Centrica Enters Into Long Term Natural Gas Sale & Purchase Agreement

The title of this post, is the same as this press release from Centrica.

This is the sub-heading,

Centrica plc today confirmed that its trading arm, Centrica Energy, has entered into a natural gas sale and purchase agreement with US-based Devon Energy Corporation.

This first paragraph adds a few more details.

Under the agreement, Devon Energy will supply 50,000 (MMBtu) per day of natural gas over a 10‑year term starting in 2028. This is equivalent to five LNG cargoes per year. The volumes will be indexed to European gas hub price (TTF). This sale and purchase agreement supports Centrica’s objective of managing market price risk in its LNG portfolio by aligning feed gas pricing with European gas prices whilst providing Devon Energy with international price exposure.

At a first look, it looks a lot of gas.

In Investment In Grain LNG, I talk about Centrica’s purchase of the Grain LNG Terminal from National Grid. But the Grain LNG Terminal comes with several things that Centrica might need for gas from Devon.

- A large amount of gas storage.

- The ability to convert liquid natural gas (LNG) into gas suitable for consumers.

- Space to build more storage if required.

- The ability to store LNG for other companies.

- Two jetties for delivering the LNG to the Grain LNG Terminal.

- The ability to load tankers with LNG, so that it can be sold on to third parties like say the Germans or the Poles.

Centrica also say this about their use of the Grain LNG Terminal in this press release, that describes the purchase of the terminal.

Aligned with Centrica’s strategy of investing in regulated and contracted assets supporting the energy transition, delivering predictable long-term, inflation-linked cash flows, with 100% of capacity contracted until 2029, >70% until 2038 and >50% until 2045.

Centrica have obviously modelled their gas supply and delivery and I believe they have come up with a simple strategy, that will work.

How Will Centrica Use The Gas From The Grain LNG Terminal?

The Wikipedia entry for the Grain LNG Terminal says this about the terminal delivering gas into the gas grid.

The terminal can handle up to 15 million tonnes per annum of LNG, has a storage capacity for one million cubic metres of LNG, and is able to regasify up to 645 GWh per day (58 million cubic metres per day) for delivery into the high pressure gas National Transmission System (NTS).

Note.

- This will be one of the major uses of the gas.

- I wouldn’t be surprised if these capacities will be increased significantly, so that more gas can be stored and processed.

In Investment in Grain LNG, I outlined how I believe that hydrogen and ammonia will be produced for the bunkering of ships on one of busiest sea lanes in Europe, if not the world.

Some LNG will be used to create these zero-carbon fuels.

Some modern ships, also run on natural gas, so I asked Google AI about their operation and received this answer.

Ships can run on natural gas, specifically liquefied natural gas (LNG), by using it as a fuel source in specially designed engines. LNG is natural gas that has been cooled to a liquid state at -162°C, making it easier to store and transport. This liquid form is then used to power the ship’s engines, either directly or by burning the boil-off gas (BOG) that naturally occurs when LNG warms up.

This means that some LNG could be used to directly fuel these ships.

What Is The Gas Capacity Of The Grain LNG Terminal?

I asked Google AI this question and received this answer.

The Grain LNG Terminal, the largest LNG import terminal in Europe, has a storage capacity of 1,000,000 cubic meters (m³) and an annual throughput capacity of 15 million tonnes of LNG. This is equivalent to about 20% of the UK’s total gas demand. The terminal also has the capacity to deliver 25% of the UK’s daily gas demand.

As the space is there, I wouldn’t be surprised to see Centrica increase the capacity of the terminal, as in cold weather, emergency gas for Germany can be delivered quicker from Kent than the United States.

Could The Grain LNG Terminal Accept Gas Deliveries From The United States?

I’m certain that it already does.

Could The Grain LNG Terminal Accept Gas Deliveries From The UK?

If we start extracting gas again from under the seas around the UK, could the Grain LNG Terminal be used to store it?

Yes, but it would have to be liquified first.

It would be more energy efficient to process the extracted gas, so it could be used directly and gasify enough gas at Grain LNG Terminal from storage to make up any shortfall.

Conclusion

Centrica have done some very deep joined up thinking, by doing a long term gas deal and the Grain LNG Terminal purchase so that they have the gas to supply and somewhere to keep it, until it is needed.

Investment in Grain LNG

The title of this post, is the same as that of this press release from Centrica.

This sub-heading outlines the deal.

Centrica plc (the “Company”, “Centrica”) is pleased to announce the acquisition of the Isle of Grain liquified natural gas terminal (“Grain LNG”) in partnership1 with Energy Capital Partners LLP (“ECP”) from National Grid group (“National Grid”) for an enterprise value of £1.5 billion. After taking into account approximately £1.1 billion of new non-recourse project finance debt, Centrica’s 50% share of the equity investment is approximately £200 million.

The press release lists these key points.

- Grain LNG delivers vital energy security for the UK, providing critical LNG import/export, regasification and rapid response gas storage capacity to balance the energy system.

- Aligned with Centrica’s strategy of investing in regulated and contracted assets supporting the energy transition, delivering predictable long-term, inflation-linked cash flows, with 100% of capacity contracted until 2029, >70% until 2038 and >50% until 2045.

- Opportunities for efficiencies to create additional near-term value, and future development options including a combined heat and power plant, bunkering, hydrogen and ammonia.

