Equinor Sets Sights On Gigawatt-Scale Floating Offshore Wind Projects In Celtic Sea

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the opening paragraph of the article.

Equinor has disclosed its interest in developing gigawatt-scale floating offshore wind in the Celtic Sea, with the upcoming Celtic Sea floating wind seabed leasing round in view.

These are some other points from the article.

- The Crown Estate is planning a seabed leasing round in the Celtic Sea in 2023.

- As the developer and soon-to-be operator of two of the world’s first floating offshore wind farms, Equinor said it views new floating opportunities in the Celtic Sea with great interest.

- Project development areas are being prepared by The Crown Estate for the development of gigawatt-scale floating offshore wind projects.

Equinor could move into the Celtic Sea in a big way.

On the Projects page of the Blue Gem website, this is said about floating wind in the Celtic Sea.

Floating wind is set to become a key technology in the fight against climate change with over 80% of the worlds wind resource in water deeper than 60 metres. Independent studies have suggested there could be as much as 50GW of electricity capacity available in the Celtic Sea waters of the UK and Ireland. This renewable energy resource could play a key role in the UK meeting the 2050 Net-Zero target required to mitigate climate change. Floating wind will provide new low carbon supply chain opportunities, support coastal communities and create long-term benefits for the region.

How much of this possible 50 GW of offshore wind in the Celtic Sea will be leased by the Crown Estate in 2023?

Centrica Re-Opens Rough Storage Facility

The title of this post, is the same as that of this press release from Centrica.

It has this sub-heading.

Rough Operational For Winter And Increases UK’s Storage Capacity By 50%.

On the face of it, this sounds like good news and these two paragraphs give more details.

Centrica has announced the reopening of the Rough gas storage facility, having completed significant engineering upgrades over the summer and commissioning over early autumn.

The initial investment programme means the company has made its first injection of gas into the site in over 5 years and is in a position to store up to 30 billion cubic feet (bcf) of gas for UK homes and businesses over winter 2022/23, boosting the UK’s energy resilience.

Note.

- The Rough gas storage facility has been able to hold up to 100 billion cubic feet of gas in the past.

- Rough is a complex field with two platforms and thirty wells transferring gas to and from the facility.

- Additionally, there is an onshore gas-processing terminal at the Easington Gas Terminal, where it connects to the UK gas network.

It appears to be a comprehensive gas storage facility, that should get us through the 2022/3 winter.

These two paragraphs from the press release, which are the thoughts of the Centrica Chief Executive are significant.

Centrica Group Chief Executive, Chris O’Shea, said “I’m delighted that we have managed to return Rough to storage operations for this winter following a substantial investment in engineering modifications. Our long-term aim remains to turn the Rough field into the world’s biggest methane and hydrogen storage facility, bolstering the UK’s energy security, delivering a net zero electricity system by 2035, decarbonising the UK’s industrial clusters, such as the Humber region by 2040, and helping the UK economy by returning to being a net exporter of energy.

“In the short term we think Rough can help our energy system by storing natural gas when there is a surplus and producing this gas when the country needs it during cold snaps and peak demand. Rough is not a silver bullet for energy security, but it is a key part of a range of steps which can be taken to help the UK this winter.”

Note.

- Effectively, in the short term, Rough is a store for gas to help us through the winter.

- In the long-term, Rough will be turned into the world’s largest gas storage facility.

- It will be able to store both methane (natural gas) and hydrogen.

Having worked with project managers on complex oil and gas platforms and chemical plants, I wouldn’t be surprised to find, that when the design of this facility is released, it will be something special.

Centrica certainly seem to have upgraded Rough to be able to play a significant short term role this winter and they also seem to have developed a plan to give it a significant long-term role in the storage of hydrogen.

Aldbrough Gas Storage

A few miles up the coast is SSE’s and Equinor’s Aldbrough Gas Storage, which is being developed in salt caverns to hold natural gas and hydrogen.

Blending Of Hydrogen And Natural Gas

I believe that we’ll see a lot of blending of hydrogen and natural gas.

- Up to 20 % of hydrogen can be blended, without the need to change appliances, boilers and processes.

- This cuts carbon dioxide emissions.

I wrote about this in a post called HyDeploy.

It might be convenient to store hydrogen in Aldbrough and natural gas in Rough, so that customers could have the blend of gas they needed.

With two large gas stores for hydrogen under development, the HumberZero cluster is on its way.

Plans Emerge For 8 GW Of Offshore Wind On Dogger Bank

Wikipedia has an entry, which is a List Of Offshore Wind Farms In The United Kingdom.

The totals are worth a look.

- Operational – 13279 MW

- Under Construction – 4125 MW

- Proposed Under The UK Government’s Contracts For Difference Round 3 – 2412 MW

- Proposed Under The UK Government’s Contracts For Difference Round 4 – 7026 MW

- Exploratory Phase, But No Contract for Difference – Scotland – 24,826 MW

- Exploratory Phase, But No Contract for Difference – England – 14,500 MW

Note.

- That gives a Grand Total of 66,168 MW or 66.168 GW.

- The government’s target is 50 GW of offshore wind by 2030.

- The typical UK power need is around 23 GW, so with nuclear and solar, we could be approaching three times the electricity generation capacity that we currently need.

The figures don’t include projects like Berwick Bank, Cerulean Wind, Norfolk Vanguard or Northern Horizons, which are not mentioned in Wikipedia’s list.

I regularly look at the list of wind farms in this Wikipedia entry and noticed that the number of Dogger Bank wind farms had increased.

They are now given as.

- Dogger Bank A – 1200 MW – Completion in 2023/24

- Dogger Bank B – 1200 MW – Completion in 2024/25

- Dogger Bank C – 1200 MW – Completion in 2024/25

- Dogger Bank D – 1320 MW – No Completion Given

- Dogger Bank South – 3000 MW – No Completion Given

Note, that gives a Grand Total of 7920 MW or 7.920 GW.

This article on offshoreWIND.biz is entitled BREAKING: SSE, Equinor Plan 1.3 GW Dogger Bank D Offshore Wind Project.

It was published on the October 6th, 2022 and starts with this summary.

