GE Vernova To Build Up To 18 MW Offshore Wind Test Turbine In Norway

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Norwegian Water Resources and Energy Directorate (NVE) has granted GE Vernova’s subsidiary Georgine Wind permission to build and operate an 18 MW test turbine in Gulen municipality.

These first three paragraphs add more detail.

The project, which is part of a test programme to advance offshore wind technology, will feature an up to 18 MW turbine, with a maximum tip height of 275 metres and up to 250 metres in rotor diameter.

The turbine is expected to have an annual electricity production of 55 GWh, which corresponds to the annual energy consumption of approximately 2,750 Norwegian households.

The unit is planned to undergo testing for up to five years, after which it will remain on land and generate electricity for an additional 25 years.

Note.

- It is the largest wind turbine to be licensed in Norway.

- The turbine will be erected atSløvåg, which is a few miles North of Bergen.

- It is the first wind power plant in Norway to be licensed within an existing industrial area.

- Research will be done to see how the giant turbine interacts with existing industry.

- I can see a lot of research being done during the 25-year lifetime of the turbine to the reactions of those living and working near the turbine.

I do feel that as GE are an American company with worldwide interests, under normal political circumstances, this turbine would have been erected at a site in the United States.

But with Trump in charge and his opposition to renewable energy, it may be that the Norwegian tax regime makes the installation in Norway, a better financial proposition.

On the other hand, the Norwegians may be looking at decarbonising remote rural areas with single large turbines.

mtu Engines From Rolls-Royce Provide Emergency Power On Offshore Wind Platforms In The UK

The title of this post, is the same as that of this press release from Rolls-Royce.

These two bullet points act as sub-headings.

- Four engines from the mtu Series 4000 provide emergency power for two converter platforms

- Norfolk wind farm will generate electricity for demand from more than four million households

This opening paragraph adds more detail.

Rolls-Royce has received a second order from Eureka Pumps AS to supply mtu Series 4000 engines to power emergency power generators for the Norfolk Offshore Wind Farm on the east coast of the United Kingdom. Rolls-Royce will thus supply a total of four mtu engines for the first and second phases of the large wind farm, which is operated by energy supplier RWE. The engines will be installed on two converter platforms at sea and onshore, which are the heart of the offshore grid connection: they ensure that the electricity generated at sea can be fed into the power grid. With a total capacity of 4.2 GW, the wind farm is expected to generate electricity for more than four million households during the course of this decade. It is located 50 to 80 kilometers off the east coast of the UK.

In some ways I find it strange, that a diesel generator is used to provide the necessary emergency power.

But when I asked Google if mtu 4000 generators can operate on hydrogen. I got this answer.

Yes, mtu Series 4000 engines, specifically the gas variants, can be adapted to run on hydrogen fuel. Rolls-Royce has successfully tested a 12-cylinder mtu Series 4000 L64 engine with 100% hydrogen fuel and reported positive results. Furthermore, mtu gas engines are designed to be “H2-ready,” meaning they can be converted to operate with hydrogen, either as a blend or with 100% hydrogen fuel.

That seems very much to be a definite affirmative answer.

So will these mtu Series 4000 engines for the Norfolk wind farms be “H2 ready”? The hydrogen needed, could be generated on the platform, using some form of electrolyser and some megawatts of electricity from the wind farms.

Will The Norfolk Wind Farms Generate Hydrogen For Germany?

Consider.

- Germany needs to replace Russian gas and their own coal, with a zero-carbon fuel.

- Germany is developing H2ercules to distribute hydrogen to Southern Germany.

- Germany is developing AquaVentus to collect 10 GW of hydrogen from wind-powered offshore electrolysers in the North Sea.

- The AquaVentus web site shows connections in the UK to Humberside and Peterhead, both of which are areas, where large hydrogen electrolysers are bing built.

- In addition Humberside has two of the world’s largest hydrogen stores and is building a 1.8 GW hydrogen-fired powerstation.

- The Norfolk wind farms with a capacity of 4.2 GW, are not far from the border between British and German waters.

- To the North of the Norfolk wind farm, RWE are developing the 3 GW Dogger Bank South wind farm.

- 7.2 GW of British hydrogen would make a large proportion of the hydrogen Germany needs.

I clipped this map from a video about Aquaventus.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

It will also be a massive Magic Money Tree for the UK Treasury.

So why is this vast hydrogen system never mentioned?

It was negotiated by Clair Coutinho and Robert Habeck, back in the days, when Boris was Prime Minister.

Centrica And Equinor Agree Major New Deal To Bolster UK Energy Security

The title of this post, is the same as that as this news item from Centrica.

This is the sub-heading.

