‘Mobilising EUR 1 Trillion in Investments’ | North Sea Countries, Industry, TSOs to Ink Offshore Wind Pact

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Government officials from Belgium, Denmark, France, Germany, Ireland, Luxembourg, the Netherlands, Norway and the UK are set to sign a declaration confirming the ambition to build 300 GW of offshore wind in the North Seas by 2050, and an investment pact with the offshore wind industry and transmission system operators (TSOs) that is said to mobilise EUR 1 trillion in economic activity.

These three paragraphs add a lot of powerful detail.

Under the Offshore Wind Investment Pact for the North Seas, to be signed today (26 January) at the North Sea Summit in Hamburg, governments of the nine North Sea countries will commit to building 15 GW of offshore wind per year from 2031 to 2040.

The heads of state and energy ministers will also vow to de-risk offshore wind investments through a commitment to provide two-sided Contracts for Difference (CfDs) as the standard for offshore wind auction design. The pact also commits governments to remove any regulatory obstacles to power purchase agreements (PPAs), according to WindEurope, which will sign the pact on behalf of the industry.

On the industry’s side, the commitment is to drive down the costs of offshore wind by 30 per cent towards 2040, mobilise EUR 1 trillion of economic activity for Europe, create 91,000 additional jobs and invest EUR 9.5 billion in manufacturing, port infrastructure and vessels.

These two paragraphs say something about cost reductions.

The cost reduction of offshore wind is planned to be achieved through scale effects, lower costs of capital and further industrialisation supported by clarity and visibility on the project pipeline.

The transmission system operators (TSOs) will identify cost-effective cooperation projects in the North Sea, including 20 GW of promising cross-border projects by 2027 for deployment in the 2030s.

I hope there is a project management system, that can step into this frenzy, just as Artemis did in the 1970s with North Sea Oil and Gas.

The BBC has reported the story under a title of UK To Join Major Wind Farm Project With Nine European Countries.

this is the sub-title.

The UK is set to back a vast new fleet of offshore wind projects in the North Sea alongside nine other European countries including Norway, Germany and the Netherlands.

These six paragraphs add more detail.

The government says the deal will strengthen energy security by offering an escape from what it calls the “fossil fuel rollercoaster”.

For the first time, some of the new wind farms will be linked to multiple countries through undersea cables known as interconnectors, which supporters say should lower prices across the region.

But it could prove controversial as wind farm operators would be able to shop around between countries to sell power to the highest bidder – potentially driving up electricity prices when supply is tight.

Energy Secretary Ed Miliband will sign a declaration on Monday at a meeting on the future of the North Sea in the German city of Hamburg, committing to complete the scheme by 2050.

Jane Cooper, deputy CEO of industry body RenewableUK, said the deal would “drive down costs for billpayers” as well as increasing “the energy security of the UK and the whole of the North Sea region significantly”.

But Claire Countinho, shadow energy secretary, warned “we cannot escape the fact that the rush to build wind farms at breakneck speed is pushing up everybody’s energy bills.”

Claire Coutinho, as an outsider at present and a member of a party out of Government had to say something negative, but her negotiations when she was UK Energy Minister with her German opposite number, which I wrote about in UK And Germany Boost Offshore Renewables Ties, seem very much a precursor to today’s agreement.

Development Consent Decision On 3 GW Dogger Bank South Project Postponed

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK Secretary of State for Energy Security and Net Zero has set a new deadline for the decision on the Development Consent Order (DCO) for Dogger Bank South, a 3 GW offshore wind project developed by RWE, which the company owns in partnership with Masdar.

These two paragraphs add more detail to the project.

The statutory deadline for the decision on the project was 10 January 2026. This has now been moved to 30 April.

According to a statement from the Minister for Energy Consumers, Martin McCluskey, the extension will allow time to request further information that was not provided for consideration during the examination period and to give all interested parties the opportunity to review and comment on such information.

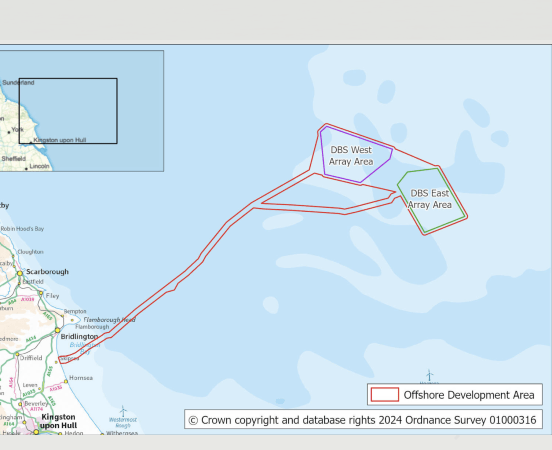

I clipped this map from the Dogger Bank South web site.

Note.

- Bridlington, Kingston-Upon-Hull and Scarborough can be picked out on the coast of East Yorkshire.

- The two wind farms and the route of the cables to the shore can be clearly seen.

I just wonder, whether the nature of the project is changing.

Consider.

- Three GW is a lot of power to move across Yorkshire to where it can be connected to the grid.

- In Consultation On Offshore Wind Reform: Hydrogen Sector Calls For Hybrid Connection Concepts And Warns Of Compensation Risks, German companies involved in the AquaVentus project are calling for more hydrogen to be produced offshore and piped to the shore.

