German Wind Tender Awards 3.46 GW Amid Record Demand, Lower Prices

The title of this post, is the same as that of this article on Renewables Now.

These are the first three paragraphs.

Germany’s Federal Network Agency (BNetzA) selected 415 projects with a combined capacity of 3,456 MW in the last onshore wind tender round for 2025, seeing record interest in the procedure and falling prices.

Until the deadline of November 1, as many as 905 bids totalling 8,155 MW were submitted, while the target was 3,450 MW. As many as 37 projects had to be excluded from the competition, the agency said on Thursday.

The value of the successful bids ranged between EUR 0.058 (USD 0.068) per kWh and EUR 0.0612 per kWh. The average volume-weighted award price stood at EUR 0.0606 per kWh, which is below the value of EUR 0.0657 per kWh in the previous round and significantly lower than the maximum possible amount of EUR 0.0735 per kWh.

Note.

- These figures show that the German onshore wind market is healthy and the price of the electricity is falling.

- The procedure marks the fourth onshore wind tender round for 2025. In the previous three rounds, the Federal Network Agency allocated capacities of 3,448 MW, 3,447 MW and 4,094 MW, respectively, so with this round’s 3,456 MW, that makes 14.445 GW or about four-and-a-half Hinckley Point Cs.

- Germany is 45 % larger than the UK in terms of land area.

If we were installing wind turbines at the same rate as the Germans, we’d have installed a few megawatts short of ten gigawatts onshore in the same period of time.

I have some thoughts on these figures.

Does More Onshore Wind Mean Lower Electricity Prices?

If we were installing onshore wind turbines at the same rate as the Germans, our energy prices might be lower.

More research needs to be done.

Do The Germans Have A Pricing Structure That Encourages The Take-Up Of Onshore Wind?

If they do, then we should think of using it in certain locations.

Ørsted-Skyborn JV Takes Legal Action Against US Gov’t Over Stop-Work Order; Seven Turbines Left To Install On Revolution Wind

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

On New Year’s Day, Revolution Wind LLC, the 50/50 joint venture between Ørsted and Skyborn Renewables, filed a supplemental complaint in the US District Court for the District of Columbia and plans to move for a preliminary injunction to block the lease suspension order recently imposed by the US government that stopped construction on its 704 MW project, which is now approximately 87 per cent complete and was expected to start generating power in January 2026.

These five paragraphs give more details of the story.

The lease suspension order, issued by the US Department of the Interior’s Bureau of Ocean Energy Management (BOEM) on 22 December 2025, directed all major offshore wind projects under construction to pause pending a review of alleged national security risks.

The developer asserts the suspension is unlawful and would cause substantial harm to the project, similar to the August 2025 stop-work order.

The project partners say Revolution Wind secured all required federal and state permits in 2023 after extensive reviews and engaged in multi-year consultations with defence authorities, resulting in formal mitigation agreements.

The project is approximately 87 per cent complete, with all foundations, offshore substations and export cables – and 58 of the total 65 wind turbines – installed, and was expected to begin generating power this month.

The developer also noted that the project will supply affordable power to over 350,000 homes under long-term power purchase agreements and support grid reliability in the Northeast.

A Verdict From Google AI

Pending any final result from my learned friends, I asked Google AI, if Revolution Wind will win their case and received this answer.

The question of whether Revolution Wind will ultimately win its case against the federal government’s Bureau of Ocean Energy Management (BOEM) has no final answer yet, as the litigation is ongoing. However, a federal judge has so far ruled in favor of Revolution Wind in a key preliminary step.

Key Developments in the Case

Initial Ruling: In September 2025, a U.S. District Court judge in D.C., Royce Lamberth, granted a preliminary injunction that allowed construction on the nearly-complete project to resume. The judge stated that Revolution Wind was likely to succeed on the merits of its claims and that the project would face “substantial harm” otherwise. The judge called the government’s initial “stop-work order” the “height of arbitrary and capricious action” because it failed to provide a factual basis for the cited national security concerns.

Outcome Uncertainty: The preliminary injunction allows work to continue while the full case proceeds, which could take years. The final outcome of the case depends on the court’s ultimate decision on the merits of the lawsuit

There is going to be some interesting reporting of this case, when the judges give their verdict.

The most interesting case, will probably be the one surrounding Coastal Virginia Offshore Wind as that is a 2.6 GW wind farm, which will generate a lot of fees for lawyers.

Britain’s Biggest Clean Power Projects Among 2.4GW Of Transmission Connections National Grid Delivers In 2025

The title of this post, is the same as that of this press release from National Grid.

This is the sub-heading.

Record-breaking renewable power projects are among the 2.4GW of new generation connections we plugged into our transmission network during 2025, in another key step in the UK’s clean energy transition.

