Centrica And Equinor Agree Major New Deal To Bolster UK Energy Security

The title of this post, is the same as that as this news item from Centrica.

This is the sub-heading.

Centrica and Equinor have today announced a £20 billion plus agreement to deliver gas to the UK. The new deal will see Centrica take delivery of five billion cubic meters (bcm) of gas per year to 2035.

These three paragraphs add more detail to the deal.

The expansive ten-year deal continues a long-term relationship with Equinor that dates back to 2005 bringing gas from Norway to the UK.

In 2024, the UK imported almost two-thirds (66.2%) of its gas demand, with 50.2% of the total imports coming from Norway1. This is an increase from the UK importing around a third of its gas requirements from Norway in 20222 and underlines the strategic importance of the Norwegian relationship to UK energy and price security.

The contract also allows for natural gas sales to be replaced with hydrogen in the future, providing further support to the UK’s hydrogen economy.

I believe there is more to this deal than, is stated in the news item.

These are my thoughts.

Where Does AquaVentus Fit In?

The AquaVentus web site has a sub heading of Hydrogen Production In The North Sea.

This video on the web site shows the structure of the project.

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- There appears to be an extra link, that would create a hydrogen link between Norway and Humberside.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

RWE

I should add that AquaVentus is a project of German energy company; RWE.

It should be noted that RWE are the largest generator of electricity in the UK.

They will soon be even larger as they are developing these offshore wind farms in British waters.

- Dogger Bank South – 3 GW

- Norfolk Boreas – 1.4 GW

- Norfolk Vanguard East – 1.4 GW

- Norfolk Vanguard West – 1.4 GW

Note.

- This is 7.2 GW of electricity.

- The three Norfolk wind farms wwere possibly acquired at a bargain price from Vattenfall.

- None of these wind farms have Contracts for Difference.

- RWE are developing large offshore electrolysers.

- East Anglia is in revolt over pylons marching across the landscape.

I wonder, if RWE will convert the electricity to hydrogen and bring it ashore using AquaVentus, coastal tankers or pipelines to existing gas terminals like Bacton.

The revenue from all this hydrogen going to Germany could explain the rise in Government spending, as it could be a Magic Money Tree like no other.

HiiROC

HiiROC is a Hull-based start-up company backed by Centrica, that can turn any hydrocarbon gas, like chemical plant waste gas, biomethane or natural gas into turquoise hydrogen and carbon black.

I asked Google about the size of Norway’s chemical industry and got this reply.

Norway’s chemical industry, including oil refining and pharmaceuticals, is a significant part of the country’s economy. In 2023, this sector generated sales of NOK 175 billion (approximately €15.2 billion), with 83% of those sales being exports. The industry employed 13,800 full-time equivalents and added NOK 454 billion (approximately €3.9 billion) in value.

Isn’t AI wonderful!

So will Norway use HiiROC or something similar to convert their natural gas and chemical off-gas into valuable hydrogen?

If AquaVentus were to be extended to Norway, then the hydrogen could be sold to both the UK and Germany.

A scenario like this would explain the option to switch to hydrogen in the contract.

Aldbrough And Brough

Earlier, I said that just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

I have read somewhere, that Germany is short of hydrogen storage, but I’m sure Centrica and SSE will help them out for a suitable fee. Centrica are also thought to be experts at buying energy at one price and selling it later at a profit.

Conclusion

I have felt for some time, that selling hydrogen to the Germans was going to be the Conservative government’s Magic Money Tree.

Has this Labour government decided to bring it back to life?

Haventus, Sarens PSG Unveil ‘On-Land to Launch’ Floating Wind Solution

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

UK companies Haventus and Sarens PSG have developed a low-cost solution for the integration and launch of floating offshore wind turbines.

These two introductory paragraphs add more details.

Haventus said that it is working to enable offshore wind project developers to acquire fully assembled floating bases and turbines at Ardersier, Scotland, as well as providing dry storage which does not require complex licensing.

A heavy-lift solution will enable safe on-land integration and launch to the harbour of fully integrated floating offshore wind turbines.

Note.

- Haventus introduce themselves on their web site, as an energy transition facilities provider, offering pivotal infrastructure for the offshore wind industry. The first facility, they are developing is the Port of Ardesier in the North of Scotland, to the North-East of Inverness.