- Could hydrogen produced in the Dogger Bank Wind farms be piped to the Northern end of the AquaVentus pipeline on the German sector of the Dogger Bank?

- A pipeline or cable could still bring energy to Yorkshire.

- The hydrogen could go to the hydrogen stores at Aldbrough and Rough.

- SSE and Centrica could play hydrogen-bankers to the Germans, as Germany is short of hydrogen storage.

- East Yorkshire is building two hydrogen power stations at Keadby and Ferrybridge.

- Support for the Dogger Bank South wind farms will probably be from RWE’S Grimsby hub.

Is this the Anglo-German co-operation, I talked about in UK And Germany Boost Offshore Renewables Ties at work?

I can see benefits for this arrangement for the UK.

- Hydrogen production is offshore.

- A lot of the onshore employment is in the UK.

- There will be a hydrogen pipeline between Germany and the vast hydrogen storage of Humberside via the German Dogger Bank and Dogger Bank South wind farms.

- Will there be a hydrogen pipeline between the North of Scotland and Humberside via the AquaVentus pipeline?

- There will also be a substantial cash flow to the UK Treasury because of all the hydrogen production in UK waters.

RWE may also be able to use a standard hydrogen production platform in German and UK waters.

This is the sort of plan, that the money men will like.

German Wind Tender Awards 3.46 GW Amid Record Demand, Lower Prices

The title of this post, is the same as that of this article on Renewables Now.

These are the first three paragraphs.

Germany’s Federal Network Agency (BNetzA) selected 415 projects with a combined capacity of 3,456 MW in the last onshore wind tender round for 2025, seeing record interest in the procedure and falling prices.

Until the deadline of November 1, as many as 905 bids totalling 8,155 MW were submitted, while the target was 3,450 MW. As many as 37 projects had to be excluded from the competition, the agency said on Thursday.

The value of the successful bids ranged between EUR 0.058 (USD 0.068) per kWh and EUR 0.0612 per kWh. The average volume-weighted award price stood at EUR 0.0606 per kWh, which is below the value of EUR 0.0657 per kWh in the previous round and significantly lower than the maximum possible amount of EUR 0.0735 per kWh.

Note.

- These figures show that the German onshore wind market is healthy and the price of the electricity is falling.

- The procedure marks the fourth onshore wind tender round for 2025. In the previous three rounds, the Federal Network Agency allocated capacities of 3,448 MW, 3,447 MW and 4,094 MW, respectively, so with this round’s 3,456 MW, that makes 14.445 GW or about four-and-a-half Hinckley Point Cs.

- Germany is 45 % larger than the UK in terms of land area.

If we were installing wind turbines at the same rate as the Germans, we’d have installed a few megawatts short of ten gigawatts onshore in the same period of time.

I have some thoughts on these figures.

Does More Onshore Wind Mean Lower Electricity Prices?

If we were installing onshore wind turbines at the same rate as the Germans, our energy prices might be lower.

More research needs to be done.

Do The Germans Have A Pricing Structure That Encourages The Take-Up Of Onshore Wind?

If they do, then we should think of using it in certain locations.

Consultation On Offshore Wind Reform: Hydrogen Sector Calls For Hybrid Connection Concepts And Warns Of Compensation Risks

The title of this post, is the same as that of this article on the AquaVentus web site.

There is this statement on the home page.

Berlin, January 02 2026. In the context of the consultation launched by the Federal Ministry for Economic Affairs and Energy (BMWE) on the reform of the Wind Energy at Sea Act (WindSeeG), the hydrogen initiative AquaVentus is calling for clear legislative action to enable a cost-efficient and system-friendly development of offshore wind energy. At the heart of its position is the timely legal establishment of hybrid connection concepts, allowing offshore wind farms to be connected via both electricity cables and hydrogen pipelines.

Note.

- I’ve always felt that copying proven technologies from the offshore oil and gas industry is good practice.

- It may be easier to recycle infrastructure like pipelines, platforms and storage by creating the hydrogen offshore.

- In the UK, Centrica and SSE are already re-purposing natural gas storage for hydrogen.

It may feel safer to some for the hydrogen to be produced a distance offshore.

The Thoughts Of Chris O’Shea

This article on This Is Money is entitled Centrica boss has bold plans to back British energy projects – but will strategy pay off?.

The article is basically an interview with a reporter and gives O’Shea’s opinions on various topics.

Chris O’Shea is CEO of Centrica and his Wikipedia entry gives more details.

These are his thoughts.

On Investing In Sizewell C

This is a paragraph from the article.

‘Sizewell C will probably run for 100 years,’ O’Shea says. ‘The person who will take the last electron it produces has probably not been born. We are very happy to be the UK’s largest strategic investor.’

Note.

- The paragraph shows a bold attitude.

- I also lived near Sizewell, when Sizewell B was built and the general feeling locally was that the new nuclear station was good for the area.

- It has now been running for thirty years and should be good for another ten.

Both nuclear power stations at Sizewell have had a good safety record. Could this be in part, because of the heavy engineering tradition of the Leiston area?