- Highly efficient funding structure, with Centrica’s equity investment of approximately £200 million alongside non-recourse project financing.

- Strong life of asset returns aligned with Centrica’s financial framework, with an expected unlevered IRR2 of around 9% and an equity IRR2 of around 14%+

Underpins delivery of £1.6 billion end-2028 EBITDA target3 – Centrica’s share of EBITDA expected to be approximately £100 million per annum and cash distributions expected to be around £20 million on average per annum for 2026-2028, representing an attractive yield on Centrica’s equity investment - Partnership with ECP (part of Bridgepoint Group plc), one of the largest private owners of natural gas generation and infrastructure assets in the U.S. with direct experience in supporting grid reliability.

This Google Map shows the various energy assets on the Isle of Grain.

Note.

- It appears that works for the 1, 400 MW NeuConnect interconnector to Wilhelmshaven in Germany, are taking place in the North-East corner of the map.

- Grain CHP powerstation is a 1,275MW CCGT power station, which is owned by German company; Uniper, that is in the South-East corner of the map, which can also supply up to 340MW of heat energy recovered from the steam condensation to run the vapourisers in the nearby liquefied natural gas terminal.

- The Grain LNG terminal is at the Western side of the map.

- In the Thames Estuary to the East of the Isle of Grain, I estimate that there are about 1,500 MW of wind turbines.

I find it interesting that two of the assets are German owned.

I have some thoughts.

It Is A Large Site With Space For Expansion

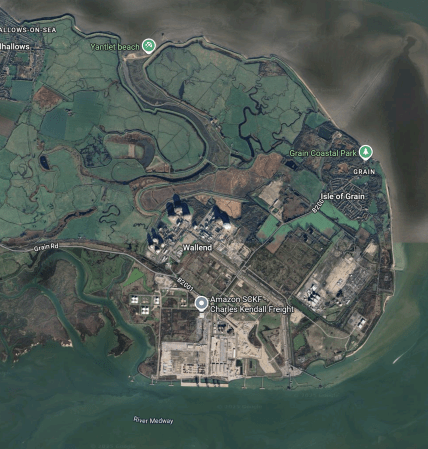

This Google Map shows the whole of the Isle of Grain.

Note.

- The Grain LNG terminal is around the label Wallend.

- The River Medway runs East-West at the bottom of the map.

- Gas tankers deliver and take on gas at jetties on the North Bank of the Medway.

There could be space to expand the terminal, if the RSPB would allow it.

As an example, I asked Google AI, if peregrine falcons nest on chemical plants and got this reply.

Yes, peregrine falcons do nest on chemical plants. They have adapted to using various urban and industrial structures, including chemical plants, for nesting. This is particularly true in areas where natural cliff habitats are scarce.

Peregrine falcons are known for their adaptability, and their population has seen a resurgence in recent decades, partly due to their ability to utilize man-made structures. These structures often mimic their natural cliffside nesting

Cliffs do seem scarce on the Isle of Grain. I also asked Google AI, if peregrine falcons ate small rodents, as several chemical and other plants, where I’ve worked, had a rodent problem. One plant had a cat problem, as there had been so many rats. This was the reply.

Yes, peregrine falcons do eat small rodents, though they primarily consume birds. While their diet mainly consists of other birds like pigeons, doves, and waterfowl, they will also hunt and eat small mammals, including rodents such as mice, rats, and voles. They are opportunistic hunters and will take advantage of readily available prey, including insects, amphibians, and even fish.

I’m sure if Centrica wanted to expand, they’d employ the best experts.

Who Are ECP?

One of the key points of the press release is that this deal is a partnership with ECP (part of Bridgepoint Group plc), one of the largest private owners of natural gas generation and infrastructure assets in the U.S. with direct experience in supporting grid reliability.

The Wikipedia entry for ECP or Energy Capital Partners has this first section.

Energy Capital Partners Management, LP (ECP) is an American investment firm headquartered in Summit, New Jersey. It focuses on investments in the energy sector. The firm has additional offices in New York City, Houston, San Diego, Fort Lauderdale and Seoul.

In August 2024, ECP merged with Bridgepoint Group to form a private assets investment platform.

The Wikipedia entry for the Bridgepoint Group has this first paragraph.

Bridgepoint Group plc is a British private investment company listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

The company had started as part of NatWest.

Are The Germans Going To Take Away Some Of Our Electricity?

Consider.

- Germany has a big need to replace Russian gas and indigenous coal, and to decarbonise.

- Neuconnect is a 1.4 GW interconnector between the Isle of Grain and Wilhelmshaven in Germany. It is scheduled to be completed in 2028.

- The Grain CHP powerstation is a 1,275MW CCGT power station, which is owned by German company; Uniper, could almost keep NeuConnect working at full power on its own.

- I said earlier, in the Thames Estuary to the East of the Isle of Grain, I estimate that there are about 1,500 MW of wind turbines. One of which is part German-owned.

The Germans are also building a large electrolyser at Wilhelshaven, which is described by Google AI like this.

The Wilhelmshaven Green Energy Hub will initially feature a 500MW electrolyzer, with plans to potentially expand to 1GW, according to Energy Monitor. The hub, a joint project between Tree Energy Solutions (TES) and EWE, aims to produce green hydrogen using renewable energy sources like offshore wind. The 500MW electrolyzer is scheduled to be operational by 2028.

