Ocean Winds Secures Third Celtic Sea Floating Wind Site

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ocean Winds has secured the third floating offshore wind site in the Celtic Sea, offered through the Crown Estate’s Round 5 auction earlier this year. The developer is joining Equinor and the Gwynt Glas joint venture, which were awarded rights for two of the three sites offered in Round 5 in June.

This paragraph outlines Ocean Winds’s deal.

On 19 November, the Crown Estate said that Ocean Winds was set to be awarded the rights for a third floating offshore wind site in the Celtic Sea.

There would now appear to be three Celtic Winds deals for wind farms.

- Gwynt Glas – 1.5 GW

- Ocean Winds – 1.5 GW

- Equinor – 1.5 GW

Note.

- 4.5 GW will be able to power a good proportion of South Wales and the South-West peninsular.

- In Gwynt Glas And South Wales Ports Combine Strength In Preparation For Multi-Billion Floating Wind Industry, I talk about partnerships between the wind farms and the ports.

- If you sign up for a large wind farm from the Crown Estate, do you get to have afternoon tea with Charles and Camilla in the garden at Highgrove or even Buckingham Palace?

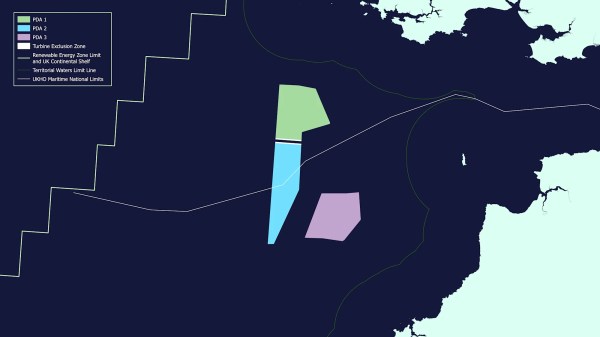

This map of the wind farms is available from download from this page on the Crown Estate web site.

Note.

- Gwynt Glas is in green.

- Ocean Winds is in blue.

- Equinor is in mauve.

- The white dot to the East of the wind farms is Lundy Island.

This triple wind farm is certainly well-placed to supply power to Cornwall, Devon and South Wales.

Equinor, EDF-ESB Joint Venture Secure 1.5 GW Sites In UK Floating Wind Leasing Round

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Crown Estate has selected Equinor and Gwynt Glas, a joint venture between EDF Renewables UK and ESB, as preferred bidders in the seabed leasing round for floating wind projects in the Celtic Sea.

These two paragraphs give more details.

Selected on 12 June, each of the two developers was awarded 1.5 GW of capacity in their respective project development area (PDA) for an annual option fee of GBP 350/MW (approximately EUR 410/MW).

The Crown Estate launched the floating wind leasing round (Offshore Wind Leasing Round 5) in February 2024, offering three areas off the coasts of Wales and South West England for a total of up to 4.5 GW of installed capacity.

Note.

- It looks like the Crown Estate are working to get a contract for the third site.

- The ports of Bristol and Port Talbot could be handling the assembly of the floating turbines.

- The Crown Estate has also established a new strategic approach with the National Energy System Operator (NESO).

Given the problems some wind and solar farms have had to get connected, the Crown Estate’s link up with NESO could be attractive to developers?

Conclusion

This looks a good bit of business by the Crown Estate in the Celtic Sea.

Did they get NESO to be helpful, by asking senior people for tea with Charles and Camilla at Highgrove?

Cammell Laird To Study Market Opportunities For UK-Built SOVs

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Offshore Renewable Energy (ORE) Catapult, in partnership with the National Shipbuilding Office and The Crown Estate, has appointed Cammell Laird, part of APCL Group, to carry out a detailed analysis of the future market opportunity for UK-built service operation vessels (SOVs) for offshore wind.

These two paragraphs explain the plan.

According to an ORE Catapult analysis, hundreds of SOVs will likely be in operation worldwide in the coming years as global offshore wind capacity is expected to grow to over 850 GW by 2050. To support the capacity expansion, the global SOV fleet will need to grow as well, with an associated global market of nearly GBP 35 billion (approximately EUR 41.6 billion) expected between now and 2050.

The UK SOV Manufacturing Business Case Development study for which Cammell Laird has been commissioned will help to develop knowledge of how the UK can provide vessel manufacturing to support offshore wind, delivering jobs and economic investment to communities around the country, according to ORE Catapult.

