Iberdrola Preparing Two East Anglia Offshore Wind Projects For UK’s Sixth CfD Round

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

ScottishPower Renewables, Iberdrola’s company in the UK, is getting the East Anglia One North and East Anglia Two offshore wind projects ready for the upcoming auction round for Contracts for Difference (CfD).

These three paragraphs give more details.

This is according to project updates Iberdrola published as part of its financial results for 2023.

Iberdrola says “good progress is being made in the key engineering and design work” for the two projects and, while they were not presented in the UK’s fifth CfD Allocation Round (AR5), preparations are being made to take part in Allocation Round 6 (AR6).

The two offshore wind farms are part of the GBP 6.5 billion (around EUR 7.6 billion) East Anglia Hub project, which also includes East Anglia Three, currently in construction and expected to start delivering electricity in 2026. The 1.4 GW East Anglia Three was awarded Contract for Difference in July 2022.

It is now possible to build a table of Iberdrola’s East Anglian Hub.

- East Anglia One – 714 MW – Commissioned in 2020.

- East Anglia One North – 800 MW – To be commissioned in 2026.

- East Anglia Two – 900 MW – To be commissioned in 2026.

- East Anglia Three – 1372 MW – To be commissioned in 2026.

Note.

- East Anglia One is the largest windfarm in Iberdrola’s history

- These four wind farms are connected to the shore at Bawdsey on the River Deben.

These wind farms are a total of 3786 MW.

In addition there are RWE’s three Norfolk wind farms.

- Norfolk Boreas – 1386 MW – To be commissioned in 2027.

- Norfolk Vanguard East – 1380 MW – To be commissioned before 2030.

- Norfolk Vanguard West – 1380 MW – To be commissioned before 2030.

These wind farms are a total of 4146 MW, with a grand total of 7932 MW.

What Will Happen To The Electricity?

Consider.

- It is a lot of electricity.

- The good people of Norfolk are already protesting about the cables and pylons, that will connect the electricity to the National Grid.

- The good people of Suffolk will probably follow, their Northern neighbours.

- The wind farms are owned by Spanish company; Iberdrola and German company; RWE.

I wonder, if someone will build a giant electrolyser at a convenient place on the coast and export the hydrogen to Europe by pipeline or tanker.

- The ports of Felixstowe, Great Yarmouth and Lowestoft could probably handle a gas tanker.

- The Bacton gas terminal has gas pipelines to Belgium and The Netherlands.

In addition, there are various electricity interconnectors in use or under construction, that could send electricity to Europe.

- National Grid’s Lion Link to the Netherlands.

- NeuConnect to Germany from the Isle of Grain.

Whoever is the UK’s Prime Minister in 2030 will reap the benefits of these East Anglian and Norfolk wind farms.

In addition.

- The Hornsea wind farm will have tripled in size from 2604 MW to 8000 MW.

- The Dogger Bank wind farm will have grown from 1235 MW to 8000 MW.

- There is 4200 MW of wind farms in Morecambe Bay and around England.

They would be so lucky.

RWE And National Grid Answer New York Offshore Wind Call

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Community Offshore Wind, a joint venture of RWE and National Grid Ventures, has submitted a proposal to the New York State Energy Research and Development Authority (NYSERDA) to develop 1.3 GW of new offshore wind capacity in response to New York’s expedited fourth competitive offshore wind solicitation.

These four paragraphs add more details.

This next phase of the project builds upon Community Offshore Wind’s provisional offtake award to deliver 1.3 GW of wind capacity as part of New York’s third solicitation for offshore wind. In total, the projects are expected to generate USD 4.4 billion in economic benefits to New York.

Combined with its provisionally awarded New York project, Community Offshore Wind is on track to deliver nearly USD 100 million in workforce and economic development investments, the developer said.

The new proposal includes nearly USD 50 million in funding for workforce and community initiatives, with a focus on creating opportunities for diverse New Yorkers and supporting local non-profit organizations.

The proposal also includes an investment of up to USD 10 million in the offshore wind supply chain, to help New York businesses prepare for the economic opportunities the growing industry will create. All of these commitments are contingent on NYSERDA’s final selections.

is this partly a result of the meeting between Energy Security Secretary Claire Coutinho and Germany’s Vice Chancellor, Robert Habeck, that I wrote abut in UK And Germany Boost Offshore Renewables Ties?

We certainly seem to be getting some good deals on renewable energy these days with the Germans and the Koreans.

Perhaps someone in the government is doing something right?

Enabling The UK To Become The Saudi Arabia Of Wind?

The title of this post, is the same as that of a paper from Imperial College.

The paper can be downloaded from this page of the Imperial College web site.

This is a paragraph from the Introduction of the paper.

In December 2020, the then Prime Minister outlined the government’s ten-point plan for a green industrial revolution, expressing an ambition “to turn the UK into the Saudi Arabia of wind power generation, enough wind power by 2030 to supply every single one of our homes with electricity”.

The reference to Saudi Arabia, one of the world’s largest oil producers for many decades, hints at the significant role the UK’s energy ambitions hoped to play in the global economy.

Boris Johnson was the UK Prime Minister at the time, so was his statement just his usual bluster or a simple deduction from the facts.

The paper I have indicated is a must-read and I do wonder if one of Boris’s advisors had read the paper before Boris’s speech. But as the paper appears to have been published in September 2023, that is not a valid scenario.

The paper though is full of important information.

The Intermittency Of Wind And Solar Power

The paper says this about the intermittency of wind and solar power.

One of the main issues is the intermittency of solar and wind electricity generation, which means it cannot be relied upon without some form of backup or sufficient storage.