On Investing In UK Energy Infrastructure

This is a paragraph from the article

‘I just thought: sustainable carbon-free electricity in a country that needs electricity – and we import 20 per cent of ours – why would we look to sell nuclear?’ Backing nuclear power is part of O’Shea’s wider strategy to invest in UK energy infrastructure.

The UK certainly needs investors in UK energy infrastructure.

On Government Support For Sizewell C

This is a paragraph from the article.

Centrica’s 500,000 shareholders include an army of private investors, many of whom came on board during the ‘Tell Sid’ privatisations of the 1980s and all of whom will be hoping he is right. What about the risks that deterred his predecessors? O’Shea argues he will achieve reliable returns thanks to a Government-backed financial model that enables the company to recover capital ploughed into Sizewell C and make a set return.

I have worked with some very innovative accountants and bankers in the past fifty years, including an ex-Chief Accountant of Vickers and usually if there’s a will, there’s a solution to the trickiest of financial problems.

On LNG

These are two paragraphs from the article.

Major moves include a £200 million stake in the LNG terminal at Isle of Grain in Kent.

The belief is that LNG, which produces significantly fewer greenhouse gas emissions than other fossil fuels and is easier and cheaper to transport and store, will be a major source of energy for the UK in the coming years.

Note.

- Centrica are major suppliers of gas-powered Combined Heat and Power units were the carbon dioxide is captured and either used or sold profitably.

- In at least one case, a CHP unit is used to heat a large greenhouse and the carbon dioxide is fed to the plants.

- In another, a the gas-fired Redditch power station, the food-grade carbon dioxide is sold to the food and construction industries.

- Grain LNG Terminal can also export gas and is only a short sea crossing from gas-hungry Germany.

- According to this Centrica press release, Centrica will run low-carbon bunkering services from the Grain LNG Terminal.

I analyse the investment in Grain LNG Terminal in Investment in Grain LNG.

On Rough Gas Storage

These are three paragraphs from the article.

O’Shea remains hopeful for plans to develop the Rough gas storage facility in the North Sea, which he re-opened in 2022.

The idea is that Centrica will invest £2 billion to ‘create the biggest gas storage facility in the world’, along with up to 5,000 jobs.

It could be used to store hydrogen, touted as a major energy source of the future, provided the Government comes up with a supportive regulatory framework as it has for Sizewell.

The German AquaVentus project aims to bring at least 100 GW of green hydrogen to mainland Germany from the North Sea.

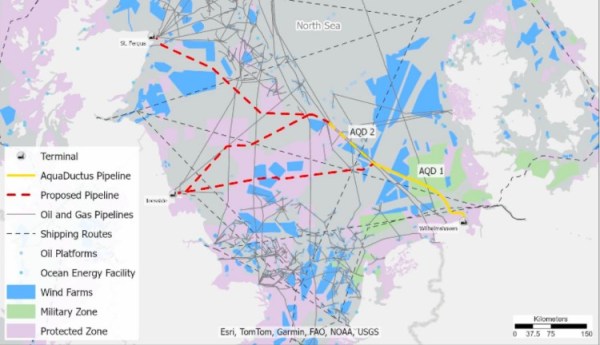

This map of the North Sea, which I downloaded from the Hydrogen Scotland web site, shows the co-operation between Hydrogen Scotland and AquaVentus

Note.

- The yellow AquaDuctus pipeline connected to the German coast near Wilhelmshaven.

- There appear to be two AquaDuctus sections ; AQD 1 and AQD 2.

- There are appear to be three proposed pipelines, which are shown in a dotted red, that connect the UK to AquaDuctus.

- The Northern proposed pipeline appears to connect to the St. Fergus gas terminal on the North-East tip of Scotland.

- The two Southern proposed pipelines appear to connect to the Easington gas terminal in East Yorkshire.

- Easington gas terminal is within easy reach of the massive gas stores, which are being converted to store hydrogen at Aldbrough and Rough.

- The blue areas are offshore wind farms.

- The blue area straddling the Southernmost proposed pipe line is the Dogger Bank wind farm, is the world’s largest offshore wind farm and could eventually total over 6 GW.

- RWE are developing 7.2 GW of wind farms between Dogger Bank and Norfolk in UK waters, which could generate hydrogen for AquaDuctus.

This cooperation seems to be getting the hydrogen Germany needs to its industry.

It should be noted, that Germany has no sizeable hydrogen stores, but the AquaVentus system gives them access to SSE’s Aldbrough and Centrica’s Rough hydrogen stores.

So will the two hydrogen stores be storing hydrogen for both the UK and Germany?

Storing hydrogen and selling it to the country with the highest need could be a nice little earner.

On X-energy

These are three paragraphs from the article.

He is also backing a £10 billion plan to build the UK’s first advanced modular reactors in a partnership with X-energy of the US.

The project is taking place in Hartlepool, in County Durham, where the existing nuclear power station is due to reach the end of its life in 2028.

As is the nature of these projects, it involves risks around technology, regulation and finance, though the potential rewards are significant. Among them is the prospect of 2,500 jobs in the town, where unemployment is high.

Note.

- This is another bold deal.

- I wrote in detail about this deal in Centrica And X-energy Agree To Deploy UK’s First Advanced Modular Reactors.

- Jobs are mentioned in the This is Money article for the second time.

I also think, if it works to replace the Hartlepool nuclear power station, then it can be used to replace other decommissioned nuclear power stations.

