US Offshore Wind Developer Sues Gov’t Over Stop-Work Order

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading

Dominion Energy has filed a federal lawsuit challenging the Trump administration’s stop-work order issued on 22 December that directed all major US offshore wind projects under construction to pause while federal agencies review alleged national security risks, AP and US media report.

This paragraph adds more detail.

In its complaint filed in the US District Court for the Eastern District of Virginia on 23 December, Dominion argues the Bureau of Ocean Energy Management (BOEM) order is “arbitrary and capricious” and violates constitutional and statutory limits on executive action.

I’m no lawyer, but I did have some excellent executive active with my late lawyer wife, so I get the gist of what is hinted.

I would not be happy, if I was an American citizen, who had to pick u[ the costs of Trump’s misdemeanours.

US Government Sends Stop Work Order To All Offshore Wind Projects Under Construction

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The US Department of Interior has paused the leases and suspended construction at all large-scale offshore wind projects currently under construction in the United States, citing ”national security risks identified by the Department of War in recently completed classified reports.”

The wind farms named are.

- Coastal Virginia Offshore Wind-Commercial – 2,600 GW

- Empire Wind 1 – 810 MW

- Revolution Wind – 704 MW

- Sunrise Wind – 924 MW

- Vineyard Wind 1 – 806 MW

Note.

- These five wind farms total 5,844 MW or 5.8 GW.

- The Empire Wind development is being led by Equinor, who are Norwegian.

- The Revolution Wind and Sunrise Wind developments are being led by Ørsted, who are Danish.

- The Vineyard Wind development is being led by Iberdrola, who are Spanish and Copenhagen Infrastructure Partners, who are Danish.

- Coastal Virginia Offshore Wind project uses 176 Siemens Gamesa SG 14-222 DD (Direct Drive) offshore wind turbines.

- Empire 1 Wind is using Vestas V236-15MW offshore wind turbines.

- Revolution Wind is using 65 Siemens Gamesa SG 11.0-200 DD offshore wind turbines.

- Sunrise Wind is using Siemens Gamesa wind turbines, specifically their 8.0 MW models (SG 8.0-167).

- Vineyard 1 Wind is using General Electric (GE) Haliade-X 13 MW offshore wind turbines.

- Some of the components for the Siemens wind turbines will be manufactured in Virginia.

- Coastal Virginia Offshore Wind has a budget of $11.2-3 billion.

- Empire 1 Wind has a budget of $5 billion.

- Resolution Wind has a budget of $4 billion.

- Sunrise Wind has a budget of $5.3 billion.

- Vineyard 1 Wind has a budget of $4 billion.

There will only be one winner in this new round of the ongoing spat between Trump and the wind industry, that he hates so much – the 1.3 million active lawyers in the United States,which is a figure from according to Google AI.

UK Gov’t Tweaking CfD Rules Ahead Of 8th Allocation Round, Proposes ‘Other Deepwater Offshore Wind’ Category

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK government has launched a consultation on proposed refinements to the Contracts for Difference (CfD) scheme ahead of Allocation Round 8 (AR8) and future rounds, including targeted changes to the terms concerning offshore wind and floating wind projects.

These two paragraphs add more details.

The consultation, published by the Department for Energy Security and Net Zero, seeks industry feedback on contractual and eligibility adjustments, some of which are intended to reflect the increasing scale and complexity of offshore wind developments, specifically floating and other deepwater projects.

For floating offshore wind, the government is proposing changes to CfD contract terms to better align with the technology’s development timelines. These include a proposed extension of the Longstop Period to give floating wind projects more time to commission and avoid termination of their CfD contract.

The government also wants to lower the Required Installed Capacity (RIC) threshold for floating offshore wind projects.

Currently, all CfD technologies are required to deliver a minimum of 95 per cent of the capacity they have contractually agreed to install, except for (fixed-bottom) offshore wind, whose RIC is set at 85 per cent to reflect the construction risks, such as encountering unsuitable seabed conditions after work has commenced. As floating wind projects, which were so far in the range of 100 MW, have grown in scale and complexity, the government plans to apply the same RIC requirement as for fixed-bottom offshore wind.