These are my thoughts.

Cammell Laird Are Also To Build A New Mersey Ferry

I wrote about this in Sail Into The Future In Style With Super-Realistic Virtual Tour Of The New Mersey Ferry.

I wouldn’t put it past Liverpool, to use one of the City’s famous icons to sell UK-built service operation vessels (SOVs) for offshore wind.

Will Rolls-Royce Get Involved?

In Rolls-Royce Powers World’s Fastest Offshore Crew Transfer Vessels, I describe how Rolls-Royce mtu are providing powerful engines for Italian Crew Offshore Vessels.

Will Rolls-Royce mtu provide the power for Cammell Laird’s service operation vessels?

The Crown Estate Awards GBP 5 Million In First Supply Chain Accelerator Round

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Crown Estate has awarded nearly GBP 5 million in funding to 13 organisations across England, Wales, and Scotland in the first round of its Supply Chain Accelerator.

These three paragraphs add more details.

According to The Crown Estate, the funding will help kick-start projects drawing down from a GBP 50 million fund established in May this year to accelerate and de-risk the early-stage development of UK supply chain projects that service the offshore wind sector.

The Crown Estate’s match funding will contribute to a combined development investment of over GBP 9 million, which, if the opportunities successfully conclude their respective development stages, could lead to more than GBP 400 million of capital investment, said the UK body.

Projects receiving funding include those enabling floating wind platforms, anchoring and mooring systems, operations and maintenance facilities, test facilities, and those supporting the skills

The grants have been widely spread in both the public and private sectors and appear to be supporting a variety of technologies.

What About Project Management?

When the four of us started Metier Management Systems to develop Artemis in the 1970s, we got no help from the Government or any agency.

I wonder what difference, government support of this nature would have made?

I don’t know whether any project management development is being supported, but it is my view, that each new generation of projects will bring forward new challenges.

Where’s The Plan, Rishi?

In RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030, I detailed how RWE intended to add an extra 10 GW of offshore wind to the seas around the UK.

As our current offshore wind capacity is around 15 GW, another 10 GW would surely be very welcome.

My post also outlined H2ercules, which is Germany’s massive project to create a hydrogen network to bring hydrogen to Southern Germany.

I also gave details of the hydrogen hub at Wilhelmshaven, which is being built by Uniper to feed H2ercules with green hydrogen from around the world.

I believe that some of this hydrogen for H2ercules will take a short trip across the North Sea from UK waters, after being created by offshore electrolysers.

Rishi Sunak’s Manifesto Speech – June 11

I also reported on Rishi Sunak’s Manifesto Speech, which he made on June 11th. This is an extract

This document on the Policy Mogul web site is entitled Rishi Sunak – Conservative Party Manifesto Speech – Jun 11.

These are three paragraphs from the speech.

We don’t just need military and border security. As Putin’s invasion of Ukraine has shown, we need energy security too. It is only by having reliable, home-grown sources of energy that we can deny dictators the ability to send our bills soaring. So, in our approach to energy policy we will put security and your family finances ahead of unaffordable eco zealotry.

Unlike Labour we don’t believe that we will achieve that energy security via a state-controlled energy company that doesn’t in fact produce any energy. That will only increase costs, and as Penny said on Friday there’s only one thing that GB in Starmer and Miliband’s GB Energy stands for, and that’s giant bills.

Our clear plan is to achieve energy security through new gas-powered stations, trebling our offshore wind capacity and by having new fleets of small modular reactors. These will make the UK a net exporter of electricity, giving us greater energy independence and security from the aggressive actions of dictators . Now let me just reiterate that, with our plan, we will produce enough electricity to both meet our domestic needs and export to our neighbours. Look at that. A clear, Conservative plan not only generating security, but also prosperity for our country.

It is now nine days since Rishi made that speech and I can’t remember any reports about an energy security policy, which he outlined in the last paragraph of my extract from his speech.

He particularly mentioned.

- New gas-powered stations

- Trebling our offshore wind capacity

- Having new fleets of small modular reactors.

He also said we would have sufficient electricity to export to our neighbours. As I said earlier some of this energy will be in the form of hydrogen, which has been created by offshore electrolysers.

If we are exporting electricity and hydrogen to Europe, this is likely to have three effects.

- An improvement in Europe’s energy security.

- H2ercules will improve and decarbonise German industry, using UK hydrogen.

- The finances of UK plc will improve.

It looks like there will be winners all round.

Rishi also said this, in his speech.