On Getting Your First Job

These are three paragraphs from the article.

His career got off to a slow start when he struggled to secure a training contract with an accountancy firm after leaving Glasgow University.

‘I had about 30, 40 rejection letters. I remember the stress of not having a job when everyone else did – you just feel different,’ he says.

He feels it is ‘a duty’ for bosses to try to give young people a start.

I very much agree with that. I would very much be a hypocrite, if I didn’t, as I was given good starts by two companies.

On Apprenticeships

This is a paragraph from the article.

‘We are committed to creating one new apprenticeship for every day of this decade,’ he points out, sounding genuinely proud.

I very much agree with that. My father only had a small printing business, but he was proud of the apprentices he’d trained.

On Innovation

Centrica have backed three innovative ideas.

- heata, which is a distributed data centre in your hot water tank, which uses the waste heat to give you hot water.

- HiiROC, which is an innovative way to generate affordable hydrogen efficiently.

- Highview Power, which stores energy as liquid air.

I’m surprised that backing innovations like these was not mentioned.

Conclusion

This article is very much a must read.

America’s Looming Electricity Crisis Is Trump’s Achilles’ Heel

The title of this post, is the same as that of this article in the Telegraph.

This is the sub-heading.

Culture war banter and point-scoring have left Maga facing a self-inflicted energy shortage

These are the first three paragraphs.

The US is in danger of losing the global AI race for the most banal and careless of reasons: it is critically short of electricity.

The country is sitting on a neglected pre-modern grid that cannot meet surging power demand for data centres, cryptocurrencies, the reshoring of semiconductor plants and the proclaimed revival of the American industrial base.

Nor can it meet the needs for air conditioning through hotter and more humid summers. While we all talk about AI, the chief cause of rising electricity use last year was for cooling. Bitcoin mining took another 2pc of US power, for no productive purpose.

It looks like we can add simple arithmetic to the skills the Trump Administration lacks.

The Telegraph article and myself have some other thoughts.

The Planned Increase In Electricity Is A Fifth Of What’s Needed

This is a paragraph from the Telegraph.

The US Energy Department said in its Resource Adequacy Report in July that the planned increase in firm electricity supply is a fifth of what is needed by 2030.

In Renewable Power By 2030 In The UK, I stated that by 2030, the UK would add nearly 59 GW of offshore wind.

Surely, using the population size difference of four times, 240 GW of offshore wind, would do the USA nicely?

But, Trump doesn’t like wind turbines.

Texas Has A Shortage Of Electricity

These are two paragraphs from the Telegraph.

The Texas grid operator Ercot expects peak power demand in its region to soar from 87 gigawatts (GW) this year to 138 GW by 2030. This is physically impossible.

Texas passed a law in June giving the state emergency authority to cut off power to data centres. Ercot is already having to deploy “mobile generation plants” at exorbitant cost to avert blackouts even today.

It sounds pretty desperate.

Texas needs another 51 GW by 2030, which is less than we intend to delivery from just offshore wind.

If Little Great Britain can do it, then surely Texas can? After all, Texas is three almost times larger than the UK.

I get the idea, that someone isn’t doing any planning.

The United States Needs A Lot Of Transformers

These are three paragraphs from the Telegraph.

The National Infrastructure Advisory Council (Niac) says the average age of America’s 60 million large power transformers is 38 years. Many are beyond their design life.

The US supply chain is not capable of delivering the 12 million new transformers needed each year to keep the show on the road. The backlog has risen to four years. The cost of transformers has jumped 80pc since the pandemic.

There is an acute shortage of electrical steel needed to make them. This comes mostly from China, Japan, Korea or Germany. In his infinite wisdom, Trump has imposed 50pc tariffs on steel, aluminium and copper. That cost shock has yet to feed through.

The Niac says it is a similar tale for “other critical grid components such as conduit, smart meters, switchgear and high-voltage circuit breakers”.

It looks like, there’s another fine mess, you’ve got us in, Donny!

Maga Wants More Coal

These are three paragraphs from the Telegraph.

The quickest way to generate more power is to roll out wind and solar. Trump is actively intervening to obstruct this. Maga wants coal instead.

This week the administration announced $625m of taxpayer subsidy to “expand and reinvigorate” the coal industry. It will open new federal lands, slash the royalty fees for extracting coal, and lift curbs on mercury pollution.

“In addition to drill, baby drill, we need to mine, baby, mine,” said Doug Burgum, the interior secretary.

When it should be spin, baby, spin.

Conclusion

Read the article in full.

We certainly, don’t want anybody, with an energy policy like Trump, influencing the UK’s energy policy.

If Trump carries on like this, he’ll end up in a terrible mess.

Scotland And AquaVentus Partner On North Sea Hydrogen Pipeline Plans

The title of this post, is the same as that of this article on H2-View.

These four paragraphs introduce the deal and add some detail.

Hydrogen Scotland has committed to working with the AquaDuctus consortium on cross-border infrastructure concepts to connect Scotland’s offshore wind power to hydrogen production in the North Sea.

Under a Memorandum of Understanding (MOU), the two organisations plan to combine Scotland’s offshore wind with AquaVentus’ offshore electrolysis expertise, linking export and import goals across the North Sea.

