SeaTwirl AB Signs Agreement To Explore Ehe Feasibility Of Electrification Of Aquaculture In Chile

The title of this post, is the same, as that of this press release from SeaTwirl.

This is the sub-heading.

SeaTwirl AB has entered into an agreement to carry out a feasibility study for electrification of fish farms together with a global industrial supplier. The intention of the collaboration is to assess the use of SeaTwirl’s floating vertical-axis wind turbines to provide renewable electricity to offshore-based equipment at aquaculture assets in Chile.

These three paragraphs add more details.

The feasibility study will cover a comprehensive scope, including energy demand and power system requirements, environmental site conditions, cost assessments, supply chain opportunities, and logistics in Chilean waters with the intention to reduce dependence on diesel. The study is expected to be completed during 2026, and the results will help determine next steps.

Chile is home to one of the largest aquaculture industries in the world, and the sector is pursuing ambitious sustainability goals including lower emissions, increased use of renewable power and reduced risk of spills. While the contractual value of the agreement is limited, at approximately SEK 0,8 million, the engagement will generate revenue and represent an important step in SeaTwirl’s commercialization effort.

“This collaboration marks an exciting step towards our purpose to enable floating wind power wherever it is needed, and to expand the use of floating wind technology beyond traditional grid-connected applications. The aquaculture industry has a clear need for offshore renewable energy, and we believe our technology can deliver a robust and cost-effective solution. It is also a major milestone to become involved in the southern hemisphere where many of the challenges we try to address, such as limited availability of cranes, vessels, and yard infrastructure, may be more challenging than in the north. We see significant potential in the aquaculture segment and look forward to beginning this journey in South America”, says Johan Sandberg, CEO of SeaTwirl.

I do find it strange, that the two vertical wind turbines, that both seem to be more than prototypes are both Scandinavian.

The Ventum Dynamics turbine, that I talked about in Are These Turbines An Alternative To Solar Panels? is Norwegian and this one is installed on Skegness Pier.

IKEA could sell these for DIY-enthusiasts to assemble and erect. On my stud, I used to have a barn, that could certainly have taken two of these 1.5 KW VX175 turbines.

This link is video of a dancing and swimming SeaTwirl.

If you follow, the SeaTwirl video to its conclusion, you’ll see one being erected in the sea. I can assure you that in the 1970s, my 25-year-old self, did the calculations for a reusable oil production platform called a Balaena, which erected on the same principle. So, I’m fairly certain, that SeaTwirls can be an alternative to traditional wind turbines.

Does Nuclear Power Not Sell Newspapers?

Five days ago, In Rolls-Royce SMR Advances To Final Stage In Swedish Nuclear Competition, I wrote about Rolls-Royce being one of two successful bids to advance to the ext stage to build Small Modular Reactors for Vatenfall in Sweden.

Since then, Rolls-Royce’s Swedish success has not featured in any newspaper in the UK, not even the Financial Times.

I can only assume, that good news stories about nuclear power, don’t sell newspapers.

Rolls-Royce SMR Advances To Final Stage In Swedish Nuclear Competition

The title of this post, is the same as that of this press release from Rolls-Royce.

This is the sub-heading.

Rolls-Royce SMR has been selected by Vattenfall as one of only two companies to reach the final stage in the process to identify Sweden’s nuclear technology partner.

These are the first two paragraphs, which add details.

After being shortlisted in 2024, Rolls-Royce SMR has progressed through a detailed assessment and will now work with Vattenfall through the final technology selection which could initially result in Rolls-Royce SMR delivering three SMRs.

This positive news is testament to Rolls-Royce SMR’s transformative approach to delivering proven nuclear technology in an innovative way through modularisation and builds on our successful selection in both the United Kingdom and Czech Republic.

Some other points from the press release.

- Sweden is initially looking to build three SMRs.

- Each SMR will supply 470MWe of clean low-carbon electricity.

- They are expected to have a lifetime of sixty years. Sizewell B was originally expected to have a lifetime of forty years, but appears to be being extended to sixty years, so I will accept Rolls-Royce’s expected lifetime.

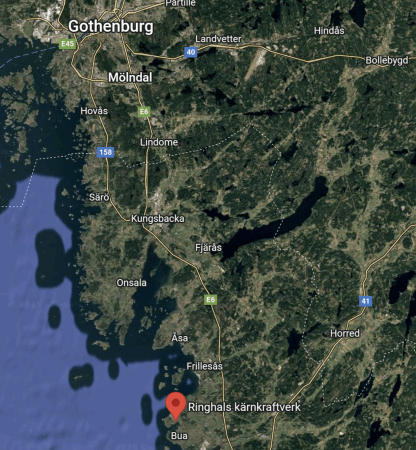

- The first units will be at the Ringhals site on the Värö Peninsula, where there is an existing nuclear power station.

