‘Windiest Part Of The UK’ Could Power Nearly 500,000 Homes

The title of this post, is the same as that of this article on the BBC.

This is the sub-heading.

Power is flowing from the Shetland Isles to mainland Britain for the first time as the UK’s most productive onshore windfarm comes on stream.

These are the first two paragraphs.

SSE says its 103-turbine project, known as Viking, can generate 443 megawatts (MW) of electricity, enough to power nearly 500,000 homes.

Shetland is the windiest part of the UK, which means it will be rare for the blades, which reach a massive 155m at their tip, not to be spinning.

Note.

- SSE has built a 160-mile long undersea cable to carry the power from Viking to Noss Head, near Wick, on the Scottish mainland.

- The company said it has invested more than £1bn in the windfarm and cable projects.

- SSE plans to plough another £20bn into renewables by the end of the decade.

Companies don’t invest billions and banks don’t lend billions, unless they know they’ll get a return, so the finance for this billion pound project must be sound.

A simple calculation, shows why they do.

- According to Google, the electricity for the average house costs £1926.24 per year.

- 500,000 houses would spend £963,120,000 per year.

Google says this about the life of a wind farm.

The average operational lifespan of a wind turbine is 20–25 years, but some turbines can last up to 30 years.

If the wind farm lasts 25 years, then it will generate something like £24 billion over its lifetime.

It looks to me, that SSE have borrowed a billion and will get almost as much as that back every year.

SSE also have the experience to keep the turbines turning and the distribution network sending electricity to the Scottish mainland.

I have some further thoughts.

What Happens If Scotland Can Get Cheaper Electricity From Its Own Wind Farms?

Shetland’s turbines can be switched off, but that is effectively throwing away electricity that can be generated.

Any spare electricity can also be diverted to an electrolyser, so that the following is produced.

- Hydrogen for transport, rocket fuel for SaxaVord Spaceport and to decarbonise houses and businesses.

- Oxygen for rocket fuel for SaxaVord Spaceport and for fish farms.

Hydrogen may also be exported to those that need it.

Project Orion

Project Orion is Shetland’s master plan to bring all the energy in and around the Shetland Islands together.

This document on the APSE web site is entitled Future Hydrogen Production In Shetland.

This diagram from the report shows the flow of electricity and hydrogen around the islands, terminals and platforms.

Note these points about what the Shetlanders call the Orion Project.

- Offshore installations are electrified.

- There are wind turbines on the islands

- Hydrogen is provided for local energy uses like transport and shipping.

- Oxygen is provided for the fish farms and a future space centre.

- There is tidal power between the islands.

- There are armadas of floating wind turbines to the East of the islands.

- Repurposed oil platforms are used to generate hydrogen.

- Hydrogen can be exported by pipeline to St. Fergus near Aberdeen, which is a distance of about 200 miles.

- Hydrogen can be exported by pipeline to Rotterdam, which is a distance of about 600 miles.

- Hydrogen can be exported by tanker to Rotterdam and other parts of Europe.

It looks a very comprehensive plan, which will turn the islands into a massive hydrogen producer.

Orion And AquaVentus

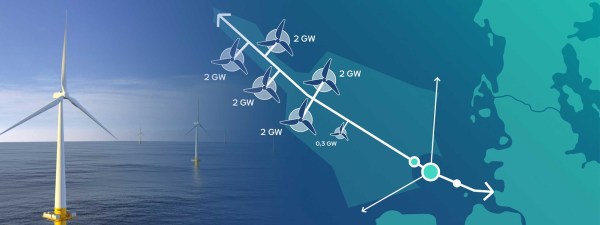

This video shows the structure of AquaVentus, which is the German North Sea network to collect hydrogen for H2ercules.

I clipped this map from the video.

Note.

- There is a link to Denmark.

- There appears to be a undeveloped link to Norway.

- There appears to be a link to Peterhead in Scotland.

- There appears to be a link to just North of the Humber in England.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Rough owned by Centrica.

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers distributing the hydrogen to where it is needed?

In the last century, the oil industry, built a substantial oil and gas network in the North Sea. It appears now the Germans are leading the building of a substantial hydrogen network.

This map is only the start and I feel, there would be nothing to stop the connection of the Orion and AquaVentus networks.

SaxaVord Spaceport

SaxaVord Spaceport is now a reality, in that it licensed and tests are being undertaken.

Energy In – Hydrogen And Carbon Dioxide Out

This article was inspired by this article in the Sunday Times, which is entitled ‘It’s A Slog’: Life Inside Britain’s Last Coal Power Station.

The article is about Ratcliffe-on-Soar power station, which is next to East Midlands Parkway station.

This is the first paragraph of the station’s Wikipedia entry.

Ratcliffe-on-Soar Power Station is a coal-fired power station owned and operated by Uniper at Ratcliffe-on-Soar in Nottinghamshire, England. Commissioned in 1968 by the Central Electricity Generating Board, the station has a capacity of 2,000 MW. It is the last remaining operational coal-fired power station in the UK, and is scheduled to close in September 2024.

I took these pictures of the power station in 2019.

Ratcliffe-on-Soar is the last of a number of large coal-fired power stations, that were built in the area, mainly along the River Trent.

- Rugeley – 600 MW – 1961

- Drakelow – 1630 MW – 1964

- Willington – 800 MW – 1962

- Castle Donington – 600 MW – 1958

- Ratcliffe-on-Soar – 2000 MW – 1968

- High Marnham – 1000 MW – 1959

- Cottam – 2000 MW – 1968

- West Burton – 2000 MW – 1968

Note.

- The date is the commissioning date.

- That is 10,630 MW of electricity.

- There are also a few large gas-fired power stations along the river, that are still operating.

- Both coal and gas-fired stations use the water from the River Trent for cooling.

At the mouth of the river, there is the Keadby cluster of gas-fired power stations.

- Keadby 1 – 734 MW – 1996

- Keadby 2 – 849 MW – 2023

- Keadby 3 – 910 MW – 2027

- Keadby Hydrogen – 900 MW – 2030

Note.

- The date is the commissioning date.

- That is 3,393 MW of electricity.