Solar PV production varies strongly along both the day-night and seasonal cycles. While output is higher during the daytime (when demand is

higher than overnight), it is close to zero when it is needed most, during the times of peak electricity demand (winter evenings from 5-6 PM).At present, when wind output is low, the UK can fall back to fossil fuels to make up for the shortfall in electricity supply. Homes stay warm, and cars keep moving.

If all sectors were to run on variable renewables, either the country needs to curb energy usage during shortfalls (unlikely to be popular with consumers), accept continued use of fossil fuels across all sectors (incompatible with climate targets), or develop a large source of flexibility such as energy storage (likely to be prohibitively expensive at present).

The intermittency of wind and solar power means we have a difficult choice to make.

The Demand In Winter

The paper says this about the demand in winter.

There are issues around the high peaks in heating demand during winter, with all-electric heating very expensive to serve (as

the generators built to serve that load are only

needed for a few days a year).Converting all the UK’s vehicles to EVs would increase total electricity demand from 279 TWh to 395 TWh. Switching all homes across the country to heat pumps would increase demand by a further 30% to 506 TWh.

This implies that the full electrification of the heating and transport sectors would increase the annual power needs in the country by 81%.

This will require the expansion of the electricity system (transmission capacity, distribution grids, transformers,

substations, etc.), which would pose serious social, economic and technical challenges.Various paths, policies and technologies for the decarbonisation of heating, transport, and industrial emissions must be considered in order for the UK to meet its zero-emission targets.

It appears that electrification alone will not keep us warm, power our transport and keep our industry operating.

The Role Of Hydrogen

The paper says this about the role of hydrogen.

Electrifying all forms of transport might prove difficult (e.g., long-distance heavy goods) or nigh impossible (e.g., aviation) due to the high energy density requirements, which current batteries cannot meet.

Hydrogen has therefore been widely suggested as a low-carbon energy source for these sectors, benefiting from high energy density (by weight), ease of storage (relative to electricity) and its versatility to be used in many ways.

Hydrogen is also one of the few technologies capable of

providing very long-duration energy storage (e.g., moving energy between seasons), which is critical to supporting the decarbonisation of the whole energy system with high shares of renewables because it allows times of supply and demand mismatch to be managed over both short and long timescales.It is a clean alternative to fossil fuels as its use (e.g., combustion) does not emit any CO2.

Hydrogen appears to be ideal for difficult to decarbonise sectors and for storing energy for long durations.

The Problems With Hydrogen

The paper says this about the problems with hydrogen.

The growth of green hydrogen technology has been held back by the high cost, lack of existing infrastructure, and its lower efficiency

of conversion.Providing services with hydrogen requires two to three times more primary energy than direct use of electricity.

There is a lot of development to be done before hydrogen is as convenient and affordable as electricity and natural gas.

Offshore Wind

The paper says this about offshore wind.

Offshore wind is one of the fastest-growing forms of renewable energy, with the UK taking a strong lead on the global stage.

Deploying wind turbines offshore typically leads to a higher electricity output per turbine, as there are typically higher wind speeds and fewer obstacles to obstruct wind flow (such as trees and buildings).

The productivity of the UK’s offshore wind farms is nearly 50% higher than that of onshore wind farms.

Offshore wind generation also typically has higher social acceptability as it avoids land usage conflicts and has a lower visual impact.

To get the most out of this resource, very large structures (more than twice the height of Big Ben) must be connected to the ocean floor and operate in the harshest conditions for decades.

Offshore wind turbines are taller and have larger rotor diameters than onshore wind turbines, which produces a more consistent and higher output.

Offshore wind would appear to be more efficient and better value than onshore.

The Scale Of Offshore Wind

The paper says this about the scale of offshore wind.

The geographical distribution of offshore wind is heavily skewed towards Europe, which hosts over 80% of the total global offshore wind capacity.

This can be attributed to the good wind conditions and the shallow water depths of the North Sea.

The UK is ideally located to take advantage of offshore wind due to its extensive resource.

The UK could produce over 6000 TWh of electricity if the offshore wind resources in all the feasible area of the exclusive economic zone (EEZ) is exploited.

Note.

- 6000 TWh of electricity per annum would need 2740 GW of wind farms if the average capacity factor was a typical 25 %.

- At a price of 37.35 £/MWh, 6000 TWh would be worth $224.1 billion.

Typically, most domestic users seem to pay about 30 pence per KWh.

The Cost Of Offshore Wind

The paper says this about the cost of offshore wind.

The cost of UK offshore wind has fallen because of the reductions in capital expenditure (CapEx), operational expenditure (OpEx), and financing costs.

This has been supported by the global roll-out of bigger offshore wind turbines, hence, causing an increase in offshore wind energy capacity.

This increase in installed capacity has been fuelled by several low-carbon support schemes from the UK government.

The effect of these schemes can be seen in the UK 2017 Contracts for Difference (CfD) auctions where offshore wind reached strike prices as low as 57.50 £/MWh and an even lower strike price of 37.35 £/MWh in 2022.

Costs and prices appear to be going the right way.

The UK’s Offshore Wind Targets

The paper says this about the UK’s offshore wind targets.

The offshore wind capacity in the UK has grown over the past decade.

Currently, the UK has a total offshore wind capacity of 13.8GW, which is sufficient to power more than 10 million homes.

This represents a more than fourfold increase compared to the capacity installed in 2012.

The UK government has set ambitious targets for offshore wind development.

In 2019, the target was to install a total of 40 GW of offshore wind capacity by 2030, and this was later raised to 50 GW, with up to 5 GW of floating offshore wind.

This will play a pivotal role in decarbonising the UK’s power system by the government’s deadline of 2035.

As I write this, the UK’s total electricity production is 31.8 GW. So 50 GW of wind will go a good way to providing the UK with zero-carbon energy. But it will need a certain amount of reliable alternative power sources for when the wind isn’t blowing.