As Putin’s invasion of Ukraine has shown, we need energy security too.

The gas-powered stations, offshore wind farms and the fleets of small modular reactors, will be part of the equation.

But I believe, we need three other components to complete our energy security.

- The upgrading of the National Grid.

- The building of four x 2 GW interconnectors between Scotland and Eastern England.

- Large amounts of energy storage.

Note.

- The Great Grid Upgrade and the four x 2 GW interconnectors are being planned.

- In Huge Boost To UK Supply Chain As National Grid Launches The Great Grid Partnership With Seven New Industry Partners, All United In The Drive To Deliver The Great Grid Upgrade, I describe how National Grid has setup the Great Grid Partnership to deliver the Great Grid Upgrade.

- In UK Infrastructure Bank, Centrica & Partners Invest £300M in Highview Power Clean Energy Storage Programme To Boost UK’s Energy Security, I describe how the big boys do a deal with Highview Power to create affordable batteries for the UK and the world.

- In Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, I describe how the very large Swardeston BESS is to be built near Norwich.

- In Mercia Power Response & RheEnergise Working Together To Build Long Duration Energy Storage Projects In The UK, I describe another UK-developed long duration energy storage system, which is now being planned.

- In National Grid Shares Proposals For Green Electricity Projects In Lincolnshire And West Norfolk, Needed To Boost Home-Grown Energy Supplies And Progress Towards Net Zero, I describe National Grid’s projects in the East of England.

- In UK ESO Unveils GBP 58 Billion Grid Investment Plan To Reach 86 GW of Offshore Wind By 2035, I show how we’re not that far away from 86 GW by 2035.

- In 400k For National Grid Innovation Projects As Part Of Ofgem Fund To Help Shape Britain’s Net Zero Transition, I describe how National Grid is using innovation to help target net-zero by 2035.

- In Iberdrola Preparing Two East Anglia Offshore Wind Projects For UK’s Sixth CfD Round, I describe how Iberdrola is getting 1.7 GW ready for commissioning in 2026.

- In National Grid To Accelerate Up To 20GW Of Grid Connections Across Its Transmission And Distribution Networks, I describe how National Grid are accelerating the development of the electricity networks. 10 GW of battery storage is a collateral benefit.

These ten projects, most of which are financed and/or underway, would appear to be good foundations, on which to build the Great Grid Upgrade.

It looks to me, that National Grid, RWE, Centrica, Iberdrola and others, by just doing what comes naturally have offered the next government a road to a future.

It will be interesting, what gets said before the election.

Debenhams Oxford – May 27th, 2024

These pictures show the current state of the Debenhams store in Oxford.

This will be the first development of those, that I talked about in Crown Estate To Spend £1.5bn On New Laboratories.

- I have deliberately shown pictures of the Junction, where the Debenhams building occupies the North-West corner.

- There is a Waterstones opposite the Debenhams building, on a busy junction between George and Magdalen Streets.

- There is a bus information display on the corner.

- There are a lot of chain eateries and a pub; the Wig & Pen.

These are a few thoughts.

Does the Debenhams Building Have Any Car Parking?

I would doubt it, but there may be a need to bring in large equipment.

Taxis To And From The Station

Note.

- I took a black taxi from the station to just outside the Debenhams building and it cost me the princely sum of £5,20.

- I also noted there was a rank at the rear of the building.

- In both locations, taxis were ready to roll.

That looked reasonable.

Buses To And From The Station

Staff at Oxford station, assured me that buses were available, but due to all the road works and Bank Holiday chaos, I suspect it could be improved, when the station upgrade is complete.

Walking To The Station

I took this second set of pictures as I walked from the Debenhams building back to the station.

Note.

- I walked from the junction by Debenhams, along George Street.

- It was a fairly straight line and level.

- There were no signposts between Debenhams and the station.

- There was quite a bit of blocked traffic.

- The route could do with some improvement like refurbished pavements and a few direction signs.

It took me about twenty-four minutes and at 76, I walked it easily.

On entering the station, I walked straight on to the platform for my train back to Reading, which was two minutes late.

Cycling

I suspect that many will cycle to work in the Debenhams building, as it is in Oxford.

But then, I suspect the Crown Estate, their architects and builders will know the appropriate provision to make.

Is The Debenhams Building At A Good Location?

When I was around 23, I used to reverse commute to ICI in Welwyn Garden City.

This involved.

- A ten-minute walk from St. John’s Wood to Chalk Farm tube station.

