£1.5 billion Enables UK-US Pair To Get Their Hands On Europe’s Giant LNG Terminal

The title of this post, is the same as that of this article on Offshore Energy.

This is the sub-heading.

UK-based energy player Centrica and U.S. investment firm Energy Capital Partners (ECP), part of Bridgeport Group, have brought into their fold a liquefied natural gas (LNG) terminal in Kent County, United Kingdom.

This paragraph gives Centrica’s view of the Grain LNG Terminal.

The UK firm portrays the terminal as Europe’s largest LNG regasification facility, with a capacity of 15 million tonnes of LNG a year. Located on the UK’s Isle of Grain, the terminal features unloading infrastructure, regasification equipment, and truck-loading facilities.

In a press release, which is entitled Investment in Grain LNG, that was published in August 2025, Centrica said this.

Opportunities for efficiencies to create additional near-term value, and future development options including a combined heat and power plant, bunkering, hydrogen and ammonia.

The tone of the article in Offshore Energy and the press release is unmistakable. – Centrica intend to make good use of their investment.

I suggest you read both documents fully.

- Europe’s largest LNG regasification facility, with a capacity of 15 million tonnes of LNG a year, will certainly need a large combined heat and power plant.

- Will any spare power from the CHP plant, be sent to Germany, through the 1.4 GW NeuConnect interconnector, which should be commissioned by 2028?

- Hydrogen, ammonia and LNG are the three low-carbon fuels used by modern ships, so I suspect hydrogen and ammonia will be produced on the island.

- Centrica are investors in the efficient hydrogen-generation process ; HiiROC.

- Hydrogen and nitrogen are the two feedstocks for ammonia.

Centrica certainly have big plans for the Grain LNG Terminal.

I shall be following Centrica closely.

Centrica Energy And Exodus Sign Landmark LNG Agreement

The title of this post, is the same as that of this press release from Centrica.

This is the sub-heading.

Centrica Energy has announced the signing of a long-term Sale and Purchase Agreement (SPA) to supply liquefied natural gas (LNG) to Exodus for Honduras, marking a new milestone in the country’s energy development.

These two paragraphs add more details.

Under the terms of the agreement, Centrica will deliver approximately six LNG cargoes per year to Exodus through a ship-to-ship operation into the Floating Storage Unit (FSU) Bilbao Knutsen, located in Puerto Cortes. The 15-year contract is expected to commence in 2026.

“This agreement reflects Centrica Energy’s commitment to expanding global LNG access through strategic partnerships,” said Arturo Gallego, Global Head of LNG at Centrica Energy. “By leveraging our global reach and operational expertise, we’re proud to support Exodus and Honduras in its journey toward a more sustainable and resilient energy future.”

It looks a good deal for Centrica, that has been snatched from under the American’s noses.

I also asked Google AI, if Honduras produced any natural gas and received this reply.

No, Honduras does not produce natural gas, but it is importing it through a new liquefied natural gas (LNG) agreement that begins in 2026. The country relies on imports to meet its energy needs, and this new deal aims to diversify its energy mix and provide cleaner energy for power generation.

That’s clear and it’s interesting that Honduras are looking to provide cleaner energy.

These two paragraphs from Centrica’s press release add details on power generation in Honduras.

The LNG will be transported to the Brassavola Combined Cycle Power Plant, an operating 150 MW thermal facility with its combined cycle under construction and set to reach 240 MW of power capacity, marking the first-ever import of natural gas for power generation in Honduras. This initiative represents a significant step toward diversifying the nation’s energy mix and reducing its reliance on less environmentally friendly fossil fuels.

Once operational, the FSU will serve as the backbone of LNG storage at a new terminal currently under construction on Honduras’ Caribbean coast. The project is designed to enhance energy security, improve generation efficiency, and support industrial growth.

This article on Riviera is entitled Honduras Turns To LNG To Meet Energy Needs and provides these points.

- Honduras is grappling with a 250 MW power shortage.

- Genesis Energías is spearheading efforts to introduce a reliable and cost-effective energy source by importing liquefied natural gas (LNG).

- Hyundai, who are one of Centrica’s partners in HiiROC, are converting the Bilbao Knutsen for its new role as a Floating Storage Unit (FSU).

It would certainly help Honduras’s economy, if they had more power generation.

I asked Google AI, if Honduras was developing offshore wind power and received this reply.

While Honduras has been actively developing onshore wind power for over a decade, there is currently no information to suggest it is developing offshore wind power projects. The country’s wind energy development has focused exclusively on land-based projects, with a number of operational farms and more in the pipeline.

I also asked Google AI if Honduras was developing solar power and received this reply.

Yes, Honduras is actively and significantly developing its solar power capacity as a cornerstone of its national energy strategy. The country has been a regional leader in solar energy penetration and continues to invest heavily in new projects to reduce its dependence on fossil fuels.

But, whether its offshore wind, onshore wind or solar power, these renewals will need backup and the 240 MW Brassavola Combined Cycle Power Plant, will be a good start.

I have some further thoughts.

Does HiiROC Have A Part To Play?

If would be good, if the 240 MW Brassavola Combined Cycle Power Plant could be zero-carbon, so that Honduras could be more zero-carbon.

Consider.

- Centrica own part of HiiROC, who can generate turquoise hydrogen efficiently from natural gas.

- Honduras will from 2026, have plenty of natural gas.

- In Hydrogen Milestone: UK’s First Hydrogen-to-Power Trial At Brigg Energy Park, I talked about how Centrica powered Brigg power station with a hydrogen blend.

- If the Brassavola Combined Cycle Power Plant was reasonably-modern like Brigg, I suspect it could be run on hydrogen or a hydrogen-blend.

- A reliable supply of hydrogen in Honduras would have its uses.

I wouldn’t be surprised to see a HiiROC plant in Honduras to help decarbonise the country.

HiiROC Creates A Lot Of Carbon Black

When a HiiROC system produces turquoise hydrogen, it produces carbon black as a by-product.

I asked Google AI, if Honduras has a use for carbon black, and received this reply.

Honduras likely has a use for carbon black because the material is a vital component in the production of many common industrial and consumer goods that are used globally. The primary applications are universal across most countries, including those in Central America.

But carbon black can also be used to improve poor agricultural land.

So I asked, Google AI, if Honduras has a lot of land to improve and received this reply.

Yes, Honduras has significant land to improve, but this is complicated by issues like deforestation, land degradation, and a lack of clear land rights for many communities. There is a need to balance economic activities like coffee plantations with conservation, improve sustainable agriculture practices, and address illegal land occupation.

It seems to me, that a sensible hollistic approach could use some of the carbon black.

I also believe, that there are many universities, who could advise Honduras on land restoration.

Does Highview Power Have A Part To Play?

Consider.

- Centrica are one of the backers of Highview Power, who are building their first two environmentally-friendly liquid air batteries in the UK.

- Their flagship battery is a 300 MW/3.2 GWh monster that can incorporate a stability island, that controls the grid.