- Keadby 2 is the most efficient CCGT in the world.

- Keadby 3 will be fitted with carbon capture.

- Keadby 2 has been designed to be retrofitted with carbon capture.

- Keadby Hydrogen will be fuelled by zero-carbon hydrogen.

As the years progress, I can see the Keadby cluster of power stations becoming a large zero-carbon power station to back-up wind farms in the North Sea.

- Hydrogen power stations will emit no carbon dioxide.

- Carbon dioxide from all gas-fired stations will be captured.

- Some carbon dioxide will be sold on, to companies who can use it, in industries like construction, agriculture and chemical manufacture.

- The remaining carbon dioxide will be stored in depleted gas fields.

As technology improves, more carbon dioxide will be used rather than stored.

Other Power Sources In The Humberside Area

In the next few sub-sections, I will list the other major power sources in the Humberside area.

Drax Power Station

Drax power station is a shadow of its former self, when it was one of the power stations fed by the newly discovered Selby coalfield.

These days it is a 2,595 MW biomass-fired power station.

Eastern Green Link 2

Eastern Green Link 2 will be a 2 GW interconnector between Peterhead in Scotland and Drax.

It is shown in this map.

Note.

- Most of the route is underwater.

- It is funded by National Grid.

- Contracts have been signed, as I talk about in Contracts Signed For Eastern Green Link 2 Cable And Converter Stations.

- It is scheduled to be completed by 2029.

This interconnector will bring up to 2 GW of Scottish wind-generated electricity to Drax and Humberside.

Drax has the substations and other electrical gubbins to distribute the electricity efficiently to where it is needed.

2 GW could also reduce the amount of biomass used at Drax.

In the long term, if the concept of the four Eastern Green Links is successful, I could see another Eastern Green Link to Drax to replace imported biomass at Drax.

I also, don’t see why a smaller Drax can’t be run on locally-sourced biomass.

Solar Farms And Batteries Along The River Trent

As the coal-fired power stations along the River Trent are demolished, solar farm developers have moved in to develop large solar farms.

Salt End Power Station And Chemical Works

These two paragraphs from the Wikipedia entry for Salt End describes the hamlet and its power station and chemical works.

Salt End or Saltend is a hamlet in the East Riding of Yorkshire, England, in an area known as Holderness. It is situated on the north bank of the Humber Estuary just outside the Hull eastern boundary on the A1033 road. It forms part of the civil parish of Preston.

Salt End is dominated by a chemical park owned by PX group, and a gas-fired power station owned by Triton Power. Chemicals produced at Salt End include acetic acid, acetic anhydride, ammonia, bio-butanol, bio-ethanol, ethyl acetate (ETAC) and ethylene-vinyl alcohol copolymer (EVOH) with animal feed also being produced on site.

I wonder, if running the complex on hydrogen would give cost and marketing advantages.

Aldbrough Hydrogen Storage Facility

This page on the SSE Thermal web site is entitled Plans For World-Leading Hydrogen Storage Facility At Aldbrough.

This is the most significant paragraph of the page, that is definitely a must-read.

With an initial expected capacity of at least 320GWh, Aldbrough Hydrogen Storage would be significantly larger than any hydrogen storage facility in operation in the world today. The Aldbrough site is ideally located to store the low-carbon hydrogen set to be produced and used in the Humber region.

This is a hydrogen storage facility for a much wider area than Humberside.

Rough Gas Storage Facility

This is the first paragraph of the Wikipedia entry for the Rough Gas Storage Facility.

Rough is a natural gas storage facility under the North Sea off the east coast of England. It is capable of storing 100 billion cubic feet of gas, nearly double the storage capacities in operation in Great Britain in 2021.

In Wood To Optimise Hydrogen Storage For Centrica’s Rough Field, I describe Centrica’s plans to convert the Rough gas storage into a massive hydrogen storage.

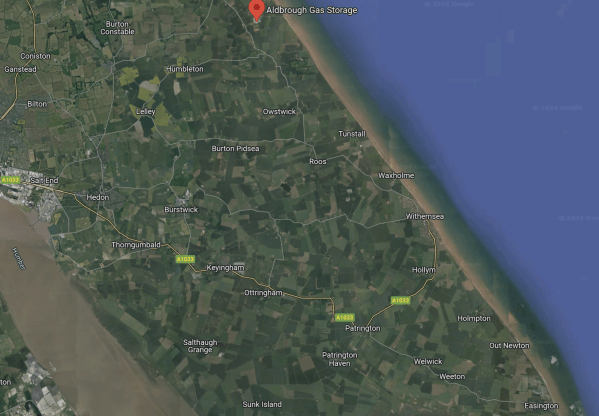

The Location Of Aldbrough Gas Storage, Rough Gas Storage, Salt End And Easington Gas Terminal

This Google Map shows between Salt End and the coast.

Note.

- The river crossing the South-West corner of the map is the Humber.

- Salt End with its power station and chemical works is on the North Bank of the Humber, where the river leaves the map.

- Aldbrough Gas Storage is marked by the red arrow at the top of the map.

- Easington Gas Terminal is in the South-East corner of the map.

- According to Wikipedia, gas flows into and out of the Rough Gas Storage are managed from Easington.

Looking at the map, I feel that the following should be possible.

- The two gas storage sites could be run together.

- Salt End power station and the related chemical works could run on hydrogen.

- Salt End will always have a reliable source of hydrogen.

- This hydrogen could be green if required.

All the chemical works at Salt End, could be run on a zero-carbon basis. Would this mean premium product prices? Just like organic does?

Enter The Germans

The Germans have a huge decarbonisation problem, with all their coal-fired power stations and other industry.

Three massive projects will convert much of the country and industry to hydrogen.

- H2ercules, which is a project of OGE and RWE, will create a hydrogen network to bring hydrogen, to where it is needed.

- In Uniper To Make Wilhelmshaven German Hub For Green Hydrogen; Green Ammonia Import Terminal, I describe how Uniper are going to build a hydrogen import terminal at Wilhelmshaven.

- AquaVentus is an RWE project that will use 10.3 GW of offshore wind power in German territorial waters to create a million tonnes per year of green hydrogen.