Centrica and Equinor have today announced a £20 billion plus agreement to deliver gas to the UK. The new deal will see Centrica take delivery of five billion cubic meters (bcm) of gas per year to 2035.

These three paragraphs add more detail to the deal.

The expansive ten-year deal continues a long-term relationship with Equinor that dates back to 2005 bringing gas from Norway to the UK.

In 2024, the UK imported almost two-thirds (66.2%) of its gas demand, with 50.2% of the total imports coming from Norway1. This is an increase from the UK importing around a third of its gas requirements from Norway in 20222 and underlines the strategic importance of the Norwegian relationship to UK energy and price security.

The contract also allows for natural gas sales to be replaced with hydrogen in the future, providing further support to the UK’s hydrogen economy.

I believe there is more to this deal than, is stated in the news item.

These are my thoughts.

Where Does AquaVentus Fit In?

The AquaVentus web site has a sub heading of Hydrogen Production In The North Sea.

This video on the web site shows the structure of the project.

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- There appears to be an extra link, that would create a hydrogen link between Norway and Humberside.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

RWE

I should add that AquaVentus is a project of German energy company; RWE.

It should be noted that RWE are the largest generator of electricity in the UK.

They will soon be even larger as they are developing these offshore wind farms in British waters.

- Dogger Bank South – 3 GW

- Norfolk Boreas – 1.4 GW

- Norfolk Vanguard East – 1.4 GW

- Norfolk Vanguard West – 1.4 GW

Note.

- This is 7.2 GW of electricity.

- The three Norfolk wind farms wwere possibly acquired at a bargain price from Vattenfall.

- None of these wind farms have Contracts for Difference.

- RWE are developing large offshore electrolysers.

- East Anglia is in revolt over pylons marching across the landscape.

I wonder, if RWE will convert the electricity to hydrogen and bring it ashore using AquaVentus, coastal tankers or pipelines to existing gas terminals like Bacton.

The revenue from all this hydrogen going to Germany could explain the rise in Government spending, as it could be a Magic Money Tree like no other.

HiiROC

HiiROC is a Hull-based start-up company backed by Centrica, that can turn any hydrocarbon gas, like chemical plant waste gas, biomethane or natural gas into turquoise hydrogen and carbon black.

I asked Google about the size of Norway’s chemical industry and got this reply.

Norway’s chemical industry, including oil refining and pharmaceuticals, is a significant part of the country’s economy. In 2023, this sector generated sales of NOK 175 billion (approximately €15.2 billion), with 83% of those sales being exports. The industry employed 13,800 full-time equivalents and added NOK 454 billion (approximately €3.9 billion) in value.

Isn’t AI wonderful!

So will Norway use HiiROC or something similar to convert their natural gas and chemical off-gas into valuable hydrogen?

If AquaVentus were to be extended to Norway, then the hydrogen could be sold to both the UK and Germany.

A scenario like this would explain the option to switch to hydrogen in the contract.

Aldbrough And Brough

Earlier, I said that just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

I have read somewhere, that Germany is short of hydrogen storage, but I’m sure Centrica and SSE will help them out for a suitable fee. Centrica are also thought to be experts at buying energy at one price and selling it later at a profit.

Conclusion

I have felt for some time, that selling hydrogen to the Germans was going to be the Conservative government’s Magic Money Tree.

Has this Labour government decided to bring it back to life?

Haventus, Sarens PSG Unveil ‘On-Land to Launch’ Floating Wind Solution

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

UK companies Haventus and Sarens PSG have developed a low-cost solution for the integration and launch of floating offshore wind turbines.

These two introductory paragraphs add more details.

Haventus said that it is working to enable offshore wind project developers to acquire fully assembled floating bases and turbines at Ardersier, Scotland, as well as providing dry storage which does not require complex licensing.

A heavy-lift solution will enable safe on-land integration and launch to the harbour of fully integrated floating offshore wind turbines.

Note.

- Haventus introduce themselves on their web site, as an energy transition facilities provider, offering pivotal infrastructure for the offshore wind industry. The first facility, they are developing is the Port of Ardesier in the North of Scotland, to the North-East of Inverness.

- Sarens PSG introduce themselves on their web site, as specialists in turnkey heavy lifting and transportation solutions for offshore wind component load-in, marshalling, assembly, deployment, and integration.

It looks to me that the two companies are ideal partners to put together flotillas of large floating wind turbines.

These two paragraphs seem to describe the objectives of the partnership.

This should shorten supply chains through single-site sourcing of key components and remove the operational, safety, logistical, and engineering complexity that comes with storage and integration activities in the marine environment.

The companies also said that the solution can also drive down the costs and accelerate floating offshore wind deployment by simplifying transport and installation requirements and remove the obstacles of weather and design life variables that must be considered with ‘wet’ storage and integration.