This first paragraph adds some detail to the headlines.

This year’s works build on the 3GW of connections we delivered in 2024 – which included a new interconnector between Wales and Ireland – and is part of 12.6GW of generation capacity we’ve connected in England and Wales over the past five years.

The rate of connections appear to have been fairly steady over the last five years, at about 2.5 GW/year.

Three projects are highlighted.

- In April the 373MW Cleve Hill Solar Park, Britain’s largest solar array, began exporting power across the network following work to connect it at our Cleve Hill substation in Kent.

- Over summer Statera Energy’s Thurrock Storage project, the country’s biggest battery energy storage system (BESS), connected at our Tilbury substation in Essex to add 300MW of flexible capacity across London and the south east.

- And in September we completed upgrades and commissioning activity at our Lackenby substation in North Yorkshire in readiness for RWE’s Sofia offshore wind farm – one of the world’s biggest – to complete construction.

They also completed works for more than 400MW of additional BESS connections during the year, including a 150MW scheme connecting at Ferrybridge substation in West Yorkshire, a 100MW facility plugging in at Thornton substation in North Yorkshire, and further projects at our substations in Enderby (Leicestershire), Rainhill (Merseyside) and Bredbury (Greater Manchester).

I think that adds up to ten projects in total.

It looks like National Grid had a good year.

Offshore Wind Turbines In 2025: China Continues Leading In Single-Unit Capacity, Vestas’s 15 MW Turbine Installed At Offshore Wind Farms

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

In offshoreWIND.biz‘s 2024 annual wind turbine overview, you could have read about the first 16 MW floating wind platform installed offshore and a 26 MW prototype under construction, both in China, and a 21 MW prototype being assembled in Europe. Wind turbine generator (WTG) technology did not stop progressing in 2025, with Chinese OEMs still leading capacity-wise, while in Europe, first offshore wind farms are now featuring 15 MW turbines and a 21+ MW model was installed onshore for testing.

The article is very much a must-read and there is a lot of innovation going on.

As a comparison, between 2020 and 2026 we commissioned or are building these offshore wind farms in the UK.

- East Anglia One – 2000 – 714 MW – 102 x 7 MW

- Hornsea One – 2020 – 1218 MW – 174 x 7 MW

- Kincardine – 2021 – 49.5 MW – 6 x floating

- Hornsea Two – 2022 – 1386 MW – 165 x 8 MW

- Moray East – 2022 – 950 MW – 100 x 9.5 MW

- Triton Knoll – 2022 – 857 MW – 90 x 9.5 MW

- Seagreen Phase 1 – 2023 – 1400 MW – 114 x 10 MW

- Dogger Bank A – 2025 – 1235 MW – 95 x 13 MW

- Moray West – 2025 – 882 MW – 60 x 14 MW

- Neart Na Gaoithe – 2025 – 450 MW – 54 x 8 MW

- Dogger Bank B – 2026 – 1235 MW – 95 x 13 MW

- East Anglia 3 – 2026 – 1372 – 95 x 14 MW

- Sofia – 2026 – 1400 MW – 100 x 14 MW

Average sizes for the various years are as follows.

- 2020 – 7 MW

- 2021 – floating

- 2022 – 8-9.5 MW

- 2023 – 10 MW

- 2025 – 8-14 MW

- 2026 – 13-14 MW

It can clearly be seen that in the last few years, turbines have been getting bigger.

I have some thoughts on the article.

2025 Saw Some Plans For And Installations Of Some Very Large Turbines

These four monsters were mentioned at the start of the article.

- 26 MW – Prototype installed for testing (China)

- 21.5 MW – Prototype installed for testing (Europe)

- 15 MW Installed at offshore wind farms (Europe)

- 50 MW Twin-turbine platform; Announced (China)

- MingYang Turbines to Spin on Hexicon’s Floating Offshore Wind Project

- World’s First Offshore Wind Farm Using 16 MW Turbines Enters Construction In China

- The Secret Of The TwinHub

- Hexicon Wins UK’s First Ever CfD Auction For Floating Offshore Wind

- The Chinese seem to be providing turbines for both manufacturers.

- The TwinHub is the Swedish design, being built for trial in Cornwall.

- This new design is a 50 MW design, whereas these two are 32 MW.

US Offshore Wind Developer Sues Gov’t Over Stop-Work Order

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading

Dominion Energy has filed a federal lawsuit challenging the Trump administration’s stop-work order issued on 22 December that directed all major US offshore wind projects under construction to pause while federal agencies review alleged national security risks, AP and US media report.

This paragraph adds more detail.

