£1.5 billion Enables UK-US Pair To Get Their Hands On Europe’s Giant LNG Terminal

The title of this post, is the same as that of this article on Offshore Energy.

This is the sub-heading.

UK-based energy player Centrica and U.S. investment firm Energy Capital Partners (ECP), part of Bridgeport Group, have brought into their fold a liquefied natural gas (LNG) terminal in Kent County, United Kingdom.

This paragraph gives Centrica’s view of the Grain LNG Terminal.

The UK firm portrays the terminal as Europe’s largest LNG regasification facility, with a capacity of 15 million tonnes of LNG a year. Located on the UK’s Isle of Grain, the terminal features unloading infrastructure, regasification equipment, and truck-loading facilities.

In a press release, which is entitled Investment in Grain LNG, that was published in August 2025, Centrica said this.

Opportunities for efficiencies to create additional near-term value, and future development options including a combined heat and power plant, bunkering, hydrogen and ammonia.

The tone of the article in Offshore Energy and the press release is unmistakable. – Centrica intend to make good use of their investment.

I suggest you read both documents fully.

- Europe’s largest LNG regasification facility, with a capacity of 15 million tonnes of LNG a year, will certainly need a large combined heat and power plant.

- Will any spare power from the CHP plant, be sent to Germany, through the 1.4 GW NeuConnect interconnector, which should be commissioned by 2028?

- Hydrogen, ammonia and LNG are the three low-carbon fuels used by modern ships, so I suspect hydrogen and ammonia will be produced on the island.

- Centrica are investors in the efficient hydrogen-generation process ; HiiROC.

- Hydrogen and nitrogen are the two feedstocks for ammonia.

Centrica certainly have big plans for the Grain LNG Terminal.

I shall be following Centrica closely.

Centrica And X-energy Agree To Deploy UK’s First Advanced Modular Reactors

The title of this post, is the same as that of this press release from Centrica.

This is the sub-heading.

Centrica and X-Energy, LLC, a wholly-owned subsidiary of X-Energy Reactor Company, LLC, today announced their entry into a Joint Development Agreement (JDA) to deploy X-energy’s Xe-100 Advanced Modular Reactors (“AMR”) in the United Kingdom.

These three paragraphs add more details.

The companies have identified EDF and Centrica’s Hartlepool site as the preferred first site for a planned U.K. fleet of up to 6 gigawatts.

The agreement represents the first stage in a new trans-Atlantic alliance which could ultimately mobilise at least £40 billion in economic value to bring clean, safe and affordable power to thousands of homes and industries across the country and substantive work for the domestic and global supply chain.

A 12-unit Xe-100 deployment at Hartlepool could add up to 960 megawatts (“MW”) of new capacity, enough clean power for 1.5 million homes and over £12 billion in lifetime economic value. It would be developed at a site adjacent to Hartlepool’s existing nuclear power station which is currently scheduled to cease generating electricity in 2028. Following its decommissioning, new reactors would accelerate opportunities for the site and its skilled workforce. The site is already designated for new nuclear under the Government’s National Policy Statement and a new plant would also play a critical role in generating high-temperature heat that could support Teesside’s heavy industries.

This is no toe-in-the-water project, but a bold deployment of a fleet of small modular reactors to provide the power for the North-East of England for the foreseeable future.

These are my thoughts.

The Reactor Design

The Wikipedia entry for X-energy has a section called Reactor Design, where this is said.

The Xe-100 is a proposed pebble bed high-temperature gas-cooled nuclear reactor design that is planned to be smaller, simpler and safer when compared to conventional nuclear designs. Pebble bed high temperature gas-cooled reactors were first proposed in 1944. Each reactor is planned to generate 200 MWt and approximately 76 MWe. The fuel for the Xe-100 is a spherical fuel element, or pebble, that utilizes the tristructural isotropic (TRISO) particle nuclear fuel design, with high-assay LEU (HALEU) uranium fuel enriched to 20%, to allow for longer periods between refueling. X-energy claims that TRISO fuel will make nuclear meltdowns virtually impossible.

Note.

- It is not a conventional design.

- Each reactor is only about 76 MW.

- This fits with “12-unit Xe-100 deployment at Hartlepool could add up to 960 megawatts (“MW”) of new capacity” in the Centrica press release.

- The 960 MW proposed for Hartlepool is roughly twice the size of the Rolls-Rpoyce SMR, which is 470 MW .

- Safety seems to be at the forefront of the design.

- I would assume, that the modular nature of the design, makes expansion easier.

I have no reason to believe that it is not a well-designed reactor.

Will Hartlepool Be The First Site?

No!

This page on the X-energy web site, describes their site in Texas, which appears will be a 320 MW power station providing power for Dow’s large site.

There appear to be similarities between the Texas and Hartlepool sites.

- Both are supporting industry clustered close to the power station.

- Both power stations appear to be supplying heat as well as electricity, which is common practice on large industrial sites.

- Both use a fleet of small modular reactors.

But Hartlepool will use twelve reactors, as opposed to the four in Texas.

How Will The New Power Station Compare With The Current Hartlepool Nuclear Power Station?

Consider.

- The current Hartlepool nuclear power station has two units with a total capacity of 1,185 MW.

- The proposed Hartlepool nuclear power station will have twelve units with a total capacity of 960 MW.

- My instinct as a Control Engineer gives me the feeling, that more units means higher reliability.

- I suspect that offshore wind will make up the difference between the power output of the current and proposed power stations.

As the current Hartlepool nuclear power station is effectively being replaced with a slightly smaller station new station, if they get the project management right, it could be a painless exercise.

Will This Be The First Of Several Projects?

The press release has this paragraph.

Centrica will provide initial project capital for development with the goal of initiating full-scale activities in 2026. Subject to regulatory approval, the first electricity generation would be expected in the mid-2030s. Centrica and X-energy are already in discussions with additional potential equity partners, as well as leading global engineering and construction companies, with the goal of establishing a UK-based development company to develop this first and subsequent projects.

This approach is very similar to the approach being taken by Rolls-Royce for their small modular reactors.

Will Centrica Use An X-energy Fleet Of Advanced Modular Reactors At The Grain LNG Terminal?

This press release from Centrica is entitled Investment In Grain LNG Terminal.

This is one of the key highlights of the press release.

Opportunities for efficiencies to create additional near-term value, and future development options including a combined heat and power plant, bunkering, hydrogen and ammonia.

Note.

- Bunkering would be provided for ships powered by LNG, hydrogen or ammonia.

- Heat would be needed from the combined heat and power plant to gasify the LNG.

- Power would be needed from the combined heat and power plant to generate the hydrogen and ammonia and compress and/or liquify gases.