These would appear to be three of Europe’s largest hydrogen projects, that few have ever heard of.

AquaVentus And The UK

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that delivers hydrogen to Germany.

- There is a link to Denmark.

- There appears to be an undeveloped link to Norway.

- There appears to be an undeveloped link to Peterhead in Scotland.

- There appears to be a link to just North of the Humber in England.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

In the last century, the oil industry, built a substantial oil and gas network in the North Sea.

It appears now the Germans are leading the building of a substantial hydrogen network in the North Sea.

These are my thoughts about development of the AquaVentus network.

Hydrogen Production And AquaVentus

This RWE graphic shows the layout of the wind farms feeding AquaVentus.

Note.

- There is a total of 10.3 GW.

- Is one of the 2 GW web sites on the UK-side of AquaVentus, the 3 GW Dogger Bank South wind farm, which is being developed by RWE?

- Is the 0.3 GW wind farm, RWE’s Norfolk wind farm cluster, which is also being developed by RWE?

Connecting wind farms using hydrogen pipelines to Europe, must surely mitigate the pylon opposition problem from Nimbys in the East of England.

As the AquaVentus spine pipeline could eventually connect to Peterhead, there will be other opportunities to add more hydrogen to AquaVentus.

Hydrogen Storage And AquaVentus

For AquaVentus to work efficiently and supply a large continuous flow of hydrogen to all users, there would need to be storage built into the system.

As AquaVentus is around 200 kilometres in length and natural gas pipelines can be up to 150 centimetres in diameter, don’t underestimate how much hydrogen can be stored in the pipeline system itself.

This page on the Uniper web site is entitled Green Wilhelmshaven: To New Horizons.

This is a sentence on the page.

Access to local hydrogen underground storage at the Etzel salt cavern site.

An Internet search gives the information, that Etzel gas storage could be developed to hold 1 TWh of hydrogen.

That would be enough hydrogen to supply 10 GW for a hundred hours.

Note that the UK branch of AquaVentus reaches the UK, just to the South of the massive hydrogen storage facilities at Aldbrough and Rough.

It would appear that both Germany and the UK are connected to AquaVentus through substantial storage.

I am certain, that all country connections to AquaVentus will have substantial storage at the country’s hydrogen terminal.

AquaDuctus

This would appear to be the first part of the AquaVentus network and has its own web site.

The web site is entitled Nucleus Of A Offshore Hydrogen Backbone.

These are the first two paragraphs.

The project partners are focusing on a scalable, demand-driven infrastructure: By 2030, AquaDuctus will connect the first large hydrogen wind farm site, SEN-1, with a generation capacity of approximately one gigawatt. SEN-1 is located in the German EEZ in the northwest of Helgoland. The pipeline will transport at a length of approx. 200 km green hydrogen produced from offshore wind to the German mainland and from there to European consumers via the onshore hydrogen infrastructure.

In the next project stage, AquaDuctus will be extended to the remote areas of the German exclusive economic zone towards the tip of the so-called duck’s bill. By that, additional future hydrogen wind farm sites will be connected. Along its way AquaDuctus will provide interconnection points with the opportunity for linking of adjacent national offshore hydrogen infrastructures originating from Denmark, Norway, the Netherlands, Belgium and United Kingdom which opens the door for Europe-wide offshore hydrogen transport by pipeline.

There is also an interactive map, that gives more details.

This paragraph explains, why the Germans have chosen to bring the energy ashore using hydrogen, rather than traditional cables.

Recent studies show that offshore hydrogen production and transport via pipelines is faster, cheaper, and more environmentally friendly than onshore electrolysis with a corresponding connection of offshore wind turbines via power cables. The German federal government has also recognized this advantage and has clearly expressed its intention to promote offshore hydrogen production in the North Sea.

I suspect, that some UK offshore wind farms will use the same techniques.

Hydrogen Production For The UK

Electrolysers will probably be built along the East Coast between Peterhead and Humberside and these will feed hydrogen into the network.

- Some electrolysers will be offshore and others onshore.

- Turning off windfarms will become a thing of the past, as all surplus electricity will be used to make hydrogen for the UK or export to Europe.

- Until needed the hydrogen will be stored in Albrough and Rough.

Backup for wind farms, will be provided using hydrogen-fired power stations like Keadby Hydrogen power station.

Financial Implications

I reported on Rishi Sunak’s Manifesto Speech, which he made on June 11th. This is an extract

This document on the Policy Mogul web site is entitled Rishi Sunak – Conservative Party Manifesto Speech – Jun 11.

These are three paragraphs from the speech.

We don’t just need military and border security. As Putin’s invasion of Ukraine has shown, we need energy security too. It is only by having reliable, home-grown sources of energy that we can deny dictators the ability to send our bills soaring. So, in our approach to energy policy we will put security and your family finances ahead of unaffordable eco zealotry.

Unlike Labour we don’t believe that we will achieve that energy security via a state-controlled energy company that doesn’t in fact produce any energy. That will only increase costs, and as Penny said on Friday there’s only one thing that GB in Starmer and Miliband’s GB Energy stands for, and that’s giant bills.

Our clear plan is to achieve energy security through new gas-powered stations, trebling our offshore wind capacity and by having new fleets of small modular reactors. These will make the UK a net exporter of electricity, giving us greater energy independence and security from the aggressive actions of dictators . Now let me just reiterate that, with our plan, we will produce enough electricity to both meet our domestic needs and export to our neighbours. Look at that. A clear, Conservative plan not only generating security, but also prosperity for our country.

I can’t remember any reports about an energy security policy, which he outlined in the last paragraph of my extract from his speech.

He also said we would have sufficient electricity to export to our neighbours. As I said earlier some of this energy will be in the form of hydrogen, which has been created by offshore electrolysers.

If we are exporting electricity and hydrogen to Europe, this is likely to have three effects.

- An improvement in Europe’s energy security.

- H2ercules will improve and decarbonise German industry, using UK hydrogen.

- The finances of UK plc will improve.

It looks like there would be winners all round.

Rishi Sunak had the cards and he played them very badly.

It is now up to Keir Starmer, Great British Energy and Jürgen Maier to play those cards to link the energy systems of the UK and Germany to ensure security and prosperity for Europe.