The UK’s Hydrogen Targets

The paper says this about the UK’s hydrogen targets.

The UK has a target of 10 GW of low-carbon hydrogen production to be deployed by 2030, as set out in the British Energy Security Strategy.

Within this target, there is an ambition for at least half of the 10 GW of production capacity to be met through green hydrogen production technologies (as opposed to hydrogen produced from steam methane reforming using carbon capture).

Modelling conducted by the Committee on Climate Change in its Sixth Carbon Budget estimated that demand for low-carbon hydrogen across the whole country could reach 161–376 TWh annually by 2050, comparable in scale to the total electricity demand.

We’re going to need a lot of electrolyser capacity.

Pairing Hydrogen And Offshore Wind

The paper says this about pairing hydrogen and offshore wind.

Green hydrogen holds strong potential in addressing the intermittent nature of renewable generation sources, particularly wind and solar energy, which naturally fluctuate due to weather conditions.

Offshore wind in particular is viewed as being a complementary technology to pair with green hydrogen production, due to three main factors: a) the high wind energy capacity factors offshore, b) the potential for large-scale deployment and c) hydrogen as a supporting technology for offshore wind energy integration.

It looks like a match made in the waters around the UK.

The Cost Of Green Hydrogen

The paper says this about the cost of green hydrogen.

The cost of green hydrogen is strongly influenced by the price of the electrolyser unit itself.

If the electrolyser is run more intensively over the course of the lifetime of the plant, a larger volume of hydrogen will be produced and so the cost of the electrolyser will be spread out more, decreasing the cost per unit of produced hydrogen.

If the variable renewable electricity source powering the electrolyser has a higher capacity factor, this will contribute towards a

lower cost of hydrogen produced.Offshore wind in the UK typically has a higher capacity factor than onshore wind energy (up to 20%), and is around five times higher than solar, so pairing

offshore wind with green hydrogen production is of interest.

It would appear that any improvements in wind turbine and electrolyser efficiency would be welcomed.

The Size Of Wind Farms

The paper says this about the size of wind farms.

Offshore wind farms can also be larger scale, due to increased availability of space and reduced restrictions on tip heights due to planning permissions.

The average offshore wind turbine in the UK had a capacity of 3.6 MW in 2022, compared to just 2.5-3 MW for onshore turbines.

As there are fewer competing uses for space, offshore wind can not only have larger turbines but the wind farms can comprise many more turbines.

Due to the specialist infrastructure requirements for hydrogen transport and storage, and the need for economies of scale to reduce the costs of

production, pairing large-scale offshore wind electricity generation with green hydrogen

production could hold significant benefits.

I am not surprised that economies of scale give benefits.

The Versatility Of Hydrogen

The paper says this about the versatility of hydrogen.

Hydrogen is a highly adaptable energy carrier with numerous potential applications and has been anticipated by some as playing a key role in the future energy system, especially when produced through electrolysis.

It could support the full decarbonisation of “hard to decarbonise” processes within the UK industrial sector, offering a solution for areas which may be difficult to electrify or are heavily reliant on fossil fuels for high-temperature heat.

When produced through electrolysis, it could be paired effectively as an energy storage technology with offshore wind, with the potential to store energy across seasons with little to no energy degradation and transport low-carbon energy internationally.

The UK – with its significant offshore wind energy resources and targets – could play a potentially leading role in producing green hydrogen to both help its pathway to net zero, and potentially create a valuable export industry.

In RWE Acquires 4.2-Gigawatt UK Offshore Wind Development Portfolio From Vattenfall, I postulated that RWE may have purchased Vattenfall’s 4.2 GW Norfolk Zone of windfarms to create a giant hydrogen production facility on the Norfolk coast. I said this.

Consider.

- Vattenfall’s Norfolk Zone is a 4.2 GW group of wind farms, which have all the requisite permissions and are shovel ready.

- Bacton Gas terminal has gas pipelines to Europe.

- Sizewell’s nuclear power stations will add security of supply.

- Extra wind farms could be added to the Norfolk Zone.

- Europe and especially Germany has a massive need for zero-carbon energy.

The only extra infrastructure needing to be built is the giant electrolyser.

I wouldn’t be surprised if RWE built a large electrolyser to supply Europe with hydrogen.

The big irony of this plan is that the BBL Pipeline between Bacton and the Netherlands was built, so that the UK could import Russian gas.

Could it in future be used to send the UK’s green hydrogen to Europe, so that some of that Russian gas can be replaced with a zero-carbon fuel?

Mathematical Modelling

There is a lot of graphs, maps and reasoning, which is used to detail how the authors obtained their conclusions.

Conclusion

This is the last paragraph of the paper.

Creating a hydrogen production industry is a transition story for UK’s oil and gas sector.

The UK is one of the few countries that could produce more hydrogen than it consumes in hydrocarbons today.

It is located in the centre of a vast resource, which premediates positioning itself at the centre of the European hydrogen supply chains.

Investing now to reduce costs and benefit from the generated value of exported hydrogen would make a reality out of the ambition to become the “Saudi Arabia of Wind”.

Boris may or may not have realised that what he said was possible.

But certainly make sure you read the paper from Imperial College.

RWE Acquires 4.2-Gigawatt UK Offshore Wind Development Portfolio From Vattenfall

The title of this post, is the same as that of this press release from RWE.

These three bullet points, act as sub-headings.

- Highly attractive portfolio of three projects at a late stage of development, with grid connections and permits secured, as well as advanced procurement of key components

- Delivery of the three Norfolk Offshore Wind Zone projects off the UK’s East Anglia coast will be part of RWE’s Growing Green investment and growth plans

- Agreed purchase price corresponds to an enterprise value of £963 million

These two paragraphs outline the deal.

