The Liquid Air Alternative To Fossil Fuels

The title of this post, is the same as that of this article on the BBC.

This is the sub-heading.

An overlooked technology for nearly 50 years, the first liquid air energy storage facility is finally set to power up in 2026. It’s hoping to compete with grid-scale lithium batteries and hydro to store clean power, and reduce the need to fall back on fossil fuels.

These three introductory paragraphs add more details.

s the world’s use of renewable electricity soars, surpassing coal for the first time, the need to store that energy when the Sun isn’t shining and the wind isn’t blowing is growing in step. While some turn to grid-scale lithium batteries and others to pumped hydro, a small but growing industry is convinced there’s a better solution still: batteries that rely on air.

Near the village of Carrington in north-west England, the foundations are being laid for the world’s first commercial-scale liquid air energy storage facility. The site will eventually become an array of industrial machinery and a number of large storage tanks, filled with air that has been compressed and cooled so much it has become a liquid, using renewable energy surplus to demand. The stored energy can be discharged later when demand exceeds supply.

If the project succeeds, more will follow. The site’s developers Highview Power are confident that liquid air energy storage will make it easier for countries to replace fossil fuels with clean renewable energy – though at present, the technology is expensive. But as the need for clean energy storage surges, they’re betting the balance will tip in favour of liquid air.

Where this article about Highview Power is different, as it gives various details on the efficiency, return and of liquid air energy storage systems.

US Installs 11.7 GW Of Clean Power In Record Q3

The title of this post, is the same as an article on Renewables Now.

Searching for the title of this post on Google AI gives this informative answer.

The United States installed a record 11.7 gigawatts (GW) of new utility-scale clean power capacity in the third quarter of 2025, marking a 14% increase over the same period in 2024. The data comes from the American Clean Power Association’s (ACP) latest “Clean Power Quarterly Market Report”.Key highlights from the report:

- Total Capacity: The 11.7 GW of new capacity includes utility-scale solar, energy storage, and onshore wind projects.

- Storage Surge: Battery storage set a new Q3 record with 4.7 GW installed, ensuring 2025 is on pace to be the biggest year for clean power deployment yet.

- Solar & Wind: Solar accounted for a large portion of new installations, and land-based wind increased 131% over Q3 2024.

- Strong Year Overall: Year-to-date installations reached 30.9 GW, already surpassing the pace of the previous record-setting year of 2024.

Despite the strong performance, the report also warns of future risks due to policy and regulatory uncertainty. Leading indicators, such as power purchase agreements (PPAs), fell significantly year-over-year, which points to potential slowdowns ahead. The full report with underlying datasets is available to ACP members, while a public version can be accessed via the press release on their website.

Centrica Energy And Exodus Sign Landmark LNG Agreement

The title of this post, is the same as that of this press release from Centrica.

This is the sub-heading.

Centrica Energy has announced the signing of a long-term Sale and Purchase Agreement (SPA) to supply liquefied natural gas (LNG) to Exodus for Honduras, marking a new milestone in the country’s energy development.

These two paragraphs add more details.

Under the terms of the agreement, Centrica will deliver approximately six LNG cargoes per year to Exodus through a ship-to-ship operation into the Floating Storage Unit (FSU) Bilbao Knutsen, located in Puerto Cortes. The 15-year contract is expected to commence in 2026.

“This agreement reflects Centrica Energy’s commitment to expanding global LNG access through strategic partnerships,” said Arturo Gallego, Global Head of LNG at Centrica Energy. “By leveraging our global reach and operational expertise, we’re proud to support Exodus and Honduras in its journey toward a more sustainable and resilient energy future.”

It looks a good deal for Centrica, that has been snatched from under the American’s noses.

I also asked Google AI, if Honduras produced any natural gas and received this reply.

No, Honduras does not produce natural gas, but it is importing it through a new liquefied natural gas (LNG) agreement that begins in 2026. The country relies on imports to meet its energy needs, and this new deal aims to diversify its energy mix and provide cleaner energy for power generation.

That’s clear and it’s interesting that Honduras are looking to provide cleaner energy.

These two paragraphs from Centrica’s press release add details on power generation in Honduras.