I wouldn’t be surprised to see that the Wilhelmshaven electrolyser were to be powered by British-generated electricity flowing down NeuConnect.

Centrica Says Their Future Development Options Include A Combined Heat And Power Plant

This objective was set in one of the key points.

This is the first paragraph of the Wikipedia entry for the Grain LNG Terminal.

Grain LNG Terminal is a Liquefied Natural Gas (LNG) terminal on the Isle of Grain, 37 miles (60 km) east of London. It has facilities for the offloading and reloading of LNG from ships at two jetties on the River Medway; for storing and blending LNG; for truck loading; and regasifying and blending natural gas to meet UK specifications. The terminal can handle up to 15 million tonnes per annum of LNG, has a storage capacity for one million cubic metres of LNG, and is able to regasify up to 645 GWh per day (58 million cubic metres per day) for delivery into the high pressure gas National Transmission System (NTS). The facility is owned and operated by National Grid Grain LNG Ltd, a wholly owned subsidiary of National Grid.

Note.

- This paragraph was written before the Centrica takeover.

- The terminal also converts liquid natural gas into gas to be distributed around the UK.

The heat needed to convert the liquid natural gas to gas is provided by the Grain CHP power station.

- Currently 340 MW of heat is provided.

- If the Grain LNG terminal is expanded, it will probably need more heat.

I can see Centrica building a combined heat and power (CHP) power station, that can be expanded to meet the current and future needs of gasification at the Grain LNG terminal.

I wouldn’t be surprised to see the CHP power station fitted with carbon capture, as Kent is surely one county, where carbon dioxide can be used in food production, so we can generate our carbon dioxide and eat it.

Centrica Says Their Future Development Options Include Hydrogen

This objective was set in one of the key points.

Consider.

- Centrica are an investor in HiiROC, who have a unique method of generating affordable zero-carbon hydrogen called thermal plasma electrolysis, which uses a fifth of the electricity, that traditional electrolysis does.

- HiiROC can use natural gas as a feedstock. Centrica won’t be short of that at Grain.

- There is space to build a large HiiROC system at the Isle of Grain site.

- The hydrogen could be taken away by tanker ships.

Like the electricity , which will use the 450 mile NeuConnect interconnector, the hydrogen could even be exported to Wilhelmshaven in Germany by pipeline.

Wilhelmshaven is being setup to be a major German hub to both generate, import and distribute hydrogen.

I asked Google AI, how much hydrogen a GWh would produce and received this answer.

A GWh of electricity can produce approximately 20-22 tonnes of hydrogen through electrolysis, depending on the efficiency of the electrolyzer. Modern commercial electrolyzers operate at an efficiency of roughly 70-80%, meaning they require about 50-55 kWh of electricity to produce 1 kg of hydrogen. A GWh (1 gigawatt-hour) is equal to 1,000,000 kWh, and 1 tonne of hydrogen contains roughly 33.33 MWh of energy.

As it is claimed on the web that HiiROC is five times more efficient than traditional electrolysis, it could need around 10-11 kWh to produce one kg. of hydrogen.

1 GWh would produce between 90-100 tonnes of hydrogen.

Centrica Says Their Future Development Options Include Ammonia

This objective was set in one of the key points.

I asked Google AI if ammonia can be produced from hydrogen and received this answer.

Yes, ammonia (NH3) can be produced from hydrogen (H2) through a process called the Haber-Bosch process. This process involves combining hydrogen with nitrogen (N2) from the air, under high temperature and pressure, in the presence of a catalyst.

Ammonia has a large number of uses, including making fertiliser and the powering of large ships.

I asked Google AI, if there are small Haber-Bosch processes to make ammonia from hydrogen and nitrogen and received this answer.

Yes, there are efforts to develop smaller-scale Haber-Bosch processes for ammonia production. While the traditional Haber-Bosch process is typically associated with large industrial plants, research and development are exploring ways to adapt it for smaller, distributed production, particularly for localized fertilizer or fuel applications.

I wondered if Centrica are involved in the efforts to develop smaller-scale Haber-Bosch processes for ammonia production.

Google AI gave me this quick answer.

Centrica is involved in research related to the Haber-Bosch process, particularly in the context of transitioning to a low-carbon energy future. They are exploring how to adapt the Haber-Bosch process, which is crucial for fertilizer production but also a significant source of CO2 emissions, to utilize renewable energy sources. This includes investigating the use of green hydrogen produced from water electrolysis and renewable electricity. Centrica is also involved in research related to using ammonia as a fuel, including potentially for power generation

That looks to be a very positive answer. Especially, as local low-carbon fertiliser production could be a very powerful concept.

Centrica Says Their Future Development Options Include Bunkering

This objective was set in one of the key points.

Bunkering is the process of refuelling ships.

I didn’t know much about bunkering, when I started to read Centrica’s press release, but the Wikipedia entry, was a good way to get some information.

This section in the Wikipedia entry is entitled Two Types Of Bunkering, where this is said.

The two most common types of bunkering procedure at sea are “ship to ship bunkering” (STSB), in which one ship acts as a terminal, while the other moors. The second type is “stern line bunkering” (SLB), which is the easiest method of transferring oil but can be risky during bad weather.