- Sarens PSG introduce themselves on their web site, as specialists in turnkey heavy lifting and transportation solutions for offshore wind component load-in, marshalling, assembly, deployment, and integration.

It looks to me that the two companies are ideal partners to put together flotillas of large floating wind turbines.

These two paragraphs seem to describe the objectives of the partnership.

This should shorten supply chains through single-site sourcing of key components and remove the operational, safety, logistical, and engineering complexity that comes with storage and integration activities in the marine environment.

The companies also said that the solution can also drive down the costs and accelerate floating offshore wind deployment by simplifying transport and installation requirements and remove the obstacles of weather and design life variables that must be considered with ‘wet’ storage and integration.

I was always told as a young engineer to define your objectives first, as you might find this helps with the design and costs of the project.

I do wonder sometimes, if the objectives of High Speed Two smelt too much of a project designed by lots of parties, who all had different objectives.

The Location Of The Port Of Ardesier

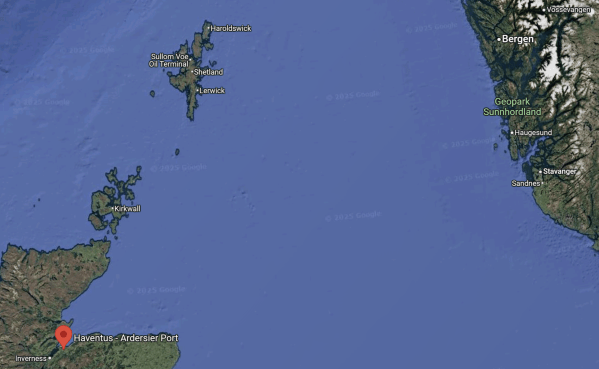

This Google Map shows the location of the Port of Ardesier in relation to Inverness, the Orkneys and Shetlands, and Norway.

The Port of Ardesier would appear to be ideally placed to bring in business for the partnership.

Ambitious £3bn Pumped Hydro Project At Loch Ness Moves Forward

The title of this post is the same as that of this article on Sustainable Times.

These are the two introductory paragraphs.

A £3 billion pumped storage hydro (PSH) project near Scotland’s iconic Loch Ness is one step closer to becoming a reality. Glen Earrach Energy (GEE) confirmed on April 25th that it has officially submitted the planning application for its ambitious 2gw scheme.

If greenlit, this project would represent nearly three-quarters of the total PSH capacity planned for Loch Ness, contributing 34 GWh of the region’s 46 GWh storage goal. But it’s not just the storage that stands out. This development would also account for two-thirds of the generating capacity, all while using just half of the water previously considered. To put it into perspective, the project’s capacity would be on par with the combined output of around 800 onshore wind turbines scattered throughout the Highland Council area.

Note.

- The generating and pumping capacity for this ambitious scheme is given as 2 GW. Only three in China and one in the United States are larger.

- The storage capacity of 34 GWh will make it the largest in the UK, possibly the second largest in Europe to Ulla-Førre in Norway and one of the ten largest in the world.

- A projected 10% reduction in the UK grid’s carbon footprint is claimed.

- The cost of three billion is high, but compare that with the tens of billions quoted for the 3.26 GW Hinckley Point C.

The Glen Earrach scheme is not short on superlatives and the article in Sustainable Times is worth a thorough read.

Fifth Hydro Project Proposed At Loch Ness, is based on a BBC article of the same name.

These were my thoughts in the related post.

The Existing Hydro Schemes On Loch Ness

According to the BBC article, there are two existing hydro schemes on Loch Ness.

- Foyers is described on this web site and is a reasonably modern 305 MW/6.3 GWh pumped storage hydroelectric power station, that was built by SSE Renewables in the last fifty years.

- Glendoe is described on this web site and is a modern 106.5 MW conventional hydroelectric power station, that was built by SSE Renewables in the last twenty years.

Foyers and Glendoe may not be the biggest hydroelectric power stations, but they’re up there in size with most solar and onshore wind farms. Perhaps we should look for sites to develop 100 MW hydroelectric power stations?

The Proposed Hydro Schemes On Loch Ness

According to the BBC article, there are four proposed hydro schemes on Loch Ness.

- Coire Glas is described on this web site and will be a 1.5GW/30 GWh pumped storage hydroelectric power station, that is being developed by SSE Renewables.

