‘Drone Boats Will Be The New Normal’

The title of this post is the same as this article on the BBC.

This is the sub-heading.

A remotely operated boat will survey an area hundreds of miles offshore – while being controlled from an inland airport.

These two paragraphs add more details to the story.

The Orsted Examiner is being launched this week from Grimsby by the renewable energy company, which is currently building the Hornsea 3 windfarm in the North Sea.

The vessel contains enough fuel to be at sea for several months, and an internet connection means it can be remotely controlled from anywhere.

Note.

- This would appear to be an elegant way to improve both productivity and safety.

- In RWE Opens ‘Grimsby Hub’ For Offshore Wind Operations And Maintenance, I indicated that RWE will have a Grimsby hub.

- Will the two companies have similar drone boats?

I certainly agree with the title of the post.

Ørsted Raises EUR 7.98 Billion In Oversubscribed Rights Issue

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted has completed its rights issue, raising DKK 59.56 billion (approximately EUR 7.98 billion) with a subscription rate of approximately 99.3 per cent, the company said on 6 October.

These two introductory paragraphs add more details.

Existing shareholders were offered new shares at DKK 66.60 (EUR 8.92) each. The demand for shares not taken up via the rights issue was “extraordinarily high,” according to the developer’s announcement of the Rights Issue results, and allocations were capped per application, meaning no subscriptions were required under the underwriting bank syndicate.

As reported in August, the company appointed a syndicate of BNP PARIBAS, Danske Bank A/S and J.P. Morgan SE as Joint Global Coordinators, next to Morgan Stanley & Co International, to jointly underwrite the rights issue for the approximately 49.9 per cent that would not be subscribed to by Ørsted’s majority shareholder, the Danish state (50.1 per cent).

I dread to think what spiteful punishment that Trumpkopf will inflict on Ørsted.

But the oversubscribed Rights Issue may be good news for the UK.

Ørsted has only one major project under development or construction in the UK.

But it is the large Hornsea Three wind farm, which has this opening paragraph on its web site.

Hornsea 3 Offshore Wind Farm will deliver enough green energy to power more than 3 million UK homes. An £8.5 billion infrastructure project, Hornsea 3 will make a significant contribution toward UK energy security, as well as the local and national economy.

Note.

- Ørsted are raising £7.98 billion and spending £8.5 billion, which must do something for the UK’s economy.

- Hornsea 3 will have a generating capacity of 2.9 GW.

- Ørsted are now delivering the world’s single largest offshore wind farm.

- Hornsea 3 will connect to the National Grid at Swardestone in Norfolk.

In Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, I describe how the 300 MW/600 MWh Swardestone BESS will be built, where Hornsea 3 connects to the grid.

As Swardestone will have 2.9 GW from Hornsea 3 and a powerful battery, I would expect someone will be looking to site a data centre or something with a need for a lot of stable electricity at or near Swardestone.

In Opportunity For Communities To Have Their Say On National Grid Proposals For Norwich To Tilbury Project, I talk about a line of pylons between Swardestone and Tilbury and show this map of the route.

This page on the National Grid web site has an interactive version of this map.

Note.

- The mauve line indicates the route of the Norwich to Tilbury project.

- Swardestone is at the Northern end of the project a few miles South of Norwich.

- Tilbury is at the Southern end of the project on the Thames estuary.

- The project connects Norwich, Ipswich, Colchester and Chelmsford to Hornsea 3 at Swardestone.

- I suspect the project will connect to Ipswich at the Bramford substation.

- The Sizewell nuclear site is to the North-East of Woodbridge and connects to the grid at the Bramford substation.

I know East Anglia well and I would suspect that Norwich, Ipswich, Colchester, Chelmsford and Southend-on-Sea could support one or more data centres.

Conclusion

I asked Google AI, who owns Hornsea 1 and received this reply.

Hornsea 1 is owned by a partnership including Ørsted, Equitix, TRIG, GLIL, Octopus, and Brookfield, with Ørsted also providing the operational management. A 2018 agreement between Ørsted and Global Infrastructure Partners (GIP) originally established the 50/50 joint venture for the project.

I then asked Google AI, who owns Hornsea 2 and received this reply.