The LNG will be transported to the Brassavola Combined Cycle Power Plant, an operating 150 MW thermal facility with its combined cycle under construction and set to reach 240 MW of power capacity, marking the first-ever import of natural gas for power generation in Honduras. This initiative represents a significant step toward diversifying the nation’s energy mix and reducing its reliance on less environmentally friendly fossil fuels.

Once operational, the FSU will serve as the backbone of LNG storage at a new terminal currently under construction on Honduras’ Caribbean coast. The project is designed to enhance energy security, improve generation efficiency, and support industrial growth.

This article on Riviera is entitled Honduras Turns To LNG To Meet Energy Needs and provides these points.

- Honduras is grappling with a 250 MW power shortage.

- Genesis Energías is spearheading efforts to introduce a reliable and cost-effective energy source by importing liquefied natural gas (LNG).

- Hyundai, who are one of Centrica’s partners in HiiROC, are converting the Bilbao Knutsen for its new role as a Floating Storage Unit (FSU).

It would certainly help Honduras’s economy, if they had more power generation.

I asked Google AI, if Honduras was developing offshore wind power and received this reply.

While Honduras has been actively developing onshore wind power for over a decade, there is currently no information to suggest it is developing offshore wind power projects. The country’s wind energy development has focused exclusively on land-based projects, with a number of operational farms and more in the pipeline.

I also asked Google AI if Honduras was developing solar power and received this reply.

Yes, Honduras is actively and significantly developing its solar power capacity as a cornerstone of its national energy strategy. The country has been a regional leader in solar energy penetration and continues to invest heavily in new projects to reduce its dependence on fossil fuels.

But, whether its offshore wind, onshore wind or solar power, these renewals will need backup and the 240 MW Brassavola Combined Cycle Power Plant, will be a good start.

I have some further thoughts.

Does HiiROC Have A Part To Play?

If would be good, if the 240 MW Brassavola Combined Cycle Power Plant could be zero-carbon, so that Honduras could be more zero-carbon.

Consider.

- Centrica own part of HiiROC, who can generate turquoise hydrogen efficiently from natural gas.

- Honduras will from 2026, have plenty of natural gas.

- In Hydrogen Milestone: UK’s First Hydrogen-to-Power Trial At Brigg Energy Park, I talked about how Centrica powered Brigg power station with a hydrogen blend.

- If the Brassavola Combined Cycle Power Plant was reasonably-modern like Brigg, I suspect it could be run on hydrogen or a hydrogen-blend.

- A reliable supply of hydrogen in Honduras would have its uses.

I wouldn’t be surprised to see a HiiROC plant in Honduras to help decarbonise the country.

HiiROC Creates A Lot Of Carbon Black

When a HiiROC system produces turquoise hydrogen, it produces carbon black as a by-product.

I asked Google AI, if Honduras has a use for carbon black, and received this reply.

Honduras likely has a use for carbon black because the material is a vital component in the production of many common industrial and consumer goods that are used globally. The primary applications are universal across most countries, including those in Central America.

But carbon black can also be used to improve poor agricultural land.

So I asked, Google AI, if Honduras has a lot of land to improve and received this reply.

Yes, Honduras has significant land to improve, but this is complicated by issues like deforestation, land degradation, and a lack of clear land rights for many communities. There is a need to balance economic activities like coffee plantations with conservation, improve sustainable agriculture practices, and address illegal land occupation.

It seems to me, that a sensible hollistic approach could use some of the carbon black.

I also believe, that there are many universities, who could advise Honduras on land restoration.

Does Highview Power Have A Part To Play?

Consider.

- Centrica are one of the backers of Highview Power, who are building their first two environmentally-friendly liquid air batteries in the UK.

- Their flagship battery is a 300 MW/3.2 GWh monster that can incorporate a stability island, that controls the grid.

- Highview Power’s batteries are zero-carbon, with a 40-50 year life.

As a Control Engineer, I believe that one of these batteries would be superb backup for the Brassavola Combined Cycle Power Plant and all those renewables.

Where Will Centrica Get Their LNG For Honduras?

I have already reported on two deals, where Centrica is purchasing LNG.

- Centrica Enters Into Long Term Natural Gas Sale & Purchase Agreement

- Centrica And PTT Sign Heads Of Agreement For Long-Term LNG Supply

I can expect more deals like this around the world.

Also, as the Grain LNG Terminal has the ability to export LNG could we be seeing UK natural gas being exported by Centrica to Honduras and the other countries hinted at in the PTT purchase?