Currently, the heat and power is provided by the 1,275 MW Grain CHP gas-fired power station, but a new nuclear power station would help to decarbonise the terminal.

Replacement Of Heysham 1 Nuclear Power Station

Heysham 1 nuclear power station is part-owned by Centrica and EdF, as is Hartlepool nuclear power station.

Heysham 1 nuclear power station is a 3,000 MW nuclear power station, which is due to be decommissioned in 2028.

I don’t see why this power station can’t be replaced in the same manner as Hartlepool nuclear power station.

Replacement Of Heysham 2 Nuclear Power Station

Heysham 2 nuclear power station is part-owned by Centrica and EdF, as is Hartlepool nuclear power station.

Heysham 2 nuclear power station is a 3,100 MW nuclear power station, which is due to be decommissioned in 2030.

I don’t see why this power station can’t be replaced in the same manner as Hartlepool nuclear power station.

Replacement Of Torness Nuclear Power Station

Torness nuclear power station is part-owned by Centrica and EdF, as is Hartlepool nuclear power station.

Torness nuclear power station is a 1,290 MW nuclear power station, which is due to be decommissioned in 2030.

I don’t see why this power station can’t be replaced in the same manner as Hartlepool nuclear power station.

But the Scottish Nationalist Party may have other ideas?

What Would Be The Size Of Centrica’s And X-energy’s Fleet Of Advanced Modular Reactors?

Suppose.

- Hartlepool, Grain CHP and Torness power stations were to be replaced by identical 960 MW ADRs.

- Heysham 1 and Heysham 2 power stations were to be replaced by identical 1,500 MW ADRs.

This would give a total fleet size of 5,880 MW.

A paragraph in Centrica’s press release says this.

The companies have identified EDF and Centrica’s Hartlepool site as the preferred first site for a planned U.K. fleet of up to 6 gigawatts.

This fleet is only 120 MW short.

Investment in Grain LNG

The title of this post, is the same as that of this press release from Centrica.

This sub-heading outlines the deal.

Centrica plc (the “Company”, “Centrica”) is pleased to announce the acquisition of the Isle of Grain liquified natural gas terminal (“Grain LNG”) in partnership1 with Energy Capital Partners LLP (“ECP”) from National Grid group (“National Grid”) for an enterprise value of £1.5 billion. After taking into account approximately £1.1 billion of new non-recourse project finance debt, Centrica’s 50% share of the equity investment is approximately £200 million.

The press release lists these key points.

- Grain LNG delivers vital energy security for the UK, providing critical LNG import/export, regasification and rapid response gas storage capacity to balance the energy system.

- Aligned with Centrica’s strategy of investing in regulated and contracted assets supporting the energy transition, delivering predictable long-term, inflation-linked cash flows, with 100% of capacity contracted until 2029, >70% until 2038 and >50% until 2045.

- Opportunities for efficiencies to create additional near-term value, and future development options including a combined heat and power plant, bunkering, hydrogen and ammonia.

- Highly efficient funding structure, with Centrica’s equity investment of approximately £200 million alongside non-recourse project financing.

- Strong life of asset returns aligned with Centrica’s financial framework, with an expected unlevered IRR2 of around 9% and an equity IRR2 of around 14%+

Underpins delivery of £1.6 billion end-2028 EBITDA target3 – Centrica’s share of EBITDA expected to be approximately £100 million per annum and cash distributions expected to be around £20 million on average per annum for 2026-2028, representing an attractive yield on Centrica’s equity investment - Partnership with ECP (part of Bridgepoint Group plc), one of the largest private owners of natural gas generation and infrastructure assets in the U.S. with direct experience in supporting grid reliability.

This Google Map shows the various energy assets on the Isle of Grain.

Note.

- It appears that works for the 1, 400 MW NeuConnect interconnector to Wilhelmshaven in Germany, are taking place in the North-East corner of the map.

- Grain CHP powerstation is a 1,275MW CCGT power station, which is owned by German company; Uniper, that is in the South-East corner of the map, which can also supply up to 340MW of heat energy recovered from the steam condensation to run the vapourisers in the nearby liquefied natural gas terminal.

- The Grain LNG terminal is at the Western side of the map.

- In the Thames Estuary to the East of the Isle of Grain, I estimate that there are about 1,500 MW of wind turbines.

I find it interesting that two of the assets are German owned.

I have some thoughts.

It Is A Large Site With Space For Expansion

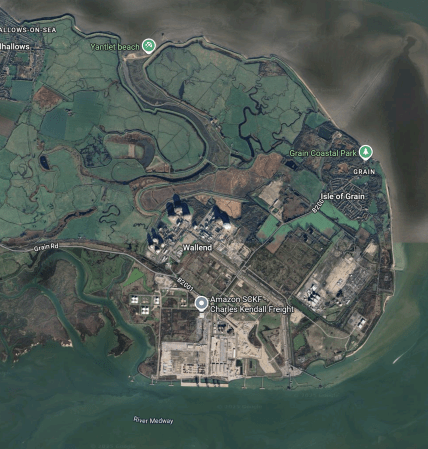

This Google Map shows the whole of the Isle of Grain.

Note.

- The Grain LNG terminal is around the label Wallend.

- The River Medway runs East-West at the bottom of the map.

- Gas tankers deliver and take on gas at jetties on the North Bank of the Medway.

There could be space to expand the terminal, if the RSPB would allow it.

As an example, I asked Google AI, if peregrine falcons nest on chemical plants and got this reply.

Yes, peregrine falcons do nest on chemical plants. They have adapted to using various urban and industrial structures, including chemical plants, for nesting. This is particularly true in areas where natural cliff habitats are scarce.

Peregrine falcons are known for their adaptability, and their population has seen a resurgence in recent decades, partly due to their ability to utilize man-made structures. These structures often mimic their natural cliffside nesting

Cliffs do seem scarce on the Isle of Grain. I also asked Google AI, if peregrine falcons ate small rodents, as several chemical and other plants, where I’ve worked, had a rodent problem. One plant had a cat problem, as there had been so many rats. This was the reply.

Yes, peregrine falcons do eat small rodents, though they primarily consume birds. While their diet mainly consists of other birds like pigeons, doves, and waterfowl, they will also hunt and eat small mammals, including rodents such as mice, rats, and voles. They are opportunistic hunters and will take advantage of readily available prey, including insects, amphibians, and even fish.

I’m sure if Centrica wanted to expand, they’d employ the best experts.

Who Are ECP?

One of the key points of the press release is that this deal is a partnership with ECP (part of Bridgepoint Group plc), one of the largest private owners of natural gas generation and infrastructure assets in the U.S. with direct experience in supporting grid reliability.

The Wikipedia entry for ECP or Energy Capital Partners has this first section.

