UK Economy To Reap GBP 6.1 Billion From 3.6 GW Dogger Bank Offshore Wind Farm

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The 3.6 GW Dogger Bank Wind Farm, which will become the world’s largest offshore wind farm once fully operational, will boost the UK economy by GBP 6.1 billion (approximately EUR 6.9 billion) during its lifetime and support thousands of UK jobs over the next decade, according to a report written by BVG Associates.

The first three phases of the Dogger Bank wind farm are scheduled to be delivered as follows.

- Dogger Bank A – 1235 MW – 2025

- Dogger Bank B – 1235 MW – 2026

- Dogger Bank C – 1218 MW – 2027

The planned dates in the North Sea are generally kept, because we’ve been building structures there since the days of World War Two.

These two paragraphs from the article add more detail.

The economic impact report was commissioned by Dogger Bank Wind Farm’s equity partners SSE, Equinor and Vårgrønn, who are currently constructing the offshore wind farm in three 1.2 GW phases at adjoining sites in the North Sea, more than 130 kilometres from the Yorkshire Coast.

Direct spend with companies in the Northeast of England and in the counties of North Yorkshire and the East Riding of Yorkshire is expected to total over GBP 3 billion, with hundreds of jobs supported in these regions.

But these three wind farms are just the hors d’oeuvre.

This article on offshoreWIND.biz is entitled SSE, Equinor Move Forward with 1.5 GW Dogger Bank D Project and it has this sub-heading.

SSE and Equinor have finalised a seabed lease with the Crown Estate to progress Dogger Bank D, the proposed fourth phase of the world’s largest offshore wind farm, the 3.6 GW Dogger Bank Wind Farm, currently under construction off the coast of England in the North Sea.

These two paragraphs from the article add more detail.

The lease allows Dogger Bank D shareholders to maximise renewable generation from the eastern part of the Dogger Bank C seabed area, located around 210 kilometres off the Yorkshire coast, with future potential to unlock an additional 1.5 GW.

SSE Renewables and Equinor previously established terms for the wind farm with the Crown Estate in July 2024. Implementation of these commercial terms was subject to the conclusion earlier this year of the plan-level Habitats Regulation Assessment (HRA) associated with the Crown Estate’s wider Capacity Increase Programme.

Note.

- The total capacity for the first four phases of the Dogger Bank Wind Farm are 5,188 MW.

- But if the Crown Estate’s wider Capacity Increase Programme is carried out, the total capacity will be 6,688 MW.

- Hinckley Point C is planned to be only 3,260 MW and is likely to be fully delivered between 2029 and 2031.

So if the Crown Estate, Equinor and SSE go for the full Dogger Bank D, I believe it is likely that we’ll get a wind farm with a capacity of two Hinckley Point Cs delivered before the nuclear power station.

.

Danish CIP To Pour USD 3 Billion Into Philippines’ Offshore Wind Push

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Denmark’s Copenhagen Infrastructure Partners (CIP) will commit USD 3 billion (approximately EUR 2.6 billion) to build its first offshore wind farm in the Philippines.

This opening paragraph gives a few more details.

In a press briefing, Presidential Communications Office Undersecretary and Palace Press Officer Claire Castro said that the company is committed to investing in the Philippines through its partner, ACEN – Renewable Energy Solutions.

It does seem that the Philippines are putting out the red carpet for Copenhagen Infrastructure Partners and no wonder if you look at the first paragraph of the Danish firm’s Wikipedia entry.

Copenhagen Infrastructure Partners P/S (“CIP”) is a Danish investment firm specializing in infrastructure investments, particularly wind power.[1][2] CIP is one of the world’s largest dedicated renewables investment firms with €32 billion raised and a project pipeline of 120 GW.

But, are these two articles on offshoreWind.biz hinting at delay in the approval of UK projects?

- UK Delays Permit Decision for CIP’s Morecambe Offshore Wind Farm

- Permit Decision Delayed for 1.5 GW UK Offshore Wind Farm

Although the second project, which is the Outer Dowsing Wind Farm, is not a Copenhagen Infrastructure Partners project delaying decisions surely doesn’t give confidence to investors.