3 GW Dogger Bank South Offshore Wind Farms Reach New Development Stage

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK Planning Inspectorate has accepted into the examination phase the Development Consent Order (DCO) application for the Dogger Bank South (DBS) Offshore Wind Farms developed by RWE and Masdar.

The first two paragraphs give a brief description of the wind Farm.

The DBS East and DBS West offshore wind farms, which could provide electricity for up to three million typical UK homes, are located in shallow waters on the Dogger Bank over 100 kilometres off the northeast coast of England. The acceptance of the DCO application moves the projects into the pre-examination phase, which will become subject to a public examination later in 2024.

Together, the projects will have up to 200 turbines with a combined estimated capacity of 3 GW. Investment by RWE and Masdar during development and construction is predicted to deliver an economic contribution (Gross Value Added) to the UK of almost GBP 1 billion, including GBP 400 million in the Humber region.

There is a detailed map in the article on offshoreWIND.biz.

The Next Steps

These are given in the article.

The next steps for the projects, following a successful Development Consent Order, would be to secure Contracts for Difference (CfD), followed by financing and construction, the developers said.

It certainly looks like the 3 GW Dogger South Bank Wind Farm is on its way.

These are my thoughts about the project.

The Turbines To Be Used

The article says this about the turbines.

Together, the projects will have up to 200 turbines with a combined estimated capacity of 3 GW.

This means that the turbines will be 15 MW.

In RWE Orders 15 MW Nordseecluster Offshore Wind Turbines At Vestas, I said this.

Does this mean that the Vestas V236-15.0 MW offshore wind turbine, is now RWE’s standard offshore turbine?

This would surely have manufacturing, installation, operation and maintenance advantages.

There would surely be advantages for all parties to use a standard turbine.

It’s A Long Way Between Yorkshire And The Dogger Bank

The article says it’s a hundred kilometres between the wind farm and the coast of Yorkshire.

Welcome To The Age Of Hydrogen

This is the title of this page of the RWE web site.

The page starts with this paragraph.

RWE is actively involved in the development of innovative hydrogen projects. The H2 molecule is considered to be an important future building block of a successful energy transition. RWE is a partner in over 30 H2 projects and is working on solutions for decarbonising the industry with associations and corporations like Shell, BASF and OGE. Hydrogen projects are comprehensively supported in the separate Hydrogen department of the subsidiary RWE Generation.

AquaVentus

I also suggest, that you read this page on the RWE web site called AquaVentus.

The page starts with this RWE graphic.

It appears that 10.3 GW of hydrogen will be created by wind farms and piped to North-West Germany.

These two paragraphs outline the AquaVentus initiative .

Hydrogen is considered the great hope of decarbonisation in all sectors that cannot be electrified, e.g. industrial manufacturing, aviation and shipping. Massive investments in the expansion of renewable energy are needed to enable carbon-neutral hydrogen production. After all, wind, solar and hydroelectric power form the basis of climate-friendly hydrogen.

In its quest for climate-friendly hydrogen production, the AquaVentus initiative has set its sights on one renewable energy generation technology: offshore wind. The initiative aims to use electricity from offshore wind farms to operate electrolysers also installed at sea on an industrial scale. Plans envisage setting up electrolysis units in the North Sea with a total capacity of 10 gigawatts, enough to produce 1 million metric tons of green hydrogen.

The page also gives these numbers.

- Total Capacity – 10 GW

- Tonnes Of Green Hydrogen – 1 million

- Members – 100 +

The web site says this about commissioning.

Commissioning is currently scheduled for early/mid 2030s.

The Germans can’t be accused of lacking ambition.

AquaVentus And The UK

This video shows the structure of AquaVentus.

I clipped this map from the video.

Note.

- There is a link to Denmark.

- There appears to be a undeveloped link to Norway.

- There appears to be a link to Peterhead in Scotland.

- There appears to be a link to just North of the Humber in England.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers distributing the hydrogen to where it is needed?

In the last century, the oil industry, built a substantial oil and gas network in the North Sea. It appears now the Germans are leading the building of a substantial hydrogen network.

AquaVentus And Aldbrough And Rough Gas Storage

Consider.

- In The Massive Hydrogen Project, That Appears To Be Under The Radar, I describe the Aldbrough Gas Storage.

- In Wood To Optimise Hydrogen Storage For Centrica’s Rough Field, I describe Centrica’s plans to turn Rough Gas Storage into the world’s largest hydrogen store.

- There is a small amount of hydrogen storage at Wilhelmshaven.

It looks like the East Riding Hydrogen Bank, will be playing a large part in ensuring the continuity and reliability of AquaVentus.

Dogger Bank South And AquaVentus

This Google Map shows the North Sea South of Sunderland and the Danish/German border.

Note.

- Sunderland is in the top-left hand corner of the map.

- A white line in the top-right corner of the map is the Danish/German border.

- Hamburg and Bremen are in the bottom-right hand corner of the map.

If you lay the AquaVentus map over this map, I believe that Dogger Bank South wind farm could be one of the three 2 GW wind farms on the South-Western side of the AquaVentus main pipeline.

- Two GW would be converted to hydrogen and fed into the AquaVentus main pipeline.

- One GW of electricity would be sent to the UK.

But this is only one of many possibilities.

Hopefully, everything will be a bit clearer, when RWE publish more details.

Conclusion

I believe, that some or all of the Dogger Bank South electricity, will be converted to hydrogen and fed into the AquaVentus main pipeline.

I also believe, that the hydrogen stores in the East Riding of Yorkshire, will form an important part of AquaVentus.

Wood To Optimise Hydrogen Storage For Centrica’s Rough Field

The title of this post, is the same as that of this press release from Wood plc.

These are the first three paragraphs.

Wood, a global leader in consulting and engineering, has been awarded a contract by Centrica Energy Storage (CES) for the redevelopment of the UK’s Rough field in readiness for future hydrogen storage.

The Rough reservoir, located in the Southern North Sea, has been used to store natural gas safely for over thirty years and has the potential to provide over half of the UK’s hydrogen storage requirements.