RWE, one of the world’s leading offshore wind companies, will acquire the UK Norfolk Offshore Wind Zone portfolio from Vattenfall. The portfolio comprises three offshore wind development projects off the east coast of England – Norfolk Vanguard West, Norfolk Vanguard East and Norfolk Boreas.

The three projects, each with a planned capacity of 1.4 gigawatts (GW), are located 50 to 80 kilometres off the coast of Norfolk in East Anglia. This area is one of the world’s largest and most attractive areas for offshore wind. After 13 years of development, the three development projects have already secured seabed rights, grid connections, Development Consent Orders and all other key permits. The Norfolk Vanguard West and Norfolk Vanguard East projects are most advanced, having secured the procurement of most key components. The next milestone in the development of these two projects is to secure a Contract for Difference (CfD) in one of the upcoming auction rounds. RWE will resume the development of the Norfolk Boreas project, which was previously halted. All three Norfolk projects are expected to be commissioned in this decade.

There is also this handy map, which shows the location of the wind farms.

Note that there are a series of assets along the East Anglian coast, that will be useful to RWE’s Norfolk Zone development.

- In Vattenfall Selects Norfolk Offshore Wind Zone O&M Base, I talked about how the Port of Great Yarmouth will be the operational base for the Norfolk Zone wind farms.

- Bacton gas terminal has gas interconnectors to Belgium and the Netherlands lies between Cromer and Great Yarmouth.

- The cable to the Norfolk Zone wind farms is planned to make landfall between Bacton and Great Yarmouth.

- Sizewell is South of Lowestoft and has the 1.25 GW Sizewell B nuclear power station, with the 3.2 GW Sizewell C on its way, for more than adequate backup.

- Dotted around the Norfolk and Suffolk coast are 3.3 GW of earlier generations of wind farms, of which 1.2 GW have connections to RWE.

- The LionLink multipurpose 1.8 GW interconnector will make landfall to the North of Southwold

- There is also the East Anglian Array, which currently looks to be about 3.6 GW, that connects to the shore at Bawdsey to the South of Aldeburgh.

- For recreation, there’s Southwold.

- I can also see more wind farms squeezed in along the coast. For example, according to Wikipedia, the East Anglian Array could be increased in size to 7.2 GW.

It appears that a 15.5 GW hybrid wind/nuclear power station is being created on the North-Eastern coast of East Anglia.

The big problem is that East Anglia doesn’t really have any large use for electricity.

But the other large asset in the area is the sea.

- Undersea interconnectors can be built to other locations, like London or Europe, where there is a much greater need for electricity.

- In addition, the UK Government has backed a consortium, who have the idea of storing energy by using pressurised sea-water in 3D-printed concrete hemispheres under the sea. I wrote about this development in UK Cleantech Consortium Awarded Funding For Energy Storage Technology Integrated With Floating Wind.

A proportion of Russian gas in Europe, will have been replaced by Norfolk wind power and hydrogen, which will be given a high level of reliability from Suffolk nuclear power.

I have some other thoughts.

Would Hydrogen Be Easier To Distribute From Norfolk?

A GW-range electrolyser would be feasible but expensive and it would be a substantial piece of infrastructure.

I also feel, that placed next to Bacton or even offshore, there would not be too many objections from the Norfolk Nimbys.

Hydrogen could be distributed from the site in one of these ways.

- By road transport, as ICI did, when I worked in their hydrogen plant at Runcorn.

- I suspect, a rail link could be arranged, if there was a will.

- By tanker from the Port of Great Yarmouth.

- By existing gas interconnectors to Belgium and the Netherlands.

As a last resort it could be blended into the natural gas pipeline at Bacton.

In Major Boost For Hydrogen As UK Unlocks New Investment And Jobs, I talked about using the gas grid as an offtaker of last resort. Any spare hydrogen would be fed into the gas network, provided safety criteria weren’t breached.

I remember a tale from ICI, who from their refinery got a substantial amount of petrol, which was sold to independent petrol retailers around the North of England.

But sometimes they had a problem, in that the refinery produced a lot more 5-star petrol than 2-star. So sometimes if you bought 2-star, you were getting 5-star.

On occasions, it was rumoured that other legal hydrocarbons were disposed of in the petrol. I was once told that it was discussed that used diluent oil from polypropylene plants could be disposed of in this way. But in the end it wasn’t!

If hydrogen were to be used to distribute all or some of the energy, there would be less need for pylons to march across Norfolk.

Could A Rail Connection Be Built To The Bacton Gas Terminal

This Google Map shows the area between North Walsham and the coast.

Note.

- North Walsham is in the South-Western corner of the map.

- North Walsham station on the Bittern Line is indicated by the red icon.

- The Bacton gas terminal is the trapezoidal-shaped area on the coast, at the top of the map.

ThisOpenRailwayMap shows the current and former rail lines in the same area as the previous Google Map.

Note.

- North Walsham station is in the South-West corner of the map.

- The yellow track going through North Walsham station is the Bittern Line to Cromer and Sheringham.

- The Bacton gas terminal is on the coast in the North-East corner of the map.

I believe it would be possible to build a small rail terminal in the area with a short pipeline connection to Bacton, so that hydrogen could be distributed by train.

There used to be a branch line from North Walsham station to Cromer Beach station, that closed in 1953.

Until 1964 it was possible to get trains to Mundesley-on-Sea station.

So would it be possible to build a rail spur to the Bacton gas terminal along the old branch line?

In the Wikipedia entry for the Bittern Line this is said.

The line is also used by freight trains which are operated by GB Railfreight. Some trains carry gas condensate from a terminal at North Walsham to Harwich International Port.

The rail spur could have four main uses.

