The Thoughts Of Chris O’Shea

This article on This Is Money is entitled Centrica boss has bold plans to back British energy projects – but will strategy pay off?.

The article is basically an interview with a reporter and gives O’Shea’s opinions on various topics.

Chris O’Shea is CEO of Centrica and his Wikipedia entry gives more details.

These are his thoughts.

On Investing In Sizewell C

This is a paragraph from the article.

‘Sizewell C will probably run for 100 years,’ O’Shea says. ‘The person who will take the last electron it produces has probably not been born. We are very happy to be the UK’s largest strategic investor.’

Note.

- The paragraph shows a bold attitude.

- I also lived near Sizewell, when Sizewell B was built and the general feeling locally was that the new nuclear station was good for the area.

- It has now been running for thirty years and should be good for another ten.

Both nuclear power stations at Sizewell have had a good safety record. Could this be in part, because of the heavy engineering tradition of the Leiston area?

On Investing In UK Energy Infrastructure

This is a paragraph from the article

‘I just thought: sustainable carbon-free electricity in a country that needs electricity – and we import 20 per cent of ours – why would we look to sell nuclear?’ Backing nuclear power is part of O’Shea’s wider strategy to invest in UK energy infrastructure.

The UK certainly needs investors in UK energy infrastructure.

On Government Support For Sizewell C

This is a paragraph from the article.

Centrica’s 500,000 shareholders include an army of private investors, many of whom came on board during the ‘Tell Sid’ privatisations of the 1980s and all of whom will be hoping he is right. What about the risks that deterred his predecessors? O’Shea argues he will achieve reliable returns thanks to a Government-backed financial model that enables the company to recover capital ploughed into Sizewell C and make a set return.

I have worked with some very innovative accountants and bankers in the past fifty years, including an ex-Chief Accountant of Vickers and usually if there’s a will, there’s a solution to the trickiest of financial problems.

On LNG

These are two paragraphs from the article.

Major moves include a £200 million stake in the LNG terminal at Isle of Grain in Kent.

The belief is that LNG, which produces significantly fewer greenhouse gas emissions than other fossil fuels and is easier and cheaper to transport and store, will be a major source of energy for the UK in the coming years.

Note.

- Centrica are major suppliers of gas-powered Combined Heat and Power units were the carbon dioxide is captured and either used or sold profitably.

- In at least one case, a CHP unit is used to heat a large greenhouse and the carbon dioxide is fed to the plants.

- In another, a the gas-fired Redditch power station, the food-grade carbon dioxide is sold to the food and construction industries.

- Grain LNG Terminal can also export gas and is only a short sea crossing from gas-hungry Germany.

- According to this Centrica press release, Centrica will run low-carbon bunkering services from the Grain LNG Terminal.

I analyse the investment in Grain LNG Terminal in Investment in Grain LNG.

On Rough Gas Storage

These are three paragraphs from the article.

O’Shea remains hopeful for plans to develop the Rough gas storage facility in the North Sea, which he re-opened in 2022.

The idea is that Centrica will invest £2 billion to ‘create the biggest gas storage facility in the world’, along with up to 5,000 jobs.

It could be used to store hydrogen, touted as a major energy source of the future, provided the Government comes up with a supportive regulatory framework as it has for Sizewell.

The German AquaVentus project aims to bring at least 100 GW of green hydrogen to mainland Germany from the North Sea.

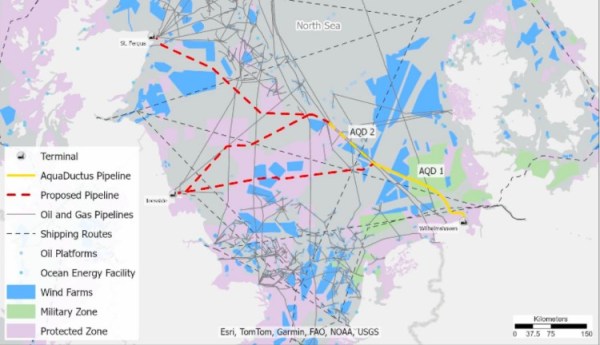

This map of the North Sea, which I downloaded from the Hydrogen Scotland web site, shows the co-operation between Hydrogen Scotland and AquaVentus

Note.