The front-end engineering design (FEED) contract, awarded to Wood, entails new pipelines, a new unmanned installation, as well as onshore injection facilities at the Easington Gas Terminal, is the first step in making the field hydrogen ready.

Offshore Magazine has this article about the deal, which is entitled Wood Assessing Hydrogen Storage Needs For North Sea Rough Reservoir.

This is a paragraph from the Offshore Magazine article.

Centrica aims to position the Rough Field as the world’s largest long-duration hydrogen storage facility, although FID on the redevelopment project would depend on government support.

It would be a very important project.

Why would Centrica be planning for this massive increase in hydrogen storage?

There could only be one reason.

There is going to be a massive increase in hydrogen production and use.

In Where’s The Plan, Rishi?, I laid out what I believe will happen in the next few years.

- In RWE Goes For An Additional 10 GW Of Offshore Wind In UK Waters In 2030, I detailed how RWE intended to add an extra 10 GW of offshore wind to the seas around the UK.

- As our current offshore wind capacity is around 15 GW, so another 10 GW would surely be very welcome.

- The Germans will develop H2ercules, which is their massive project to create a hydrogen network to bring hydrogen to Southern Germany.

- A hydrogen hub at Wilhelmshaven is being built by Uniper to feed H2ercules with green hydrogen from around the world.

But would it not be better, if instead of feeding H2ercules with hydrogen from around the world, some came from the UK, a few hundred miles across the North Sea?

- RWE are developing the 3 GW Dogger Bank South wind farm, which is not in the best place for a cable to the UK. So could this wind farm have an offshore electrolyser and send the hydrogen to Wilhelmshaven, by pipeline or coastal tanker?

- RWE are also developing the 4.2 GW Norfolk cluster of wind farms to the North-East of Great Yarmouth. It might be better, if the output of these wind farms took a hydrogen route to Wilhelmshaven.

- I also believe that a third offshore electrolyser might be situated North of the Wash to bring more hydrogen to Germany.

- Hydrogen could also be sent from the Rough facility to Wilhelmshaven.

The coastal tanker route gives flexibility, so green hydrogen could be sent as required to the UK mainland.

Rishi Sunak’s Manifesto Speech – June 11

I also reported on Rishi Sunak’s Manifesto Speech, which he made on June 11th. This is an extract

This document on the Policy Mogul web site is entitled Rishi Sunak – Conservative Party Manifesto Speech – Jun 11.

These are three paragraphs from the speech.

We don’t just need military and border security. As Putin’s invasion of Ukraine has shown, we need energy security too. It is only by having reliable, home-grown sources of energy that we can deny dictators the ability to send our bills soaring. So, in our approach to energy policy we will put security and your family finances ahead of unaffordable eco zealotry.

Unlike Labour we don’t believe that we will achieve that energy security via a state-controlled energy company that doesn’t in fact produce any energy. That will only increase costs, and as Penny said on Friday there’s only one thing that GB in Starmer and Miliband’s GB Energy stands for, and that’s giant bills.

Our clear plan is to achieve energy security through new gas-powered stations, trebling our offshore wind capacity and by having new fleets of small modular reactors. These will make the UK a net exporter of electricity, giving us greater energy independence and security from the aggressive actions of dictators . Now let me just reiterate that, with our plan, we will produce enough electricity to both meet our domestic needs and export to our neighbours. Look at that. A clear, Conservative plan not only generating security, but also prosperity for our country.

It is now nineteen days since Rishi made that speech and I can’t remember any reports about an energy security policy, which he outlined in the last paragraph of my extract from his speech.

He particularly mentioned.

- New gas-powered stations

- Trebling our offshore wind capacity

- Having new fleets of small modular reactors.

He also said we would have sufficient electricity to export to our neighbours. As I said earlier some of this energy will be in the form of hydrogen, which has been created by offshore electrolysers.

If we are exporting electricity and hydrogen to Europe, this is likely to have three effects.

- An improvement in Europe’s energy security.

- H2ercules will improve and decarbonise German industry, using UK hydrogen.

- The finances of UK plc will improve.

It looks like there will be winners all round.

Conclusion

Centrica’s plan for a massive hydrogen store at Rough, close to SSE’s existing gas storage in the salt caverns at Aldbrough, would appear to make sense, if the UK’s excess of offshore wind is converted into green hydrogen, which is then stored and distributed as needed.

Centrica Business Solutions And Highview Power

Centrica Business Solutions is one of Centrica’s business units.

It has its own web page, with this sub heading.

Helping Organisations Balance Planet And Profit

This is followed by this mission statement.

Centrica Business Solutions helps organisations to balance the demands of planet and profit, by delivering integrated energy solutions that help you save money and become a sustainable business.

Several pictures show some of the solutions, that Centrica Business Solutions can provide.

Centrica Business Solutions In Numbers

These numbers are given about the customers of Centrica Business Solutions.

- Customer Sites Globally – 7000

- Solar PV Installations Delivered Worldwide – 16,380+

- Solar PV Installations Delivered Power – 240 MW

- CHP Units Operated And Maintained Globally – 700 MW+

- Energy Data Points Collected Each Month Globally – 29 billion

Theses are large numbers.

How Would Centrica Business Solutions Use Highview Power’s Batteries?

The obvious use of Highview Power’s batteries is to connect them between a solar or wind farm and the grid, for when the sun isn’t shining or when the wind isn’t blowing.

Currently, there are three sizes of Highview Power batteries, either working on under development.

5MW/15 MWh

This is the demonstration system, which is described on this page of the Highview web site.

Surely, if a system of this size is very useful for Viridor, there may be other applications and customers out there.

This system will provide 5 MW for three hours.

50MW/300MWh

This is the Carrington system, which is described on this page of the Highview web site.

The Highview web site says this about output potential and connectivity.

The facility will store enough clean, renewable energy to serve the needs of 480,000 homes, as well as providing essential grid stabilisation services. The site will use existing substation and transmission infrastructure.

This system will provide 50 MW for six hours.

200MW/2.5GWh

This is the larger system for Scotland and the North East, which is under development and described on this page of the Highview web site.

The Highview web site says this about output their use.