SSE Renewables and Equinor are looking into building what would be the fourth part of Dogger Bank Wind Farm, the world’s largest offshore wind farm, whose three phases (A, B and C) are currently under construction. Surveys are now underway at an offshore site where the partners want to develop Dogger Bank D, which would bring Dogger Bank Wind Farm’s total capacity to nearly 5 GW if built.

Obviously, there are a few ifs and buts about this development, but it does look like SSE Renewables and Equinor are serious about developing Dogger Bank D.

More Dogger Bank Gigawatts for UK As RWE Moves Forward With Two 1.5 GW Projects

This subheading describes, the 3 GW wind farm, that I listed earlier as Dogger Bank South.

These three paragraphs describe the projects.

RWE is now moving forward with two new offshore wind farms in the Zone, each with a 1.5 GW generation capacity, after the company obtained approval from the UK Secretary of State for Business, Energy and Industrial Strategy (BEIS) to enter into an Agreement for Lease with The Crown Estate this Summer, following the Round 4 leasing process.

The wind farms will be built at two adjacent sites located just southwest of the Dogger Bank A offshore wind farm and are dubbed Dogger Bank South (DBS) East and Dogger Bank South (DBS) West.

RWE has also started with geophysical seabed surveys within the wind turbine array areas for its two new projects.

It appears that they have already got the leasing process started.

When Will Dogger Bank D And Dogger Bank South Be Operational?

Consider.

- In How Long Does It Take To Build An Offshore Wind Farm?, showed that a lot of offshore wind farms have gone from planning permission to first operation in six years.

- I don’t think that there will be planning permission problems on the Dogger Bank.

- The two wind farms are a continuation of Dogger Bank A, B and C and the Sofia wind farms.

- A lot of the construction, would be more of the same.

With average luck, I can see Dogger Bank D and Dogger Bank South in full production before the end of 2028.

An Update To Will We Run Out Of Power This Winter?

My Methods

Project Timescales For Wind Farms

In How Long Does It Take To Build An Offshore Wind Farm?, I came to these conclusions.

- It will take six years or less from planning consent to commissioning.

- It will take two years or less from the start of construction to commissioning.

I shall use these timescales, as any accelerations by the government, will only reduce them.

Dates

If a date is something like 2024/25, I will use the latest date. i.e. 2025 in this example.

The Update

In Will We Run Out Of Power This Winter?, which I wrote in July this year, I did a calculation of how much renewable energy would come on stream in the next few years.

I summarised the amount of new renewable energy coming on stream like this.

- 2022 – 3200 MW

- 2023 – 1500 MW

- 3024 – 2400 MW

- 2025 – 6576 MW

- 2026 – 1705 MW

- 2027 – 7061 GW

This totals to 22442 MW.

But I had made two omissions.

- Hornsea 3 wind farm will add 2582 MW in 2026/27.

- Hinckley Point C nuclear power station will add 3260 MW in 2027.

Ørsted have also brought forward the completion date of the Sofia wind farm to 2023, which moves 1400 GW from 2024 to 2023.

The new renewables summary figures have now changed to.

- 2022 – 3200 MW

- 2023 – 2925 MW

- 3024 – 1326 MW

- 2025 – 6576 MW

- 2026 – 1705 MW

- 2027 – 13173 MW

This totals to 28554 MW.

Note.

- The early delivery of the Sofia wind farm has increased the amount of wind farms coming onstream next year, which will help the Winter of 2023/2024.

- It will also help the Liz Truss/Kwasi Kwarteng government at the next election, that should take place in early 2025.

- Hornsea 3 and Hinckley Point C make 2027 a big year for new renewable energy commissioning.

By 2027, we have more than doubled our renewable energy generation.

The Growth Plan 2022

In this document from the Treasury, the following groups of wind farms are listed for acceleration.

- Remaining Round 3 Projects

- Round 4 Projects

- Extension Projects

- Scotwind Projects

- INTOG Projects

- Floating Wind Commercialisation Projects

- Celtic Sea Projects

I will look at each in turn.

Remaining Round 3 Projects

In this group are the the 1200 MW Dogger Bank B and Dogger Bank C wind farms, which are due for commissioning in 2024/25.

Suppose that as with the Sofia wind farm in the same area, they were to be able to be brought forward by a year.

The new renewables summary figures would change to.

- 2022 – 3200 MW

- 2023 – 2925 MW

- 3024 – 3726 MW

- 2025 – 5076 MW

- 2026 – 1705 MW

- 2027 – 13173 MW

This totals to 28554 MW.

It looks like if Dogger Bank B and Dogger Bank C can be accelerated by a year, it has four effects.

- The renewables come onstream at a more constant rate.

- SSE and Equinor, who are developing the Dogger Bank wind farms start to get paid earlier.

- The UK gets more electricity earlier, which helps bridge the gap until Hornsea 3 and Hinckley Point C come onstream in 2027.

- The UK Government gets taxes and lease fees from the Dogger Bank wind farms at an earlier date.

Accelerating the remaining Round 3 projects would appear to be a good idea.

Round 4 Projects

According to Wikipedia’s list of proposed wind farms, there are six Round 4 wind farms, which total up to 7026 MW.

Accelerating these projects, is probably a matter of improved government regulations and pressure, and good project management.

But all time savings in delivering the wind farms benefits everybody all round.

This document from the Department of Business, Industry and Industrial Strategy lists all the Contracts for Difference Allocation Round 4 results for the supply of zero-carbon electricity.

Many of these projects are smaller projects and I suspect quite a few are shovel ready.

But as with the big wind farms, there are some projects that can be brought forward to everybody’s benefit.

Norfolk Boreas

Norfolk Boreas wind farm is one of the Round 4 projects.

The wind farm is shown as 1400 MW on Wikipedia.

On the web site, it now says construction will start in 2023, which could mean a completion by 2025, as these projects seem to take about two years from first construction to commissioning, as I showed in How Long Does It Take To Build An Offshore Wind Farm?.

The new renewables summary figures would change to.

- 2022 – 3200 MW

- 2023 – 2925 MW

- 3024 – 3726 MW

- 2025 – 6476 MW

- 2026 – 1705 MW

- 2027 – 11773 MW

This still totals to 28554 MW.

This acceleration of a large field would be beneficial, as the 2025 figure has increased substantially.