The AquaDuctus pipeline is a planned offshore hydrogen link designed to carry green hydrogen through the North Sea, using a pipes and wires hybrid approach. The German consortium plans 10GW of offshore electrolysers in the North Sea, producing around one million tonnes of green hydrogen.

The pipeline design allows offshore wind farms to deliver electricity when the grid needs it, or convert power into hydrogen via electrolysis and transport it through pipelines.

Germany is embracing hydrogen in a big way.

- I introduce AquaVentus in AquaVentus, which I suggest you read.

- AquaVentus is being developed by RWE.

- AquaVentus connects to a German hydrogen network called H2ercules to actually distribute the hydrogen.

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Rough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

I believe that offshore electrolysers could be built in the area of the Hornsea 4, Dogger Bank South and other wind farms and the hydrogen generated would be taken by AquaVentus to either Germany or the UK.

- Both countries get the hydrogen they need.

- Excess hydrogen would be stored in Aldbrough and Rough.

- British Steel at Scunthorpe gets decarbonised.

- A 1.8 GW hydrogen-fired powerstation at Keadby gets the hydrogen it needs to backup the wind farms.

Germany and the UK get security in the supply of hydrogen.

Conclusion

This should be a massive deal for Germany and the UK.

DB And PKP To Expand Cross-Border Rail Services Between Germany And Poland

The title of this post, is the same of that as this article on Railway=News.

These two introductory paragraphs add more detail.

From mid-December 2025, Deutsche Bahn (DB) and PKP Intercity (PKP) are expanding their joint long-distance rail services, increasing the number of direct daily connections between Germany and Poland by more than 50 percent.

Starting on 14 December, 17 daily train pairs will operate across the border, up from the current 11. The additional capacity will provide a two-hourly service on the Berlin–Warsaw route, with seven trains in each direction.

I did a lot of this route, when I did a Home Run From Krakov.

I feel this German-Polish route will attract a lot of passengers, as it serves three excellent Polish cities Gdansk, Krakov and Warsaw, where you can spend a few days and it connects you to Berlin.

Centrica Enters Into Long Term Natural Gas Sale & Purchase Agreement

The title of this post, is the same as this press release from Centrica.

This is the sub-heading,

Centrica plc today confirmed that its trading arm, Centrica Energy, has entered into a natural gas sale and purchase agreement with US-based Devon Energy Corporation.

This first paragraph adds a few more details.

Under the agreement, Devon Energy will supply 50,000 (MMBtu) per day of natural gas over a 10‑year term starting in 2028. This is equivalent to five LNG cargoes per year. The volumes will be indexed to European gas hub price (TTF). This sale and purchase agreement supports Centrica’s objective of managing market price risk in its LNG portfolio by aligning feed gas pricing with European gas prices whilst providing Devon Energy with international price exposure.

At a first look, it looks a lot of gas.

In Investment In Grain LNG, I talk about Centrica’s purchase of the Grain LNG Terminal from National Grid. But the Grain LNG Terminal comes with several things that Centrica might need for gas from Devon.

- A large amount of gas storage.

- The ability to convert liquid natural gas (LNG) into gas suitable for consumers.

- Space to build more storage if required.

- The ability to store LNG for other companies.

- Two jetties for delivering the LNG to the Grain LNG Terminal.

- The ability to load tankers with LNG, so that it can be sold on to third parties like say the Germans or the Poles.

Centrica also say this about their use of the Grain LNG Terminal in this press release, that describes the purchase of the terminal.

Aligned with Centrica’s strategy of investing in regulated and contracted assets supporting the energy transition, delivering predictable long-term, inflation-linked cash flows, with 100% of capacity contracted until 2029, >70% until 2038 and >50% until 2045.

Centrica have obviously modelled their gas supply and delivery and I believe they have come up with a simple strategy, that will work.

How Will Centrica Use The Gas From The Grain LNG Terminal?

The Wikipedia entry for the Grain LNG Terminal says this about the terminal delivering gas into the gas grid.

The terminal can handle up to 15 million tonnes per annum of LNG, has a storage capacity for one million cubic metres of LNG, and is able to regasify up to 645 GWh per day (58 million cubic metres per day) for delivery into the high pressure gas National Transmission System (NTS).

Note.

- This will be one of the major uses of the gas.

- I wouldn’t be surprised if these capacities will be increased significantly, so that more gas can be stored and processed.

In Investment in Grain LNG, I outlined how I believe that hydrogen and ammonia will be produced for the bunkering of ships on one of busiest sea lanes in Europe, if not the world.

Some LNG will be used to create these zero-carbon fuels.

Some modern ships, also run on natural gas, so I asked Google AI about their operation and received this answer.

Ships can run on natural gas, specifically liquefied natural gas (LNG), by using it as a fuel source in specially designed engines. LNG is natural gas that has been cooled to a liquid state at -162°C, making it easier to store and transport. This liquid form is then used to power the ship’s engines, either directly or by burning the boil-off gas (BOG) that naturally occurs when LNG warms up.

This means that some LNG could be used to directly fuel these ships.

What Is The Gas Capacity Of The Grain LNG Terminal?

I asked Google AI this question and received this answer.