Over the years, I have found, that two zero-carbon fuels are under development, for powering ships; hydrogen and ammonia. Others are developing ships powered by naturalo gas.

I asked Google AI if hydrogen can power ships and received this answer.

Yes, hydrogen can power ships. It can be used as a fuel for fuel cells, which generate electricity to power the ship’s propulsion and other systems, or it can be burned in modified combustion engines. Hydrogen offers a zero-emission solution for shipping, with water vapor being the only byproduct when used in fuel cells.

Google AI also told me this.

The world’s first hydrogen-powered cruise ship, the “Viking Libra”, is currently under construction and is scheduled for delivery in late 2026. This innovative vessel, a collaboration between Viking Cruises and Italian shipbuilder Fincantieri, will utilize hydrogen for both propulsion and electricity generation, aiming for zero-emission operation.

I also asked Google AI if ammonia can power ships and received this answer.

Yes, ammonia can be used to power ships and is considered a promising alternative fuel for the maritime industry. Several companies and organizations are actively developing ammonia-powered ship designs and technologies. While challenges remain, particularly around safety and infrastructure, ammonia is seen as a key potential fuel for decarbonizing shipping.

Finally, I asked I asked Google AI if natural gas can power ships and received this answer.

Yes, ships can be powered by natural gas, specifically in the form of liquefied natural gas (LNG). LNG is increasingly used as a marine fuel, offering environmental benefits over traditional fuels like diesel.

It would seem to be a case of you pays your money and makes a choice between one of four technologies; ammonia, hydrogen fuel-cell, hydrogen-ICE and LNG.

I looks to me, that if Centrica provide bunkering services for ships, they have the means to cover most of the market by providing hydrogen and ammonia, in addition to natural gas.

Although, I don’t know much about bunkering, I do feel that the two current methods, that work for oil, could be made to work for these fuels.

This Google Map shows the Thames Estuary.

Note.

- The Port of Tilbury is in the South-West corner of the map.

- London Gateway is indicated by the red arrow.

- The Isle of Grain is in the South-East corner of the map.

- Other ports between Tilbury and the Isle of Grain include Barking, Dagenham, Dartford, Erith, Greenwich, Northfleet, Purfleet, Silvertown and Thurrock.

There was never a more true phrase than – “Location, Location and Location”. And the Isle of Grain would appear to be in the right place to send out a bunkering tanker to a passing ship, that was calling at a port in London or just passing through the Strait of Dover.

This Google Map shows the Thames between London Gateway and the Isle of Grain.

Note.

- London Gateway is indicated by the red arrow.

- The Isle of Grain is in the South-East corner of the map.

It seems to me, that a refuelling philosophy could easily be worked out.

How Large is The Bunkering Market?

I asked Google AI this question and received this answer.

The world bunker fuel market is a multi-billion dollar industry, with the market size valued at USD 150.93 billion in 2023. It is projected to reach USD 242.29 billion by 2032, growing at a CAGR of 5.4% according to SkyQuest Technology. In terms of volume, the global bunker demand was estimated at 233.1 million metric tons in 2023 according to the IMO.

The market is not small!

Hydrogen Deployment Milestone For Cemex And HiiROC

The title of this post, is the same as that of this article on Agg-Net.

This is the sub-heading.

Cemex kick-start first-of-a-kind low-carbon hydrogen project using thermal plasma electrolysis in cement production

These first two paragraphs add more detail.

CEMEX Ventures, Cemex’s corporate venture capital (CVC) and open innovation unit, announced today an initial hydrogen deployment at industrial scale with HiiROC, the pioneering British hydrogen company that produces affordable, clean hydrogen, at their Rugby cement plant in the UK.

Hydrogen has emerged as a low-carbon energy source within the construction industry’s decarbonization roadmap and offers potential as an energy solution to help reduce the sector’s reliance on fossil fuels and lower CO2 emissions. This venture marks a significant milestone for Cemex, as it represents the beginning of a large-scale strategic project plan with the aim to further lower their carbon emissions in cement production.

These third paragraph is a good outline of HiiROC and how it can be deployed.

HiiROC produce carbon-neutral hydrogen using their proprietary Thermal Plasma Electrolysis (TPE) process, which requires just one-fifth of the electrical energy used in water electrolysis and captures carbon as a solid by-product, avoiding CO2 emissions – a game-changer for the industry. HiiROC’s modular solution can be deployed as single units to full-scale industrial plants, and the hydrogen produced can be used as an alternative energy source to fuel clinker production processes, helping Cemex to achieve their decarbonization goals.

Centrica, Cemex, Hyundai, Kia and others are investors in HiiROC.

I asked Google AI, what percentage of carbon emissions came from cement production and got this answer.

Cement production accounts for roughly 8% of global carbon dioxide (CO2) emissions, according to think tank Chatham House. This makes it a significant contributor to climate change, with the industry’s emissions comparable to the total emissions of some countries.

If HiiROC can take a big bite out of carbon emissions, by reducing cement production’s 8 % share, they would be on a winner.

British Gas Owner Mulls Mini-Nuke Challenge To Rolls-Royce

The title of this post, is the same as that of this article in The Telegraph.

This is the sub-heading.

Centrica is looking to follow Rolls-Royce in developing small modular reactors

These are the first three paragraphs.