Are Centrica Proposing A Comprehensive Solution To A Nation’s Power Problem?

It certainly looks like they are.

And Honduras would be getting a zero-carbon energy system.

This could be repeated all around the world.

Conclusion

This certainly looks like a good deal for Centrica, that can be repeated in other places.

Highview Surpasses Half A Billion Pounds Of Funding With Latest £130m Capital Raise For Phase One Of Long Duration Energy Storage Facility At Hunterston, Ayrshire

The title of this post, is the same as that of this news story from Highview Power.

Funding Round Enables Build Of “Stability Island” Which Will Deliver Crucial Grid Stability Services; Represents Phase One Of LDES Facility At Hunterston

These two paragraphs outline the funding raised and where it will initially be used.

Highview has secured £130 million in funding to commence work on the first stage of its planned 3.2GWh hybrid long-duration energy storage solution in Hunterston, Scotland. This brings the total raised to commercialise and roll out Highview’s long duration storage solutions to over £500 million.

This latest investment round, involving Scottish National Investment Bank (SNIB), the British multinational energy and services company Centrica, and investors including Goldman Sachs, KIRKBI and Mosaic Capital, will fund construction of the first phase of the Hunterston project, a “stability island”, which will provide system support to the electricity grid.

The Concept Of The Stability Island

This paragraph describes the concept of the Stability Island.This stability island is a key component of Highview’s LDES system. It can operate independently of the energy storage elements and will deliver critical inertia, short circuit and voltage support to the UK power grid. The asset will support the grid at a location that faces considerable stability challenges. In turn, this will enable more power to be transmitted from the point of generation in Scotland to areas of high demand, preventing curtailment of wind energy across Scotland

A large amount of energy will be routed through Hunterston from Scotland to England, Wales and the island of Ireland and the stability island will tightly control the flow of energy.

The Facility At Hunterston

These two paragraphs describe the facility at Hunterston.

As well as the stability island, the facility at Hunterston will also eventually incorporate a hybrid long duration energy storage system, combining both liquid air storage and lithium-ion batteries for greater operational performance. This means that the entire facility will be able to send more power to the grid for longer, in a flexible way, maximising the asset for the benefit of the system operator.

The energy storage element of the Hunterston facility received significant validation recently, when it was named as an eligible project for Ofgem’s Cap and Floor support scheme for long duration energy storage, along with a planned facility at Killingholme, Lincolnshire.

I suspect the Stability Island will actually distribute the energy to where it is needed.

Great Yarmouth Terminal Set For Redevelopment Under Port Of East Anglia Name

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

The UK’s Peel Ports Group has decided to invest a further GBP 10 million (approximately EUR 11.3 million) into its Great Yarmouth site, which is being rebranded as the Port of East Anglia.

These four paragraphs add details to the story.

The newly announced GBP 10 million brings this year’s total investment to GBP 70 million across the site and will be used to redevelop the port’s Northern Terminal, helping to accommodate the next generation of offshore wind projects across the region, according to Peel Ports.

Earlier this year, a substantial investment into its Southern Terminal was announced by the port, which has earmarked GBP 60 million to transform capacity and improve efficiencies.

This involves ensuring the port can support multiple hydrogen, carbon capture, offshore wind, and nuclear projects for decades to come.

Its existing terminals service a variety of construction customers, including infrastructure projects such as Sizewell C and offshore energy projects based in the southern North Sea.

Note.

- In Yarmouth Harbour To Be ‘Completed’ In £60m Project, I talk about the work to be done on the Southern Terminal.

- The work on the Southern Terminal includes a roll-on roll-off (RORO) lift ramp and a large storage area.

- Start on the work on the Southern Terminal will start in 2026.

With all the construction work mentioned in the last two paragraphs, I suspect that the Port of Great Yarmouth will be busy?

These are some further thoughts.

Why Is The Port Of Great Yarmouth Being Renamed?

The article says this.

The new name, which will come into effect in early 2026, also aligns with the creation of a new combined authority for Suffolk and Norfolk, according to Peel Ports.

Peel Ports name change is fairly sensible, but as I was conceived in Suffolk and I’m an Ipswich Town supporter, I don’t feel that the two counties should be merged.

Does The Mention Of Hydrogen Mean That The Port Of Great Yarmouth Will Be Hosting A Hydrogen Electrolyser, To Fuel Trucks And Ships?