Energy Capital Partners Management, LP (ECP) is an American investment firm headquartered in Summit, New Jersey. It focuses on investments in the energy sector. The firm has additional offices in New York City, Houston, San Diego, Fort Lauderdale and Seoul.

In August 2024, ECP merged with Bridgepoint Group to form a private assets investment platform.

The Wikipedia entry for the Bridgepoint Group has this first paragraph.

Bridgepoint Group plc is a British private investment company listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

The company had started as part of NatWest.

Are The Germans Going To Take Away Some Of Our Electricity?

Consider.

- Germany has a big need to replace Russian gas and indigenous coal, and to decarbonise.

- Neuconnect is a 1.4 GW interconnector between the Isle of Grain and Wilhelmshaven in Germany. It is scheduled to be completed in 2028.

- The Grain CHP powerstation is a 1,275MW CCGT power station, which is owned by German company; Uniper, could almost keep NeuConnect working at full power on its own.

- I said earlier, in the Thames Estuary to the East of the Isle of Grain, I estimate that there are about 1,500 MW of wind turbines. One of which is part German-owned.

The Germans are also building a large electrolyser at Wilhelshaven, which is described by Google AI like this.

The Wilhelmshaven Green Energy Hub will initially feature a 500MW electrolyzer, with plans to potentially expand to 1GW, according to Energy Monitor. The hub, a joint project between Tree Energy Solutions (TES) and EWE, aims to produce green hydrogen using renewable energy sources like offshore wind. The 500MW electrolyzer is scheduled to be operational by 2028.

I wouldn’t be surprised to see that the Wilhelmshaven electrolyser were to be powered by British-generated electricity flowing down NeuConnect.

Centrica Says Their Future Development Options Include A Combined Heat And Power Plant

This objective was set in one of the key points.

This is the first paragraph of the Wikipedia entry for the Grain LNG Terminal.

Grain LNG Terminal is a Liquefied Natural Gas (LNG) terminal on the Isle of Grain, 37 miles (60 km) east of London. It has facilities for the offloading and reloading of LNG from ships at two jetties on the River Medway; for storing and blending LNG; for truck loading; and regasifying and blending natural gas to meet UK specifications. The terminal can handle up to 15 million tonnes per annum of LNG, has a storage capacity for one million cubic metres of LNG, and is able to regasify up to 645 GWh per day (58 million cubic metres per day) for delivery into the high pressure gas National Transmission System (NTS). The facility is owned and operated by National Grid Grain LNG Ltd, a wholly owned subsidiary of National Grid.

Note.

- This paragraph was written before the Centrica takeover.

- The terminal also converts liquid natural gas into gas to be distributed around the UK.

The heat needed to convert the liquid natural gas to gas is provided by the Grain CHP power station.

- Currently 340 MW of heat is provided.

- If the Grain LNG terminal is expanded, it will probably need more heat.

I can see Centrica building a combined heat and power (CHP) power station, that can be expanded to meet the current and future needs of gasification at the Grain LNG terminal.

I wouldn’t be surprised to see the CHP power station fitted with carbon capture, as Kent is surely one county, where carbon dioxide can be used in food production, so we can generate our carbon dioxide and eat it.

Centrica Says Their Future Development Options Include Hydrogen

This objective was set in one of the key points.

Consider.

- Centrica are an investor in HiiROC, who have a unique method of generating affordable zero-carbon hydrogen called thermal plasma electrolysis, which uses a fifth of the electricity, that traditional electrolysis does.

- HiiROC can use natural gas as a feedstock. Centrica won’t be short of that at Grain.

- There is space to build a large HiiROC system at the Isle of Grain site.

- The hydrogen could be taken away by tanker ships.

Like the electricity , which will use the 450 mile NeuConnect interconnector, the hydrogen could even be exported to Wilhelmshaven in Germany by pipeline.

Wilhelmshaven is being setup to be a major German hub to both generate, import and distribute hydrogen.

I asked Google AI, how much hydrogen a GWh would produce and received this answer.

A GWh of electricity can produce approximately 20-22 tonnes of hydrogen through electrolysis, depending on the efficiency of the electrolyzer. Modern commercial electrolyzers operate at an efficiency of roughly 70-80%, meaning they require about 50-55 kWh of electricity to produce 1 kg of hydrogen. A GWh (1 gigawatt-hour) is equal to 1,000,000 kWh, and 1 tonne of hydrogen contains roughly 33.33 MWh of energy.

As it is claimed on the web that HiiROC is five times more efficient than traditional electrolysis, it could need around 10-11 kWh to produce one kg. of hydrogen.

1 GWh would produce between 90-100 tonnes of hydrogen.

Centrica Says Their Future Development Options Include Ammonia

This objective was set in one of the key points.

I asked Google AI if ammonia can be produced from hydrogen and received this answer.

Yes, ammonia (NH3) can be produced from hydrogen (H2) through a process called the Haber-Bosch process. This process involves combining hydrogen with nitrogen (N2) from the air, under high temperature and pressure, in the presence of a catalyst.

Ammonia has a large number of uses, including making fertiliser and the powering of large ships.

I asked Google AI, if there are small Haber-Bosch processes to make ammonia from hydrogen and nitrogen and received this answer.

Yes, there are efforts to develop smaller-scale Haber-Bosch processes for ammonia production. While the traditional Haber-Bosch process is typically associated with large industrial plants, research and development are exploring ways to adapt it for smaller, distributed production, particularly for localized fertilizer or fuel applications.

I wondered if Centrica are involved in the efforts to develop smaller-scale Haber-Bosch processes for ammonia production.

Google AI gave me this quick answer.

Centrica is involved in research related to the Haber-Bosch process, particularly in the context of transitioning to a low-carbon energy future. They are exploring how to adapt the Haber-Bosch process, which is crucial for fertilizer production but also a significant source of CO2 emissions, to utilize renewable energy sources. This includes investigating the use of green hydrogen produced from water electrolysis and renewable electricity. Centrica is also involved in research related to using ammonia as a fuel, including potentially for power generation

That looks to be a very positive answer. Especially, as local low-carbon fertiliser production could be a very powerful concept.

Centrica Says Their Future Development Options Include Bunkering

This objective was set in one of the key points.

Bunkering is the process of refuelling ships.

I didn’t know much about bunkering, when I started to read Centrica’s press release, but the Wikipedia entry, was a good way to get some information.

This section in the Wikipedia entry is entitled Two Types Of Bunkering, where this is said.

The two most common types of bunkering procedure at sea are “ship to ship bunkering” (STSB), in which one ship acts as a terminal, while the other moors. The second type is “stern line bunkering” (SLB), which is the easiest method of transferring oil but can be risky during bad weather.

Over the years, I have found, that two zero-carbon fuels are under development, for powering ships; hydrogen and ammonia. Others are developing ships powered by naturalo gas.