I would suspect that Vattenfall are looking hard to accelerate their Norfolk projects.

Extension Projects

I first talked about extension projects in Offshore Wind Extension Projects 2017.

The target was to add 2.85 GW of offshore wind and in the end seven projects were authorised.

- Sheringham Shoal offshore wind farm – 719 MW with Dudgeon

- Dudgeon offshore wind farm – 719 MW with Sheringham Shoal

- Greater Gabbard offshore wind farm

- Galloper offshore wind farm

- Rampion offshore wind farm – 1200 MW

- Gwynt y Môr offshore wind farm – 1100 MW

- Thanet offshore wind farm – 340 MW

These are the best figures I have and they add up to an interim total of 3359 MW.

I suspect that these projects could be easy to accelerate, as the developers have probably been designing these extensions since 2017.

I think it is reasonable to assume that these seven wind farms will add at least 3000 MW, that can be commissioned by 2027.

The new renewables summary figures would change to.

- 2022 – 3200 MW

- 2023 – 2925 MW

- 3024 – 3726 MW

- 2025 – 6476 MW

- 2026 – 1705 MW

- 2027 – 14773 MW

This now totals to 31554 MW.

Accelerating the extension projects would be a good idea, especially, as they were awarded some years ago, so are probably well into the design phase.

ScotWind Projects

I first talked about ScotWind in ScotWind Offshore Wind Leasing Delivers Major Boost To Scotland’s Net Zero Aspirations.

It was planned to do the following.

- Generate 9.7 GW from six wind farms with fixed foundations.

- Generate 14.6 GW from ten floating wind farms.

But since then three more floating wind farms with a total capacity of 2800 MW have been added, as I wrote about in Three Shetland ScotWind Projects Announced.

I suspect that some of these projects are ripe for acceleration and some may well be generating useful electricity by 2030 or even earlier.

INTOG Projects

I wrote about INTOG in What Is INTOG?.

I can see the INTOG Projects contributing significantly to our fleet of offshore wind turbines.

I have already found a 6 GW/£30 billion project to decarbonise oil and gas rigs around our shores, which is proposed by Cerulean Winds and described on this web page.

If the other large INTOG projects are as good as this one, then we’ll be seeing some sensational engineering.

Floating Wind Commercialisation Projects

This page on the Carbon Trust website is entitled Floating Wind Joint Industry Programme (JIP).

They appear to be very much involved in projects like these.

The page has this description.

The Floating Wind Joint Industry Programme is a world leading collaborative research and development (R&D) initiative dedicated to overcoming technological challenges and advancing commercialisation of floating offshore wind.

This graphic shows the partners and advisors.

Most of the big wind farm builders and turbine and electrical gubbins manufacturers are represented.

Celtic Sea Projects

The Celtic Sea lies between South-East Ireland, Pembrokeshire and the Devon and Cornwall peninsular.

The Crown Estate kicked this off with press release in July 2022, that I wrote about in The Crown Estate Announces Areas Of Search To Support Growth Of Floating Wind In The Celtic Sea.

This map shows the five areas of search.

One Celtic Sea project has already been awarded a Contract for Difference in the Round 4 allocation, which I wrote about in Hexicon Wins UK’s First Ever CfD Auction For Floating Offshore Wind.

Other wind farms have already been proposed for the Celtic Sea.

In DP Energy And Offshore Wind Farms In Ireland, I said this.

They are also developing the Gwynt Glas offshore wind farm in the UK sector of the Celtic Sea.

- In January 2022, EDF Renewables and DP Energy announced a Joint Venture partnership to combine their knowledge and

expertise, in order to participate in the leasing round to secure seabed rights to develop up to 1GW of FLOW in the Celtic Sea. - The wind farm is located between Pembroke and Cornwall.

The addition of Gwynt Glas will increase the total of floating offshore wind in the UK section of the Celtic Sea.

- Blue Gem Wind – Erebus – 100 MW Demonstration project – 27 miles offshore

- Blue Gem Wind – Valorus – 300 MW Early-Commercial project – 31 miles offshore

- Falck Renewables and BlueFloat Energy – Petroc – 300 MW project – 37 miles offshore

- Falck Renewables and BlueFloat Energy – Llywelyn – 300 MW project – 40 miles offshore

- Llŷr Wind – 100 MW Project – 25 miles offshore

- Llŷr Wind – 100 MW Project – 25 miles offshore

- Gwynt Glas – 1000 MW Project – 50 miles offshore

This makes a total of 2.2 GW, with investors from several countries.

It does seem that the Celtic Sea is becoming the next area of offshore wind around the British Isles to be developed.

How do these wind farms fit in with the Crown Estate’s plans for the Celtic Sea?

I certainly, don’t think that the Crown Estate will be short of worthwhile proposals.

Conclusion

More and more wind farms keep rolling in.

Significant Step Forward For Keadby 3 Carbon Capture Power Station

The title of this post, is the same as that of this press release from SSE.

These three paragraphs outline the project.

A landmark project in the Humber which could become the UK’s first power station equipped with carbon capture technology has taken a major leap forward following an announcement by the UK Government today.

Keadby 3 Carbon Capture Power Station, which is being jointly developed by SSE Thermal and Equinor, has been selected to be taken forward to the due diligence stage by the Department for Business, Energy and Industry Strategy (BEIS) as part of its Cluster Sequencing Process.

This process will give the project the opportunity to receive government support, allowing it to deploy cutting edge carbon capture technology, and to connect to the shared CO2 pipelines being developed through the East Coast Cluster, with its emissions safely stored under the Southern North Sea. The common infrastructure will also supply low-carbon hydrogen to potential users across the region.

The press release also says this about the power station.

- Keadby 3 power station could have a generating capacity of up to 910MW.

- It could be operational by 2027.

- It would capture up to one and a half million tonnes of CO2 a year.

It would provide low-carbon, flexible power to back-up renewable generation.

The H2H Saltend Project

The press release also says this about the H2H Saltend project.

Equinor’s H2H Saltend project, the ‘kick-starter’ for the wider Zero Carbon Humber ambition, has also been taken to the next stage of the process by BEIS. The planned hydrogen production facility could provide a hydrogen supply to Triton Power’s Saltend Power Station as well as other local industrial users. In June, SSE Thermal and Equinor entered into an agreement to acquire the Triton Power portfolio.