- Fearna is described on this web site and will be a 1.8GW/37 GWh pumped storage hydroelectric power station, that is being developed by Gilkes Energy.

- Loch Kemp is described on this web site and will be a 600MW/9 GWh pumped storage hydroelectric power station, that is being developed by Statera.

- Loch Na Cathrach is described on this web site and will be a 450MW/2.8 GWh pumped storage hydroelectric power station, that is being developed by Statktaft.

In addition there is, there is the recently announced Glen Earrach.

- Glen Earrach is described on this web site and will be a 2GW/34 GWh pumped storage hydroelectric power station, that is being developed by Glen Earrach Energy.

Note.

- The total power of the seven pumped storage hydroelectric power stations is 4.76 GW.

- The total storage capacity is 89.1 GWh.

- The storage capacity is enough to run all turbines flat out for nearly nineteen hours.

I estimate that if 2 GW/34 GWh of pumped storage will cost £3 billion, then 4.76 GW/89.1 GWh of pumped storage will cost around £7-8 billion.

The Empires Strike Back

The theme of this post was suggested by this article in The Times by Gerard Baker, which is entitled Karma has come for Mark Carney — and Canada.

This is the sub-heading.

This embodiment of globalism finds himself championing national sovereignty just as Trump eyes a North American union

These are the two introductory paragraphs.

Mark Carney is the very embodiment of the globalist ideal that ruled the world for a quarter-century after the end of the Cold War. Born in the mid-1960s in the far Northwest Territories, he grew up in Alberta in the kind of place previous generations would never have left. But the brilliant kid from a large Catholic family won a scholarship to Harvard and then took a masters and doctorate at Oxford.

Marked out as a member of the intellectual elite of his generation, he followed their well-worn path and joined Goldman Sachs, working in the US, the UK and Japan. As international borders came down, goods and capital flowed around the world like water, and rootless young men and women feasted on the pot of gold at the End of History, Carney jetted from capital to capital, developing bond issuance strategies in post-apartheid South Africa and helping deal with the consequences of the Russian debt crisis of 1998.

Mark Carney has done very well!

I have a few thoughts.

Energy Production In Canada And The UK

I have just looked up how Canada produces its electricity.

- 17.5 % -Fossil fuel

- 14.6 % – Nuclear

- 8 % – Renewables

So how does Canada produce the other sixty percent?

Hydro! Wow!

As I write, the UK is producing electricity as follows.

- 10.7 % – Fossil fuel

- 37.7 % – Low-carbon

- 51.6 % – Renewables

Changes To Energy Use In The Next Ten Years

Three things will happen to energy generation and use in the next ten years.

- Our use of renewable and non-zero carbon sources will converge with Canada’s at about 75 %.

- The use of energy storage will grow dramatically in Canada and the UK.

- Green hydrogen production will increase dramatically to decarbonise difficult and expensive-to-decarbonise industries like aviation, cement, chemicals, glass, heavy transport, refining and steel.

Canada and the UK, together with a few other sun-, water- or wind-blessed countries, like Australia, Denmark, Falkland Islands, Iceland, Japan, Korea, New Zealand and Norway, who share a lot of our values, will be in the prime position to produce all this green hydrogen.

Conclusion

It does look like all the old empires of the Middle Ages are reasserting themselves.

Hence the title of this post!

Mark Carney is now in the right position to use Canada’s and a few other countries hydrogen muscles to power the world to net-zero.

Norway Drops Fixed-Bottom Offshore Wind Plans, Shifts Focus To Floating Wind

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Norwegian government has cancelled plans for another fixed-bottom offshore wind tender in the North Sea due to cost concerns, shifting its focus toward developing floating offshore wind projects.

As cost concerns are mentioned in the sub-heading, I suspect that quite a few people are surprised that floating wind is cheaper with all its complications.

But we do know the following.

- Floating wind farms seem to generate electricity with a higher capacity factor.

- Floating wind farms may be cheaper to assemble and service, as this can be carried out in a port with a crane, which may be less susceptible to random disturbance caused by weather.

- Floating wind farms can be placed in deeper waters, which may be better areas for electricity generation.

- Floating wind farms can be placed further out to sea, so Nimbys don’t object to them as much, causing extra costs.