- Taking passengers to and from Mundesley-on-Sea and Bacton.

- Collecting gas condensate from the Bacton gas terminal.

- Collecting hydrogen from the Bacton gas terminal.

- Bringing in heavy equipment for the Bacton gas terminal.

It looks like another case of one of Dr. Beeching’s closures coming back to take a large chunk out of rail efficiency.

Claire Coutinho And Robert Habeck’s Tete-a-Tete

I wrote about their meeting in Downing Street in UK And Germany Boost Offshore Renewables Ties.

- Did Habeck run the RWE/Vattenfall deal past Coutinho to see it was acceptable to the UK Government?

- Did Coutinho lobby for SeAH to get the contract for the monopile foundations for the Norfolk Zone wind farms?

- Did Coutinho have a word for other British suppliers like iTMPower.

Note.

- I think we’d have heard and/or the deal wouldn’t have happened, if there had been any objections to it from the UK Government.

- In SeAH To Deliver Monopiles For Vattenfall’s 2.8 GW Norfolk Vanguard Offshore Wind Project, I detailed how SeAH have got the important first contract they needed.

So it appears so far so good.

Rackheath Station And Eco-Town

According to the Wikipedia entry for the Bittern Line, there are also plans for a new station at Rackheath to serve a new eco-town.

This is said.

A new station is proposed as part of the Rackheath eco-town. The building of the town may also mean a short freight spur being built to transport fuel to fire an on-site power station. The plans for the settlement received approval from the government in 2009.

The eco-town has a Wikipedia entry, which has a large map and a lot of useful information.

But the development does seem to have been ensnared in the planning process by the Norfolk Nimbys.

The Wikipedia entry for the Rackheath eco-town says this about the rail arrangements for the new development.

The current rail service does not allow room for an extra station to be added to the line, due to the length of single track along the line and the current signalling network. The current service at Salhouse is only hourly during peak hours and two-hourly during off-peak hours, as not all trains are able to stop due to these problems. Fitting additional trains to this very tight network would not be possible without disrupting the entire network, as the length of the service would increase, missing the connections to the mainline services. This would mean that a new 15-minute shuttle service between Norwich and Rackheath would have to be created; however, this would interrupt the main service and cause additional platforming problems. Finding extra trains to run this service and finding extra space on the platforms at Norwich railway station to house these extra trains poses additional problems, as during peak hours all platforms are currently used.

In addition, the plans to the site show that both the existing and the new rail station, which is being built 300m away from the existing station, will remain open.

. As the trains cannot stop at both stations, changing between the two services would be difficult and confusing, as this would involve changing stations.

I feel that this eco-town is unlikely to go ahead.

Did RWE Buy Vattenfall’s Norfolk Zone To Create Green Hydrogen For Europe?

Consider.

- Vattenfall’s Norfolk Zone is a 4.2 GW group of wind farms, which have all the requisite permissions and are shovel ready.

- Bacton Gas terminal has gas pipelines to Europe.

- Sizewell’s nuclear power stations will add security of supply.

- Extra wind farms could be added to the Norfolk Zone.

- Europe and especially Germany has a massive need for zero-carbon energy.

The only extra infrastructure needing to be built is the giant electrolyser.

I wouldn’t be surprised if RWE built a large electrolyser to supply Europe with hydrogen.

RWE’s Welsh Offshore Wind Project Powers Ahead

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Natural Resources Wales has awarded marine licences for RWE’s Awel y Môr offshore wind project off the North Wales Coast.

These two paragraphs outline the project.

The offshore wind farm, which could power more than half of Wales’ homes, has secured all of its necessary planning approvals with the award of its marine licences from Natural Resources Wales, RWE said.

The marine licences have been awarded on behalf of Welsh Government ministers following the granting of a Development Consent Order in September.

With all the wind action in the East, we tend to forget that the Liverpool Bay area has a lot of wind.

- Awel y Môr – 500 MW – Before 2030

- Barrow – 90 MW – 2006

- Burbo Bank – 90 MW – 2007

- Burbo Bank Extension – 258 MW – 2017

- Gwynt y Môr – 576 MW – 2015

- Mona – 1500 MW – 2029

- Morecambe – 480 MW – 2028

- Morgan – 1500 MW – 2029

- North Hoyle – 60 MW – 2003

- Ormonde – 150 MW – 2012

- Rhyl Flats – 90 MW – 2009

- Walney – 367 MW – 2010

- Walney Extension – 659 MW – 2018

- West Of Duddon Sands – 389 MW – 2014

Note.

- This is a total of 6709 MW to be delivered before 2030.

- All the wind farms have fixed foundations.

- RWE have an interest in three of the Welsh wind farms.

The Times today has this article which is entitled Energy Minnow Sees Pathway To Irish Sea Gasfield Via London IPO, where these are the first three paragraphs.

An energy minnow that is seeking to develop a gasfield in the Irish Sea is planning to list on Aim, the junior London stock exchange, in an attempt to buck the downturn in initial public offerings.

EnergyPathways has announced its intention to float, seeking to raise at least £2 million.

It owns the rights to Marram, a small gasfield discovered in 1993 about 20 miles offshore from Blackpool. It is seeking permission from the government for its plan to develop the field in the Irish Sea quickly by connecting it with existing infrastructure that serves the already-producing gasfields in Morecambe Bay. It aims to be producing gas as soon as 2025.

This gasfield should produce enough gas until the large Liverpool Bay wind farms come on stream at the end of the decade.

RWE Partners With Masdar For 3 GW Dogger Bank South Offshore Wind Projects

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

RWE has signed an agreement with UAE’s Masdar as a partner for its 3 GW Dogger Bank South (DBS) offshore wind projects in the UK.

These three paragraphs outline the deal.