I asked Google AI, “If A Hydrogen Electrolyser is To Be Built In The Port Of Great Yarmouth?”, and received this answer.

While there are no current public plans for an immediate construction of a large-scale hydrogen electrolyser within the Port of Great Yarmouth, significant port expansion and infrastructure upgrades are underway to ensure it can support future hydrogen projects and related clean energy initiatives.

Note.

- If technology to handle hydrogen, is copied from North Sea gas, there is certainly a lot of proven technology that can be used again.

- There may even be depleted gas fields, where captured carbon dioxide, hydrogen or North Sea gas can be stored.

I find the most exciting thing, would be to send hydrogen to Germany.

Why Would Anybody Export Hydrogen To Germany?

I asked Google AI, the question in the title of this section and received this answer.

Countries would export hydrogen to Germany because Germany has a large, growing demand for hydrogen to power its heavily industrialised economy and achieve its decarbonisation goals, but lacks sufficient domestic renewable energy capacity to produce the required amounts.

Germany also, uses a lot of bloodstained Russian gas and indigenous polluting coal.

How Could Anybody Export Hydrogen To Germany?

- Wilhelmshaven is one of the main import ports for hydrogen in North West Germany.

- Great Yarmouth is probably the closest larger port to Germany.

- Great Yarmouth and Wilhelmshaven are probably about 300 miles apart, by the shortest route.

- Great Yarmouth would need to build infrastructure to export hydrogen.

The easiest way to transport the hydrogen from Great Yarmouth to Wilhelmshaven, is probably to use a gas tanker built especially for the route.

This Google Map shows the route between Great Yarmouth and Wilhelmshaven.

Note.

- The North-East corner of East Anglia with Great Yarmouth to the North of Lowestoft, is in the bottom-left corner of the map.

- Wilhelmshaven is a few miles inland in the top-right corner of the map.

- Could a coastal tanker go along the Dutch and German coasts to Wilhelmshaven?

I have no skills in boats, but would Great Yarmouth to Wilhelmshaven to take hydrogen to Germany?

RWE Are Developing Three Wind Farms To The North-East of Great Yarmouth

RWE are a large German Electricity company and the UK’s largest generator of electricity.

The company is developing three wind farms to the North-East of Great Yarmouth.

- Norfolk Boreas – 1.2 GW – 45 miles offshore

- Norfolk Vanguard West – 1.2 GW – 29 miles offshore

- Norfolk Vanguard East – 1.2 GW – 28 miles offshore

Note.

- The electricity for all three wind farms is to be brought ashore at Happisburgh South, which is about 22 miles North of Great Yarmouth.

- The original plan was to take the electricity halfway across Norfolk to the Necton substation to connect to the grid.

- The natives will not be happy about a 4.2 GW overhead line between Happisburgh and Necton.

- RWE have built offshore electrolysers before in German waters.

- Could an electrical cable or a hydrogen pipe be laid in the sea between Happisburgh South and the Port of Great Yarmouth?

- The electrolyser could either be offshore at Happisburgh or onshore in the Port of Great Yarmouth.

As I don’t suspect these three wind farms will be the last connected to the Port of Great Yarmouth, I would expect that RWE will put the electrolyser offshore at Happisburgh and connect it by a hydrogen pipeline to the Port of Great Yarmouth.

Could There Be A Connection To The Bacton Gas Terminal?

Consider.

The Bacton Gas Terminal, which feeds gas into the UK Gas Network, is only 4.2 miles up the coast from Happisburgh South.

Some climate scientists advocate blending hydrogen into the gas supply to reduce carbon emissions.

In Better Than A Kick In The Teeth – As C Would Say!, I disclosed that I now have a new hydrogen-ready boiler, so I’m not bothered, if I get changed to a hydrogen blend.

So could hydrogen from the Norfolk wind farms be fed into the grid to reduce carbon emissions?

Could The Port Of Great Yarmouth Become A Hydrogen Distribution Centre?

Thinking about it, the port could also become a distribution centre for green hydrogen.

Consider.

- Hydrogen-powered ships, tugs and workboats could be refuelled.

- Hydrogen-powered trucks could also be refuelled.

- Tanker-trucks could distribute hydrogen, to truck and bus operators, farms and factories, that need it for their transport and operations.