The owner of British Gas is considering investing in mini nuclear power plants in the UK as it seeks to cash in on burgeoning demand for the technology.

Centrica is in early talks with the Government about a potential future deal that could see the energy giant participate in the development of so-called small modular reactors (SMRs).

It comes after Ed Miliband, the Energy Secretary, last month announced billions of pounds in funding for SMRs, which will form part of a new “golden age” for atomic energy.

In Centrica Really Can’t Lose At Sizewell, I looked at Centrica’s involvement in Sizewell C and in particular the financing of the nuke and what Centrica would do with their share of the electricity, that the nuke will produce.

I listed these uses for hydrogen in the East of England.

- Transport – Buses, Coaches and Trucks

- Large Construction Projects

- Rail

- Ports

- Airports

- Agriculture And The Rural Economy

- Exports

I do wonder, if Centrica made the investment in Sizewell C, when they realised that there were a lot of uses for hydrogen and producing hydrogen using the electricity from a nuclear power station was a good way to generate hydrogen.

- Sizewell B is a 1.2 GW nuclear powerstation.

- Sizewell C is a 3.2 GW nuclear powerstation.

- Their investment in HiiROC surely gives them access to the technology to generate hydrogen.

- Centrica have a lot of experience of selling natural gas to customers, who need energy.

- There were also substantial government guarantees involved.

- Hydrogen made by a nuclear reaxtor is generally referred to as pink hydrogen.

- In Westinghouse And Bloom Energy To Team Up For Pink Hydrogen, I describe how two American companies have formed a partnership to make pink hydrogen.

Before they invested in Sizewell C, they would have done detailed financial and technical due diligence.

Did Centrica then scale the calculations to see if funding a Small Modular Reactor (SMR) to make hydrogen was a viable deal?

- SMRs are typically around 400-500 MW.

- The article mentions Rolls-Royce, but other companies are developing SMRs.

- Centrica use Rolls-Royce mtu generators for some of their installations.

- Some SMR/HiiROC systems could be built close to steelworks or other high energy users.

This is a very interesting development in taking the UK to net-zero.

Centrica Really Can’t Lose At Sizewell

The title of this post, is the same as that of this article in The Times.

This is the sub-heading.

Centrica’s £1.3 billion investment in Sizewell C guarantees substantial returns, even with cost overruns.

These two-and-a-half paragraphs explain the funding.

Now we know what Ed Miliband means by his “golden age of nuclear” — golden for the companies putting their money into Sizewell C. Yes, reactor projects have a habit of blowing up private investors. But maybe not this one. It looks more like an exercise in transferring risk to consumers and the taxpayer.

Sure, nobody builds a £38 billion nuke on a Suffolk flood plain without a frisson of danger. But the energy secretary and his Treasury chums have done their bit to make things as safe as possible for the companies putting in equity alongside the government’s 44.9 per cent stake: Canada’s La Caisse with 20 per cent, British Gas-owner Centrica (15 per cent), France’s EDF (12.5 per cent) and Amber Infrastructure (7.6 per cent).

For starters, nearly all the debt for the 3.2 gigawatt plant, three-quarters funded by loans, is coming from the state-backed National Wealth Fund. It’s bunging in up to £36.6 billion, with £5 billion more guaranteed by a French export credit agency.

It looks to me that between them the British and French governments are providing £41.5 billion of loans to build the £38 billion nuke.

These are my thoughts.

Hydrogen And Sizewell C

This page on the Sizewell C web site is entitled Hydrogen And Sizewell C.

Under a heading of Hydrogen Buses, this is said.

At Sizewell C, we are exploring how we can produce and use hydrogen in several ways. We are working with Wrightbus on a pilot scheme which, if successful, could see thousands of workers transported to and from site on hydrogen double decker buses. You can read more about the pilot scheme in our press release

Firstly, it could help lower emissions during construction of the power station. Secondly, once Sizewell C is operational, we hope to use some of the heat it generates (alongside electricity) to make hydrogen more efficiently.

This would appear to be a more general statement about hydrogen and that the following is planned.

- Hydrogen-powered buses will be used to bring workers to the site. A press release on the Sizewell C web site, talks about up to 150 buses. That would probably be enough buses for all of Suffolk.

- Hydrogen-powered construction equipment will be used in the building of the power station.

- It also talks about using the excess heat from the power station to make hydrogen more efficiently. I talk about this process in Westinghouse And Bloom Energy To Team Up For Pink Hydrogen.

This is a substantial investment in hydrogen.

Centrica And Electricity From Sizewell C

The article in The Times, also says this.

Even so, there’s a fair bit of protection for the likes of Centrica, which has also agreed a 20-year offtake deal for its share of Sizewell’s electricity. The price of that is not yet known.

Nothing is said in the article about the size of Centrica’s electricity offtake.

- If they get 15 % of Sizewell C, that would by 480 MW.

- If they get 15 % of Sizewell B + C, that would by 660 MW.

If they use their share to generate hydrogen, Suffolk would have a massive hydrogen hub.

To power the buses and construction of Sizewell C, Sizewell B could be used to provide electricity to create the hydrogen.

How Would The Hydrogen Be Produced?

Centrica, along with other companies, who include Hyundai and Kia, are backers of a company in Hull called HiiROC, who use a process called Thermal Plasma Electrolysis to generate hydrogen.