- The yellow AquaDuctus pipeline connected to the German coast near Wilhelmshaven.

- There appear to be two AquaDuctus sections ; AQD 1 and AQD 2.

- There are appear to be three proposed pipelines, which are shown in a dotted red, that connect the UK to AquaDuctus.

- The Northern proposed pipeline appears to connect to the St. Fergus gas terminal on the North-East tip of Scotland.

- The two Southern proposed pipelines appear to connect to the Easington gas terminal in East Yorkshire.

- Easington gas terminal is within easy reach of the massive gas stores, which are being converted to store hydrogen at Aldbrough and Rough.

- The blue areas are offshore wind farms.

- The blue area straddling the Southernmost proposed pipe line is the Dogger Bank wind farm, is the world’s largest offshore wind farm and could eventually total over 6 GW.

- RWE are developing 7.2 GW of wind farms between Dogger Bank and Norfolk in UK waters, which could generate hydrogen for AquaDuctus.

This cooperation seems to be getting the hydrogen Germany needs to its industry.

It should be noted, that Germany has no sizeable hydrogen stores, but the AquaVentus system gives them access to SSE’s Aldbrough and Centrica’s Rough hydrogen stores.

So will the two hydrogen stores be storing hydrogen for both the UK and Germany?

Storing hydrogen and selling it to the country with the highest need could be a nice little earner.

On X-energy

These are three paragraphs from the article.

He is also backing a £10 billion plan to build the UK’s first advanced modular reactors in a partnership with X-energy of the US.

The project is taking place in Hartlepool, in County Durham, where the existing nuclear power station is due to reach the end of its life in 2028.

As is the nature of these projects, it involves risks around technology, regulation and finance, though the potential rewards are significant. Among them is the prospect of 2,500 jobs in the town, where unemployment is high.

Note.

- This is another bold deal.

- I wrote in detail about this deal in Centrica And X-energy Agree To Deploy UK’s First Advanced Modular Reactors.

- Jobs are mentioned in the This is Money article for the second time.

I also think, if it works to replace the Hartlepool nuclear power station, then it can be used to replace other decommissioned nuclear power stations.

On Getting Your First Job

These are three paragraphs from the article.

His career got off to a slow start when he struggled to secure a training contract with an accountancy firm after leaving Glasgow University.

‘I had about 30, 40 rejection letters. I remember the stress of not having a job when everyone else did – you just feel different,’ he says.

He feels it is ‘a duty’ for bosses to try to give young people a start.

I very much agree with that. I would very much be a hypocrite, if I didn’t, as I was given good starts by two companies.

On Apprenticeships

This is a paragraph from the article.

‘We are committed to creating one new apprenticeship for every day of this decade,’ he points out, sounding genuinely proud.

I very much agree with that. My father only had a small printing business, but he was proud of the apprentices he’d trained.

On Innovation

Centrica have backed three innovative ideas.

- heata, which is a distributed data centre in your hot water tank, which uses the waste heat to give you hot water.

- HiiROC, which is an innovative way to generate affordable hydrogen efficiently.

- Highview Power, which stores energy as liquid air.

I’m surprised that backing innovations like these was not mentioned.

Conclusion

This article is very much a must read.

UK Infrastructure Bank, Centrica & Partners Invest £300M in Highview Power Clean Energy Storage Programme To Boost UK’s Energy Security

The title of this post, is the same as that of this news item from Highview Power.

This is the sub-heading.

Highview Power kickstarts its multi-billion pound renewable energy programme to accelerate the UK’s transition to net zero in Carrington, Manchester.

These three paragraphs outline the investment.

Highview Power has secured the backing of the UK Infrastructure Bank and the energy industry leader Centrica with a £300 million investment for the first commercial-scale liquid air energy storage (LAES) plant in the UK.