The Grain LNG Terminal, the largest LNG import terminal in Europe, has a storage capacity of 1,000,000 cubic meters (m³) and an annual throughput capacity of 15 million tonnes of LNG. This is equivalent to about 20% of the UK’s total gas demand. The terminal also has the capacity to deliver 25% of the UK’s daily gas demand.

As the space is there, I wouldn’t be surprised to see Centrica increase the capacity of the terminal, as in cold weather, emergency gas for Germany can be delivered quicker from Kent than the United States.

Could The Grain LNG Terminal Accept Gas Deliveries From The United States?

I’m certain that it already does.

Could The Grain LNG Terminal Accept Gas Deliveries From The UK?

If we start extracting gas again from under the seas around the UK, could the Grain LNG Terminal be used to store it?

Yes, but it would have to be liquified first.

It would be more energy efficient to process the extracted gas, so it could be used directly and gasify enough gas at Grain LNG Terminal from storage to make up any shortfall.

Conclusion

Centrica have done some very deep joined up thinking, by doing a long term gas deal and the Grain LNG Terminal purchase so that they have the gas to supply and somewhere to keep it, until it is needed.

Investment in Grain LNG

The title of this post, is the same as that of this press release from Centrica.

This sub-heading outlines the deal.

Centrica plc (the “Company”, “Centrica”) is pleased to announce the acquisition of the Isle of Grain liquified natural gas terminal (“Grain LNG”) in partnership1 with Energy Capital Partners LLP (“ECP”) from National Grid group (“National Grid”) for an enterprise value of £1.5 billion. After taking into account approximately £1.1 billion of new non-recourse project finance debt, Centrica’s 50% share of the equity investment is approximately £200 million.

The press release lists these key points.

- Grain LNG delivers vital energy security for the UK, providing critical LNG import/export, regasification and rapid response gas storage capacity to balance the energy system.

- Aligned with Centrica’s strategy of investing in regulated and contracted assets supporting the energy transition, delivering predictable long-term, inflation-linked cash flows, with 100% of capacity contracted until 2029, >70% until 2038 and >50% until 2045.

- Opportunities for efficiencies to create additional near-term value, and future development options including a combined heat and power plant, bunkering, hydrogen and ammonia.

- Highly efficient funding structure, with Centrica’s equity investment of approximately £200 million alongside non-recourse project financing.

- Strong life of asset returns aligned with Centrica’s financial framework, with an expected unlevered IRR2 of around 9% and an equity IRR2 of around 14%+

Underpins delivery of £1.6 billion end-2028 EBITDA target3 – Centrica’s share of EBITDA expected to be approximately £100 million per annum and cash distributions expected to be around £20 million on average per annum for 2026-2028, representing an attractive yield on Centrica’s equity investment - Partnership with ECP (part of Bridgepoint Group plc), one of the largest private owners of natural gas generation and infrastructure assets in the U.S. with direct experience in supporting grid reliability.

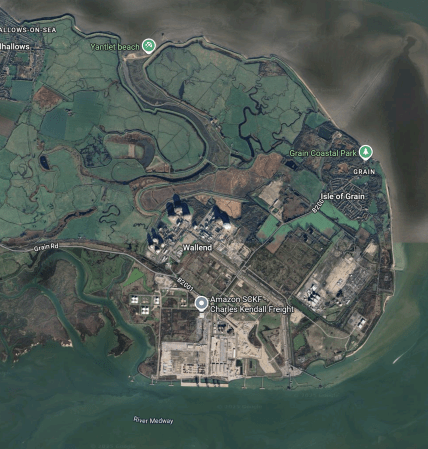

This Google Map shows the various energy assets on the Isle of Grain.

Note.

- It appears that works for the 1, 400 MW NeuConnect interconnector to Wilhelmshaven in Germany, are taking place in the North-East corner of the map.

- Grain CHP powerstation is a 1,275MW CCGT power station, which is owned by German company; Uniper, that is in the South-East corner of the map, which can also supply up to 340MW of heat energy recovered from the steam condensation to run the vapourisers in the nearby liquefied natural gas terminal.

- The Grain LNG terminal is at the Western side of the map.

- In the Thames Estuary to the East of the Isle of Grain, I estimate that there are about 1,500 MW of wind turbines.

I find it interesting that two of the assets are German owned.

I have some thoughts.

It Is A Large Site With Space For Expansion

This Google Map shows the whole of the Isle of Grain.

Note.

- The Grain LNG terminal is around the label Wallend.

- The River Medway runs East-West at the bottom of the map.

- Gas tankers deliver and take on gas at jetties on the North Bank of the Medway.

There could be space to expand the terminal, if the RSPB would allow it.

As an example, I asked Google AI, if peregrine falcons nest on chemical plants and got this reply.

Yes, peregrine falcons do nest on chemical plants. They have adapted to using various urban and industrial structures, including chemical plants, for nesting. This is particularly true in areas where natural cliff habitats are scarce.

Peregrine falcons are known for their adaptability, and their population has seen a resurgence in recent decades, partly due to their ability to utilize man-made structures. These structures often mimic their natural cliffside nesting

Cliffs do seem scarce on the Isle of Grain. I also asked Google AI, if peregrine falcons ate small rodents, as several chemical and other plants, where I’ve worked, had a rodent problem. One plant had a cat problem, as there had been so many rats. This was the reply.