So have Copenhagen Infrastructure Partners decided to test the new virgin waters of the Philippines?

Operational UK Utility-Scale Ground Mount Solar Capacity Tips Over 14GWp, 2025 On Track For 2.5GWp

The title of this post, is the same as that of this article on Solar Power Portal.

This is the sub-heading.

Josh Cornes gives an overview of the UK’s operational solar capacity, which continues to rise at a healthy rate.

As I write this at five o’clock on a dark November evening.

- The UK is using 29.33 GW in total.

- 3.036 GW is coming from solar power.

- 8.939 GW is coming from wind power.

But as the graph shows the amount of solar is increasing year-on-year.

HiiROC And Agile Energy Unite To Advance Hydrogen Production In Scotland

The title of this post, is the same as that of this article on Offshore Energy.

This is sub-heading.

HiiROC, a UK hydrogen production company, and Agile Energy Recovery Limited, a compatriot developer of low-carbon energy parks, have partnered to evaluate the deployment of HiiROC’s proprietary process to produce low-carbon hydrogen at Agile’s Thainstone Energy Park in Inverurie, Scotland.

These three paragraphs add more detail.

It is understood that Agile is building a Swedish-style Integrated Resource Facility (IRF), which is expected to process up to 200,000 tonnes of municipal and industrial residual waste per year and produce power and heat for the surrounding area.

As for HiiROC, its Thermal Plasma Electrolysis (TPE) process reportedly requires less electricity than conventional water electrolysis and does not generate CO2 emissions, aligning with the UK’s Low Carbon Hydrogen Standard (LCHS). By leveraging the existing gas network and locating hydrogen production at the point of use, the company said it can avoid costly new infrastructure or waiting for new hydrogen pipelines or CCS clusters to come online. HiiROC’s first commercial units are planned for 2026.

The partners noted they will aim to maximize integration of their two plants, with the option to combine CO2 emissions from the IRF with HiiROC’s hydrogen to produce low-carbon e-methanol, an emerging alternative to diesel in maritime applications.

This plant would appear too be built around some impressive chemistry to process 200,000 tonnes of municipal and industrial waste per year.

Out of curiosity, I asked Google AI how much waste the London Borough of Hackney, where I live, collects per year and received this answer.

The London Borough of Hackney processed approximately 113,554 tonnes of total local authority collected waste in the 2021/22 financial year.

More recent, unaudited data for the 2023/24 financial year indicates that the total amount of household waste collected was around 313.6 kg per person. With an estimated population of nearly 280,000 people, this suggests roughly 87,800 tonnes of household waste were collected in 2023/24.

It looks to me, that a lot of councils could explore the HiiROC route to dispose of their waste.

Great Yarmouth Terminal Set For Redevelopment Under Port Of East Anglia Name

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK’s Peel Ports Group has decided to invest a further GBP 10 million (approximately EUR 11.3 million) into its Great Yarmouth site, which is being rebranded as the Port of East Anglia.

These four paragraphs add details to the story.

The newly announced GBP 10 million brings this year’s total investment to GBP 70 million across the site and will be used to redevelop the port’s Northern Terminal, helping to accommodate the next generation of offshore wind projects across the region, according to Peel Ports.

Earlier this year, a substantial investment into its Southern Terminal was announced by the port, which has earmarked GBP 60 million to transform capacity and improve efficiencies.

This involves ensuring the port can support multiple hydrogen, carbon capture, offshore wind, and nuclear projects for decades to come.

Its existing terminals service a variety of construction customers, including infrastructure projects such as Sizewell C and offshore energy projects based in the southern North Sea.

Note.

- In Yarmouth Harbour To Be ‘Completed’ In £60m Project, I talk about the work to be done on the Southern Terminal.

- The work on the Southern Terminal includes a roll-on roll-off (RORO) lift ramp and a large storage area.

- Start on the work on the Southern Terminal will start in 2026.

With all the construction work mentioned in the last two paragraphs, I suspect that the Port of Great Yarmouth will be busy?

These are some further thoughts.

Why Is The Port Of Great Yarmouth Being Renamed?

The article says this.