The £300 million funding round was led by the UK Infrastructure Bank (UKIB) and the British multinational energy and services company Centrica, alongside a syndicate of investors including Rio Tinto, Goldman Sachs, KIRKBI and Mosaic Capital.

The investment will enable the construction of one of the world’s largest long duration energy storage (LDES) facilities in Carrington, Manchester, using Highview Power’s proprietary LAES technology. Once complete, it will have a storage capacity of 300 MWh and an output power of 50 MWs per hour for six hours. Construction will begin on the site immediately, with the facility operational in early 2026, supporting over 700 jobs in construction and the supply chain.

Note.

- The backers are of a high quality.

- The Carrington LDES appears to be a 50 MW/300 MWh battery.

It finally looks like Highview Power is on its way.

These are my thoughts on the rest of news item.

Centrica’s Involvement

This paragraph talks about Centrica’s involvement.

Energy leader Centrica comes on board as Highview Power’s strategic partner and a key player in the UK’s energy transition, supporting Carrington and the accelerated roll-out of the technology in the UK through a £70 million investment. The programme will set the bar for storage energy systems around the world, positioning the UK as the global leader in energy storage and flexibility.

I suspect that Centrica have an application in mind.

In Centrica Business Solutions Begins Work On 20MW Hydrogen-Ready Peaker In Redditch, I talk about how Centrica is updating an old peaker plant.

In the related post I refer to this news item from Centrica Business Systems.

This paragraph in the Centrica Business Systems news item, outlines Centrica’s plans.

The Redditch peaking plant is part of Centrica’s plans to deliver around 1GW of flexible energy assets, that includes the redevelopment of several legacy-owned power stations, including the transformation of the former Brigg Power Station in Lincolnshire into a battery storage asset and the first plant in the UK to be part fuelled by hydrogen.

As Redditch power station is only 20 MW, Centrica could be thinking of around fifty assets of a similar size.

It seems to me, that some of these assets could be Highview Power’s LDES batteries of an appropriate size. They may even be paired with a wind or solar farm.

Larger Systems

Highview Power’s news item, also has this paragraph.

Highview Power will now also commence planning on the next four larger scale 2.5 GWh facilities (with a total anticipated investment of £3 billion). Located at strategic sites across the UK, these will ensure a fast roll-out of the technology to align with UK LDES support mechanisms and enable the ESO’s Future Energy Scenario Plans.

Elsewhere on their web site, Highview Power say this about their 2.5 GWh facilities.

Highview Power’s next projects will be located in Scotland and the North East and each will be 200MW/2.5GWh capacity. These will be located on the national transmission network where the wind is being generated and therefore will enable these regions to unleash their untapped renewable energy potential and store excess wind power at scale.

So will the four larger systems have a 200MW/2.5GWh capacity?

They could, but 200 MW may not be an appropriate output for the location. Or a longer duration may be needed.

Highview Power’s design gives the flexibility to design a system, that meets each application.

Working With National Grid

Highview Power’s news item, also has this sentence.

Highview Power’s technology will also provide stability services to the National Grid, which will allow for the long-term replacement of fossil fuel-based power plants for system support.

Highview Power’s technology is also an alternative to Battery Energy Storage Systems (BESS) of a similar capacity.

How does Highview Power’s technology compare with the best lithium-ion systems on price, performance and reliability?

Curtailment Of Wind Farms

Highview Power’s news item, also has these two paragraphs.

This storage will help reduce curtailment costs – which is significant as Britain spent £800m in 2023 to turn off wind farms.

Highview Power aims to accelerate the roll-out of its larger facilities across the UK by 2035 in line with one of National Grid’s target scenario forecasts of a 2 GW requirement from LAES, which would represent nearly 20% of the UK’s long duration energy storage needs. By capturing and storing excess renewable energy, which is now the cheapest form of electricity, storage can help keep energy costs from spiralling, and power Britain’s homes with 24/7 renewable clean energy.

I can see several wind farms, that are regularly curtailed would have a Highview Power battery installed at their onshore substation.