- Highview Power’s batteries are zero-carbon, with a 40-50 year life.

As a Control Engineer, I believe that one of these batteries would be superb backup for the Brassavola Combined Cycle Power Plant and all those renewables.

Where Will Centrica Get Their LNG For Honduras?

I have already reported on two deals, where Centrica is purchasing LNG.

- Centrica Enters Into Long Term Natural Gas Sale & Purchase Agreement

- Centrica And PTT Sign Heads Of Agreement For Long-Term LNG Supply

I can expect more deals like this around the world.

Also, as the Grain LNG Terminal has the ability to export LNG could we be seeing UK natural gas being exported by Centrica to Honduras and the other countries hinted at in the PTT purchase?

Are Centrica Proposing A Comprehensive Solution To A Nation’s Power Problem?

It certainly looks like they are.

And Honduras would be getting a zero-carbon energy system.

This could be repeated all around the world.

Conclusion

This certainly looks like a good deal for Centrica, that can be repeated in other places.

Rolls-Royce Successfully Tests First Pure Methanol Marine Engine – Milestone For More Climate-Friendly Propulsion Solutions

The title of this post, is the same as that of this press release from Rolls-Royce.

These four bullet points act as sub-headings.

- World first: first high-speed 100 percent methanol engine for ships successfully tested

- Cooperation: Rolls-Royce, Woodward L’Orange and WTZ Roßlau are developing sustainable propulsion technology in the meOHmare research project

- Green methanol: CO2-neutral, clean and safe marine fuel

- Dual-fuel engines as a bridging technology on the road to climate neutrality

Rolls-Royce has successfully tested the world’s first high-speed marine engine powered exclusively by methanol on its test bench in Friedrichshafen. Together with their partners in the meOHmare research project, Rolls-Royce engineers have thus reached an important milestone on the road to climate-neutral and environmentally friendly propulsion solutions for shipping.

“This is a genuine world first,” said Dr. Jörg Stratmann, CEO of Rolls-Royce Power Systems AG. “To date, there is no other high-speed engine in this performance class that runs purely on methanol. We are investing specifically in future technologies in order to open up efficient ways for our customers to reduce CO2 emissions and further expand our leading role in sustainable propulsion systems.”

Rolls-Royce’s goal is to offer customers efficient ways to reduce their CO2 emissions, in-line with the ‘lower carbon’ strategic pillar of its multi-year transformation programme. The project also aligns with the strategic initiative in Power Systems to grow its marine business.

These are some questions.

Why Methanol?

Rolls-Royce answer this question in the press release.

Green methanol is considered one of the most promising alternative fuels for shipping. If it is produced using electricity from renewable energies in a power-to-X process, its operation is CO2-neutral. Compared to other sustainable fuels, methanol is easy to store, biodegradable, and causes significantly fewer pollutants.

“For us, methanol is the fuel of the future in shipping – clean, efficient, and climate-friendly. It burns with significantly lower emissions than fossil fuels and has a high energy density compared to other sustainable energy sources,” said Denise Kurtulus.

Note that Denise Kurtulus is Senior Vice President Global Marine at Rolls-Royce.

Could Methanol-Powered Engines Be Used In Railway Locomotives?

Given, there are hundreds of railway locomotives, that need to be decarbonised, could this be handled by a change of fuel to methanol?

I asked Google AI, the question in the title of this section and received the following answer.

Yes, methanol-powered engines can be used in railway locomotives, but they require a modification like high-pressure direct injection (HPDI) technology to be used in traditional compression ignition (CI) diesel engines. These modified engines typically use methanol as the primary fuel with a small amount of diesel injected to act as a pilot fuel for ignition, a process known as “pilot ignition”. Research and simulations have shown that this approach can achieve performance and thermal efficiencies close to those of standard diesel engines

From the bullet points of this article, it looks like Rolls-Royce have this pilot ignition route covered.

How Easy Is Methanol To Handle?

Google AI gave this answer to the question in the title of this section.

Methanol is not easy to handle safely because it is a highly flammable, toxic liquid that can be absorbed through the skin, inhaled, or ingested. It requires rigorous safety measures, proper personal protective equipment (PPE), and good ventilation to mitigate risks like fire, explosion, and severe health consequences, including blindness or death.

It sounds that it can be a bit tricky, but then I believe with the right training much more dangerous chemicals than methanol can be safety handled.

How Easy Is Green Methanol To Produce?

Google AI gave this answer to the question in the title of this section.

Producing green methanol is not easy; it is currently more expensive and capital-intensive than traditional methods due to high production costs, feedstock constraints, and the need for specialized infrastructure. However, new technologies are making it more feasible, with methods that combine renewable energy with captured carbon dioxide and renewable hydrogen to synthesize methanol.

Production methods certainly appear to be getting better and greener.

Which Companies Produce Methanol In The UK?

Google AI gave this answer to the question in the title of this section.

While there are no major, existing methanol production companies in the UK, Proman is planning to build a green methanol plant in the Scottish Highlands, and other companies like Wood PLC and HyOrc are involved in the engineering and construction of methanol production facilities in the UK. Several UK-based companies also act as distributors or suppliers for products, such as Brenntag, Sunoco (via the Anglo American Oil Company), and JennyChem.

It does appear, that we have the capability to build methanol plants and supply the fuel.

How Is Green Methanol Produced?

Google AI gave this answer to the question in the title of this section.

Green methanol is produced by combining carbon dioxide and hydrogen under heat and pressure, where the hydrogen is created using renewable electricity and the carbon dioxide is captured from sustainable sources like biomass or industrial emissions. Two main pathways exist e-methanol uses green hydrogen and captured carbon dioxide, while biomethanol is made from the gasification of biomass and other organic waste.

Note.

- We are extremely good at producing renewable electricity in the UK.

- In Rolls-Royce To Be A Partner In Zero-Carbon Gas-Fired Power Station In Rhodesia, I discuss how carbon dioxide is captured from a power station in Rhodesia, which is a suburb of Worksop.

In the Rhodesia application, we have a Rolls-Royce mtu engine running with carbon-capture in a zero-carbon manner, producing electricity and food-grade carbon-dioxide, some of which could be used to make methanol to power the Rolls-Royce mtu engines in a marine application.

I am absolutely sure, that if we need green methanol to power ships, railway locomotives and other machines currently powered by large diesel engines, we will find the methods to make it.

What Are The Green Alternatives To Methanol For Ships?

This press release from Centrica is entitled Investment in Grain LNG, and it gives hints as to their plans for the future.

This heading is labelled as one of the key highlights.

Opportunities for efficiencies to create additional near-term value, and future development options including a combined heat and power plant, bunkering, hydrogen and ammonia.

Bunkering is defined in the first three paragraphs of its Wikipedia entry like this.

Bunkering is the supplying of fuel for use by ships (such fuel is referred to as bunker), including the logistics of loading and distributing the fuel among available shipboard tanks. A person dealing in trade of bunker (fuel) is called a bunker trader.