The new name, which will come into effect in early 2026, also aligns with the creation of a new combined authority for Suffolk and Norfolk, according to Peel Ports.

Peel Ports name change is fairly sensible, but as I was conceived in Suffolk and I’m an Ipswich Town supporter, I don’t feel that the two counties should be merged.

Does The Mention Of Hydrogen Mean That The Port Of Great Yarmouth Will Be Hosting A Hydrogen Electrolyser, To Fuel Trucks And Ships?

I asked Google AI, “If A Hydrogen Electrolyser is To Be Built In The Port Of Great Yarmouth?”, and received this answer.

While there are no current public plans for an immediate construction of a large-scale hydrogen electrolyser within the Port of Great Yarmouth, significant port expansion and infrastructure upgrades are underway to ensure it can support future hydrogen projects and related clean energy initiatives.

Note.

- If technology to handle hydrogen, is copied from North Sea gas, there is certainly a lot of proven technology that can be used again.

- There may even be depleted gas fields, where captured carbon dioxide, hydrogen or North Sea gas can be stored.

I find the most exciting thing, would be to send hydrogen to Germany.

Why Would Anybody Export Hydrogen To Germany?

I asked Google AI, the question in the title of this section and received this answer.

Countries would export hydrogen to Germany because Germany has a large, growing demand for hydrogen to power its heavily industrialised economy and achieve its decarbonisation goals, but lacks sufficient domestic renewable energy capacity to produce the required amounts.

Germany also, uses a lot of bloodstained Russian gas and indigenous polluting coal.

How Could Anybody Export Hydrogen To Germany?

- Wilhelmshaven is one of the main import ports for hydrogen in North West Germany.

- Great Yarmouth is probably the closest larger port to Germany.

- Great Yarmouth and Wilhelmshaven are probably about 300 miles apart, by the shortest route.

- Great Yarmouth would need to build infrastructure to export hydrogen.

The easiest way to transport the hydrogen from Great Yarmouth to Wilhelmshaven, is probably to use a gas tanker built especially for the route.

This Google Map shows the route between Great Yarmouth and Wilhelmshaven.

Note.

- The North-East corner of East Anglia with Great Yarmouth to the North of Lowestoft, is in the bottom-left corner of the map.

- Wilhelmshaven is a few miles inland in the top-right corner of the map.

- Could a coastal tanker go along the Dutch and German coasts to Wilhelmshaven?

I have no skills in boats, but would Great Yarmouth to Wilhelmshaven to take hydrogen to Germany?

RWE Are Developing Three Wind Farms To The North-East of Great Yarmouth

RWE are a large German Electricity company and the UK’s largest generator of electricity.

The company is developing three wind farms to the North-East of Great Yarmouth.

- Norfolk Boreas – 1.2 GW – 45 miles offshore

- Norfolk Vanguard West – 1.2 GW – 29 miles offshore

- Norfolk Vanguard East – 1.2 GW – 28 miles offshore

Note.

- The electricity for all three wind farms is to be brought ashore at Happisburgh South, which is about 22 miles North of Great Yarmouth.

- The original plan was to take the electricity halfway across Norfolk to the Necton substation to connect to the grid.

- The natives will not be happy about a 4.2 GW overhead line between Happisburgh and Necton.

- RWE have built offshore electrolysers before in German waters.

- Could an electrical cable or a hydrogen pipe be laid in the sea between Happisburgh South and the Port of Great Yarmouth?

- The electrolyser could either be offshore at Happisburgh or onshore in the Port of Great Yarmouth.

As I don’t suspect these three wind farms will be the last connected to the Port of Great Yarmouth, I would expect that RWE will put the electrolyser offshore at Happisburgh and connect it by a hydrogen pipeline to the Port of Great Yarmouth.

Could There Be A Connection To The Bacton Gas Terminal?

Consider.

The Bacton Gas Terminal, which feeds gas into the UK Gas Network, is only 4.2 miles up the coast from Happisburgh South.

Some climate scientists advocate blending hydrogen into the gas supply to reduce carbon emissions.