In its complaint filed in the US District Court for the Eastern District of Virginia on 23 December, Dominion argues the Bureau of Ocean Energy Management (BOEM) order is “arbitrary and capricious” and violates constitutional and statutory limits on executive action.

I’m no lawyer, but I did have some excellent executive active with my late lawyer wife, so I get the gist of what is hinted.

I would not be happy, if I was an American citizen, who had to pick u[ the costs of Trump’s misdemeanours.

US Government Sends Stop Work Order To All Offshore Wind Projects Under Construction

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The US Department of Interior has paused the leases and suspended construction at all large-scale offshore wind projects currently under construction in the United States, citing ”national security risks identified by the Department of War in recently completed classified reports.”

The wind farms named are.

- Coastal Virginia Offshore Wind-Commercial – 2,600 GW

- Empire Wind 1 – 810 MW

- Revolution Wind – 704 MW

- Sunrise Wind – 924 MW

- Vineyard Wind 1 – 806 MW

Note.

- These five wind farms total 5,844 MW or 5.8 GW.

- The Empire Wind development is being led by Equinor, who are Norwegian.

- The Revolution Wind and Sunrise Wind developments are being led by Ørsted, who are Danish.

- The Vineyard Wind development is being led by Iberdrola, who are Spanish and Copenhagen Infrastructure Partners, who are Danish.

- Coastal Virginia Offshore Wind project uses 176 Siemens Gamesa SG 14-222 DD (Direct Drive) offshore wind turbines.

- Empire 1 Wind is using Vestas V236-15MW offshore wind turbines.

- Revolution Wind is using 65 Siemens Gamesa SG 11.0-200 DD offshore wind turbines.

- Sunrise Wind is using Siemens Gamesa wind turbines, specifically their 8.0 MW models (SG 8.0-167).

- Vineyard 1 Wind is using General Electric (GE) Haliade-X 13 MW offshore wind turbines.

- Some of the components for the Siemens wind turbines will be manufactured in Virginia.

- Coastal Virginia Offshore Wind has a budget of $11.2-3 billion.

- Empire 1 Wind has a budget of $5 billion.

- Resolution Wind has a budget of $4 billion.

- Sunrise Wind has a budget of $5.3 billion.

- Vineyard 1 Wind has a budget of $4 billion.

There will only be one winner in this new round of the ongoing spat between Trump and the wind industry, that he hates so much – the 1.3 million active lawyers in the United States,which is a figure from according to Google AI.

UK Gov’t Tweaking CfD Rules Ahead Of 8th Allocation Round, Proposes ‘Other Deepwater Offshore Wind’ Category

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK government has launched a consultation on proposed refinements to the Contracts for Difference (CfD) scheme ahead of Allocation Round 8 (AR8) and future rounds, including targeted changes to the terms concerning offshore wind and floating wind projects.

These two paragraphs add more details.

The consultation, published by the Department for Energy Security and Net Zero, seeks industry feedback on contractual and eligibility adjustments, some of which are intended to reflect the increasing scale and complexity of offshore wind developments, specifically floating and other deepwater projects.

For floating offshore wind, the government is proposing changes to CfD contract terms to better align with the technology’s development timelines. These include a proposed extension of the Longstop Period to give floating wind projects more time to commission and avoid termination of their CfD contract.

The government also wants to lower the Required Installed Capacity (RIC) threshold for floating offshore wind projects.

Currently, all CfD technologies are required to deliver a minimum of 95 per cent of the capacity they have contractually agreed to install, except for (fixed-bottom) offshore wind, whose RIC is set at 85 per cent to reflect the construction risks, such as encountering unsuitable seabed conditions after work has commenced. As floating wind projects, which were so far in the range of 100 MW, have grown in scale and complexity, the government plans to apply the same RIC requirement as for fixed-bottom offshore wind.

The CfD scheme currently supports two categories of offshore wind technology: fixed-bottom offshore wind and floating offshore wind, with the regulations in use (Allocation Regulations 2014) considering only the foundation designs that float to be floating offshore wind. With the ODOW category, the government wants to make room for the novel hybrid foundation designs, “which may be suitable for deepwater deployment but do not technically float and would therefore not be considered eligible as ‘floating foundations’ under the existing legal definition of ‘floating offshore wind’.”

This last paragraph sums up the reasons for the changes.

The proposed refinements are intended to ensure the CfD scheme remains fit for purpose as offshore wind technologies evolve, while maintaining investor confidence and supporting timely project delivery.

Hopefully developments at ports like Belfast, East Anglia, Inverness & Cromarty FreePort,Lowestoft and Tyne will encourage to develop wind farms around the shores of the UK.