- I believe, that construction equipment will be increasingly hydrogen-powered.

In my life, I have lived at times in two country houses, that were heated by propane and there are about 200,000 off-grid houses in the UK, that are heated this way.

The two houses, where I lived would have been a nightmare to convert to heat pumps, but it would have been very easy to convert them to a hydrogen boiler and power it from a tank in the garden.

It should be noted, that the new boiler in my house in London is hydrogen-ready.

So the Port of Great Yarmouth could be the major centre for hydrogen distribution in Norfolk.

In the 1960s, I used to work in ICI’s hydrogen plant at Runcorn. If you ride in a hydrogen bus in England, it is likely that the hydrogen came from the same plant. Handled correctly, hydrogen is no less safe and reliable than natural gas or propane.

UK’s Largest Solar Plant Cleve Hill Supplying Full Power To The Grid

The title of this post, is the same as that of this article on the Solar Power Portal.

This is the sub-heading.

Quinbrook Infrastructure Partners has completed construction and started commercial operations of the 373MW Cleve Hill Solar Park, now the largest operational in the UK.

Note.

- According to Quinbrook, during the commissioning phase in May, electricity exports from Cleve Hill peaked at a level equivalent to 0.7% of the UK’s national power demand.

- Construction of the 373 MW solar project began in 2023, and Quinbrook said construction is now underway on a 150 MW co-located battery energy storage system (BESS).

- The gas-fired power stations at Coolkeeragh, Corby, Enfield, Great Yarmouth and Shoreham are all around 410-420 MW for comparison.

- On completion of the BESS, Cleve Hill will go from the largest solar plant in the UK to the largest co-located solar plus storage project constructed in the UK.

- The solar and storage plant was the first solar power project to be consented as a nationally significant infrastructure project (NSIP) and is supported by the largest solar + BESS project financing undertaken in the UK.

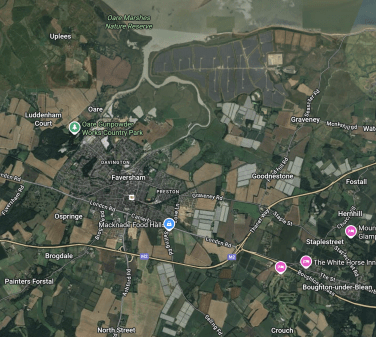

This Google Map shows the location of the solar farm with respect to Faversham.

Note.

The town of Faversham to the left of the middle of the map.

Faversham station has the usual railway station logo.

The North Kent coast is at the top of the map.

Cleve Hill Solar Park is on the coast to the East of the River Swale.

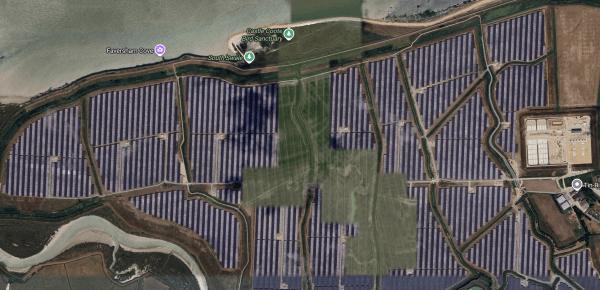

This second Google Map shows a close up of the solar farm.

Note.

- The large number of solar panels.

- The North Kent coast is at the top of the map.

- The River Swale in the South-West corner of the map.

- It appears that Cleve Hill substation is at the right edge of the map.

- The boxes at the left of the substation appear to be the batteries.

- The 630 MW London Array wind farm, which has been operational since 2013, also connects to the grid at Cleeve Hill substation.

- When completed, the London Array was the largest offshore wind farm in the world.

As a Control Engineer, I do like these Battery+Solar+Wind power stations, as they probably provide at least a reliable 500 MW electricity supply.

Could A System Like Cleeve Hill Solar Park Replace A 410 MW Gas-Fired Power Station?

The three elements of Cleeve Hill are as follows.

- Solar Farm – 373 MW

- BESS – 150 MW

- Wind Farm – 630 MW

That is a total of only 1,153 MW, which means a capacity factor of only 35.6 % would be needed.

How Much Power Does A Large Solar Roof Generate?

Some people don’t like solar panels on farmland, so how much energy do solar panels on a warehouse roof generate?