In Better Than A Kick In The Teeth – As C Would Say!, I disclosed that I now have a new hydrogen-ready boiler, so I’m not bothered, if I get changed to a hydrogen blend.

So could hydrogen from the Norfolk wind farms be fed into the grid to reduce carbon emissions?

Could The Port Of Great Yarmouth Become A Hydrogen Distribution Centre?

Thinking about it, the port could also become a distribution centre for green hydrogen.

Consider.

- Hydrogen-powered ships, tugs and workboats could be refuelled.

- Hydrogen-powered trucks could also be refuelled.

- Tanker-trucks could distribute hydrogen, to truck and bus operators, farms and factories, that need it for their transport and operations.

- I believe, that construction equipment will be increasingly hydrogen-powered.

In my life, I have lived at times in two country houses, that were heated by propane and there are about 200,000 off-grid houses in the UK, that are heated this way.

The two houses, where I lived would have been a nightmare to convert to heat pumps, but it would have been very easy to convert them to a hydrogen boiler and power it from a tank in the garden.

It should be noted, that the new boiler in my house in London is hydrogen-ready.

So the Port of Great Yarmouth could be the major centre for hydrogen distribution in Norfolk.

In the 1960s, I used to work in ICI’s hydrogen plant at Runcorn. If you ride in a hydrogen bus in England, it is likely that the hydrogen came from the same plant. Handled correctly, hydrogen is no less safe and reliable than natural gas or propane.

UK’s Largest Solar Plant Cleve Hill Supplying Full Power To The Grid

The title of this post, is the same as that of this article on the Solar Power Portal.

This is the sub-heading.

Quinbrook Infrastructure Partners has completed construction and started commercial operations of the 373MW Cleve Hill Solar Park, now the largest operational in the UK.

Note.

- According to Quinbrook, during the commissioning phase in May, electricity exports from Cleve Hill peaked at a level equivalent to 0.7% of the UK’s national power demand.

- Construction of the 373 MW solar project began in 2023, and Quinbrook said construction is now underway on a 150 MW co-located battery energy storage system (BESS).

- The gas-fired power stations at Coolkeeragh, Corby, Enfield, Great Yarmouth and Shoreham are all around 410-420 MW for comparison.

- On completion of the BESS, Cleve Hill will go from the largest solar plant in the UK to the largest co-located solar plus storage project constructed in the UK.

- The solar and storage plant was the first solar power project to be consented as a nationally significant infrastructure project (NSIP) and is supported by the largest solar + BESS project financing undertaken in the UK.

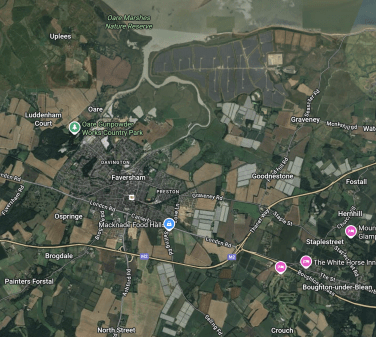

This Google Map shows the location of the solar farm with respect to Faversham.

Note.

The town of Faversham to the left of the middle of the map.

Faversham station has the usual railway station logo.

The North Kent coast is at the top of the map.

Cleve Hill Solar Park is on the coast to the East of the River Swale.

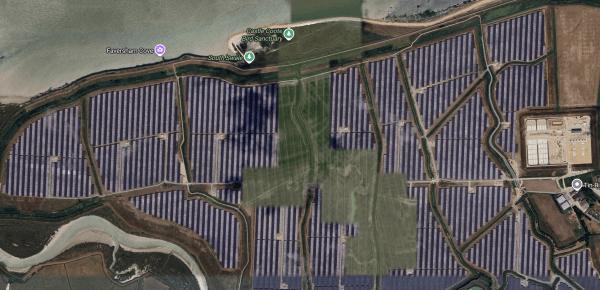

This second Google Map shows a close up of the solar farm.

Note.

- The large number of solar panels.

- The North Kent coast is at the top of the map.

- The River Swale in the South-West corner of the map.

- It appears that Cleve Hill substation is at the right edge of the map.

- The boxes at the left of the substation appear to be the batteries.