The partners acknowledged the signing of the new partnership during a ceremony at COP28 in Dubai.

Masdar will acquire a 49 per cent stake in the landmark renewables projects while RWE, with a 51 per cent share, will remain in charge of development, construction, and operation throughout the life cycle of the projects.

RWE’s proposed DBS offshore wind project is made up of two offshore wind farms, Dogger Bank South East and Dogger Bank South West (DBS East and DBS West), each 1.5 GW, which are located over 100 kilometres offshore in the shallow area of the North Sea known as Dogger Bank.

Note.

- Masdar is an energy company headquartered in Abu Dubai.

- The Chairman of Masdar is President of COP28.

Does this deal indicate that wind farms are good investments for those individuals, companies and organisations with money?

Crown Estate Mulls Adding 4 GW Of Capacity From Existing Offshore Wind Projects

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The Crown Estate has revealed that it is taking steps to enable the generation of up to an additional 4 GW of electricity from several offshore wind projects in development, within the timeframe of the 50 GW 2030 target.

These are the first two paragraphs.

This follows requests from the developers of seven offshore wind farm projects who believe additional capacity can be generated from the areas of the seabed they hold existing rights for.

According to the Crown Estate, the technology has advanced and more capacity could be developed at projects that are already underway.

The seven wind farms are.

- Awel y Môr – Estimates 500 MW – Fixed – RWE

- Dogger Bank D – 1320 MW – Fixed – SSE Renewables, Equinor

- Dudgeon and Sheringham Shoal Extension – 719 MW – Fixed – Equinor

- Five Estuaries – TBD – Fixed – RWE

- North Falls – 504 MW – Fixed – SSE Renewables, RWE

- Rampion 2 – 1200 MW – Fixed – E-ON

Note.

- The Dudgeon and Sheringham Shoal Extensions seem to have been combined.

- One website connected to the wind farm, gives Five Estuaries as 353 MW.

- All are fixed wind farms.

- All are by large, established developers.

The total size is 4596 MW, using 500 MW for Awel y Môr and 353 MW for Five Estuaries.

Uprating by 8596/4596 could give these capacities.

- Awel y Môr – 935 MW

- Dogger Bank D – 2469 MW

- Dudgeon and Sheringham Shoal Extension – 1345 MW

- Five Estuaries – 660 MW

- North Falls – 943 MW

- Rampion 2 – 2244 MW

The total size is 8596 MW

Conclusion

This seems to be a sensible way to increase offshore wind capacity.

UK And Germany Boost Offshore Renewables Ties

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

A new partnership between the UK and German governments has been agreed on 3 November to help secure safe, affordable, and clean energy for consumers in both nations for the long-term and bolster energy security. Both countries commit to strengthening cooperation in renewables, notably offshore wind and electricity interconnection.

These two paragraphs introduce the deal.

Under the new partnership signed in London by Energy Security Secretary Claire Coutinho and Germany’s Vice Chancellor, Robert Habeck, the UK and Germany have reaffirmed their shared ambition and commitment to net zero and progressing the energy transition.

Europe’s two largest economies have also doubled down on commitments made under the Paris Agreement to limit global warming to 1.5 degrees.

i think this could be a worthwhile follow-up to the relationship, that Boris Johnson and Olaf Scholz seemed to encourage after their high profile meeting in April 2022.

This press release from Downing Street is entitled PM meeting with German Chancellor Olaf Scholz: 8 April 2022 and this is the first two paragraphs.

The Prime Minister welcomed German Chancellor Olaf Scholz to Downing Street this afternoon to discuss the West’s response to Putin’s barbaric invasion of Ukraine.

The two leaders shared their disgust at the Russian regime’s onslaught and condemned Putin’s recent attacks.

I wrote Armoured Vehicles For Ukraine based on some of the things said in the press conference after what seemed to be a very wide discussion.

But it was these paragraphs in the press release that caught my eye.

They also agreed on the need to maximise the potential of renewable energy in the North Sea and collaborate on climate ambitions and green energy.

The Prime Minister said he wanted to further deepen the UK’s relationship with Germany, and intensify its cooperation across defence and security, innovation and science.

After Boris and Olaf’s meeting at Downing Street, I have been able to write these posts about the Anglo-German energy relationship and also make some other observations.

- Mona, Morgan And Morven

- UK-German Energy Link Reaches Financial Close

- RWE, Siemens and other German companies seem to be building a strong presence in the UK.

- Rolls-Royce are doing the same in Germany.

Claire Coutinho and Robert Habeck seem to be wanting to continue the co-operation, judging by this paragraph from the article on offshoreWIND,biz.

The energy and climate partnership sees both countries commit to enhancing cooperation in renewables, particularly in offshore wind and electricity interconnection, including offshore hybrid interconnection.

The most significant part of this paragraph is the mention of offshore hybrid interconnection.

If you want more details on their meeting, this document is the official UK Government declaration.

I have my thoughts.

What Is Meant By Offshore Hybrid Interconnection?

Type “Offshore Hybrid Interconnection” into Google and the first page is this page from National Grid, that is entitled Offshore Hybrid Assets, that has this sub-heading.

How the North Sea has the potential to become Europe’s green energy ‘powerhouse’

This is the introductory paragraph.

Now more than ever we need more renewable energy to make energy cleaner, more affordable, and more secure. The North Sea offers an incredible opportunity for the UK and our European neighbours to deliver huge increases in offshore wind. But delivering new offshore wind will require more infrastructure, which will have an impact on communities.

Hybrid is all-purpose comfort word like cashmere, platinum or puppies.

The page on the National Grid web site describes The Next Generation Interconnector with these paragraphs.

Interconnectors already provide a way to share electricity between countries safely and reliably. But what if they could do much more than that? What if interconnectors could become an offshore connection hub for green energy?