The term bunkering originated in the days of steamships, when coal was stored in bunkers. Nowadays, the term bunker is generally applied to the petroleum products stored in tanks, and bunkering to the practice and business of refueling ships. Bunkering operations take place at seaports and include the storage and provision of the bunker (ship fuels) to vessels.

The Port of Singapore is currently the largest bunkering port in the world. In 2023, Singapore recorded bunker fuel sales volume totaling 51,824,000 tonnes, setting a new industry standard.

Note.

- After Rolls-Royce’s press release, I suspect that methanol should be added to hydrogen and ammonia.

- I don’t think Centrica will be bothered to supply another zero-carbon fuel.

- I can see the Isle of Grain providing a lot of fuel to ships as they pass into London and through the English Channel.

- Centrica have backed HiiROC technology, that makes hydrogen efficiently.

I can see the four fuels ammonia, hydrogen, LNG and methanol competing with each other.

What Are The Green Alternatives To Methanol For Railway Locomotives?

The same fuels will be competing in the market and also Hydrotreated Vegetable Oil (HVO) will be used.

The Thoughts Of Chris O’Shea

This article on This Is Money is entitled Centrica boss has bold plans to back British energy projects – but will strategy pay off?.

The article is basically an interview with a reporter and gives O’Shea’s opinions on various topics.

Chris O’Shea is CEO of Centrica and his Wikipedia entry gives more details.

These are his thoughts.

On Investing In Sizewell C

This is a paragraph from the article.

‘Sizewell C will probably run for 100 years,’ O’Shea says. ‘The person who will take the last electron it produces has probably not been born. We are very happy to be the UK’s largest strategic investor.’

Note.

- The paragraph shows a bold attitude.

- I also lived near Sizewell, when Sizewell B was built and the general feeling locally was that the new nuclear station was good for the area.

- It has now been running for thirty years and should be good for another ten.

Both nuclear power stations at Sizewell have had a good safety record. Could this be in part, because of the heavy engineering tradition of the Leiston area?

On Investing In UK Energy Infrastructure

This is a paragraph from the article

‘I just thought: sustainable carbon-free electricity in a country that needs electricity – and we import 20 per cent of ours – why would we look to sell nuclear?’ Backing nuclear power is part of O’Shea’s wider strategy to invest in UK energy infrastructure.

The UK certainly needs investors in UK energy infrastructure.

On Government Support For Sizewell C

This is a paragraph from the article.

Centrica’s 500,000 shareholders include an army of private investors, many of whom came on board during the ‘Tell Sid’ privatisations of the 1980s and all of whom will be hoping he is right. What about the risks that deterred his predecessors? O’Shea argues he will achieve reliable returns thanks to a Government-backed financial model that enables the company to recover capital ploughed into Sizewell C and make a set return.

I have worked with some very innovative accountants and bankers in the past fifty years, including an ex-Chief Accountant of Vickers and usually if there’s a will, there’s a solution to the trickiest of financial problems.

On LNG

These are two paragraphs from the article.

Major moves include a £200 million stake in the LNG terminal at Isle of Grain in Kent.

The belief is that LNG, which produces significantly fewer greenhouse gas emissions than other fossil fuels and is easier and cheaper to transport and store, will be a major source of energy for the UK in the coming years.

Note.

- Centrica are major suppliers of gas-powered Combined Heat and Power units were the carbon dioxide is captured and either used or sold profitably.

- In at least one case, a CHP unit is used to heat a large greenhouse and the carbon dioxide is fed to the plants.

- In another, a the gas-fired Redditch power station, the food-grade carbon dioxide is sold to the food and construction industries.

- Grain LNG Terminal can also export gas and is only a short sea crossing from gas-hungry Germany.

- According to this Centrica press release, Centrica will run low-carbon bunkering services from the Grain LNG Terminal.

I analyse the investment in Grain LNG Terminal in Investment in Grain LNG.

On Rough Gas Storage

These are three paragraphs from the article.

O’Shea remains hopeful for plans to develop the Rough gas storage facility in the North Sea, which he re-opened in 2022.

The idea is that Centrica will invest £2 billion to ‘create the biggest gas storage facility in the world’, along with up to 5,000 jobs.

It could be used to store hydrogen, touted as a major energy source of the future, provided the Government comes up with a supportive regulatory framework as it has for Sizewell.

The German AquaVentus project aims to bring at least 100 GW of green hydrogen to mainland Germany from the North Sea.

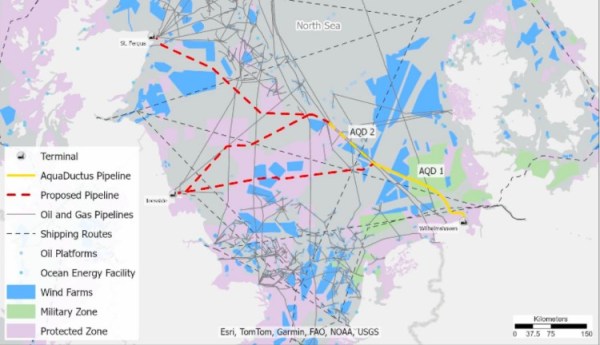

This map of the North Sea, which I downloaded from the Hydrogen Scotland web site, shows the co-operation between Hydrogen Scotland and AquaVentus

Note.

- The yellow AquaDuctus pipeline connected to the German coast near Wilhelmshaven.

- There appear to be two AquaDuctus sections ; AQD 1 and AQD 2.

- There are appear to be three proposed pipelines, which are shown in a dotted red, that connect the UK to AquaDuctus.

- The Northern proposed pipeline appears to connect to the St. Fergus gas terminal on the North-East tip of Scotland.

- The two Southern proposed pipelines appear to connect to the Easington gas terminal in East Yorkshire.

- Easington gas terminal is within easy reach of the massive gas stores, which are being converted to store hydrogen at Aldbrough and Rough.

- The blue areas are offshore wind farms.

- The blue area straddling the Southernmost proposed pipe line is the Dogger Bank wind farm, is the world’s largest offshore wind farm and could eventually total over 6 GW.

- RWE are developing 7.2 GW of wind farms between Dogger Bank and Norfolk in UK waters, which could generate hydrogen for AquaDuctus.

This cooperation seems to be getting the hydrogen Germany needs to its industry.

It should be noted, that Germany has no sizeable hydrogen stores, but the AquaVentus system gives them access to SSE’s Aldbrough and Centrica’s Rough hydrogen stores.

So will the two hydrogen stores be storing hydrogen for both the UK and Germany?

Storing hydrogen and selling it to the country with the highest need could be a nice little earner.

On X-energy

These are three paragraphs from the article.

He is also backing a £10 billion plan to build the UK’s first advanced modular reactors in a partnership with X-energy of the US.

The project is taking place in Hartlepool, in County Durham, where the existing nuclear power station is due to reach the end of its life in 2028.

As is the nature of these projects, it involves risks around technology, regulation and finance, though the potential rewards are significant. Among them is the prospect of 2,500 jobs in the town, where unemployment is high.