On their web site, they have this sub-heading.

A Transformational New Process For Affordable Clean Hydrogen

The web site also describes the process as scalable from small modular units up to industrial scale. It also says this about the costs of the system: As cheap as SMR without needing CCUS; a fraction of the energy/cost of water electrolysis.

If HiiROC have achieved their objective of scalability, then Centrica could grow their electrolyser to meet demand.

How Would The Hydrogen Be Distributed?

Consider.

- Currently, the Sizewell site has both road and rail access.

- I can still see in my mind from the 1960s, ICI’s specialist articulated Foden trucks lined up in the yard at Runcorn, taking on their cargoes of hydrogen for delivery all over the country.

- As that factory is still producing hydrogen and I can’t remember any accidents in the last sixty years, I am fairly sure that a range of suitable hydrogen trucks could be developed to deliver hydrogen by road.

- The road network to the Siewell site is being updated to ensure smooth delivery of workers and materials.

- The rail access to the Sizewell site is also being improved, for the delivery of bulk materials.

I believe there will be no problems delivering hydrogen from the Sizewell site.

I also believe that there could be scope for a special-purpose self-propelled hydrogen tanker train, which could both distribute and supply the hydrogen to the vehicles, locomotives and equipment that will be using it.

Where Will The Hydrogen Be Used?

I have lived a large part of my life in Suffolk and know the county well.

In my childhood, there was quite a lot of heavy industry, but now that has all gone and employment is based on agriculture, the Port of Felixstowe and service industries.

I can see hydrogen being used in the following industries.

Transport

Buses and heavy trucks would be powered by hydrogen.

The ports in the East of England support a large number of heavy trucks.

Large Construction Projects

Sizewell C is not the only large construction project in the East of England, that is aiming to use low-carbon construction involving hydrogen. In Gallagher Group Host Hydrogen Fuel Trial At Hermitage Quarry, I talked about a hydrogen fuel trial for the Lower Thames Crossing, that involved JCB and Ryse Hydrogen.

Hydrogen for the Lower Thames Crossing could be delivered from Sizewell by truck, down the A12.

Rail

We may not ever see hydrogen-powered passenger trains in this country, but I do believe that we could see hydrogen-powered freight locomotives.

Consider.

- The latest electro-diesel Class 99 locomotives from Stadler have a Cummins diesel engine.

- The diesel engine is used, when there is no electrification.

- Cummins have developed the technology, that allows them to convert their latest diesel engines to hydrogen or natural gas power, by changing the cylinder head and the fuel system.

- Access to the Port of Felixstowe and London Gateway needs a locomotive with a self-powered capability for the last few miles of the route.

A Class 99 locomotive converted to hydrogen would be able to run with out emitting any carbon dioxide from Felixstowe or London Gateway to Glasgow or Edinburgh.

Ports

Ports have three main uses for hydrogen.

- To power ground-handing equipment, to create a pollution-free atmosphere for port workers.

- To fuel ships of all sizes from the humblest work-boat to the largest container ships.

- There may need to be fuel for hydrogen-powered rail locomotives in the future.

There are seven ports with excellent road and/or rail connections to the Sizewell site; Felixstowe, Great Yarmouth, Harwich, Ipswich, London Gateway, Lowestoft and Tilbury.

The proposed Freeport East is also developing their own green hydrogen hub, which is described on this page on the Freeport East web site.

Airports

Airports have two main uses for hydrogen.

- To power ground-handing equipment, to create a pollution-free atmosphere for airport workers.

- In the future, there is likely to be hydrogen-powered aircraft.

There are three airports with excellent road and/or rail connections to the Sizewell site; Norwich, Southend and Stansted.

Agriculture And The Rural Economy

Agriculture and the rural economy would be difficult to decarbonise.

Consider.

- Currently, most farms would use diesel power for tractors and agricultural equipment, which is delivered by truck.

- Many rural properties are heated by propane or fuel oil, which is delivered by truck.

- Some high-energy rural businesses like blacksmiths rely on propane, which is delivered by truck.

- Electrification could be possible for some applications, but ploughing the heavy land of Suffolk, with the added weight of a battery on the tractor, would probably be a mathematical impossibility.

- JCB are developing hydrogen-powered construction equipment and already make tractors.

- Hydrogen could be delivered by truck to farms and rural properties.

- Many boilers can be converted from propoane to run on hydrogen.

I feel, that hydrogen could be the ideal fuel to decarbonise agriculture and the rural economy.

I cover this application in detail in Developing A Rural Hydrogen Network.

Exports

Consider.

- Sizewell B and Sizewell C nuclear powerstations have a combined output of 4.4 GW.

- A rough calculation shows that there is a total of 7.2 GW of wind farms planned off the Suffolk coast.

- The East Anglian Array wind farm alone is said in Wikipedia to be planned to expand to 7.2 GW.

- The Sizewell site has a high capacity connection to the National Grid.

Nuclear plus wind should keep the lights on in the East of England.

Any excess electricity could be converted into hydrogen.

This Google Map shows the location of Sizewell B in relation to Belgium, Germany and The Netherlands.

The Sizewell site is indicated by the red arrow.

The offshore oil and gas industry has used technology like single buoy moorings and coastal tankers to collect offshore natural gas for decades.