Yes, peregrine falcons do eat small rodents, though they primarily consume birds. While their diet mainly consists of other birds like pigeons, doves, and waterfowl, they will also hunt and eat small mammals, including rodents such as mice, rats, and voles. They are opportunistic hunters and will take advantage of readily available prey, including insects, amphibians, and even fish.

I’m sure if Centrica wanted to expand, they’d employ the best experts.

Who Are ECP?

One of the key points of the press release is that this deal is a partnership with ECP (part of Bridgepoint Group plc), one of the largest private owners of natural gas generation and infrastructure assets in the U.S. with direct experience in supporting grid reliability.

The Wikipedia entry for ECP or Energy Capital Partners has this first section.

Energy Capital Partners Management, LP (ECP) is an American investment firm headquartered in Summit, New Jersey. It focuses on investments in the energy sector. The firm has additional offices in New York City, Houston, San Diego, Fort Lauderdale and Seoul.

In August 2024, ECP merged with Bridgepoint Group to form a private assets investment platform.

The Wikipedia entry for the Bridgepoint Group has this first paragraph.

Bridgepoint Group plc is a British private investment company listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

The company had started as part of NatWest.

Are The Germans Going To Take Away Some Of Our Electricity?

Consider.

- Germany has a big need to replace Russian gas and indigenous coal, and to decarbonise.

- Neuconnect is a 1.4 GW interconnector between the Isle of Grain and Wilhelmshaven in Germany. It is scheduled to be completed in 2028.

- The Grain CHP powerstation is a 1,275MW CCGT power station, which is owned by German company; Uniper, could almost keep NeuConnect working at full power on its own.

- I said earlier, in the Thames Estuary to the East of the Isle of Grain, I estimate that there are about 1,500 MW of wind turbines. One of which is part German-owned.

The Germans are also building a large electrolyser at Wilhelshaven, which is described by Google AI like this.

The Wilhelmshaven Green Energy Hub will initially feature a 500MW electrolyzer, with plans to potentially expand to 1GW, according to Energy Monitor. The hub, a joint project between Tree Energy Solutions (TES) and EWE, aims to produce green hydrogen using renewable energy sources like offshore wind. The 500MW electrolyzer is scheduled to be operational by 2028.

I wouldn’t be surprised to see that the Wilhelmshaven electrolyser were to be powered by British-generated electricity flowing down NeuConnect.

Centrica Says Their Future Development Options Include A Combined Heat And Power Plant

This objective was set in one of the key points.

This is the first paragraph of the Wikipedia entry for the Grain LNG Terminal.

Grain LNG Terminal is a Liquefied Natural Gas (LNG) terminal on the Isle of Grain, 37 miles (60 km) east of London. It has facilities for the offloading and reloading of LNG from ships at two jetties on the River Medway; for storing and blending LNG; for truck loading; and regasifying and blending natural gas to meet UK specifications. The terminal can handle up to 15 million tonnes per annum of LNG, has a storage capacity for one million cubic metres of LNG, and is able to regasify up to 645 GWh per day (58 million cubic metres per day) for delivery into the high pressure gas National Transmission System (NTS). The facility is owned and operated by National Grid Grain LNG Ltd, a wholly owned subsidiary of National Grid.

Note.

- This paragraph was written before the Centrica takeover.

- The terminal also converts liquid natural gas into gas to be distributed around the UK.

The heat needed to convert the liquid natural gas to gas is provided by the Grain CHP power station.

- Currently 340 MW of heat is provided.

- If the Grain LNG terminal is expanded, it will probably need more heat.

I can see Centrica building a combined heat and power (CHP) power station, that can be expanded to meet the current and future needs of gasification at the Grain LNG terminal.

I wouldn’t be surprised to see the CHP power station fitted with carbon capture, as Kent is surely one county, where carbon dioxide can be used in food production, so we can generate our carbon dioxide and eat it.

Centrica Says Their Future Development Options Include Hydrogen

This objective was set in one of the key points.

Consider.

- Centrica are an investor in HiiROC, who have a unique method of generating affordable zero-carbon hydrogen called thermal plasma electrolysis, which uses a fifth of the electricity, that traditional electrolysis does.

- HiiROC can use natural gas as a feedstock. Centrica won’t be short of that at Grain.

- There is space to build a large HiiROC system at the Isle of Grain site.

- The hydrogen could be taken away by tanker ships.

Like the electricity , which will use the 450 mile NeuConnect interconnector, the hydrogen could even be exported to Wilhelmshaven in Germany by pipeline.

Wilhelmshaven is being setup to be a major German hub to both generate, import and distribute hydrogen.

I asked Google AI, how much hydrogen a GWh would produce and received this answer.

A GWh of electricity can produce approximately 20-22 tonnes of hydrogen through electrolysis, depending on the efficiency of the electrolyzer. Modern commercial electrolyzers operate at an efficiency of roughly 70-80%, meaning they require about 50-55 kWh of electricity to produce 1 kg of hydrogen. A GWh (1 gigawatt-hour) is equal to 1,000,000 kWh, and 1 tonne of hydrogen contains roughly 33.33 MWh of energy.

As it is claimed on the web that HiiROC is five times more efficient than traditional electrolysis, it could need around 10-11 kWh to produce one kg. of hydrogen.