Note.

- This is another bold deal.

- I wrote in detail about this deal in Centrica And X-energy Agree To Deploy UK’s First Advanced Modular Reactors.

- Jobs are mentioned in the This is Money article for the second time.

I also think, if it works to replace the Hartlepool nuclear power station, then it can be used to replace other decommissioned nuclear power stations.

On Getting Your First Job

These are three paragraphs from the article.

His career got off to a slow start when he struggled to secure a training contract with an accountancy firm after leaving Glasgow University.

‘I had about 30, 40 rejection letters. I remember the stress of not having a job when everyone else did – you just feel different,’ he says.

He feels it is ‘a duty’ for bosses to try to give young people a start.

I very much agree with that. I would very much be a hypocrite, if I didn’t, as I was given good starts by two companies.

On Apprenticeships

This is a paragraph from the article.

‘We are committed to creating one new apprenticeship for every day of this decade,’ he points out, sounding genuinely proud.

I very much agree with that. My father only had a small printing business, but he was proud of the apprentices he’d trained.

On Innovation

Centrica have backed three innovative ideas.

- heata, which is a distributed data centre in your hot water tank, which uses the waste heat to give you hot water.

- HiiROC, which is an innovative way to generate affordable hydrogen efficiently.

- Highview Power, which stores energy as liquid air.

I’m surprised that backing innovations like these was not mentioned.

Conclusion

This article is very much a must read.

Centrica And X-energy Agree To Deploy UK’s First Advanced Modular Reactors

The title of this post, is the same as that of this press release from Centrica.

This is the sub-heading.

Centrica and X-Energy, LLC, a wholly-owned subsidiary of X-Energy Reactor Company, LLC, today announced their entry into a Joint Development Agreement (JDA) to deploy X-energy’s Xe-100 Advanced Modular Reactors (“AMR”) in the United Kingdom.

These three paragraphs add more details.

The companies have identified EDF and Centrica’s Hartlepool site as the preferred first site for a planned U.K. fleet of up to 6 gigawatts.

The agreement represents the first stage in a new trans-Atlantic alliance which could ultimately mobilise at least £40 billion in economic value to bring clean, safe and affordable power to thousands of homes and industries across the country and substantive work for the domestic and global supply chain.

A 12-unit Xe-100 deployment at Hartlepool could add up to 960 megawatts (“MW”) of new capacity, enough clean power for 1.5 million homes and over £12 billion in lifetime economic value. It would be developed at a site adjacent to Hartlepool’s existing nuclear power station which is currently scheduled to cease generating electricity in 2028. Following its decommissioning, new reactors would accelerate opportunities for the site and its skilled workforce. The site is already designated for new nuclear under the Government’s National Policy Statement and a new plant would also play a critical role in generating high-temperature heat that could support Teesside’s heavy industries.

This is no toe-in-the-water project, but a bold deployment of a fleet of small modular reactors to provide the power for the North-East of England for the foreseeable future.

These are my thoughts.

The Reactor Design

The Wikipedia entry for X-energy has a section called Reactor Design, where this is said.

The Xe-100 is a proposed pebble bed high-temperature gas-cooled nuclear reactor design that is planned to be smaller, simpler and safer when compared to conventional nuclear designs. Pebble bed high temperature gas-cooled reactors were first proposed in 1944. Each reactor is planned to generate 200 MWt and approximately 76 MWe. The fuel for the Xe-100 is a spherical fuel element, or pebble, that utilizes the tristructural isotropic (TRISO) particle nuclear fuel design, with high-assay LEU (HALEU) uranium fuel enriched to 20%, to allow for longer periods between refueling. X-energy claims that TRISO fuel will make nuclear meltdowns virtually impossible.

Note.

- It is not a conventional design.

- Each reactor is only about 76 MW.

- This fits with “12-unit Xe-100 deployment at Hartlepool could add up to 960 megawatts (“MW”) of new capacity” in the Centrica press release.

- The 960 MW proposed for Hartlepool is roughly twice the size of the Rolls-Rpoyce SMR, which is 470 MW .

- Safety seems to be at the forefront of the design.

- I would assume, that the modular nature of the design, makes expansion easier.

I have no reason to believe that it is not a well-designed reactor.

Will Hartlepool Be The First Site?

No!

This page on the X-energy web site, describes their site in Texas, which appears will be a 320 MW power station providing power for Dow’s large site.

There appear to be similarities between the Texas and Hartlepool sites.

- Both are supporting industry clustered close to the power station.

- Both power stations appear to be supplying heat as well as electricity, which is common practice on large industrial sites.

- Both use a fleet of small modular reactors.

But Hartlepool will use twelve reactors, as opposed to the four in Texas.

How Will The New Power Station Compare With The Current Hartlepool Nuclear Power Station?

Consider.

- The current Hartlepool nuclear power station has two units with a total capacity of 1,185 MW.

- The proposed Hartlepool nuclear power station will have twelve units with a total capacity of 960 MW.

- My instinct as a Control Engineer gives me the feeling, that more units means higher reliability.

- I suspect that offshore wind will make up the difference between the power output of the current and proposed power stations.

As the current Hartlepool nuclear power station is effectively being replaced with a slightly smaller station new station, if they get the project management right, it could be a painless exercise.

Will This Be The First Of Several Projects?

The press release has this paragraph.

Centrica will provide initial project capital for development with the goal of initiating full-scale activities in 2026. Subject to regulatory approval, the first electricity generation would be expected in the mid-2030s. Centrica and X-energy are already in discussions with additional potential equity partners, as well as leading global engineering and construction companies, with the goal of establishing a UK-based development company to develop this first and subsequent projects.

This approach is very similar to the approach being taken by Rolls-Royce for their small modular reactors.

Will Centrica Use An X-energy Fleet Of Advanced Modular Reactors At The Grain LNG Terminal?

This press release from Centrica is entitled Investment In Grain LNG Terminal.

This is one of the key highlights of the press release.

Opportunities for efficiencies to create additional near-term value, and future development options including a combined heat and power plant, bunkering, hydrogen and ammonia.

Note.

- Bunkering would be provided for ships powered by LNG, hydrogen or ammonia.

- Heat would be needed from the combined heat and power plant to gasify the LNG.

- Power would be needed from the combined heat and power plant to generate the hydrogen and ammonia and compress and/or liquify gases.

Currently, the heat and power is provided by the 1,275 MW Grain CHP gas-fired power station, but a new nuclear power station would help to decarbonise the terminal.

Replacement Of Heysham 1 Nuclear Power Station

Heysham 1 nuclear power station is part-owned by Centrica and EdF, as is Hartlepool nuclear power station.

Heysham 1 nuclear power station is a 3,000 MW nuclear power station, which is due to be decommissioned in 2028.

I don’t see why this power station can’t be replaced in the same manner as Hartlepool nuclear power station.

Replacement Of Heysham 2 Nuclear Power Station

Heysham 2 nuclear power station is part-owned by Centrica and EdF, as is Hartlepool nuclear power station.