Instead of individual wind farms connecting one by one to the shore, offshore hybrid assets (OHAs) will allow clusters of offshore wind farms to connect all in one go, plugging into the energy systems of neighbouring countries.

And then there is this section entitled Tomorrow’s Solution: Offshore Wind And Interconnectors In Harmony, where this is said.

Today, offshore wind and interconnectors operate alongside each other, connecting to the shore individually. In the future, offshore hybrid assets could enable offshore wind and interconnection to work together as a combined asset.

We now call this type of infrastructure an offshore hybrid asset (OHA), but we used to refer to it as a multi-purpose interconnector (MPI). We changed it because we work so closely together with Europe, it made sense to use the same terminology.

The page on the National Grid web site also has an interactive graphic, which shows the benefit of the approach.

LionLink

National Grid are already developing LionLink, with Dutch grid operator; TenneT, which will be a multi-purpose interconnector linking the UK and the Netherlands.

LionLink is described on this page from National Grid, where this is the sub-heading.

We’re developing a first-of-its-kind electricity link to connect offshore wind between the UK and the Netherlands.

This is the introductory paragraph.

Designed together with our Dutch partners TenneT, LionLink (formerly known as EuroLink) is an electricity link that can supply around 1.8 gigawatts of clean electricity, enough to power approximately 1.8 million British homes. By connecting Dutch offshore wind to Dutch and British markets via subsea electricity cables called interconnectors, LionLink will strengthen our national energy security and support the UK’s climate and energy goals.

Will we be planning a similar electric handshake with the Germans?

How Much Offshore Wind Power Are We Talking About?

This is answered by the last two paragraphs of the article on offshoreWIND.biz.

Around 75 per cent of installed offshore wind capacity in the North Sea is in German and British waters. This is helping to drive the UK’s ambition for up to 50 GW of offshore wind, including up to 5 GW of floating wind, by 2030, the governments said.

Germany is aiming at installing 30 GW by 2030.

That is an Anglo-German starter for eighty GW.

Electrolysers In The Middle If The North Sea

Why Not?

This is a clip from National Grid’s graphic on the page that introduces Offshore Hybrid Assets,

It shows an offshore hydrogen electrolyser.

- You could have an offshore hybrid asset that went between say Bacton in Norfolk and Hamburg via these assets.

- One or more wind farms in UK territorial waters.

- A mammoth offshore electrolyser, with hydrogen storage, possibly in a depleted gas field.

- One or more wind farms in German territorial waters.

Electricity will be able to go three ways; to the UK, to Germany or to the electrolyser.

The Involvement Of German Energy Companies In UK Territorial Waters

Wikipedia lists offshore fifteen wind farms, that have German owners in UK territorial waters, that total 12,960 MW.

This compares with.

- Equinor – 6 wind farms totalling 6466 MW.

- Ørsted – 15 wind farms totalling 9683 MW.

- Scottish Power – 2 wind farms totalling 5,000 MW.

- SSE Renewables – 15 wind farms totalling 15,591 MW.

- Vattenfall – 6 wind farms totalling 4384 MW.

As there is a number of partnerships, these figures only show the relative sizes of the investment by individual companies.

But at nearly 13 GW, the amount of total German investment in UK territorial waters is substantial.

Is This Solely An Anglo-German Club Or Can Others Join?

Consider.

- It seems to me, that because of the LionLink, the Dutch are already involved.

- TenneT is also a large electricity distributor in Germany.

- Countries with substantial shares of the water and winds of the North Sea in addition to Germany, the Netherlands and the UK, include Belgium, Denmark and Norway.

- The UK has interconnectors with Belgium, Denmark, France, Germany, Norway and the Netherlands.

It appears that the world’s largest multi-national power generator is evolving by stealth.

North Sea Wind Power Hub

This concept seems to have developed around 2017, by Danish, Dutch and German interests.

The Wikipedia entry introduces it like this.

North Sea Wind Power Hub is a proposed energy island complex to be built in the middle of the North Sea as part of a European system for sustainable electricity. One or more “Power Link” artificial islands will be created at the northeast end of the Dogger Bank, a relatively shallow area in the North Sea, just outside the continental shelf of the United Kingdom and near the point where the borders between the territorial waters of Netherlands, Germany, and Denmark come together. Dutch, German, and Danish electrical grid operators are cooperating in this project to help develop a cluster of offshore wind parks with a capacity of several gigawatts, with interconnections to the North Sea countries. Undersea cables will make international trade in electricity possible.

Currently, the UK is developing these wind farms on their portion of the Dogger Bank.

- Doggerbank A – 1235 MW – Started producing electricity in 2023.

- Doggerbank B – 1235 MW – Planned commissioning in 2024.

- Doggerbank C – 1218 MW – Planned commissioning in 2025.

- Doggerbank D – 1320 MW – Being planned.

- Doggerbank South – 3000 MW – Being planned.

Note.

- That’s a total of 8 GW.

- A, B, C and D are being developed by a consortium of SSE Renewables and Equinor.

- South is being developed by RWE.

- This web site is for Dogger Bank D.

- This web site is for Dogger Bank South.

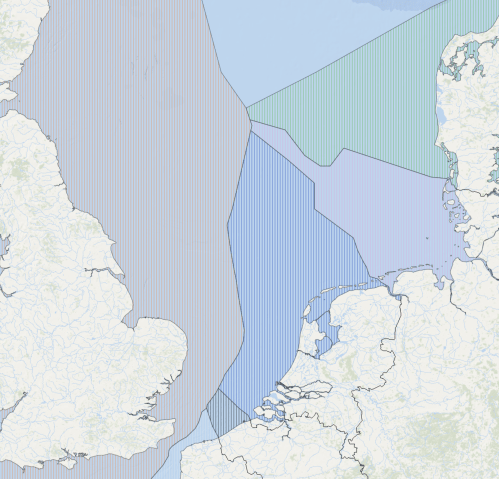

This map from the European Atlas of the Seas, shows the various exclusive economic zones (EEZ) in the North Sea.