This Google Map shows the Ringhals site in relation to Gothenburg.

The site is marked by the red arrow.

On taking a closer look, it appears to be a site with expansion possibilities.

The British Media Don’t Seem Very Interested

It is now the 31st of August and the only paper to report the story has been the Financial Times.

Heart Aerospace Relocates Corporate Headquarters To Los Angeles, California

The title of this post, is the same as that of this news item from Heart Aerospace.

This is the sub-heading.

Hybrid-electric airplane manufacturer Heart Aerospace has announced the relocation of its corporate headquarters from Gothenburg, Sweden to Los Angeles, California. This strategic move aims to bolster the company’s product development in the United States, supporting the upcoming experimental flights of its Heart X1 prototype and the future Heart X2 prototype.

These two introductory paragraphs add ,ore detail.

Scheduled for its maiden flight in 2025, the X1 marks a major milestone in Heart’s innovation journey, setting the stage for X2.

“Our move to Los Angeles marks a new chapter in Heart Aerospace’s journey—one that prioritizes iterative development and deeper vertical integration,” said Anders Forslund, co-founder and CEO of Heart Aerospace. “For the X2, we’re developing key technologies like batteries, actuation systems, software, and hybrid-electric hardware in-house. This approach allows us to refine and enhance our systems continuously, just as we’ve done with the X1 prototype, which has seen extensive testing and major design updates since its initial rollout in 2024.”

In some ways, I find this move to California slightly sad, as I suspect most of those associated with the airliner, would have liked to see the development stay in Sweden.

This paragraph gives more details on the reasons for the move.

“We are deeply grateful to our team in Sweden for being part of this chapter of Heart’s journey, and for all the support we have received in Sweden,” said Anders Forslund. “However, as our customers, partners, and investors are increasingly based in the U.S, we see greater opportunity in focusing our resources here. By consolidating our operations in Los Angeles, we can accelerate development, strengthen collaboration, and better position Heart Aerospace for the future.”

They are not mentioned, but I do hope, Trump’s tariffs have nothing to do with it.

The Odd Sugary Snack May Be Good For You (But Lay Off Sugary Drinks)

The title of this post, is the same as that of this article in The Tunes.

I shall be discussing this research with my cardiologist. My relationship with him is as doctor/patient, researcher/lab-rat and just friends. I am also coeliac and very much feel that I need to take the odd sugary snack to keep my energy levels up. I also had a serious stroke at 64, thirteen years ago, due to atrial fibrillation.

Sweden and coeliac disease could be another complicating factor here, as Sweden went the wrong way to try to eliminate coeliac disease after WW2 and just created a lot more.

I found about this Swedish research in a peer-reviewed paper entitled Coeliac Disease: Can We Avert The Impending Epidemic In India? in the Indian Journal of Research Medicine.

A History Of Sugary Snacks And Drinks And Me

Growing up in London, after World War 2, I didn’t get much sugar, as it was rationed.

But I did put it in tea and coffee.

I never ate many cakes, except for some chocolate ones.

My habit of not eating cakes and proper puddings really annoyed my mother-in-law.

I was a sickly child and I didn’t really get better until I was found to be coeliac at 50.

I am fairly certain, that my consumption of sugary snacks has got more, as I’ve got older.

But because American drinks, sweets and snacks could use sugar made from wheat, I don’t touch any American sweetened products.

But I haven’t put on any weight, since I was fifty.

Thanks to the likes of Leon, Marks and Spencer and the cafe at Worksop station for excellent sugary gluten-free snacks to keep me going!

RWE And the Norfolk Wind Farms

In March 2024, I wrote RWE And Vattenfall Complete Multi-Gigawatt Offshore Wind Transaction In UK, which described how Vattenfall had sold 4.2 GW of offshore wind farms, situated off North-East Norfolk to RWE.

This map from RWE shows the wind farms.

Note.

- The Norfolk Zone consists of three wind farms; Norfolk Vanguard West, Norfolk Boreas and Norfolk Vanguard East.

- The three wind farms are 1.4 GW fixed-foundation wind farms.

- In Vattenfall Selects Norfolk Offshore Wind Zone O&M Base, I describe how the Port of Great Yarmouth had been selected as the O & M base.

- Great Yarmouth and nearby Lowestoft are both ports, with a long history of supporting shipbuilding and offshore engineering.

The wind farms and the operational port are all close together, which probably makes things convenient.

So why did Vattenfall sell the development rights of the three wind farms to RWE?

Too Much Wind?

East Anglia is fringed with wind farms all the way between the Wash and the Thames Estuary.