1 GWh would produce between 90-100 tonnes of hydrogen.

Centrica Says Their Future Development Options Include Ammonia

This objective was set in one of the key points.

I asked Google AI if ammonia can be produced from hydrogen and received this answer.

Yes, ammonia (NH3) can be produced from hydrogen (H2) through a process called the Haber-Bosch process. This process involves combining hydrogen with nitrogen (N2) from the air, under high temperature and pressure, in the presence of a catalyst.

Ammonia has a large number of uses, including making fertiliser and the powering of large ships.

I asked Google AI, if there are small Haber-Bosch processes to make ammonia from hydrogen and nitrogen and received this answer.

Yes, there are efforts to develop smaller-scale Haber-Bosch processes for ammonia production. While the traditional Haber-Bosch process is typically associated with large industrial plants, research and development are exploring ways to adapt it for smaller, distributed production, particularly for localized fertilizer or fuel applications.

I wondered if Centrica are involved in the efforts to develop smaller-scale Haber-Bosch processes for ammonia production.

Google AI gave me this quick answer.

Centrica is involved in research related to the Haber-Bosch process, particularly in the context of transitioning to a low-carbon energy future. They are exploring how to adapt the Haber-Bosch process, which is crucial for fertilizer production but also a significant source of CO2 emissions, to utilize renewable energy sources. This includes investigating the use of green hydrogen produced from water electrolysis and renewable electricity. Centrica is also involved in research related to using ammonia as a fuel, including potentially for power generation

That looks to be a very positive answer. Especially, as local low-carbon fertiliser production could be a very powerful concept.

Centrica Says Their Future Development Options Include Bunkering

This objective was set in one of the key points.

Bunkering is the process of refuelling ships.

I didn’t know much about bunkering, when I started to read Centrica’s press release, but the Wikipedia entry, was a good way to get some information.

This section in the Wikipedia entry is entitled Two Types Of Bunkering, where this is said.

The two most common types of bunkering procedure at sea are “ship to ship bunkering” (STSB), in which one ship acts as a terminal, while the other moors. The second type is “stern line bunkering” (SLB), which is the easiest method of transferring oil but can be risky during bad weather.

Over the years, I have found, that two zero-carbon fuels are under development, for powering ships; hydrogen and ammonia. Others are developing ships powered by naturalo gas.

I asked Google AI if hydrogen can power ships and received this answer.

Yes, hydrogen can power ships. It can be used as a fuel for fuel cells, which generate electricity to power the ship’s propulsion and other systems, or it can be burned in modified combustion engines. Hydrogen offers a zero-emission solution for shipping, with water vapor being the only byproduct when used in fuel cells.

Google AI also told me this.

The world’s first hydrogen-powered cruise ship, the “Viking Libra”, is currently under construction and is scheduled for delivery in late 2026. This innovative vessel, a collaboration between Viking Cruises and Italian shipbuilder Fincantieri, will utilize hydrogen for both propulsion and electricity generation, aiming for zero-emission operation.

I also asked Google AI if ammonia can power ships and received this answer.

Yes, ammonia can be used to power ships and is considered a promising alternative fuel for the maritime industry. Several companies and organizations are actively developing ammonia-powered ship designs and technologies. While challenges remain, particularly around safety and infrastructure, ammonia is seen as a key potential fuel for decarbonizing shipping.

Finally, I asked I asked Google AI if natural gas can power ships and received this answer.

Yes, ships can be powered by natural gas, specifically in the form of liquefied natural gas (LNG). LNG is increasingly used as a marine fuel, offering environmental benefits over traditional fuels like diesel.

It would seem to be a case of you pays your money and makes a choice between one of four technologies; ammonia, hydrogen fuel-cell, hydrogen-ICE and LNG.

I looks to me, that if Centrica provide bunkering services for ships, they have the means to cover most of the market by providing hydrogen and ammonia, in addition to natural gas.

Although, I don’t know much about bunkering, I do feel that the two current methods, that work for oil, could be made to work for these fuels.

This Google Map shows the Thames Estuary.

Note.

- The Port of Tilbury is in the South-West corner of the map.

- London Gateway is indicated by the red arrow.

- The Isle of Grain is in the South-East corner of the map.

- Other ports between Tilbury and the Isle of Grain include Barking, Dagenham, Dartford, Erith, Greenwich, Northfleet, Purfleet, Silvertown and Thurrock.

There was never a more true phrase than – “Location, Location and Location”. And the Isle of Grain would appear to be in the right place to send out a bunkering tanker to a passing ship, that was calling at a port in London or just passing through the Strait of Dover.

This Google Map shows the Thames between London Gateway and the Isle of Grain.

Note.

- London Gateway is indicated by the red arrow.

- The Isle of Grain is in the South-East corner of the map.

It seems to me, that a refuelling philosophy could easily be worked out.

How Large is The Bunkering Market?

I asked Google AI this question and received this answer.

The world bunker fuel market is a multi-billion dollar industry, with the market size valued at USD 150.93 billion in 2023. It is projected to reach USD 242.29 billion by 2032, growing at a CAGR of 5.4% according to SkyQuest Technology. In terms of volume, the global bunker demand was estimated at 233.1 million metric tons in 2023 according to the IMO.

The market is not small!