I wrote about H2H Saltend and the acquisition of Triton Power in SSE Thermal And Equinor To Acquire Triton Power In Acceleration Of Low-Carbon Ambitions.

In the related post, I added up all the power stations and wind farms, that are owned by SSE Thermal and it came to a massive 9.1 GW, which should all be available by 2027.

Collaboration Between SSE Thermal And Equinor

The press release also says this about collaboration between SSE Thermal and Equinor.

The two companies are also collaborating on major hydrogen projects in the Humber. Keadby Hydrogen Power Station could be one of the world’s first 100% hydrogen-fuelled power stations, while Aldbrough Hydrogen Storage could be one of the world’s largest hydrogen storage facilities. In addition, they are developing Peterhead Carbon Capture Power Station in Aberdeenshire, which would be a major contributor to decarbonising the Scottish Cluster.

This collaboration doesn’t lack ambition.

I also think, that there will expansion of their ambitions.

Horticulture

Lincolnshire is about horticulture and it is a generally flat county, which makes it ideal for greenhouses.

I wouldn’t be surprised to see a large acreage of greenhouses built close to the Humber carbon dioxide system, so that flowers, salad vegetables, soft fruit, tomatoes and other plants can be grown to absorb the carbon dioxide.

It should also be noted that one of the ingredients of Quorn is carbon dioxide from a fertiliser plant, that also feeds a large tomato greenhouse.

We would have our carbon dioxide and eat it.

Other Uses Of Carbon Dioxide

Storing carbon dioxide in depleted gas fields in the North Sea will probably work, but it’s a bit like putting your rubbish in the shed.

Eventually, you run out of space.

The idea I like comes from an Australian company called Mineral Carbonation International.

- I wrote about their success at COP26 in Mineral Carbonation International Win COP26 Clean Energy Pitch Battle.

- The company has developed the technology to convert carbon dioxide into building products like blocks and plasterboard.

- Their mission is to remove a billion tonnes of CO2 by 2040 safely and permanently.

We would have our carbon dioxide and live in it.

I also think other major uses will be developed.

A Large Battery

There is the hydrogen storage at Aldbrough, but that is indirect energy storage.

There needs to be a large battery to smooth everything out.

In Highview Power’s Second Commercial System In Yorkshire, I talk about Highview Power’s proposal for a 200MW/2.5GWh CRYOBattery.

This technology would be ideal, as would several other technologies.

Conclusion

Humberside will get a giant zero-carbon power station.

Equinor Is Counting On Tax Breaks With Plans For North Sea Oilfield

The title of this post, is the same as that, of this article in The Times.

These paragraphs outline the project.

Norway’s state-owned oil company is pushing ahead with plans to develop Britain’s biggest untapped oilfield after confirming that it stands to benefit from “helpful” tax breaks introduced alongside the windfall levy.

Equinor could lower its windfall tax bill by as much as £800 million in the years to come thanks to investment relief if it develops the Rosebank field, according to Uplift, a campaign group.

Rosebank, to the west of Shetland, could cost £4.1 billion to develop and may account for about 8 per cent of British oil output in the second half of this decade, producing 300 million barrels of oil by 2050.

Equinor said yesterday that it hoped to take a final investment decision on the field by next year and to start production by 2026. It has applied for environmental approval from the government.

Needless to say Greenpeace are not amused.

We Have Both Long Term And Short Term Energy Problems

In the UK, energy is generally used as electricity or gas and to power industry and transport.

Electricity

In the long term, we need to decarbonise our electricity production, so that all our electricity is produced from zero-carbon sources like nuclear, solar, tidal, wave and wind.

- As I write this, our electricity production is around 26.8 GW of which 62 % is coming from renewable sources.

- Surprisingly around 45 % of the renewables is coming from solar. Who’d have ever thought that in an predominantly-grey UK?

- As we have committed to around 50 GW of wind power by 2030 and the 3.26 GW Hinckley Point C will be on stream by the end of the decade, the long term future of electricity production looks to be fairly secure.

- It would be even more secure, if we added around 600 GWh of storage, as proposed in Highview Power’s Plan To Add Energy Storage To The UK Power Network, which would be used as backup when the sun doesn’t shine and the wind doesn’t blow.

It looks to me, that our long term electricity problem is capable of being solved.

For the next few years, we will need to rely on our existing gas-fired power stations until the renewables come on stream.

Gas

Gas could be more of a problem.

- I wouldn’t be surprised to see a lot of resistance to the replacement of natural gas for heating, cooking and industrial processes.

- Natural gas is becoming increasingly difficult to source.

- As I said in the previous section, we will still need some gas for electricity generation, until the massive wind farms are completed.

On the other hand, there is HyDeploy.

I like the HyDeploy concept, where up to 20 % of hydrogen is blended with natural gas.

- Using a blend of hydrogen and natural gas doesn’t require any changes to boilers, appliances or industrial processes.

- The hydrogen blend would make the most of our existing world class gas network.

- Customers do not require disruptive and expensive changes in their homes.

- Enormous environmental benefits can be realised through blending low carbon hydrogen with fossil gas.

- The hydrogen blending could happen, where the natural gas enters the network at terminals which receive gas from the UK continental shelf or where liquified natural gas is imported.

- Alternatively, it may be possible to surround a gas production platform with an offshore wind farm. This could enable hydrogen production and blending to be performed offshore.

The amount of gas we need would drop by twenty percent.

In The Mathematics Of Blending Twenty Percent Of Hydrogen Into The UK Gas Grid, I calculated that 148.2 tonnes per hour of hydrogen would be needed, to blend twenty per cent of hydrogen into UK natural gas supplies.

I also said this about the electricity needed.

To create 148.2 tonnes per hour of hydrogen would need 8,180.64 MW of electricity or just under 8.2 GW.

I also calculated the effect of the hydrogen on carbon dioxide emissions.

As twenty percent will be replaced by hydrogen, carbon dioxide emission savings will be 24,120,569.99 tonnes.

I believe that generating the 8.2 GW of electricity and delivering the 148.2 tonnes per hour of hydrogen is feasible.