Accountants and financiers will always prefer lower-cost options.

15+ MW Floating Wind Turbines to Be Tested At Norway’s METCentre

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Three companies have signed contracts with Norway’s Marine Energy Test Centre (METCentre) to test new technology aimed at reducing the costs of floating offshore wind by demonstrating floaters equipped with 15+ MW turbines.

These are the first two paragraphs.

According to Norwegian Offshore Wind, this is the turbine size that will be relevant for future floating offshore wind farms.

The test area is located just a few kilometres away from the Utsira Nord zone, where Norway’s first commercial floating offshore wind farm will be located.

This sounds like the sort of sensible test philosophy, that you’d expect from the Norwegians.

Equinor Acquires Minority Stake In Ørsted, Becomes Second-Largest Shareholder

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Norway-headquartered Equinor has acquired a 9.8 per cent minority stake in Denmark’s Ørsted, making it the second-largest shareholder behind the Danish state, which holds a controlling stake in the company.

These are the first two paragraphs.

According to Equinor, the company is supportive of Ørsted’s strategy and management and is not seeking board representation.

“Equinor has a long-term perspective and will be a supportive owner in Ørsted. This is a counter-cyclical investment in a leading developer, and a premium portfolio of operating offshore wind assets”, said Anders Opedal, CEO of Equinor.

Could it also be two Scandinavian companies getting together to put up a stronger front to outside interests?

Are they frightened of the actions that might be taken by Great British Energy and by the Germans with their massive thirst for hydrogen?

Norway Plans EUR 3 Billion Subsidy For Floating Offshore Wind

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Norwegian government has proposed NOK 35 billion (approximately EUR 3 billion) for a support scheme dedicated towards the first commercial floating offshore wind tender within the Vestavind F and Vestavind B areas.

These are the first two paragraphs.

According to the press release, the government is making progress in following up on its ambitious plan to allocate project areas for 30 GW of offshore wind by 2040.

Norway plans to conduct the next tendering round for offshore wind in 2025. After that, the government intends to hold regularly scheduled tendering rounds and state aid competitions leading up to 2040.

The original press release is called A Responsible Approach To Floating Offshore Wind.

Some politicians and green sceptics might not call three billion euros responsible.

I do suspect that Great British Energy will have to deal in this size of numbers to be able to compete with the Norwegians.

We’ll have to work hard to meet our target of 100 GW by 2040.

But at least as the UK’s target is higher, does that mean that the target should be easier. Or do we have more suitable sea?

Global Offshore Wind To Top 520 GW By 2040, Floating Wind To Play Major Role – Rystad Energy

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

According to Rystad Energy, global offshore wind capacity will surpass 520 GW by 2040, with floating wind installations nearing 90 GW by that time

These are the first three paragraphs.

In 2023, the offshore wind sector saw a seven per cent increase in new capacity additions compared to the previous year, said Rystad Energy. This momentum is expected to accelerate this year, with new capacity additions expected to grow by nine per cent to over 11 GW by the end of the year.

By 2040, Europe is expected to account for more than 70 per cent of global floating wind installations. Although some project delays beyond 2030 are anticipated, there will likely be a strong push to accelerate deployment, according to Rystad Energy.

As a result, floating wind capacity is projected to approach 90 GW by 2040, led by the UK, France, and Portugal, with Asia (excluding mainland China) expected to account for 20 per cent of global installations.

Note, that Rystad Energy is an independent energy research and business intelligence company headquartered in Oslo, Norway.

Implications For Energy Storage

In Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, I talk about how the 2.9 GW Hornsea Three wind farm will have a connection to the grid, that incorporates a 300 MW/600 MWh battery.

With 520 GW of offshore wind to be installed by 2040, I suspect that energy storage companies and funds will do well.

If the 520 GW of offshore wind were fitted with batteries like the 2.9 GW Hornsea Three wind farm, there would be a need for around 60 GW of battery output, with a capacity of around 120 GWh.

I doubt, there would be enough lithium for all those batteries.

Some countries like Norway, the United States, Australia, France, Spain, Japan, India, China and others will be able to develop large pumped storage hydroelectricity systems, but others will have to rely on newer, developing technologies.

The UK will be well-placed with around 80 GWh of pumped storage hydroelectricity under development and several promising developing storage technologies.