Note.

- The pinkish zone to the East of the UK, is the UK’s EEZ.

- The light blue zone at the top is Norway’s EEZ.

- The greenish zone in the North-East corner of the map is Denmark’s EEZ.

- The light blue zone below Denmark’s EEZ is Germany’s EEZ.

- Then we have the EEZs for The Netherlands, Belgium and France.

The Dogger Bank is situated where the British, Dutch, German and Norwegian EEZs meet.

All five Dogger Bank wind farms are in British waters.

The Wikipedia entry for the Dogger Bank says this about its size.

The bank extends over about 17,600 square kilometres (6,800 sq mi), and is about 260 by 100 kilometres (160 by 60 mi) in extent. The water depth ranges from 15 to 36 metres (50 to 120 ft), about 20 metres (65 ft) shallower than the surrounding sea.

This probably makes it easy to accommodate a large fixed-foundation wind farm.

Overlaying the map in the Wikipedia entry, with the EEZ map, I’m fairly sure that the northeast end of the Dogger Bank is close to where the EEZs meet.

Progress On The North Sea Wind Power Hub

The North Sea Wind Power Hub has a web site, but it seems to be more about thinking than doing.

It seems to have been hijacked by that august body; The Institute of Meetings Engineers.

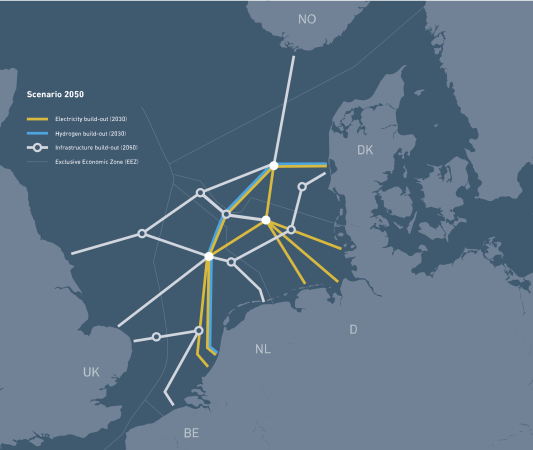

This page on the web site, which is entitled Explore The Future Energy Highways, has a simple interactive map.

This shows its vision for 2030.

Note.

- Yellow is electricity links to be built before 2030.

- Blue is hydrogen links to be built before 2030.

- Feint lines indicate the EEZ boundaries.

There are two problems with this layout.

- It doesn’t connect to the Dogger Bank area, where the original plan as detailed in Wikipedia talked about “Power Link” artificial islands.

- No hydrogen is delivered direct to Germany.

This shows its vision for 2050.

Note.

- Yellow, blue and feint lines are as before.

- White is electricity links to be built before 2050.

- There appears to be a node on the Dogger Bank in the German EEZ. This node could be connected to the “Power Link” artificial islands.

- The Southernmost connection to East Anglia could be Bacton.

- The other Norfolk connection could be where wind farms are already connected.

- The Northern connection could be Teesside, where some of the Dogger Bank wind farms connect.

- If the Northern connection to England is Teesside, then first node, which is in the British EEZ, could be one of the offshore sub-stations in the Dogger Bank wind farm complex.

This all seems a lot more feasible.

A New Offshore Hybrid Asset Between Teesside And Germany

Consider.

- A new offshore sub-station will be needed in the German EEZ to connect the “Power Link” artificial islands to the power network.

- The new offshore sub-station will eventually have three interconnectors to the German coast.

- Only the 1218 MW Dogger Bank C wind farm will be connected to the Teesside onshore substation.

- Germany has a power supply problem, after shutting down nuclear power stations and building more coal-fired power stations.

A new Offshore Hybrid Asset between Teesside and Germany could be created by building the following.

- A the new offshore sub-station in the German EEZ to connect the “Power Link” artificial islands to the power network.

- An interconnector between a sub-station of the Dogger Bank wind farm complex and the new sub-station

- A second interconnector to connect the new sub-station for the “Power Link” artificial islands to the German electricity grid.

All of the work would be done mainly in the German EEZ, with a small amount in the British EEZ.

Where Does Dogger Bank South Fit In?

Consider.

- Dogger Bank South is planned to be a 3 GW wind farm.

- It will need a 3 GW connection to the onshore electricity grid.

- Creyke Beck substation is the proposed location for the onshore connection.

- It is owned by German electricity company; RWE.

Could it be that some of the electricity produced by Dogger Bank South is going to be sent to Germany or to another node to produce hydrogen?

It certainly illustrates the value of an Offshore Hybrid Asset.

Fourth Phase Could Bring 2 GW More To World’s Already Largest Offshore Wind Farm Under Construction

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Dogger Bank D, the potential fourth phase of the Dogger Bank Wind Farm, whose first three phases totalling 3.6 GW are currently being built, is planned to have a generation capacity of around 2 GW. If built, the fourth phase would bring the total installed capacity of the UK project – already the world’s largest offshore wind farm under construction – to over 5.5 GW.

This is the introductory paragraph.

SSE Renewables and Equinor, which own the Dogger Bank A, B and C offshore wind farms through a consortium that also comprises Vårgrønn, have now launched a public consultation period on the Dogger Bank D proposals that runs until 7 November.

As RWE are developing the 3 GW Dogger Bank South, the Dogger Bank wind farm will be up to 8.5 GW in a few years.