The CfD scheme currently supports two categories of offshore wind technology: fixed-bottom offshore wind and floating offshore wind, with the regulations in use (Allocation Regulations 2014) considering only the foundation designs that float to be floating offshore wind. With the ODOW category, the government wants to make room for the novel hybrid foundation designs, “which may be suitable for deepwater deployment but do not technically float and would therefore not be considered eligible as ‘floating foundations’ under the existing legal definition of ‘floating offshore wind’.”

This last paragraph sums up the reasons for the changes.

The proposed refinements are intended to ensure the CfD scheme remains fit for purpose as offshore wind technologies evolve, while maintaining investor confidence and supporting timely project delivery.

Hopefully developments at ports like Belfast, East Anglia, Inverness & Cromarty FreePort,Lowestoft and Tyne will encourage to develop wind farms around the shores of the UK.

ABP’s New Lowestoft Facility To Support East Anglia Two & Three O&M Ops

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

UK port operator Associated British Ports (ABP) and ScottishPower Renewables have entered into a long-term agreement for supporting operations and maintenance (O&M) activities at the East Anglia Two and East Anglia Three offshore wind farms from ABP’s Lowestoft Eastern Energy Facility (LEEF).

These two initial paragraphs add a few more details.

Under the agreement, ScottishPower Renewables will utilise berths at LEEF for service operations vessels (SOVs) and crew transfer vessels (CTVs) that will serve the East Anglian offshore wind farms. The company already operates its East Anglia One O&M base in Lowestoft.

LEEF was officially opened by the UK Secretary of State for Energy Security and Net Zero in January 2025, after ABP invested GBP 35 million (almost EUR 40 million) in the port infrastructure. The facility features deep-water berths, modern utilities and future-proofed infrastructure to support shore power and alternative fuels, according to the port operator.

These are some of my thoughts

How Large Are The East Anglian Wind Farms?

There are four East Anglian Wind Farms.

- East Anglian 1 – 714 MW, which was commissioned in 2020.

- East Anglian 1 North – 800 MW, which is planned to be commissioned in 2026.

- East Anglian 2 – 963 MW, which is planned to be commission in 2029.

- East Anglian 3 -1372 MW, which is planned to be commission in 2026.

That makes a total of 3849 MW.

Where Do The Cables Come Ashore?

Google AI gives this answer to the question.

The subsea export cables for the East Anglia wind farms, including East Anglia ONE, come ashore at Bawdsey in Suffolk, where they connect to onshore cables that run underground for about 23-37 km to the Bramford converter station, near Ipswich, to join the National Grid.

I know Bawdsey well from about the late 1950s until we moved my wife and I moved our family from East Suffolk to West Suffolk in the 1990s.

These posts are two memories of Bawdsey Manor and Felixstowe Ferry on the other side of Deben, that I wrote after one of my last visits to the Deben Estuary in 2009.

It hasn’t changed much over the years.

CIP’s UK Offshore Wind Project Granted Development Consent

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK Secretary of State for Energy Security and Net Zero has approved the Development Consent Order (DCO) for the Morecambe offshore wind farm in the Irish Sea, owned by Copenhagen Infrastructure Partners (CIP).

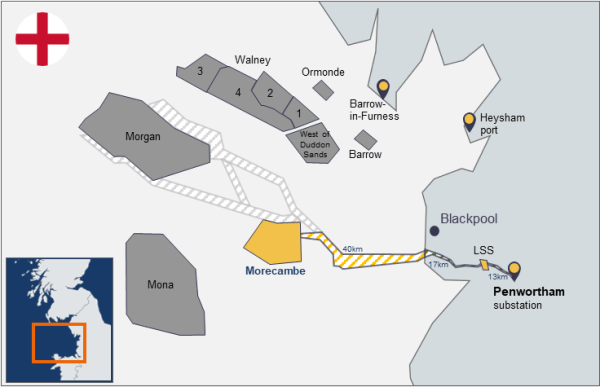

The article also shows this map from Copenhagen Infrastructure Partners.

Note.