Receently, I wrote Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, which described how Ørsted are installing a 300 MW/600 MWh Battery Energy Storage Systems (BESS) at Swardeston substation, where Hornsea Three connects to the grid.

I would suspect that the purpose of the battery is to avoid turning off the wind farm.

Would a Highview Power battery be better value?

What’s In It For Rio Tinto?

I can understand, why most companies are investing, but Rio Tinto are a mining company. My only thought is that they have a lot of redundant holes in the ground, that cost them a lot of money and by the use of Highview Power’s technology, they can be turned into productive assets.

Collateral Benefits

Highview Power’s news item, also has this paragraph.

Beyond contributing to the UK’s energy security by reducing the intermittency of renewables, Highview Power’s infrastructure programme will make a major contribution to the UK economy, requiring in excess of £9 billion investment in energy storage infrastructure over the next 10 years – with the potential to support over 6,000 jobs and generate billions of pounds in value add to the economy. It will also contribute materially to increasing utilisation of green energy generation, reducing energy bills for consumers and providing significantly improved energy stability and security.

If Highview Power can do that for the UK, what can it do for other countries?

No wonder companies of the quality of Centrica, Rio Tinto and Goldman Sachs are investing.

Centrica Completes Work On 20MW Hydrogen-Ready Peaker In Redditch

The title of this post, is the same as that of this press release from Centrica.

This is the sub-heading.

Construction is complete on Centrica’s new 20MW hydrogen-blend-ready gas-fired peaking plant in Worcestershire, transforming the previously decommissioned Redditch power plant.

These paragraphs give more details of the project.

The plant is designed to support times of high or peak demand for electricity. Peaking plants only operate when production from renewables can’t meet demand, supporting the energy transition by maintaining a stable electricity supply. The Redditch site can power the equivalent of 2,000 homes for a full day, helping to maintain stability and reliability on the grid.

The plant is capable of using a blend of natural gas and hydrogen, futureproofing the site and supporting the UK’s transition towards a decarbonised energy system.

The Redditch peaking plant forms part of Centrica’s plans to invest between £600m – £800m a year until 2028 in renewable generation, security of supply, and its customers, including building out a portfolio of flexible energy assets. That includes the redevelopment of several legacy power stations, including the Brigg Energy Park in to a power generation and battery storage asset, and the first power station in the UK to be part-fuelled by hydrogen.

I also wrote Centrica Business Solutions Begins Work On 20MW Hydrogen-Ready Peaker In Redditch, about this project.

HiiROC

I wonder if this power station will be fitted with a HiiROC system, which will split the natural gas into two useful products; hydrogen and carbon black.

I wrote about HiiROC in Centrica Partners With Hull-Based HiiRoc For Hydrogen Fuel Switch Trial At Humber Power Plant.

I can see lots of HiiROC systems creating a hydrogen feed, to decarbonise various processes.

Whose Engines Are Used At Redditch?

Centrica still haven’t disclosed, whose engines they are using.

Centrica Business Solutions Begins Work On 20MW Hydrogen-Ready Peaker In Redditch

The title of this post, is the same as that as this news item from Centrica Business Systems.

This is the sub-heading.

Centrica Business Solutions has started work on a 20MW hydrogen-ready gas-fired peaking plant in Worcestershire, as it continues to expand its portfolio of energy assets.

These three paragraphs outline the project.

Centrica has purchased a previously decommissioned power plant in Redditch, and is set to install eight UK assembled containerised engines to burn natural gas.

Expected to be fully operational later this year, the peaking power plant will run only when there is high or peak demand for electricity, or when generation from renewables is low. The Redditch project will have the capacity to power the equivalent of 2,000 homes for a full day when required, helping to maintain stability and reliability on the grid.

The engines will also be capable of burning a blend of natural gas and hydrogen, futureproofing the site and helping the UK transition towards a decarbonised energy system.

- The original power station had Rolls-Royce generators.

- Cummins and Rolls-Royce mtu and possibly other companies can probably supply the dual fuel generators.

- Cummins have received UK Government funding to develop hydrogen-powered internal combustion engines.