The ownership of the Hornsea 2 wind farm is shared between several entities, including a 37.55% stake held by Ørsted, a 25% stake each by AXA IM Alts and Crédit Agricole Assurances, and a 12.45% stake held by Brookfield. The wind farm is located offshore in the UK’s North Sea, approximately 89 km off the Yorkshire coast.

In November 2019, I also wrote World’s Largest Wind Farm Attracts Huge Backing From Insurance Giant.

It does seem to me that Ørsted are past masters of developing a wind farm, then selling it on and using that money to develop the next wind farm.

The Rights Issue just makes that process easier.

Scotland And AquaVentus Partner On North Sea Hydrogen Pipeline Plans

The title of this post, is the same as that of this article on H2-View.

These four paragraphs introduce the deal and add some detail.

Hydrogen Scotland has committed to working with the AquaDuctus consortium on cross-border infrastructure concepts to connect Scotland’s offshore wind power to hydrogen production in the North Sea.

Under a Memorandum of Understanding (MOU), the two organisations plan to combine Scotland’s offshore wind with AquaVentus’ offshore electrolysis expertise, linking export and import goals across the North Sea.

The AquaDuctus pipeline is a planned offshore hydrogen link designed to carry green hydrogen through the North Sea, using a pipes and wires hybrid approach. The German consortium plans 10GW of offshore electrolysers in the North Sea, producing around one million tonnes of green hydrogen.

The pipeline design allows offshore wind farms to deliver electricity when the grid needs it, or convert power into hydrogen via electrolysis and transport it through pipelines.

Germany is embracing hydrogen in a big way.

- I introduce AquaVentus in AquaVentus, which I suggest you read.

- AquaVentus is being developed by RWE.

- AquaVentus connects to a German hydrogen network called H2ercules to actually distribute the hydrogen.

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Rough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

I believe that offshore electrolysers could be built in the area of the Hornsea 4, Dogger Bank South and other wind farms and the hydrogen generated would be taken by AquaVentus to either Germany or the UK.

- Both countries get the hydrogen they need.

- Excess hydrogen would be stored in Aldbrough and Rough.

- British Steel at Scunthorpe gets decarbonised.

- A 1.8 GW hydrogen-fired powerstation at Keadby gets the hydrogen it needs to backup the wind farms.

Germany and the UK get security in the supply of hydrogen.

Conclusion

This should be a massive deal for Germany and the UK.

Reform Declares War On County’s Net-Zero Projects

The title of this post, is the same as that of this article on the BBC.

This is the sub-heading.

Reform UK leaders in Lincolnshire say they have “declared war” on green energy projects.

These three paragraphs outline their policies.

Boston and Skegness MP Richard Tice, Greater Lincolnshire’s mayor Dame Andrea Jenkyns and Councillor Sean Matthews, who leads the county council, launched a campaign at a press conference held in Boston earlier.

They said they opposed wind and solar farms and battery storage facilities, with Tice adding: “It is an absolute outrage what the madness of net stupid zero is doing to our county, as well as to our country.”

The government said green energy was vital in delivering energy security, while Labour MP Melanie Onn argued Reform’s stance posed a risk to thousands of jobs.

It should be noted that Lincolnshire has a lot of projects, that will be concerned with renewable energy.

Lincolnshire is one of the UK counties, with the highest level of wind power.

- There are over 7 GW of wind farms, that already do or will land their electricity in the county including 5.5 GW from the world’s largest offshore wind farm; Hornsea.

- There is approaching 300 MW of onshore wind in the county, which includes England’s largest onshore wind farm at Keadby, which is 68 MW.

I asked Google how much solar there was in the county and I got this AI Overview.

Lincolnshire has a significant amount of solar power capacity, with several large solar farms and numerous smaller installations. The county is a major location for solar energy development, with some projects aiming to power tens or even hundreds of thousands of homes.

In the real world of wind and solar energy, all of this renewable energy will need backup and the county has it in hundreds of megawatts.

- Keadby One is a 732 MW gas-fired power station owned by SSE Thermal.

- Keadby Two is a 849 MW gas-fired power station owned by SSE Thermal.

- Keadby Three will be a 910 gas-fired power station, fitted with carbon capture, that is being developed by SSE Thermal.