I don’t see why coastal hydrogen tankers couldn’t export excess hydrogen to places around the North Sea, who need the fuel.

It should be born in mind, that Centrica have a good reputation in doing natural gas trading. This expertise would surely be useful in hydrogen trading.

Conclusion

I believe that a hydrogen hub developed at Sizewell makes sense and I also believe that Centrica have the skills and technology to make it work.

Centrica And PTT Sign Heads Of Agreement For Long-Term LNG Supply

The title of this post, is the same as that as this press release from Centrica.

These two paragraphs add details to the deal.

Under the agreement, PTT will supply LNG to Centrica for a 10-year period across a range of destinations in Asia, with deliveries expected to begin in 2028.

This agreement marks a significant step forward in Centrica’s strategic efforts to grow its LNG portfolio. The agreement provides access to diverse markets in Asia, whilst deepening Centrica’s relationship with PTT, an important partner in Asia. For PTT, this deal represents its first, long-term, international LNG sale.

I wonder if this is a much wider deal than it first appears.

There are a lot of small nations in Asia and it looks as the press release talks about a range of destinations in Asia, that Centrica are setting themselves up as a major supplier of LNG to the smaller nations in Asia.

Centrica are also building up a portfolio of products, that they could offer to these small nations.

- LNG terminals from their own engineering resources.

- Domestic client management software.

- Hydrogen production from HiiROC, which they have backed.

- Carbon black for soil improvement from HiiROC.

- Liquid Air energy storage from Highview Power, which they have backed.

- Gas-fired power stations perhaps based on Rolls-Royce mtu diesel engines running on natural gas or hydrogen.

Countries could get these products and services from China, but at what price?

The British Mini Nuclear Fusion Reactor That Actually Works

The title of this post, is the same as that as this article in The Times.

This is the sub-heading.

The only functional model in the world is so small it fits on a table and is set to help diagnose and cure cancer

These are the first two paragraphs, which add more details.

There are a few things that mark this nuclear fusion reactor out as unusual. For one, it is rather small: it could fit on a table top. For another, this research model currently has a little more gaffer tape than you might expect of the energy technology of the future.

But the biggest difference between it and its competitors is that this nuclear fusion reactor, in a warehouse north of Bristol, is actually working. And it is on the cusp of doing something more unusual still: making money.

It almost makes you think, that it should be filed under Too Good To Be True!

In the late 1960s, I shared an office at ICI Mond Division in Runcorn, with a guy, who was working on a process to make acetylene by a revolutionary route.

The process never worked, but now it has turned up being used by a company called HiiROC to make hydrogen.

They are also backed by some big names like Centrica, Hyundai, Kia and others.

I wonder how many other old ideas are finally ripe for developing, due to improvements in manufacturing and systems to control them.

Centrica And Equinor Agree Major New Deal To Bolster UK Energy Security

The title of this post, is the same as that as this news item from Centrica.

This is the sub-heading.

Centrica and Equinor have today announced a £20 billion plus agreement to deliver gas to the UK. The new deal will see Centrica take delivery of five billion cubic meters (bcm) of gas per year to 2035.

These three paragraphs add more detail to the deal.

The expansive ten-year deal continues a long-term relationship with Equinor that dates back to 2005 bringing gas from Norway to the UK.

In 2024, the UK imported almost two-thirds (66.2%) of its gas demand, with 50.2% of the total imports coming from Norway1. This is an increase from the UK importing around a third of its gas requirements from Norway in 20222 and underlines the strategic importance of the Norwegian relationship to UK energy and price security.

The contract also allows for natural gas sales to be replaced with hydrogen in the future, providing further support to the UK’s hydrogen economy.

I believe there is more to this deal than, is stated in the news item.

These are my thoughts.

Where Does AquaVentus Fit In?

The AquaVentus web site has a sub heading of Hydrogen Production In The North Sea.

This video on the web site shows the structure of the project.

I clipped this map from the video.

Note.

- The thick white line running North-West/South-East is the spine of AquaVentus, that will deliver hydrogen to Germany.

- There is a link to Esbjerg in Denmark, that is marked DK.

- There appears to be an undeveloped link to Norway, which goes North,

- There appears to be an undeveloped link to Peterhead in Scotland, that is marked UK.

- There appears to be a link to just North of the Humber in England, that is marked UK.

- There appears to be an extra link, that would create a hydrogen link between Norway and Humberside.

- Just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

- Aldbrough and Rough gas storage sites are being converted into two of the largest hydrogen storage sites in the world!

- There appear to be small ships sailing up and down the East Coast of the UK. Are these small coastal tankers, that are distributing the hydrogen to where it is needed?

When it is completed, AquaVentus will be a very comprehensive hydrogen network.

RWE

I should add that AquaVentus is a project of German energy company; RWE.

It should be noted that RWE are the largest generator of electricity in the UK.

They will soon be even larger as they are developing these offshore wind farms in British waters.

- Dogger Bank South – 3 GW

- Norfolk Boreas – 1.4 GW

- Norfolk Vanguard East – 1.4 GW

- Norfolk Vanguard West – 1.4 GW

Note.

- This is 7.2 GW of electricity.

- The three Norfolk wind farms wwere possibly acquired at a bargain price from Vattenfall.