- Lincs – 270 MW

- Lynn and Inner Dowsing – 194 MW

- Race Bank – 580 MW

- Triton Knoll – 857 MW

- Sheringham Shoal – 317 MW

- Dudgeon – 402 MW

- Hornsea 3 – 2852 MW *

- Scroby Sands – 60 MW

- East Anglia One North – 800 MW *

- East Anglia Two – 900 MW *

- East Anglia Three – 1372 MW *

- Greater Gabbard – 504 MW

- Galloper – 353 MW

- Five Estuaries – 353 MW *

- North Falls – 504 MW *

- Gunfleet Sands – 172 MW

- London Array – 630 MW

Note.

- Wind farms marked with an * are under development or under construction.

- There is 4339 MW of operational wind farms between the Wash and the Thames Estuary.

- An extra 6781 MW is also under development.

If all goes well, East Anglia will have over 11 GW of operational wind farms or over 15 GW, if the three Norfolk wind farms are built.

East Anglia is noted more for its agriculture and not for its heavy industries consuming large amounts of electricity, so did Vattenfall decide, that there would be difficulties selling the electricity?

East Anglia’s Nimbies

East Anglia’s Nimbies seem to have started a campaign against new overground cables and all these new wind farms will need a large capacity increase between the main substations of the National Grid and the coast.

So did the extra costs of burying the cable make Vattenfall think twice about developing these wind farms?

East Anglia and Kent’s Interconnectors

East Anglia and Kent already has several interconnectors to Europe

- Viking Link – Bicker Fen and Jutland – 1.4 GW

- LionLink – Suffolk and the Netherlands – 1.8 GW – In Planning

- Nautilus – Suffolk or Isle of Grain and Belgium – 1.4 GW – In Planning

- BritNed – Isle of Grain and Maasvlakte – 1.0 GW

- NeuConnect – Isle of Grain and Wilhelmshaven – 1.4 GW – Under Construction

- GridLink Interconnector – Kingsnorth and Warande – 1.4 GW – Proposed

- HVDC Cross-Channel – Sellinge and Bonningues-lès-Calais – 2.0 GW

- ElecLink – Folkestone and Peuplingues – 1.0 GW

- Nemo Link – Richborough and Zeebrugge – 1.0 GW

Note.

- Five interconnectors with a capacity of 6.4 GW.

- A further four interconnectors with a capacity of 6 GW are on their way.

At 12.4 GW, the future capacity of the interconnectors between South-East England and Europe, is nor far short of South-East English wind power.

There are also two gas pipelines from the Bacton gas terminal between Cromer and Great Yarmouth to Europe.

The Wikipedia entry for the Bacton gas terminal gives these descriptions of the two gas pipelines.

Interconnector UK – This can import gas from, or export gas to, Zeebrugge, Belgium via a 235 km pipeline operating at up to 147 bar. There is a 30-inch direct access line from the SEAL pipeline. The Interconnector was commissioned in 1998.

BBL (Bacton–Balgzand line) – This receives gas from the compressor station in Anna Paulowna in the Netherlands. The BBL Pipeline is 235 km long and was commissioned in December 2006.

It would appear that East Anglia and Kent are well connected to the Benelux countries, with both electricity and gas links, but with the exception of the Viking Link, there is no connection to the Scandinavian countries.

Did this lack of connection to Sweden make convincing the Swedish government, reluctant to support Vattenfall in their plans?

Bringing The Energy From The Norfolk Wind Farms To Market

It looks to me, that distributing up to 4.2 GW from the Norfolk wind farms will not be a simple exercise.

- Other wind farms like the 2852 MW Hornsea 3 wind farm, may need a grid connection on the North Norfolk coast.

- The Nimbies will not like a South-Western route to the National Grid at the West of Norwich.

- An interconnector to Denmark or Germany from North Norfolk would probably help.

But at least there are two gas pipelines to Belgium and the Netherlands.

RWE, who now own the rights to the Norfolk wind farms, have a large amount of interests in the UK.

- RWE are the largest power producer in the UK.

- They supply 15 % of UK electricity.

- They have interest in twelve offshore wind farms in the UK. When fully-developed, they will have a capacity of almost 12 GW.

- RWE are developing the Pembroke Net Zero Centre, which includes a hydrogen electrolyser.

RWE expects to invest up to £15 billion in the UK by 2030 in new and existing green technologies and infrastructure as part of this.

Could this be RWE’s plan?

As the Norfolk wind farms are badly placed to provide electricity to the UK grid could RWE have decided to use the three Norfolk wind farms to produce hydrogen instead.

- The electrolyser could be placed onshore or offshore.

- If placed onshore, it could be placed near to the Bacton gas terminal.

- There are even depleted gas fields, where hydrogen could be stored.

How will the hydrogen be distributed and/or used?