- The 630 MW London Array wind farm, which has been operational since 2013, also connects to the grid at Cleeve Hill substation.

- When completed, the London Array was the largest offshore wind farm in the world.

As a Control Engineer, I do like these Battery+Solar+Wind power stations, as they probably provide at least a reliable 500 MW electricity supply.

Could A System Like Cleeve Hill Solar Park Replace A 410 MW Gas-Fired Power Station?

The three elements of Cleeve Hill are as follows.

- Solar Farm – 373 MW

- BESS – 150 MW

- Wind Farm – 630 MW

That is a total of only 1,153 MW, which means a capacity factor of only 35.6 % would be needed.

How Much Power Does A Large Solar Roof Generate?

Some people don’t like solar panels on farmland, so how much energy do solar panels on a warehouse roof generate?

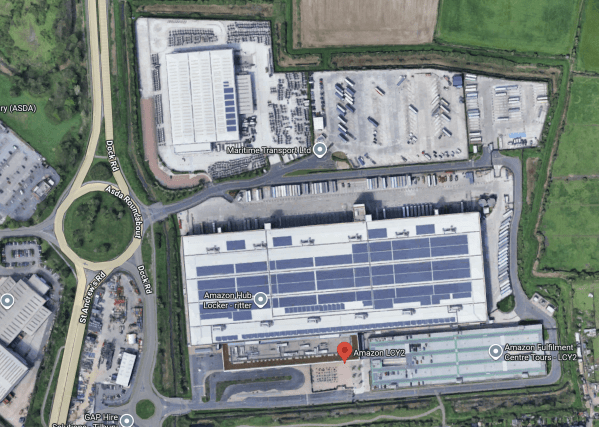

This Google Map shows Amazon’s warehouse at Tilbury.

I asked Google AI to tell me about Amazon’s solar roof at Tilbury and it said this.

Amazon’s solar roof at the Tilbury fulfillment center is the largest rooftop solar installation at any Amazon site in Europe, featuring 11,500 panels across the two-million-square-foot roof. Unveiled in 2020, it is part of Amazon’s larger goal to power its operations with 100% renewable energy by 2025 and reduce its emissions, contributing to its Climate Pledge to be net-zero carbon by 2040.

It generates 3.4 MW, which is less that one percent of Cleeve Hill Solar Park.

The Thoughts Of Chris O’Shea

This article on This Is Money is entitled Centrica boss has bold plans to back British energy projects – but will strategy pay off?.

The article is basically an interview with a reporter and gives O’Shea’s opinions on various topics.

Chris O’Shea is CEO of Centrica and his Wikipedia entry gives more details.

These are his thoughts.

On Investing In Sizewell C

This is a paragraph from the article.

‘Sizewell C will probably run for 100 years,’ O’Shea says. ‘The person who will take the last electron it produces has probably not been born. We are very happy to be the UK’s largest strategic investor.’

Note.

- The paragraph shows a bold attitude.

- I also lived near Sizewell, when Sizewell B was built and the general feeling locally was that the new nuclear station was good for the area.

- It has now been running for thirty years and should be good for another ten.

Both nuclear power stations at Sizewell have had a good safety record. Could this be in part, because of the heavy engineering tradition of the Leiston area?

On Investing In UK Energy Infrastructure

This is a paragraph from the article

‘I just thought: sustainable carbon-free electricity in a country that needs electricity – and we import 20 per cent of ours – why would we look to sell nuclear?’ Backing nuclear power is part of O’Shea’s wider strategy to invest in UK energy infrastructure.

The UK certainly needs investors in UK energy infrastructure.

On Government Support For Sizewell C

This is a paragraph from the article.

Centrica’s 500,000 shareholders include an army of private investors, many of whom came on board during the ‘Tell Sid’ privatisations of the 1980s and all of whom will be hoping he is right. What about the risks that deterred his predecessors? O’Shea argues he will achieve reliable returns thanks to a Government-backed financial model that enables the company to recover capital ploughed into Sizewell C and make a set return.

I have worked with some very innovative accountants and bankers in the past fifty years, including an ex-Chief Accountant of Vickers and usually if there’s a will, there’s a solution to the trickiest of financial problems.