- Keadby Next Generation Power Station is a 1800 MW hydrogen-powered power station, that is being developed by Equinor and SSE Thermal. I wrote about it in Consultation On Plans For Keadby Hydrogen Power Station To Begin and it will generate 900 MW of zero-carbon electricity.

Now that it what I call backup.

Conclusion

Lincolnshire generates a lot of renewable energy and Reform UK want to throw it all away.

As I showed in US Gov’t Withdraws All Offshore Wind Energy Areas, Trump’s policies against renewable energy and wind in particular are not good for investment and employment.

We don’t want Trump’s policies in the UK.

And especially in Lincolnshire, where all this energy can attract jobs.

RWE, Masdar Move Forward With 3 GW Dogger Bank South Offshore Wind Farms

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK’s Planning Inspectorate has concluded its six-month Nationally Significant Infrastructure Project (NSIP) examination period for the Dogger Bank South (DBS) offshore wind farms, being developed by RWE and Abu Dhabi’s Masdar.

These two introductory paragraphs add more details.

Since the start of the examination this January, the Planning Inspectorate has assessed the environmental, socio-economic, and technical attributes of the DBS projects against the UK’s standards for sustainable infrastructure development.

The Inspectorate plans to prepare and submit a detailed report with recommendations to the Secretary of State for Energy Security and Net Zero within the next three months, and a consent decision is expected within the next six months.

The development of this wind farm moves on.

- The lease with the Crown Estate was signed in Jan 2023.

- In November 2023, Masdar took a 49 % stake as I reported in RWE Partners With Masdar For 3 GW Dogger Bank South Offshore Wind Projects.

But there is no completion date anywhere for the whole project, that I can find with Google.

If you type RWE offshore electrolysis into Google AI, you get this answer.

RWE is actively involved in several hydrogen projects utilizing offshore wind power for electrolysis, particularly in the Netherlands and Germany. These projects aim to produce green hydrogen, which is then used in various applications like industrial processes, transportation, and potentially for export. RWE is a major player in offshore wind and is leveraging this experience to advance hydrogen production.

Note.

- RWE are one of the largest, if not the largest electricity generator in the UK.

- In RWE Opens ‘Grimsby Hub’ For Offshore Wind Operations And Maintenance, I stated that RWE are developing almost 12 GW of offshore wind power around our shores.

So just as RWE are utilizing offshore wind power for electrolysis, particularly in the Netherlands and Germany, could they be also be planning to do the same in UK waters with the Dogger Bank South wind farm?

The hydrogen would be brought ashore in a pipeline.

There would be no need for any 3 GW overhead power lines marching across East Yorkshire and around the town of Beverley.

Two large hydrogen stores are being developed at Aldbrough and Rough in East Yorkshire.

H2ercules And AquaVentus

These are two massive German projects, that will end the country’s reliance on Russian gas and coal.

- H2ercules is a series of pipelines that will distribute the hydrogen in Southern Germany.

- AquaVentus will build a network of pipelines to bring 10.3 GW of green hydrogen from the North Sea to the German mainland for H2ercules to distribute.

Germany is embracing hydrogen in a big way.

- I introduce AquaVentus in AquaVentus, which I suggest you read.

- AquaVentus is being developed by RWE.

- AquaVentus connects to a German hydrogen network called H2ercules to actually distribute the hydrogen.

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Rough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

I believe that offshore electrolysers could be built in the area of the Hornsea 4, Dogger Bank South and other wind farms and the hydrogen generated would be taken by AquaVentus to either Germany or the UK.

- Both countries get the hydrogen they need.

- Excess hydrogen would be stored in Aldbrough and Rough.

- British Steel at Scunthorpe gets decarbonised.

- A 1.8 GW hydrogen-fired powerstation at Keadby gets the hydrogen it needs to backup the wind farms.

Germany and the UK get security in the supply of hydrogen.

Ørsted Pulls Plug On 2.4 GW Hornsea 4 Offshore Wind Project In UK

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted has discontinued the development of the UK’s Hornsea 4 offshore wind farm in its current form. The developer said the 2.4 GW project has faced rising supply chain costs, higher interest rates, and increased construction and delivery risks since the Contract for Difference (CfD) award in Allocation Round 6 (AR6) in September 2024.

