18 GW Of New Offshore Wind Could Be Developed Off Ireland’s Coast

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ireland’s Department of Environment, Climate and Communications has released the Offshore Wind Technical Resource Assessment, providing detailed analysis and recommendations that estimate an additional 3.5 GW to 18 GW of fixed-bottom offshore wind could be developed around the country’s coast.

These paragraph adds more detail to the story.

The assessment concludes that there could be an additional 3.5-18 GW of fixed-bottom offshore wind that could be developed around the coast, in addition to the 8 GW of offshore wind already planned in Ireland between Phase One projects and the South Coast Designated Maritime Area Plan (DMAP).

Note.

- This expansion could give Ireland 26 GW of offshore wind.

- According to this page, 41.4 % of the electricity in the Republic of Ireland was produced by wind in December 2024, with a similar amount from non-renewables.

- The assessment also seems to want to wait for floating wind power, which could be prudent.

Ireland is going green.

Haventus, Sarens PSG Unveil ‘On-Land to Launch’ Floating Wind Solution

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

UK companies Haventus and Sarens PSG have developed a low-cost solution for the integration and launch of floating offshore wind turbines.

These two introductory paragraphs add more details.

Haventus said that it is working to enable offshore wind project developers to acquire fully assembled floating bases and turbines at Ardersier, Scotland, as well as providing dry storage which does not require complex licensing.

A heavy-lift solution will enable safe on-land integration and launch to the harbour of fully integrated floating offshore wind turbines.

Note.

- Haventus introduce themselves on their web site, as an energy transition facilities provider, offering pivotal infrastructure for the offshore wind industry. The first facility, they are developing is the Port of Ardesier in the North of Scotland, to the North-East of Inverness.

- Sarens PSG introduce themselves on their web site, as specialists in turnkey heavy lifting and transportation solutions for offshore wind component load-in, marshalling, assembly, deployment, and integration.

It looks to me that the two companies are ideal partners to put together flotillas of large floating wind turbines.

These two paragraphs seem to describe the objectives of the partnership.

This should shorten supply chains through single-site sourcing of key components and remove the operational, safety, logistical, and engineering complexity that comes with storage and integration activities in the marine environment.

The companies also said that the solution can also drive down the costs and accelerate floating offshore wind deployment by simplifying transport and installation requirements and remove the obstacles of weather and design life variables that must be considered with ‘wet’ storage and integration.

I was always told as a young engineer to define your objectives first, as you might find this helps with the design and costs of the project.

I do wonder sometimes, if the objectives of High Speed Two smelt too much of a project designed by lots of parties, who all had different objectives.

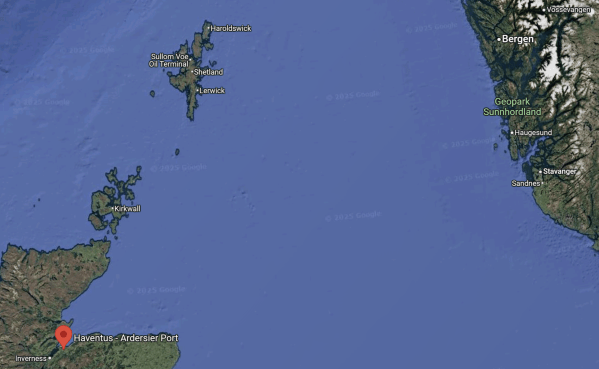

The Location Of The Port Of Ardesier

This Google Map shows the location of the Port of Ardesier in relation to Inverness, the Orkneys and Shetlands, and Norway.

The Port of Ardesier would appear to be ideally placed to bring in business for the partnership.

Equinor May Ditch Empire Wind 1 ‘In Coming Days’ Unless Stop-Work Order Lifted – Reports

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Equinor could abandon the Empire Wind 1 offshore wind project “in the coming days” if the stop-work order, issued by the US government soon after the project started offshore construction work, is not lifted, president of Equinor Renewables Americas, Molly Morris, recently shared in an interview.