On LNG

These are two paragraphs from the article.

Major moves include a £200 million stake in the LNG terminal at Isle of Grain in Kent.

The belief is that LNG, which produces significantly fewer greenhouse gas emissions than other fossil fuels and is easier and cheaper to transport and store, will be a major source of energy for the UK in the coming years.

Note.

- Centrica are major suppliers of gas-powered Combined Heat and Power units were the carbon dioxide is captured and either used or sold profitably.

- In at least one case, a CHP unit is used to heat a large greenhouse and the carbon dioxide is fed to the plants.

- In another, a the gas-fired Redditch power station, the food-grade carbon dioxide is sold to the food and construction industries.

- Grain LNG Terminal can also export gas and is only a short sea crossing from gas-hungry Germany.

- According to this Centrica press release, Centrica will run low-carbon bunkering services from the Grain LNG Terminal.

I analyse the investment in Grain LNG Terminal in Investment in Grain LNG.

On Rough Gas Storage

These are three paragraphs from the article.

O’Shea remains hopeful for plans to develop the Rough gas storage facility in the North Sea, which he re-opened in 2022.

The idea is that Centrica will invest £2 billion to ‘create the biggest gas storage facility in the world’, along with up to 5,000 jobs.

It could be used to store hydrogen, touted as a major energy source of the future, provided the Government comes up with a supportive regulatory framework as it has for Sizewell.

The German AquaVentus project aims to bring at least 100 GW of green hydrogen to mainland Germany from the North Sea.

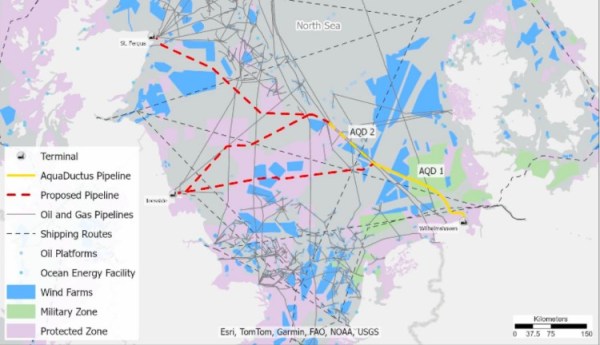

This map of the North Sea, which I downloaded from the Hydrogen Scotland web site, shows the co-operation between Hydrogen Scotland and AquaVentus

Note.

- The yellow AquaDuctus pipeline connected to the German coast near Wilhelmshaven.

- There appear to be two AquaDuctus sections ; AQD 1 and AQD 2.

- There are appear to be three proposed pipelines, which are shown in a dotted red, that connect the UK to AquaDuctus.

- The Northern proposed pipeline appears to connect to the St. Fergus gas terminal on the North-East tip of Scotland.

- The two Southern proposed pipelines appear to connect to the Easington gas terminal in East Yorkshire.

- Easington gas terminal is within easy reach of the massive gas stores, which are being converted to store hydrogen at Aldbrough and Rough.

- The blue areas are offshore wind farms.

- The blue area straddling the Southernmost proposed pipe line is the Dogger Bank wind farm, is the world’s largest offshore wind farm and could eventually total over 6 GW.

- RWE are developing 7.2 GW of wind farms between Dogger Bank and Norfolk in UK waters, which could generate hydrogen for AquaDuctus.

This cooperation seems to be getting the hydrogen Germany needs to its industry.

It should be noted, that Germany has no sizeable hydrogen stores, but the AquaVentus system gives them access to SSE’s Aldbrough and Centrica’s Rough hydrogen stores.

So will the two hydrogen stores be storing hydrogen for both the UK and Germany?

Storing hydrogen and selling it to the country with the highest need could be a nice little earner.

On X-energy

These are three paragraphs from the article.

He is also backing a £10 billion plan to build the UK’s first advanced modular reactors in a partnership with X-energy of the US.

The project is taking place in Hartlepool, in County Durham, where the existing nuclear power station is due to reach the end of its life in 2028.

As is the nature of these projects, it involves risks around technology, regulation and finance, though the potential rewards are significant. Among them is the prospect of 2,500 jobs in the town, where unemployment is high.