This introductory paragraph adds more detail.

In combination, these developments have increased the execution risk and deteriorated the value creation of the project, which led to Ørsted stopping further spending on the project at this time and terminating the project’s supply chain contracts, according to the Danish company. This means that the firm will not deliver Hornsea 4 under the CfD awarded in AR6.

Consider.

- Hornsea 4 will be connected to the grid at a new Wanless Beck substation, which will also include a battery and solar farm, which will be South West of the current Creyke Beck substation. Are Ørsted frightened of opposition from the Nimbies to their plans?

- I also wonder if political uncertainty in the UK, and the possibility of a Reform UK government, led by Nigel Farage is worrying companies like Ørsted.

So will factors like these prompt companies like Ørsted to move investment to countries, where they welcome wind turbines like Denmark, Germany and The Netherlands.

Could Ørsted Be Looking At An Alternative?

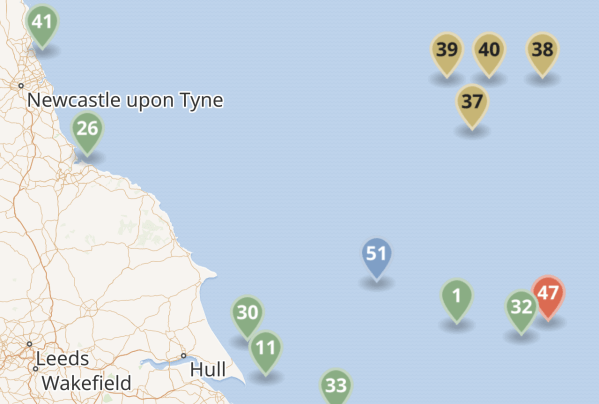

This is a map of wind farms in the North Sea in the Dogger Bank and Hornsea wind farms, that I clipped from Wikipedia..

These are the Dogger Bank and Hornsea wind farms and their developers and size

- 37 – Dogger Bank A – SSE Renewables/Equinor – 1,235 MW

- 39 – Dogger Bank B – SSE Renewables/Equinor – 1,235 MW

- 38 – Dogger Bank C – SSE Renewables/Equinor – 1,218 MW

- 40 – Sofia – RWE – 1,400 MW

- 1 – Hornsea 1 – Ørsted/Global Infrstructure Partners – 1,218 MW

- 32 – Hornsea 2 – Ørsted/Global Infrstructure Partners – 1,386 MW

- 47 – Hornsea 3 – Ørsted – 2,852 MW

- 51 – Hornsea 4 – Ørsted – 2,400 MW

Note.

- That is a total of 12, 944 MW, which is probably enough electricity to power all of England and a large part of Wales.

- Wikipedia’s List of offshore wind farms in the United Kingdom, also lists a 3,000 MW wind farm, that is being developed by German company ; RWE called Dogger Bank South,

- The Dogger Bank South wind farm is not shown on the map, but would surely be South of wind farms 37 to 40 and East of 51.

- The Dogger Bank South wind farm will raise the total of electricity in the Dogger Bank and Hornsea wind farms to just short of 16 GW.

Connecting 16 GW of new electricity into the grid, carrying it away to where it is needed and backing it up, so that power is provided, when the wind doesn’t blow, will not be a nightmare, it will be impossible.

An alternative plan is needed!

AquaVentus To The Rescue!

AquaVentus is a German plan to bring 10 GW of green hydrogen to the German mainland from the North Sea, so they can decarbonise German industry and retire their coal-fired power stations.

- I introduce AquaVentus in AquaVentus, which I suggest you read.

- AquaVentus is being developed by RWE.

- AquaVentus connects to a German hydrogen network called H2ercules to actually distribute the hydrogen.

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

I believe that offshore electrolysers could be built in the area of the Hornsea 4 and Dogger Bank South wind farms and the hydrogen generated would be taken by AquaVentus to either Germany or the UK.

- Both countries get the hydrogen they need.

- Excess hydrogen would be stored in Aldbrough and Rough.

- British Steel gets decarbonised.

- A 1.8 GW hydrogen-fired powerstation at Keadby gets the hydrogen it needs to backup the wind farms.