I was always told as a young engineer to define your objectives first, as you might find this helps with the design and costs of the project.

I do wonder sometimes, if the objectives of High Speed Two smelt too much of a project designed by lots of parties, who all had different objectives.

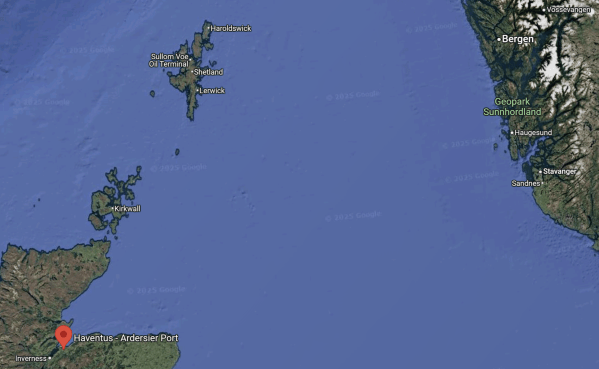

The Location Of The Port Of Ardesier

This Google Map shows the location of the Port of Ardesier in relation to Inverness, the Orkneys and Shetlands, and Norway.

The Port of Ardesier would appear to be ideally placed to bring in business for the partnership.

Ambitious £3bn Pumped Hydro Project At Loch Ness Moves Forward

The title of this post is the same as that of this article on Sustainable Times.

These are the two introductory paragraphs.

A £3 billion pumped storage hydro (PSH) project near Scotland’s iconic Loch Ness is one step closer to becoming a reality. Glen Earrach Energy (GEE) confirmed on April 25th that it has officially submitted the planning application for its ambitious 2gw scheme.

If greenlit, this project would represent nearly three-quarters of the total PSH capacity planned for Loch Ness, contributing 34 GWh of the region’s 46 GWh storage goal. But it’s not just the storage that stands out. This development would also account for two-thirds of the generating capacity, all while using just half of the water previously considered. To put it into perspective, the project’s capacity would be on par with the combined output of around 800 onshore wind turbines scattered throughout the Highland Council area.

Note.

- The generating and pumping capacity for this ambitious scheme is given as 2 GW. Only three in China and one in the United States are larger.

- The storage capacity of 34 GWh will make it the largest in the UK, possibly the second largest in Europe to Ulla-Førre in Norway and one of the ten largest in the world.

- A projected 10% reduction in the UK grid’s carbon footprint is claimed.

- The cost of three billion is high, but compare that with the tens of billions quoted for the 3.26 GW Hinckley Point C.

The Glen Earrach scheme is not short on superlatives and the article in Sustainable Times is worth a thorough read.

Fifth Hydro Project Proposed At Loch Ness, is based on a BBC article of the same name.

These were my thoughts in the related post.

The Existing Hydro Schemes On Loch Ness

According to the BBC article, there are two existing hydro schemes on Loch Ness.

- Foyers is described on this web site and is a reasonably modern 305 MW/6.3 GWh pumped storage hydroelectric power station, that was built by SSE Renewables in the last fifty years.

- Glendoe is described on this web site and is a modern 106.5 MW conventional hydroelectric power station, that was built by SSE Renewables in the last twenty years.

Foyers and Glendoe may not be the biggest hydroelectric power stations, but they’re up there in size with most solar and onshore wind farms. Perhaps we should look for sites to develop 100 MW hydroelectric power stations?

The Proposed Hydro Schemes On Loch Ness

According to the BBC article, there are four proposed hydro schemes on Loch Ness.

- Coire Glas is described on this web site and will be a 1.5GW/30 GWh pumped storage hydroelectric power station, that is being developed by SSE Renewables.

- Fearna is described on this web site and will be a 1.8GW/37 GWh pumped storage hydroelectric power station, that is being developed by Gilkes Energy.

- Loch Kemp is described on this web site and will be a 600MW/9 GWh pumped storage hydroelectric power station, that is being developed by Statera.

- Loch Na Cathrach is described on this web site and will be a 450MW/2.8 GWh pumped storage hydroelectric power station, that is being developed by Statktaft.

In addition there is, there is the recently announced Glen Earrach.

- Glen Earrach is described on this web site and will be a 2GW/34 GWh pumped storage hydroelectric power station, that is being developed by Glen Earrach Energy.

Note.

- The total power of the seven pumped storage hydroelectric power stations is 4.76 GW.

- The total storage capacity is 89.1 GWh.

- The storage capacity is enough to run all turbines flat out for nearly nineteen hours.

I estimate that if 2 GW/34 GWh of pumped storage will cost £3 billion, then 4.76 GW/89.1 GWh of pumped storage will cost around £7-8 billion.