These are the first three paragraphs.

Morris told Politico that the standstill was costing the company millions each day and USD 50 million (around EUR 45 million) per week but that a lawsuit would take too long as the work offshore needs to get off the ground again soon.

Last month, Anders Opedal, CEO and President of Equinor, called the US government’s order to stop construction activities on Empire Wind 1 “unlawful” and said the company was seeking to engage directly with the US administration to clarify the matter and was considering its legal options.

AP reports that Morris said the project was now at risk of missing the summer construction window as it began this month and would be set back a year if that happens. This is why the company is pushing for the order to be lifted by the government as that would allow for the work to be resumed while legal action could get the project tied up in courts, according to AP’s report.

When this project is late and inevitably loses money, it will be Trump’s fault.

I’ve seen it all before with housing and railway projects in the UK and other countries.

But Trump is bringing pointless political interference for a whole new stupid level.

How

Ørsted Pulls Plug On 2.4 GW Hornsea 4 Offshore Wind Project In UK

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted has discontinued the development of the UK’s Hornsea 4 offshore wind farm in its current form. The developer said the 2.4 GW project has faced rising supply chain costs, higher interest rates, and increased construction and delivery risks since the Contract for Difference (CfD) award in Allocation Round 6 (AR6) in September 2024.

This introductory paragraph adds more detail.

In combination, these developments have increased the execution risk and deteriorated the value creation of the project, which led to Ørsted stopping further spending on the project at this time and terminating the project’s supply chain contracts, according to the Danish company. This means that the firm will not deliver Hornsea 4 under the CfD awarded in AR6.

Consider.

- Hornsea 4 will be connected to the grid at a new Wanless Beck substation, which will also include a battery and solar farm, which will be South West of the current Creyke Beck substation. Are Ørsted frightened of opposition from the Nimbies to their plans?

- I also wonder if political uncertainty in the UK, and the possibility of a Reform UK government, led by Nigel Farage is worrying companies like Ørsted.

So will factors like these prompt companies like Ørsted to move investment to countries, where they welcome wind turbines like Denmark, Germany and The Netherlands.

Could Ørsted Be Looking At An Alternative?

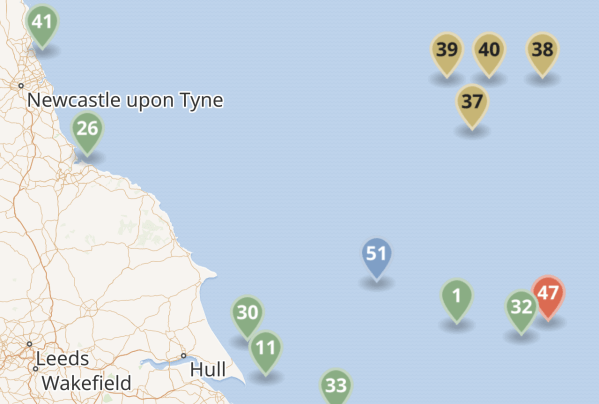

This is a map of wind farms in the North Sea in the Dogger Bank and Hornsea wind farms, that I clipped from Wikipedia..

These are the Dogger Bank and Hornsea wind farms and their developers and size

- 37 – Dogger Bank A – SSE Renewables/Equinor – 1,235 MW

- 39 – Dogger Bank B – SSE Renewables/Equinor – 1,235 MW

- 38 – Dogger Bank C – SSE Renewables/Equinor – 1,218 MW

- 40 – Sofia – RWE – 1,400 MW

- 1 – Hornsea 1 – Ørsted/Global Infrstructure Partners – 1,218 MW

- 32 – Hornsea 2 – Ørsted/Global Infrstructure Partners – 1,386 MW

- 47 – Hornsea 3 – Ørsted – 2,852 MW

- 51 – Hornsea 4 – Ørsted – 2,400 MW

Note.

- That is a total of 12, 944 MW, which is probably enough electricity to power all of England and a large part of Wales.