- None of these wind farms have Contracts for Difference.

- RWE are developing large offshore electrolysers.

- East Anglia is in revolt over pylons marching across the landscape.

I wonder, if RWE will convert the electricity to hydrogen and bring it ashore using AquaVentus, coastal tankers or pipelines to existing gas terminals like Bacton.

The revenue from all this hydrogen going to Germany could explain the rise in Government spending, as it could be a Magic Money Tree like no other.

HiiROC

HiiROC is a Hull-based start-up company backed by Centrica, that can turn any hydrocarbon gas, like chemical plant waste gas, biomethane or natural gas into turquoise hydrogen and carbon black.

I asked Google about the size of Norway’s chemical industry and got this reply.

Norway’s chemical industry, including oil refining and pharmaceuticals, is a significant part of the country’s economy. In 2023, this sector generated sales of NOK 175 billion (approximately €15.2 billion), with 83% of those sales being exports. The industry employed 13,800 full-time equivalents and added NOK 454 billion (approximately €3.9 billion) in value.

Isn’t AI wonderful!

So will Norway use HiiROC or something similar to convert their natural gas and chemical off-gas into valuable hydrogen?

If AquaVentus were to be extended to Norway, then the hydrogen could be sold to both the UK and Germany.

A scenario like this would explain the option to switch to hydrogen in the contract.

Aldbrough And Brough

Earlier, I said that just North of the Humber are the two massive gas storage sites of Aldbrough owned by SSE and Brough owned by Centrica.

I have read somewhere, that Germany is short of hydrogen storage, but I’m sure Centrica and SSE will help them out for a suitable fee. Centrica are also thought to be experts at buying energy at one price and selling it later at a profit.

Conclusion

I have felt for some time, that selling hydrogen to the Germans was going to be the Conservative government’s Magic Money Tree.

Has this Labour government decided to bring it back to life?

South Korea Aims To Lead The Global Market With Hydrogen Train

The title of this post, is the same as that of this article on Railly News.

These are the first two introductory paragraphs.

South Korea is taking an ambitious step with a vision of becoming a major player in the rapidly growing global hydrogen rail market. To 26,4 billion dollars The country that wants to gain a competitive advantage in this market that is expected to reach A self-developed Hydrogen Train by 2028 announced plans to introduce.

This strategic project is the national railway operator of South Korea korail will be managed by Korail, Building a two-car hydrogen train prototype by 2027 and creating the necessary legal and operational infrastructure for the dissemination of this technology. $23 million will make an investment. South Korean officials also clearly state that they aim to set international standards in the field of hydrogen-based mobility with this project.

I’ve thought for some time, that the Koreans have been serious about hydrogen-powered transport, as Hyundai keeps popping up with hydrogen transport and other ideas.

British company; Centrica owns a big share with Hyundai, Kia and others of a British start-up company from Hull, called HiiROC.

This is the HiiROC web site.

HiiROC can take any hydocarbon gas and split it into green hydrogen and carbon black.

Green hydrogen is obviously useful and the carbon black can be used for making tyres for vehicles, anodes for lithium-ion batteries and in agriculture for soil improvement.

Waste off-gas from a chemical plant can be split into green hydrogen and carbon black.

Biomethane from a sewage plant can be split into hydrogen and carbon black. Could a sewage plant on an estate be used to create biomethane for cooking and feeding to the HiiROC plant? Yes!

Could green hydrogen produced on the estate be used to drive vehicles like cars, vans and ride-on-mowers. Yes! If the manufacturer of the vehicle allows it!

How convenient would it be to have Hydrogen-at-Home?

The Korean investment in HiiROC by Hyundai and Kia clearly fits with the philosophy expressed in the second paragraph of the article of creating the hydrogen infrastructure.

I believe that at some point in the future, you will be able to buy a HiiROC device, that gives you as much hydrogen as you need to power your car, truck, bus, tram or train. The Koreans have a track record of turning ideas like this into reality.

Another Headache For Fossil Fuels: Liquid Air Energy Storage

The title of this post, is the same as that of this article on Clean Technica.

This article is an honest American look at Highview Power’s liquid air batteries and a must-read.

This is the first paragraph.

Whatever happened to liquid air energy storage? The UK startup Highview Power was going to bring its new liquid air system to the US back in 2019, providing the kind of scaled-up and long duration energy storage needed to support more wind and solar power on the grid. Highview switched gears and headed back home where the grass is greener. Our loss is the UK’s gain…

They first wrote about Highview Power in 2011, which shows how long some of these projects take to come to fruition.

The article also has this view on the state of offshore wind in the United States today.

Perhaps it’s just as well that Highview dropped its US plans when it did. Offshore wind stakeholders in the US were just beginning to find their footing along the Atlantic coast when President Trump took office on January 20 and promptly sent the offshore industry into a death spiral.

If I lived in the US today, I’d thinking about leaving given Trump’s barmy energy policies.

This paragraph from Highview Power’s web site, discloses their backers.

The £300 million funding round was led by the UK Infrastructure Bank (UKIB) and the British multinational energy and services company Centrica, alongside a syndicate of investors including Rio Tinto, Goldman Sachs, KIRKBI and Mosaic Capital.

So at least some American companies believe in Highview Power. KIRKBI is the investment vehicle of the family, that invented Lego.