I asked Google AI if hydrogen can power ships and received this answer.

Yes, hydrogen can power ships. It can be used as a fuel for fuel cells, which generate electricity to power the ship’s propulsion and other systems, or it can be burned in modified combustion engines. Hydrogen offers a zero-emission solution for shipping, with water vapor being the only byproduct when used in fuel cells.

Google AI also told me this.

The world’s first hydrogen-powered cruise ship, the “Viking Libra”, is currently under construction and is scheduled for delivery in late 2026. This innovative vessel, a collaboration between Viking Cruises and Italian shipbuilder Fincantieri, will utilize hydrogen for both propulsion and electricity generation, aiming for zero-emission operation.

I also asked Google AI if ammonia can power ships and received this answer.

Yes, ammonia can be used to power ships and is considered a promising alternative fuel for the maritime industry. Several companies and organizations are actively developing ammonia-powered ship designs and technologies. While challenges remain, particularly around safety and infrastructure, ammonia is seen as a key potential fuel for decarbonizing shipping.

Finally, I asked I asked Google AI if natural gas can power ships and received this answer.

Yes, ships can be powered by natural gas, specifically in the form of liquefied natural gas (LNG). LNG is increasingly used as a marine fuel, offering environmental benefits over traditional fuels like diesel.

It would seem to be a case of you pays your money and makes a choice between one of four technologies; ammonia, hydrogen fuel-cell, hydrogen-ICE and LNG.

I looks to me, that if Centrica provide bunkering services for ships, they have the means to cover most of the market by providing hydrogen and ammonia, in addition to natural gas.

Although, I don’t know much about bunkering, I do feel that the two current methods, that work for oil, could be made to work for these fuels.

This Google Map shows the Thames Estuary.

Note.

- The Port of Tilbury is in the South-West corner of the map.

- London Gateway is indicated by the red arrow.

- The Isle of Grain is in the South-East corner of the map.

- Other ports between Tilbury and the Isle of Grain include Barking, Dagenham, Dartford, Erith, Greenwich, Northfleet, Purfleet, Silvertown and Thurrock.

There was never a more true phrase than – “Location, Location and Location”. And the Isle of Grain would appear to be in the right place to send out a bunkering tanker to a passing ship, that was calling at a port in London or just passing through the Strait of Dover.

This Google Map shows the Thames between London Gateway and the Isle of Grain.

Note.

- London Gateway is indicated by the red arrow.

- The Isle of Grain is in the South-East corner of the map.

It seems to me, that a refuelling philosophy could easily be worked out.

How Large is The Bunkering Market?

I asked Google AI this question and received this answer.

The world bunker fuel market is a multi-billion dollar industry, with the market size valued at USD 150.93 billion in 2023. It is projected to reach USD 242.29 billion by 2032, growing at a CAGR of 5.4% according to SkyQuest Technology. In terms of volume, the global bunker demand was estimated at 233.1 million metric tons in 2023 according to the IMO.

The market is not small!

Energy Security Boost After Centrica And Repsol Agree LNG Supply Deal

The title of this post, is the same as that of this press release from Centrica.

This is the sub-heading.

Centrica Energy and Repsol today announced the signing of a deal that will improve the UK’s energy security in the coming years.

These two paragraphs give more details of the deal.

The deal will see Centrica purchase 1 million tonnes of Liquified Natural Gas (LNG) shipments between 2025 and 2027. All of these cargoes are expected to be delivered to the Grain LNG import terminal in Kent.

The deal marks an additional move by Centrica to build further resilience in the UK’s energy security. It follows a 15 year, $8bn deal with Delfin Midstream in July 2023, a three-year supply agreement with Equinor that will heat 4.5m UK homes through to 2024 and the reopening and expansion of the Rough gas storage facility in October 2022 and June 2023 respectively. Rough now provides half of the UK’s total gas storage capacity with the potential to store over 50 billion cubic feet (bcf) of gas, enough to heat almost 10% of UK homes throughout winter.

Centrica do seem to be keeping us supplied with gas.

Two days ago, National Grid published this press release, which is entitled Grain LNG Signs New Deal With Venture Global Further Strengthening The Security Of Supply Of LNG To The United Kingdom.

This is the sub-heading.

Today (5 February), Grain LNG and Venture Global have announced the execution of a binding long-term terminal use agreement (TUA) enabling the regasification and sale of LNG from all of Venture Global’s LNG terminals in Louisiana, including CP2 LNG, subject to obtaining necessary federal permits.

These two paragraphs give more details of the deal.

Under the agreement, Venture Global will have the ability to access 3 million tonnes per annum (3MTPA) of LNG storage and regasification capacity at the Isle of Grain LNG receiving terminal for sixteen years beginning in 2029, equivalent of up to 5% of average UK gas demand.

This is the second agreement from Grain LNG’s competitive auction process which was launched in September 2023. The successful outcome of the auction further secures the future of Europe’s largest LNG import terminal into the mid 2040s.

Two big deals in the same week is not to be sneezed at and must be good for the UK’s energy security.

Grain LNG

The Grain LNG web site, greets you with this message.

Welcome To Europe’s Largest Liquified Natural Gas Terminal, Grain LNG

Grain LNG is the gateway connecting worldwide LNG to the European energy market, making a genuine difference to people’s lives. Find out all about our cutting-edge operations – showcasing our leadership in powering the future – and why Grain LNG is at the forefront of energy as we move towards net zero.

There is also a video.

This Google Map shows the location of Grain LNG on the Isle of Grain.

Note.

- The River Medway flows into the River Thames between the Isle of Grain on the left and the Isle of Sheppey on the right.

- From South to North, the red arrows indicate, the National Grid – Grain Terminal, National Grid L N G and Grain LNG.

There would appear to be space for expansion.

Southeastern Keen On Battery EMUs

The title of this post, is the same as that of a small section in the August 2023 Edition of Modern Railways.

This is said.

Southeastern is to seek pre-qualification interest from manufacturers and leasing companies for a replacement fleet for the Networker Class 465 and 466 inner-suburban stock, now over 30 years old. The company intends to compare the price of new and cascaded stock.

Southeastern MD Steve White told Modern Railways his preference is for a bi-mode EMU, capable of working off both the third rail supply and batteries. Battery EMUs were originally proposed for the Networker replacements so they could work through services to the unelectrified Isle of Grain branch, after Medway Council put forward plans to restore passenger services on the Hoo peninsular to serve new housing there.

Despite the extension of services to Sharnal Street on the Isle of Grain having since been put on hold by Medway Council on cost grounds (p13, May issue).

Southeastern is still pursuing battery EMUs, even though the company’s existing network is all electrified on the third rail system.