These will be located on the national transmission network where the wind is being generated and therefore will enable these regions to unleash their untapped renewable energy potential and store excess wind power at scale.

This system will provide 200 MW for 12.5 hours.

In Rio Tinto Punts On British Start-Up To Plug Renewables Gap, I said this.

In Britain, Highview hopes to be putting four 2.5-gigawatt assets into planning this year – one in Scotland, three with Orsted in England.

This sentence was originally published in this article on the Australian Financial Review.

I believe that Centrica could find applications for all three sizes of Highview’s batteries.

Suppose, though Centrica find that an application needs say a 100 MW/1 GWh battery.

From the mathematics, I did at ICI in the 1970s, when looking at the scaling of chemical plants, I believe that Highview’s battery design could be scalable, by just using appropriately-sized turbomachinery, matched to the right number of tanks.

So the customer would get the battery size they needed!

How Much Electricity Could One Of Highview’s Batteries Store?

This image shows large LNG tanks at Milford Haven.

In Could A Highview Power CRYOBattery Use A LNG Tank For Liquid Air Storage?, I did a rough calculation and found that the largest LNG tanks could hold enough liquid air, that would be the equivalent of around one GWh.

So the image above could be a 5 GWh battery.

This image clipped from Highview’s web site, shows large tanks for liquified gas storage.

With tanks like these, Highview could be building batteries with storage to rival the smaller pumped storage hydroelectric power stations.

In Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, I talked about how Ørsted were planning the Swardeston BESS, where the 2852 MW Hornsea Three wind farm connects to the grid.

The chosen battery will be from Tessla with an output of 300 MW and a capacity of 600 MWh.

I suspect Ørsted couldn’t wait for Highview, but circumstances might have changed now, with the financing deal for the Carrington battery!

Are Combined Heat And Power Units And Highview’s Batteries Interchangeable And Complementary Technologies?

According to the Centrica Business Systems web site, they have deployed over 700 MW of CHP systems globally.

I wonder how many of these systems could have used a standard Highview battery?

Perhaps, Centrica Business Systems have done a survey and found that it could be quite a few.

So, perhaps if Centrica Business Systems had access to Highview’s technology, it would increase their sales.

In addition how many of Centrica Business Systems existing CHP systems, would be improved with the addition of a Highview battery?

It appears to me, that if Centrica Business Systems were to develop a series of standard solutions based on Highview’s technology, they could substantially increase their sales.

What Could Centrica Business Systems Do For Highview Power?

Centrica Business Systems could probably develop several standard applications with Hoghview’s technology, which would be to the benefit of both companies.

But, I believe that as Centrica Business Systems are supporting large number of systems globally, that they are in a good place to help develop and possibly run Highview Power’s support network.

Conclusion

I can see Centrica Business Systems and Highview Power having a long and profitable relationship.

Centrica Invests In Renewable Energy Storage Capabilities To Boost UK’s Energy Security And Accelerate Transition To Net Zero

The title of this post, is the same as that of this press release from Centrica.

These two paragraphs are effectively headings.

Centrica plc announces a strategic partnership and £70 million investment in Highview Power and its first clean energy storage project in Carrington, Manchester.

Centrica’s investment will be a key part of a £300 million funding package to develop the first commercial-scale Liquid Air Energy Storage plant in the UK, which will boost the UK’s energy security and accelerate the transition to net zero.

These four paragraphs give more details on the deal.

The investment, which forms part of our plans to invest between £600m – £800m a year until 2028, will be structured as £25m of convertible debt at Highview Enterprises Limited, being the Highview Power holding company and £45m of debt funding at the Carrington Liquid Air Energy Storage project, phased over the project construction. The investment delivers several benefits to Centrica:

Robust standalone returns aligned with Centrica’s capital allocation framework and returns thresholds

Aligned to our green-focused investment programme targeting assets which complement our existing capabilities, provide balance to the portfolio, and align to the needs of the energy transition

Includes rights to equity participation and energy optimisation from future projects in Highview’s £9 billion project pipeline.

At a first look, it appears to give Centrica robust returns and some security for their £70 million investment.

But it is the last paragraph that I like. Does it mean that Centrica can cherry-pick, the projects that it likes and fit its own objectives and expertise from Highview’s £9 billion project pipeline and take-up some equity?

Whatever it means, It looks like it will be good for Centrica.

Do the other partners have similar rights to equity?

Suppose Goldman Sachs have a long-term client in the Mid-West of the United States, who are an electricity generator, with perhaps half-a-dozen coal-fired power stations.

As the client needs to decarbonise and it is believed that Highview’s long duration batteries can replace small coal-fired power stations, it is likely that a Highview solution will at least be examined.

If the client goes down the Highview route, Goldman Sachs might like to continue their long-term relationship, by taking a share in the equity.

Are Goldman Sachs Stitching Together A Large Deal On Energy Storage?

In UK Infrastructure Bank, Centrica & Partners Invest £300M in Highview Power Clean Energy Storage Programme To Boost UK’s Energy Security, I talked about a deal to invest £300 million into energy storage company; Highview Power.

These three paragraphs are from the Highview Power news item, on which I based my post.

Highview Power has secured the backing of the UK Infrastructure Bank and the energy industry leader Centrica with a £300 million investment for the first commercial-scale liquid air energy storage (LAES) plant in the UK.

The £300 million funding round was led by the UK Infrastructure Bank (UKIB) and the British multinational energy and services company Centrica, alongside a syndicate of investors including Rio Tinto, Goldman Sachs, KIRKBI and Mosaic Capital.

The investment will enable the construction of one of the world’s largest long duration energy storage (LDES) facilities in Carrington, Manchester, using Highview Power’s proprietary LAES technology. Once complete, it will have a storage capacity of 300 MWh and an output power of 50 MWs per hour for six hours. Construction will begin on the site immediately, with the facility operational in early 2026, supporting over 700 jobs in construction and the supply chain.

Note.

- The UK Infrastructure Bank is a is a British state-owned development bank.

- Centrica plc is an international energy and services company.

- Rio Tinto is a leading global mining group that focuses on finding, mining and processing the Earth’s mineral resources.

- The Goldman Sachs Group, Inc. is a leading global investment banking, securities and investment management firm.