- Wikipedia’s List of offshore wind farms in the United Kingdom, also lists a 3,000 MW wind farm, that is being developed by German company ; RWE called Dogger Bank South,

- The Dogger Bank South wind farm is not shown on the map, but would surely be South of wind farms 37 to 40 and East of 51.

- The Dogger Bank South wind farm will raise the total of electricity in the Dogger Bank and Hornsea wind farms to just short of 16 GW.

Connecting 16 GW of new electricity into the grid, carrying it away to where it is needed and backing it up, so that power is provided, when the wind doesn’t blow, will not be a nightmare, it will be impossible.

An alternative plan is needed!

AquaVentus To The Rescue!

AquaVentus is a German plan to bring 10 GW of green hydrogen to the German mainland from the North Sea, so they can decarbonise German industry and retire their coal-fired power stations.

- I introduce AquaVentus in AquaVentus, which I suggest you read.

- AquaVentus is being developed by RWE.

- AquaVentus connects to a German hydrogen network called H2ercules to actually distribute the hydrogen.

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

I believe that offshore electrolysers could be built in the area of the Hornsea 4 and Dogger Bank South wind farms and the hydrogen generated would be taken by AquaVentus to either Germany or the UK.

- Both countries get the hydrogen they need.

- Excess hydrogen would be stored in Aldbrough and Rough.

- British Steel gets decarbonised.

- A 1.8 GW hydrogen-fired powerstation at Keadby gets the hydrogen it needs to backup the wind farms.

Germany and the UK get security in the supply of hydrogen.

These may be my best guesses, but they are based on published plans.

18-State Coalition Sues Trump Administration Over Block On Wind Energy Projects

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

A coalition of 18 state attorneys general has filed a lawsuit challenging the Trump administration’s directive to stop federal approvals for both onshore and offshore wind energy developments, warning that the policy could seriously damage the wind industry and hinder progress on renewable energy.

These two introductory paragraphs add some details.

The coalition alleges that the administration’s directive and federal agencies’ subsequent implementation of it violate the Administrative Procedure Act and other laws by offering no reasoned justification for reversing federal policy and freezing all approvals.

The lawsuit, led by New York state, also alleges that the sudden halt on all permitting violates numerous federal statutes that prescribe specific procedures and timelines for federal permitting and approvals.

As New York state is mentioned, I wonder if this case could end up in front of The Lady On The Train, who turned out to be a New York State Supreme Court Judge.

Plan For England’s Largest Wind Farm ‘Scaled Back’

The title of this post, is the same as that of this article on the BBC.

This is the sub-heading.

Plans for the largest onshore wind farm in England have been scaled back by a developer.

These two introductory paragraphs add more details.

Calderdale Energy Park said it would apply for permission to build 41 turbines instead of the 65 originally planned on land near Hebden Bridge in West Yorkshire.

A consultation period has now begun and people have been invited to submit their views on the project over the next six weeks.

Note.

- The number of wind turbines has been reduced by 37 %.

- Are the turbines now larger?

- In another paragraph, the developers say the solar element has been removed.

- Batteries, which I feel are essential to smooth the output of wind farms, are not mentioned.

Given comments by Stop Calderdale Wind Farm about peat bogs, there will be a large fight over building this wind farm.

New York Governor: ‘I Will Not Allow This Federal Overreach To Stand’

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Following the order of the US Department of the Interior (DOI) to halt all construction activities on the Empire Wind 1 offshore wind project, New York Governor Kathy Hochul said she would fight the federal decision.

This fight could get very nasty.

In the green corner, we have the New York governor; Kathy Hochul, Østed, Denmark and probably a lot of workers who thought they’d retrained for a new growing industry.

And in the orange corner, we have Donald Trump, Vladimir Putin and all the other useful idiots.

Interestingly, I may have met one of referees to this spat.

In The Lady On The Train, I describe a meeting with one of the most powerful justices in the United States.

As she either sat on the US Supreme Court or the New York State Supreme Court, it will be interesting how she would judge this case, given the liberal scientifically-correct conversation we had a few years ago.