Merseyrail is already adopting battery EMU technology, with seven of the new fleet of 53×4-car Class 777 units being equipped with batteries to enable them to serve the unelectrified extension to Headbolt Lane (p82, July 2022 issue).

Mr. White says there are a number of reasons battery EMUs are attractive.

-

- Increasing levels of mental health issues in society have led to trespass being a major issue the railway: battery EMUs would make it feasible to keep trains moving at slow speed when the current supply has to be switched off to protect a trespasser.

- Battery EMUs would be able to keep moving on occasions when the third rail supply fails, due to technical failures or ice on the conductor rail. This would avoid the compounding of problems, as when delayed passengers got out on the track at Lewisham in March 2018 when the third rail iced up, forcing Network Rail to cut the electricity supply and making it more difficult to get trains moving again.

- Battery EMUs would make it feasible to remove third rail from depots, making them safer places in which to work. A train cleaner was electrocuted and died at West Marina depot in St. Leonards in May 2014, and the Office of Road and Rail has well-publicised concerns on safety grounds about any extensions to the third rail system.

- Battery EMUs would be able to cater for service extensions on unelectrified lines, such as the Isle of Grain.

Mt. White says the trespass issue is the major driver, and if the principle of battery EMUs becomes established it might prove feasible to remove the third rail from platform areas at inner-suburban stations with a persistent trespass problem. He points out this approach might unlock extension of third rail to routes such as the Uckfield line, allowing station areas to be left unelectrified. Replacement of DMUs by electric stock on the Uckfield branch would eliminate diesel working at London Bridge, with air-quality and carbon removal benefits for the capital.

There are a 5-star hotel and a major hospital close to the diesel-worked plstform at London Bridge.

I will now look at some of the issues in detail.

Range Of A Battery EMU

I discuss range of battery EMUs in these posts.

- Stadler FLIRT Akku Battery Train Demonstrates 185km Range

- New Merseyrail Train Runs 135km On Battery

Note.

- Both trains are built by Stadler.

- 135 km. is 84 miles.

- A Bombardier engineer told me eight years ago, that the prototype battery-electric Class 379 train had a range of sixty miles.

I feel it is reasonable to assume that a 100 mph battery-electric train, designed to replace Southeastern’s Networkers could have a range of at least sixty miles.

Distances Of Cannon Street Metro Services

These are distances of services from Cannon Street.

- Erith Loop via Greenwich, Woolwich Arsenal and Bexleyheath – 28.5 miles

- Gravesend – 24.5 miles

- Orpington – 12.6 miles

- Grove Park – 7.1 miles

- Slade Green – 14.5 miles

Note.

- The Erith Loop services start and finish at Cannon Street station.

- The Gravesend service terminates in an electrified bay platform.

- The Orpington service terminates in an electrified bay platform.

- Grove Park and Slade Green are depots.

If trains could be fully charged at Cannon Street station, all services out of the station could be worked by a battery EMU with a range of forty miles.

Charging At Cannon Street

Consider.

- All Cannon Street services arrive at the station via London Bridge station.

- All Cannon Street services leave the station via London Bridge station.

- Trains typically take 4-5 minutes between Cannon Street and London Bridge station.

- Trains typically wait at least 7 minutes in Cannon Street station before leaving.

- Typically, a battery EMU takes fifteen minutes to charge.

A train running from London Bridge to London Bridge would probably take a minimum of fifteen minutes, which should be enough to charge the train.

The track between London Bridge and Cannon Street would need a strong level of protection from trespassers.

I suspect that with some slight timetable adjustments, all Cannon Street services could be run using battery EMUs.

Distances Of Charing Cross Metro Services

These are distances of services from Charing Cross.

- Maidstone East – 38.9 miles

- Dartford – 17.1 miles

- Gravesend – 23.8 miles

- Hayes – 14.3 miles

- Sevenoaks – 22.2 miles

- Grove Park – 8 miles

Note.

- The Gravesend service terminates in an electrified bay platform, which could be used to charge the train before return.

- The Maidstone East service terminates in an electrified platform.

- Grove Park is a depot.

If trains could be fully charged at Charing Cross station, all services out of the station could be worked by a battery EMU with a range of fifty miles.

Charging At Charing Cross

Consider.

- All Charing Cross services arrive at the station via London Bridge station.

- All Charing Cross services leave the station via London Bridge station.

- Trains typically take 10 minutes between Charing Cross and London Bridge station.

- Trains typically wait at least 7 minutes in Charing Cross station before leaving.

- Typically, a battery EMU takes fifteen minutes to charge.

A train running from London Bridge to London Bridge would probably take a minimum of twenty minutes, which should be enough to charge the train.

The track between London Bridge and Charing Cross would need a strong level of protection from trespassers.

I suspect that with some slight timetable adjustments, all Charing Cross services could be run using battery EMUs.

Distances Of Victoria Metro Services

These are distances of services from Victoria.

- Gillingham – 37.2 miles

- Orpington – 14.7 miles

- Dartford – 18.9 miles

Note.

- The Orpington service terminates in an electrified bay platform.

- The Gillingham service terminates in an electrified bay platform.

- The Dartford service terminates in an electrified platform.

If trains could be fully charged at Victoria station, all services out of the station could be worked by a battery EMU with a range of fifty miles.

Charging At Victoria

Consider.

- All Victoria services arrive at the station via Shepherds Lane junction.

- All Victoria services leave the station via Shepherds Lane junction.

- Trains typically take five minutes between Victoria and Shepherds Lane junction.

- Trains typically wait at least 7 minutes in Victoria station before leaving.

- Typically, a battery EMU takes fifteen minutes to charge.

A train running from Shepherds Lane junction to Shepherds Lane junction would probably take a minimum of seventeen minutes, which should be enough to charge the train.

The track between Shepherds Lane junction and Victoria would need a strong level of protection from trespassers.

Conclusion

It certainly appears that if the Networker Class 465 and Class 466 trains were replaced by new trains with the following specification.

- 100 mph operating speed.

- Range of fifty miles on battery power.

- Ability to charge batteries in fifteen minutes.

- Third-rail operation

- It might be an idea to add a pantograph, so the trains could use 25 KVAC overhead wires where necessary and charge batteries on a short length of overhead electrification.

Then a substantial part of the Southeastern Metro network could be made safer, by selective removal of third rail at trespassing hot spots.

Grain LNG Launches Market Consultation For Existing Capacity

The title of this post is the same as that of this press release from National Grid.

This is the sub-heading.

Grain LNG, the largest liquefied natural gas (LNG) terminal in Europe, is pleased to announce the launch of a market consultation for the auction of 375 Gwh/d (approx. 9 mtpa) of existing capacity. The initial consultation phase for the Auction of Existing Capacity will commence on 14 June and run until 26 July.