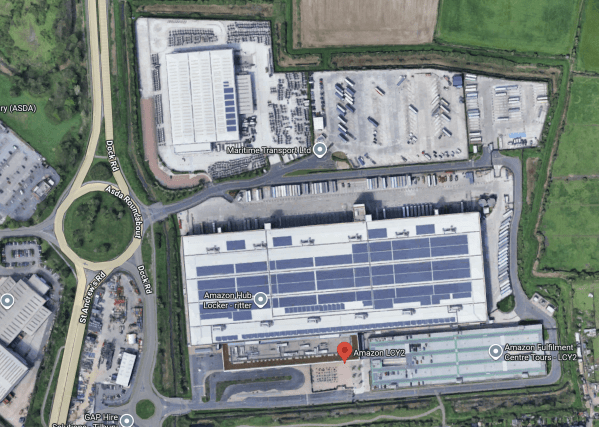

This Google Map shows Amazon’s warehouse at Tilbury.

I asked Google AI to tell me about Amazon’s solar roof at Tilbury and it said this.

Amazon’s solar roof at the Tilbury fulfillment center is the largest rooftop solar installation at any Amazon site in Europe, featuring 11,500 panels across the two-million-square-foot roof. Unveiled in 2020, it is part of Amazon’s larger goal to power its operations with 100% renewable energy by 2025 and reduce its emissions, contributing to its Climate Pledge to be net-zero carbon by 2040.

It generates 3.4 MW, which is less that one percent of Cleeve Hill Solar Park.

The Thoughts Of Chris O’Shea

This article on This Is Money is entitled Centrica boss has bold plans to back British energy projects – but will strategy pay off?.

The article is basically an interview with a reporter and gives O’Shea’s opinions on various topics.

Chris O’Shea is CEO of Centrica and his Wikipedia entry gives more details.

These are his thoughts.

On Investing In Sizewell C

This is a paragraph from the article.

‘Sizewell C will probably run for 100 years,’ O’Shea says. ‘The person who will take the last electron it produces has probably not been born. We are very happy to be the UK’s largest strategic investor.’

Note.

- The paragraph shows a bold attitude.

- I also lived near Sizewell, when Sizewell B was built and the general feeling locally was that the new nuclear station was good for the area.

- It has now been running for thirty years and should be good for another ten.

Both nuclear power stations at Sizewell have had a good safety record. Could this be in part, because of the heavy engineering tradition of the Leiston area?

On Investing In UK Energy Infrastructure

This is a paragraph from the article

‘I just thought: sustainable carbon-free electricity in a country that needs electricity – and we import 20 per cent of ours – why would we look to sell nuclear?’ Backing nuclear power is part of O’Shea’s wider strategy to invest in UK energy infrastructure.

The UK certainly needs investors in UK energy infrastructure.

On Government Support For Sizewell C

This is a paragraph from the article.

Centrica’s 500,000 shareholders include an army of private investors, many of whom came on board during the ‘Tell Sid’ privatisations of the 1980s and all of whom will be hoping he is right. What about the risks that deterred his predecessors? O’Shea argues he will achieve reliable returns thanks to a Government-backed financial model that enables the company to recover capital ploughed into Sizewell C and make a set return.

I have worked with some very innovative accountants and bankers in the past fifty years, including an ex-Chief Accountant of Vickers and usually if there’s a will, there’s a solution to the trickiest of financial problems.

On LNG

These are two paragraphs from the article.

Major moves include a £200 million stake in the LNG terminal at Isle of Grain in Kent.

The belief is that LNG, which produces significantly fewer greenhouse gas emissions than other fossil fuels and is easier and cheaper to transport and store, will be a major source of energy for the UK in the coming years.

Note.

- Centrica are major suppliers of gas-powered Combined Heat and Power units were the carbon dioxide is captured and either used or sold profitably.

- In at least one case, a CHP unit is used to heat a large greenhouse and the carbon dioxide is fed to the plants.

- In another, a the gas-fired Redditch power station, the food-grade carbon dioxide is sold to the food and construction industries.

- Grain LNG Terminal can also export gas and is only a short sea crossing from gas-hungry Germany.

- According to this Centrica press release, Centrica will run low-carbon bunkering services from the Grain LNG Terminal.

I analyse the investment in Grain LNG Terminal in Investment in Grain LNG.

On Rough Gas Storage

These are three paragraphs from the article.