The fight in the Courts would be very hard against a whole bench of formidable adversaries like this lady.

Chinese firm ‘Will Not Bid’ To Run Essex Nuclear Plant

The title of this post, is the same as that of this article on The Times.

This is the sub-heading.

Sources no longer expect planning applications to be submitted by China General Nuclear Power Group for Bradwell B

These three paragraphs give brief details of the current situation.

Plans for China’s state-run nuclear company to develop and operate a proposed nuclear site in Essex will no longer go ahead, The Times can reveal amid renewed focus on Chinese involvement in Britain’s critical infrastructure.

Bradwell B, the proposed nuclear power station, was earmarked for investment by China General Nuclear Power Group (CGN) in 2015. CGN is the majority investor in the proposed development alongside French energy company EDF.

But government and industry sources told The Times and Times Radio they no longer expected planning applications to be submitted by CGN for the site, and EDF will look to take back the lease from the Chinese firm at the earliest opportunity.

So what will happen to the Bradwell Site?

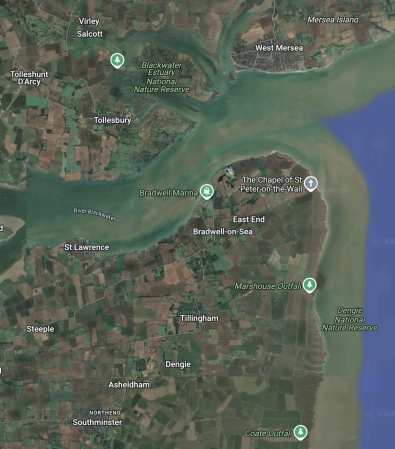

This Google Map shows the Blackwater Estuary to the North of Southend.

Note.

- The Blackwater Estuary is at the top of the map.

- Bradwell Marina and Bradwell-on-Sea can be seen on the map to the South of the Blackwater Estuary.

- Southminster has a rail connection, which was used to handle the nuclear fuel and now has a passenger service to Wickford on the Southend Victoria to London Liverpool Street Line.

This second Google Map shows Bradwell-on-Sea and the North of the peninsular in greater detail.

Note.

- The remains of the three runways of the Second World War RAF Bradwell Bay can be picked out.

- The remains of Bradwell A nuclear power station are towards the coast to the North-West of the former runways.

- It is large site.

I wonder, if the site could be used for backup to all the offshore wind farms in the area.

This is a list of all the wind farms, that are planned in the sea to the North and East of the Bradwell site.

- The East Anglia Array is partly operational, but could grow to as much as 7.2 GW.

- Greater Gabbard is 504 MW

- Gunfleet Sands is 172 MW

- London Array is 630 MW

- North Falls is 504 MW

Note.

- That is a total of roughly 9 GW.

- There’s also plenty of space in the sea for more turbines.

All these wind turbines will need backup for when the wind goes on strike.

These are possibilities for backup.

Another Hinckley Point C Or Sizewell C

You can see why the government wants to build a big nuke on the Bradwell site.

The 3.26 GW of a power station, which would be the size of Hinckley Point C would provide more than adequate backup.

But the builders of these power stations haven’t exactly covered themselves in glory!

- Construction of Hinckley Point C started in the late 2010s and first power is expected in 2031.

- Hinckley Point C power station has all the stink of bad project management.

- The Nimbbies would also be out in force at Bradwell.

There are also all the financial problems and those with the Chinese, indicated in The Times article.

A Fleet Of Small Modular Reactors

Hinckley Point C will hopefully be a 3260 MW nuclear power station and Rolls-Royce are saying that their small modular reactors will have a capacity of 470 MW.

Simple mathematics indicate that seven Rolls-Royce SMRs could do the same job as Hinckley Point C.

The advantages of providing this capacity with a fleet of SMRs are as follows.

- Each reactor can be built separately.

- They don’t all have to be of the same type.

- The total 3260 MW capacity could also be built at a pace, that matched the need of the wind farms.