Heysham 2 nuclear power station is a 3,100 MW nuclear power station, which is due to be decommissioned in 2030.

I don’t see why this power station can’t be replaced in the same manner as Hartlepool nuclear power station.

Replacement Of Torness Nuclear Power Station

Torness nuclear power station is part-owned by Centrica and EdF, as is Hartlepool nuclear power station.

Torness nuclear power station is a 1,290 MW nuclear power station, which is due to be decommissioned in 2030.

I don’t see why this power station can’t be replaced in the same manner as Hartlepool nuclear power station.

But the Scottish Nationalist Party may have other ideas?

What Would Be The Size Of Centrica’s And X-energy’s Fleet Of Advanced Modular Reactors?

Suppose.

- Hartlepool, Grain CHP and Torness power stations were to be replaced by identical 960 MW ADRs.

- Heysham 1 and Heysham 2 power stations were to be replaced by identical 1,500 MW ADRs.

This would give a total fleet size of 5,880 MW.

A paragraph in Centrica’s press release says this.

The companies have identified EDF and Centrica’s Hartlepool site as the preferred first site for a planned U.K. fleet of up to 6 gigawatts.

This fleet is only 120 MW short.

Centrica Enters Into Long Term Natural Gas Sale & Purchase Agreement

The title of this post, is the same as this press release from Centrica.

This is the sub-heading,

Centrica plc today confirmed that its trading arm, Centrica Energy, has entered into a natural gas sale and purchase agreement with US-based Devon Energy Corporation.

This first paragraph adds a few more details.

Under the agreement, Devon Energy will supply 50,000 (MMBtu) per day of natural gas over a 10‑year term starting in 2028. This is equivalent to five LNG cargoes per year. The volumes will be indexed to European gas hub price (TTF). This sale and purchase agreement supports Centrica’s objective of managing market price risk in its LNG portfolio by aligning feed gas pricing with European gas prices whilst providing Devon Energy with international price exposure.

At a first look, it looks a lot of gas.

In Investment In Grain LNG, I talk about Centrica’s purchase of the Grain LNG Terminal from National Grid. But the Grain LNG Terminal comes with several things that Centrica might need for gas from Devon.

- A large amount of gas storage.

- The ability to convert liquid natural gas (LNG) into gas suitable for consumers.

- Space to build more storage if required.

- The ability to store LNG for other companies.

- Two jetties for delivering the LNG to the Grain LNG Terminal.

- The ability to load tankers with LNG, so that it can be sold on to third parties like say the Germans or the Poles.

Centrica also say this about their use of the Grain LNG Terminal in this press release, that describes the purchase of the terminal.

Aligned with Centrica’s strategy of investing in regulated and contracted assets supporting the energy transition, delivering predictable long-term, inflation-linked cash flows, with 100% of capacity contracted until 2029, >70% until 2038 and >50% until 2045.

Centrica have obviously modelled their gas supply and delivery and I believe they have come up with a simple strategy, that will work.

How Will Centrica Use The Gas From The Grain LNG Terminal?

The Wikipedia entry for the Grain LNG Terminal says this about the terminal delivering gas into the gas grid.

The terminal can handle up to 15 million tonnes per annum of LNG, has a storage capacity for one million cubic metres of LNG, and is able to regasify up to 645 GWh per day (58 million cubic metres per day) for delivery into the high pressure gas National Transmission System (NTS).

Note.

- This will be one of the major uses of the gas.

- I wouldn’t be surprised if these capacities will be increased significantly, so that more gas can be stored and processed.

In Investment in Grain LNG, I outlined how I believe that hydrogen and ammonia will be produced for the bunkering of ships on one of busiest sea lanes in Europe, if not the world.

Some LNG will be used to create these zero-carbon fuels.

Some modern ships, also run on natural gas, so I asked Google AI about their operation and received this answer.

Ships can run on natural gas, specifically liquefied natural gas (LNG), by using it as a fuel source in specially designed engines. LNG is natural gas that has been cooled to a liquid state at -162°C, making it easier to store and transport. This liquid form is then used to power the ship’s engines, either directly or by burning the boil-off gas (BOG) that naturally occurs when LNG warms up.

This means that some LNG could be used to directly fuel these ships.

What Is The Gas Capacity Of The Grain LNG Terminal?

I asked Google AI this question and received this answer.

The Grain LNG Terminal, the largest LNG import terminal in Europe, has a storage capacity of 1,000,000 cubic meters (m³) and an annual throughput capacity of 15 million tonnes of LNG. This is equivalent to about 20% of the UK’s total gas demand. The terminal also has the capacity to deliver 25% of the UK’s daily gas demand.

As the space is there, I wouldn’t be surprised to see Centrica increase the capacity of the terminal, as in cold weather, emergency gas for Germany can be delivered quicker from Kent than the United States.

Could The Grain LNG Terminal Accept Gas Deliveries From The United States?

I’m certain that it already does.

Could The Grain LNG Terminal Accept Gas Deliveries From The UK?

If we start extracting gas again from under the seas around the UK, could the Grain LNG Terminal be used to store it?

Yes, but it would have to be liquified first.

It would be more energy efficient to process the extracted gas, so it could be used directly and gasify enough gas at Grain LNG Terminal from storage to make up any shortfall.

Conclusion

Centrica have done some very deep joined up thinking, by doing a long term gas deal and the Grain LNG Terminal purchase so that they have the gas to supply and somewhere to keep it, until it is needed.

Investment in Grain LNG

The title of this post, is the same as that of this press release from Centrica.

This sub-heading outlines the deal.

Centrica plc (the “Company”, “Centrica”) is pleased to announce the acquisition of the Isle of Grain liquified natural gas terminal (“Grain LNG”) in partnership1 with Energy Capital Partners LLP (“ECP”) from National Grid group (“National Grid”) for an enterprise value of £1.5 billion. After taking into account approximately £1.1 billion of new non-recourse project finance debt, Centrica’s 50% share of the equity investment is approximately £200 million.

The press release lists these key points.

- Grain LNG delivers vital energy security for the UK, providing critical LNG import/export, regasification and rapid response gas storage capacity to balance the energy system.

- Aligned with Centrica’s strategy of investing in regulated and contracted assets supporting the energy transition, delivering predictable long-term, inflation-linked cash flows, with 100% of capacity contracted until 2029, >70% until 2038 and >50% until 2045.

- Opportunities for efficiencies to create additional near-term value, and future development options including a combined heat and power plant, bunkering, hydrogen and ammonia.

- Highly efficient funding structure, with Centrica’s equity investment of approximately £200 million alongside non-recourse project financing.

- Strong life of asset returns aligned with Centrica’s financial framework, with an expected unlevered IRR2 of around 9% and an equity IRR2 of around 14%+

Underpins delivery of £1.6 billion end-2028 EBITDA target3 – Centrica’s share of EBITDA expected to be approximately £100 million per annum and cash distributions expected to be around £20 million on average per annum for 2026-2028, representing an attractive yield on Centrica’s equity investment - Partnership with ECP (part of Bridgepoint Group plc), one of the largest private owners of natural gas generation and infrastructure assets in the U.S. with direct experience in supporting grid reliability.

