Department of Defense (DOD) have signed a memorandum of understanding (MoU) to support the coordinated development of offshore wind on the US Outer Continental Shelf (OCS).

These three paragraphs give more details of the agreement.

The agreement calls for DOD and BOEM to find mutual solutions that support renewable energy in a manner compatible with essential military operations.

The MoU also requires the organizations to collaborate early in the offshore wind leasing process and maintain regular communication at all levels.

Additionally, the agreement calls for DOD and BOEM to determine what areas should be deferred from leasing to enable the performance of DOD activities on the OCS.

I feel this is a very sensible agreement, as time progress, I’m sure that the co-operation will lead to several joint projects.

- Support boats ensuring safety, like the deal between Ørsted and the RNLI, that I talked about in Ørsted Evolves Long-Standing Partnership With RNLI,

- Offshore structures like electrolysers and substations could have a secondary use as military training facilities.

- Smaller ships, like minehunters, coastguard cutters and fishery protection vessels could go electric and the wind farms could provide charging facilities.

If the United States Navy are hanging around the wind farms, it might discourage Putin’s friends.

Wind farms and the US military could be good neighbours.

Brendan Owens, who is the Assistant Secretary of Defense for Energy, Installations, and Environment, said this.

We will continue to work with BOEM and our other interagency partners, to find solutions that enable offshore wind development while ensuring long-term compatibility with testing, training, and operations critical to our military readiness.

Other nations with large amounts of continental shelf and ambitions to install large amounts of offshore wind like Australia, Belgium, Canada, Denmark, France, Germany, the Netherlands, Portugal, Spain and the UK could do worse that follow the American strategy.

Ørsted Evolves Long-Standing Partnership With RNLI

The title of this post, is the same as this news item from Ørsted.

This is the sub-heading.

Ørsted, the global leader in offshore wind power and one of the largest renewable energy companies in the world, has announced the latest phase of its long-standing partnership with the Royal National Lifeboat Institution (RNLI).

These three paragraphs give a few more details of the partnership.

Over the next two years, Ørsted will provide more than £140,000 to help the charity in its mission to save lives at sea.

The RNLI is the charity that saves lives at sea and its volunteers provide a 24-hour search and rescue service across the British Isles.

Established in 2015, the partnership previously focused on supporting seven individual lifeboat stations in areas where Ørsted operates its offshore windfarms and is now evolving to support even more lifeboat stations.

Little is said about what benefits Ørsted get from the partnership.

Although, this is said.

Previously focused on supporting seven individual lifeboat stations in areas where Ørsted operates its offshore windfarms.

Does this mean, that for small incidents, the RNLI can do the rescue or perhaps tow a broken-down workboat to the shore?

In a busy area, the RNLI might even act as backup to Ørsted’s own safety boat, if a second incident occurred.

It might be a more affordable way to ensure safe operation, which is obviously paramount.

Conclusion

As the partnership is being extended, it must surely have been working well.

Equinor Acquires Minority Stake In Ørsted, Becomes Second-Largest Shareholder

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Norway-headquartered Equinor has acquired a 9.8 per cent minority stake in Denmark’s Ørsted, making it the second-largest shareholder behind the Danish state, which holds a controlling stake in the company.

These are the first two paragraphs.

According to Equinor, the company is supportive of Ørsted’s strategy and management and is not seeking board representation.

“Equinor has a long-term perspective and will be a supportive owner in Ørsted. This is a counter-cyclical investment in a leading developer, and a premium portfolio of operating offshore wind assets”, said Anders Opedal, CEO of Equinor.

Could it also be two Scandinavian companies getting together to put up a stronger front to outside interests?

Are they frightened of the actions that might be taken by Great British Energy and by the Germans with their massive thirst for hydrogen?