- Building could even start with one of each of the chosen two initial types, the Government has said it will order.

- I also believe that there could be advantages in the sharing of resources.

- The rail link to Southminster would enable the bringing in of the smaller components needed for SMRs by rail.

Hopefully, the power of a big nuke could be added to the grid in a shorter time.

A Number of Long Duration Energy Stores

Highview Power is building 4 x 200 MW/2.5 GWh liquid air batteries for Orsted in the UK ; 2 in Scotland and 2 in England. They are backed by the likes of Centrica, Goldman Sachs, Rio Tinto, the Lego family trust and others.

Each GWh of liquid air needs a tank about the largest size of those used to store LNG. I suspect like LNG tanks they could be partly underground to reduce the bulk.

A Hybrid System

Bradwell is a large site and could easily accommodate a pair of Highview Power batteries, two SMRs, and all the other electrical gubbins, which would total to around 1.5 GW/5 GWh. This should be sufficient backup, but there would be space to add more batteries or SMRs as needed.

AI Forecast To Fuel Doubling In Data Centre Electricity Demand By 2030

The title of this post, is the same as that as this article in The Times.

This is the sub-heading.

International Energy Agency predicts that artificial intelligence could help reduce total greenhouse gas emissions

These are the first two paragraphs.

Data centres will use more than twice as much electricity by 2030 than they do today as artificial intelligence drives demand, the International Energy Agency predicts.

The agency forecast that all data centres globally will use about 945 terawatt-hours of electricity each year by 2030, roughly three times as much as the UK’s total annual demand of 317 terawatt-hours in 2023.

I am very much an optimist, that here in the UK, we will be able to satisfy demand for the generation and distribution of electricity.

- Our seas can accommodate enough wind turbines to provide the baseload of electricity we will need.

- Roofs and fields will be covered in solar panels.

- SSE seem to be getting their act together with pumped storage hydro in Scotland.

- I am confident, that new energy storage technologies like Highview Power with the packing of companies like Centrica, Goldman Sachs, Rio Tinto and others will come good, in providing power, when the wind doesn’t blow and the sun doesn’t shine.

- Hopefully, Hinckley Point C and Sizewell C will be online and soon to be joined by the first of the new small modular nuclear reactors.

- Hopefully, Mersey Tidal Power will be operating.

- There will be innovative ideas like heata from Centrica’s research. The economical water heater even made BBC’s One Show last week.

The only problem will be the Nimbies.

1.2 GW Rampion 2 Offshore Wind Farm Granted Development Consent

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK has granted development consent to Rampion 2, the proposed 1.2 GW extension to the 400 MW Rampion offshore wind farm in Sussex. The Development Consent Order (DCO), issued by the Secretary of State for Energy Security and Net Zero on 4 April, will come into force on 28 April.

Rampion 2 is one of a number of extension wind farms that are listed in this list on Wikipedia.

They include.

- Awel y Môr which is a 500 MW wind farm, that is adjacent to the 576 MW Gwynt y Môr wind farm

- Five Estuaries, which is a 353 MW wind farm, that is adjacent to the 353 MW Galloper wind farm

- North Falls, which is a 504 MW wind farm, that is adjacent to the 504 MW Greater Gabbard wind farm

- Outer Dowsing is a 1500 MW extension to the 194 MW Lynn and Inner Dowsing wind farm.

- Rampion 2 is a 1200 MW extension to the 400 MW Rampion wind farm.

- Seagreen 1A is a 500 MW extension to the 1400 MW Seagreen 1 wind farm.

- Sheringham Shoal and Dudgeon Extensions, which is a 353 MW wind farm, that is adjacent to the 575 MW Sheringham Shoal and Dudgeon wind farms

In total 3780 MW of wind farms are being increased in size by 4406 MW.

A parcel of seven web sites have been more than doubled in size. Is this more efficient to do them this way, as some resources from the previous wind farms can be shared and better use can be made of resources like ships and cranes?

I feel that some serious project management may have been done.