These paragraphs detail what Grain LNG, which is a subsidiary of National Grid are offering.

GLNG has used the positive feedback received from the recent ‘Expression of Interest’ exercise and subsequent market engagement to offer three lots of capacity:

- Each lot will be entitled to 42 berthing slots, 200,000 m3 of storage and 125GWh/d (approx. 3 mtpa) of regasification capacity from as early as January 2029.

- This product is specifically designed for parties who wish to acquire a substantial stake in a major terminal in Northwest Europe, at a reduced cost and with shorter contract lengths when compared to new-build projects.

- As the terminal’s capacity already exists, parties involved will not be subjected to the FID approvals or potential delays that can arise from construction issues commonly associated with new build terminals.

Simon Culkin, Importation Terminal Manager at Grain LNG, said: “We are really pleased with the high level of interest shown by the market at a time of significant geo-political influence on our energy markets. It has allowed us to engage with potential customers and shape our offering to best meet their needs, whilst optimising access to this strategic asset. “

Reading the Wikipedia entry for the Grain LNG Terminal, it looks like it gets used as a handy store for natural gas.

About Phase 1 (2002–05), Wikipedia says this.

The new facilities enabled the Grain terminal to become a base supply to the NTS, with the ability to deliver gas continuously when required. The cost of the Phase 1 project was £130m. A 20-year contract with BP / Sonatrach enabled Grain LNG to import LNG on a long-term basis from July 2005.

About Phase 2 (2005–08), Wikipedia says this.

The development provided an additional five million tonnes of capacity per annum. All this capacity was contracted out from December 2010. Customers included BP, Iberdrola, Sonatrach, Centrica, E.ON and GDF Suez.

Under Current Facilities, Wikipedia says this.

Grain LNG Ltd does not own the LNG or the gas that it handles but charges for gasifying it. Current (2016) users include BP, Centrica (British Gas Trading), Iberdrola (Spain), Sonatrach (Algeria), Engie (France), and Uniper (Germany).

National Grid must be pleased that some customers seem loyal.

I feel that National Grid’s basic plan is to carry on with more of the same.

But will they develop more storage and other facilities on the site.

There are certainly other projects and interconnectors, that make the Isle of Grain and energy hub connecting the UK, Netherlands and Germany.

- In Did I See The UK’s Hydrogen-Powered Future In Hull Today?, I mentioned, that I thought that the Isle of Grain could be a location for an electrolyser and a hydrogen store.

- In EuroLink, Nautilus And Sea Link, I talk about new interconnectors, if which Nautilus might come to the Isle of Grain.

- In UK-German Energy Link Reaches Financial Close, I talk about NeuConnect, which will be an interconnector between the Isle of Grain ans Wilhelmshaven in Germany.

- The Isle of Grain is the landing point for the BritNed undersea power cable between The Netherlands and the UK.

I could also see National Grid building an East Coast interconnector to bring power from the wind farms off the East Coast of England to the Isle of Grain for distribution.

These are major wind farms South of the Humber.

- Dudgeon – 402 MW

- East Anglia 1 – 714 MW

- East Anglia 1 North – 800 MW

- East Anglia 2 – 900 MW

- Galloper – 504 MW – RWE

- Greater Gabbard – 504 MW

- Gunfleet Sands – 174 MW

- Hornsea 1 – 1218 MW

- Hornsea 2 – 1386 MW

- Hornsea 3 – 2852 MW

- Humber Gateway – 219 MW

- Lincs – 270 MW

- London Array – 630 MW

- Lynn and Inner Dowsing – 194 MW

- Race Bank – 580 MW

- Scroby Sands – 60 MW

- Sheringham Shoal – 317 MW

- Triton Knoll – 857 MW – RWE

- Dogger Bank A – 1235 MW

- Dogger Bank B – 1235 MW

- Dogger Bank C – 1218 MW

- Dogger Bank D – 1320 MW

- Dogger Bank South – 3000 MW RWE

- East Anglia 3 – 1372 MW

- Norfolk Boreas – 1396 MW

- Norfolk Vanguard – 1800 MW

- Outer Dowsing – 1500 MW

- North Falls – 504 MW – RWE

- Sheringham Shoal and Dudgeon Extensions – 719 MW

- Five Estuaries – 353 MW – RWE

Note.

- These figures give a total capacity of 28,333 MW.

- Five wind farms marked RWE are owned by that company.

- These five wind farms have a total capacity of 5618 MW.

- Will RWE export, their electricity to Germany through NeuConnect?

I can certainly see National Grid building one of the world’s largest electrolysers and some energy storage on the Isle of Grain, if an East Coast Interconnector is built.

Did I See The UK’s Hydrogen-Powered Future In Hull Today?

I went from London to Hull today on Hull Trains for £50.80 return (with my Senior Railcard) to see SSE’s presentation for their Aldbrough Pathfinder Hydrogen project, which will feature a 35 MW green hydrogen electrolyser and 320 GWh of hydrogen storage in the thick layers of salt under East Yorkshire.

- Green electricity would come mainly from the part-SSE owned 8 GW Dogger Bank wind farm complex.

- According to their web site, Meld Energy are planning a 100 MW electrolyser, which would produce 13,400 tonnes of hydrogen per year.

Every large helps!

- It should be noted that the thick layers of salt stretch all the way to Germany, and as drilling and storage technology improves, the amount of hydrogen storage available will increase.

- I was also impressed by the ambition, competence and enthusiasm, of the SSE engineers that I met.

- As has been pointed out, HiiROC, who have backing from Centrica, Hyundai, Kia and others, are also in Hull!

I believe, that I saw our hydrogen-powered future in Hull today!

We need more hydrogen mega-projects like these! Perhaps in Aberdeen, Clydeside, Freeport East, Isle of Grain, Merseyside, Milford Haven and Teesside?

UK Confirms £205 Million Budget To Power More Of Britain From Britain

The title of this post, is the same as that of this press release from the Department of Energy Security And NetZero.

This is the sub title.

UK government confirms budget for this year’s Contracts for Difference scheme as it enters its first annual auction, boosting energy security.

These are the three bullet points.

- Government announces significant financial backing for first annual flagship renewables auction, boosting Britain’s energy security

- £170 million pledged for established technologies to ensure Britain remains a front runner in renewables and £10 million ring-fenced budget for tidal

- Scheme will bolster investment into the sector every year, delivering clean, homegrown energy as well as green growth and jobs

These are my thoughts.

First And Annual

The scheme is flagged as both first and annual!

Does this mean, that each Budget will bring forward a pot of money for renewables every year?

My father, who being a letterpress printer and a Cockney poet would say it did and I’ll follow his lead.

Two Pots

In Contracts for Difference Round 4, there were three pots.