- A Northern Line train to King’s Cross station.

- A suburban train to Welwyn Garden City station.

- A fifteen-minute walk to my place of work.

St. John’s Wood to Oxford would involve.

- A fourteen-minute bus ride to St. Paddington station.

- A suburban train to Oxford station.

- A twenty-minute walk to my place of work.

A Brompton bicycle would help.

Knowing Cambridge as I do, the Debenhams building would be very well-located, if it were in Cambridge in a similar location, with respect to the railway station.

I feel that the Debenhams building passes the location test.

UK Unveils GBP 50 Million Fund To Boost Offshore Wind Supply Chain

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Crown Estate has initiated a Supply Chain Accelerator to stimulate early-stage investment in the UK offshore wind supply chain.

These are the first three paragraphs.

The accelerator is a new GBP 50 million (approximately EUR 58.7 million) fund created to accelerate and de-risk the early-stage development of projects linked to offshore wind.

An initial GBP 10 million round of funding is now open for Expressions of Interest for businesses looking to establish UK projects that could support the development of a new UK supply chain capability for floating offshore wind in the Celtic Sea.

The application process opens formally in mid-June and closes at the end of July. The final announcement will be made in October 2024.

This sounds like a very good idea.

This is the next paragraph.

Earlier this year, the Crown Estate published research, the Celtic Sea Blueprint, which predicted that 5,300 jobs and a GBP 4.1 billion economic boost could be generated through deploying the first floating offshore wind capacity, that will result from the current leasing Round 5 process, under which leases for up to 4.5 GW of generation capacity will be awarded in the waters off South Wales and South-West England.

It looks to me, that the £100 million could help prime the pumps to do the following for South Wales and South-West England.

- Create 5,300 jobs

- Create a £ 4.1 billion economic boost.

- Develop up to 4.5 GW of generation capacity.

If we assume the following.

- 4.5 GW of generation capacity.

- Capacity factor of 50 %.

- Strike price of £ 35/MWh.

- A year has 8,760 hours.

We can say the following.

- Average hourly generation is 2,250 MWh

- Average yearly generation is 19,710 GWh or 19,710,000 MWh

This would be a yearly income of £ 689, 850 million.

Crown Estate To Spend £1.5bn On New Laboratories

The title of this post, is the same as that of this article on The Times.

These three paragraphs introduce the Crown Estate’s plan.

The Crown Estate is to spend £1.5 billion over the next decade building more laboratories nationwide and will start by redeveloping the old Debenhams store in Oxford city centre.

The King’s property company, which looks after the royal family’s £16 billion historic land portfolio, will invest £125 million to buy the former department store and will turn it into laboratory space.

The building has been empty for omore than three years, having closed down in early 2021 after Debenhams collapsed during the pandemic. The Crown has bought a long leasehold of the store from DTZ Investors, the freeholder, which is keeping the street-level retail units. Subject to planning, construction is expected to start at the site next year, with the labs expected to be fully operational in 2027 or 2028.

This looks very much like a smaller version of British Land’s plan for the Euston Tower, which I wrote about in British Land Unveils Plans To Transform London’s Euston Tower Into A Life Sciences And Innovation Hub.

These are my thoughts.

Helping Start-Ups

I have been involved with perhaps half a dozen start-up ventures. Two were very successful and the others generally scraped along or just failed.

One common theme, was the lack of small convenient premises, where perhaps up to a dozen people could work.

- I don’t know Oxford well, but I would assume that the Debenhams site, is good for public transport and cycle parking.

- I also hope there’s a good real ale pub nearby, for some productive group thinking!

If this venture from Crown Estate helps start-ups to get over the first difficult hurdle, then it will be a development to be welcomed.

Location, Location, Location

It has been said, that the three most important things in property development are location, location and location.

This 3D Google Map shows the approximate location of the Debenhams building.

Note.

- The red arrow indicates a pub called the Wig and Pen , which is on the opposite side of George Street to the Debenhams building.

- The railway with its excellent connections runs North-South down the Western edge of the map.

- I estimate that walking distance to the station is about 500-600 metres.

I shall be going to Oxford in the next couple of days to take some pictures of the building and the walk.

We Can’t Have Too Many Laboratories

The British and the sort of people we attract to these isles seem to be born innovators and inventors.