It could be delivered by tanker ship or tanker truck to anyone who needs it.

In Developing A Rural Hydrogen Network, I describe how a rural hydrogen network could be developed, that decarbonises the countryside.

There are three major gas pipelines leading away from the Bacton gas terminal.

- The connection to the UK gas network.

- Interconnector UK to Belgium.

- BBL to The Netherlands.

These pipelines could be used to distribute hydrogen as a hydrogen blend with natural gas.

In UK – Hydrogen To Be Added To Britain’s Gas Supply By 2025, I describe the effects of adding hydrogen to the UK’s natural gas network.

SeaTwirl And Verlume Join Forces To Drive Decarbonisation Of Offshore Assets

The title of this post, is the same as that of this article on offshoreWIND.biz.

This is the sub-heading.

Swedish energy-tech company SeaTwirl and UK-based energy management and energy storage firm Verlume have signed a memorandum of understanding (MoU) to collaborate on the electrification of offshore assets and decarbonisation of the oil and gas industry.

This is the first two paragraphs.

The MoU will see the two companies identify and pursue potential opportunities for decarbonisation of offshore oil and gas and other associated offshore electrification opportunities using renewable energy, seabed-based energy storage, and intelligent energy management.

SeaTwirl and Verlume plan to develop systems for commercial sale, using combined technologies.

Note.

- This YouTube video introduces SeaTwirl.

- This YouTube video introduces Verlume.

This could be an MoU made in engineering heaven.

Verlume And Wave Power

The last two paragraphs of the article describe another project involving Verlume.

Aberdeen’s intelligent energy management specialists Verlume has developed a GBP 2 million (approximately USD 2.5 million) project linking the Blue X wave energy converter constructed by Mocean Energy with a Halo underwater battery storage system.

The industry-supported project, situated five kilometres east of Orkney Mainland, demonstrates the integration of green technologies to deliver consistent and sustainable low-carbon power and communication to subsea equipment.

Could Verlume, be the missing link that wave power needs?

H2 Green Steel Raises More Than €4 billion In Debt Financing For The World’s First Large-Scale Green Steel Plant

The title of this post, is the same as that of this press release from H2 Green Steel.

This is the sub-heading.

H2 Green Steel signs definitive debt financing agreements for €4.2 billion in project financing and increases the previously announced equity raised by €300 million. Total equity funding to date amounts to €2.1 billion. The company has also been awarded a €250 million grant from the EU Innovation Fund. H2 Green Steel has now secured funding of close to €6.5 billion for the world’s first large-scale green steel plant in Northern Sweden.

These three paragraphs describe the company and outlines the financing.

H2 Green Steel is driving one of the largest climate impact initiatives globally. The company was founded in 2020 with the purpose to decarbonize hard-to-abate industries, starting by producing steel with up to 95% lower CO2 emissions than steel made with coke-fired blast furnaces. The construction of the flagship green steel plant in Boden, with integrated green hydrogen and green iron production, is well under way. The supply contracts for the hydrogen-, iron- and steel equipment are in place. A large portion of the electricity needed has been secured in long-term power purchase agreements, and half of the initial yearly volumes of 2.5 million tonnes of near zero steel have been sold in binding five- to seven-year customer agreements.

Today H2 Green Steel announces a massive milestone on its journey to accelerate the decarbonization of the steel industry, which is still one of the world’s dirtiest. The company has signed debt financing of €4.2 billion, added equity of close to €300 million and been awarded a €250 million grant from the Innovation Fund. Funding amounts to €6.5 billion in total.

H2 Green Steel has signed definitive financing documentation for €3.5 billion in senior debt and an up-to-€600 million junior debt facility:

Note.

- I first wrote about H2 Green Steel about three years ago in Green Hydrogen To Power First Zero Carbon Steel Plant.

- The Wikipedia entry for Boden in Northern Sweden, indicates it’s a coldish place to live.

- In that original post, H2 Green Steel said they needed €2.5 billion of investment, but now they’ve raised €4 billion, which is a 60 % increase in financing costs in just three years.

Is this Sweden’s HS2?

The Future Of Green Steelmaking

The finances of H2 Green Steel look distinctly marginal.

I have a feeling that green steel, as the technology now stands is an impossible dream.

But I do believe that perhaps in five or ten years, that an affordable zero carbon method of steel production will be developed.

You have to remember, Pilkington developed float glass in the 1950s and completely changed an industry. Today, we’d call that a classic example of disruptive innovation.

The same opportunity exists in steelmaking. And the rewards would be counted in billions.

Beware Beaver At Work!

Some years ago, I went on a wildlife tour of Sweden, called Sweden’s Mammals.

The company; Wild Sweden, have just sent me this YouTube video.

Enjoy!