O’Shea remains hopeful for plans to develop the Rough gas storage facility in the North Sea, which he re-opened in 2022.

The idea is that Centrica will invest £2 billion to ‘create the biggest gas storage facility in the world’, along with up to 5,000 jobs.

It could be used to store hydrogen, touted as a major energy source of the future, provided the Government comes up with a supportive regulatory framework as it has for Sizewell.

The German AquaVentus project aims to bring at least 100 GW of green hydrogen to mainland Germany from the North Sea.

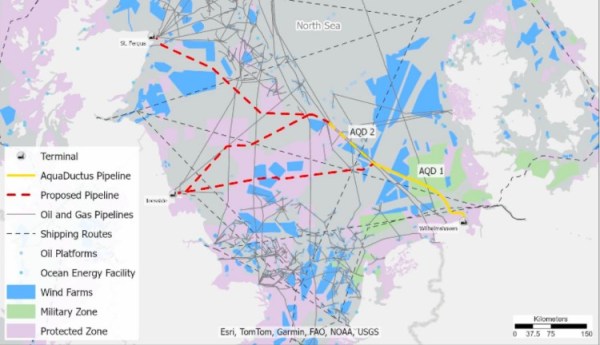

This map of the North Sea, which I downloaded from the Hydrogen Scotland web site, shows the co-operation between Hydrogen Scotland and AquaVentus

Note.

- The yellow AquaDuctus pipeline connected to the German coast near Wilhelmshaven.

- There appear to be two AquaDuctus sections ; AQD 1 and AQD 2.

- There are appear to be three proposed pipelines, which are shown in a dotted red, that connect the UK to AquaDuctus.

- The Northern proposed pipeline appears to connect to the St. Fergus gas terminal on the North-East tip of Scotland.

- The two Southern proposed pipelines appear to connect to the Easington gas terminal in East Yorkshire.

- Easington gas terminal is within easy reach of the massive gas stores, which are being converted to store hydrogen at Aldbrough and Rough.

- The blue areas are offshore wind farms.

- The blue area straddling the Southernmost proposed pipe line is the Dogger Bank wind farm, is the world’s largest offshore wind farm and could eventually total over 6 GW.

- RWE are developing 7.2 GW of wind farms between Dogger Bank and Norfolk in UK waters, which could generate hydrogen for AquaDuctus.

This cooperation seems to be getting the hydrogen Germany needs to its industry.

It should be noted, that Germany has no sizeable hydrogen stores, but the AquaVentus system gives them access to SSE’s Aldbrough and Centrica’s Rough hydrogen stores.

So will the two hydrogen stores be storing hydrogen for both the UK and Germany?

Storing hydrogen and selling it to the country with the highest need could be a nice little earner.

On X-energy

These are three paragraphs from the article.

He is also backing a £10 billion plan to build the UK’s first advanced modular reactors in a partnership with X-energy of the US.

The project is taking place in Hartlepool, in County Durham, where the existing nuclear power station is due to reach the end of its life in 2028.

As is the nature of these projects, it involves risks around technology, regulation and finance, though the potential rewards are significant. Among them is the prospect of 2,500 jobs in the town, where unemployment is high.

Note.

- This is another bold deal.

- I wrote in detail about this deal in Centrica And X-energy Agree To Deploy UK’s First Advanced Modular Reactors.

- Jobs are mentioned in the This is Money article for the second time.

I also think, if it works to replace the Hartlepool nuclear power station, then it can be used to replace other decommissioned nuclear power stations.

On Getting Your First Job

These are three paragraphs from the article.

His career got off to a slow start when he struggled to secure a training contract with an accountancy firm after leaving Glasgow University.

‘I had about 30, 40 rejection letters. I remember the stress of not having a job when everyone else did – you just feel different,’ he says.

He feels it is ‘a duty’ for bosses to try to give young people a start.

I very much agree with that. I would very much be a hypocrite, if I didn’t, as I was given good starts by two companies.

On Apprenticeships

This is a paragraph from the article.

‘We are committed to creating one new apprenticeship for every day of this decade,’ he points out, sounding genuinely proud.

I very much agree with that. My father only had a small printing business, but he was proud of the apprentices he’d trained.

On Innovation

Centrica have backed three innovative ideas.