I also believe that HyDeploy could be a valuable way to reduce our demand for natural gas by twenty per cent.

Transport

Not every vehicle, ship, aircraft and train can be powered by electricity, although batteries will help.

Hydrogen will help, but we must also develop our capability for sustainable fuels made from rubbish diverted from landfill and biologically-derived ingredients like used cooking oil.

Summing Up Our Long Term And Short Term Energy Problems

We obviously have got the problem of creating enough renewable energy for the future, but there is also the problem of how we keep everything going in the interim.

We will need gas, diesel, petrol and other fossil fuel derived products for the next few years.

Is Rosebank Our Short Term Solution?

This page on the Equinor web site is entitled Rosebank Oil And Gas Field.

This introductory paragraph described the field.

Rosebank is an oil and gas field 130 kilometres off the coast of the Shetland Islands. Equinor acquired the operatorship in 2019 and has since then been working to optimise and mature a development solution for the field together with our partners.

Could the field with its resources of oil and gas, be just the sort of field to tide us over in the next few difficult years.

But given the position, it will surely not be an easy field to develop.

These two paragraphs set out Equinor’s strategy in developing the field.

Equinor believes the field can be developed as part of the UK Government North Sea Transition deal, bringing much needed energy security and investment in the UK while supporting the UKs net zero target. According to a socioeconomic study (see link below) based on data and analysis by Wood Mackenzie and Voar Energy, if sanctioned Rosebank is estimated to create GBP 8.1 billion of direct investment, of which GBP 6.3 billion is likely to be invested in UK-based businesses. Over the lifetime of the project, Rosebank will generate a total of GBP 24.1 billion of gross value add (GVA), comprised of direct, indirect and induced economic impacts.

Equinor together with our partners are working with the supply chain to ensure that a substantial part of investment comes to Scotland and the UK. A supplier day was held in Aberdeen in partnership with EIC in order to increase the number of local suppliers to tender.

Note.

- The sums that could accrue to the UK economy are worthwhile.

- The Government North Sea Transition Deal is worth a read.

- A lot of the deal is about converting oil and gas skills to those of a renewable energy economy.

Planned properly, we should get all the oil and gas we need to get through difficult years.

I particularly like these two paragraphs, which are towards the end of the Government North Sea Transition Deal.

Through the Deal, the UK’s oil and gas sector and the government will work together to deliver

the skills, innovation and new infrastructure required to decarbonise North Sea oil and gas

production as well as other carbon intensive industries. Not only will it transform the sector in

preparation for a net zero future, but it will also catalyse growth throughout the UK economy.

Delivering large-scale decarbonisation solutions will strengthen the position of the existing UK

energy sector supply chain in a net zero world, securing new high-value jobs in the UK,

supporting the development of regional economies and competing in clean energy export

markets.

By creating the North Sea Transition Deal, the government and the UK’s oil and gas sector are

ambitiously seeking to tackle the challenges of reaching net zero, while repositioning the UK’s

capabilities to serve the global energy industry. The Deal will take the UKCS through to

maturity and help the sector pivot towards new opportunities to keep the UK at the forefront of

the changing 21st century energy landscape.

I believe that developing Rosebank could enable the following.

- The oil and gas we need in the next few years would be obtained.

- The economic situation of the UK would be improved.

- The skills and techniques we need to decarbonise the UK would be delivered.

- Net-zero would be reached in the required time.

- Jobs will be created.

- The export of surplus oil and gas.

I strongly believe that developing the Rosebank field would be worthwhile to the UK.

I have some other thoughts.

Electrification Of Platforms

This page on the Equinor web site is entitled Electrification Of Platforms.

This paragraph explains what that means.

Electrification means replacing a fossil-based power supply with renewable energy, enabling a reduction in greenhouse gas emissions. Equinor is fully committed to reducing emissions from our offshore oil & gas production.

Note.

- Typically, platforms use gas turbine engines running on natural gas to provide the electricity needed on the platform.

- Platforms in the future will get their electricity from renewable sources like wind and will have an electricity cable to the shore.

- Rosebank will be powered in this way.

This document on the Equinor web site is entitled Rosebank: Investing In Energy Security And Powering A Just Transition, which has a section called How Is Rosebank Different?, where this is said.

The key difference of Rosebank compared to other oil fields is that it

aims to draw on new technology applications to help reduce carbon

emissions from its production, through FPSO electrification.Building offshore installations that can be powered by electricity reduces

reliance on gas powered generators which are the biggest source

of production emissions. The electrification of UKCS assets is vital to

meeting the North Sea Transition Deal’s target of reducing production

emissions by 50% by 2030, with a view to being net zero by 2050.Electrification of Rosebank is a long-term investment that will drastically

cut the carbon emissions caused by using the FPSO’s gas turbines for

power. Using electricity as a power source on Rosebank results in a

reduction in emissions equivalent to taking over 650,000 cars off the

road for a year compared with importing 300 million barrels of oil from

international sources.

Note.

- An FPSO is a Floating Production Storage And Offloading Unit, which is the method of production, that Equinor have chosen for the Rosebank field.

- If we are going to extract fossil fuels then we must extract them in a manner, that doesn’t add to the problem by emitting extra carbon dioxide.

- We will probably extract fossil fuels for some years yet, as they are the easiest route to some important chemicals.

- I also believe that we will increasingly find uses for any carbon dioxide captured in combustion and chemical processes.

I already know of a farmer, who heats greenhouses using a gas-powered combined heat and power unit, who pipes the carbon dioxide to the tomatoes in the greenhouses.

Despite what Greenpeace and others say, carbon dioxide is not all bad.

Energy Security

The last page of this document on the Equinor web site is entitled Rosebank: Investing In Energy Security And Powering A Just Transition, is entitled Energy Security.

Look at the numbers.

- £8.1 billion – Total field investment with 78% of this being spent in the UK

- 1600 – Estimated peak number of direct FTE jobs

- £24.1 billion – Estimated gross value add

- 8 % – Of UK oil production from Rosebank to 2030

- 39 million cubic feet per day – Average daily gas production over the first 10 years of field life, equivalent to almost twice Aberdeen’s daily gas consumption

- 250kt CO2 – Carbon avoided by reusing existing FPSO

And if you have time read it fully.