My father’s male line is Jewish and my paternal great-great-great-grandfather had to leave his home city of Königsberg in East Prussia for the sole reasons he was eighteen, male and Jewish. As both Königsberg and London, were on the trading routes of the Hanseatic League, he probably just got on a ship. As he was a trained tailor, he set up in business in Bexley.

My mother’s male line is Huguenot and somewhere in the past, one of her ancestors left France for England. My grandfather was an engraver, which is a common Huguenot craft. Intriguingly, my mother had very French brown eyes.

Why did my ancestors come here?

It was probably a choice between escape to the UK or die!

This Wikipedia entry, which us entitled History of the Jews in Königsberg, gives a lot of detail.

Note.

- My ancestor left Königsberg around 1800.

- He probably brought my coeliac disease with him.

- In 1942, many of the Jews remaining in Königsberg were sent to the Nazi concentration camps.

- About 2,000 Jews remain in Königsberg, which is now Kaliningrad in Russia.

I am an atheist, but some years ago, I did a computing job for a devout Orthodox Jewish oncologist and he felt my personal philosophy was very much similar to his.

This Wikipedia entry, which is entitled Huguenots, gives a brief history of the Huguenots.

Whatever you’re attitude to immigration, you can’t deny these facts.

- Immigration increases the population.

- As the population increases, we’re going to need more innovation to maintain a good standard of living.

- Just as we need more places to house immigrants, we also need more places, where they can work.

- Immigration brings in those with all types of morals, sexualities and intelligences.

- Like the Jews and Huguenots of over two centuries ago, some emigrants will dream of using their skills and intelligence to start a successful business.

- It is likely, that some immigrants, who came here to study, might also want to stay on and seek employment here, using the skills they’ve learned and acquired. Some may even start successful businesses.

I also wonder, if immigration is difficult, does this mean, that the intelligent and resourceful are likely to be successful migrants. I heard this theory from a Chinese lady, who started her immigration to the UK, by swimming from mainland China to Hong Kong.

I feel, that unless we are prepared to ban immigration completely, not allow students to come here and study and be prepared to accept our current standard of living for the future, then we will need more laboratories and suitable places for entrepreneurs to start new businesses.

Conclusion

The Crown Estate appears to be getting more entrepreneurial.

In UK Unveils GBP 50 Million Fund To Boost Offshore Wind Supply Chain, I describe how they6 are using funds to accelerate the building of wind farms in theCetic Sea.

Has the King changed the boss or the rules?

Or have they employed a world-class mathematical modeller?

It is my experience, that modelling financial systems, can bring surprising results.

With Wind Turbines Is It Bigger Are Better?

The offshoreWIND.biz web site has two stories today, with a similar theme.

- Scots Greenlight Slimmed-Down Turbine Plan For 100 MW Pentland Floating Offshore Wind Farm, which described how the Pentland wind farm is reducing the number of turbines from ten to seven, but increasing their size from 10 to 14 MW, to produce the same power output.

- Fred. Olsen Seawind, EDF Slash Turbine Count For Codling Wind Park, described how in the Irish wind farm; Codling wind farm, the number of turbines are being reduced from hundred to seventy-five.

There are also some wind farms, where capacity has the potential to be increased.

- Ossian Floating Wind Farm Could Have Capacity Of 3.6 GW

- Crown Estate Mulls Adding 4 GW Of Capacity From Existing Offshore Wind Projects

Note.

- With the exception of the floating Pentland wind farm, all wind farms have fixed foundations.

- It certainly does look, that larger turbines may have reasons to be used.

- Perhaps installing a large turbine is very much the same as a small turbine.

It looks like a victory for the accountants.

UK’s Sixth Contracts For Difference Round Open

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK Government has opened the sixth allocation round (AR6) of the Contracts for Difference (CfD) scheme on 27 March and will continue until 19 April 2024. The round will see a range of renewable technologies, including offshore wind compete for the government’s support.

This paragraph outlines how to apply and when the results will be published.

Applications may be submitted via National Grid ESO’s EMR Portal. The results are expected to be published at some point this summer.

The fifth round was a bit of a disaster for offshore wind and hopefully, it will be better this time, as the government will be upping prices.

At least it appears that Iberdrola will be bidding for two wind farm in their East Anglia Array, as I wrote about in Iberdrola Preparing Two East Anglia Offshore Wind Projects For UK’s Sixth CfD Round.

In The Crown Estate Refines Plans For Celtic Sea Floating Wind, I wrote about developments in the Celtic Sea, where contracts should be signed this year.

2024 could be a bumper year for new wind farm contracts.