- This press release from Cummins, which is entitled Dawn Of A New Chapter From Darlington, gives more details on Cummins’ plans for the Darlington factory and hydrogen.

Given that Cummins manufactured sixty-six thousand engines in Darlington in 2021 and it is stated that these containerised engines will be assembled in the UK, I feel, that these engines may be from Cummins.

Centrica’s Plans

This paragraph in the Centrica Business Systems news item, outlines their plans.

The Redditch peaking plant is part of Centrica’s plans to deliver around 1GW of flexible energy assets, that includes the redevelopment of several legacy-owned power stations, including the transformation of the former Brigg Power Station in Lincolnshire into a battery storage asset and the first plant in the UK to be part fuelled by hydrogen.

As Redditch power station is only 20 MW, Centrica could be thinking of around fifty assets of a similar size.

Brigg Power Station

The Wikipedia entry for Brigg Power station gives these details of the station.

- The station was built in 1993.

- It is a combined cycle gas turbine power station.

- The primary fuel is natural gas, but it can also run on diesel.

- It has a nameplate capacity of 240 MW.

Brigg power station is also to be used as a test site for hydrogen firing.

This news item from Centrica is entitled Centrica And HiiROC To Inject Hydrogen At Brigg Gas-Fired Power Station In UK First Project.

These paragraphs from the news item explains the process.

The 49MW gas fired plant at Brigg is designed to meet demand during peak times or when generation from renewables is low, typically operating for less than three hours a day. Mixing hydrogen in with natural gas reduces the overall carbon intensity.

It’s anticipated that during the trial, getting underway in Q3 2023, no more than three per cent of the gas mix could be hydrogen, increasing to 20% incrementally after the project. Longer term, the vision is to move towards 100% hydrogen and to deploy similar technology across all gas-fired peaking plant.

HiiROC’s proprietary technology converts biomethane, flare gas or natural gas into clean hydrogen and carbon black, through an innovative Thermal Plasma Electrolysis process. This results in a low carbon, or potentially negative carbon, ‘emerald hydrogen’.

Because the byproduct comes in the form of a valuable, solid, pure carbon it can be easily captured and used in applications ranging from tyres, rubbers and toners, and in new use cases like building materials and even as a soil enhancer.

It looks to me, that HiiROC are using an updated version of a process called pyrolysis, which is fully and well-described in this Wikipedia entry. This is the first paragraph.

The pyrolysis (or devolatilization) process is the thermal decomposition of materials at elevated temperatures, often in an inert atmosphere. It involves a change of chemical composition. The word is coined from the Greek-derived elements pyro “fire”, “heat”, “fever” and lysis “separating”.

Pyrolysis is more common than you think and is even used in cooking to do things like caramelise onions. This is a video of a chef giving a demonstration of caramelising onions.

On an industrial scale, pyrolysis is used to make coke and charcoal.

I came across pyrolysis in my first job after graduating, when I worked at ICI Runcorn.

ICI were trying to make acetylene in a process plant they had bought from BASF. Ethylene was burned in an atmosphere, that didn’t have much oxygen and then quenched in naphtha. This should have produced acetylene , but all it produced was tonnes of black soot, that it spread all over Runcorn.

I shared an office with a guy, who was using a purpose-built instrument to measure acetylene in the off-gas from the burners.

When he discovered that the gas could be in explosive limits, ICI shut the plant down. The Germans didn’t believe this and said, that anyway it was impossible to do the measurement.

ICI gave up on the process and demolished their plant, but sadly the German plant blew up.

It does look like HiiROC have tamed the process to be able to put hydrocarbons in one end and get hydrogen and carbon black out the other.

I wonder how many old and possibly dangerous chemical processes can be reimagined using modern technology.

It certainly appears that Centrica are not holding back on innovation.

Conclusion

I’ve never run a large electricity network. Not even a simulated one.

But I’m fairly sure that having a large number of assets of different sizes, that can be optimised to the load and the fuel available, creates a more reliable and efficient network.

Heavy energy users may even have their own small efficient power station, that is powered by gases piped from the local landfill.