Germany and the UK get security in the supply of hydrogen.

These may be my best guesses, but they are based on published plans.

Ørsted Breaks Ground On Innovative UK Battery Energy Storage System

The title of this post, is the same as that, as this news item from Ørsted.

This is the sub-heading.

Ørsted, a global leader in offshore wind energy, has marked breaking ground for its first large-scale UK battery energy storage system (BESS) with a golden shovel ceremony.

These four paragraphs give more details of the project.

Located alongside Ørsted’s Hornsea 3 Offshore Wind Farm, near Norwich, Norfolk, the system will have a capacity of 600 MWh (and a 300 MW power rating), equivalent to the daily power consumption of 80,000 UK homes.

The golden shovel ceremony officially kicks off the construction phase of the project, known as Iceni after the Norfolk-based warrior tribe of the Roman era. It is expected to be operational by the end of 2026.

Preparatory works are now complete and the Ørsted, Knights Brown and Tesla Iceni team will continue with the remainder of the installation.

When completed, the battery energy storage system will be one of the largest in Europe.

Note.

- The batteries themselves are from Tesla.

- The project was previously known as the Swardeston BESS.

- The project will be located near to the Swardeston substation to the South of Norwich.

- The project doesn’t seem very innovative to me, as it appears to be a BESS built from Tesla batteries.

Like many batteries, it is designed to supply power for two hours.

UK Wind Risks ‘Exponentially Rising’ Curtailment Without Energy Storage

The title of this post, is the same as that of this article on Recharge.

This is the sub-heading.

UK liquid battery pioneer Highview Power is working with renewable energy giant Orsted on plan to store excess power from its Hornsea offshore wind projects

This is the introductory paragraph.

The UK wind sector faces “exponentially” increasing curtailment of assets without a rapid rollout of energy storage, says the chief of liquid battery pioneer Highview Power, which is working with Orsted on a project to store excess offshore wind power.

The article also states that according to Octopus Energy, this cost could have been as high as a billion pounds last year.

In Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, I described how Ørsted were planning to build a large BESS near the Swardeston substation in Norfolk, where the Hornsea 3 wind farm will connect to the grid.

Have Ørsted decided to put a Highview Power battery on the Swardeston site, as it can be a bigger battery, as Highview Power talk about 200MW/2.5GWh capacity batteries on the projects page of the web site?

Highview also say this about co-operation with Ørsted on that page.

Highview Power and Ørsted’s joint study shows that the co-location of LAES with Ørsted’s offshore wind offers a step forward in reducing wind curtailment, and helping to move to a more flexible, resilient zero carbon grid.

The words are accompanied by pictures of a smart gas storage site, which shows four of the largest tanks, that might be used to store LNG.

In Could A Highview Power CRYOBattery Use A LNG Tank For Liquid Air Storage?, I estimated that one of the largest LNG tanks could hold about a GWh of energy.

So Highview Power’s visualisation on their project page would be a 4 GWh battery.

.

South Korean Firm To Supply Power Equipment For Ørsted’s Hornsea 4 Offshore Wind Farm

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Denmark’s Ørsted has awarded a contract to Hyosung Heavy Industries for the supply of ultra-high voltage power equipment for the Hornsea 4 offshore wind farm in the UK

These two paragraphs add a bit of detail.

Under the contract, the South Korean company will supply 400 kV ultra-high voltage transformers and reactors, essential components for improving power quality for the 2.4 GW Hornsea 4 offshore wind project.

The most recent contract further strengthens the company’s presence in Europe, where it has accumulated over 1 trillion won (about EUR 667 million) in orders this year, as reported by the company.

Hyosung Heavy Industries seem to be doing rather well at supplying electrical gubbins in Europe.

But then Korean companies seem to be doing well in Europe and especially the UK, after the state visit of the Korean President and his wife in November 2023.

In the last century, we did very well dealing with Korean companies with Artemis; the project management computer system, that I wrote.

In Hyundai Heavy Sets Sights On Scottish Floating Offshore Wind, I describe some of our dealings there.

Conclusion

From other posts, I have written, it looks like the UK and Korea are building a strong partnership with offshore wind, and a secondary one with tidal power might be emerging. We also shouldn’t forget the partnership in North London over football.