- The 480 MW Morecambe wind farm is shown in yellow.

- The 1.5 GW Morgan wind farm received its DCO in August 2025.

- The 1.5 GW Mona wind farm received its DCO in July 2025.

- Both Morgan and Mona wind farms are being developed by a consortium of EnBW and JERA Nex bp.

- Morgan and Morecambe wind farms will connect to the grid at Penwortham substation.

- Mona wind farm will connect to the grid at Bodelwyddan National Grid substation in Denbighshire, North Wales.

- Morgan and Morecambe wind farms appear to be being developed jointly.

I must admit, I’m a bit surprised that Mona doesn’t connect to Penwortham substation.

US Judge Overturns Trump’s Ban On Wind Energy Project Permits

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

A federal judge has struck down the US President Donald Trump’s indefinite halt of all federal approvals and permitting for new wind energy projects.

Trump is obviously very strong in his opposition to wind power, as he issued the ”Wind Order” on his first day back in office.

He received this robust reply from Oceantic Network CEO Liz Burdock.

Today’s decision is welcome news, not just for the thousands of American workers and businesses across 40 states supporting offshore wind in the U.S., but also for the critical relief the wind industry will provide to lower skyrocketing electricity prices for millions of American families with reliable, affordable power.

Overturning the unlawful blanket halt to offshore wind permitting activities is needed to achieve our nation’s energy and economic priorities of bringing more power online quickly, improving grid reliability, and driving billions of new American steel manufacturing and shipbuilding investments. We thank the Attorneys General and the Alliance for Clean Energy New York for taking this case forward to protect American business interests against the politicization of our energy sector.

I don’t think we’ve heard the last of this legal argument.

Is Carbon Black Used To Make Offshore Electrical Cable?

I asked Google AI, the answer to this question and received this answer.

Yes, carbon black is extensively used to make offshore electrical cables. It serves two primary functions: providing electrical conductivity to specific components and offering UV protection to outer jacketing materials.

That seems a positive answer.

It also could be a very complementary one.

HiiROC have a process that splits any hydrocarbon gas including natural gas, chemical plant off gas and biomethane, into turquoise hydrogen and carbon black.

Two methods of bringing energy to the shore from an offshore wind farm are electricity and hydrogen, through a cable or pipe respectively.

This looks to me, that there could be a possibility to use one of Baldrick’s cunning hybrid plans to bring energy onshore using both hydrogen and electricity.

Effectively, the transmission and use of the system, would use both the hydrogen and carbon black produced by HiiROC.

First Monopile In At ‘Most Ecological Offshore Wind Farm Yet’

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Van Oord, using its installation vessel Boreas, installed the first monopile at the Ecowende offshore wind farm on 3 December. The project, a joint venture between Shell, Eneco and Chubu Electric Power, is being built off the coast of the Netherlands and is said to become the most ecological offshore wind farm to date.

These four paragraphs add more details.

The offshore wind farm, located approximately 53 kilometres off the Dutch coast near IJmuiden, will have 52 monopile foundations produced by Sif and Smulders supporting 52 Vestas V236-15.0 MW wind turbines.

The offshore wind farm is dubbed “the most ecological to date” since it incorporates several technologies and methodologies that are nature-inclusive, including monopiles coming in two diameters, 8.8 metres and 9.3 metres, to support varying turbine tower heights, as research indicates that higher turbine tip heights may allow birds to fly more safely between the structures, reducing collision risks.

Some of the wind turbines will feature red blades as part of a trial to assess whether increased visibility reduces bird collisions.

Offshore construction on Ecowende (Hollandse Kust West Site VI) offshore wind farm started in September with the installation of eco-friendly scour protection.

Note.

- It looks like its a 780 MW wind farm.

- They’re certainly looking after the birds.

- Scour protection is mainly to protect the wind farm, but at least it’s eco-friendly.

But then the Dutch must know a bit about building windmills, that last a long time.

£100m ‘Global Players’ Wind Farm Deal To Create 300 Jobs

The title of this post, is the same as this article on the BBC.

This is the sub-heading.

A £100m deal which will create about 300 jobs has been agreed between the developers of two Irish Sea offshore wind farms and Belfast Harbour.