Could The Rosebank FPSO Be Powered By Floating Offshore Wind?

Floating wind turbines are now being installed around the world.

- They can use the largest turbines.

- Some designs perform in the roughest of seas.

- They have a high capacity factor.

- They are generally brought into a suitable port for servicing and updating.

- Floating wind farms can be connected to floating substations

There is at least 20 GW of floating wind turbines planned for UK waters.

So could an appropriately-sized floating wind farm be placed near the Rosebank FPSO to provide it with electricity?

I don’t see why not, if there were some energy storage in the system, for when the wind wasn’t blowing.

Floating Offshore Wind Close To The Rosebank FPSO Would Be Challenging

Rosebank is an oil and gas field 130 kilometres off the West coast of the Shetland Islands.

That would be a challenging location for floating wind turbines.

But solving the installation problems would set precedents for floating wind farms all over the world.

Could The Rosebank FPSO Handle Hydrogen From Floating Offshore Wind?

It would surely be possible to put an electrolyser in the system somewhere, so that hydrogen was also stored in the tanks of the FPSO.

I also don’t think it unfeasible, that twenty percent of hydrogen could be blended into the natural gas to create the low-carbon natural gas, that has been proposed by the HyDeploy project.

Equinor And Partners Consider 1 GW Offshore Wind Farm Off The Coast Of Western Norway

The title of this post, is the same as that of this press release from Equinor.

This is the first paragraph.

Equinor and its partners Petoro, TotalEnergies, Shell and ConocoPhillips in the Troll and Oseberg fields, have initiated a study and are looking into possible options for building a floating offshore wind farm in the Troll area some 65 kilometres west of Bergen, Norway.

This second paragraph describes the production and use of the electricity.

With an installed capacity of about ~1 GW and an annual production of ~4.3 TWh, with a startup in 2027, Trollvind could provide much of the electricity needed to run the offshore fields Troll and Oseberg through an onshore connection point. The Bergen area already serves several of these installations with power – and needs more input to its electricity grid. The plan is that the partnership will buy as much energy as the wind farm can produce at a price that can make the project possible.

The press release includes a map of the wind farm, the oil and gas fields and Bergen.

This is not the first time, I’ve heard of plans to use wind-generated electricity to power offshore oil and gas fields.

It could be argued that if the gas is sold to the UK or Germany, then that country is responsible for the carbon emissions.

I doubt that Vlad the Mad’s bloodstained gas is produced using a carbon-free process.

The Massive Hydrogen Project, That Appears To Be Under The Radar

This page on the SSE Thermal web site, is entitled Aldbrough Gas Storage.

This is the introductory paragraph.

The Aldbrough Gas Storage facility, in East Yorkshire, officially opened in June 2011. The last of the nine caverns entered commercial operation in November 2012.

This page on Hydrocarbons Technology is entitled Aldbrough Underground Gas Storage Facility, Yorkshire.

It gives these details of how Aldbrough Gas Storage was constructed.

The facility was originally planned to be developed by British Gas and Intergen in 1997. British Gas planned to develop Aldbrough North as a gas storage facility while Intergen planned to develop Aldbrough South.

SSE and Statoil became owners of the two projects in 2002 and 2003. The two companies combined the projects in late 2003. Site work commenced in March 2004 and leaching of the first cavern started in March 2005.

The storage caverns were created by using directional drilling. From a central area of the site, boreholes were drilled down to the salt strata located 2km underground.

After completion of drilling, leaching was carried out by pumping seawater into the boreholes to dissolve salt and create a cavern. Natural gas was then pumped into the caverns and stored under high pressure.

Six of the nine caverns are already storing gas. As of February 2012, dewatering and preparation of the remaining three caverns is complete. Testing has been completed at two of these caverns.

The facility is operated remotely from SSE’s Hornsea storage facility. It includes an above ground gas processing plant equipped with three 20MW compressors. The gas caverns of the facility are connected to the UK’s gas transmission network through an 8km pipeline.

Note.

- The caverns are created in a bed of salt about two kilometres down.

- It consists of nine caverns with the capacity to store around 370 million cubic metres (mcm) of gas.

- Salt caverns are very strong and dry, and are ideal for storing natural gas. The technique is discussed in this section in Wikipedia.

As I worked for ICI at Runcorn in the late 1960s, I’m very familiar with the technique, as the company extracted large amounts of salt from the massive reserves below the Cheshire countryside.

This Google Map shows the location of the Aldbrough Gas Storage to the North-East of Hull.

Note.

- The red-arrow marks the site of the Aldbrough Gas Storage.

- It is marked on the map as SSE Hornsea Ltd.

- Hull is in the South-West corner of the map.

This Google Map shows the site in more detail.

It appears to be a compact site.

Atwick Gas Storage

This page on the SSE Thermal web site, is entitled Atwick Gas Storage.

This is said on the web site.

Our Atwick Gas Storage facility is located near Hornsea on the East Yorkshire coast.

It consists of nine caverns with the capacity to store around 325 million cubic metres (mcm) of gas.

The facility first entered commercial operation in 1979. It was purchased by SSE in September 2002.

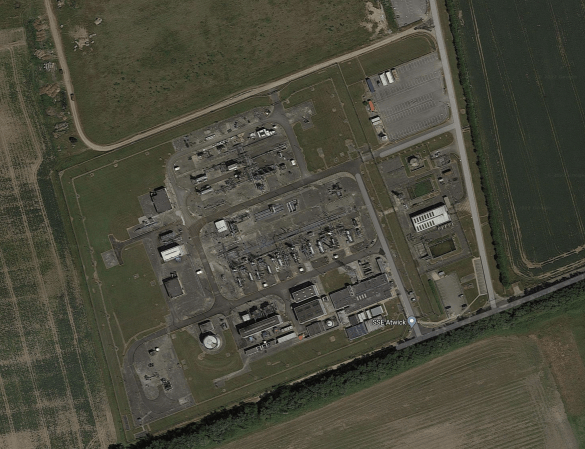

This Google Map shows the location of the Atwick Gas Storage to the North-East of Beverley.

Note.

- The red-arrow marks the site of the Atwick Gas Storage.