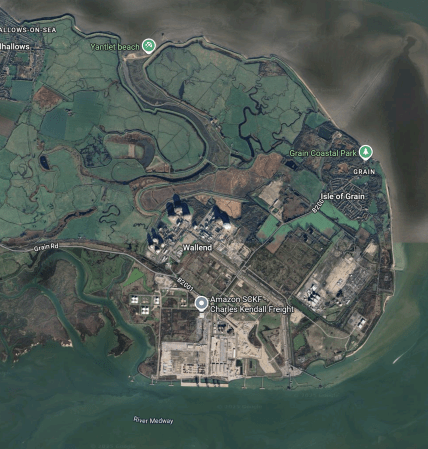

This Google Map shows the various energy assets on the Isle of Grain.

Note.

- It appears that works for the 1, 400 MW NeuConnect interconnector to Wilhelmshaven in Germany, are taking place in the North-East corner of the map.

- Grain CHP powerstation is a 1,275MW CCGT power station, which is owned by German company; Uniper, that is in the South-East corner of the map, which can also supply up to 340MW of heat energy recovered from the steam condensation to run the vapourisers in the nearby liquefied natural gas terminal.

- The Grain LNG terminal is at the Western side of the map.

- In the Thames Estuary to the East of the Isle of Grain, I estimate that there are about 1,500 MW of wind turbines.

I find it interesting that two of the assets are German owned.

I have some thoughts.

It Is A Large Site With Space For Expansion

This Google Map shows the whole of the Isle of Grain.

Note.

- The Grain LNG terminal is around the label Wallend.

- The River Medway runs East-West at the bottom of the map.

- Gas tankers deliver and take on gas at jetties on the North Bank of the Medway.

There could be space to expand the terminal, if the RSPB would allow it.

As an example, I asked Google AI, if peregrine falcons nest on chemical plants and got this reply.

Yes, peregrine falcons do nest on chemical plants. They have adapted to using various urban and industrial structures, including chemical plants, for nesting. This is particularly true in areas where natural cliff habitats are scarce.

Peregrine falcons are known for their adaptability, and their population has seen a resurgence in recent decades, partly due to their ability to utilize man-made structures. These structures often mimic their natural cliffside nesting

Cliffs do seem scarce on the Isle of Grain. I also asked Google AI, if peregrine falcons ate small rodents, as several chemical and other plants, where I’ve worked, had a rodent problem. One plant had a cat problem, as there had been so many rats. This was the reply.

Yes, peregrine falcons do eat small rodents, though they primarily consume birds. While their diet mainly consists of other birds like pigeons, doves, and waterfowl, they will also hunt and eat small mammals, including rodents such as mice, rats, and voles. They are opportunistic hunters and will take advantage of readily available prey, including insects, amphibians, and even fish.

I’m sure if Centrica wanted to expand, they’d employ the best experts.

Who Are ECP?

One of the key points of the press release is that this deal is a partnership with ECP (part of Bridgepoint Group plc), one of the largest private owners of natural gas generation and infrastructure assets in the U.S. with direct experience in supporting grid reliability.

The Wikipedia entry for ECP or Energy Capital Partners has this first section.

Energy Capital Partners Management, LP (ECP) is an American investment firm headquartered in Summit, New Jersey. It focuses on investments in the energy sector. The firm has additional offices in New York City, Houston, San Diego, Fort Lauderdale and Seoul.

In August 2024, ECP merged with Bridgepoint Group to form a private assets investment platform.

The Wikipedia entry for the Bridgepoint Group has this first paragraph.

Bridgepoint Group plc is a British private investment company listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

The company had started as part of NatWest.

Are The Germans Going To Take Away Some Of Our Electricity?

Consider.

- Germany has a big need to replace Russian gas and indigenous coal, and to decarbonise.

- Neuconnect is a 1.4 GW interconnector between the Isle of Grain and Wilhelmshaven in Germany. It is scheduled to be completed in 2028.

- The Grain CHP powerstation is a 1,275MW CCGT power station, which is owned by German company; Uniper, could almost keep NeuConnect working at full power on its own.

- I said earlier, in the Thames Estuary to the East of the Isle of Grain, I estimate that there are about 1,500 MW of wind turbines. One of which is part German-owned.

The Germans are also building a large electrolyser at Wilhelshaven, which is described by Google AI like this.

The Wilhelmshaven Green Energy Hub will initially feature a 500MW electrolyzer, with plans to potentially expand to 1GW, according to Energy Monitor. The hub, a joint project between Tree Energy Solutions (TES) and EWE, aims to produce green hydrogen using renewable energy sources like offshore wind. The 500MW electrolyzer is scheduled to be operational by 2028.

I wouldn’t be surprised to see that the Wilhelmshaven electrolyser were to be powered by British-generated electricity flowing down NeuConnect.

Centrica Says Their Future Development Options Include A Combined Heat And Power Plant

This objective was set in one of the key points.

This is the first paragraph of the Wikipedia entry for the Grain LNG Terminal.

Grain LNG Terminal is a Liquefied Natural Gas (LNG) terminal on the Isle of Grain, 37 miles (60 km) east of London. It has facilities for the offloading and reloading of LNG from ships at two jetties on the River Medway; for storing and blending LNG; for truck loading; and regasifying and blending natural gas to meet UK specifications. The terminal can handle up to 15 million tonnes per annum of LNG, has a storage capacity for one million cubic metres of LNG, and is able to regasify up to 645 GWh per day (58 million cubic metres per day) for delivery into the high pressure gas National Transmission System (NTS). The facility is owned and operated by National Grid Grain LNG Ltd, a wholly owned subsidiary of National Grid.

Note.

- This paragraph was written before the Centrica takeover.

- The terminal also converts liquid natural gas into gas to be distributed around the UK.

The heat needed to convert the liquid natural gas to gas is provided by the Grain CHP power station.

- Currently 340 MW of heat is provided.

- If the Grain LNG terminal is expanded, it will probably need more heat.

I can see Centrica building a combined heat and power (CHP) power station, that can be expanded to meet the current and future needs of gasification at the Grain LNG terminal.

I wouldn’t be surprised to see the CHP power station fitted with carbon capture, as Kent is surely one county, where carbon dioxide can be used in food production, so we can generate our carbon dioxide and eat it.

Centrica Says Their Future Development Options Include Hydrogen

This objective was set in one of the key points.

Consider.

- Centrica are an investor in HiiROC, who have a unique method of generating affordable zero-carbon hydrogen called thermal plasma electrolysis, which uses a fifth of the electricity, that traditional electrolysis does.

- HiiROC can use natural gas as a feedstock. Centrica won’t be short of that at Grain.

- There is space to build a large HiiROC system at the Isle of Grain site.

- The hydrogen could be taken away by tanker ships.