Note.

- This is another bold deal.

- I wrote in detail about this deal in Centrica And X-energy Agree To Deploy UK’s First Advanced Modular Reactors.

- Jobs are mentioned in the This is Money article for the second time.

I also think, if it works to replace the Hartlepool nuclear power station, then it can be used to replace other decommissioned nuclear power stations.

On Getting Your First Job

These are three paragraphs from the article.

His career got off to a slow start when he struggled to secure a training contract with an accountancy firm after leaving Glasgow University.

‘I had about 30, 40 rejection letters. I remember the stress of not having a job when everyone else did – you just feel different,’ he says.

He feels it is ‘a duty’ for bosses to try to give young people a start.

I very much agree with that. I would very much be a hypocrite, if I didn’t, as I was given good starts by two companies.

On Apprenticeships

This is a paragraph from the article.

‘We are committed to creating one new apprenticeship for every day of this decade,’ he points out, sounding genuinely proud.

I very much agree with that. My father only had a small printing business, but he was proud of the apprentices he’d trained.

On Innovation

Centrica have backed three innovative ideas.

- heata, which is a distributed data centre in your hot water tank, which uses the waste heat to give you hot water.

- HiiROC, which is an innovative way to generate affordable hydrogen efficiently.

- Highview Power, which stores energy as liquid air.

I’m surprised that backing innovations like these was not mentioned.

Conclusion

This article is very much a must read.

South West Freight Set For Resurgence

The title of this article is the same as that of a feature article in the November Edition of Modern Railways.

One of the topics, the article discusses is lithium mining in Cornwall and its transport from the South West.

I started by asking, Google AI, where lithium is mined in Europe, and received this answer.

Portugal is the only country in the EU currently mining lithium, with the Barroso project being the main focus of future production. However, there are multiple other European countries with significant lithium deposits that are expected to begin mining in the near future, including the Czech Republic, Finland, France, Germany, Spain, and Serbia.

So Cornish lithium will be one of several sources, but surely ideal for UK batteries.

The Modern Railways article has two paragraphs, which describe lithium mining in Cornwall.

But it’s the potential for lithium that may be the most exciting development for rail freight in the region. Cornish Lithium plans to extract it from an open pit at Trelavour, near St Austell, and it is adamant that rail will be vital for its plans to come to fruition. Trelavour is next to the Parkandillack china clay processing plant, and Cornish Lithium plans to use this to bring in essential materials. The volumes are significant – an estimated 180,000 tonnes per year of input are anticipated, most if not all brought in by rail, and the site’s output of around 8,000 tonnes per year could also go by rail. It is hoped the first traffic could run to the site before the end of Control Period 7 in March 2029 in a project that could run for 20 years.

It isn’t just Cornish Lithium seeking to extract this ‘white gold’ from Cornwall. Imerys British Lithium is extracting lithium and producing lithium carbonate, initially at a pilot site in Roche – with the aim of producing around 21,000 tonnes of the material every year for 30 years.

In total the two sites will produce 790,000 tonnes of lithium ores over thirty years, which when averaged is about 72 tonnes per day.

I then asked Google AI, where the lithium will be processed and refined and received this answer.

Lithium from Cornwall will be processed and refined at demonstration and full-scale plants located within the county. Specifically, Cornish Lithium has a demonstration plant in St Dennis and plans to build a full-scale plant there to produce refined lithium hydroxide. Similarly, the British Lithium project, a joint venture with Imerys, is developing a pilot plant and full-scale processing facility in the St Austell area to produce lithium carbonate from granite, says BBC News.

That seems a very comprehensive answer from a computer!