- KIRKBI is the Kirk Kristiansen family’s private holding and investment company founded to build a sustainable future for the family ownership of the LEGO Group.

- Mosaic Capital are an American investment firm.

With six partners, that is just £50 million per partner.

As that sum is very much small change for the likes of these guys and the question of taking an equity stake is not mentioned in Highview Power’s news item, it looks like this deal could be a try-before-you-buy deal with some of the partners or a simple investment with others.

Consider.

- Gresham House, Gore Street and others have proven that investing in lithium-ion batteries give a good return on investment.

- The Carrington long duration energy storage facility will be located near to the 884 MW gas-fired Carrington power station. I suspect that Centrica and Rio Tinto will be interested to see how the hybrid power-station performs.

- Could the Lego Group owners be looking at using solar power, wind power and a LDES to reduce the carbon footprint of their stores?

I would assume, that all the investors would get full details on the performance of the batteries.

Someone To Build The LDES

In Bilfinger Drives Highview Power’s Innovative Storage Project, Accelerating The Energy Transition, I describe how German company will build the Carrington LDES.

The Advantages Of An LDES over a BESS

This is only a short list, of the advantages I see.

- An LDES is easily recyclable.

- The LDES has less exotic materials.

- An LDES can be built from zero-carbon steel.

- Highview are claiming a 40-year life for their LDES.

- Highview is already talking about 200MW/2.5GWh LDES systems.

- Two 200MW/2.5GWh systems working together with a wind or solar farm, can replace a 400 MW gas- or coal-fired station.

- I suspect one of Highview’s LDES systems could be placed offshore, if needed.

I also believe that Highview’s LDES systems could be incorporated into complex chemical plants to increase the efficiency.

Are Goldman Sachs Stitching Together A Large Deal On Energy Storage?

Everything now seems to be in place to build these LDES one after the other, to accelerate the energy transition.

With a good supply of orders and enough money to build each system, I cab see no reason, why several systems a month cannot be built and installed.

I have worked with companies like Goldman Sachs in the past, and I wouldn’t be surprised to find, that they have created the consortium, so that all members get the returns and recognition, they disserve.

Adding Lego Group To The Consortium Could Be A Masterstroke

The Lego Group has lots of stores and theme parks worldwide and a reputation for good design and environmental standards.

Last year, I wrote Bedford Depot’s Massive Solar Roof Helps Thameslink On Way To Net Zero. This was putting a solar roof on a rail depot, but surely buildings like this would be suitable for a Highview LDES.

UK Infrastructure Bank, Centrica & Partners Invest £300M in Highview Power Clean Energy Storage Programme To Boost UK’s Energy Security

The title of this post, is the same as that of this news item from Highview Power.

This is the sub-heading.

Highview Power kickstarts its multi-billion pound renewable energy programme to accelerate the UK’s transition to net zero in Carrington, Manchester.

These three paragraphs outline the investment.

Highview Power has secured the backing of the UK Infrastructure Bank and the energy industry leader Centrica with a £300 million investment for the first commercial-scale liquid air energy storage (LAES) plant in the UK.

The £300 million funding round was led by the UK Infrastructure Bank (UKIB) and the British multinational energy and services company Centrica, alongside a syndicate of investors including Rio Tinto, Goldman Sachs, KIRKBI and Mosaic Capital.

The investment will enable the construction of one of the world’s largest long duration energy storage (LDES) facilities in Carrington, Manchester, using Highview Power’s proprietary LAES technology. Once complete, it will have a storage capacity of 300 MWh and an output power of 50 MWs per hour for six hours. Construction will begin on the site immediately, with the facility operational in early 2026, supporting over 700 jobs in construction and the supply chain.

Note.

- The backers are of a high quality.

- The Carrington LDES appears to be a 50 MW/300 MWh battery.

It finally looks like Highview Power is on its way.

These are my thoughts on the rest of news item.

Centrica’s Involvement

This paragraph talks about Centrica’s involvement.

Energy leader Centrica comes on board as Highview Power’s strategic partner and a key player in the UK’s energy transition, supporting Carrington and the accelerated roll-out of the technology in the UK through a £70 million investment. The programme will set the bar for storage energy systems around the world, positioning the UK as the global leader in energy storage and flexibility.

I suspect that Centrica have an application in mind.

In Centrica Business Solutions Begins Work On 20MW Hydrogen-Ready Peaker In Redditch, I talk about how Centrica is updating an old peaker plant.

In the related post I refer to this news item from Centrica Business Systems.

This paragraph in the Centrica Business Systems news item, outlines Centrica’s plans.

The Redditch peaking plant is part of Centrica’s plans to deliver around 1GW of flexible energy assets, that includes the redevelopment of several legacy-owned power stations, including the transformation of the former Brigg Power Station in Lincolnshire into a battery storage asset and the first plant in the UK to be part fuelled by hydrogen.

As Redditch power station is only 20 MW, Centrica could be thinking of around fifty assets of a similar size.

It seems to me, that some of these assets could be Highview Power’s LDES batteries of an appropriate size. They may even be paired with a wind or solar farm.

Larger Systems

Highview Power’s news item, also has this paragraph.

Highview Power will now also commence planning on the next four larger scale 2.5 GWh facilities (with a total anticipated investment of £3 billion). Located at strategic sites across the UK, these will ensure a fast roll-out of the technology to align with UK LDES support mechanisms and enable the ESO’s Future Energy Scenario Plans.

Elsewhere on their web site, Highview Power say this about their 2.5 GWh facilities.

Highview Power’s next projects will be located in Scotland and the North East and each will be 200MW/2.5GWh capacity. These will be located on the national transmission network where the wind is being generated and therefore will enable these regions to unleash their untapped renewable energy potential and store excess wind power at scale.

So will the four larger systems have a 200MW/2.5GWh capacity?

They could, but 200 MW may not be an appropriate output for the location. Or a longer duration may be needed.

Highview Power’s design gives the flexibility to design a system, that meets each application.

Working With National Grid

Highview Power’s news item, also has this sentence.

Highview Power’s technology will also provide stability services to the National Grid, which will allow for the long-term replacement of fossil fuel-based power plants for system support.