Like the electricity , which will use the 450 mile NeuConnect interconnector, the hydrogen could even be exported to Wilhelmshaven in Germany by pipeline.

Wilhelmshaven is being setup to be a major German hub to both generate, import and distribute hydrogen.

I asked Google AI, how much hydrogen a GWh would produce and received this answer.

A GWh of electricity can produce approximately 20-22 tonnes of hydrogen through electrolysis, depending on the efficiency of the electrolyzer. Modern commercial electrolyzers operate at an efficiency of roughly 70-80%, meaning they require about 50-55 kWh of electricity to produce 1 kg of hydrogen. A GWh (1 gigawatt-hour) is equal to 1,000,000 kWh, and 1 tonne of hydrogen contains roughly 33.33 MWh of energy.

As it is claimed on the web that HiiROC is five times more efficient than traditional electrolysis, it could need around 10-11 kWh to produce one kg. of hydrogen.

1 GWh would produce between 90-100 tonnes of hydrogen.

Centrica Says Their Future Development Options Include Ammonia

This objective was set in one of the key points.

I asked Google AI if ammonia can be produced from hydrogen and received this answer.

Yes, ammonia (NH3) can be produced from hydrogen (H2) through a process called the Haber-Bosch process. This process involves combining hydrogen with nitrogen (N2) from the air, under high temperature and pressure, in the presence of a catalyst.

Ammonia has a large number of uses, including making fertiliser and the powering of large ships.

I asked Google AI, if there are small Haber-Bosch processes to make ammonia from hydrogen and nitrogen and received this answer.

Yes, there are efforts to develop smaller-scale Haber-Bosch processes for ammonia production. While the traditional Haber-Bosch process is typically associated with large industrial plants, research and development are exploring ways to adapt it for smaller, distributed production, particularly for localized fertilizer or fuel applications.

I wondered if Centrica are involved in the efforts to develop smaller-scale Haber-Bosch processes for ammonia production.

Google AI gave me this quick answer.

Centrica is involved in research related to the Haber-Bosch process, particularly in the context of transitioning to a low-carbon energy future. They are exploring how to adapt the Haber-Bosch process, which is crucial for fertilizer production but also a significant source of CO2 emissions, to utilize renewable energy sources. This includes investigating the use of green hydrogen produced from water electrolysis and renewable electricity. Centrica is also involved in research related to using ammonia as a fuel, including potentially for power generation

That looks to be a very positive answer. Especially, as local low-carbon fertiliser production could be a very powerful concept.

Centrica Says Their Future Development Options Include Bunkering

This objective was set in one of the key points.

Bunkering is the process of refuelling ships.

I didn’t know much about bunkering, when I started to read Centrica’s press release, but the Wikipedia entry, was a good way to get some information.

This section in the Wikipedia entry is entitled Two Types Of Bunkering, where this is said.

The two most common types of bunkering procedure at sea are “ship to ship bunkering” (STSB), in which one ship acts as a terminal, while the other moors. The second type is “stern line bunkering” (SLB), which is the easiest method of transferring oil but can be risky during bad weather.

Over the years, I have found, that two zero-carbon fuels are under development, for powering ships; hydrogen and ammonia. Others are developing ships powered by naturalo gas.

I asked Google AI if hydrogen can power ships and received this answer.

Yes, hydrogen can power ships. It can be used as a fuel for fuel cells, which generate electricity to power the ship’s propulsion and other systems, or it can be burned in modified combustion engines. Hydrogen offers a zero-emission solution for shipping, with water vapor being the only byproduct when used in fuel cells.

Google AI also told me this.

The world’s first hydrogen-powered cruise ship, the “Viking Libra”, is currently under construction and is scheduled for delivery in late 2026. This innovative vessel, a collaboration between Viking Cruises and Italian shipbuilder Fincantieri, will utilize hydrogen for both propulsion and electricity generation, aiming for zero-emission operation.

I also asked Google AI if ammonia can power ships and received this answer.

Yes, ammonia can be used to power ships and is considered a promising alternative fuel for the maritime industry. Several companies and organizations are actively developing ammonia-powered ship designs and technologies. While challenges remain, particularly around safety and infrastructure, ammonia is seen as a key potential fuel for decarbonizing shipping.

Finally, I asked I asked Google AI if natural gas can power ships and received this answer.

Yes, ships can be powered by natural gas, specifically in the form of liquefied natural gas (LNG). LNG is increasingly used as a marine fuel, offering environmental benefits over traditional fuels like diesel.

It would seem to be a case of you pays your money and makes a choice between one of four technologies; ammonia, hydrogen fuel-cell, hydrogen-ICE and LNG.

I looks to me, that if Centrica provide bunkering services for ships, they have the means to cover most of the market by providing hydrogen and ammonia, in addition to natural gas.

Although, I don’t know much about bunkering, I do feel that the two current methods, that work for oil, could be made to work for these fuels.

This Google Map shows the Thames Estuary.

Note.

- The Port of Tilbury is in the South-West corner of the map.

- London Gateway is indicated by the red arrow.

- The Isle of Grain is in the South-East corner of the map.

- Other ports between Tilbury and the Isle of Grain include Barking, Dagenham, Dartford, Erith, Greenwich, Northfleet, Purfleet, Silvertown and Thurrock.

There was never a more true phrase than – “Location, Location and Location”. And the Isle of Grain would appear to be in the right place to send out a bunkering tanker to a passing ship, that was calling at a port in London or just passing through the Strait of Dover.

This Google Map shows the Thames between London Gateway and the Isle of Grain.

Note.

- London Gateway is indicated by the red arrow.

- The Isle of Grain is in the South-East corner of the map.

It seems to me, that a refuelling philosophy could easily be worked out.

How Large is The Bunkering Market?

I asked Google AI this question and received this answer.

The world bunker fuel market is a multi-billion dollar industry, with the market size valued at USD 150.93 billion in 2023. It is projected to reach USD 242.29 billion by 2032, growing at a CAGR of 5.4% according to SkyQuest Technology. In terms of volume, the global bunker demand was estimated at 233.1 million metric tons in 2023 according to the IMO.

The market is not small!

Energy Security Boost After Centrica And Repsol Agree LNG Supply Deal

The title of this post, is the same as that of this press release from Centrica.

This is the sub-heading.

Centrica Energy and Repsol today announced the signing of a deal that will improve the UK’s energy security in the coming years.

These two paragraphs give more details of the deal.

The deal will see Centrica purchase 1 million tonnes of Liquified Natural Gas (LNG) shipments between 2025 and 2027. All of these cargoes are expected to be delivered to the Grain LNG import terminal in Kent.

The deal marks an additional move by Centrica to build further resilience in the UK’s energy security. It follows a 15 year, $8bn deal with Delfin Midstream in July 2023, a three-year supply agreement with Equinor that will heat 4.5m UK homes through to 2024 and the reopening and expansion of the Rough gas storage facility in October 2022 and June 2023 respectively. Rough now provides half of the UK’s total gas storage capacity with the potential to store over 50 billion cubic feet (bcf) of gas, enough to heat almost 10% of UK homes throughout winter.