ABP’s New Lowestoft Facility To Support East Anglia Two & Three O&M Ops

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

UK port operator Associated British Ports (ABP) and ScottishPower Renewables have entered into a long-term agreement for supporting operations and maintenance (O&M) activities at the East Anglia Two and East Anglia Three offshore wind farms from ABP’s Lowestoft Eastern Energy Facility (LEEF).

These two initial paragraphs add a few more details.

Under the agreement, ScottishPower Renewables will utilise berths at LEEF for service operations vessels (SOVs) and crew transfer vessels (CTVs) that will serve the East Anglian offshore wind farms. The company already operates its East Anglia One O&M base in Lowestoft.

LEEF was officially opened by the UK Secretary of State for Energy Security and Net Zero in January 2025, after ABP invested GBP 35 million (almost EUR 40 million) in the port infrastructure. The facility features deep-water berths, modern utilities and future-proofed infrastructure to support shore power and alternative fuels, according to the port operator.

These are some of my thoughts

How Large Are The East Anglian Wind Farms?

There are four East Anglian Wind Farms.

- East Anglian 1 – 714 MW, which was commissioned in 2020.

- East Anglian 1 North – 800 MW, which is planned to be commissioned in 2026.

- East Anglian 2 – 963 MW, which is planned to be commission in 2029.

- East Anglian 3 -1372 MW, which is planned to be commission in 2026.

That makes a total of 3849 MW.

Where Do The Cables Come Ashore?

Google AI gives this answer to the question.

The subsea export cables for the East Anglia wind farms, including East Anglia ONE, come ashore at Bawdsey in Suffolk, where they connect to onshore cables that run underground for about 23-37 km to the Bramford converter station, near Ipswich, to join the National Grid.

I know Bawdsey well from about the late 1950s until we moved my wife and I moved our family from East Suffolk to West Suffolk in the 1990s.

These posts are two memories of Bawdsey Manor and Felixstowe Ferry on the other side of Deben, that I wrote after one of my last visits to the Deben Estuary in 2009.

It hasn’t changed much over the years.

CIP’s UK Offshore Wind Project Granted Development Consent

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK Secretary of State for Energy Security and Net Zero has approved the Development Consent Order (DCO) for the Morecambe offshore wind farm in the Irish Sea, owned by Copenhagen Infrastructure Partners (CIP).

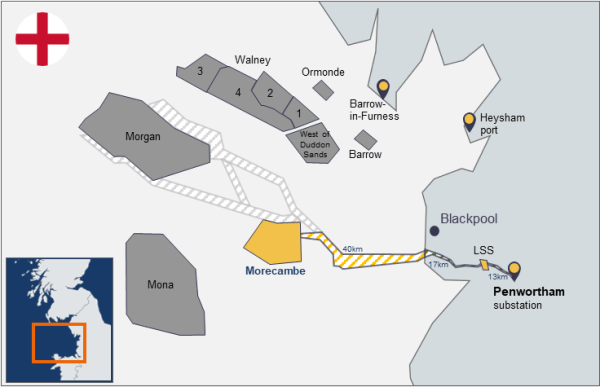

The article also shows this map from Copenhagen Infrastructure Partners.

Note.

- The 480 MW Morecambe wind farm is shown in yellow.

- The 1.5 GW Morgan wind farm received its DCO in August 2025.

- The 1.5 GW Mona wind farm received its DCO in July 2025.

- Both Morgan and Mona wind farms are being developed by a consortium of EnBW and JERA Nex bp.

- Morgan and Morecambe wind farms will connect to the grid at Penwortham substation.

- Mona wind farm will connect to the grid at Bodelwyddan National Grid substation in Denbighshire, North Wales.

- Morgan and Morecambe wind farms appear to be being developed jointly.

I must admit, I’m a bit surprised that Mona doesn’t connect to Penwortham substation.

US Judge Overturns Trump’s Ban On Wind Energy Project Permits

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

A federal judge has struck down the US President Donald Trump’s indefinite halt of all federal approvals and permitting for new wind energy projects.

Trump is obviously very strong in his opposition to wind power, as he issued the ”Wind Order” on his first day back in office.

He received this robust reply from Oceantic Network CEO Liz Burdock.

Today’s decision is welcome news, not just for the thousands of American workers and businesses across 40 states supporting offshore wind in the U.S., but also for the critical relief the wind industry will provide to lower skyrocketing electricity prices for millions of American families with reliable, affordable power.

Overturning the unlawful blanket halt to offshore wind permitting activities is needed to achieve our nation’s energy and economic priorities of bringing more power online quickly, improving grid reliability, and driving billions of new American steel manufacturing and shipbuilding investments. We thank the Attorneys General and the Alliance for Clean Energy New York for taking this case forward to protect American business interests against the politicization of our energy sector.

I don’t think we’ve heard the last of this legal argument.