- Pot 1 – Onshore Wind and Solar

- Pot 2 – Floating Offshore Wind, Remote Island Wind and Tidal Stream

- Pot 3 – Fixed Foundation Offshore Wind

This document on the government web site lists all the results.

For Contracts for Difference Round 5, there will be two pots, which is described in this paragraph of the press release.

Arranged across 2 ‘pots’, this year’s fifth Allocation Round (AR5) includes an allocation of £170 million to Pot 1 for established technologies, which for the first time includes offshore wind and remote island wind – and confirms an allocation of £35 million for Pot 2 which covers emerging technologies such as geothermal and floating offshore wind, as well as a £10 million ring-fenced budget available for tidal stream technologies.

It could be described as a two-pot structure with a smaller ring-fenced pot for tidal stream technologies.

Contract for Difference

There is a Wikipedia entry for Contract for Difference and I’m putting in an extract, which describes how they work with renewable electricity generation.

To support new low carbon electricity generation in the United Kingdom, both nuclear and renewable, contracts for difference were introduced by the Energy Act 2013, progressively replacing the previous Renewables Obligation scheme. A House of Commons Library report explained the scheme as:

Contracts for Difference (CfD) are a system of reverse auctions intended to give investors the confidence and certainty they need to invest in low carbon electricity generation. CfDs have also been agreed on a bilateral basis, such as the agreement struck for the Hinkley Point C nuclear plant.

CfDs work by fixing the prices received by low carbon generation, reducing the risks they face, and ensuring that eligible technology receives a price for generated power that supports investment. CfDs also reduce costs by fixing the price consumers pay for low carbon electricity. This requires generators to pay money back when wholesale electricity prices are higher than the strike price, and provides financial support when the wholesale electricity prices are lower.

The costs of the CfD scheme are funded by a statutory levy on all UK-based licensed electricity suppliers (known as the ‘Supplier Obligation’), which is passed on to consumers.

In some countries, such as Turkey, the price may be fixed by the government rather than an auction.

Note.

- I would trust the House of Commons Library to write up CfDs properly.

- As a Control Engineer, I find a CfD an interesting idea.

- If a generator has more electricity than expected, they will make more money than they expected. So this should drop the wholesale price, so they would get less. Get the parameters right and the generator and the electricity distributor would probably end up in a stable equilibrium. This should be fairly close to the strike price.

I would expect in Turkey with Erdogan as President, there are also other factors involved.

Renewable Generation With Energy Storage

I do wonder, if wind, solar or tidal energy, is paired with energy storage, this would allow optimisation of the system around the Contract for Difference.

If it did, it would probably mean that the generator settled into a state of equilibrium, where it supplied a constant amount of electricity.

Remote Island Wind

Remote Island Wind was introduced in Round 4 and I wrote about it in The Concept Of Remote Island Wind.

This was my conclusion in that post.

I must admit that I like the concept. Especially, when like some of the schemes, when it is linked to community involvement and improvement.

Only time will tell, if the concept of Remote Island Wind works well.

There are possibilities, although England and Wales compared to Scotland and Ireland, would appear to be short of islands.

This map shows the islands of the Thames Estuary.

Note.

- In Kent, there is the Isle of Sheppey and the Isle of Grain.

- Between the two islands is a large gas terminal , a gas-fired power station and an electricity sub-station connecting to Germany.

- In Essex, there is Canvey, Foulness and Potton Islands.

- There is also the site at Bradwell, where there used to be a nuclear power station.

If we assume that each island could support 200 MW, there could be a GW of onshore wind for London and perhaps a couple of SMRs to add another GW.

This map shows the islands around Portsmouth.

Note.

- Hayling Island is to the East of Portsmouth.

- Further East is Thorney Island with an airfield.

The Isle of Wight could be the sort of island, that wouldn’t welcome wind farms, although they do make the blades for turbines. Perhaps they should have a wind farm to make the blades even more green.

But going round England and Wales there doesn’t seem to be many suitable places for Remote Island Wind.

I do think though, that Scotland could make up the difference.

Geothermal Energy

This is directly mentioned as going into the emerging technologies pot, which is numbered 2.

I think we could see a surprise here, as how many commentators predicted that geothermal heat from the London Underground could be used to heat buildings in Islington, as I wrote about in ‘World-First’ As Bunhill 2 Launches Using Tube Heat To Warm 1,350 Homes.

Perhaps, Charlotte Adams and her team at Durham University, will capitalise on some of their work with a abandoned coal mine, that I wrote about in Exciting Renewable Energy Project for Spennymoor.

Timescale

This paragraph gives the timescale.

The publication of these notices mean that AR5 is set to open to applications on 30 March with results to be announced in late summer/early autumn 2023, with the goal of building upon the already paramount success of the scheme.

It does look like the Government intends this round to progress at a fast pace.

Conclusion

If this is going to be an annual auction, this could turn out to be a big spur to the development of renewable energy.

Supposing you have a really off-beat idea to generate electricity and the idea place in the world is off the coast of Anglesey.

You will certainly be able to make a bid and know like Eurovision, one auction will come along each year.

Extending The Elizabeth Line – A Branch To The Isle Of Grain

In Elizabeth Line To Ebbsfleet Extension Could Cost £3.2 Billion, I talked about extending the Elizabeth Line to Ebbsfleet International and Gravesend stations.

In Gibb Report – Hoo Junction Depot, I talked about how Chris Gibb proposed using the former Hoo branch to create a depot for Thameslink trains.

I am a great believer in the idea, that modern railways are a great way of levelling up an area.

I have watched as Dalston and Hackney have risen as the London Overground has developed more and more frequent services through the area.

So when I wrote about the Ebbsfleet Extension to the Elizabeth Line, I asked this question.

Could The Elizabeth Line Be Extended To The Proposed Hoo Station?

The Hundred of Hoo Railway, leaves the North Kent Line about three miles to the East of Gravesend and runs across the Isle of Grain.

I wrote about the proposed reopening of the Hundred of Hoo Railway or the Hoo Branch as it is commonly known in Effort To Contain Costs For Hoo Reopening.

I then put various proposals and facts together.

It is proposed that the Elizabeth Line runs a four trains per hour (tph) service to Gravesend station.

- Gravesend station is a not very suitable station to turn nine-car Class 345 trains, that are over two hundred metres long, as it is on a cramped site.

- Government money has been pledged to build a station on the Isle of Grain to support the new housing on the island.

- According to Chris Gibb, there is space to build a depot.

So why not build a terminal station for the Elizabeth Line on the Isle of Grain?

I had these thoughts on the proposed Hoo station.

- It would be under ten kilometres from Hoo Junction, where the North Kent Line is electrified.