These three paragraphs add more detail.

The joint developers of the Mona and Morgan offshore wind farms will lease Belfast Harbour’s D1 terminal for the assembly and preparation of wind turbine components.

Work is being carried out to get the site ready for use from 2028.

Joe O’Neill, chief executive of Belfast Harbour, described it as a “huge deal”, not just for the harbour but for Belfast and the wider region.

Joe O’Neill seems happy with the deal, if you read the full BBC article.

This Google Map shows Belfast Harbour with the D1 Terminal in the centre.

Note.

- The red arrow indicates the D1 Terminal.

- It appears to be within walking distance of Belfast City Airport.

- The harbour is not that far from the city centre.

I would expect, this could be an ideal harbour to prepare wind turbines for erection.

But Where Will The Cruise Ships Dock In Belfast, If The D1 Terminal Is Being Used To Prepare And Assemble Wind Turbines?

Google AI gave this answer to my question!

Cruise ships will dock at a new deepwater berth at Belfast Harbour’s D3 terminal starting with the 2028 cruise season. This new facility is a dual-purpose terminal being built to accommodate both the largest cruise vessels and the assembly and installation of offshore wind turbines.

Note.

- The date fits with the new site for turbine work being ready by 2028.

- The new D3 Terminal will take some of the largest cruise vessels.

- I suspect, it will be able to supply ships with suitable low-carbon fuel, as required.

- Could it also take the very large ships used to install turbines?

- It’s almost as if Belfast Harbour are making an attraction of the turbines.

Google AI gives this overview of the D3 Terminal.

The Belfast Harbour D3 cruise terminal is a new £90 million dual-purpose deepwater quay under construction, designed to accommodate the world’s largest cruise ships and support the offshore wind energy industry. Construction on the project, which is Belfast Harbour’s largest-ever investment, began in April 2025 and is expected to be operational for the 2028 cruise season. The facility will include a 340m quay and new terminal building for passengers, and will be converted for cargo handling during the cruise season.

It certainly looks like Belfast is designing a dual-purpose terminal, that will bring the maximum benefit to the city and its people.

Which Offshore Wind Projects Will Use Belfast Harbour?

Google AI gave this answer to my question!

The Mona and Morgan offshore wind farms, being developed by EnBW and JERA Nex bp, will use Belfast Harbour. The port’s D1 terminal will serve as the hub for the assembly and marshalling of wind turbine components for these projects, which are planned for the Irish Sea and are expected to be operational by 2028.

I suspect there will be others.

EDF Developing Offshore Wind-Powered Hydrogen Production Project In French EEZ

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

EDF Power Solutions has invited applications for a tender for Environmental Impact Assessment (EIA) services and hazard studies as part of a project to develop an offshore hydrogen production station in France’s Exclusive Economic Zone (EEZ).

This is the first paragraph.

The project, dubbed HYODE (HYdrogen Offshore DunkerquE), will produce green hydrogen by coupling offshore wind farms with an offshore electrolyser near Dunkirk, France, and is planned to also include storage and transport by ship to port, forming what EDF describes as an “innovative solution” to help scale green hydrogen production.

I asked Google AI, if there are any operational offshore hydrogen electrolysers and received this answer.

Yes, there are operational offshore electrolyser projects, though large-scale, dedicated offshore hydrogen platforms are still in development. The first operational offshore production on an existing gas platform is planned for late 2024 with the PosHYdon project. Additionally, a pilot project in the UK is testing the full integration of a hydrogen electrolyser onto an existing offshore wind turbine, with another project in the Netherlands installing an offshore hydrogen production and storage platform.

But, I did get this page on page on the Ramboll web site, which is entitled The Rise Of Offshore Hydrogen Production At Scale, which has this introductory paragraph.

The stage is set for producing green hydrogen from offshore wind and desalinated seawater. Building on existing and proven technology, offshore wind farms have the potential to become future production hubs for green hydrogen production at scale to meet increasing demand.

That sounds very promising, especially, if proven technology is borrowed from the offshore oil and gas industry.

It’s