Highview Power’s technology is also an alternative to Battery Energy Storage Systems (BESS) of a similar capacity.

How does Highview Power’s technology compare with the best lithium-ion systems on price, performance and reliability?

Curtailment Of Wind Farms

Highview Power’s news item, also has these two paragraphs.

This storage will help reduce curtailment costs – which is significant as Britain spent £800m in 2023 to turn off wind farms.

Highview Power aims to accelerate the roll-out of its larger facilities across the UK by 2035 in line with one of National Grid’s target scenario forecasts of a 2 GW requirement from LAES, which would represent nearly 20% of the UK’s long duration energy storage needs. By capturing and storing excess renewable energy, which is now the cheapest form of electricity, storage can help keep energy costs from spiralling, and power Britain’s homes with 24/7 renewable clean energy.

I can see several wind farms, that are regularly curtailed would have a Highview Power battery installed at their onshore substation.

Receently, I wrote Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, which described how Ørsted are installing a 300 MW/600 MWh Battery Energy Storage Systems (BESS) at Swardeston substation, where Hornsea Three connects to the grid.

I would suspect that the purpose of the battery is to avoid turning off the wind farm.

Would a Highview Power battery be better value?

What’s In It For Rio Tinto?

I can understand, why most companies are investing, but Rio Tinto are a mining company. My only thought is that they have a lot of redundant holes in the ground, that cost them a lot of money and by the use of Highview Power’s technology, they can be turned into productive assets.

Collateral Benefits

Highview Power’s news item, also has this paragraph.

Beyond contributing to the UK’s energy security by reducing the intermittency of renewables, Highview Power’s infrastructure programme will make a major contribution to the UK economy, requiring in excess of £9 billion investment in energy storage infrastructure over the next 10 years – with the potential to support over 6,000 jobs and generate billions of pounds in value add to the economy. It will also contribute materially to increasing utilisation of green energy generation, reducing energy bills for consumers and providing significantly improved energy stability and security.

If Highview Power can do that for the UK, what can it do for other countries?

No wonder companies of the quality of Centrica, Rio Tinto and Goldman Sachs are investing.

Recurrent Energy’s Middle Road Project Sold To Centrica

The title of this post, is the same as that pf this article on Solar Power Portal.

These are the first two paragraphs.

Recurrent Energy, a global solar and energy storage developer and a subsidiary of Canadian Solar, announced the sale of its 49.9 MWp Middle Road solar project in Harbury, Warwickshire, to Centrica Business Solutions. The subsidy-free project, slated for construction this summer, will commence operations in 2025.

The Middle Road project is just one piece of Recurrent Energy’s expanding UK pipeline, which boasts over 2.6 GWp of solar PV and 6.7 GWh of battery storage projects. This mirrors the broader trend of increased investment in UK solar. Indeed, Recurrent announced €1.3 billion of financing for EU and UK solar projects earlier this week.

This 49.9 MW solar project shows three ways to make money from a solar project.

The Developer

Recurrent Energy would appear to have developed the expertise to put together these solar farms and do all the legals and administration to connect them to the National Grid.

They obviously can show their financial backers, the cash flow, that the farms generates.

So if you’re good at building solar farms, I suspect you can develop a substantial pipeline of projects, each with their own case flow.

The Operator

Initially in the early days, Recurrent Energy will probably be the operator, so they can sort out any teething problems and build the financial profile of the site.

The Owner

But as at Middle Road, they may decide to cash in their investment.

Centrica have now taken over the ownership and they can operate the farm themselves or pay, Recurrent Energy a fee.

Note.

- Developer, operator and owner all have ways of making money from this solar farm.

- Developer and owner can use the solar farm, as an asset on which to raise money.

- Similar cash flows and inside probably apply to batteries and wind farms.

By buying, selling and updating the various assets, a financial operator, can use their assets to make money.

As Centrica are also an electricity supplier, they can probably suggest to developers, where a solar farm or battery-electric storage system is needed.

Are Centrica Developing A Pipeline Of Projects?

In Centrica Set For Solar Boost With Acquisition Of Two Projects In South-West England, I talked about how Centrica had acquired two projects in South-West England.

The Middle Road project is the third project that Centrica has purchased this year.

As a Control and Electrical Engineer, I know, that by careful management of the assets, Centrica can achieve the following.

- Delivery of electricity to their customers at a competitive price.

- If a battery is included in the local grid, higher supply reliability can be achieved.

- Batteries also allow the local network to carry out other tasks, like frequency stabilisation.

The flexibility of the local network should allow other assets to be added.

Korean Hydrogen Bus Adoption Emerging To Block Low-Priced Electric Buses From China

The title of this post, is the same as that of this article on BusinessKorea.

These are the first two paragraphs.

Major Korean business groups such as Samsung, SK, Hyundai Motor, and POSCO are expanding the introduction of hydrogen buses. They are more efficient than electric buses, and can run 635 kilometers on a single charge, making them suitable for long-distance commuting. Expanding hydrogen mobility, including buses, is considered the first step in building an entire hydrogen ecosystem.

SK Group is one of the most active companies in expanding hydrogen buses. According to SK Group on May 26, SK siltron has decided to replace its commuter buses for employees of its Gumi plant in North Gyeongsang Province with hydrogen buses. Additional deployments are under consideration after a pilot run in the first half of the year. In early May, SK hynix introduced three of the Universe model, Hyundai’s hydrogen bus for commuting. SK E&S recently completed the world’s largest liquefied hydrogen plant in Incheon and plans to soon expand its hydrogen refueling stations nationwide to 20.

The Korean bus seem to have developed a strategy to protect themselves from the Chinese.

I have a few thoughts.

Korea And HiiROC

Hyundai and Kia have joined Centrica in taking stakes in Hull-based startup HiiROC, which I wrote about in Meet HiiROC, The Startup Making Low-Cost Hydrogen Free From Emissions.

London’s Future Bus Fleet

There are rumours on the Internet that Sadiq Khan, will replace all London’s buses with new Chinese buses.

How will I get around, as I don’t ride in anything that was made in China?

Conclusion

We live in interesting times.