- A single platform could handle 4 tph, but provision for two platforms would be prudent.

- A couple of sidings could provide stabling.

- Services would join the North Kent Line at Hoo Junction.

- Services would use battery power between Hoo Junction and Hoo station.

- If charging were needed at Hoo station a short length of 25 KVAC overhead electrification would be needed.

- There is plenty of power available locally to power any electrification.

The only problem is that there would be a need for battery-electric Class 345 trains, but as Aventra trains were designed and built with battery operation in mind, this shouldn’t be too challenging.

I have a few other thoughts.

Housing By An Elizabeth Line Station

Woolwich station was built to serve a housing development and the developers even built the station box, which I wrote about in Exploring The Woolwich Station Box.

So I don’t think the developers of the housing on the Isle of Grain will be against the Elizabeth Line station.

What Would Be The Frequency To Hoo Station?

As I said, the proposed Hoo branch, could easily have a capacity of four tph.

But services to Heathrow Terminal 4, Heathrow Terminal 5, Maidenhead and Reading are all two tph. Only Abbey Wood, Paddington and Shenfield have a higher frequency.

I suspect that two tph maximises the number of passengers, as they are prepared to wait thirty minutes.

Conclusion

I can see the branch to Hoo station on the Isle of Grain, being one of these options.

- A branch to turn trains running to Gravesend.

- A short branch to level-up the Isle of Grain.

- A short branch to provide transport for new housing.

Or perhaps a mixture of some or all options.

Could we see other branches like Hoo?

EuroLink, Nautilus And Sea Link

EuroLink, Nautilus and Sea Link are three proposed interconnectors being developed by National Grid Ventures.

EuroLink

EuroLink has a web site, where this is said.

To support the UK’s growing energy needs, National Grid Ventures (NGV) is bringing forward proposals for a Multi-Purpose Interconnector (MPI) called EuroLink, which will deliver a new electricity link between Great Britain to the Netherlands.

EuroLink could supply up to 1.8 gigawatts (GW) of electricity, which will be enough to power approximately 1.8 million homes, as well as contribute to our national energy security and support the UK’s climate and energy goals. We’re holding a non-statutory public consultation to inform you about our EuroLink proposals, gather your feedback to help refine our plans and respond to your questions.

Note, that EuroLink is a Multi-Purpose Interconnector (MPI) and they are described on this page of the National Grid website.

In EuroLink’s case, this means it is basically an interconnector between the UK and The Netherlands, that also connects wind farms on the route to the shore.

- Coastal communities get less disruption, as the number of connecting cables coming ashore is reduced.

- Less space is needed onshore for substations.

- Electricity from the wind farms can be directed to where it is needed or can be stored.

As an Electrical and Control Engineer, I like the MPI approach.

The technology to implement the MPI approach is very much tried and tested.

There are many references to EuroLink terminating at Friston.

Nautilus

Nautilus has a web site, where this is said.

Nautilus could connect up to 1.4 gigawatts (GW) of offshore wind to each country through subsea electricity whilst connecting to offshore wind farm/s at sea. By combining offshore wind generation with interconnector capacity between the UK and Belgium, Nautilus would significantly reduce the amount of infrastructure and disruption required both onshore and offshore.

With this new technology, we hope to reduce the impact of infrastructure on local communities and the environment, as well as support the government’s net zero and energy security targets. We are already working closely with other developers in the area to coordinate activities and minimise impact on local communities. We believe that through improved coordination, the UK government can achieve and support the co-existence of renewable energy with coastal communities.

Nautilus is another MPI.

This is said on the web site.

Last year, National Grid Ventures ran a non-statutory consultation for Nautilus, which proposed a connection at Friston.

NGV holds a connection agreement on the Isle of Grain in Kent as part of its development portfolio and we are currently investigating if this could be a potential location for Nautilus. Until this is confirmed to be technically feasible, Nautilus will be included as part of our coordination work in East Suffolk.

So it looks like, Nautilus could connect to the UK grid at Friston or the Isle of Grain.

Sea Link

Sea Link has a web site, and is a proposed interconnector across the Thames Estuary between Suffolk and Kent.

This is said on the web site about the need for and design of Sea Link.

The UK electricity industry is evolving at pace to help lead the way in meeting the climate challenge, whilst also creating a secure energy supply based on renewable and low carbon technologies.

The demands on the electricity network are set to grow as other sectors of the economy diversify their energy consumption from using fossil fuels towards cleaner forms, the move towards electric vehicles being just one example.

Where we’re getting our power from is changing and we need to change too. The new sources of renewable and low-carbon energy are located along the coastline. We need to reinforce existing transmission network and build new electricity infrastructure in these areas in order to transport the power to where it’s needed. This is the case along the whole of the East Coast including Suffolk and Kent.

To allow this increase in energy generation, we need to reinforce the electricity transmission system. Sea Link helps to reinforce the electricity network across Suffolk and Kent.

Our proposals include building an offshore high voltage direct current (HVDC) link between Suffolk and Kent with onshore converter stations and connections back to the national electricity transmission system.

On the web site, in answer to a question of What Is Sea Link?, this is said.

Sea Link is an essential upgrade to Britain’s electricity network in East Anglia and Kent using subsea and underground cable. The proposal includes approximately 130km of subsea cables between Sizewell area in East Suffolk and Richborough in Kent. At landfall, the cables would go underground for up to 5 km to a converter station (one at each end). The converter station converts direct current used for the subsea section to alternating current, which our homes and businesses use. A connection is then made to the existing transmission network. In Suffolk, via the proposed Friston substation; in Kent via a direct connection to the overhead line between Richborough and Canterbury.

Note, that from Kent electricity can also be exported to the Continent.

All Cables Lead To Friston In Suffolk

It looks like EuroLink, Nautilus and Sea Link could all be connected to a new substation at Friston.

But these will not be the only cables to pass close to the village.

This Google Map shows the village.

Running South-West to North-East across the map can be seen the dual line of electricity pylons, that connect the nuclear power stations at Sizewell to the UK electricity grid.

Has Friston been chosen for the substation, so that, the various interconnectors can be connected to the power lines, that connect the Sizewell site to the UK electricity grid.

This would enable EuroLink, Nautilus and/or Sea Link to stand in for the Sizewell nuclear stations, if they are shut down for any reason?

It does appear from reports on the Internet that the Friston substation is not welcome.

Exploring Opportunities For Coordination

The title of this section is a heading in the EuroLink web site, where this is said.

In response to stakeholder feedback, NGV’s Eurolink and Nautilus projects and NGET’s Sea Link project are exploring potential opportunities to coordinate. Coordination could range from co-location of infrastructure from different projects on the same site, to coordinating construction activities to reduce potential impacts on local communities and the environment.

That sounds very sensible.