The Empires Strike Back

The theme of this post was suggested by this article in The Times by Gerard Baker, which is entitled Karma has come for Mark Carney — and Canada.

This is the sub-heading.

This embodiment of globalism finds himself championing national sovereignty just as Trump eyes a North American union

These are the two introductory paragraphs.

Mark Carney is the very embodiment of the globalist ideal that ruled the world for a quarter-century after the end of the Cold War. Born in the mid-1960s in the far Northwest Territories, he grew up in Alberta in the kind of place previous generations would never have left. But the brilliant kid from a large Catholic family won a scholarship to Harvard and then took a masters and doctorate at Oxford.

Marked out as a member of the intellectual elite of his generation, he followed their well-worn path and joined Goldman Sachs, working in the US, the UK and Japan. As international borders came down, goods and capital flowed around the world like water, and rootless young men and women feasted on the pot of gold at the End of History, Carney jetted from capital to capital, developing bond issuance strategies in post-apartheid South Africa and helping deal with the consequences of the Russian debt crisis of 1998.

Mark Carney has done very well!

I have a few thoughts.

Energy Production In Canada And The UK

I have just looked up how Canada produces its electricity.

- 17.5 % -Fossil fuel

- 14.6 % – Nuclear

- 8 % – Renewables

So how does Canada produce the other sixty percent?

Hydro! Wow!

As I write, the UK is producing electricity as follows.

- 10.7 % – Fossil fuel

- 37.7 % – Low-carbon

- 51.6 % – Renewables

Changes To Energy Use In The Next Ten Years

Three things will happen to energy generation and use in the next ten years.

- Our use of renewable and non-zero carbon sources will converge with Canada’s at about 75 %.

- The use of energy storage will grow dramatically in Canada and the UK.

- Green hydrogen production will increase dramatically to decarbonise difficult and expensive-to-decarbonise industries like aviation, cement, chemicals, glass, heavy transport, refining and steel.

Canada and the UK, together with a few other sun-, water- or wind-blessed countries, like Australia, Denmark, Falkland Islands, Iceland, Japan, Korea, New Zealand and Norway, who share a lot of our values, will be in the prime position to produce all this green hydrogen.

Conclusion

It does look like all the old empires of the Middle Ages are reasserting themselves.

Hence the title of this post!

Mark Carney is now in the right position to use Canada’s and a few other countries hydrogen muscles to power the world to net-zero.

Norway Drops Fixed-Bottom Offshore Wind Plans, Shifts Focus To Floating Wind

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Norwegian government has cancelled plans for another fixed-bottom offshore wind tender in the North Sea due to cost concerns, shifting its focus toward developing floating offshore wind projects.

As cost concerns are mentioned in the sub-heading, I suspect that quite a few people are surprised that floating wind is cheaper with all its complications.

But we do know the following.

- Floating wind farms seem to generate electricity with a higher capacity factor.

- Floating wind farms may be cheaper to assemble and service, as this can be carried out in a port with a crane, which may be less susceptible to random disturbance caused by weather.

- Floating wind farms can be placed in deeper waters, which may be better areas for electricity generation.

- Floating wind farms can be placed further out to sea, so Nimbys don’t object to them as much, causing extra costs.

Accountants and financiers will always prefer lower-cost options.

15+ MW Floating Wind Turbines to Be Tested At Norway’s METCentre

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Three companies have signed contracts with Norway’s Marine Energy Test Centre (METCentre) to test new technology aimed at reducing the costs of floating offshore wind by demonstrating floaters equipped with 15+ MW turbines.

These are the first two paragraphs.

According to Norwegian Offshore Wind, this is the turbine size that will be relevant for future floating offshore wind farms.

The test area is located just a few kilometres away from the Utsira Nord zone, where Norway’s first commercial floating offshore wind farm will be located.

This sounds like the sort of sensible test philosophy, that you’d expect from the Norwegians.

Equinor Acquires Minority Stake In Ørsted, Becomes Second-Largest Shareholder

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Norway-headquartered Equinor has acquired a 9.8 per cent minority stake in Denmark’s Ørsted, making it the second-largest shareholder behind the Danish state, which holds a controlling stake in the company.

These are the first two paragraphs.

According to Equinor, the company is supportive of Ørsted’s strategy and management and is not seeking board representation.

“Equinor has a long-term perspective and will be a supportive owner in Ørsted. This is a counter-cyclical investment in a leading developer, and a premium portfolio of operating offshore wind assets”, said Anders Opedal, CEO of Equinor.

Could it also be two Scandinavian companies getting together to put up a stronger front to outside interests?

Are they frightened of the actions that might be taken by Great British Energy and by the Germans with their massive thirst for hydrogen?