- heata, which is a distributed data centre in your hot water tank, which uses the waste heat to give you hot water.

- HiiROC, which is an innovative way to generate affordable hydrogen efficiently.

- Highview Power, which stores energy as liquid air.

I’m surprised that backing innovations like these was not mentioned.

Conclusion

This article is very much a must read.

Ørsted Raises EUR 7.98 Billion In Oversubscribed Rights Issue

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Ørsted has completed its rights issue, raising DKK 59.56 billion (approximately EUR 7.98 billion) with a subscription rate of approximately 99.3 per cent, the company said on 6 October.

These two introductory paragraphs add more details.

Existing shareholders were offered new shares at DKK 66.60 (EUR 8.92) each. The demand for shares not taken up via the rights issue was “extraordinarily high,” according to the developer’s announcement of the Rights Issue results, and allocations were capped per application, meaning no subscriptions were required under the underwriting bank syndicate.

As reported in August, the company appointed a syndicate of BNP PARIBAS, Danske Bank A/S and J.P. Morgan SE as Joint Global Coordinators, next to Morgan Stanley & Co International, to jointly underwrite the rights issue for the approximately 49.9 per cent that would not be subscribed to by Ørsted’s majority shareholder, the Danish state (50.1 per cent).

I dread to think what spiteful punishment that Trumpkopf will inflict on Ørsted.

But the oversubscribed Rights Issue may be good news for the UK.

Ørsted has only one major project under development or construction in the UK.

But it is the large Hornsea Three wind farm, which has this opening paragraph on its web site.

Hornsea 3 Offshore Wind Farm will deliver enough green energy to power more than 3 million UK homes. An £8.5 billion infrastructure project, Hornsea 3 will make a significant contribution toward UK energy security, as well as the local and national economy.

Note.

- Ørsted are raising £7.98 billion and spending £8.5 billion, which must do something for the UK’s economy.

- Hornsea 3 will have a generating capacity of 2.9 GW.

- Ørsted are now delivering the world’s single largest offshore wind farm.

- Hornsea 3 will connect to the National Grid at Swardestone in Norfolk.

In Grid Powers Up With One Of Europe’s Biggest Battery Storage Sites, I describe how the 300 MW/600 MWh Swardestone BESS will be built, where Hornsea 3 connects to the grid.

As Swardestone will have 2.9 GW from Hornsea 3 and a powerful battery, I would expect someone will be looking to site a data centre or something with a need for a lot of stable electricity at or near Swardestone.

In Opportunity For Communities To Have Their Say On National Grid Proposals For Norwich To Tilbury Project, I talk about a line of pylons between Swardestone and Tilbury and show this map of the route.

This page on the National Grid web site has an interactive version of this map.

Note.

- The mauve line indicates the route of the Norwich to Tilbury project.

- Swardestone is at the Northern end of the project a few miles South of Norwich.

- Tilbury is at the Southern end of the project on the Thames estuary.

- The project connects Norwich, Ipswich, Colchester and Chelmsford to Hornsea 3 at Swardestone.

- I suspect the project will connect to Ipswich at the Bramford substation.

- The Sizewell nuclear site is to the North-East of Woodbridge and connects to the grid at the Bramford substation.

I know East Anglia well and I would suspect that Norwich, Ipswich, Colchester, Chelmsford and Southend-on-Sea could support one or more data centres.

Conclusion

I asked Google AI, who owns Hornsea 1 and received this reply.

Hornsea 1 is owned by a partnership including Ørsted, Equitix, TRIG, GLIL, Octopus, and Brookfield, with Ørsted also providing the operational management. A 2018 agreement between Ørsted and Global Infrastructure Partners (GIP) originally established the 50/50 joint venture for the project.

I then asked Google AI, who owns Hornsea 2 and received this reply.

The ownership of the Hornsea 2 wind farm is shared between several entities, including a 37.55% stake held by Ørsted, a 25% stake each by AXA IM Alts and Crédit Agricole Assurances, and a 12.45% stake held by Brookfield. The wind farm is located offshore in the UK’s North Sea, approximately 89 km off the Yorkshire coast.

In November 2019, I also wrote World’s Largest Wind Farm Attracts Huge Backing From Insurance Giant.

It does seem to me that Ørsted are past masters of developing a wind farm, then selling it on and using that money to develop the next wind farm.

The Rights Issue just makes that process easier.