Centrica do seem to be keeping us supplied with gas.

Two days ago, National Grid published this press release, which is entitled Grain LNG Signs New Deal With Venture Global Further Strengthening The Security Of Supply Of LNG To The United Kingdom.

This is the sub-heading.

Today (5 February), Grain LNG and Venture Global have announced the execution of a binding long-term terminal use agreement (TUA) enabling the regasification and sale of LNG from all of Venture Global’s LNG terminals in Louisiana, including CP2 LNG, subject to obtaining necessary federal permits.

These two paragraphs give more details of the deal.

Under the agreement, Venture Global will have the ability to access 3 million tonnes per annum (3MTPA) of LNG storage and regasification capacity at the Isle of Grain LNG receiving terminal for sixteen years beginning in 2029, equivalent of up to 5% of average UK gas demand.

This is the second agreement from Grain LNG’s competitive auction process which was launched in September 2023. The successful outcome of the auction further secures the future of Europe’s largest LNG import terminal into the mid 2040s.

Two big deals in the same week is not to be sneezed at and must be good for the UK’s energy security.

Grain LNG

The Grain LNG web site, greets you with this message.

Welcome To Europe’s Largest Liquified Natural Gas Terminal, Grain LNG

Grain LNG is the gateway connecting worldwide LNG to the European energy market, making a genuine difference to people’s lives. Find out all about our cutting-edge operations – showcasing our leadership in powering the future – and why Grain LNG is at the forefront of energy as we move towards net zero.

There is also a video.

This Google Map shows the location of Grain LNG on the Isle of Grain.

Note.

- The River Medway flows into the River Thames between the Isle of Grain on the left and the Isle of Sheppey on the right.

- From South to North, the red arrows indicate, the National Grid – Grain Terminal, National Grid L N G and Grain LNG.

There would appear to be space for expansion.

Grain LNG Launches Market Consultation For Existing Capacity

The title of this post is the same as that of this press release from National Grid.

This is the sub-heading.

Grain LNG, the largest liquefied natural gas (LNG) terminal in Europe, is pleased to announce the launch of a market consultation for the auction of 375 Gwh/d (approx. 9 mtpa) of existing capacity. The initial consultation phase for the Auction of Existing Capacity will commence on 14 June and run until 26 July.

These paragraphs detail what Grain LNG, which is a subsidiary of National Grid are offering.

GLNG has used the positive feedback received from the recent ‘Expression of Interest’ exercise and subsequent market engagement to offer three lots of capacity:

- Each lot will be entitled to 42 berthing slots, 200,000 m3 of storage and 125GWh/d (approx. 3 mtpa) of regasification capacity from as early as January 2029.

- This product is specifically designed for parties who wish to acquire a substantial stake in a major terminal in Northwest Europe, at a reduced cost and with shorter contract lengths when compared to new-build projects.

- As the terminal’s capacity already exists, parties involved will not be subjected to the FID approvals or potential delays that can arise from construction issues commonly associated with new build terminals.

Simon Culkin, Importation Terminal Manager at Grain LNG, said: “We are really pleased with the high level of interest shown by the market at a time of significant geo-political influence on our energy markets. It has allowed us to engage with potential customers and shape our offering to best meet their needs, whilst optimising access to this strategic asset. “

Reading the Wikipedia entry for the Grain LNG Terminal, it looks like it gets used as a handy store for natural gas.

About Phase 1 (2002–05), Wikipedia says this.

The new facilities enabled the Grain terminal to become a base supply to the NTS, with the ability to deliver gas continuously when required. The cost of the Phase 1 project was £130m. A 20-year contract with BP / Sonatrach enabled Grain LNG to import LNG on a long-term basis from July 2005.

About Phase 2 (2005–08), Wikipedia says this.

The development provided an additional five million tonnes of capacity per annum. All this capacity was contracted out from December 2010. Customers included BP, Iberdrola, Sonatrach, Centrica, E.ON and GDF Suez.

Under Current Facilities, Wikipedia says this.

Grain LNG Ltd does not own the LNG or the gas that it handles but charges for gasifying it. Current (2016) users include BP, Centrica (British Gas Trading), Iberdrola (Spain), Sonatrach (Algeria), Engie (France), and Uniper (Germany).

National Grid must be pleased that some customers seem loyal.

I feel that National Grid’s basic plan is to carry on with more of the same.

But will they develop more storage and other facilities on the site.

There are certainly other projects and interconnectors, that make the Isle of Grain and energy hub connecting the UK, Netherlands and Germany.

- In Did I See The UK’s Hydrogen-Powered Future In Hull Today?, I mentioned, that I thought that the Isle of Grain could be a location for an electrolyser and a hydrogen store.

- In EuroLink, Nautilus And Sea Link, I talk about new interconnectors, if which Nautilus might come to the Isle of Grain.

- In UK-German Energy Link Reaches Financial Close, I talk about NeuConnect, which will be an interconnector between the Isle of Grain ans Wilhelmshaven in Germany.

- The Isle of Grain is the landing point for the BritNed undersea power cable between The Netherlands and the UK.

I could also see National Grid building an East Coast interconnector to bring power from the wind farms off the East Coast of England to the Isle of Grain for distribution.

These are major wind farms South of the Humber.

- Dudgeon – 402 MW

- East Anglia 1 – 714 MW

- East Anglia 1 North – 800 MW

- East Anglia 2 – 900 MW

- Galloper – 504 MW – RWE

- Greater Gabbard – 504 MW

- Gunfleet Sands – 174 MW

- Hornsea 1 – 1218 MW

- Hornsea 2 – 1386 MW

- Hornsea 3 – 2852 MW

- Humber Gateway – 219 MW

- Lincs – 270 MW

- London Array – 630 MW

- Lynn and Inner Dowsing – 194 MW

- Race Bank – 580 MW

- Scroby Sands – 60 MW

- Sheringham Shoal – 317 MW

- Triton Knoll – 857 MW – RWE

- Dogger Bank A – 1235 MW

- Dogger Bank B – 1235 MW

- Dogger Bank C – 1218 MW

- Dogger Bank D – 1320 MW

- Dogger Bank South – 3000 MW RWE

- East Anglia 3 – 1372 MW

- Norfolk Boreas – 1396 MW

- Norfolk Vanguard – 1800 MW

- Outer Dowsing – 1500 MW

- North Falls – 504 MW – RWE

- Sheringham Shoal and Dudgeon Extensions – 719 MW

- Five Estuaries – 353 MW – RWE

Note.

- These figures give a total capacity of 28,333 MW.

- Five wind farms marked RWE are owned by that company.

- These five wind farms have a total capacity of 5618 MW.

- Will RWE export, their electricity to Germany through NeuConnect?

I can certainly see National Grid building one of the world’s largest electrolysers and some energy storage on the Isle of Grain, if an East Coast Interconnector is built.