- It is marked on the map as SSE Atwick.

- Beverley is in the South-West corner of the map.

This Google Map shows the site in more detail.

As with the slightly larger Aldbrough Gas Storage site, it appears to be compact.

Conversion To Hydrogen Storage

It appears that SSE and Equinor have big plans for the Aldbrough Gas Storage facility.

This page on the SSE Thermal web site is entitled Plans For World-Leading Hydrogen Storage Facility At Aldbrough.

These paragraphs introduce the plans.

SSE Thermal and Equinor are developing plans for one of the world’s largest hydrogen storage facilities at their existing Aldbrough site on the East Yorkshire coast. The facility could be storing low-carbon hydrogen as early as 2028.

The existing Aldbrough Gas Storage facility, which was commissioned in 2011, is co-owned by SSE Thermal and Equinor, and consists of nine underground salt caverns, each roughly the size of St. Paul’s Cathedral. Upgrading the site to store hydrogen would involve converting the existing caverns or creating new purpose-built caverns to store the low-carbon fuel.

With an initial expected capacity of at least 320GWh, Aldbrough Hydrogen Storage would be significantly larger than any hydrogen storage facility in operation in the world today. The Aldbrough site is ideally located to store the low-carbon hydrogen set to be produced and used in the Humber region.

Hydrogen storage will be vital in creating a large-scale hydrogen economy in the UK and balancing the overall energy system by providing back up where large proportions of energy are produced from renewable power. As increasing amounts of hydrogen are produced both from offshore wind power, known as ‘green hydrogen’, and from natural gas with carbon capture and storage, known as ‘blue hydrogen’, facilities such as Aldbrough will provide storage for low-carbon energy.

I have a few thoughts.

Will Both Aldbrough and Atwick Gas Storage Facilities Be Used?

As the page only talks of nine caverns and both Aldbrough and Atwick facilities each have nine caverns, I suspect that at least initially only Aldbrough will be used.

But in the future, demand for the facility could mean all caverns were used and new ones might even be created.

Where Will The Hydrogen Come From?

These paragraphs from the SSE Thermal web page give an outline.

Equinor has announced its intention to develop 1.8GW of ‘blue hydrogen’ production in the region starting with its 0.6GW H2H Saltend project which will supply low-carbon hydrogen to local industry and power from the mid-2020s. This will be followed by a 1.2GW production facility to supply the Keadby Hydrogen Power Station, proposed by SSE Thermal and Equinor as the world’s first 100% hydrogen-fired power station, before the end of the decade.

SSE Thermal and Equinor’s partnership in the Humber marks the UK’s first end-to-end hydrogen proposal, connecting production, storage and demand projects in the region. While the Aldbrough facility would initially store the hydrogen produced for the Keadby Hydrogen Power Station, the benefit of this large-scale hydrogen storage extends well beyond power generation. The facility would enable growing hydrogen ambitions across the region, unlocking the potential for green hydrogen, and supplying an expanding offtaker market including heat, industry and transport from the late 2020s onwards.

Aldbrough Hydrogen Storage, and the partners’ other hydrogen projects in the region, are in the development stage and final investment decisions will depend on the progress of the necessary business models and associated infrastructure.

The Aldbrough Hydrogen Storage project is the latest being developed in a long-standing partnership between SSE Thermal and Equinor in the UK, which includes the joint venture to build the Dogger Bank Offshore Wind Farm, the largest offshore wind farm in the world.

It does seem to be, a bit of an inefficient route to create blue hydrogen, which will require carbon dioxide to be captured and stored or used.

Various scenarios suggest themselves.

- The East Riding of Yorkshire and Lincolnshire are agricultural counties, so could some carbon dioxide be going to help greenhouse plants and crops, grow big and strong.

- Carbon dioxide is used as a major ingredient of meat substitutes like Quorn.

- Companies like Mineral Carbonation International are using carbon dioxide to make building products like blocks and plasterboard.

I do suspect that there are teams of scientists in the civilised world researching wacky ideas for the use of carbon dioxide.

Where Does The Dogger Bank Wind Farm Fit?

The Dogger Bank wind farm will be the largest offshore wind farm in the world.

- It will consist of at least three phases; A, B and C, each of which will be 1.2 GW.

- Phase A and B will have a cable to Creyke Beck substation in Yorkshire.

- Phase C will have a cable to Teesside.

Creyke Beck is almost within walking distance of SSE Hornsea.

Could a large electrolyser be placed in the area, to store wind-power from Dogger Bank A/B as hydrogen in the Hydrogen Storage Facility At Aldbrough?

Conclusion

SSE and Equinor may have a very cunning plan and we will know more in the next few years.

Plans Announced For ‘Low Carbon’ Power Stations In Lincolnshire

The title of this post, is the same as that of this article on the BBC.

This is the introductory paragraph.

Hundreds of jobs could be created after plans were announced to build two “low carbon” power stations in North Lincolnshire.

Last year, I only had one night away from home and that was in Doncaster, from where I explored North East Lincolnshire and wrote Energy In North-East Lincolnshire, where I made a few predictions.

These are my thoughts on my predictions and other points made in the BBC article.

Keadby 1

Keadby 1 is a 734 MW gas-fired power station, that was commissioned in 1996.

Keadby 2

- Keadby 2 will be a 840 MW gas-fired power station.

- It will be possible to add Carbon Capture and Storage technology to Keadby 2 to make the plant net-zero carbon.

- Keadby 2 will be able to run on hydrogen.

Keadby 2 is under construction.

Keadby 3 And Keadby 4

I predicted that two new power stations would be added to the Keadby cluster.

- When I wrote the other post, SSE were still designing Keadby 3, but had said it would be a 910 MW station.

- This would mean that Keadby 1, Keadby 2 and Keadby 3 would have a combined capacity of 2484 MW of electricity.

- Adding a fourth station, which I called Keadby 4, which I proposed to be the same size as Keadby 3 would give a combined capacity of 3394 MW.

This will be more than the planned capacity of the under-construction Hinckley Point C nuclear power station will be able to generate 3200 MW.

The BBC article says this about the plans for Keadby.