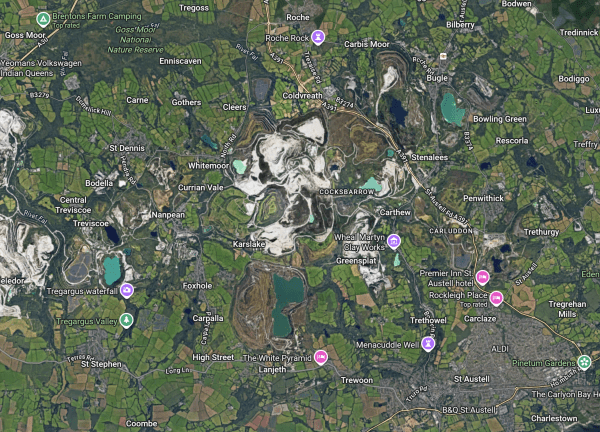

This Google Map shows the area of Cornwall between St. Dennis and St. Austell.

Note.

- St. Austell is in the South-East corner of the map.

- St. Dennis is in the North-West corner of the map.

- Trelavour appears to be just South of St. Dennis.

- In the middle of the map, are the china clay workings.

Although rail is mentioned, it looks like new tracks will have to be laid.

The Modern Railways article says this about using rail.

Should these plans come to fruition, it seems likely rail will play a part in the supply chain. It is not much of an exaggeration to suggest that Cornwall’s lithium deposits offer a generational opportunity for the Duchy, and by extension, for rail freight.

But, if I’m right about the daily amount being around 72 tonnes, then not many trains will be needed.

I have a few further thoughts.

How Much Will The Lithium Be Worth?

I asked Google AI, what is a tonne of lithium metal worth and got this answer.

A tonne of battery-grade lithium metal is worth approximately $77,962 to $80,398 USD, with an average of about $79,180 USD. The price fluctuates significantly based on market conditions, and the value can differ for industrial-grade lithium metal or other lithium compounds like carbonate or hydroxide.

Assuming a price of $80,000, then a day’s production is worth $5,760,000 and a year’s production is worth about $2 billion.

This could be a massive Magic Money Mine for Rachel from Accounts.

Will The Royal Albert Bridge Cope With The Extra Trains?

The Modern Railways article says this.

While there is excitement about the potential from Cornwall’s new and revived minerals industries, there are caveats. One is the train weight limit on the Royal Albert Bridge, Saltash.

Note.

- A five-car Class 802 train weighs 243 tonnes and I’ve seen pairs in Cornwall.

- Other trains may be heavier, but if the lithium refining is done in Cornwall, the lithium trains won’t be too heavy.

As lithium is the lightest metal, is it sensible to perform the processing and refining in Cornwall and leave the unwanted rocks in the Duchy?

NSTA Gives 1.1bn Barrel Boost To North Sea Oil Reserve Estimates

The title of this post, is the same as that of an article on Energy Voice.

As I don’t have access to Energy Voice articles, I asked Google AI what it can tell me of North Sea oil and gas reserves boost and received this answer.

North Sea oil and gas reserves have increased by 1.1 billion barrels, driven by new licensing rounds, with the North Sea Transition Authority (NSTA) reporting a 31% rise in potential resources. This boost could significantly impact the UK’s energy security and economy by potentially allowing the UK to meet half its oil and gas needs and support jobs. However, this development occurs alongside political debate over new drilling licenses and the UK’s Net Zero targets.

These are my thoughts.

Am I Using AI To Get Round The Paywall?

Some may argue that I am, but then as my tame and pleasureable lawyer has passed on, I shall leave this question to Google’s lawyers.

Although in the 1970s, I will admit to spending hours in libraries finding data and algorithms for the solution of these problems.

- The understanding of the dynamics of the sulphonation reaction, which may have led to a valuable patent.

- The linking between datasets, which may have led to the first relational database.

My searches these days, would be a lot easier with artificial intelligence.

A 31% Rise Is Very Worthwhile

This article in the Telegraph also looks at the NSTA report and these are three paragraphs.

Martin Copeland, the chief financial officer at Serica Energy, a North Sea oil and gas producer, said: “This NSTA report shows that there at least 11 billion barrels of oil and gas which could still be developed in the North Sea.

“This almost meets the amount that the Climate Change Committee says we will need before the net zero target year of 2050 of 13 billion to 15 billion barrels.

“So with the right policy changes and tax regime, the UK could effectively be self-sufficient on the oil and gas it will need and would otherwise have to import.”

The rise must surely be very worthwhile for the UK.