One plant would burn natural gas and use carbon capture technology to remove the CO2 from its emissions. The CO2 would then be transported along pipelines before being securely stored in rocks under the North Sea.

The hydrogen power station would produce “zero emissions at the point of combustion”, its developers claimed.

It looks like Keadby will have the power of a Hinckley Point nuclear station, but running on gas.

Carbon Capture And Storage

From what I read on the sseThermal web site and published in Energy In North-East Lincolnshire, it looks like Keadby 2 and Keadby 3 will use carbon capture and storage and Keadby 4 will use hydrogen.

There are plenty of depleted gas fields connected to the Easington terminal that can be used for carbon-dioxide storage.

The Zero Carbon Humber Network

The Zero Carbon Humber is going to be a gas network along the Humber, that will distribute hydrogen to large industrial users and return carbon dioxide for storage under the North Sea.

This map shows the Zero Carbon Humber pipeline layout.

Note.

- The orange line is a proposed carbon dioxide pipeline

- The black line alongside it, is a proposed hydrogen pipeline.

- Drax, Keadby and Saltend are power stations.

- Easington gas terminal is connected to around twenty gas fields in the North Sea.

- The terminal imports natural gas from Norway using the Langeled pipeline.

- The Rough field has been converted to gas storage and can hold four days supply of natural gas for the UK.

I can see this network being extended, with some of the depleted gas fields being converted into storage for natural gas, hydrogen or carbon dioxide.

Enter The Vikings

This article on The Times is entitled SSE and Equinor’s ‘Blue Hydrogen’ Power Plant Set To Be World First.

This is the introductory paragraph.

The world’s first large-scale power station to burn pure hydrogen could be built in Britain this decade by SSE and Equinor to generate enough low-carbon energy to supply more than a million homes.

This second paragraph explains the working of the production of the blue hydrogen.

The proposed power station near Scunthorpe would burn “blue hydrogen”, produced by processing natural gas and capturing and disposing of waste CO2 in a process that has low but not zero emissions. Equinor is already working on plans for a blue hydrogen production facility at Saltend in the Humber.

This may seem to some to be a wasteful process in that you use energy to produce blue hydrogen from natural gas and then use the hydrogen to generate power, but I suspect there are good reasons for the indirect route.

I believe that green hydrogen will become available from the North Sea from combined wind-turbine electrolysers being developed by Orsted and ITM Power, before the end of the decade.

Green hydrogen because it is produced by electrolysis will have less impurities than blue hydrogen.

Both will be zero-carbon fuels.

According to this document on the TNO web site, green hydrogen will be used for fuel cell applications and blue hydrogen for industrial processes.

Blue hydrogen would be able to power Keadby 2, 3 and 4.

I can see a scenario where Equinor’s blue hydrogen will reduce the price of hydrogen steelmaking and other industrial processes. It will also allow the purer and more costly green hydrogen to be reserved for transport and other fuel cell applications.

Using The Carbon Instead Of Storing

The document on the TNO web site has this surprising paragraph.

Hydrogen produced from natural gas using the so-called molten metal pyrolysis technology is called ‘turquoise hydrogen’ or ‘low carbon hydrogen’. Natural gas is passed through a molten metal that releases hydrogen gas as well as solid carbon. The latter can find a useful application in, for example, car tyres. This technology is still in the laboratory phase and it will take at least ten years for the first pilot plant to be realised.

This technical paper is entitled Methane Pyrolysis In A Molten Gallium Bubble Column Reactor For Sustainable Hydrogen Production: Proof Of Concept & Techno-Economic Assessment.

This may be a few years away, but just imagine using the carbon dioxide from power stations and industrial processes to create a synthetic rubber.

But I believe there is a better use for the carbon dioxide in the interim to cut down the amount that goes into long-term storage, which in some ways is the energy equivalent of landfill except that it isn’t in the least way toxic, as carbon-dioxide is one of the most benign substances on the planet.

Lincolnshire used to be famous for flowers. On a BBC Countryfile program a couple of weeks ago, there was a feature on the automated growing and harvesting of tulips in greenhouses.

There are references on the Internet to of carbon dioxide being fed to flowers in greenhouses to make them better flowers.

So will be see extensive building of greenhouses on the flat lands of Lincolnshire growing not just flowers, but soft fruits and salad vegetables.

Conclusion

The plans of SSE and Equinor as laid out in The Times and the BBC could create a massive power station cluster.

- It would be powered by natural gas and hydrogen.

- Blue hydrogen will be produced by an efficient chemical process.

- Green hydrogen will be produced offshore in massive farms of wind-turbine/electrolysers.

- It would generate as much electricity as a big nuclear power station.

- All carbon-dioxide produced would be either stored or used to create useful industrial products and food or flowers in greenhouses.

Do power stations like this hasten the end of big nuclear power stations?

Probably, until someone finds a way to turn nuclear waste into something useful.

SSE Goes Global To Reap The Wind

The title of this article on This Is Money is Renewable Energy Giant SSE Launches Plan To Become Britain’s First Global Windfarm Business As it Invests Up To £15bn Over Next Decade.

The title is a good summary of their plans to build wind farms in Continental Europe, Denmark, Japan and the US, in addition to the UK and Ireland.

I can also see the company developing more integrated energy clusters using the following technologies.

- Wind farms that generate hydrogen rather than electricity using integrated electrolysers and wind turbines, developed by companies like ITM Power and Ørsted.

- Reusing of worked out gasfields and redundant gas pipelines.

- Zero-carbon CCGT power stations running on Hydrogen.

- Lots of Energy storage.

I talked about this type of integration in Batteries Could Save £195m Annually By Providing Reserve Finds National Grid ESO Trial.

In the related post, I talked about the Keadby cluster of gas-fired power stations, which are in large part owned by SSE.

Conclusion

I think that SSE could be going the way of Equinor and Ørsted and becoming a global energy company.

It is also interesting the BP and Shell are investing in renewable energy to match the two Scandinavian companies.

Big Oil seems to be transforming itself into Big Wind.

All these companies seem to lack grid-scale energy storage, although hydrogen can be generated and stored in worked-out gas fields.

So I would expect that some of the up-and-coming energy storage companies like Gravitricity, Highview Power and RheEnergise could soon have connections with some of these Big Wind companies.